Vietnam Cattle Feed Market Size, Share, Trends and Forecast by Animal Type, Ingredient, and Region, 2026-2034

Vietnam Cattle Feed Market Overview:

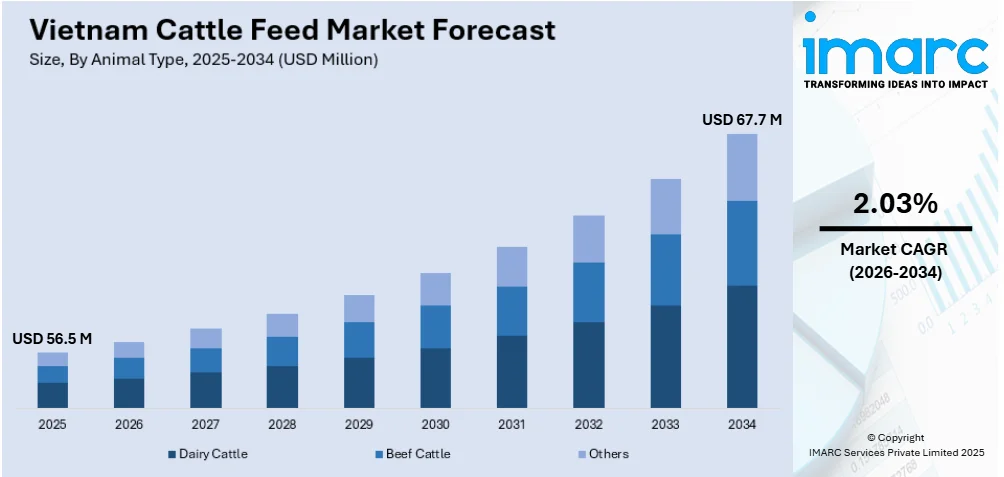

The Vietnam cattle feed market size was valued at USD 56.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 67.7 Million by 2034, exhibiting a CAGR of 2.03% from 2026-2034. Southern Vietnam dominates the market, holding 40.7% of the market share. The market is experiencing significant growth, driven by the rising demand for meat and dairy products, as well as the growth of commercial farming. The increasing shift towards more efficient feeding practices and the adoption of advanced feed technologies are also key growth factors. With continuous investments in feed formulations and production, the market is poised for further development, contributing to a larger Vietnam cattle feed market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 56.5 Million |

|

Market Forecast in 2034

|

USD 67.7 Million |

| Market Growth Rate 2026-2034 | 2.03% |

Vietnam’s cattle feed market is pushed forward by the country’s growing demand for meat, especially beef, as incomes rise and urban diets shift. This has encouraged livestock farmers to move from traditional grazing to more intensive feeding methods. As a result, demand for high-quality feed has increased. The shift is also supported by government initiatives that aim to modernize agriculture and improve animal productivity. For instance, in September 2024, the American Feed Industry Association (AFIA) signed a five-year MOU with Vietnam's Feed Association and Animal Husbandry Association to enhance the country's feed and livestock sectors. This partnership aims to modernize practices, promote sustainability, and improve animal health, supported by USDA funding and a commitment to industry growth and safety. These factors have created steady pressure to scale up production, making cattle feed an essential part of the chain.

To get more information on this market Request Sample

The market is also shaped by a rise in commercial farming and foreign investment. Larger farms and feedlots are being set up with backing from both local and international players. This has led to greater use of compound feed, including protein-rich and vitamin-enhanced mixes. Feed manufacturers are adjusting formulas to improve growth rates and reduce costs. As land becomes more limited, there’s also a growing focus on efficiency using feed to reduce time to slaughter and improve yield per animal. For instance, in May 2023, Japfa Comfeed Vietnam inaugurated a new animal feed mill and slaughterhouse in Bình Phước Province, bolstering its "Feed-Farm-Food" model. This facility, with an annual capacity of 240,000 tons, is designed to promote sustainable livestock development and cater to the market needs in the Southeast and Central Highlands regions.

Vietnam Cattle Feed Market Trends:

Precision Nutrition Gaining Ground

One notable Vietnam cattle feed market trend is the rising adoption of precision nutrition. Farmers are moving away from standard feed and turning to customized blends that match the specific needs of different cattle breeds and growth stages. This shift improves weight gain, enhances feed efficiency, and reduces waste. It also allows farms to better manage costs and animal health. As commercial operations expand, more producers are relying on feed specialists to develop exact formulations. For instance, in January 2024, Cargill inaugurated a new Provimi premix plant in Giang Dien, Vietnam, significantly enhancing production capacity to 40,000 tons annually. The USD 28 Million facility features advanced technology, a 95% automation rate, and sustainable practices, aiming to meet growing demands in the livestock and aquaculture sectors while reducing environmental impact. The growing interest in data-driven, targeted feeding marks a significant Vietnam cattle feed market trend.

Sustainability Focus

Sustainability is becoming a key focus in Vietnam's cattle feed market as companies increasingly recognize the need to reduce their environmental footprint. Several feed manufacturers are implementing strategies to reduce greenhouse gas emissions by optimizing their production methods to decrease energy consumption and transforming to renewable sources of energy like wind or solar. Furthermore, there is an increasing emphasis on sustainably sourcing raw materials, utilizing by-products from other industries to minimize waste. These initiatives contribute to environmental objectives and resonate with global consumer demands for more sustainable and responsible food production. The Vietnam cattle feed market outlook suggests that sustainability will remain a key factor influencing the industry.

Shift Toward Local Sourcing of Raw Materials

The Vietnam cattle feed market is witnessing a significant shift toward local sourcing of raw materials, driven by the need to reduce dependency on global supply chains. Recent disruptions in international trade and rising import costs have highlighted the vulnerabilities of relying on imported ingredients like soybeans and corn. In response, feed manufacturers are increasingly sourcing locally grown raw materials such as rice bran, cassava, and other agricultural by-products. This move helps stabilize supply and supports local agriculture. By focusing on domestic sourcing, companies can reduce costs, ensure more consistent feed quality, and minimize environmental impact. The Vietnam cattle feed market forecast suggests that this trend will strengthen in the coming years as producers continue to prioritize local supply chains for greater resilience.

Vietnam cattle feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam cattle feed market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on animal type and ingredient.

Analysis by Animal Type:

- Dairy Cattle

- Beef Cattle

- Others

Dairy cattle stand as the largest animal type in 2025, holding around 50.8% of the market, due to the growing demand for dairy based products like milk, cheese, and yogurt. The rise in domestic consumption of dairy, coupled with a growing urban population, has led to a greater emphasis on efficient milk production. Dairy farms are adopting more intensive farming methods, relying on specialized feed to boost milk yield, improve cow health, and optimize feed conversion. The focus on high-quality, balanced nutrition for dairy cattle is shaping feed formulations to meet the specific needs of lactating cows. This growing demand for tailored feed solutions is a key factor driving the Vietnam cattle feed market demand.

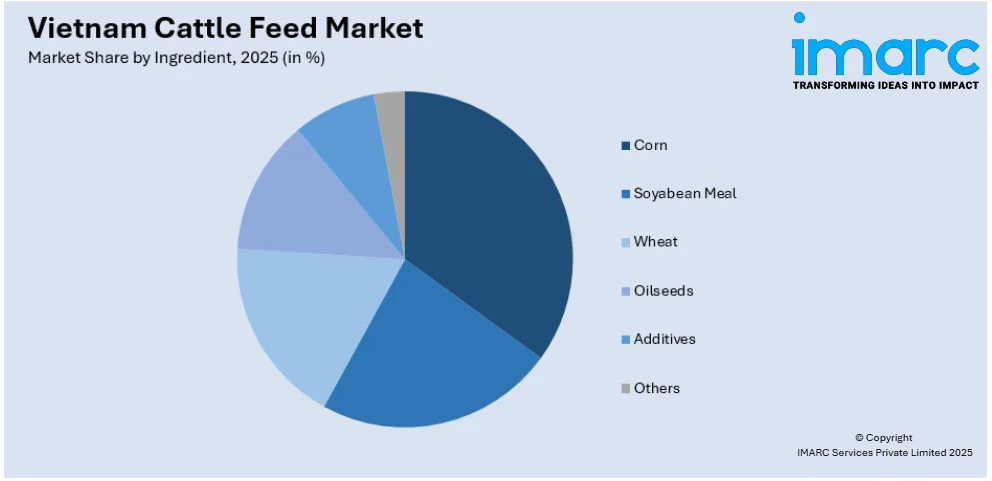

Analysis by Ingredient:

Access the comprehensive market breakdown Request Sample

- Corn

- Soyabean Meal

- Wheat

- Oilseeds

- Additives

- Others

Corn leads the market with around 33.7% of market share in 2025 due to its high energy content and availability. It is a key source of carbohydrates, supporting livestock growth and enhancing feed conversion rates. As the demand for efficient and cost-effective feed grows with the increasing scale of commercial livestock operations, corn remains a preferred choice for cattle feed formulations. Its versatility and relatively lower cost compared to other grains contribute to its widespread use in feed mills. This reliance on corn plays a significant role in driving the Vietnam cattle feed market growth, ensuring that the feed industry can meet the nutritional needs of growing livestock populations while keeping costs competitive.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2025, Southern Vietnam accounted for the largest market share of over 40.7%. Southern Vietnam plays a central role in the country’s cattle feed market, largely due to its extensive agricultural base and strong industrial farming presence. The region is home to a large number of commercial livestock farms, including those focused on dairy and beef cattle. Its favorable climate supports the cultivation of essential raw materials for cattle feed, such as corn, soybeans, and rice by-products. Additionally, Southern Vietnam’s proximity to major ports facilitates the import of feed ingredients and machinery, contributing to a well-established feed production infrastructure. The growth of the livestock industry in this region, combined with increasing demand for meat and dairy products, drives the demand for cattle feed, making Southern Vietnam a key area for market development and expansion.

Competitive Landscape:

The Vietnamese cattle feed sector is marked by significant competition, with numerous companies vying for a stake in this fast-growing market. Feed producers are focused on delivering high-quality and affordable feed options to meet the increasing demand for effective livestock production. Companies are under pressure to innovate, providing specialized feeds designed for various animal types and developmental stages. Local suppliers are leveraging domestic sources of raw materials, while others are investigating advanced technologies to enhance feed formulations. Additionally, the market is experiencing increased competition from international feed manufacturers aiming to take advantage of the burgeoning Vietnamese livestock sector, which further amplifies the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam cattle feed market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: The US Grains Council (USGC) signed a memorandum of understanding with Vietnam’s Ministry of Agriculture and Environment to strengthen trade in animal feed and biofuels. The agreement includes workshops, educational initiatives, and efforts to reduce trade barriers, enhancing U.S. agricultural exports to Vietnam. February 2025: BAF Vietnam established three subsidiaries to develop Vietnam's first modern multi-story livestock farm in Tay Ninh. The project includes a 600,000-ton annual feed production capacity and aims for 64,000 sows and 1.6 million market pigs. BAF also acquired Xuan Nghi Phat, boosting its livestock operations.

- December 2024: GREENFEED recognized for its sustainable practices, earning a top spot in Vietnam’s CSI2024 rankings. The company advances circular agriculture by reducing plastic packaging, producing organic cattle feed, and implementing renewable energy and waste management systems. GREENFEED aims for net-zero emissions by 2050. September 2024: Aboitiz Foods launched the USD 45 Million Gold Coin Feedmill Long An factory in Vietnam’s Long An province. The factory, with a capacity of 300,000 tons annually, aims to support sustainable growth in the livestock industry, create jobs, and boost the regional economy. July 2024: Japan’s Nippn Corporation announced plans to establish a subsidiary in Vietnam, with a USD 13 Million investment in Dong Nai. The subsidiary will include an animal feed factory, producing 4,300 tons of premix annually. This expansion aims to boost Nippn’s overseas sales and market presence in ASEAN.

Vietnam Cattle Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Dairy Cattle, Beef Cattle, Others |

| Ingredients Covered | Corn, Soyabean Meal, Wheat, Oilseeds, Additives, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam cattle feed market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam cattle feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam cattle feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cattle feed market in the Vietnam was valued at USD 56.5 Million in 2025

The Vietnam cattle feed market is projected to exhibit a CAGR of 2.03% during 2026-2034, reaching a value of USD 67.7 Million by 2034

The Vietnam cattle feed market is driven by rising demand for dairy and meat products, increasing adoption of commercial farming, and the need for higher feed efficiency. Government support for agriculture, urbanization, and the shift to intensive farming methods further boost the demand for quality feed solutions.

Southern Vietnam accounts for the largest share of the cattle feed market, driven by its strong agricultural output, the presence of large-scale commercial farms, and proximity to key ports for feed ingredient imports. This region plays a central role in the livestock and feed production sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)