Vietnam Construction Equipment Rental Market Report by Solution Type (Products, Services), Equipment Type (Heavy Construction Equipment, Compact Construction Equipment), Type (Loader, Cranes, Forklift, Excavator, Dozers, and Others), Application (Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, and Others), Industry (Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, and Others), and Region 2025-2033

Market Overview:

Vietnam construction equipment rental market size is projected to exhibit a growth rate (CAGR) of 7.03% during 2025-2033. The ongoing technological advancements in machinery, which allow companies to access the latest and most efficient equipment without the need for a long-term investment, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 7.03% |

Construction equipment rental is a practice where companies or individuals can lease machinery and tools for temporary use rather than purchasing them outright. This arrangement offers several advantages, including cost-effectiveness, flexibility, and access to a wide range of specialized equipment. Construction equipment available for rental spans from earthmoving machinery like excavators and bulldozers to smaller tools such as concrete mixers and power drills. Renting allows construction businesses to adapt to project-specific needs without the burden of long-term ownership costs, maintenance responsibilities, and storage concerns. Additionally, it enables companies to access state-of-the-art equipment without the hefty upfront investment. This approach promotes efficiency in construction projects, enhances financial flexibility, and aligns with the dynamic demands of the industry. Construction equipment rental is a strategic solution for optimizing resources and maintaining competitiveness in the ever-evolving construction landscape.

Vietnam Construction Equipment Rental Market Trends:

The construction equipment rental market in Vietnam is experiencing robust growth, primarily propelled by a surge in infrastructure development projects. Additionally, the increasing trend among construction companies to opt for rental services rather than outright purchases is a key driver. This shift is driven by the cost-effectiveness and flexibility offered by equipment rental arrangements. Moreover, the growing emphasis on sustainable construction practices has led to a preference for newer and more eco-friendly equipment, further boosting the demand for rental services. Furthermore, the evolving regulatory landscape, which often imposes stringent emission standards and safety requirements, encourages construction firms to regularly update their equipment fleet. This has led to a higher turnover in equipment, favoring the rental market. The rise in mega construction projects, such as airports, highways, and smart cities, also plays a pivotal role in propelling the demand for construction equipment rental. In addition to this, the cyclical nature of construction projects, where equipment needs vary throughout different phases, is expected to drive the construction equipment rental market in Vietnam during the forecast period.

Vietnam Construction Equipment Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on solution type, equipment type, type, application, and industry.

Solution Type Insights:

- Products

- Services

The report has provided a detailed breakup and analysis of the market based on the solution type. This includes products and services.

Equipment Type Insights:

- Heavy Construction Equipment

- Compact Construction Equipment

A detailed breakup and analysis of the market based on the equipment type have also been provided in the report. This includes heavy construction equipment and compact construction equipment.

Type Insights:

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes loader, cranes, forklift, excavator, dozers, and others.

Application Insights:

- Excavation and Mining

- Lifting and Material Handling

- Earth Moving

- Transportation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes excavation and mining, lifting and material handling, earth moving, transportation, and others.

Industry Insights:

- Oil and Gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the industry. This includes oil and gas, construction and infrastructure, manufacturing, mining, and others.

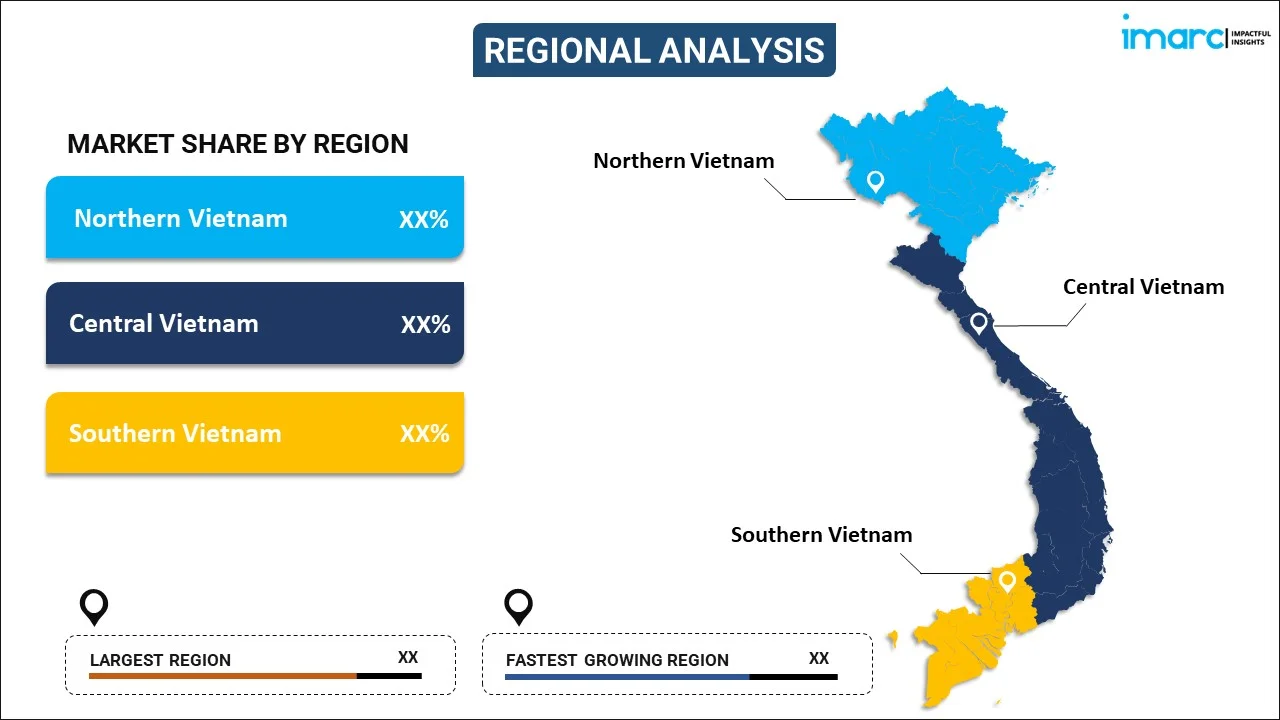

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Construction Equipment Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Solution Types Covered | Products, Services |

| Equipment Types Covered | Heavy Construction Equipment, Compact Construction Equipment |

| Types Covered | Loader, Cranes, Forklift, Excavator, Dozers, Others |

| Applications Covered | Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, Others |

| Industries Covered | Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam construction equipment rental market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Vietnam construction equipment rental market?

- What is the breakup of the Vietnam construction equipment rental market on the basis of solution type?

- What is the breakup of the Vietnam construction equipment rental market on the basis of equipment type?

- What is the breakup of the Vietnam construction equipment rental market on the basis of type?

- What is the breakup of the Vietnam construction equipment rental market on the basis of application?

- What is the breakup of the Vietnam construction equipment rental market on the basis of industry?

- What are the various stages in the value chain of the Vietnam construction equipment rental market?

- What are the key driving factors and challenges in the Vietnam construction equipment rental?

- What is the structure of the Vietnam construction equipment rental market and who are the key players?

- What is the degree of competition in the Vietnam construction equipment rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam construction equipment rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam construction equipment rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam construction equipment rental industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)