Vietnam Loan Insurance Market Size, Share, Trends and Forecast by Insurance Type, Coverage Type, Organization Size, Application, and Region, 2026-2034

Vietnam Loan Insurance Market Overview:

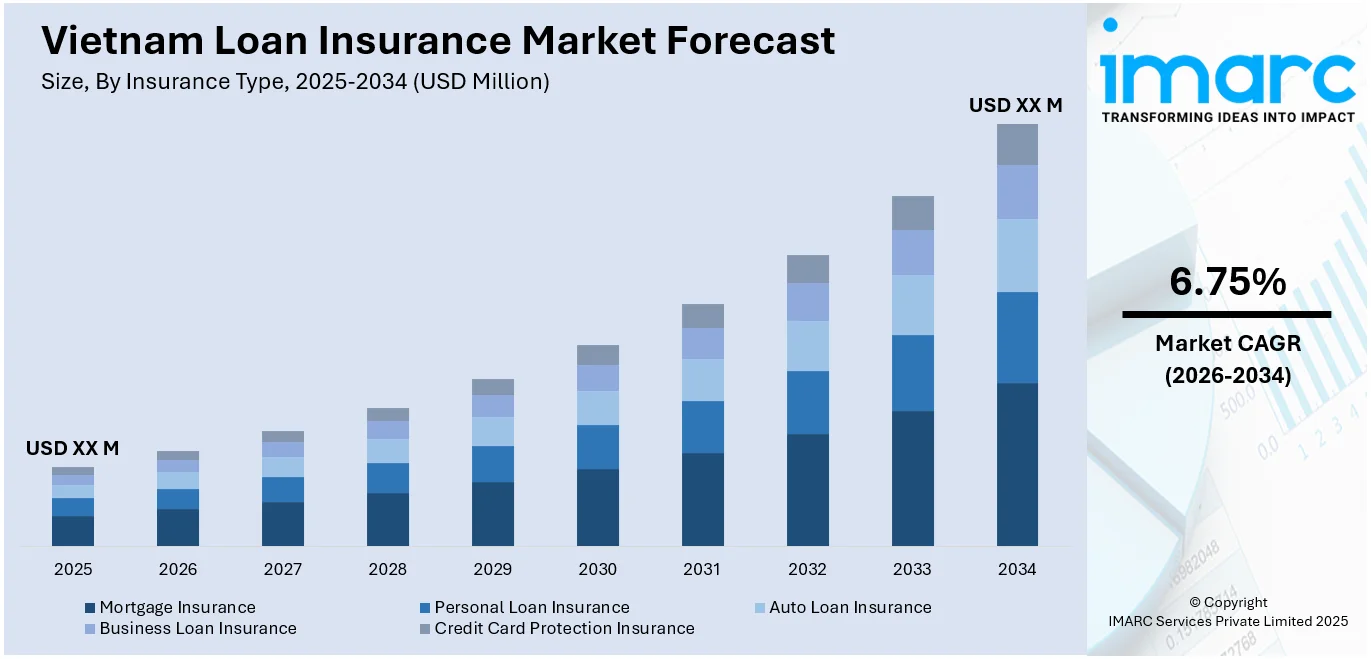

The Vietnam loan insurance market size is projected to exhibit a growth rate (CAGR) of 6.75% during 2026-2034. The market growth is driven by the expansion of the banking sector and targeted financial inclusion initiatives that increase access to credit and insurance among underserved populations, encourage competitive offerings, and promote safer, more diverse financial products across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Growth Rate (2026-2034) | 6.75% |

Vietnam Loan Insurance Market Trends:

Expansion of the Banking and Financial Services Sector

The loan insurance market in Vietnam is growing in step with the rapid development of its banking and financial services sector. The emergence of new banks and financial institutions is resulting in a broader array of financial products, increasing the accessibility and promotion of loan insurance. For instance, in 2025, Shinhan Bank Vietnam collaborated with Petrolimex Insurance Corporation (PJICO) to broaden financial and insurance offerings across the country. The partnership aims to distribute PJICO's non-life insurance offerings, such as vehicle, asset, and health protection. It similarly emphasizes PJICO for loans and refinancing, intending to improve client advantages and financial development. With growing competition, providers are presenting more appealing offers and incorporating insurance directly into lending packages to attract a wider range of clients. Organizations are also focusing on neglected segments, particularly in rural regions, by using microfinance companies, credit unions, and non-bank lenders, which are assisting in raising awareness and promoting the use of loan insurance. This wider access, along with a rise in credit activity, is catalyzing the demand for protective products that minimize risk for lenders and borrowers alike. The growth in the sector indicates a transition towards safer and more varied financial products.

To get more information on this market Request Sample

Emergence of Financial Inclusion Initiatives

Financial inclusion efforts in Vietnam are playing a key role in expanding the loan insurance market. These programs, often led by the government in collaboration with non-governmental organizations (NGOs) and financial institutions, are designed to bring formal financial services to segments of the population that have traditionally been excluded, including women, low-income households, and rural communities. As more people gain access to loans through these initiatives, the demand for loan insurance naturally increases, offering protection to borrowers who may be more financially vulnerable. Microfinance institutions and smaller banks are central to this progress, offering loan insurance options that align with the financial capacity and needs of these groups. By making insurance more accessible and better suited to underserved populations, financial inclusion programs are fostering a more secure borrowing environment and encouraging economic participation. This, in turn, is expanding the overall reach of the loan insurance market. In 2025, the US International Development Finance Corporation (DFC) approved a $100 million loan to SeABank to enhance financial inclusion and empower small businesses in Vietnam. This follows a $200 million loan in 2022, focusing on women entrepreneurs. DFC has committed over $737 million in investments to Vietnam, the largest in ASEAN, underscoring the importance of inclusive financial growth in driving insurance adoption.

Vietnam Loan Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on insurance type, coverage type, organization size, and application.

Insurance Type Insights:

- Mortgage Insurance

- Personal Loan Insurance

- Auto Loan Insurance

- Business Loan Insurance

- Credit Card Protection Insurance

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes mortgage insurance, personal loan insurance, auto loan insurance, business loan insurance, and credit card protection insurance.

Coverage Type Insights:

- Death and Disability Coverage

- Job Loss Protection

- Critical Illness Coverage

- Loan Repayment Assistance

A detailed breakup and analysis of the market based on the coverage type have also been provided in the report. This includes death and disability coverage, job loss protection, critical illness coverage, and loan repayment assistance.

Organization Size Insights:

- Individuals

- SMEs (Small & Medium Enterprises)

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes individuals, SMEs (small & medium enterprises), and large enterprises.

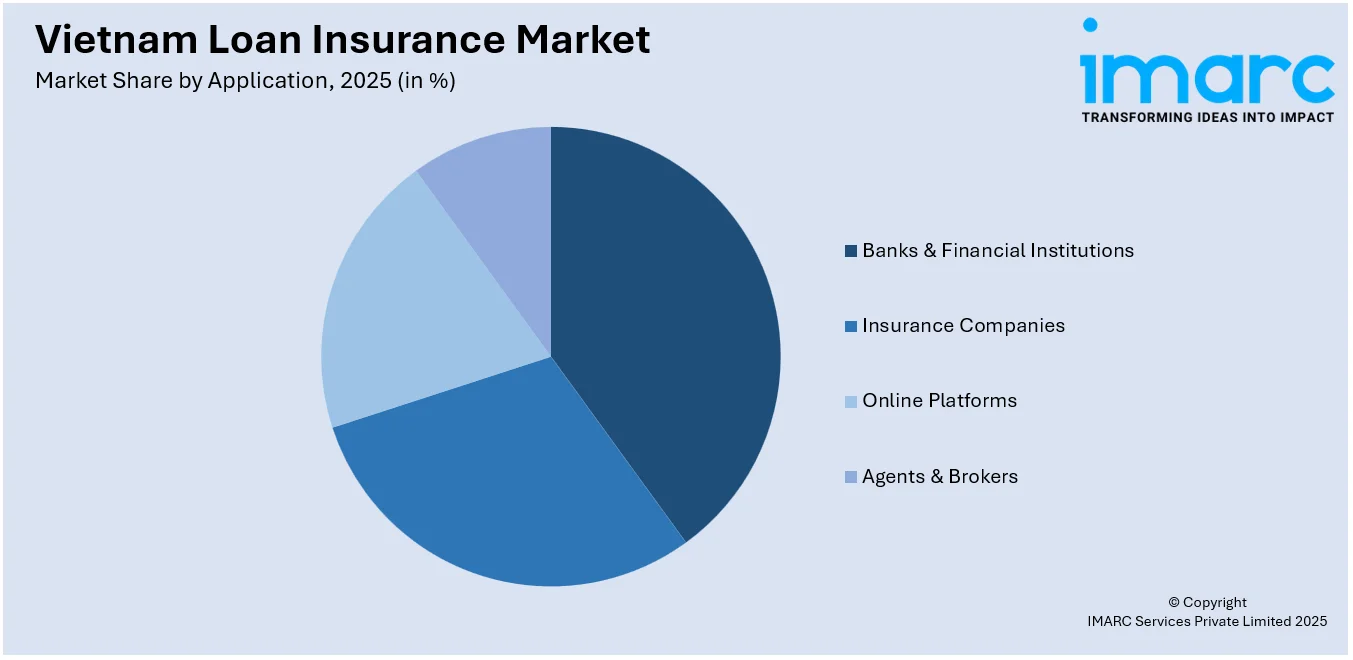

Application Insights:

Access the comprehensive market breakdown Request Sample

- Banks & Financial Institutions

- Insurance Companies

- Online Platforms

- Agents & Brokers

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes banks & financial institutions, insurance companies, online platforms, and agents & brokers.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Loan Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Mortgage Insurance, Personal Loan Insurance, Auto Loan Insurance, Business Loan Insurance, Credit Card Protection Insurance |

| Coverages Covered | Death and Disability Coverage, Job Loss Protection, Critical Illness Coverage, Loan Repayment Assistance |

| Organizations Covered | Individuals, SMEs (Small & Medium Enterprises), Large Enterprises |

| Applications Covered | Banks & Financial Institutions, Insurance Companies, Online Platforms, Agents & Brokers |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam loan insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam loan insurance market on the basis of insurance type?

- What is the breakup of the Vietnam loan insurance market on the basis of coverage type?

- What is the breakup of the Vietnam loan insurance market on the basis of organization size?

- What is the breakup of the Vietnam loan insurance market on the basis of application?

- What is the breakup of the Vietnam loan insurance market on the basis of region?

- What are the various stages in the value chain of the Vietnam loan insurance market?

- What are the key driving factors and challenges in the Vietnam loan insurance market?

- What is the structure of the Vietnam loan insurance market and who are the key players?

- What is the degree of competition in the Vietnam loan insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam loan insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam loan insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam loan insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)