Vietnam Payments Market Report by Mode of Payment (Point of Sale, Online Sale), End Use Industry (Retail, Entertainment, Healthcare, Hospitality, and Others), and Region 2026-2034

Market Overview:

Vietnam payments market size reached USD 17.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 37.2 Billion by 2034, exhibiting a growth rate (CAGR) of 8.96% during 2026-2034. The rapid digitization of the economy, implementation of favorable government initiatives, integration of contactless payment methods, increasing innovations in fintech services, burgeoning tourism sector, rising international transactions, and the growing business-to-business (B2B) payments represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 17.2 Billion |

|

Market Forecast in 2034

|

USD 37.2 Billion |

| Market Growth Rate 2026-2034 | 8.96% |

Access the full market insights report Request Sample

Payments are transactions that involve the transfer of funds from a payer to a payee, usually facilitated by various financial instruments. It is broadly classified into cash, electronic funds transfer (EFT), wire transfers, cryptocurrencies, and various types of cards, such as prepaid, debit, and credit cards. Payments can also be categorized by function into point-of-sale, online, and mobile payments. It is built on a robust and secure financial infrastructure comprising cryptographic algorithms for digital transactions and advanced polymers or metal threads for physical currency. Payments are integral to numerous applications, including e-commerce, in-store retail, utility bill payments, investment transactions, salaries, governmental transactions, healthcare services, tourism, and education. It offers various benefits, including convenience, speed, traceability, lower fraud risk, and greater financial inclusion. Moreover, payment provides multiple advantages, such as revenue generation through transaction fees, enhanced consumer engagement, and economic development.

Vietnam Payments Market Trends:

The rapid digitization of the economy, facilitating faster, safer, and more convenient transactions, is one of the major factors providing a considerable boost to the market growth. Moreover, the increasing focus by the government on modernizing its financial sector and cashless payments is positively impacting the market growth. In line with this, the widespread popularity of mobile payments and e-wallets, due to the high smartphone and internet penetration, is creating a positive outlook for the market growth. Along with this, the integration of contactless payments through near-field communication (NFC) and quick response (QR) codes, offering enhanced security features and expediting the transaction process, is acting as a growth-inducing factor. In confluence with this, the rising trend of integrating payments with other services, such as transport and e-commerce, that provide consumers with a seamless experience is supporting the market growth. In addition to this, the increasing need for secure and efficient methods for international fund transfers is favoring the market growth. Along with this, rapid innovations in fintech services, offering more accessible and cost-effective remittance solutions, are bolstering the market growth. Furthermore, the growing financial inclusion initiatives, bringing unbanked populations into the formal financial system that enlarges the user base for various payment methods, are positively influencing the market growth. Apart from this, the burgeoning tourism sector, which requires diversified payment options to cater to international visitors, is propelling the market growth. Moreover, the growing business-to-business (B2B) payments as companies look for automated, secure options that can handle large volumes and comply with regulatory requirements are providing remunerative growth opportunities for the market.

Vietnam Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on mode of payment and end use industry.

Mode of Payment Insights:

To get detailed segment analysis of this market Request Sample

- Point of Sale

- Card Payments

- Digital Wallet

- Cash

- Others

- Online Sale

- Card Payments

- Digital Wallet

- Others

The report has provided a detailed breakup and analysis of the market based on the mode of payment. This includes point of sale (card payments, digital wallet, cash, and others) and online sale (card payments, digital wallet, and others).

End Use Industry Insights:

- Retail

- Entertainment

- Healthcare

- Hospitality

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes retail, entertainment, healthcare, hospitality, and others.

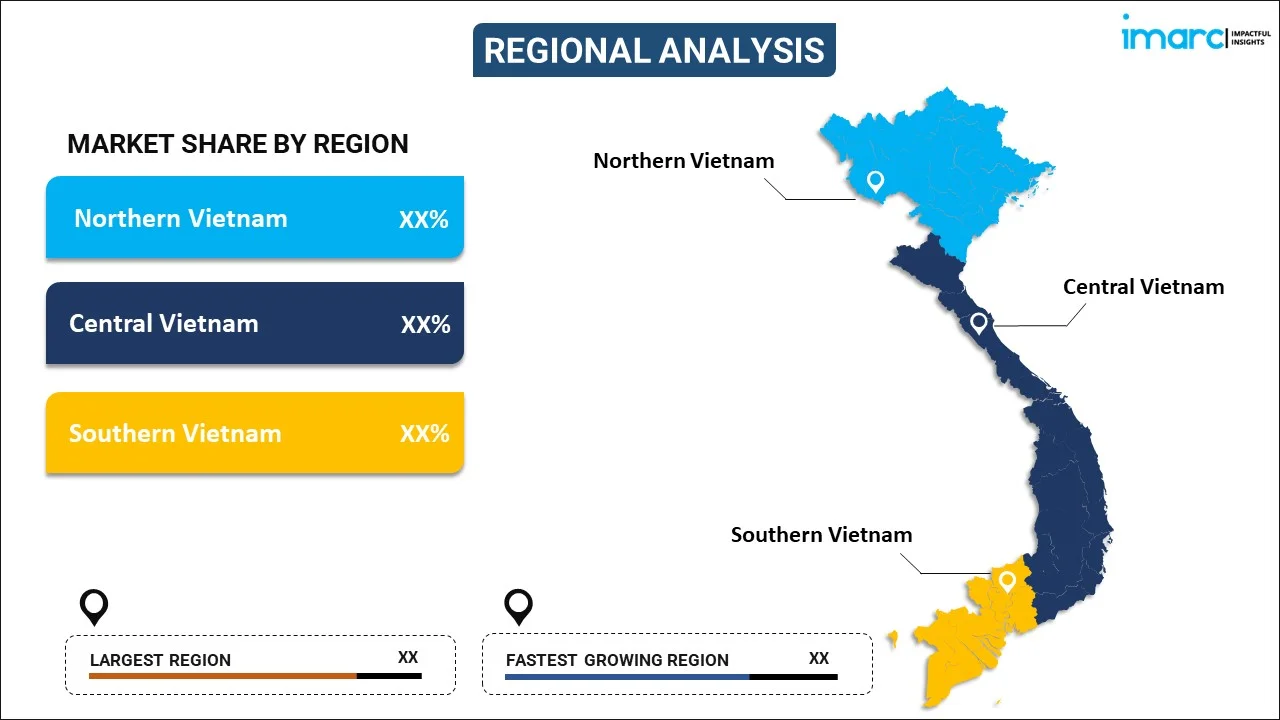

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Mode of Payments Covered |

|

| End Use Industries Covered | Retail, Entertainment, Healthcare, Hospitality, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam payments market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Vietnam payments market?

- What is the breakup of the Vietnam payments market on the basis of mode of payment?

- What is the breakup of the Vietnam payments market on the basis of end use industry?

- What are the various stages in the value chain of the Vietnam payments market?

- What are the key driving factors and challenges in the Vietnam payments?

- What is the structure of the Vietnam payments market and who are the key players?

- What is the degree of competition in the Vietnam payments market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam payments market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)