Vietnam Food Service Market Size, Share, Trends and Forecast by Foodservice Type, Outlet, Location, and Region, 2026-2034

Vietnam Food Service Market Summary:

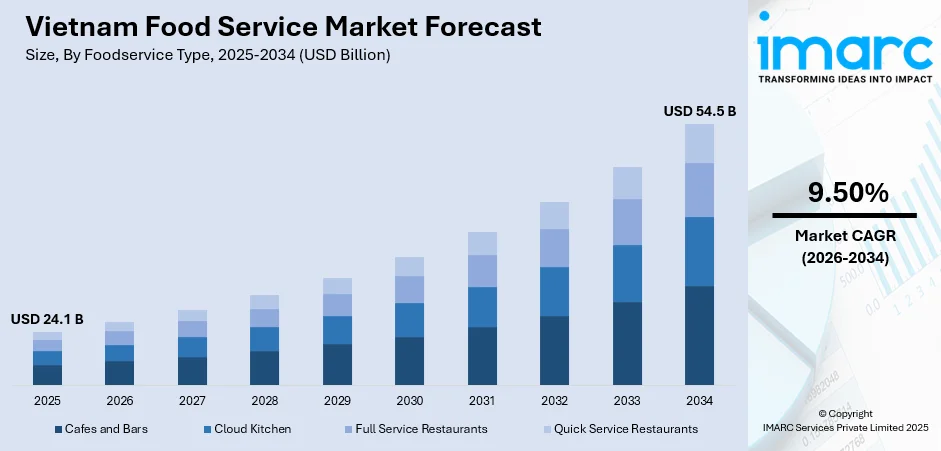

The Vietnam food service market size was valued at USD 24.1 Billion in 2025 and is projected to reach USD 54.5 Billion by 2034, growing at a compound annual growth rate of 9.50% from 2026-2034.

The Vietnam food service market is experiencing stable expansion driven by evolving consumer dining preferences, urbanization trends, and increasing tourism activities. Full-service restaurants continue to dominate the landscape as Vietnamese consumers prioritize experiential dining and social gatherings. The proliferation of digital ordering platforms and growing demand for diverse culinary experiences are reshaping industry dynamics and strengthening the Vietnam food service market share.

Key Takeaways and Insights:

-

By Foodservice type: Full service restaurants dominate the market with a share of 41% in 2025, owing to Vietnamese consumers' strong preference for experiential dining that combines quality food with social interaction opportunities. Rising disposable incomes and cultural emphasis on communal meals continue driving segment expansion.

-

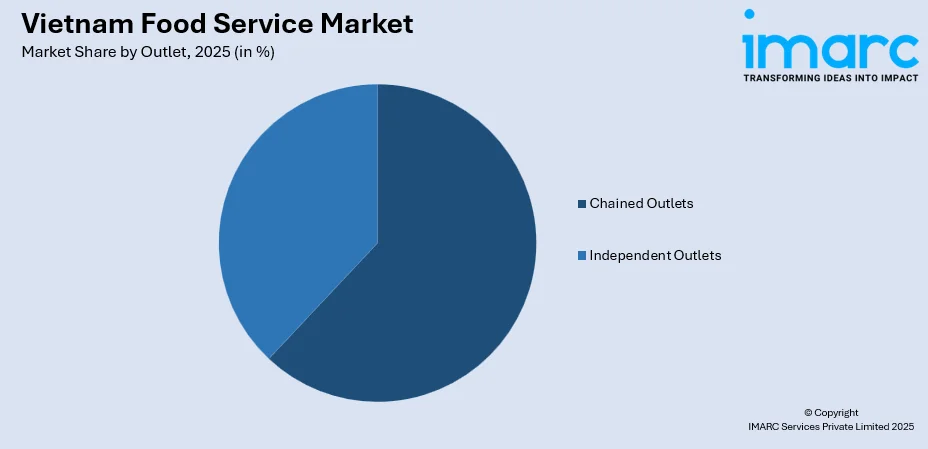

By Outlet: Chained outlets lead the market with a share of 62% in 2025. This dominance is driven by standardized operations, consistent food quality assurance, centralized purchasing advantages, and strong brand recognition that resonates with safety-conscious consumers seeking reliable dining experiences.

-

By Location: Standalone exhibits a clear dominance in the market with 29% share in 2025, reflecting Vietnam's deeply embedded street-food heritage and cultural identity. Neighborhood-based dining establishments serve as community pillars offering authentic culinary experiences that resonate with residents and visitors alike.

-

By Region: Northern Vietnam is the largest region with 35% share in 2025, driven by Hanoi's position as the capital city with concentrated economic activities, growing international tourism arrivals, and expanding middle-class population demanding diverse culinary offerings and premium dining experiences.

-

Key Players: Key players drive the Vietnam food service market by expanding restaurant portfolios, enhancing service quality standards, and strengthening nationwide distribution networks. Their investments in digital transformation, menu innovation, and strategic partnerships boost consumer engagement and accelerate market penetration across diverse dining segments. Some of the key players operating in the market include Golden Gate JSC, Jollibee Foods Corporation, Lotte GRS Co. Ltd, The Al Fresco's Group Vietnam, Yum! Brands Inc., Lotteria Vietnam Co., Ltd, Imex Pan Pacific Group, Mesa Asia Pacific Trading Services Company Ltd, Restaurant Brands International, Inc. and AFG Vietnam.

To get more information on this market Request Sample

The Vietnam food service market is advancing as consumers embrace diverse dining formats ranging from traditional full-service restaurants to innovative cloud kitchens. By greatly increasing market accessibility through improved transit networks and strategic commercial real estate development, rapid urbanization is changing the foodservice industry. The government's strategic implementation of tax relief measures has provided essential financial support to foodservice operators managing increased input costs. Tourism recovery continues strengthening market fundamentals, with Vietnam welcoming over 17.5 Million international visitors in 2024, representing a significant increase from previous years and approaching pre-pandemic peak levels. This tourism resurgence drives renewed spending across restaurants, cafes, and food delivery platforms. Digital transformation has emerged as a significant growth driver, with cashless payments expanding rapidly while QR code payment systems have become standard features across urban establishments. Vietnamese consumers dedicate substantial portions of household income to food and beverages, ranging from twenty to forty-eight percent monthly, supporting continued Vietnam food service market growth.

Vietnam Food Service Market Trends:

Digital Transformation and Online Food Ordering Expansion

The Vietnam food service market is witnessing accelerated digital adoption as consumers increasingly embrace online ordering platforms and mobile applications for meal procurement. Due to their convenience and wide menu selection, food delivery services have grown to be essential parts of the eating experience. Restaurants are investing in digital infrastructure improvements, including user-friendly applications, efficient delivery systems, and enhanced customer service capabilities. This digital shift is influencing menu optimization for delivery formats, ensuring food quality and appropriate packaging that withstands transit. The growing preference for contactless transactions and app-based ordering continues reshaping operational strategies across urban foodservice establishments.

Rise of Cloud Kitchens and Virtual Restaurant Concepts

Cloud kitchens are experiencing rapid expansion across Vietnam as their business model requires lower capital investment while meeting growing demand for food delivery services. These delivery-only facilities eliminate the need for dine-in spaces, streamlining operational costs and enabling competitive pricing strategies. The innovative model aligns with modern consumer demands for convenience, speed, and culinary variety. Multi-brand cloud kitchen operations allow culinary entrepreneurs to leverage existing kitchen infrastructure for operating distinct food concepts simultaneously. This strategic adoption enhances overall flexibility and adaptability within the online food delivery ecosystem supporting Vietnam food service market growth.

Growing Consumer Demand for Premium and International Dining Experiences

Vietnamese consumers are increasingly seeking elevated dining experiences that combine quality cuisines with exceptional service standards. Higher-income demographics are driving demand for international flavors ranging from Korean barbeque and Japanese hotpot to European fine dining concepts. In order to satisfy changing premium tastes, upscale coffee shops, specialty tea houses, and branded restaurant chains are growing quickly. Health and wellness considerations are shaping menu preferences, with consumers seeking low-sugar options, organic produce, and nutrient-rich food offerings. This premiumization trend reflects growing sophistication among Vietnamese diners who prioritize experiential dining over basic sustenance.

Market Outlook 2026-2034:

The Vietnam food service market outlook remains positive as fundamental growth drivers including urbanization, tourism expansion, and rising consumer spending continue strengthening industry prospects. Government initiatives supporting the hospitality sector through favorable policies and infrastructure investments are creating an enabling environment for market participants. The market generated a revenue of USD 24.1 Billion in 2025 and is projected to reach a revenue of USD 54.5 Billion by 2034, growing at a compound annual growth rate of 9.50% from 2026-2034. Quick-service restaurants and coffee chains represent fastest-growing segments catering to both domestic consumers and international visitors. Sustainability practices are gaining prominence as establishments adopt eco-friendly operations responding to environmentally conscious consumer preferences. Continued foreign direct investment inflows and strategic partnerships between domestic and international operators will further accelerate market development and expansion across secondary cities.

Vietnam Food Service Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Foodservice Type | Full Service Restaurants | 41% |

| Outlet | Chained Outlets | 62% |

| Location | Standalone | 29% |

| Region | Northern Vietnam | 35% |

Foodservice Type Insights:

- Cafes and Bars

- Bars and Pubs

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- Cloud Kitchen

- Full Service Restaurants

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- Quick Service Restaurants

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

Full service restaurants dominate with a market share of 41% of the total Vietnam food service market in 2025.

Full-service restaurants maintain market leadership by offering complete dining experiences that successfully combine high-quality food offerings with opportunities for social gatherings in pleasant environments. Vietnamese consumers consistently choose establishments that provide table service and diverse menu selections spanning breakfast, lunch, and dinner options. The segment benefits from cultural traditions emphasizing communal dining and family gatherings where multiple generations share meals together. Asian full-service restaurants hold prominent positions due to widespread utilization of familiar ingredients and cooking styles that resonate with local preferences for authentic culinary experiences reflecting regional heritage.

The Michelin Guide Vietnam 2025 edition recognized nine one-star restaurants across Hanoi, Ho Chi Minh City, and Da Nang, underscoring the growing sophistication of Vietnam's full-service dining scene. Within urban locations, Korean and Japanese restaurants demonstrate strong performance, while Vietnamese regional cuisines remain successful across all restaurant categories. Premium dining concepts continue gaining traction as higher-income demographics seek elevated culinary experiences combining international flavors with exceptional service standards and refined ambiance that distinguish upscale establishments from casual alternatives.

Outlet Insights:

Access the comprehensive market breakdown Request Sample

- Chained Outlets

- Independent Outlets

Chained outlets lead with a share of 62% of the total Vietnam food service market in 2025.

Chained outlets are gaining significant momentum across Vietnam, thereby leveraging advantages in standardized operations, centralized purchasing capabilities, and strong brand recognition that resonates with quality-conscious consumers. The franchise business model has become increasingly attractive as it combines benefits of rapid expansion while preserving local ownership structures. Vietnamese consumers are expressing heightened concerns about food safety, driving preference for chain establishments that implement stringent quality control protocols. These standardized operations ensure consistent dining experiences across multiple locations, building consumer trust and loyalty through reliable food quality assurance.

Jollibee Foods Corporation opened its two-hundredth store in Vietnam in December 2024 at Ho Chi Minh City, making Vietnam the brand's largest international market outside the Philippines. Local brands like Trung Nguyen E-Coffee have set ambitious targets exceeding three thousand stores, while international players including Minor Food Group aim to double their footprint to exceed two hundred outlets by 2026. This expansion reflects growing consumer preference for branded dining experiences.

Location Insights:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

The standalone exhibits a clear dominance with a 29% share of the total Vietnam food service market in 2025.

Standalone locations underscore Vietnam's deeply embedded street-food heritage and cultural identity that has evolved over generations. These neighborhood-based dining establishments serve as vital community pillars, offering authentic culinary experiences that resonate with both local residents and international visitors seeking genuine Vietnamese flavors. The prevalence of standalone operations reflects time-honored traditions where recipes and cooking techniques have been carefully preserved and transmitted across generations. Independent proprietors maintain authentic character through personalized service and specialized menus that distinguish their offerings from standardized chain alternatives.

The Michelin Guide Vietnam 2025 selection includes sixty-three Bib Gourmand establishments, many of which are standalone street food venues and local eateries honored for providing quality food at moderate prices. Standalone operators benefit from lower overhead costs through reduced rental expenses, particularly family-owned establishments operating from residential properties. Urban migration continues creating demand for neighborhood dining options that provide convenient meal solutions for busy professionals and families. The flexibility of standalone operators enables rapid adaptation to evolving consumer preferences and local taste preferences that larger chains cannot easily replicate.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam represents the leading segment with a 35% share of the total Vietnam food service market in 2025.

Northern Vietnam maintains market leadership driven by Hanoi's position as the national capital with concentrated economic activities and government institutions that attract business travelers and domestic visitors throughout the year. The region continues experiencing strong growth in international tourist arrivals, with cultural tourism products, night tourism initiatives, and heritage experience tours extending visitor stays and increasing dining expenditures across restaurants and cafes throughout the capital region. The concentration of diplomatic missions, corporate headquarters, and educational institutions creates sustained demand for diverse foodservice offerings ranging from casual dining to premium restaurant experiences.

Northern Vietnam benefits from well-developed transportation infrastructure connecting major population centers, facilitating convenient access to dining establishments across urban and suburban areas. The region's distinct culinary traditions featuring refined flavors and sophisticated preparation techniques attract food enthusiasts seeking authentic northern Vietnamese cuisine. Growing middle-class populations in secondary cities surrounding Hanoi are expanding market opportunities beyond the capital, while continued infrastructure investments enhance connectivity and support foodservice industry expansion throughout the northern region.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Food Service Market Growing?

Rising Tourism and Resurgence of International Visitor Arrivals

The Vietnam food service market is experiencing significant growth driven by the remarkable recovery of international tourism following favorable visa policy reforms and effective promotional campaigns. The extension of electronic visa validity to ninety days for citizens of all countries and territories has streamlined entry procedures, while visa exemptions extended to forty-five days for citizens of twenty-four countries have substantially boosted arrivals. International tourists consistently seek authentic and diverse dining experiences, directly benefiting restaurants, cafes, and food delivery platforms across major tourist destinations. The accommodation and food services sector continues posting strong revenue growth, with tourism revenue reaching impressive figures during peak travel seasons. Popular destinations including Hanoi, Ho Chi Minh City, Da Nang, and Phu Quoc report sustained increases in international arrivals, building solid foundations for food service expansion. Vietnam's recognition through multiple World Travel Awards as a leading culinary destination further strengthens tourism-driven demand for diverse dining experiences.

Urbanization and Expanding Middle-Class Consumer Base

Rapid urbanization is fundamentally transforming Vietnam's foodservice landscape by improving market accessibility through enhanced transportation networks and strategic commercial real estate development. The expanding middle class represents a powerful consumption engine. Higher disposable incomes translate to increased dining-out frequency, with surveys indicating nearly seventy percent of individuals dined out on weekends during recent periods. Urban consumers demonstrate growing sophistication in dining preferences, seeking diverse culinary experiences ranging from traditional street food to premium international cuisines. The average monthly income per person in urban areas reached significantly higher levels compared to rural areas, enabling increased expenditure on food and beverage consumption outside the home.

Digital Payment Adoption and Technology Integration

Digital transformation has emerged as a significant growth driver for the Vietnam food service market, with technology adoption reshaping consumer engagement and operational efficiency across the industry. The widespread adoption of smartphones, with penetration rates exceeding eighty-seven percent among the population, has significantly propelled growth of online food delivery services and cloud kitchen operations. QR code payment systems have become standard features across urban establishments, facilitating convenient and contactless transactions that appeal to tech-savvy consumers. Food delivery platforms have become integral to dining experiences, offering convenience and extensive menu variety. Vietnam's online food delivery market is experiencing remarkable growth, driven by changing consumer habits and increased mobile application usage. Restaurants are increasingly partnering with digital platforms to expand reach and cater to evolving consumer behaviors, investing in digital infrastructure improvements to remain competitive in the rapidly evolving marketplace.

Market Restraints:

What Challenges the Vietnam Food Service Market is Facing?

Intense Market Competition and Margin Pressure

The Vietnam food service market faces heightened competition from rapidly scaling domestic and international chains, combined with rising ingredient and operational costs that pressure profit margins. Independent operators struggle to compete against established brands leveraging extensive resources, centralized purchasing power, and brand recognition advantages. Price wars among delivery platforms and promotional discounting strategies further compress margins, making it challenging for smaller establishments to maintain profitability while delivering quality dining experiences.

Food Safety and Regulatory Compliance Challenges

Vietnam's food service sector grapples with persistent food safety challenges, with concerns raised about bacterial contamination, pesticide overuse, and oversight of imported ingredients. Maintaining stringent food safety and hygiene standards across extensive supply chains requires substantial investment in quality control systems and staff training. Evolving regulatory requirements demand continuous adaptation, while compliance costs burden smaller operators lacking resources to implement comprehensive food safety management protocols throughout their operations.

Rising Operational Costs and Labor Market Pressures

Food service operators face mounting challenges from rising operational costs including labor expenses, rental rates in prime locations, and ingredient procurement costs. Minimum wage increases pressure labor-intensive restaurant operations, while competition for skilled culinary and service staff intensifies across major urban centers. Supply chain disruptions and input cost volatility affect pricing strategies, requiring operators to balance affordability expectations with sustainable business operations amid ongoing inflationary pressures affecting the broader economy.

Competitive Landscape:

The Vietnam food service market remains highly competitive with both domestic and international players actively expanding their presence across the country. Market participants are focusing on diversifying restaurant concepts, improving service quality standards, and enhancing operational efficiency to attract broader customer bases. Competition is increasingly driven by investments in digital transformation, delivery infrastructure, and localized menu innovations that resonate with Vietnamese consumer preferences. Strategic partnerships between technology platforms and restaurant operators are fostering innovation while accelerating product launches and improving after-sales support capabilities. Franchise models have gained traction as they combine rapid expansion benefits with local ownership structures, enabling brands to achieve nationwide coverage efficiently. Leading operators are investing in commissary facilities and centralized kitchen operations to support ambitious store expansion plans while maintaining consistent food quality standards. The competitive environment encourages continuous refinement of business strategies as market players seek to strengthen their positions and capitalize on Vietnam's growing demand for diverse and quality dining experiences.

Some of the key players include:

- Golden Gate JSC

- Jollibee Foods Corporation

- Lotte GRS Co. Ltd

- The Al Fresco's Group Vietnam

- Yum! Brands Inc.

- Lotteria Vietnam Co., Ltd

- Imex Pan Pacific Group

- Mesa Asia Pacific Trading Services Company Ltd

- Restaurant Brands International, Inc.

- AFG Vietnam

Vietnam Food Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Vietnam Food Service Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Foodservice Types Covered |

|

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | Golden Gate JSC, Jollibee Foods Corporation, Lotte GRS Co. Ltd, The Al Fresco's Group Vietnam, Yum! Brands Inc., Lotteria Vietnam Co., Ltd, Imex Pan Pacific Group, Mesa Asia Pacific Trading Services Company Ltd, Restaurant Brands International, Inc., AFG Vietnam, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam food service market size was valued at USD 24.1 Billion in 2025.

The Vietnam food service market is expected to grow at a compound annual growth rate of 9.50% from 2026-2034 to reach USD 54.5 Billion by 2034.

Full service restaurants dominated the market with a share of 41%, driven by Vietnamese consumers' strong preference for experiential dining that combines quality food offerings with social gathering opportunities in pleasant environments.

Key factors driving the Vietnam food service market include rising international tourism arrivals, rapid urbanization and expanding middle-class consumer base, digital payment adoption, growing demand for diverse dining experiences, and favorable government policies supporting the hospitality sector.

Major challenges include intense market competition and margin pressure, food safety and regulatory compliance requirements, rising operational and labor costs, supply chain disruptions, and the need for continuous digital transformation investments to remain competitive.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)