Vietnam Copper Pipes Market Size, Share, Trends and Forecast by Type, Product, Outer Diameter, Application, and Region, 2026-2034

Vietnam Copper Pipes Market Summary:

The Vietnam copper pipes market size reached 20.9 thousand tons in 2025 and is projected to reach 29.6 thousand tons by 2034, growing at a compound annual growth rate of 3.94% from 2026-2034.

The Vietnam copper pipes market is experiencing robust expansion driven by the country's booming construction sector and rising demand for HVAC and refrigeration systems. Rapid urbanization, infrastructure development initiatives, and the growing awareness of copper's superior thermal conductivity and corrosion resistance properties are fueling market growth across residential, commercial, and industrial applications throughout the nation.

Key Takeaways and Insights:

-

By Type: L Type dominates the market with a share of 48% in 2025, owing to its versatile applications in both residential and commercial plumbing systems. L Type copper pipes offer an optimal balance of wall thickness and durability, making them the preferred choice for interior water distribution and general-purpose installations across Vietnam's expanding construction sector.

- By Product: Tubes lead the market with a share of 45% in 2025, driven by their extensive utilization in HVAC systems, refrigeration equipment, and heat exchange applications. Copper tubes' superior heat transfer capabilities and flexibility in installation make them indispensable components in Vietnam's rapidly growing cooling and heating infrastructure.

- By Outer Diameter: 3/4 inch dominates the market with a share of 21% in 2025, reflecting its widespread adoption in standard HVAC installations and plumbing applications. This diameter offers versatility for various residential and commercial projects, providing adequate flow capacity while maintaining installation convenience.

- By Application: HVAC lead the market with a share of 64% in 2025, fueled by Vietnam's tropical climate creating sustained demand for air conditioning and ventilation systems. The expanding commercial real estate sector, hospitality industry growth, and increasing adoption of modern cooling solutions in residential buildings drive copper pipe consumption.

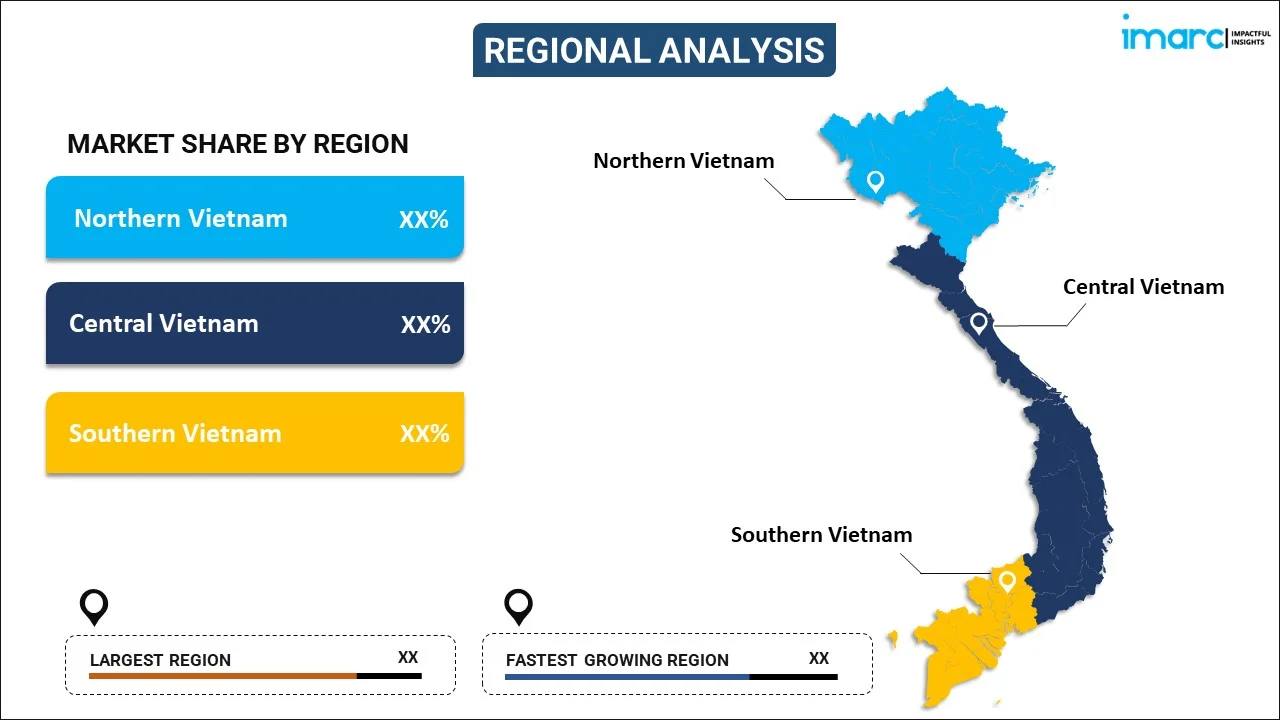

- By Region: Northern Vietnam dominates the market with a share of 39% in 2025, benefiting from the concentration of industrial zones, manufacturing facilities, and major construction activities around Hanoi and surrounding provinces. The region's robust economic development and infrastructure investments support strong copper pipe demand.

- Key Players: The Vietnam copper pipes market features a competitive landscape comprising both domestic manufacturers and international suppliers. Market participants compete on product quality, pricing strategies, distribution network strength, and technical service capabilities. The industry continues attracting investments as demand grows across construction, HVAC, and industrial applications.

The Vietnam copper pipes industry is undergoing significant transformation as the country emerges as a manufacturing hub in Southeast Asia. The construction boom spanning residential towers, commercial complexes, and industrial facilities creates sustained demand for quality piping materials. Copper pipes are increasingly preferred over alternative materials due to their natural antimicrobial properties, longevity, and recyclability characteristics. Vietnam’s Toan Phat Cooper Tube Joint Stock Company, with nearly 20 years of copper tube manufacturing experience and exports to over 20 countries, showcased its products at ACREX India 2024, highlighting expanding global reach for Vietnamese copper segments. The HVAC and refrigeration segments represent primary consumption drivers as Vietnam's tropical climate necessitates extensive cooling infrastructure. Modern building standards and green construction practices further support copper pipe adoption. The market benefits from improving domestic manufacturing capabilities alongside established import channels, ensuring product availability across price segments and quality specifications.

Vietnam Copper Pipes Market Trends:

Growing Adoption of Energy-Efficient HVAC Systems

Vietnam’s HVAC industry is rapidly transitioning toward energy‑efficient, eco‑friendly systems, a shift that is driving strong demand for high‑quality copper pipes that maximize heat transfer. According to the Ministry of Construction, more than 50% of new urban development projects in Vietnam now incorporate energy‑efficient HVAC systems to meet government mandates on reducing emissions, reflecting the country’s push toward greener building standards. Building developers are increasingly prioritizing sustainable solutions, while the growing adoption of inverter technology and variable refrigerant flow (VRF) systems further fuels the need for reliable, premium copper piping infrastructure.

Expansion of Green Building Construction Practices

Sustainable construction is rapidly advancing in Vietnam, with copper pipes benefiting from their eco‑friendly attributes. As of 2025, over 559 projects totaling 13.6 million m² have received green building certification, underscoring the country’s commitment to energy-efficient, environmentally responsible construction. Copper’s recyclability and durability align with certification standards, prompting architects and engineers to specify it in green projects. Its use enhances building performance and reduces lifecycle environmental impact compared to synthetic alternatives, reinforcing copper’s role in sustainable infrastructure.

Industrial Manufacturing Sector Expansion

Vietnam’s rise as a global manufacturing hub is driving increased demand for copper pipes in industrial applications. In January 2025, Ho Chi Minh City’s industrial parks and export processing zones attracted over US $5.3 billion in new and adjusted investments, surpassing annual targets and signaling rapid factory expansion. Sectors such as electronics, food processing, pharmaceuticals, and automotive assembly rely on advanced heat exchange and process piping. Industrial parks nationwide are adopting modern facilities that use copper pipes for cooling systems, clean rooms, and specialized manufacturing processes.

Market Outlook 2026-2034:

The Vietnam copper pipes market is positioned for sustained growth throughout the forecast period, underpinned by favorable macroeconomic conditions and robust construction sector expansion. Infrastructure development initiatives, urbanization trends, and rising living standards will continue driving demand across residential, commercial, and industrial segments. The HVAC and refrigeration industries represent primary growth catalysts as Vietnam addresses cooling requirements for its tropical climate and expanding built environment. Manufacturing sector expansion and government infrastructure investments provide additional demand support. The market size was estimated at 20.9 thousand tons in 2025 and is expected to reach 29.6 thousand tons by 2034, reflecting a compound annual growth rate of 3.94% over the forecast period 2026-2034.

Vietnam Copper Pipes Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

L Type |

48% |

|

Product |

Tubes |

45% |

|

Outer Diameter |

3/4 Inch |

21% |

|

Application |

HVAC |

64% |

|

Region |

Northern Vietnam |

39% |

Type Insights:

To get more information on this market, Request Sample

- L Type

- M Type

- K Type

The L type dominates with a market share of 48% of the total Vietnam copper pipes market in 2025.

L Type copper pipes continue to dominate the market due to their malleability and economic viability as well as ease of handling for various plumbing purposes. These copper pipes incorporate a medium thickness of the pipe walls to ensure they can withstand reasonable pressures while being easily manageable during handling or installation. Such factors make L Type copper pipes the most sought-after option for water supply lines or plumbing purposes.

The general specification of L type copper in construction codes further cements its leading position in the market. Contractors find this particular type of copper preferable because of its familiarity and successful application in various uses. Notably, as the construction industry in Vietnam continues to grow in size, L type copper pipes are readily supported by distribution channels in the construction sector.

Product Insights:

- Rods

- Wires

- Plates

- Strips

- Tubes

The tubes lead with a share of 45% of the total Vietnam copper pipes market in 2025.

Copper tubes lead the product segment due to their vital role in HVAC, refrigeration, and heat exchange systems. Their high thermal conductivity ensures efficient cooling in air conditioners, chillers, and refrigeration units. Vietnam’s Ruby Copper JSC, a leading copper tube manufacturer, recently highlighted its presence in over 50 global markets and continues strengthening supply reliability and international partnerships as it enters 2026 with expanded export commitments, reinforcing Vietnam’s role in the global HVACR supply chain.

The country’s tropical climate sustains strong demand for copper‑based cooling infrastructure. The advancements in manufacturing processes have improved the quality and consistency of copper tubes, thus enabling their usage in more critical industrial applications. The different tube configurations, such as level wound coil, pancake coil, and straight length format, address various installation needs. The product type also continues to gain from the growing HVAC installations within residential towers, commercial buildings, hospitality properties, and industries across Vietnam, thereby sustaining demand and encouraging long-term market growth.

Outer Diameter Insights:

- 3/8 Inch

- 1/2 Inch

- 5/8 Inch

- 3/4 Inch

- 7/8 Inch

- 1 Inch

- Above 1 Inch

The 3/4 inch dominates with a market share of 21% of the total Vietnam copper pipes market in 2025.

The 3/4 inch outer diameter segment leads the market, reflecting the huge adoption of this diameter across standard HVAC and plumbing applications. This diameter provides optimal flow characteristics for residential and light commercial installations while maintaining installation convenience. For this reason, 3/4 inch pipes can be applied to different purposes such as water distribution systems, refrigerant lines, and any other heat exchange applications.

The specifications for construction normally refer to 3/4 inch copper pipes for standard building services. This is also because these diameters offer favorable economics of material cost and installation labor versus system performance. In growing the total building stock of Vietnam, the 3/4 inch segment positively benefits from established specification practice in addition to broad contractor familiarity with this standard sizing.

Application Insights:

- HVAC

- Refrigeration

The HVAC leads with a share of 64% of the total Vietnam copper pipes market in 2025.

The HVAC segment holds the largest market share, driven by Vietnam’s tropical climate and growing demand for air conditioning and ventilation infrastructure. In September 2024, Chinese HVAC component maker Sanhua expanded its Hai Phong factory, raising annual output from 7,000 tons to 11,900 tons to supply valves, heat exchangers, and other components to global brands in Vietnam and the Asia‑Pacific . Rising living standards, a growing middle class, and commercial development further boost demand for copper piping in modern cooling systems.

The hospitality sector's expansion with new hotels, resorts, and serviced apartments creates substantial demand for commercial HVAC installations utilizing copper piping. Industrial facilities including electronics manufacturing plants, pharmaceutical factories, and food processing operations require sophisticated climate control systems. The ongoing urbanization trend and construction of modern office buildings, shopping centers, and residential towers continue driving copper pipe consumption in HVAC applications.

Regional Insights:

To get more information on this market, Request Sample

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam exhibits a clear dominance with a 39% share of the total Vietnam copper pipes market in 2025.

Northern Vietnam maintains market leadership supported by the concentration of industrial zones, manufacturing facilities, and major construction activities around Hanoi and surrounding provinces. The region hosts numerous foreign-invested factories requiring sophisticated HVAC and process piping systems. Government infrastructure investments including transportation networks, public buildings, and urban development projects create sustained copper pipe demand, reinforcing regional growth and attracting further industrial expansion.

The region benefits from established supply chains, distribution networks, and proximity to copper manufacturing facilities. Industrial parks in provinces like Bac Ninh, Hai Duong, and Vinh Phuc house electronics and manufacturing operations with significant cooling requirements. Hanoi's urban expansion with new residential developments and commercial projects supports consistent market growth for copper piping products, ensuring steady demand across both industrial and construction sectors.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Copper Pipes Market Growing?

Rapid Urbanization and Construction Sector Expansion

Vietnam is witnessing rapid urbanization, with millions migrating to cities each year, fueling extensive construction across residential, commercial, and industrial sectors. In December 2025, Hanoi launched seven major infrastructure projects worth around US $68.4 billion, covering urban renewal, transport, and social housing, highlighting the scale of city expansion and construction demand. Growth of IT parks, malls, high-rise apartments, and office complexes drives steady demand for copper-based plumbing and HVAC systems. Major urban centers, including Hanoi, Ho Chi Minh City, Da Nang, and secondary cities, sustain consistent copper pipe consumption, supported by domestic and foreign real estate investments.

Tropical Climate Driving HVAC Demand

Vietnam’s tropical climate, with year-round high temperatures and humidity, drives strong demand for air conditioning and refrigeration systems. In late 2025, the country launched its first National Sustainable Cooling Plan to cut cooling-related emissions by up to 97% and enhance energy efficiency across buildings and industrial systems, highlighting government support for efficient cooling solutions. Rising middle-class incomes boost residential comfort cooling, while commercial and industrial sectors invest in HVAC systems and cold chain infrastructure, creating consistent demand for copper tubing in refrigeration and climate control applications.

Superior Material Properties and Performance Advantages

Copper pipes provide key advantages over alternatives, including excellent thermal conductivity, corrosion resistance, and natural antimicrobial properties. In 2025, the Vietnamese government hosted Vietnam Green Building and Green Transport Week to promote sustainable construction, energy-efficient materials, and eco-friendly technologies across the sector. These qualities make copper ideal for healthcare, food processing, and water distribution applications. Its durability, long service life, and full recyclability reduce maintenance costs, ensuring copper remains a premium piping choice as building standards and performance expectations continue to rise.

Market Restraints:

What Challenges the Vietnam Copper Pipes Market is Facing?

Raw Material Price Volatility

International pricing for commodities such as copper can be significantly different due to demands and occurrences worldwide. Exchange rate fluctuations and global trading disruptions can add to difficulties for project planners and producers when they have to estimate project costs. The dependence on imports for commodities can expose Vietnam to volatile exchange rates as well as global trading disruptions.

Competition from Alternative Materials

Less expensive piping material options such as PVC, CPVC, PEX, and PEXA compete with copper. However, alternatives such as aluminum tubing exist with regard to HVAC. There could be possibilities of competitors winning more market in cases where costs matter more compared to performance or where specifications do not state usage of copper.

Skilled Labor Requirements for Installation

The installation process in copper pipes requires technical know-how in soldering, brazing, or copper pipe fittings. The absence of technicians in some places can contribute to copper pipes not being chosen as a preferred type of conduit due to easier handling associated with other materials. Training remains an ever-evolving process that reduces readiness to use copper pipes everywhere.

Competitive Landscape:

The Vietnam copper pipes market features a competitive landscape with both domestic manufacturers and international suppliers serving diverse customer segments. Market participants differentiate through product quality, technical specifications, pricing strategies, distribution network coverage, and customer service capabilities. Local manufacturers benefit from proximity to customers and understanding of market requirements, while international suppliers leverage global expertise and brand recognition. The competitive environment encourages product innovation, operational efficiency improvements, and enhanced customer support. Strategic partnerships between manufacturers and distributors strengthen market reach across geographic regions and customer segments.

Vietnam Copper Pipes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | L Type, M Type, K Type |

| Products Covered | Rods, Wires, Plates, Strips, Tubes |

| Outer Diameters Covered | 3/8 Inch, 1/2 Inch, 5/8 Inch, 3/4 Inch, 7/8 Inch, 1 Inch, Above 1 Inch |

| Applications Covered | HVAC, Refrigeration |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 9-11 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam copper pipes market reached a volume of 20.9 thousand tons in 2025.

The Vietnam copper pipes market is expected to grow at a compound annual growth rate of 3.94% from 2026-2034 to reach 29.6 thousand tons by 2034.

L Type dominated the Vietnam copper pipes market with a share of 48%, owing to its versatile applications in both residential and commercial plumbing systems and optimal balance of wall thickness and durability.

Key factors driving the Vietnam copper pipes market include rapid urbanization and construction sector expansion, tropical climate driving HVAC and refrigeration demand, superior material properties of copper including thermal conductivity and corrosion resistance, and government infrastructure development initiatives.

Major challenges include raw material price volatility affecting cost predictability, competition from alternative piping materials in price-sensitive segments, skilled labor requirements for proper copper pipe installation, and import dependency for raw materials exposing the market to currency fluctuations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)