Vietnam Dairy Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

Vietnam Dairy Market Size and Share:

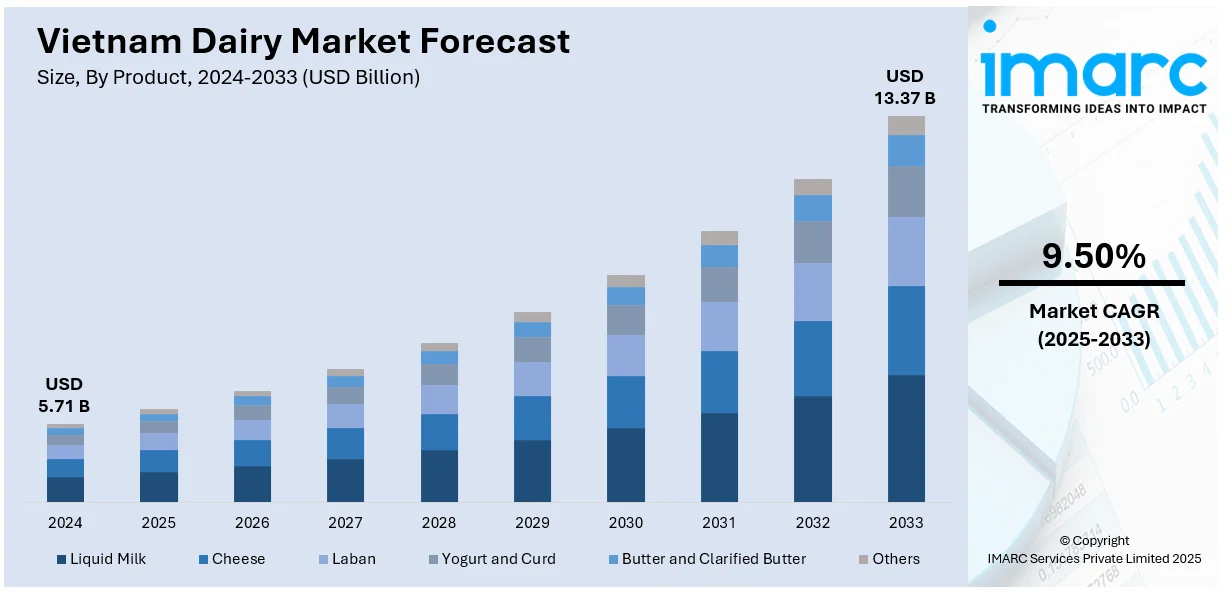

The Vietnam dairy market size was valued at USD 5.71 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.37 Billion by 2033, exhibiting a CAGR of 9.50% from 2025-2033. The market is driven by rising health awareness, higher disposable incomes, and shifting dietary preferences toward nutritious products. Government support, foreign investments, and expanding retail infrastructure further boost production, innovation, and accessibility across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.71 Billion |

| Market Forecast in 2033 | USD 13.37 Billion |

| Market Growth Rate 2025-2033 | 9.50% |

Vietnamese consumers are increasingly focusing on health and nutrition, fueling a consistent increase in dairy consumption. This trend is particularly evident in urban regions, where improved access to health education and online platforms has enhanced awareness of the advantages of calcium, protein, and probiotics. Parents are actively introducing fortified milk, yogurt, and nutritional supplements into the children's diet, while the elderly population demands dairy products that are bone-friendly and immunity-boosting. Ready-to-consume (RTC) convenient dairy foods are also becoming increasingly popular under the backdrop of increasing lifestyle speeds. Underpinning this trend, per capita consumption of milk in Vietnam is expected to hit 40 liters annually by 2030, expanding at a CAGR of approximately 4%. All in all, dairy is becoming a daily table necessity, graduating from supplement to integral part of contemporary, health-oriented life.

Vietnam's economic growth and increasing income levels have greatly increased dairy consumption. With more families becoming middle class, there is a change in eating patterns towards higher-value foods, such as premium and imported dairy products. Enhanced affordability enables families to purchase not only plain milk, but also value-added products like flavored yogurts, cheese, and organic foods. The growth of contemporary retail outlets like supermarkets and convenience stores makes these products more widespread. Additionally, urbanization is transforming consumer tastes, and increasing demand is coming for convenient, packaged milk and dairy products. As disposable incomes increase, dairy is no longer regarded as a luxury but as an integral component of contemporary Vietnamese diets.

Vietnam Dairy Market Trends:

Demand for Dairy-Based Products

The expansion of the middle-class population and the growing health consciousness among consumers are currently driving the market. According to a survey conducted on behalf of the Business Association of High-Quality Vietnam Products, the customers care about fundamental elements, such as durability, perceived quality, and price, the freshness and safety of the food, the understanding of the nutritional value, the place of origin, etc. Apart from this, the increasing level of urbanization is also fueling the Vietnam dairy market share. As per the authorized website of the Ministry of Construction online, Vietnam is one of the promptly urbanizing countries in Southeast Asia. There are a entirety of 888 urban cities in the country as of September 2022, and the urbanization rate is covering 41.5%. Moreover, consumers are willing to pay extra for healthy and high-quality dairy products. Companies are fighting back by introducing fortified milk, organic milk brands, and functional milk brands that cater to the specific health needs of consumers. As an example, in August 2023, Orion collaborated with Dutch Mill to enter Vietnam's dairy business. Similarly, Morinaga Milk Industry Group (ELOVI Vietnam) teamed up with WinCommerce General Trading Services Joint Stock Company in November 2023 to launch two premium products, i.e., Morinaga Zero-Fat Yogurt and Climeal Nutritional Drink, at Vietnamese retail chain WinMart. The products are well-liked among Westernized generations of younger generations and promoting the Vietnam dairy market demand.

Consciousness Towards Sustainability

The rising trend for ethically manufactured dairy foods, due to the increasing awareness among consumers about sustainability, is driving the growth of the Vietnam dairy market. Furthermore, the growing emphasis on green production methodologies, thus seeking enhanced domestic demand, is playing another key role in driving Vietnam dairy market growth. When the 4th Vietnam International Milk & Dairy Products Exhibition began in May 2024, Tran Quang Trung, Chairman of the Vietnam Dairy Association, accentuated this key route. Besides this, consumers are also seeking brands that are following eco-friendly practices and maintaining animal welfare, which is driving the revenue of the Vietnam dairy market. For instance, in Dec 2023, Vinamilk, Vietnam's dairy products joint stock company, launched the Vinamilk Green Farm product range, manufactured with carbon zero green farming methods and advanced double vacuum technology. Correspondingly, Vinamilk also gained significant acclaim in Brand Finance's Food and Drink 2023 league tables, confirming its status as a major industry player focused on sustainability. In addition, the mass adoption of sustainable practices by businesses, as they are undertaking corporate social responsibility (CSR) activities, is likely to raise the Vietnam dairy market's recent price in the next few years. For instance, in October 2022, FrieslandCampina Vietnam, being one of the dairy cooperatives, launched a sustainable development plan that aims to enhance the well-being of farmers, minimize environmental footprints, offer nutritious products to consumers, etc.

Strategic Partnerships and Investments

In accordance with the statistics released by Research and Markets, Vietnam's per capita milk consumption will rise by approximately 40%, from 28 liters in 2021 to 40 liters annually by 2030. Despite growing demand, Vietnam's local milk production remains insufficient, with only 1,097 tons produced in 2021 compared to over 3,705 tons imported, according to the FAO. This huge difference between demand and supply reflects the increasing significance of dairy imports to satisfy consumers. Additionally, the extensive foreign direct investments (FDI) by dairy processing firms in the country, since they have been engaged in the manufacture and distribution of dairy products for many years, are some of the recent Vietnam dairy market opportunities. For instance, in November 2023, Growtheum Capital Partners invested around USD 100 Million in buying a 15% interest in the Vietnam International Dairy Joint Stock Company (IDP). In May 2023, Morinaga Milk Industry Co., Ltd. joined with Le May, a local dairy manufacturer, belonging to Hoa Sen Group to establish the Morinaga Le May Vietnam Joint Stock Company.

Vietnam Dairy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam dairy market, along with forecast at the regional levels from 2025-2033. The market has been categorized based on product, application, and distribution channel.

Analysis by Product:

- Liquid Milk

- Cheese

- Laban

- Yogurt and Curd

- Butter and Clarified Butter

- Others

Liquid milk is the most consumed dairy product in Vietnam, available in fresh, UHT, and flavored forms. It's a daily staple for all age groups, valued for its calcium and protein content. It’s widely used for drinking, in cooking, and as a base for other dairy products.

Additionally, the cheese consumption in Vietnam is growing, particularly in urban areas, driven by Western food influences and increasing demand for premium, high-protein snacks. Common types include processed and mozzarella, often used in fast food, baked goods, and home cooking. Cheese is also gaining popularity among children and young adults.

Moreover, the laban, or fermented milk, is a traditional drink similar to yogurt, offering probiotic benefits. It's popular for aiding digestion and improving gut health. Laban is often consumed as a refreshing beverage or light dessert, especially during hot weather, and is increasingly available in flavored and packaged variants in urban markets.

Besides this, the yogurt and curd are widely consumed for their digestive and nutritional benefits. Available in plain, flavored, and drinkable forms, they appeal to health-conscious consumers. These products are often fortified with probiotics, making them popular among children and the elderly. Their versatility also supports growing demand across age groups.

Furthermore, the butter and clarified butter (ghee) are niche but growing segments in Vietnam, used mainly in baking, cooking, and premium food preparation. As home cooking trends rise and Western cuisine spreads, these products are slowly gaining traction, particularly among middle- and upper-income households and in the hospitality industry.

Also, the others category involves niche or emerging dairy products like condensed milk, cream, milk powder, and plant-based alternatives. Condensed milk is widely used in Vietnamese coffee and desserts. Milk powders are common in infant and adult nutrition. Plant-based dairy substitutes are also gaining popularity among health-conscious and lactose-intolerant consumers.

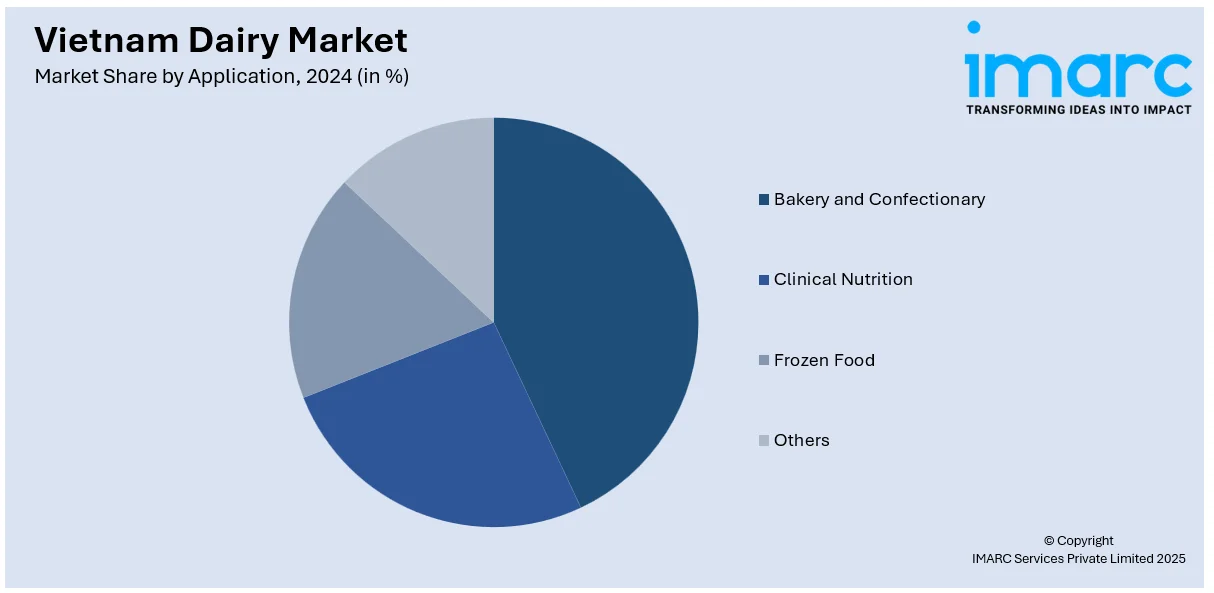

Analysis by Application:

- Bakery and Confectionary

- Clinical Nutrition

- Frozen Food

- Others

Dairy ingredients like milk, butter, and cheese are essential in Vietnam’s growing bakery and confectionery market. They enhance flavor, texture, and shelf life in products like cakes, pastries, and chocolates. Rising demand for Western-style baked goods and premium desserts is driving higher dairy usage in this segment.

However, the clinical nutrition uses specialized dairy-based products designed to meet medical or dietary needs. These include fortified milk powders and supplements rich in protein, calcium, and vitamins. Commonly used for infants, seniors, and patients recovering from illness, this segment is expanding with Vietnam’s aging population and increasing health consciousness.

Along with this, the frozen foods like ice cream, frozen desserts, and ready meals is a key component in dairy market. As urban lifestyles grow busier, demand for convenient, tasty frozen items is rising. Dairy enhances flavor and texture, making it integral to both traditional frozen treats and modern quick-prep food solutions.

Furthermore, the others category includes a wide range of dairy applications such as sauces, coffee creamers, infant formulas, and beverages. Condensed and evaporated milk are especially popular in Vietnamese coffee culture. Demand for dairy in diverse food and drink innovations continues to grow with changing tastes and evolving consumption habits.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Stores

- Others

Based on the Vietnam dairy market forecast, the supermarkets and hypermarkets are key distribution channels for dairy in Vietnam, offering a wide variety of local and imported products. Their organized layouts, promotions, and quality assurance attract middle- and upper-income shoppers. These outlets are especially popular in urban areas for bulk buying and one-stop shopping convenience.

In line with this, the convenience stores cater to on-the-go urban consumers seeking quick, accessible dairy products like yogurt drinks, milk, and snacks. Open long hours and located in high-traffic areas, they appeal to young professionals and students. Their smaller formats support impulse purchases and growing demand for ready-to-consume (RTC) dairy options.

Moreover, the specialist retailers focus on health, nutrition, or premium goods, offering curated dairy selections like organic milk, imported cheeses, and dietary supplements. These stores attract health-conscious and high-income consumers looking for quality and product knowledge. They also often provide personalized service and nutritional advice, supporting targeted and informed buying decisions.

Besides this, online platforms are rapidly growing in Vietnam’s dairy market, driven by convenience, home delivery, and wide selection. E-commerce allows consumers to compare prices, access niche or imported products, and benefit from promotions. The rise of digital payments and mobile apps supports this trend, especially among younger, tech-savvy shoppers.

Along with this, the others category includes traditional markets, vending machines, and direct sales. While traditional markets still serve rural and older demographics, newer formats like vending machines in offices and schools offer quick dairy access. Direct sales, including home delivery services and milk subscription models, are also gaining popularity in select urban areas.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam, including Hanoi, is known for its traditional consumption of dairy, with a focus on fresh milk and yogurt. The region has a growing middle class, driving demand for dairy products. However, dairy consumption is still lower than in southern parts due to cultural preferences and dietary habits.

Concurrently, the Central Vietnam, with cities like Da Nang and Hue, sees moderate dairy consumption. While the region has urban centers that embrace Western-style dairy products like cheese and yogurt, rural areas still prefer traditional foods. Economic growth and urbanization are slowly increasing demand for diverse dairy products in this region.

Also, Southern Vietnam, especially Ho Chi Minh City, is the largest market for dairy items due to increased disposable incomes and urbanization. The diversified population of the region, shaped by Western society, consumes an extensive range of dairy, ranging from fresh milk to cheese and yogurt. Southern Vietnam accounts for the highest dairy demand in the country.

Competitive Landscape:

The Vietnam dairy market features a dynamic and competitive landscape marked by both local and international players striving for market share. Competition is driven by innovation, pricing strategies, and product diversification, with companies continuously introducing new offerings such as organic, plant-based, and fortified dairy to meet evolving consumer preferences. Branding and trust play key roles, as consumers prioritize quality, safety, and nutritional value. The rise of e-commerce and modern retail formats has intensified competition, enabling broader product reach and more targeted marketing. Additionally, companies are investing in supply chain improvements and sustainability initiatives to gain a competitive edge. Overall, the market remains highly responsive to consumer trends, with agility and brand loyalty being critical success factors.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam dairy market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Dutch Lady, under FrieslandCampina Vietnam, launched a new fortified milk product to combat child malnutrition and hidden hunger. Unveiled in Ho Chi Minh City and Hanoi, the product features enhanced nutrients, including added vitamin C.

- October 2024: The a2 Milk Company launched six premium dairy products in Vietnam, including the a2 Platinum range. Products feature only A2-type beta-casein protein, with support from local distributors and events like the VietBaby Fair and Hanoi launch.

- June 2024: Vietcoco launched its plant-based Coconut Milk beverage at Vietnam Dairy 2024 in Ho Chi Minh City. Aligning with World Milk Day, the brand highlighted its UHT-treated and preservative-free products.

- May 2024: One of the dairy manufacturers in Vietnam, International Dairy Products JSC (IDP), announced a dairy product with jelly pieces in SIG XSlimBloc carton packs under its popular KUN brand, thereby offering nutritious ready-to-drink milk for kids.

Vietnam Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Liquid Milk, Cheese, Laban, Yogurt and Curd, Butter and Clarified Butter, Others |

| Applications Covered | Bakery and Confectionary, Clinical Nutrition, Frozen Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialist Retailers, Online Stores, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam dairy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam dairy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam dairy market was valued at USD 5.71 Billion in 2024.

The Vietnam Dairy market was valued at USD 13.37 Billion in 2033 exhibiting a CAGR of 9.50% during 2025-2033.

Key factors driving the Vietnam dairy market include rising health awareness, growing middle-class income, urbanization, and increased demand for nutritious, convenient food options. Expanding modern retail, government support for dairy development, and evolving consumer preferences toward premium and functional products also contribute significantly to market growth and diversification.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)