Vietnam ICT Market Size, Share, Trends and Forecast by Type, Industry Vertical, and Region, 2026-2034

Vietnam ICT Market Size and Share:

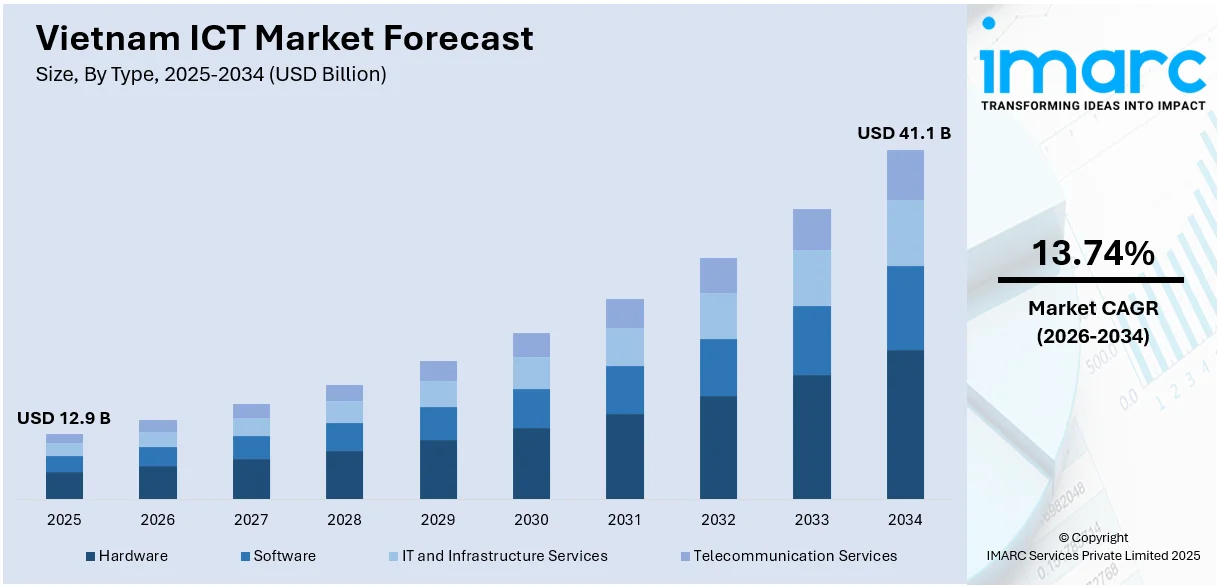

The Vietnam ICT market size was valued at USD 12.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 41.1 Billion by 2034, exhibiting a CAGR of 13.74% during 2026-2034. E-commerce expansion, digital payments, remote work, and rising cyber threats are key contributors of the market growth. Concurrent with this, rapid digital transformation, the dominance of hardware segment, and the rollout of 5G networks are driving the growth of Vietnam ICT market share. Further, the growing need to protect sensitive data and infrastructure is accelerating the development of this market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 12.9 Billion |

|

Market Forecast in 2034

|

USD 41.1 Billion |

| Market Growth Rate 2026-2034 | 13.74% |

The market is growing steadily due to strong government support for digital transformation, particularly in areas like e-governance, digital infrastructure, and smart cities. The rising demand for cloud services, cybersecurity, and enterprise software is being driven by the private sector’s shift toward digital tools. A young, tech-savvy population is accelerating growth in e-commerce, fintech, and online entertainment. Vietnam is also attracting global attention as a manufacturing and technology outsourcing destination, supported by skilled labor and competitive costs. Foreign investment is rising in electronics, semiconductors, and telecom infrastructure. Ongoing improvements in internet connectivity and data center development are making Vietnam a more attractive base for digital services and regional operations. Overall, public policy alignment, private innovation, and global integration are shaping the sector’s momentum.

To get more information on this market Request Sample

Vietnam is becoming a preferred destination for digital collaboration, with a strong supply of tech professionals and growing expertise in emerging technologies. Its expanding role in areas like AI, blockchain, and IoT is drawing attention from global players seeking reliable partners for innovation and scalable software development. For instance, in September 2024, the Vietnam ICT Service Conference in Hong Kong highlighted Vietnam’s growing tech sector as a solution to talent shortages. With 57,000 IT graduates annually, Vietnam is emerging as a key digital partner. Over 200 firms, including MOR Software and AMELA Technology, showcased strengths in AI, blockchain, and IoT, reinforcing Vietnam’s role in global ICT collaboration.

Vietnam ICT Market Trends:

Enhancing Access, Security, and AI Integration

Enterprises are increasingly embracing cloud computing for scalable data management and remote collaboration, while artificial intelligence is revolutionizing industries like healthcare, finance, and manufacturing through automation and predictive analytics. The country’s ICT sector is evolving rapidly, driven by transformative trends such as 5G adoption in Vietnam, cloud adoption, AI integration, and cybersecurity enhancement. For instance, in October 2024, Viettel launched Vietnam's first 5G network, marking a significant milestone in the ICT market. The 5G rollout, combined with 20 years of mobile service leadership, introduced ultra-low latency, advanced technology, and diverse industry applications, boosting digital infrastructure and enhancing connectivity across Vietnam. This development is expected to accelerate smart city projects and the deployment of IoT. Meanwhile, cybersecurity is becoming a top priority, with organizations investing in advanced threat detection and response systems to safeguard digital assets. These converging trends are not only modernizing Vietnam’s digital landscape but also positioning the country as a rising tech hub in Southeast Asia. As innovation continues to drive growth, Vietnam is poised to emerge as a competitive force in the global digital economy.

Widening Scope of Digital Adoption

Digital services are becoming more embedded in everyday life across Vietnam, reshaping how people work, shop, communicate, and access services. Online platforms are gaining traction across sectors, supported by growing internet access and a younger, tech-savvy population. As businesses and institutions shift toward digital-first approaches, there’s a broader move toward integrated systems, cloud-based tools, and mobile solutions. This shift is also prompting upgrades in infrastructure and a stronger push for innovation. The momentum signals a deepening reliance on digital channels, setting the stage for more connected and technology-driven experiences in the coming years. According to the International Trade Administration, Vietnam’s digital economy is projected to reach approximately USD 45 Billion by 2025 and could grow to between USD 90 Billion to USD 200 Billion by 2030.

Expanding Digital Participation and Innovation

Based on the Vietnam ICT market outlook, digital connectivity in Vietnam continues to deepen, with a growing share of the population actively online. Government-backed programs are playing a key role in encouraging broader adoption of digital tools and services. The focus on national digital transformation is prompting investment in online infrastructure, regulatory support, and digital literacy. This environment is also energizing local start-ups, especially in areas like financial services, online retail, and digital learning. With strong institutional backing and rising user engagement, digital platforms are becoming more integrated into everyday life, enabling new models of service delivery and business development across the country. For example, Freedom House reported that, at the start of 2024, Vietnam’s internet penetration rate stood at 79.1%. Government support through initiatives like the "National Digital Transformation Program" and a thriving start-up ecosystem fosters innovation in fintech, e-commerce, and edtech.

Rising Demand for Digital Infrastructure and Payments

The growth of online commerce in Vietnam is driving greater focus on strengthening digital systems and transaction security. As more consumers turn to digital platforms for shopping and services, the need for reliable internet connectivity, efficient data handling, and user-friendly payment gateways has become more pronounced. This shift is encouraging investment in ICT infrastructure, including cloud services, cybersecurity, and integrated logistics technologies. Businesses and service providers are adapting quickly to meet evolving digital expectations, signaling a broader push toward seamless, secure, and scalable digital operations that can support increasing online activity across sectors. For instance, the e-commerce sector in Vietnam reached a market value of USD 25 Billion in 2024, highlighting the need for robust ICT infrastructure and secure payment solutions.

Vietnam ICT Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam ICT market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and industry vertical.

Analysis by Type:

- Hardware

- Network Switches

- Routers and WLAN

- Servers and Storage

- Others

- Software

- IT and Infrastructure Services

- Telecommunication Services

Based on Vietnam ICT market forecast, the hardware segment is expanding due to rising demand for consumer electronics, enterprise computing systems, and telecommunications infrastructure, supported by foreign investments in local manufacturing. The government’s push for digital transformation in education, healthcare, and public services has further accelerated this growth. On the software side, demand for enterprise solutions, cloud services, and cybersecurity tools is increasing, driven by digitalization among small and medium enterprises and the fintech boom. Vietnam’s focus on smart cities and e-government platforms also fuels software adoption. Together, these segments are creating a balanced demand across ICT infrastructure and solutions, making them central to the market’s upward trajectory.

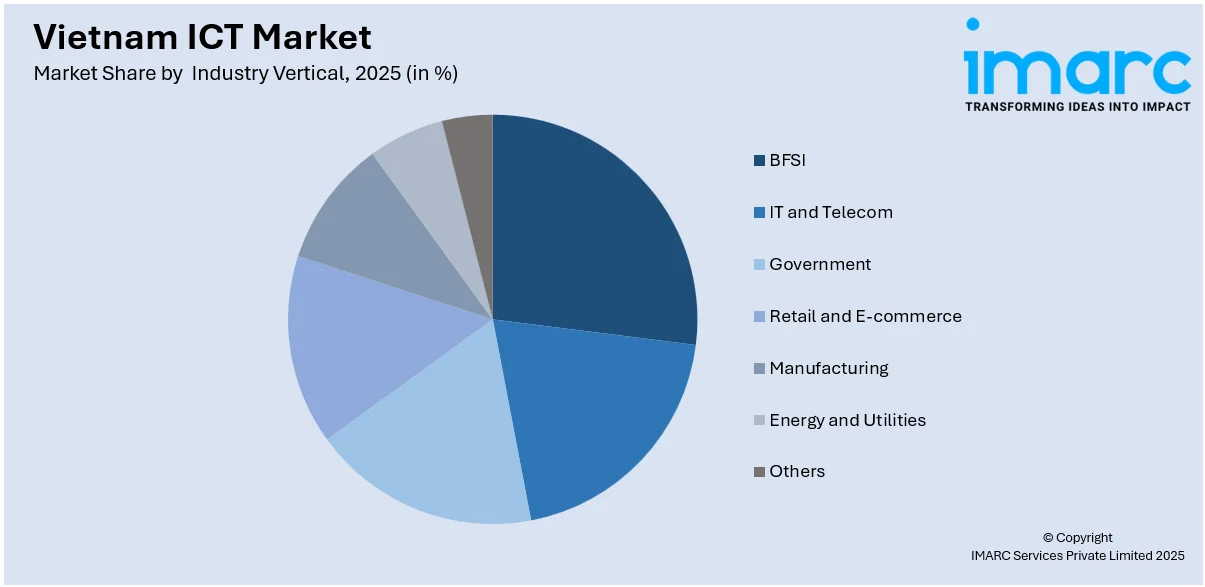

Analysis by Industry Vertical:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Government

- Retail and E-commerce

- Manufacturing

- Energy and Utilities

- Others

As per Vietnam ICT market analysis, the BFSI segment is rapidly adopting digital banking, mobile payments, and AI-driven financial services to meet the rising demand for contactless and efficient transactions. This shift is fueling investment in secure cloud infrastructure, analytics, and cybersecurity. Meanwhile, the IT and Telecom sector is expanding with growing internet penetration, 5G rollout, and increased demand for data centers and network upgrades. The surge in remote work and digital platforms has further accelerated ICT spending in these sectors. Their combined push for modernization and service innovation is boosting demand for ICT solutions, making them central contributors to the market’s ongoing expansion.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam, especially Hanoi, benefits from strong government support, a concentration of tech startups, and major public investments in smart city initiatives and digital infrastructure. The presence of numerous universities and research institutes also supports a skilled workforce pipeline. Central Vietnam, led by cities like Da Nang, is emerging as a technology hub with a growing number of IT parks and software export zones. The region is attracting both domestic and foreign firms due to its favorable business environment and improved connectivity. Together, these regions are fostering digital adoption, infrastructure expansion, and tech innovation, significantly contributing to the Vietnam ICT market growth.

Competitive Landscape:

Vietnam's ICT sector is experiencing significant momentum, driven by government-led digital transformation programs and a surge in private sector innovation. Key developments include the establishment of AI research centers, expansion of 5G infrastructure, and increased focus on cloud computing and cybersecurity. Collaborations between domestic and international entities are fostering advancements in areas like fintech, e-commerce, and smart city technologies. Government initiatives are also promoting the integration of emerging technologies such as AI and IoT across various industries. Among these activities, partnerships and collaborative agreements are particularly prevalent, serving as a common practice to accelerate technological adoption and innovation in the market.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam ICT market with detailed profiles of all major companies, including:

- Microsoft Corporation

- Cisco Systems Inc.

- Oracle Corporation

- VMware, Inc.

- SAP SE

- Dell Technologies

- HP Inc.

- IBM Corporation

- Viettel

- Qualcomm Technologies, Inc.

Latest News and Developments:

- March 2025: FPT showcased advanced AI and semiconductor technologies at AISC 2025 in Hanoi, boosting Vietnam’s ICT sector. The innovations in smart manufacturing, automotive AI, and chip design strengthened digital infrastructure and positioned Vietnam as a rising hub for next-gen computing.

- March 2025: Viettel High Tech began 5G equipment trials with UAE-based telecom operator du, marking a strategic ICT development for Vietnam. This initiative supported smart cities, industrial IoT, and VR/AR, enhancing Vietnam’s global tech presence and accelerating regional digital transformation.

- March 2025: MobiFone launched its 5G mobile services in Vietnam, becoming the country’s third provider to do so. Initially available in major cities, the service featured speeds up to 1.5 Gbps.

- February 2025: BBIX and CMC Telecom launched two Internet Exchange (IX) points in Hanoi and Ho Chi Minh City. This ICT development enhanced Vietnam’s digital infrastructure, improving internet speed, reliability, and regional connectivity, and supported the country’s ambition to become a Southeast Asian data hub.

- January 2025: Singapore-based fintech firm ROSHI announced that it would be entering Vietnam's lending market with its AI-driven platform, marking its first international expansion. Initially focusing on consumer financing products, ROSHI plans to expand its offerings based on market demand and regulatory frameworks.

- January 2025: Vietcombank launched the VCB CashUp mobile app for corporate customers to improve financial management with features like biometric login, two-factor authentication, real-time transaction tracking, and cross-device synchronization.

- December 2024: NVIDIA opened its first R&D center in Vietnam to support AI development, partnering with the government to foster innovation. The center focused on software development and collaboration with startups, universities, and agencies.

- December 2024: Google announced that it would officially launch Google Vietnam Co., Ltd. in Ho Chi Minh City in 2025, marking a significant milestone in the country's ICT sector. This local entity will assume responsibilities from Google Asia Pacific, including managing advertising contracts, issuing service invoices, and processing payments

Vietnam ICT Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Industry Verticals Covered | BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | Microsoft Corporation, Cisco Systems Inc., Oracle Corporation, VMware, Inc., SAP SE, Dell Technologies, HP Inc., IBM Corporation, Viettel, Qualcomm Technologies, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 9-11 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam ICT market from 2020-2034.

- The Vietnam ICT market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam ICT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ICT market in Vietnam was valued at USD 12.9 Billion in 2025.

The Vietnam ICT market is projected to grow at a CAGR of 13.74% during 2026-2034.

Key factors driving Vietnam’s ICT market include rapid digital transformation, 5G deployment, AI and semiconductor innovation, cloud adoption, strong government support, foreign investment, and growing demand for smart infrastructure. These elements collectively enhance connectivity, boost productivity, and position Vietnam as a regional tech hub.

COVID-19 accelerated digital transformation in Vietnam's ICT market, boosting demand for remote work solutions, e-commerce, and cloud services. The pandemic also highlighted gaps in cybersecurity and digital infrastructure, prompting increased investment in these areas to support a more resilient economy.

Based on the type, the Vietnam ICT market has been segmented into hardware, software, IT and infrastructure services, and telecommunication services.

Based on the industry vertical, the Vietnam ICT market has been segmented into BFSI, IT and telecom, government, retail and e-commerce, manufacturing, energy and utilities, and others.

On a regional level, the Vietnam ICT market has been segmented into Northern Vietnam, Central Vietnam, and Southern Vietnam.

Some of the major players in the Vietnam ICT market include Microsoft Corporation, Cisco Systems Inc., Oracle Corporation, VMware, Inc., SAP SE, Dell Technologies, HP Inc., IBM Corporation, Viettel, Qualcomm Technologies, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)