Vietnam E-bike Market Report by Mode (Throttle, Pedal Assist), Motor Type (Hub Motor, Mid Drive, and Others), Battery Type (Lead Acid, Lithium Ion, Nickel-Metal Hydride (NiMH), and Others), Class (Class I, Class II, Class III), Design (Foldable, Non-Foldable), Application (Mountain/Trekking Bikes, City/Urban, Cargo, and Others), and Region 2026-2034

Vietnam E-Bike Market:

Vietnam e-bike market size reached USD 113.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 205.3 Million by 2034, exhibiting a growth rate (CAGR) of 6.84% during 2026-2034. The need for sustainable alternative to conventional motor vehicles owing to the rising pollution levels, favorable government incentives promoting eco-friendly transportation, and technological advancements in battery and motor efficiency represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 113.2 Million |

| Market Forecast in 2034 | USD 205.3 Million |

| Market Growth Rate (2026-2034) | 6.84% |

Access the full market insights report Request Sample

Vietnam E-Bike Market Analysis:

- Major Market Drivers: The rising environmental consciousness, numerous governmental initiatives, rapid urbanization and increasing levels of pollution are some of the key factors escalating the Vietnam e-bike market demand. Moreover, Vietnam faces significant air pollution challenges, particularly in its major cities. E-bikes produce zero emissions, making them an environmentally friendly alternative to traditional gasoline-powered motorbikes, thereby acting as another growth-inducing factor.

- Key Market Trends: The growing preference for lightweight vehicles, subsidies and tax benefits on electric bikes, regulatory support, improved battery technology, etc., are expected to proliferate the market demand. Additionally, the development of charging infrastructure, including public charging stations, is making it easier for e-bike users to charge their vehicles, thereby propelling the industry’s growth.

- Challenges and Opportunities: Limited access to charging stations, poor road conditions, high initial investment, and lack of awareness regarding the benefits of e-bikes are some of the challenges that the market is facing. However, rapid urbanization and increasing traffic congestion make e-bikes an attractive option for urban commuters seeking efficient and cost-effective transportation, which represents significant Vietnam e-bike market recent opportunities.

Vietnam E-Bike Market Trends:

Government Incentives and Subsidy

The Vietnamese government is playing a significant role in driving the growth of the e-bike market through a range of initiatives and subsidies aimed at promoting sustainable transportation and reducing environmental pollution. The government provides subsidies to consumers who purchase e-bikes, reducing the overall cost and making them more affordable. For instance, in August 2023, according to Bui Hoa An, deputy director of the municipal transportation department, Ho Chi Minh City would assist residents in switching from gas-powered motorbikes to electric vehicles by offering subsidies. Moreover, import duties and value-added tax (VAT) on e-bikes and their components are reduced or exempted, lowering the cost for both manufacturers and buyers, further making it an attractive option. For instance, imported EVs were subject to special consumption taxes of up to 70% of the purchase price prior to 2022. On the other hand, EV excise tax rates were lowered by up to 12% as of March 1, 2022. Apart from this, the Vietnam government conducts numerous campaigns to raise awareness about the environmental and economic benefits of e-bikes, encouraging more people to consider them as a viable transportation option. For instance, in June 2023, the United Nations Development Program (UNDP) in collaboration with the Ministry of Transport conducted a workshop to promote the design and adoption of an electric vehicle-sharing model in Vietnam. The workshop focused on sharing experiences, success, and challenges of electric bikes. These factors are further contributing to the Vietnam e-bike market share.

Rise in Environmental Concerns Among Individuals

The increasing focus on reducing greenhouse gas (GHG) emissions is a significant driver of the growth in Vietnam's e-bike market. Vietnam is a signatory to the Paris Agreement and has committed to reducing its GHG emissions. The transportation sector is a key area for achieving these reductions. As part of its NDCs, Vietnam has set ambitious targets for lowering emissions, which include promoting electric vehicles (EVs), such as e-bikes, to replace traditional gasoline-powered vehicles, thereby influencing the Vietnam e-bike market’s recent price. For instance, in July 2023, according to the updated Nationally Determined Contribution (NDC), Vietnam established a mitigation goal to cut emissions by 15.8% by 2030 along with providing incentives to encourage the transition to EVs, as well as implementing a preferential loan scheme to facilitate a shift towards EV. Apart from this, the government has implemented stricter emission standards for vehicles, encouraging a shift towards electric alternatives that produce zero tailpipe emissions. For instance, in January 2022, Vietnam applied Euro emission five standards to cut the emissions of air pollutants. Vietnam intends to reduce net greenhouse gas emissions to zero by 2050. By 2040, the transportation sector aims to gradually reduce and eliminate the manufacturing, assembly, and import of vehicles and motorcycles powered by fossil fuels. By 2050, all motor vehicles will run on electricity and alternative energy. Therefore, developing recharge stations is vital. These factors are positively influencing the Vietnam e-bike market forecast.

Ongoing Infrastructural Development

Infrastructure development plays a pivotal role in driving the growth of the e-bike market in Vietnam. Improvements and investments in infrastructure make e-bikes a more practical, convenient, and appealing option for consumers. The Vietnamese government and private Vietnam e-bike market companies are investing in expanding the network of charging stations across urban and suburban areas. This development alleviates range anxiety, ensuring that e-bike users can easily find places to charge their vehicles. For instance, in March 2024, Vinfast, an electric vehicle manufacturer in Vietnam, launched an EV charging station company named V-Green. Moreover, the development of dedicated bike lanes and paths in major cities ensures safer and more efficient travel for e-bike users. These lanes help reduce accidents and make commuting by e-bikes more attractive. Segregated lanes for e-bikes and bicycles reduce congestion on roads and provide a smoother, faster travel experience. For instance, in January 2024, the Hanoi Department of Transport announced to launch first bike-only lane which is 4km long and 4m wide along with To Lich River through the Cau Giay and Dong Da districts. There will be six public bicycle stations along the route, including two significant ones at Transportation University and Lang Station. It is expected that approximately 100 bicycles and electric bikes will be available to suit the needs of passengers in Hanoi, particularly students. These factors are further bolstering the Vietnam e-bike market revenue.

Vietnam E-bike Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on mode, motor type, battery type, class, design, and application.

Breakup by Mode:

To get detailed segment analysis of this market Request Sample

- Throttle

- Pedal Assist

The report has provided a detailed breakup and analysis of the market based on the mode. This includes throttle and pedal assist.

Throttle e-bikes operate similarly to a motorcycle or scooter, allowing the rider to control speed using a handlebar-mounted throttle. This type of e-bike provides power on demand without the need to pedal, making it convenient for quick acceleration and for riders who may not want to exert themselves. Pedal assist e-bikes, on the other hand, provide assistance only when the rider is pedaling. The motor's output is proportional to the rider's input, offering a more integrated and natural riding experience.

Breakup by Motor Type:

- Hub Motor

- Mid Drive

- Others

A detailed breakup and analysis of the market based on the motor type have also been provided in the report. This includes hub motor, mid drive, and others.

According to the Vietnam e-bike market outlook, hub motors are generally less expensive than mid-drive motors, making them a more budget-friendly option. These motors have fewer moving parts, leading to reduced maintenance needs. They are also sealed, which protects them from the elements. While mid-drive motors are mounted centrally, providing better balance and handling. This is particularly beneficial for off-road and technical riding. These motors use the bike's existing gears, allowing for better performance on hills and varied terrains. This makes them ideal for mountain biking and hilly regions.

Breakup by Battery Type:

- Lead Acid

- Lithium Ion

- Nickel-Metal Hydride (NiMH)

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lead acid, lithium ion, nickel-metal hydride (NiMH), and others.

Lead-acid batteries are inexpensive and durable, making them a popular choice for budget-conscious consumers. They are also widely available and have a relatively fast charging time. While NiMH batteries offer a higher energy density and are more environmentally friendly compared to lead-acid batteries. They are also less prone to memory effects and can tolerate overcharging and over-discharging better. Moreover, lithium-ion batteries are the most popular choice for e-bikes due to their high energy density, longer lifespan, and lightweight. They have a low self-discharge rate and provide better performance in terms of power and range. These batteries are also environmentally friendly and require less maintenance.

Breakup by Class:

- Class I

- Class II

- Class III

A detailed breakup and analysis of the market based on the class have also been provided in the report. This includes class I, class II, and class III.

Class I e-bikes are equipped with a motor that provides assistance only when the rider is pedaling and ceases to provide assistance when the bicycle reaches the speed of 20 mph. The motor assists only when the rider is pedaling, commonly known as pedal assist or pedelec. Class II e-bikes are equipped with a motor that can be used exclusively to propel the bicycle and also ceases to provide assistance when the bicycle reaches the speed of 20 mph. The motor can be activated by a throttle without the need for pedaling. Moreover, class III e-bikes are equipped with a motor that provides assistance only when the rider is pedaling and ceases to provide assistance when the bicycle reaches the speed of 28 mph (45 km/h).

Breakup by Design:

- Foldable

- Non-Foldable

The report has provided a detailed breakup and analysis of the market based on the design. This includes foldable and non-foldable.

According to the Vietnam e-bike market overview, the primary advantage of foldable e-bikes is their portability. They can be folded into a compact size, making them ideal for commuters who need to combine cycling with other modes of transportation like buses, trains, or cars. These are easy to store in small spaces, such as apartments, offices, or even under desks. They are great for urban dwellers with limited storage space. While non-foldable e-bikes often offer superior performance compared to foldable models. They may have larger motors, batteries, and frames, providing more power, longer range, and greater stability at higher speeds. These e-bikes typically feature larger wheels and more advanced suspension systems, offering a smoother and more comfortable ride, especially on rough terrain or longer distances.

Breakup by Application:

- Mountain/Trekking Bikes

- City/Urban

- Cargo

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mountain/trekking bikes, city/urban, cargo, and others.

These mountain e-bikes are designed for off-road trails and rugged terrain. They typically feature durable frames, wide tires with aggressive tread patterns for traction, and suspension systems (front, rear, or both) to absorb shocks. While city or urban e-bikes are designed for commuting and navigating city streets. They usually have a more upright riding position for comfort and visibility, as well as features like fenders, lights, and racks for practicality. Moreover, cargo e-bikes are specially designed to carry heavy loads, whether it's groceries, children, or other cargo. They typically have sturdy frames, extended wheelbases, and either front or rear cargo racks or boxes.

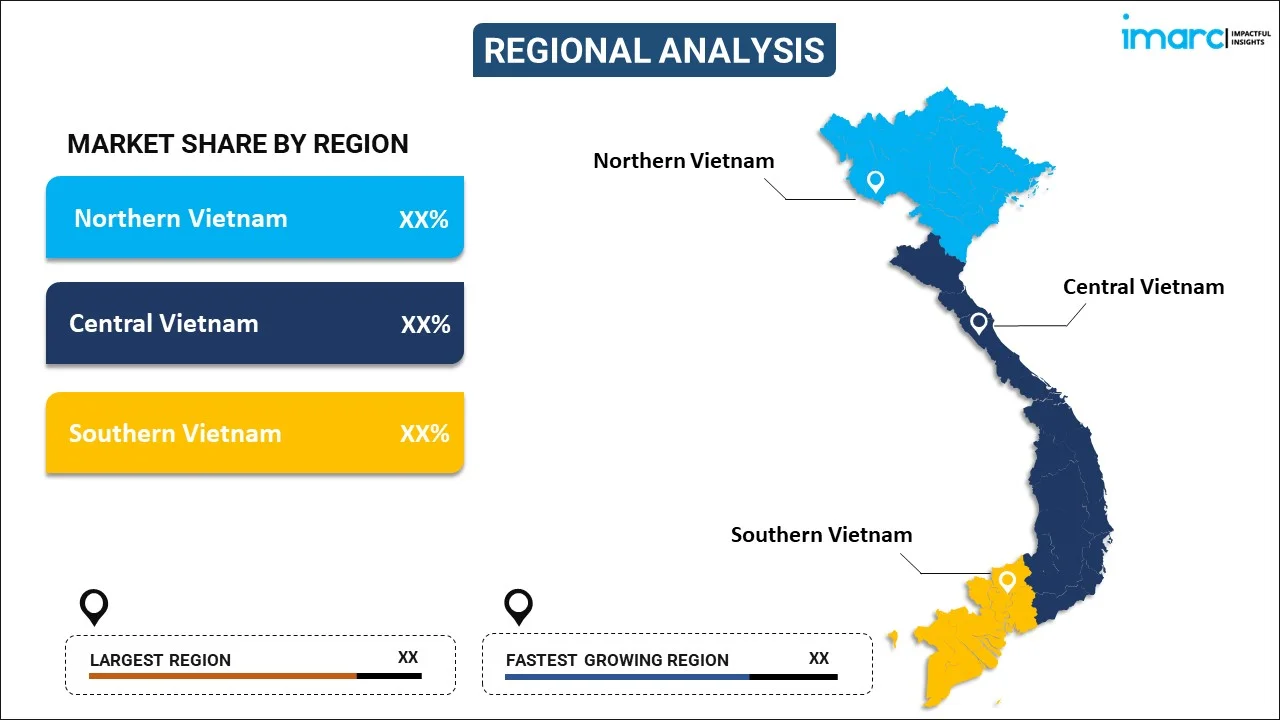

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

According to the Vietnam e-bike market statistics, in Northern Vietnam, in cities like Hanoi and Haiphong, where traffic congestion is common, is a significant demand for e-bikes due to their maneuverability and ability to navigate through crowded streets. While in Central Vietnam, cities like Hue, Danang, and Hoi An in Central Vietnam also see moderate demand for e-bikes, influenced by factors such as tourism, infrastructure development, and urbanization. In tourist destinations like Hoi An, e-bike rentals for exploring the ancient town or nearby countryside could be popular among visitors seeking sustainable and convenient transportation options. Moreover, Ho Chi Minh City (Saigon) and other urban centers in Southern Vietnam might experience significant demand for e-bikes due to their large population, rapid urbanization, and congested traffic conditions. E-bikes could be favored for intra-city commuting, particularly in districts with heavy traffic congestion and limited parking space.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam E-Bike Market News:

- March 2024: Vinfast, an electric vehicle manufacturer in Vietnam, launched an EV charging station company named V-Green.

- January 2024: The Hanoi Department of Transport announced to launch first bike-only lane, which is 4km long and 4m wide along with To Lich River through the Cau Giay and Dong Da districts.

- November 2023: Dat Bike, a domestic electric two-wheeler manufacturer in Vietnam, launched its first electric scooter.

Vietnam E-bike Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modes Covered | Throttle, Pedal Assist |

| Motor Types Covered | Hub Motor, Mid Drive, Others |

| Battery Types Covered | Lead Acid, Lithium Ion, Nickel-Metal Hydride (NiMH), Others |

| Classes Covered | Class I, Class II, Class III |

| Designs Covered | Foldable, Non-Foldable |

| Applications Covered | Mountain/Trekking Bikes, City/Urban, Cargo, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam E-bike market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Vietnam E-bike market?

- What is the breakup of the Vietnam E-bike market on the basis of mode?

- What is the breakup of the Vietnam E-bike market on the basis of motor type?

- What is the breakup of the Vietnam E-bike market on the basis of battery type?

- What is the breakup of the Vietnam E-bike market on the basis of class?

- What is the breakup of the Vietnam E-bike market on the basis of design?

- What is the breakup of the Vietnam E-bike market on the basis of application?

- What are the various stages in the value chain of the Vietnam E-bike market?

- What are the key driving factors and challenges in the Vietnam E-bike?

- What is the structure of the Vietnam E-bike market and who are the key players?

- What is the degree of competition in the Vietnam E-bike market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam E-bike market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam E-bike market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam E-bike industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)