Vietnam Cement Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Vietnam Cement Market Size and Share:

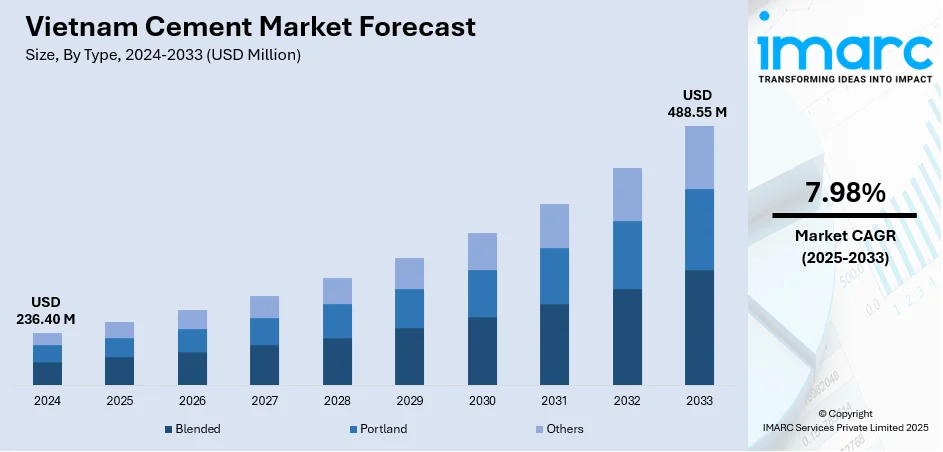

The Vietnam cement market size was valued at USD 236.40 Million in 2024. Looking forward, the market is expected to reach USD 488.55 Million by 2033, exhibiting a CAGR of 7.98% during 2025-2033. Southern Vietnam currently dominates the market, holding a significant market share of 42.2% in 2024. The rising construction of residential and commercial buildings, increasing adoption of cleaner technologies and more sustainable practices within the industry, and rapid improvements in logistics and transportation networks represent some of the key factors driving the Vietnam cement market share

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 236.40 Million |

| Market Forecast in 2033 | USD 488.55 Million |

| Market Growth Rate 2025-2033 | 7.98% |

Vietnam’s cement market is primarily driven by robust urbanization, infrastructure development, and strong government investment in transportation, housing, and industrial zones. Major projects such as highways, metro systems, and industrial parks have significantly boosted domestic cement consumption. Additionally, Vietnam’s position as a major cement exporter, owing to abundant limestone reserves and competitive production costs, supports market growth, especially in regions like China, the Philippines, and Africa. For instance, in June 2025, the Vietnamese government officially initiated the pilot stage of its emissions trading scheme, designed to motivate key industrial sectors to reduce their carbon dioxide output. As outlined in a government decree, the program requires producers in the cement, steel, and thermal power industries to purchase emissions allowances based on their carbon intensity, measured as the volume of CO₂ emitted per unit of production.

To get more information on this market, Request Sample

The Vietnam cement market growth is also driven by technological advancements and environmental regulations. Producers are adopting energy-efficient technologies, alternative fuels, and clinker substitutes to reduce emissions, driven by Vietnam’s push for sustainable growth and participation in carbon reduction initiatives. For instance, in September 2024, Fico Tay Ninh Cement introduced a new ‘green-labelled’ cement variant that emits only 350–600 kg of CO₂ per ton, representing a 70% reduction compared to conventional Portland cement, as reported by Tuoi Tre News. According to Director Nguyen Cong Bao, the company has committed resources to automation and R&D to manufacture this environmentally friendly cement. By leveraging cost-efficient technologies, the company aims to make the product competitively priced while promoting sustainability. The government’s environmental roadmap and the upcoming carbon credit market also push companies toward greener production practices.

Vietnam Cement Market Trends:

Infrastructure Development and Urbanization

Vietnam’s rapid urbanization and large-scale infrastructure expansion are key drivers of cement demand. The government continues to invest heavily in public works such as highways, metro rail, airports, industrial parks, and housing projects. Urban population growth is increasing the need for residential and commercial buildings, fueling sustained construction activity. The General Statistics Office reported that around 2.5 million people in Vietnam moved from rural areas to major cities between 2015 and 2020. The National Master Plan and smart city projects further contribute to long-term cement consumption. Additionally, the push for rural development and modernization of logistics infrastructure has created consistent demand for concrete and cement-based materials. According to the Vietnam cement market forecast, these trends ensure a steady domestic market base for cement producers, despite seasonal fluctuations or export uncertainties.

Export Opportunities and Global Market Positioning

Vietnam is among the world’s leading cement exporters, due to its abundant limestone reserves, low labor costs, and growing production capacity. Cement and clinker exports to key markets like China, the Philippines, and Africa have increased, especially where domestic shortages or infrastructure booms exist. Competitive pricing and favorable trade conditions enable Vietnam to fill supply gaps in global markets. Government support through bilateral trade agreements also enhances export viability. As such, Vietnam aims to complete 3,000 kilometers of highways by 2025, with an investment of approximately 200 Trillion VND (USD 8 Billion). The government is accelerating investment disbursements, addressing challenges like site clearance and construction quality, with ongoing projects covering over 1,700km and 1,400km set to start soon. Despite global economic fluctuations, Vietnam's strategic location and scalable production give it an edge, allowing local manufacturers to offset domestic oversupply through stable and growing international demand.

Sustainability Regulations and Green Innovation

Environmental regulations and carbon reduction initiatives are reshaping Vietnam’s cement industry. With the launch of a pilot emissions trading scheme, cement producers must now account for their CO₂ intensity and buy allowances accordingly. According to the Vietnam cement market trends, this has accelerated investment in low-emission technologies, alternative fuels, and blended cements. Companies are also adopting automation and digital tools to optimize energy use and minimize environmental impact. Green-labelled products, like those introduced by Fico Tay Ninh Cement, reflect a broader trend toward sustainable manufacturing. As global and domestic stakeholders prioritize ESG compliance, innovation in eco-friendly cement production is becoming a critical factor in long-term competitiveness and profitability. For instance, in December 2024, Thailand’s SCG Group increased the output of its eco-friendly SCG Low Carbon Cement products to meet growing demand in southern Vietnam.

Vietnam Cement Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam cement market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and end use.

Analysis by Type:

- Blended

- Portland

- Others

Portland stands as the largest type in 2024, holding 57.9% of the market due to its widespread use in infrastructure, residential, and commercial construction. It is preferred for its high strength, durability, and versatility, making it suitable for a broad range of structural applications. Additionally, Portland cement is cost-effective and easily available across the country, supported by Vietnam’s abundant limestone reserves and established manufacturing capacity. Its compatibility with traditional construction methods also contributes to its dominance. Despite emerging demand for green alternatives, the familiarity, reliability, and standardized performance of Portland cement continue to make it the preferred choice for large-scale projects and routine construction across Vietnam.

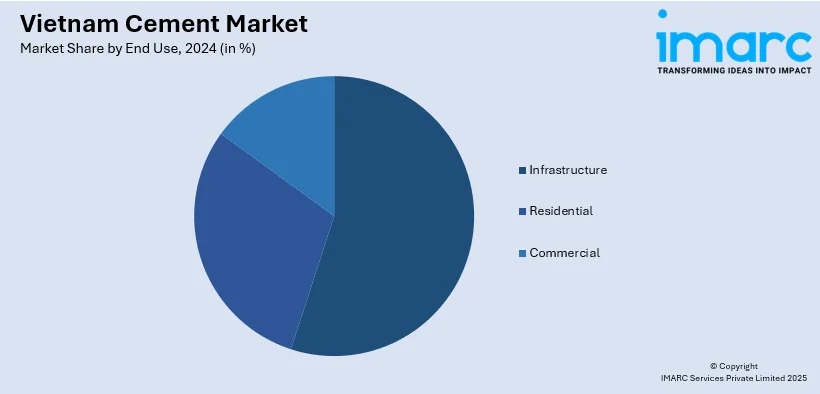

Analysis by End Use:

- Residential

- Commercial

- Infrastructure

Infrastructure leads the market with 48.5% of market share in 2024. Infrastructure accounts for the largest share in the Vietnam cement market due to the government’s ongoing commitment to improving the country’s transportation and public works systems. Projects such as roads, bridges, ports, and urban transit developments rely heavily on cement for their construction, which is creating a positive impact on the Vietnam cement market outlook. These initiatives are central to Vietnam’s broader goals of economic development and regional connectivity. Cement is essential for building durable and large-scale structures, making it a vital material for infrastructure work. Additionally, infrastructure projects are typically long-term and backed by government funding, ensuring steady demand. This sustained activity solidifies the infrastructure’s dominant role in driving cement consumption across the country.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2024, Southern Vietnam accounted for the largest market share of 42.2%. The Vietnam cement market demand in the southern region is driven by rapid urbanization, robust industrial growth, and expanding infrastructure development. Southern cities like Ho Chi Minh City are witnessing a surge in residential, commercial, and industrial construction, creating strong demand for cement. Industrial zones, logistics hubs, and transportation projects—including highways, ports, and metro lines—are key contributors. Additionally, proximity to major export ports makes the South a strategic location for cement production and distribution. The growing adoption of eco-friendly and low-carbon cement, supported by sustainability initiatives and green construction trends, is further shaping the market. Rising investment from both domestic and foreign developers enhances long-term cement demand in Southern Vietnam.

Competitive Landscape:

The Vietnam cement market is highly competitive, with a mix of state-owned enterprises, private companies, and foreign-invested firms. Major players include VICEM (Vietnam Cement Industry Corporation), Holcim (INSEE), Fico-YTL, and SCG Group, all of which have strong nationwide distribution and large production capacities. Companies compete on pricing, product quality, and innovation, particularly in green and low-carbon cement offerings. Export-oriented firms are expanding their presence in international markets, leveraging Vietnam’s cost advantages and abundant raw materials. Sustainability trends and government emissions regulations are pushing companies to invest in energy-efficient technologies and alternative fuels. Strategic mergers, capacity expansions, and research and development (R&D) initiatives define the market’s evolving competitive dynamics.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam cement market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Siam Cement Plc planned to reopen its USD 5.4 Billion Long Son petrochemicals plant in Vietnam, which has been closed since October due to weak demand and prices. The company anticipates a price rebound, aided by a US-China tariff truce and increased manufacturing in China.

- March 2025: Fico Tay Ninh Cement launched 'green-labelled' cement, reducing CO₂ emissions by 70% compared to traditional Portland cement. SCG Concrete Roof Company also introduced its own eco-friendly cement, cutting carbon emissions by 20%. Both companies aim to offer competitive prices with cost-saving technologies.

- February 2025: Xuan Son Group launched Xuan Son Cement at their new plant in Hoa Binh Province. The plant, with a capacity of 3.3 million tons annually, integrates advanced technologies for energy efficiency and sustainable production. The event marked a significant milestone in Vietnam's construction industry.

- September 2024: VICEM and FLSmidth announced a partnership to promote sustainable cement production in Vietnam. The collaboration aims to reduce emissions, utilize alternative fuels, and improve energy efficiency. Focus areas include waste-to-energy solutions, carbon reduction, and waste-heat recovery, supporting Vietnam's environmental goals for the cement sector.

- June 2024: SCG launched its first SCG Low Carbon Super Cement in Vietnam, aiming to support the country’s net-zero target by 2050. The eco-friendly cement reduces carbon emissions by 20%, offers enhanced durability, and uses green manufacturing practices, setting a new standard in Vietnam’s construction industry.

Vietnam Cement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam cement market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam cement market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cement market in Vietnam was valued at USD 236.40 Million in 2024

The Vietnam cement market is projected to exhibit a CAGR of 7.98% during 2025-2033, reaching a value of USD 488.55 Million by 2033.

Vietnam’s cement market is driven by rapid urbanization, large-scale infrastructure projects, and growing export demand. Government investments, abundant limestone reserves, and low production costs support expansion. Additionally, rising sustainability regulations and the adoption of green technologies are encouraging innovation, while increased foreign and private investments boost competitiveness and production efficiency.

Southern Vietnam holds the largest share of the Vietnam cement market due to rapid urban development, industrial zone expansion, infrastructure projects, proximity to export ports, and rising demand for eco-friendly construction materials amid growing sustainability efforts

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)