Vietnam Pharmacy Retail Market Size, Share, Trends and Forecast by Market Structure, Product Type, Therapeutic Area, Drug Type, Pharmacy Location, and Region, 2025-2033

Vietnam Pharmacy Retail Market Size and Share:

The Vietnam pharmacy retail market size was valued at USD 8.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.8 Billion by 2033, exhibiting a CAGR of 6.7% during 2025-2033. The market is growing due to rising health awareness, higher disposable incomes, and an aging population. E-commerce and digital pharmacies are gaining popularity, driven by convenience and post-pandemic trends. Increased foreign investment enhances product variety and service standards. Stricter regulations also strengthen consumer trust in licensed pharmacies. Additionally, rapid urbanization and modern retail expansion are improving accessibility, while government healthcare is further augmenting the Vietnam pharmacy retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.9 Billion |

|

Market Forecast in 2033

|

USD 16.8 Billion |

| Market Growth Rate 2025-2033 | 6.7% |

The market is primarily driven by rising healthcare awareness and inflating disposable incomes. As the population becomes more health-conscious, demand for over-the-counter (OTC) medicines, vitamins, and wellness products has accelerated. The Vietnamese pharmaceutical industry is witnessing rapid expansion, with more than 70% of the market consisting of over-the-counter (OTC) drugs and 26% comprising branded and unbranded generics. Due to a population of 98 million and 90% of its citizens having health insurance coverage, the healthcare market offers significant opportunities, particularly for international players with a focus on innovative pharma. However, domestic competition is limited, making Vietnam an appealing market for high-margin pharmaceuticals. Furthermore, rapid urbanization and the entry of new retail chains in the market is contributing immensely towards the growth of the market, thereby increasing the availability of pharmaceutical products. As the government continues to prioritize improving the health infrastructure of the nation and expanding insurance coverage, consumers are becoming increasingly conscious of taking proper medical advice and contributing to enhancing pharmacy sales. The aging population, on the other hand, needs to take medicines more often than any other population segment, and this keeps pushing demand for pharmacies, making them a must-have in the urban as well as the rural setting.

.webp)

In addition, the rapid digital transformation and e-commerce penetration in Vietnam’s pharmaceutical sector are creating a positive Vietnam pharmacy retail market outlook. Online pharmacy platforms are gaining traction, offering convenience and competitive pricing, especially among younger, tech-savvy consumers. The COVID-19 pandemic accelerated this shift, with consumers preferring contactless purchases of medicines and health supplements. Moreover, increasing foreign investment in Vietnam’s healthcare sector further leads to the entry of international pharmacy chains, enhancing product diversity and service quality. In 2023, Vietnam's private healthcare sector witnessed a major rise in foreign investment, with 11 mergers and acquisitions worth USD 508 Million, twice the value of the previous year. Some of the major deals include Thomson Medical's acquisition of FV Hospital for USD 381.4 Million and Warburg Pincus' investment in X Coworkers Facility Hospital. As the middle class expands, there is an increasing demand for high-quality healthcare services in Vietnam, most notably in the pharma sector, offering big opportunities for retail pharmacy. Moreover, regulatory reforms, such as stricter drug safety standards, are also enhancing consumer trust in licensed pharmacies. These factors collectively create a dynamic and expanding market with significant opportunities for both local and global players.

Vietnam Pharmacy Retail Market Trends:

Population Growth in Vietnam

The population in Vietnam is steadily growing, which has wider implications for several industries, including healthcare. Additionally, the increased demand for drugs and other medical products and services is largely due to this constant increase in population. For instance, according to the United Nations Population Fund report of 2023, Vietnam's population is projected to approach 100 million, positioning it as the 15th most populous nation globally. Additionally, Vietnam presently boasts the highest percentage of youth, with 21.1% aged between 10 and 24 years. The World Bank projected that the middle and upper classes will experience fast population growth, accounting for 20% of the country’s total population by 2030. The majority of this expanding population is young, which is creating a vibrant market for health-related items. It also highlights the necessity of expanding healthcare experts and infrastructure to meet the growing demand. As a result, demographic shifts require a strong reaction from the public and commercial healthcare sectors to manage the growing population demand, thus contributing to the Vietnam pharmacy retail market demand.

Prevalence of Chronic Diseases

The growing health concerns in Vietnam regarding the increasing chronic illnesses, including diabetes, heart disease, and cancer, are significantly influencing the market. This trend is strongly related to aging populations and changing lifestyles. For example, the prevalence of cardiovascular diseases (CVDs) includes disorders including coronary heart disease, stroke, hypertension, and others that are caused by anomalies in the heart and blood arteries. Cardiovascular diseases (CVDs) continue to be the primary cause of mortality in Vietnam accounting for 31% of all deaths in 2016, surpassing 170,000 deaths across the region. The need for appropriate pharma drugs stems from the long-term treatment and management of different chronic ailments. These diseases occur more in the elderly, whose management is thus more challenging in terms of healthcare practice and resources, among others. Apart from that, lifestyle interventions such as rapid urbanization, changes in diet and physical activity patterns, and so on exacerbate the disease and increases the chances of getting such diseases. Therefore, the healthcare industry is solving the problem, indicating that pharma products and healthcare systems need to be enhanced, which is propelling the market.

Increasing Healthcare Expenditure

The population now with more disposable income due to the significant economic growth in Vietnam is raising healthcare costs, which is positively impacting Vietnam pharmacy retail market growth. market growth. Additionally, healthcare spending increased significantly in Vietnam as per the Economist Intelligence Unit (EIU) reports Vietnam allocated around USD18.5 Billion toward healthcare expenditure in 2022, constituting approximately 4.6% of the nation's GDP. This increase in spending is a sign of the growing awareness among individuals regarding the importance of health. Besides this, consumers are more likely to invest in higher-quality health services and goods when their income levels improve, which increases the need for a wider selection of healthcare solutions, such as cutting-edge medications and treatment options. Thus, the government is also very important since better infrastructure and accessibility to healthcare are made possible by more public health spending, which helps the overall well-being of the population, which is also strengthening the market.

Vietnam Pharmacy Retail Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam pharmacy retail market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on market structure, product type, therapeutic area, drug type, pharmacy, and location.

Analysis by Market Structure:

- Unorganized

- Organized

The unorganized sector is made up of numerous tiny, individual pharmacies that can be found in rural and urban areas. These pharmacies are recurrently run by families, have a strong local presence, and pride themselves on delivering personalized care. They usually stock a limited selection of necessary medications and healthcare supplies to meet neighborhood demands. Their familiarity and closeness to the community make them strong candidates for trusted neighborhood healthcare providers across the region.

Organized pharmacy chains and franchised stores follow set operating procedures included in the organized section. These businesses take advantage of economies of scale to deliver a wider range of goods and services. They draw in numerous customers with their more contemporary retail methods, such as customer loyalty programs and internet platforms. The organized healthcare sector appeals to urban consumers looking for one-stop shopping for all of their healthcare needs due to its ease and competence. These sectors are essential to the healthcare system of Vietnam to serve different customer needs and market conditions, which makes pharmaceutical goods and services certainly accessible and reasonably priced.

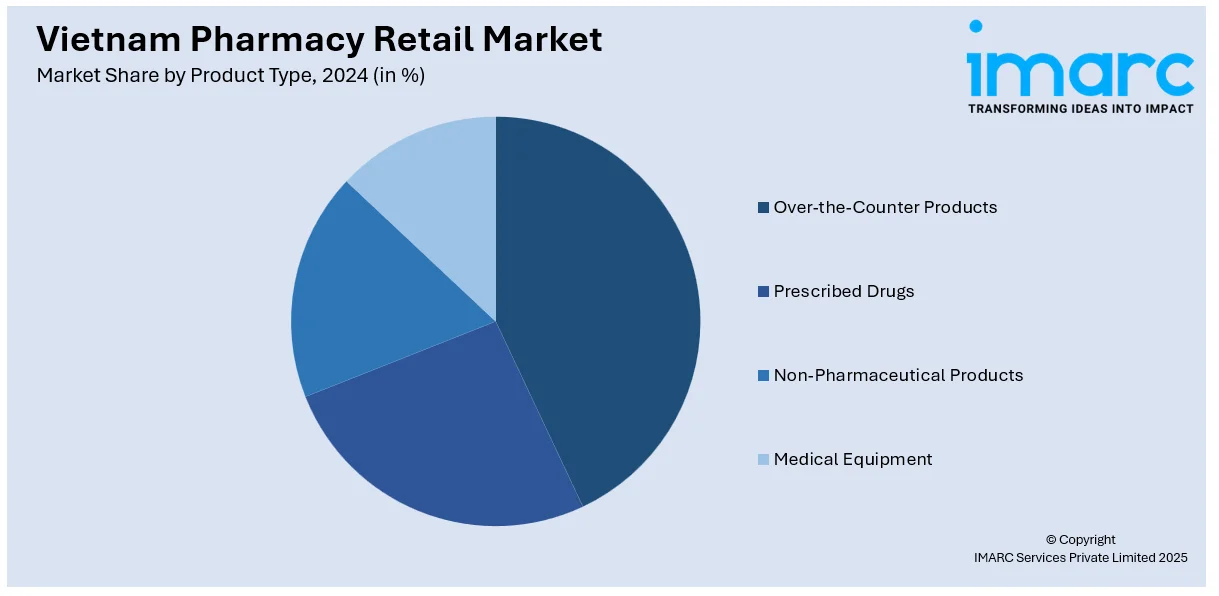

Analysis by Product Type:

- Over-the-Counter Products

- Prescribed Drugs

- Non-Pharmaceutical Products

- Medical Equipment

Over-the-counter (OTC) product comprises a significant portion of the market, which include drugs and other healthcare items that may be purchased without a prescription. These include over-the-counter painkillers, cold and flu medicines, vitamins, and skincare items. OTC products are widely used by consumers for preventative healthcare and self-treatment of mild illnesses. Additionally, pharmacies frequently provide a large assortment of over-the-counter (OTC) products to meet the varying requirements and tastes of their customers. Some pharmacies even specialize in particular areas, such as natural cures or pediatric healthcare.

Prescription drug sales reached USD3.9 Billion in 2017, projected to increase to USD6.7 Billion by 2022 and USD10.5 Billion by 2027, indicating a compound annual growth rate of 10.3% in USD terms over ten years. With prescription drugs expected to claim a larger portion of the market, gradually increasing from the current 75% of total medicine sales, their growth will surpass that of OTC drugs, driven by the importation of costly patented products and rising demand for advanced medications.

Vietnam pharmacy retail growth also accounts for prescribed drug sales for a sizeable share of retail business. These medications are usually used to address particular medical issues and need a prescription from a qualified healthcare provider. Prescription pharmaceuticals for managing chronic illnesses, infections, and specialty treatments are all kept in stock by pharmacies. Pharmacies are vital healthcare providers in the community as they offer patients access to prescription drugs, which is critical for managing chronic conditions or receiving medical treatment. The sales of prescription drugs reached USD 3.9 Billion in 2017 and are expected to expand to USD 10.5 Billion by 2027, meaning that over ten years, the compound annual growth rate in USD terms would be 10.3%.

Non-pharmaceutical products category includes several wellness and healthcare items that supplement prescription drugs. This covers product including herbal treatments, dietary supplements, medical equipment, and personal hygiene items. Consumers looking for complementary or alternative therapies for a range of health issues, such as chronic illnesses or maintaining general well-being, are drawn to non-pharmaceutical items. Non-pharmaceutical products may be carefully chosen by pharmacies, frequently in response to customer demand and new developments in the health industry. Furthermore, pharmacists are essential in advising and educating customers on how to utilize these drugs safely and effectively to achieve the best possible health results.

The medical equipment sector includes several tools and equipment for home healthcare, medical diagnosis, and treatment. For instance, nebulizers, glucose meters, blood pressure monitors, and mobility aids enable pharmacies to sell or rent out more specialized medical equipment, or they may stock basic equipment for purchase. According to the International Trade Administration, over 90% of medical equipment utilized in Vietnam is imported, with the medical device market estimated at USD 1.5 Billion in 2022. Industry projections indicate a compound annual growth rate (CAGR) of 9.7% from 2021 to 2026, with the market anticipated to expand to USD 2.1 Billion by 2026. According to the Vietnam pharmacy retail market forecast, the provision of medical equipment in pharmacies, especially for persons with restricted mobility or those in need of continuous medical supervision, is contributing to the market growth.

Analysis by Therapeutic Area:

- Cardiovascular

- Pain Relief/Analgesics

- Vitamins/Minerals/Nutrients

- Anti-Infective

- Anti-Diabetic

- Others

Cardiovascular refers to drugs and dietary supplements used to treat heart-related disorders such as high blood pressure, heart failure, and high cholesterol. Additionally, pharmacies provide prescription medications such as beta-blockers, ACE inhibitors, and statins, with some over-the-counter (OTC) products such as omega-3 fatty acids and vitamin E supplements. With cardiovascular disorders becoming more common in Vietnam, pharmacies are vital for enabling customers access to necessary drugs and raising their awareness of heart health issues.

Pain relief and analgesics include numerous over-the-counter drugs that are intended to reduce pain from minor to severe. Popular analgesics such as aspirin, ibuprofen, and paracetamol are available in pharmacies, along with topical lotions and patches for localized pain relief. Pharmacies play a critical role in providing patients access to safe and effective pain relief medications while also providing advice on proper usage and potential adverse effects, as awareness of the significance of pain management is growing.

The vitamins, minerals, and nutrients are driven by the increased consumer interest in wellness and preventive healthcare in Vietnam's pharmacy retail industry. It provides a wide selection of dietary supplements, such as probiotics, calcium, iron, and multivitamins, to meet a range of dietary needs and preferences. Customers are turning to pharmacies more frequently for guidance on supplement selection and dose due to changing dietary habits and growing health consciousness. As a result, this market segment significantly contributes to total pharmacy sales and revenue in Vietnam.

The anti-infective is critical in the country's continuous fight against infectious disorders such as respiratory infections, gastrointestinal ailments, and sexually transmitted infections. Additionally, pharmacies carry a large variety of prescription and over-the-counter antibiotics, antivirals, and antifungals to effectively treat bacterial, viral, and fungal infections. Pharmacy access to key anti-infective drugs is crucial, as is their promotion of responsible antibiotic usage and infection prevention practices in light of the advent of antimicrobial resistance and periodic outbreaks of infectious illnesses.

Anti-diabetic addresses the needs of individuals with diabetes, a chronic illness that affects millions of citizens in the US. A wide variety of diabetic treatments, such as insulin analogs, blood glucose monitors, and oral hypoglycemic drugs, are available from pharmacies to help patients manage their blood sugar levels and avoid complications. Pharmacies are vital to the management of diabetes as they offer information, assistance, and easy access to necessary drugs and supplies. Nowadays, diabetes is becoming more common due to the aging population and changing lifestyles of individuals across the region.

Analysis by Drug Type:

- Generic

- Patented

The generic medications market is prominent, as generic medications are bioequivalent to their branded equivalents but usually less expensive and serve a large patient population looking for low-cost medical options. It covers a broad spectrum of necessary drugs, such as painkillers, antibiotics, and therapies for chronic illnesses. Nowadays, generic medications are preferred by patients and healthcare professionals, making them a vital component of the pharmacy industry of Vietnam and the backbone of the healthcare system across the nation. Hence, key players are introducing advanced product variants to meet these needs. Besides this, on 14 April 2024, Traphaco, a leading pharmaceutical company in Vietnam, announced that the company is prioritizing modern medication and committing to investing in EU-GMP-certified factories. It also reported strong business performance for 2023, overcoming global challenges, as announced during the company's Annual General Meeting on April 12th.

The patented drugs consist of innovative pharmaceutical drugs that are shielded by patents and make up the majority of the patented pharmaceuticals category. These medications frequently offer distinctive therapeutic advantages for numerous medical diseases, reflecting state-of-the-art developments in medical research and technology. Patented medications may have a competitive advantage over generic equivalents, even though they are usually more costly due to exclusive rights, marketing campaigns, and brand awareness. Customers in this market sector are looking for the newest therapies and individualized healthcare solutions, which medical specialists frequently recommend for particular medical requirements. Patented medications are more expensive, yet they are essential to improving healthcare outcomes and stimulating innovation in Vietnam's pharmaceutical industry.

Analysis by Pharmacy Location:

- Street/Mall Based

- Hospital Based

Streets and mall-based pharmacies make up a substantial portion of the pharmacy retail industry in Vietnam. These pharmacies are conveniently situated in busy business districts and retail centers to provide convenience for their patrons. They usually keep a large assortment of over-the-counter (OTC) medications, health supplements, and personal hygiene items in store to meet the varied needs of their customers. These pharmacies frequently concentrate on creating eye-catching displays and promotional offers to attract walk-in clients and increase brand visibility in fiercely competitive metropolitan marketplaces.

Hospital-based pharmacies can be found in a variety of healthcare settings, such as private clinics, public hospitals, and specialty medical institutes. They mainly assist patients receiving care or consultation on hospital grounds by giving them access to medical supplies, prescription drugs, and other associated services. Hospital pharmacies are an integral aspect of the healthcare delivery ecosystem in Vietnam, providing easy access to pharmaceutical items and vital medications, hence facilitating continuity of care.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The retail pharmacy market in Northern Vietnam is distinguished by a combination of conventional and contemporary businesses. Cities such as Hanoi have a mix of independent pharmacies and larger, more established drugstore chains. These establishments serve a varied clientele by providing an extensive assortment of medical services and prescription goods. Furthermore, the rural sections of the region frequently depend on neighborhood pharmacies to supply residents with healthcare advice and necessary medications. Pharmacies in Northern Vietnam, with an emphasis on price and accessibility, are vital to the region's capacity to obtain healthcare.

The retail pharmacy market in Central Vietnam is a reflection of the distinctive economic and demographic landscape of this area. In Da Nang and Hue cities, there are numerous large pharmacy chains, local pharmacies, and specialty healthcare facilities. They provide a wide variety of pharmaceutical products and medical services to urban and rural dwellers. Pharmacies in rural areas conduct health education and the dispensing of drugs required by the poor. Central Vietnam's pharmacies are run in an ever-changing market, which is constantly transforming with the changing healthcare needs of individuals.

The retail pharmacy market in Southern Vietnam is a vibrant and competitive environment, especially in major cities such as Ho Chi Minh City. Additionally, big pharmacy chains, foreign merchants, and individual pharmacies compete for market share in this area offering, a broad range of pharmaceutical items and healthcare services with a modest ratio of 17.3 pharmacists per 100,000 individuals, the country features a robust abundance of drug outlets, with 30.2 per 100,000 population, nearly matching the European Region's figure of 30.6, as per the National Library of Medicine. Thus, pharmacies in Southern Vietnam are vibrant and adaptable to the various needs of its urban and rural populace.

Competitive Landscape:

The market is becoming more competitive due to the continuous expansion of stores, digitalization, and product portfolio extension. The large chains are targeting the positioning of pharmacies in cities and suburbs while targeting modern store formats to make the customer experience more appealing. Technology-savvy consumers are increasingly using mobile apps and online transactions, and they are also increasingly using online consultations and home delivery services. Numerous pharmacy firms extend their collaboration with the health care providers and the insurers thus offering bundled services. Building up the private label and wellness portfolio and the enhancement in profit margins are the objectives. Most new regulations compel businesses to pay attention to compliance and traceability within the supply chain, and therefore, the Vietnamese market for pharmacy retail is becoming more professional. The competition is also fueled by the growing number of foreign investors that is compelling domestic businesses to continue innovating and enhancing the customer experience in order to protect their market position.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam pharmacy retail market with detailed profiles of all major companies, including:

- FPT Digital Retail Joint Stock Company

- ECO Pharma

- Pharmacity Pharmaceutical Joint Stock Company

- ABC Pharmacy

- Matsumoto Kiyoshi Vietnam Joint Stock Company

- An Khang Pharmacy

- Guardian Vietnam

Latest News and Developments:

- March 2025: GS25 and Dongwha Pharm launched Vietnam’s first convenience store-pharmacy shop-in-shop in Koh Kong City. The store combines food, beverages, and professional pharmacist services. Following a January MOU, the partners plan over 10 new locations in 2025 to expand healthcare access and retail presence across Vietnam.

- December 2024: RV Group introduced unit dosage formulations in Vietnam to enhance medication safety, accuracy, and convenience. Targeting Vietnam’s pharmacy retail sector, the innovation ensures pre-measured doses, reducing errors and augmenting trust. The initiative supports modern pharmacy retail trends and aims to improve nationwide access to safer medication practices.

- September 2024: Lotus Pharmaceutical acquired Alpha Choay from Sanofi, securing trademark, marketing rights, and know-how in Vietnam and Cambodia. This move strengthens Lotus's footprint in Vietnam's pharmacy retail market, adding a top-selling anti-inflammatory drug with 2023 sales exceeding USD 22 Million and expanding access through pharmacy channels nationwide.

- April 2024: FPT Retail announced plans to transform its Long Chau pharmacy chain into a full healthcare ecosystem. It aims to open 400 new pharmacies, 100 vaccination centers, clinics, hospitals, and launch homecare and insurance-linked medicine programs, expanding its dominant position in Vietnam’s fast-growing pharmacy retail market.

- August 2023: Dongwha Pharm announced a USD 30 Million acquisition of 51% shares in Vietnam’s Trung Son Pharma, which operates 140 pharmacy stores. The move strengthens Dongwha’s entry into Vietnam’s fragmented pharmacy retail market, aiming to expand Trung Son to 460 outlets and augment sales of OTC drugs and health products.

Vietnam Pharmacy Retail Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Market Structures Covered | Unorganized, Organized |

| Product Types Covered | Over-the-Counter Products, Prescribed Drugs, Non-Pharmaceutical Products, Medical Equipment |

| Therapeutic Areas Covered | Cardiovascular, Pain Relief/Analgesics, Vitamins/Minerals/Nutrients, Anti-Infective, Anti-Diabetic, Others |

| Drug Types Covered | Generic, Patented |

| Pharmacy Locations Covered | Street/Mall Based, Hospital Based |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | FPT Digital Retail Joint Stock Company, ECO Pharma, Pharmacity Pharmaceutical Joint Stock Company, ABC Pharmacy, Matsumoto Kiyoshi Vietnam Joint Stock Company, An Khang Pharmacy, Guardian Vietnam, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam pharmacy retail market from 2019-2033.

- The Vietnam pharmacy retail market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam pharmacy retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam pharmacy retail market was valued at USD 8.9 Billion in 2024.

The growth of the market is driven by rising health awareness, increasing disposable incomes, an aging population, and the expansion of modern retail chains. The growth of e-commerce and digital pharmacies, along with stricter regulations enhancing consumer trust, also contributes to market expansion. Increased foreign investment enhances product variety and service standards.

The Vietnam pharmacy retail market is projected to exhibit a CAGR of 6.7% during 2025-2033, reaching a value of USD 16.8 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)