Vietnam Electric Car Market Size, Share, Trends and Forecast by Type, Vehicle Class, Drive Type, and Region, 2026-2034

Vietnam Electric Car Market Summary:

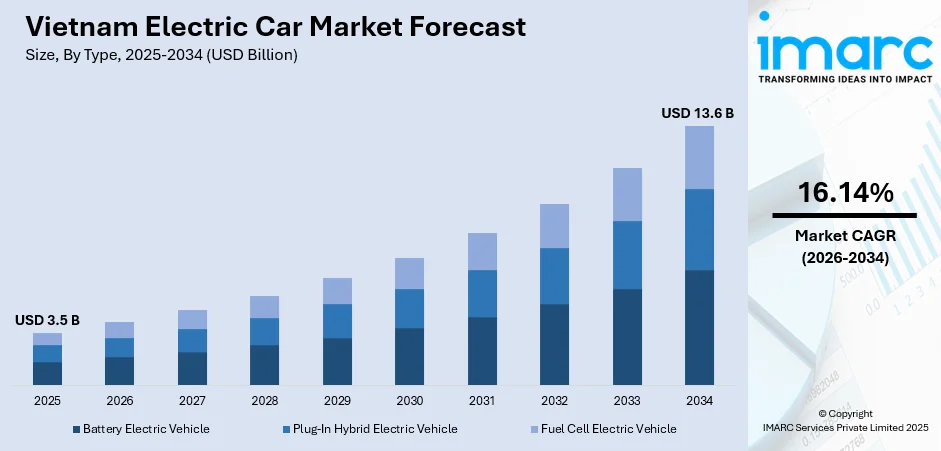

The Vietnam electric car market size was valued at USD 3.5 Billion in 2025 and is projected to reach USD 13.6 Billion by 2034, growing at a compound annual growth rate of 16.14% from 2026-2034.

The market is driven by an increasing environmental consciousness among urban consumers, supportive government policies including tax exemptions and registration fee waivers, expanding charging infrastructure across major cities, and rising fuel costs that enhance the total cost of ownership benefits of electric vehicles (EVs). Growing middle-class population and improved EV affordability further accelerate adoption, strengthening the Vietnam electric car market share.

Key Takeaways and Insights:

-

By Type: Battery electric vehicle dominates the market with a share of 58.03% in 2025, driven by government incentives prioritizing pure electric powertrains, zero registration fees, and expanding dedicated charging networks.

-

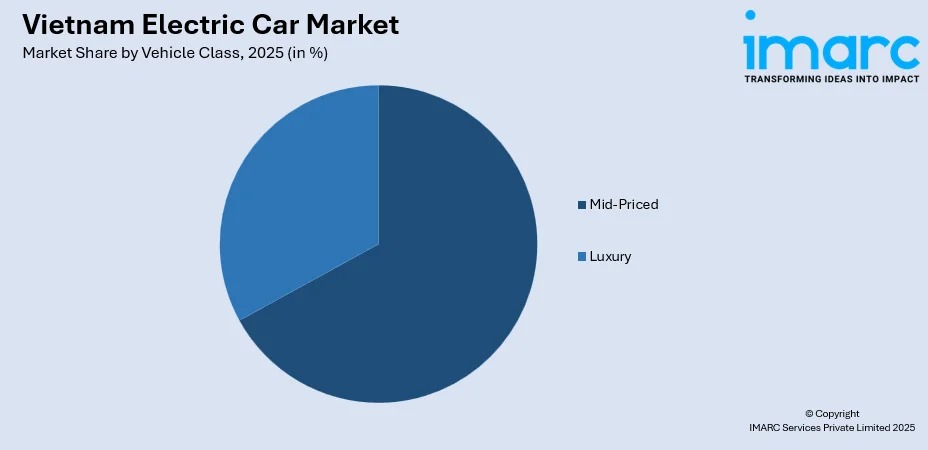

By Vehicle Class: Mid-priced leads the market with a share of 67.01% in 2025, owing to accessibility for the expanding middle-class population and optimal balance between affordability and practical features.

-

By Drive Type: Front wheel drive represents the largest segment with a market share of 50.06% in 2025, driven by lower manufacturing complexity, competitive pricing, superior energy efficiency, and suitability for Vietnamese road infrastructure.

-

By Region: Southern Vietnam dominates the market with a share of 48.4% in 2025, owing to economic concentration in Ho Chi Minh City, higher disposable incomes, and advanced charging infrastructure development.

-

Key Players: The Vietnam electric car market exhibits a dynamic competitive landscape with domestic manufacturers establishing strong market presence alongside international automotive corporations entering the segment. Market participants compete through product diversification, pricing strategies, charging infrastructure investments, and strategic partnerships with ride-hailing and fleet operators.

To get more information on this market Request Sample

The Vietnam electric car market is experiencing robust expansion fueled by a confluence of favorable factors that are reshaping the country's automotive landscape. Government commitment to carbon neutrality by mid-century has translated into comprehensive policy support encompassing tax incentives, registration fee exemptions, and infrastructure development initiatives. Rising urbanization in major metropolitan areas creates pressing demand for sustainable transportation solutions that address air quality concerns and traffic congestion. The growing middle-class population with increasing purchasing power demonstrates heightened environmental awareness and preference for technologically advanced vehicles. Additionally, escalating fuel costs enhance the economic appeal of EVs by significantly reducing operational expenses compared to conventional internal combustion engine alternatives. The development of domestic manufacturing capabilities has improved vehicle availability and affordability while strengthening consumer confidence in after-sales support and service networks. As per sources, in June 2025, VinFast inaugurated its Hà Tĩnh electric vehicle (EV) manufacturing plant, featuring 200,000 vehicles annual capacity, strengthening domestic EV production and supporting Vietnam’s electric mobility transition.

Vietnam Electric Car Market Trends:

Accelerating Urban Charging Infrastructure Development

Vietnam is witnessing unprecedented expansion of electric vehicle (EV) charging networks across major urban centers and intercity corridors. Metropolitan areas are prioritizing the installation of public charging stations at commercial complexes, residential developments, and transportation hubs to address range anxiety concerns. According to sources, V-Green opened Hanoi’s largest fast-charging station with 42 units of 120 kW DC chargers, enabling 84 EVs to charge simultaneously, strengthening Vietnam’s urban EV infrastructure. Moreover, the integration of fast charging technology enables convenient top-ups during shopping or dining activities, making EV ownership increasingly practical for urban residents. Strategic placement along major highways facilitates intercity travel and expands the functional range of EVs beyond daily commuting distances.

Integration with Smart Mobility Ecosystems

The electric car segment is becoming deeply integrated with broader smart mobility solutions that are transforming urban transportation patterns. Ride-hailing platforms are increasingly incorporating EVs into their fleets, exposing consumers to zero-emission mobility experiences and building familiarity with EV technology. Furthermore, public transit electrification initiatives create synergies with private EV adoption by normalizing electric mobility and demonstrating its reliability for intensive commercial operations. Connected vehicle technologies enable seamless integration with smart city infrastructure, offering features such as real-time charging station availability, route optimization, and vehicle-to-grid communication capabilities.

Domestic Manufacturing Expansion and Localization

Vietnam is experiencing significant growth in domestic EV manufacturing capacity as the country positions itself as a regional production hub. Local assembly operations are expanding to meet rising domestic demand while developing export capabilities for neighbouring markets. Component localization efforts are strengthening supply chain resilience and creating employment opportunities in advanced manufacturing sectors. Investment in battery technology and electric powertrain development supports long-term competitiveness and reduces dependence on imported components. As per sources, in July 2025, Vietnam’s VinFast partnered with India’s BatX Energies to implement high-voltage battery recycling and repurposing, strengthening sustainable supply chains and supporting EV production across its facilities.

Market Outlook 2026-2034:

The Vietnam electric car market is poised for substantial revenue growth during the forecast period as multiple growth catalysts converge to accelerate adoption. Government policies supporting clean transportation are expected to intensify, with progressive mandates requiring electrification of public transit and commercial fleets in major cities. Continued expansion of charging infrastructure will address range anxiety concerns and enable EVs to serve broader geographic areas and use cases. Declining battery costs and improved energy density will enhance vehicle affordability and performance, making EVs increasingly competitive with conventional alternatives. The market generated a revenue of USD 3.5 Billion in 2025 and is projected to reach a revenue of USD 13.6 Billion by 2034, growing at a compound annual growth rate of 16.14% from 2026-2034.

Vietnam Electric Car Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Battery Electric Vehicle |

58.03% |

|

Vehicle Class |

Mid-Priced |

67.01% |

|

Drive Type |

Front Wheel Drive |

50.06% |

|

Region |

Southern Vietnam |

48.4% |

Type Insights:

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

The battery electric vehicle dominates with a market share of 58.03% of the total Vietnam electric car market in 2025.

Battery electric vehicle represents the largest segment within the Vietnam electric car market, commanding the majority revenue share due to favorable government policies. This dominance reflects policy priorities providing maximum incentives for zero-emission vehicles while maintaining higher tax burdens on hybrid alternatives. These vehicle benefits from complete registration fee exemptions and reduced special consumption taxes that significantly lower total ownership costs. According to sources, Vietnam extended full electric car registration fee exemptions until February 28, 2027, supporting EV adoption, green transition, and industry growth. Moreover, government strategies explicitly prioritize pure electric powertrains as the preferred pathway toward national carbon neutrality objectives.

The segment's leadership position is further reinforced by rapid development of dedicated charging infrastructure addressing range limitations across urban centers. Consumers particularly favor battery electric vehicles for daily commuting where home charging capabilities eliminate fuel station visits entirely. Advancing battery technology continues improving range capabilities and reducing charging times, progressively eliminating practical barriers to adoption. The segment is expected to maintain its dominant position as continued technology improvements and infrastructure expansion further enhance the overall value proposition for mainstream buyers.

Vehicle Class Insights:

Access the comprehensive market breakdown Request Sample

- Mid-Priced

- Luxury

The mid-priced leads with a share of 67.01% of the total Vietnam electric car market in 2025.

The mid-priced captures the largest share of the Vietnam electric car market by offering an optimal combination of affordability and features resonating with mainstream consumers. According to reports, in 2025, VinFast delivered over 12,100 EVs in Vietnam, with the VF 5 and VF 3 leading sales, while 45,813 pre-orders were received for the Green mini-EV series. Moreover, this vehicle class provides sufficient range, performance, and amenities for typical usage patterns while remaining accessible to middle-income households seeking reliable transportation solutions. Competitive financing options and favorable ownership economics further enhance the appeal of mid-priced EVs to cost-conscious buyers prioritizing value over premium features and luxury specifications.

Mid-priced benefit from economies of scale in production enabling competitive pricing relative to comparable internal combustion engine alternatives available in the market. This segment attracts first-time EV buyers seeking proven technology and established service networks rather than cutting-edge innovations. The growing availability of diverse model options within this price range provides consumers with meaningful choices across body styles and specifications. Market participants are intensifying competition through enhanced features, improved range, and attractive pricing strategies expanding the addressable consumer base.

Drive Type Insights:

- Front Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

The front wheel drive exhibits a clear dominance with a 50.06% share of the total Vietnam electric car market in 2025.

Front wheel drive dominates the Vietnam electric car market due to their efficiency advantages and cost-effective manufacturing characteristics suited for urban mobility. This drivetrain layout maximizes energy efficiency by minimizing mechanical complexity and power losses, directly translating to extended driving range from equivalent battery capacity. Lower production costs enable manufacturers to offer competitive pricing that aligns with mainstream consumer budgets. The configuration provides optimal performance characteristics for typical Vietnamese driving conditions and road infrastructure requirements.

The predominance of urban usage patterns favors front wheel drive vehicles that excel in city driving conditions with frequent stops and acceleration cycles. Vietnamese road infrastructure and typical driving requirements do not necessitate the traction advantages of all-wheel drive systems for most consumers. Front wheel drive EVs demonstrate adequate performance for daily commuting and routine transportation needs while offering superior efficiency metrics. The segment benefits from extensive model availability as manufacturers prioritize this configuration to effectively address the volume market opportunity. According to sources, in 2025, VinFast delivered 10,922 electric vehicles in Vietnam, with the VF 5 leading at 2,745 units, maintaining the company’s position as the country’s top EV manufacturer.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Southern Vietnam dominates with a market share of 48.4% of the total Vietnam electric car market in 2025.

Southern Vietnam commands the largest regional share of the electric car market, anchored by economic significance and population density of the Ho Chi Minh City metropolitan area. This region concentrates substantial purchasing power with higher average household incomes enabling vehicle purchases across various price segments. Progressive urban development policies actively promote clean transportation adoption through infrastructure investments and supportive regulatory frameworks. The concentration of commercial activity and corporate headquarters drives fleet electrification demand among businesses pursuing operational efficiency and sustainability objectives.

The region benefits from advanced charging infrastructure development that reduces range anxiety and supports convenient EV operation for daily users. Commercial and industrial activity generates sustained demand for fleet electrification among businesses seeking operational efficiency and corporate sustainability credentials. The concentration of technology-oriented consumers with high environmental awareness creates favorable market conditions for accelerated EV adoption rates. Ongoing urbanization and robust economic growth are expected to sustain regional market leadership while supporting continued revenue expansion throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Electric Car Market Growing?

Comprehensive Government Policy Support and Incentive Programs

The Vietnamese government has implemented an extensive framework of policies and incentives specifically designed to accelerate EV adoption and domestic industry development. Tax incentives including reduced special consumption taxes and import duty exemptions substantially lower vehicle costs and improve affordability for mainstream consumers. Registration fee waivers eliminate significant upfront expenses that traditionally represent barriers to vehicle purchase decisions. Strategic policy alignment with national carbon neutrality objectives ensures sustained government commitment to electric mobility promotion through continued and enhanced incentive programs. According to sources, in 2025, Vietnam plans 100,000 and 350,000 EV charging stations over 15 years, addressing limited infrastructure challenges and supporting projected one million EVs by 2030, according to VNA.

Rising Environmental Consciousness and Air Quality Concerns

Growing awareness of environmental issues among Vietnamese consumers, particularly in densely populated urban areas, is driving significant interest in clean transportation alternatives. Major cities face persistent air quality challenges attributed partially to vehicle emissions that directly impact public health and quality of life for millions of residents. Younger demographic cohorts demonstrate particularly strong environmental values that influence purchasing decisions across product categories including automobiles. Corporate sustainability initiatives and emissions reduction commitments are driving commercial fleet electrification among businesses seeking to demonstrate environmental responsibility.

Expanding Charging Infrastructure and Improved Accessibility

The rapid expansion of EV charging infrastructure across Vietnam is systematically addressing range anxiety concerns that historically limited consumer adoption. Public charging networks are proliferating at commercial locations, residential developments, and dedicated charging stations throughout major metropolitan areas. As per sources, in 2025, Hanoi mandated that by the end of 2026, at least 10% of parking spaces in existing buildings and 30% in new projects must be equipped with EV chargers. Furthermore, fast charging technology deployment enables convenient charging during routine activities such as shopping or dining, minimizing disruption to daily schedules. Intercity charging corridors are extending the practical operating range of EVs and enabling long-distance travel applications. Home charging solutions provide overnight charging convenience that aligns with typical vehicle usage patterns and eliminates fuel station visits entirely.

Market Restraints:

What Challenges the Vietnam Electric Car Market is Facing?

High Initial Vehicle Acquisition Costs

Despite government incentives, EVs continue commanding price premiums compared to equivalent conventional vehicles that constrain adoption among price-sensitive consumers. The upfront cost differential remains particularly significant for middle-income households with limited budgets for vehicle purchases. Battery technology represents a substantial portion of vehicle costs, and while prices are declining, parity with internal combustion alternatives remains a future prospect.

Uneven Geographic Distribution of Charging Infrastructure

While major metropolitan areas benefit from expanding charging networks, significant infrastructure gaps persist in suburban, rural, and remote regions. Consumers residing outside primary urban centers face practical limitations on EV utility due to insufficient charging access. Long-distance travel between secondary cities remains challenging due to limited intercity charging availability along certain routes.

Limited Consumer Awareness and Technology Familiarity

Substantial portions of the Vietnamese consumer population remain unfamiliar with EV technology, capabilities, and ownership requirements. Misconceptions regarding vehicle range, charging requirements, and battery longevity create a hesitation among the potential buyers considering the technology. Limited opportunities for direct experience with EVs inhibit consumer confidence in making significant purchase commitments.

Competitive Landscape:

The Vietnam electric car market features an evolving competitive environment characterized by diverse participation from domestic manufacturers, established international automotive brands, and emerging global EV specialists. Market participants differentiate through product portfolio breadth, pricing strategies, technology features, and service network coverage. Domestic manufacturers leverage local market understanding, established distribution networks, and patriotic consumer sentiment to maintain strong market positions. International competitors bring global technology expertise, established brand equity, and experience from mature EV markets to attract discerning consumers. Competition extends beyond vehicles to encompass charging infrastructure investments, ecosystem partnerships, and integrated mobility services that enhance customer value propositions.

Recent Developments:

-

In October 2024, BYD strengthened its presence in Vietnam’s electric vehicle market by launching two new models, the Han EV sedan and M6 MPV, bringing its local lineup to five. These launches follow the July introduction of the Dolphin, Seal, and Atto 3, underscoring BYD’s commitment to expanding EV accessibility in the region.

-

In September 2024, Chinese premium electric vehicle brand Zeekr, owned by Geely, entered Vietnam via a distribution agreement with Tasco. Imported from China, Zeekr targets high-end customers, offering advanced safety and driving-assistance technologies, joining other Chinese EV brands like BYD and Lynk & Co in expanding Vietnam’s luxury electric vehicle market.

Vietnam Electric Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, Fuel Cell Electric Vehicle |

| Vehicle Classes Covered | Mid-Priced, Luxury |

| Drive Types Covered | Front Wheel Drive, Rear Wheel Drive, All-Wheel Drive |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam electric car market size was valued at USD 3.5 Billion in 2025.

The Vietnam electric car market is expected to grow at a compound annual growth rate of 16.14% from 2026-2034 to reach USD 13.6 Billion by 2034.

Battery electric vehicle held the largest Vietnam electric car market share driven by maximum government incentives including registration fee exemptions, favorable tax treatment, expanding dedicated charging infrastructure, and advancing battery technology that improves range and reduces costs.

Key factors driving the Vietnam electric car market include comprehensive government incentives such as tax reductions and registration fee exemptions, growing environmental awareness among urban consumers, expanding charging infrastructure, rising fuel costs enhancing EV economics, and increasing middle-class purchasing power.

Major challenges include high upfront vehicle costs, limited charging infrastructure in remote areas, inconsistent government incentives, long battery replacement times, supply chain constraints, and low consumer awareness about electric mobility benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)