Vietnam Coffee Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Vietnam Coffee Market Summary:

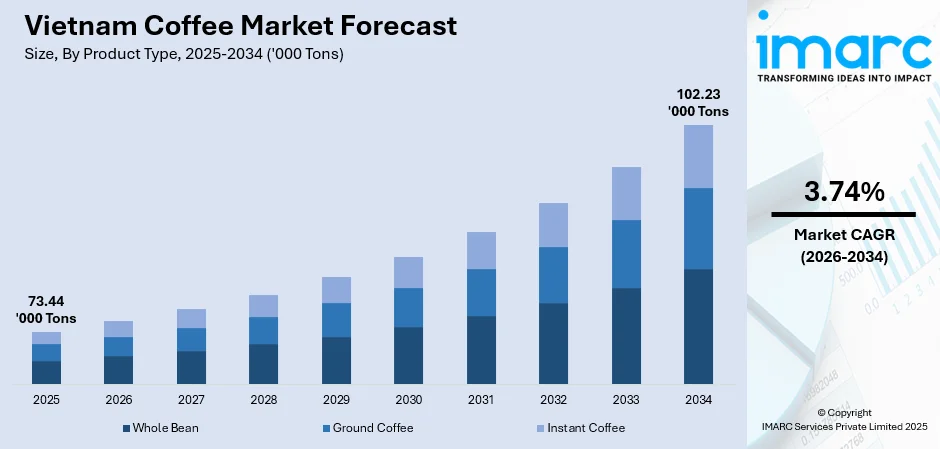

The Vietnam coffee market size reached 73.44 Thousand Tons in 2025 and is projected to reach 102.23 Thousand Tons by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

Due to rising domestic consumption and a thriving café culture that has proven essential to urban lifestyles, Vietnam's coffee market is expanding. Market dynamics are strengthened by the nation's status as the top producer of robusta and the second-largest exporter of coffee worldwide. Vietnam's coffee market share is changing due to rising disposable incomes, fast urbanization, and changing customer tastes for premium and specialty coffee variants.

Key Takeaways and Insights:

-

By Product Type: Instant coffee dominates the market with a share of 47% in 2025, owing to its convenience, affordability, and alignment with busy urban lifestyles. Major domestic and international brands continue introducing diverse flavors and quality options appealing to varied consumer tastes.

-

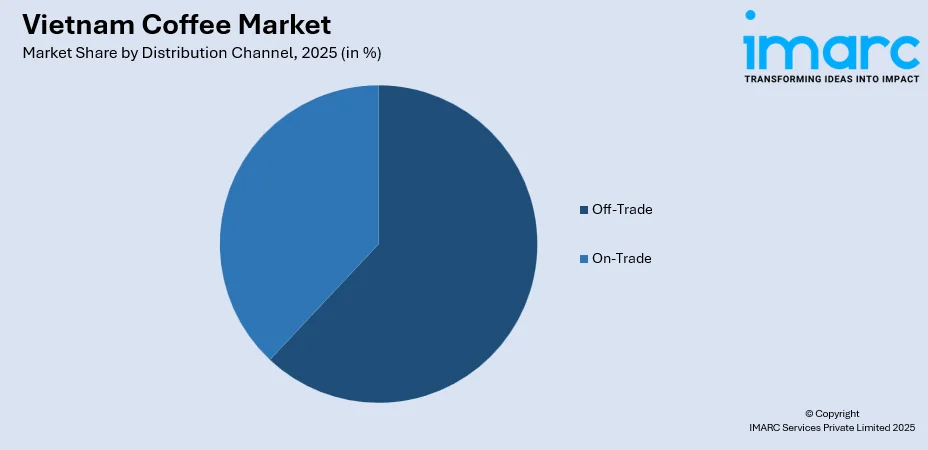

By Distribution Channel: Off-trade leads the market with a share of 62% in 2025. This dominance is driven by widespread availability through supermarkets, convenience stores, and expanding e-commerce platforms that support at-home coffee consumption among working professionals and younger demographics.

-

By Region: Southern Vietnam comprises the largest region with 51% share in 2025, driven by ideal climatic conditions in the Central Highlands, well-established coffee plantations, advanced infrastructure, and robust supply chains supporting efficient production and distribution.

-

Key Players: Key players drive the Vietnam coffee market by expanding processing capacities, investing in premium product development, and strengthening distribution networks. Their strategic initiatives in sustainability certifications and technological innovations enhance market competitiveness and ensure consistent product availability. Some of the key players operating in the market include Anni Coffee, Highlands Coffee, Len's Coffee LLC, Nestlé S.A., Starbucks Corporation, Trung Nguyên and Vinacafé Bien Hoa Joint Stock Company.

To get more information on this market Request Sample

Vietnam's coffee industry is undergoing significant transformation driven by strategic investments in value-added production and technological advancements across the supply chain. Local producers are investing heavily in processing technologies to shift from raw bean exports to higher-margin products such as roasted, ground, and specialty coffee. The emergence of domestic brands building distinct identities both locally and internationally reflects the market's evolution. The rapid proliferation of coffee shop chains underscores the sector's vibrancy. Digital platforms and precision agriculture tools are reshaping production and distribution efficiency, while government initiatives such as the Database System for Forest and Coffee Growing Areas launched in December 2024 promote traceability and environmental accountability.

Vietnam Coffee Market Trends:

Rising Demand for Premium and Specialty Coffee

Specialty coffee that offers superior quality, transparent origin traceability, and sustainable production methods is becoming more and more popular among Vietnamese customers. Coffee drinking is seen by younger generations as a lifestyle statement, and they look for unique experiences through premium beans, interesting origin tales, and sophisticated roasting methods. Coffee shops have developed into multipurpose venues for social interaction, work, and entertainment, increasing demand for high-end products in urban and semi-urban areas. With discriminating consumers prepared to spend more for single-origin kinds, artisanal roasts, and ethically sourced goods that fit their preferences and values, this trend reflects broader shifts in consumer expectations.

Digital Transformation and E-Commerce Expansion

In Vietnam's coffee market, consumer purchasing habits are changing due to the fast digitization of retail and growing internet penetration. To take advantage of the expanding online customer base, major chains are launching mobile applications, loyalty programs, and close interaction with delivery platforms. Instant coffee goods are becoming more accessible thanks to e-commerce platforms, and large firms' revenue streams are greatly boosted by online retail. Direct-to-consumer interactions and tailored marketing tactics are made possible by this digital transformation, which increases brand loyalty among younger, tech-savvy consumers. The way Vietnamese customers find, buy, and interact with their favorite coffee brands is still changing due to the ease of doorstep delivery and subscription models.

Sustainability Initiatives and Regulatory Compliance

In order to comply with international standards and preserve access to important export markets, Vietnam is aggressively putting sustainability measures into practice. Through extensive traceability systems and thorough farmer databases, the nation has established itself as a leader in adhering to the European Union Deforestation Regulation. In order to create strong documentation frameworks that confirm coffee origins and manufacturing methods, government organizations are working with industry players. These programs go beyond following regulations to include more comprehensive environmental stewardship, such as conserving water, using fewer chemicals, and protecting biodiversity in developing areas. These initiatives guarantee Vietnam's long-term competitiveness in ecologically sensitive international markets while enhancing the country's standing as a responsible provider.

Market Outlook 2026-2034:

The future for the Vietnamese coffee market is still favorable due to rising investments in processing facilities, growing export prospects, and steady increase in domestic consumption. The market is anticipated to gain from excellent weather that increases crop yields and increases demand for Vietnamese robusta coffee worldwide. In both established European markets and developing Asian markets, strategic investments in value-added production and adherence to global sustainability standards will improve market positioning. Consumption tendencies are further reinforced by the expansion of contemporary retail channels and the growing café culture among younger urban populations. Technological developments in digital supply chain management and precision agriculture are improving operational efficiency throughout the industry. The market size was estimated at 73.44 Thousand Tons in 2025 and is expected to reach 102.23 Thousand Tons by 2034, reflecting a compound annual growth rate of 3.74% over the forecast period 2026-2034.

Vietnam Coffee Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Instant Coffee | 47% |

| Distribution Channel | Off-Trade | 62% |

| Region | Southern Vietnam | 51% |

Product Type Insights:

- Whole Bean

- Ground Coffee

- Instant Coffee

Instant coffee dominates with a market share of 47% of the total Vietnam coffee market in 2025.

The instant coffee segment leads the Vietnam coffee market due to its exceptional convenience and affordability, which align perfectly with the fast-paced lifestyles of urban Vietnamese consumers. The segment benefits from Vietnam's expertise in robusta coffee production, which is ideal for instant blends, ensuring a steady and cost-effective supply of raw materials. Major players continue innovating with premium offerings such as freeze-dried and microground variants to capture evolving consumer preferences. The development of diverse flavor profiles and packaging formats caters to varied taste preferences across different consumer demographics.

Vietnam's instant coffee production has demonstrated consistent growth, reflecting the segment's strong market positioning. The widespread availability through modern retail formats and e-commerce platforms enhances consumer accessibility, while aggressive marketing campaigns by leading brands strengthen brand loyalty. The segment's integration into everyday consumption patterns, particularly among working professionals seeking quick preparation options, continues driving sustained demand. Product innovations emphasizing improved taste profiles and premium ingredients are attracting consumers who previously favored freshly brewed alternatives. For instance, in December 2023, Trung Nguyen reinforced its market position by launching new G7 instant coffee mixes blending convenience with improved quality.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

- Supermarket and Hypermarket

- Specialty Stores

- Online Retail

- Others

Off-trade leads with a share of 62% of the total Vietnam coffee market in 2025.

The off-trade distribution channel dominates the Vietnam coffee market through widespread availability of packaged coffee products across supermarkets, convenience stores, specialty retailers, and expanding online platforms. Rising urbanization and changing consumer lifestyles have increased demand for at-home coffee consumption, particularly among working professionals and younger demographics seeking convenient brewing solutions. The expansion of modern retail infrastructure and promotional campaigns in retail outlets enhance product visibility and drive consistent purchasing behavior. Supermarkets and hypermarkets serve as primary touchpoints for mass-market instant coffee products, offering competitive pricing and bulk purchase options that appeal to price-conscious consumers. Specialty stores cater to premium segments by curating selections of artisanal and single-origin offerings that attract discerning coffee enthusiasts seeking elevated home brewing experiences.

E-commerce has emerged as a transformative force within the off-trade segment, enabling coffee producers to reach broader consumer bases with enhanced efficiency. Online retail platforms have become particularly effective in capturing younger consumers who prefer digital purchasing experiences and value doorstep delivery convenience. Major brands have capitalized on this trend by developing direct-to-consumer channels and premium visibility strategies through targeted digital advertising and influencer partnerships. The combination of physical retail presence and digital capabilities creates a comprehensive distribution network supporting sustained market growth across diverse consumer segments.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Southern Vietnam exhibits a clear dominance with a 51% share of the total Vietnam coffee market in 2025.

Southern Vietnam dominates the Vietnam coffee market due to its ideal climatic conditions, fertile volcanic soil, and well-established coffee plantations concentrated in the Central Highlands region. The region benefits from favorable elevation, distinct wet and dry seasons, and advanced agricultural practices that create optimal conditions for cultivating high-quality robusta coffee. The presence of major processing facilities and export ports facilitates efficient production and distribution to both domestic and international markets. Generations of farming expertise have been passed down through local communities, creating a skilled agricultural workforce capable of maximizing yields while maintaining quality standards.

The Central Highlands provinces including Dak Lak, Lam Dong, Dak Nong, Gia Lai, and Kon Tum form the backbone of Vietnam's coffee production capabilities. The region has developed robust infrastructure and supply chains that enable seamless connectivity between farmers, processors, and exporters. Experienced farmers and cooperatives implement modern cultivation techniques while maintaining productivity levels significantly above global averages through intensive crop management practices and selective harvesting methods. Favorable rainfall patterns continue supporting crop development, with precipitation in key provinces reaching more than twice seasonal averages during critical growing periods.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Coffee Market Growing?

Rising Domestic Consumption and Café Culture Expansion

Vietnam's coffee market is experiencing significant growth driven by rising domestic consumption and a thriving café culture that has become central to urban lifestyles. The country has witnessed a remarkable proliferation of coffee establishments, with over five hundred thousand coffee shops operating nationwide, ranging from traditional street vendors to sophisticated modern chains. Young urban populations increasingly view coffee consumption as a social activity and lifestyle statement, driving frequent visits to cafés for work, entertainment, and social interaction. Takeaway and home-brewed coffee trends are gaining momentum, particularly among younger demographics seeking convenient consumption formats. The expansion of major chains including Highlands Coffee, Phuc Long, and The Coffee House reflects sustained demand. In 2024, Phuc Long added thirty-three new outlets and achieved a thirteen percent rise in average daily sales.

Strategic Investments in Processing and Value Addition

The Vietnam coffee market is significantly driven by increasing emphasis on value-added production and vertical integration across the supply chain. Local and international producers are investing heavily in processing technologies to shift from raw bean exports to higher-margin products including roasted, ground, specialty, and instant coffee. These investments enhance competitive positioning and capture greater value from the coffee production cycle. Major industry players have collectively committed substantial capital to expand processing capacities and modernize facilities. In April 2025, Nestlé Vietnam announced an additional USD 75 Million investment in its Tri An plant, bringing total investment for 2024-2025 to USD 175 Million.

Strong Export Performance and Premium Market Access

Vietnam's position as one of the world's largest coffee exporters and leading robusta producer provides a strong foundation for sustained market growth. The country supplies a significant portion of global robusta demand, benefiting from favorable growing conditions and extensive cultivation expertise developed over decades. Premium pricing dynamics have emerged as robusta quality improvements drive higher export values despite volume fluctuations in certain periods. Asian markets including China, South Korea, the Philippines, and Indonesia are emerging as premium buyers, paying significantly higher prices compared to traditional European markets. Germany remains the largest buyer of Vietnamese coffee, while the European Union collectively accounts for the majority of exports. The classification of Vietnam as a low-risk country under the EU Deforestation Regulation strengthens long-term market access and reinforces the country's reputation as a reliable and compliant supplier to environmentally conscious international buyers.

Market Restraints:

What Challenges the Vietnam Coffee Market is Facing?

Climate Change and Weather Volatility

Vietnam's coffee production faces significant challenges from climate change impacts, including prolonged droughts, irregular rainfall patterns, and temperature fluctuations affecting key growing regions. Extreme weather events have reduced national coffee output and stressed crop yields, particularly in the Central Highlands where the majority of robusta is cultivated. These climate-related disruptions create supply uncertainties and increase production costs for farmers.

Regulatory Compliance and Traceability Requirements

The European Union Deforestation Regulation imposes complex traceability and documentation requirements on Vietnamese coffee exporters. Meeting stringent standards for verifiable non-deforestation sourcing demands significant investments in data systems, farmer training, and supply chain monitoring. While Vietnam is proactively preparing for compliance, the regulatory burden increases operational costs and creates challenges for smallholder farmers with limited resources.

Supply Chain Disruptions and Rising Costs

Vietnam's coffee supply chain faces ongoing disruptions from farmers hoarding beans in anticipation of higher prices, labor shortages, and rising production costs. These factors create supply uncertainties for processors and exporters while complicating forward contract commitments. Increased fertilizer and labor costs strain smallholder farmer margins, with some transitioning to alternative crops, potentially reducing long-term coffee output.

Competitive Landscape:

The Vietnam coffee market features intense competition among domestic and international players, with major brands commanding significant market presence. Companies operating in the industry compete through product innovation, premium offerings development, and extensive distribution network expansion. Strategic investments in processing facilities and sustainability certifications enhance competitive positioning. Players focus on diversifying product portfolios emphasizing specialty and organic varieties while expanding retail footprints through flagship stores and franchise models. Digital transformation initiatives including mobile applications and e-commerce integration strengthen consumer engagement and brand loyalty.

Some of the key players include:

- Anni Coffee

- Highlands Coffee

- Len's Coffee LLC

- Nestlé S.A.

- Starbucks Corporation

- Trung Nguyên

- Vinacafé Bien Hoa Joint Stock Company

Vietnam Coffee Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Whole Bean, Ground Coffee, Instant Coffee |

| Distribution Channels Covered |

|

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | Anni Coffee, Highlands Coffee, Len's Coffee LLC, Nestlé S.A., Starbucks Corporation, Trung Nguyên, Vinacafé Bien Hoa Joint Stock Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 9-11 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam coffee market reached a volume of 73.44 Thousand Tons in 2025.

The Vietnam coffee market is expected to grow at a compound annual growth rate of 3.74% from 2026-2034 to reach 102.23 Thousand Tons by 2034.

Instant coffee dominated the market with a share of 47%, driven by its convenience, affordability, and alignment with urban consumer lifestyles seeking quick preparation options.

Key factors driving the Vietnam coffee market include rising domestic consumption, expanding café culture, strategic investments in processing infrastructure, strong export performance, and growing demand for premium and specialty coffee varieties.

Major challenges include climate change impacts on crop yields, complex regulatory compliance requirements under the EU Deforestation Regulation, supply chain disruptions from farmer stockholding, rising production costs, and labor shortages in key growing regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)