Video Conferencing Market Size, Share, Trends and Forecast by Component, Conference Type, Deployment Mode, Enterprise Size, Application, End-Use, and Region, 2026-2034

Video Conferencing Market Size and Share:

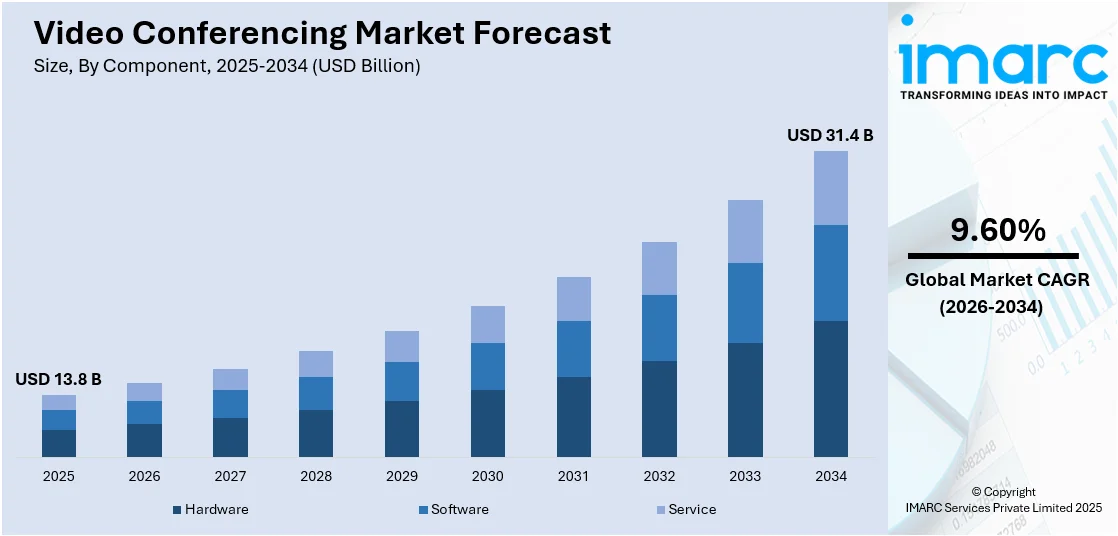

The global video conferencing market size was valued at USD 13.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 31.4 Billion by 2034, exhibiting a CAGR of 9.60% from 2026-2034. North America currently dominates the market, holding a market share of over 39.8% in 2025. The market is driven by the growing reliance on high-speed internet connection and mobile devices, the high number of cost reducing initiatives, and the increasing availability of advanced features.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 13.8 Billion |

| Market Forecast in 2034 | USD 31.4 Billion |

| Market Growth Rate 2026-2034 | 9.60% |

The growing demand for remote work and hybrid work models represents one of the key factors positively influencing the market. Businesses are employing video conferencing solutions for facilitating collaboration and enhancing productivity across different teams. Besides this, technological advancements, such as artificial intelligence (AI)-enabled features, improved video quality, and user-friendly interfaces, make these tools more effective and accessible. In addition, the increasing use of high-speed internet and mobile connectivity is encouraging the use of video conferencing tools, particularly in developing regions. Apart from this, the rising utilization of video conferencing platforms in industries like healthcare, education, and retail for telemedicine, online learning, and virtual customer engagement, is propelling the market growth. Moreover, the need to reduce travel expenses and carbon footprints is also contributing to the market growth.

To get more information on this market Request Sample

The United States has emerged as a major region in the video conferencing market owing to many factors. The market is driven by the widespread adoption of remote and hybrid work models across industries due to evolving workplace preferences. Additionally, high internet penetration and advanced digital infrastructure support seamless video communication, enabling businesses, schools, and healthcare providers to leverage these tools effectively. As per the data published on the official website of Pew Research Centre, 96% of US adults use the internet in 2024. Apart from this, the rising shift towards telehealth services and online education significantly contributes to market growth, as video conferencing platforms facilitate virtual consultations and remote learning. Moreover, technological innovations, such as enhanced security, and integration with productivity tools, further attract enterprises looking to streamline operations and improve collaboration.

Video Conferencing Market Trends:

Growing Adoption of Remote Work Culture

The rapid adoption of the remote work culture due to the changing workplace preferences has influenced the overall market. As companies around the world seek to shift towards remote work setups for sustaining the operations of their businesses, the need for highly efficient tools of virtual collaboration is rising. In the United States, as of February 2023, 52% of remote-capable employees were working in a hybrid arrangement, 28% were fully remote, and 20% were on-site, as per industry reports. Consequently, video conferencing has become an irreplaceable means of communication and collaboration for dispersed teams, allowing them to maintain face-to-face contact despite the geographical separation. As a result, many companies have adopted the remote work model permanently. The demand for this type of solutions is expected to hold strong, further promoting the market growth.

Availability of High-speed Internet

The widespread availability of high-speed internet connectivity and the ubiquity of smartphones and tablets have democratized access to video conferencing solutions across diverse demographics. According to the Global System for Mobile Communications (GSMA), over 90% of the worldwide population has access to 4G or higher mobile networks. With internet infrastructure improvements and affordable data plans, individuals and businesses can readily engage in high-quality video conferencing sessions from virtually anywhere, transcending geographical barriers. This accessibility fosters inclusivity and enables participation from remote or underserved regions, facilitating higher connectivity and knowledge exchange. High-speed internet allows more complex video conferencing setups, such as virtual collaboration spaces or telepresence systems, which require a robust connection to function optimally.

Focus on Cost Reduction and Mitigation of Carbon Emissions

The increasing emphasis on cost-saving endeavors and a carbon-neutral process by umpteen organizations is encouraging the shift from regular conferences towards virtual meetings. The cost of business travel is also reduced significantly due to video conferencing, which relieves businesses of the financial burden of transportation, hotels, food, and venue rentals. According to an industrial report, video conferencing is playing a pivotal role in reducing business travel costs by approximately 30%. Simultaneously, fewer people will need to drive to work, lowering the carbon footprint of companies attempting to meet their environmental obligations. As businesses strive for continuing optimization and minimal eco-effect, video conferencing-related trends and the future of communication and collaboration are set to evolve in a virtual environment.

Video Conferencing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global video conferencing market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, conference type, deployment mode, enterprise size, application, and end-use.

Analysis by Component:

- Hardware

- Camera

- Microphone/Headphone

- Others

- Software

- Service

- Professional Services

- Managed Services

Hardware (camera, microphone/headphone, and others) represents the largest segment, holding 49.8% of the market share. This segment is driven by the increasing demand for high-quality audiovisual experiences, with consumers and businesses alike seeking advanced hardware solutions to enhance their video conferencing capabilities. Essential hardware devices ensure high-quality video and audio during virtual meetings. Many businesses and institutions prefer investing in dedicated hardware, such as conference room systems, to provide professional and seamless experience. Additionally, advanced hardware solutions, like 4K cameras and noise-canceling microphones, cater to the need for better communication quality. Moreover, the rise in hybrid and remote work models also drives the need for reliable hardware to support employees working from different locations. Sectors like healthcare and education also require specialized devices for telemedicine consultations and virtual classrooms. Hardware upgrades are often necessary as organizations look to scale operations and improve performance.

Analysis by Conference Type:

- Telepresence System

- Integrated System

- Desktop System

- Service-Based System

The telepresence system accounts for the majority of the market share due to the escalating need for immersive virtual meeting experience. It uses high-definition video and advanced audio technology to make participants feel like they are physically present in the same room, even when they are miles apart. This is crucial for high-stakes meetings, like boardrooms or executive-level discussions, where effective communication and collaboration are key. Telepresence setups are designed to replicate in-person interactions as closely as possible, with large screens and room layouts that mimic real-world settings, and multiple cameras that capture the entire room. Businesses, especially large enterprises, prefer these systems for their ability to create a sense of presence, making remote meetings feel more natural and engaging. Additionally, telepresence systems offer superior quality, reducing the strain of poor connections and miscommunications often seen in standard video calls. This makes them the go-to choice for important conferences and decision-making discussions.

Analysis by Deployment Mode:

- On-Premises

- Cloud-Based

On-premises exhibits a clear dominance, holding 58.7% of the market share, because they give businesses complete control over their infrastructure, security, and data. With on-premises systems, companies can ensure that sensitive information stays within their own network, reducing the risks associated with cloud-based solutions. This plays a pivotal role for industries like finance and healthcare wherein data privacy and compliance are crucial. On-premises deployments also offer more customization options, as they allow businesses to tailor the systems to their specific needs and integrate them with other internal tools and software for smoother operations. Additionally, on-premises solutions often provide better scalability and performance, especially in large organizations where network speed and reliability are crucial. While cloud solutions are becoming more popular due to their ease of use, on-premises systems continue to be favored by businesses that prioritize security, control, and long-term cost efficiency. They offer a robust and reliable option for organizations with strict requirements.

Analysis by Enterprise Size:

- Large Enterprises

- SME (Small and Medium-sized enterprises)

The large enterprises comprise the largest segment, holding 55.9% of the market share. They have greater resources and a higher demand for effective communication across multiple locations. These organizations operate in various regions, with teams spreading out worldwide, making video conferencing a critical tool for collaboration. The need for seamless and high-quality communication encourages large companies to invest in advanced video conferencing systems that can support numerous users and complex features. Large enterprises also require highly secure and customizable solutions to meet specific business needs. They choose on-premises or hybrid solutions, as they provide more control over security and data management. With a larger workforce, these companies benefit from scaling video conferencing solutions to accommodate frequent and high-level meetings, training sessions, and cross-departmental collaboration. Additionally, large enterprises have bigger budgets to spend on sophisticated technology like telepresence systems, which provide a more immersive experience. This investment enables them to stay ahead in terms of efficiency and productivity.

Analysis by Application:

- Corporate Communications

- Training and Development

- Marketing and Client Engagement

Corporate communications hold the biggest market share, which can be attributed to the growing need for seamless internal as well as external communication within different organizations. Corporate communications via video conferencing are essential for day-to-day business operations. Companies rely on video conferencing for internal meetings, team collaborations, client presentations, and executive briefings. As businesses grow and become more widespread, effective communication across different locations is crucial for maintaining productivity and alignment. Video conferencing is the go-to tool for corporate communications because it allows real-time interactions, making it easier for employees to connect without the need for travel. This saves both time and money, which is especially important for large enterprises with teams spread across regions. Additionally, video conferencing solutions are designed to integrate with other corporate tools, such as email, document sharing, and project management software, making communication even more efficient. The ability to conduct high-quality video calls with strong security features ensures that corporate communications remain confidential and reliable.

Analysis by End-Use:

Access the comprehensive market breakdown Request Sample

- Corporate

- Education

- Healthcare

- Government and Defense

- BFSI

- Media and Entertainment

- Others

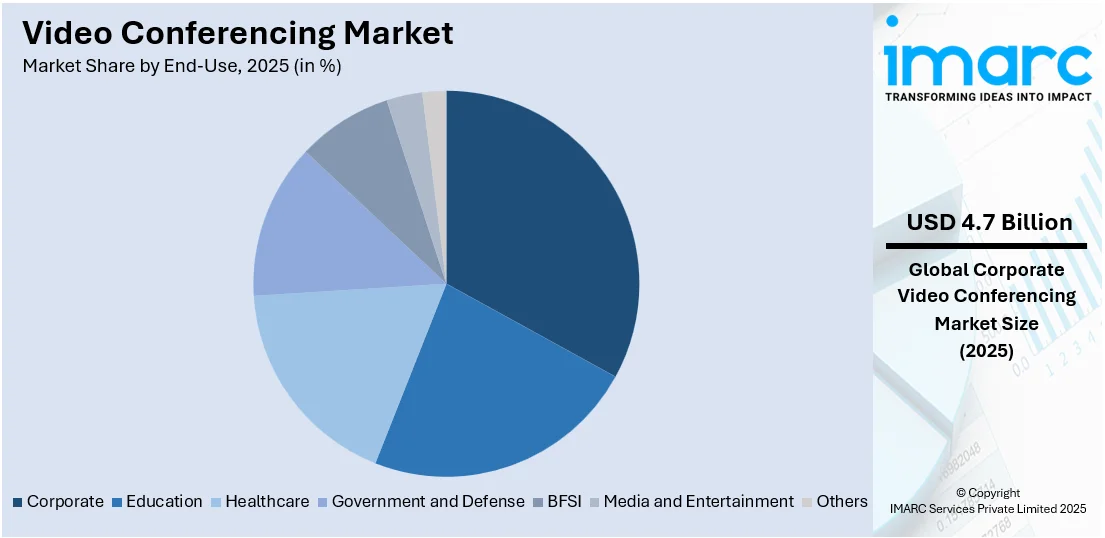

Corporate dominates the market with 37.6% share. Businesses rely on video conferencing tools for communication, collaboration, and decision-making. Video conferencing allows companies to connect with employees, clients, and stakeholders worldwide, eliminating the need for travel and saving time and money. Whether for team meetings, client presentations, or training sessions, video conferencing is important for improving productivity and maintaining smooth business operations. Corporations also use video conferencing to facilitate remote work, which has become more common. It helps teams to stay connected, share ideas, and collaborate in real-time, irrespective of where they are located. In addition, video conferencing supports higher-level communications, such as executive meetings, board discussions, and strategy sessions, ensuring that important decisions are made efficiently. Since businesses have specific needs for security, scalability, and integration with other tools, they often choose advanced video conferencing systems tailored to their requirements.

Analysis by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America enjoys the leading position in the market, accounting for 39.8% of the share. The market is driven by advancements in technology, which enables seamless virtual communication and collaboration across diverse sectors, ranging from corporate enterprises to educational institutions and healthcare facilities. Additionally, the increasing trend of remote work and virtual learning encourages the usage of video conferencing platforms as essential tools for maintaining productivity and continuity in operations. As organizations adopt hybrid work models and educational institutions integrate remote learning options into curricula, the demand for flexible and scalable video conferencing solutions is high. Furthermore, this region benefits from a highly competitive landscape characterized by innovation and product differentiation. Leading technology companies continuously introduce modern features and enhancements to their video conferencing offerings, catering to evolving user needs and preferences. In June 2024, Owl Labs, the first company to develop AI-enabled 360-degree video conferencing solutions, unveiled its next-generation flagship product, the Meeting Owl 4+, featuring 4K Ultra HD videos, in the United States, Canada, and Europe. It operates on the new owl intelligence system (OIS) software, enabling wireless pairing of additional devices and allowing organizations to tailor their environments to suit their changing requirements. Customers in the US can buy it for USD1,999 via OwlLabs.com, Amazon, or various third-party resellers and distribution associates.

Key Regional Takeaways:

United States Video Conferencing Market Analysis

The United States holds 84.30% of the market share in North America. The market is driven by the growing need for remote work, telemedicine, and virtual education. An industrial report states that 12.2% of the US workers are fully remote while around 28.5% of the employees were working from home at least sometimes in 2023, meaning the requirement for video conferencing solutions has increased to great extents. Similarly, according to the data published on the official website of the Department of Health and Human Services, the US Federal Communications Commission (FCC) has made huge efforts towards the expansion of the broadband infrastructure with the help of an investment of USD 2.75 Billion allocated for it in 2023. It aims to bring much-needed high-speed broadband internet to rural parts of the United States. Major companies wager on creating advanced tools, which is further propelling the market growth.

Europe Video Conferencing Market Analysis

The European video conferencing market is experiencing market expansion due to the rising trend of hybrid working and government-funded initiatives for developing digital infrastructure. In 2023, 8.9% of employees in the European Union reportedly worked from home, with that figure ranging widely between member countries, which, for instance, had a high of 21% among Finns and just 1% among Romanians, as reported by the European Commission. The UK, Netherlands, and the Nordics were some of the highest users of remote working, accounting for a healthy share in the demand for video conferencing platforms. In Germany, government agencies allocate funds to ensure the digitalization of public administration, a factor increasing the video conferencing adoption. Similarly, France's Ministry of Education reported a registration of more than 10,000 schools adopting video conferencing solutions in 2023 to support hybrid learning environments. Further, with a focus on cybersecurity, the European Union is using tough data protection laws, where fines amounted to about EUR 1.5 Billion (USD 1.56 Billion) in 2023 for companies breaching privacy regulations, keeping the integrity and growth of secure video communication solutions afloat.

Asia Pacific Video Conferencing Market Analysis

The video conferencing market is growing in the Asia Pacific region because of government initiatives in that area and high investments by private companies. In fact, internet penetration in China is reported by China's Ministry of Industry and Information Technology at 77.5% by 2023. This substantially boosts the online communications tools that video conferencing uses. In Japan, 24.8% of employees worked remotely in 2023, and that number continues to grow, as per reports. The government dedicated JPY 3.1 trillion (USD 23 Billion) in 2023 under its digital transformation fund, and that includes spending on smart technologies that support video communication. Because of the ever-increasing need for video conferencing in sectors, such as education, government services, and business collaboration, the Asia Pacific region is a huge player in this market.

Latin America Video Conferencing Market Analysis

In Latin America, government initiatives to extend digital connectivity are encouraging the adoption of video conferencing solutions. Brazil's Ministry of Communications, Juscelino Filho, announced a significant increase in funding for internet projects in these underserved regions to support digital communication tools, such as video conferencing. The Inter-American Development Bank (IDB) has also sanctioned a USD 100 Million loan for Brazil's federal government to develop digital connectivity and fixed broadband coverage for small municipalities in order to have increased access to video conferencing platforms. Moreover, Brazilians' increased access to the internet and liberalized gun ownership regulations, which have led to massive civilian demand, including over 1.6 million firearm licenses issued, keeps leading the market to grow.

Middle East and Africa Video Conferencing Market Analysis

In the Middle East and Africa, the demand for video conferencing is growing rapidly, especially due to the implementation of remote work and government-supported digital initiatives. According to an industrial report, in Saudi Arabia, 40% of the total workforce was working remotely in 2023, and this number is likely to rise further, thus creating the need for video conferencing platforms. Saudi Arabia is investing heavily in its long-term development plan called Vision 2030, which is mainly into digital transformation and supporting education, healthcare, and business communication. The government agencies of Saudi Arabia are focusing on improving internet infrastructure for this transition and have significant investments from the Ministry of Communications and Information Technology. The other regions include the UAE where the government agencies encourage all businesses to employ digital solutions as part of their economic diversification.

Competitive Landscape:

Key players in the market are capitalizing on the rising need for remote communication solutions. These companies are financing research and development (R&D) efforts to launch better and advanced features for improving the overall user experience and addressing evolving needs. Major companies focus on improving video and audio quality, reducing latency, and optimizing bandwidth usage to deliver seamless and immersive virtual meeting experiences. They are also integrating AI and machine learning (ML) technologies to automate tasks, enhance collaboration, and personalize user interactions. Furthermore, there is a concerted effort among industry leaders to enhance security and compliance capabilities, ensuring that their platforms meet stringent data protection regulations and address the growing concerns about privacy and confidentiality. Additionally, many players are prioritizing partnerships and acquisitions to broaden their user base and access new markets. For instance, in March 2024, Zoom and Avaya announced that they are merging to form an alliance through Zoom's AI-oriented collaborative platform, the ‘Zoom Workplace’ and Avaya's ‘Communication & Collaboration Suite’. The facility aims to streamline communication as well as workflow management between Avaya customers through enhanced video conferencing features.

The report provides a comprehensive analysis of the competitive landscape in the video conferencing market with detailed profiles of all major companies, including:

- Adobe Inc.

- Amazon Web Services Inc.

- Avaya Inc.

- Cisco Systems Inc.

- Goto Group Inc.

- HP Inc

- Huawei Technologies Co. Ltd.

- Logitech International S.A.

- Microsoft Corporation

- Vidyo Inc.

- Zoom Video Communications Inc.

Latest News and Developments:

- October 2024: Adobe Inc. announced at Adobe MAX that the Firefly family of generative AI models now includes video. Available in limited beta, the Firefly video model is the first commercially safe video solution. Since March 2023, it has generated over 13 billion images.

- September 2024: GoTo launched GoTo Connect CX, an affordable and AI-enabled multichannel customer experience solution. It brings together the award-winning GoTo Connect suite and AI enhancements to enable small and medium-sized businesses (SMBs) and multi-location businesses to communicate with their customers more efficiently and engage them better.

- September 2024: HP Inc. declares at the HP Imagine that the innovations include next-gen AI personal computers (PCs), AI-enabled video conferencing solutions, and scalable graphics processing unit (GPU) performance to offer solutions for AI developers. These advancements are expected to redefine work dynamics to enhance growth and creativity through enhanced audio, video, and AI platforms.

- May 2024: Logitech introduced MeetUp 2, which is an AI-powered USB conference camera for BYOD and PC-based setups in huddles and small meeting rooms. The video bar offers AI-driven video and audio, powered by RightSight 2 and RightSound 2, with dynamic views and advanced noise suppression. The device is constructed from recycled plastics to ensure sustainability.

Video Conferencing Market Report Scope:

| Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Conference Types Covered | Telepresence System, Integrated System, Desktop System, Service-Based System |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Enterprise Sizes Covered | Large Enterprises, SME (Small and Medium-sized enterprises) |

| Applications Covered | Corporate Communications, Training and Development, Marketing and Client Engagement |

| End-Uses Covered | Corporate, Education, Healthcare, Government and Defense, BFSI, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adobe Inc., Amazon Web Services Inc., Avaya Inc., Cisco Systems Inc., Goto Group Inc., HP Inc, Huawei Technologies Co. Ltd., Logitech International S.A., Microsoft Corporation, Vidyo Inc., Zoom Video Communications Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the video conferencing market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global video conferencing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the video conferencing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Video conferencing facilitates real-time communication as well as collaboration among individuals or groups via video and audio transmission. It allows participants to connect virtually, regardless of their physical location, using devices such as computers, smartphones, or specialized conferencing systems. It is widely used in business, education, healthcare, and personal communication, to facilitate meetings, presentations, and training sessions.

The global video conferencing market was valued at USD 13.8 Billion in 2025.

IMARC estimates the global video conferencing market to exhibit a CAGR of 9.60% during 2026-2034.

The rising integration of AI, enhanced video and audio quality, and user-friendly interfaces is improving functionality and user experience, which is impelling the market growth. Additionally, the compatibility of video conferencing tools with project management and productivity software is adding value for enterprise users. Apart from this, the increasing reliance on remote and hybrid work models is driving the demand for video conferencing solutions.

In 2025, hardware represented the largest segment by component because devices like cameras, microphones, and monitors ensure seamless communication and deliver high-quality video and audio essential for professional meetings and specialized applications like telemedicine.

Telepresence system exhibits a clear dominance in the market by conference type owing to the its high-quality and immersive experiences with lifelike video and audio, which makes it ideal for important meetings where clear communication and presence are crucial.

On-premises accounts for the majority of the market share by deployment mode, which can be attributed to the greater control, security, and customization for businesses it offers. It allows companies to manage data and infrastructure directly without relying on third-party services.

Large enterprises dominate the market by enterprise size since they have international teams, higher communication needs, and bigger budgets to invest in advanced, secure, and scalable video conferencing solutions for seamless collaboration.

The corporate communications hold the biggest market share by application because companies depend on video conferencing solutions for meetings, presentations, and internal collaboration. This assists in developing effective communication across teams, departments, and locations for better decision-making and productivity.

The corporate exhibits a clear dominance in the market by end-use, as businesses rely on video conferencing tools for meetings, collaboration, and decision-making, enabling worldwide connectivity, reducing travel costs, and enhancing productivity for teams and executives alike.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global video conferencing market include Adobe Inc., Amazon Web Services Inc., Avaya Inc., Cisco Systems Inc., Goto Group Inc., HP Inc, Huawei Technologies Co. Ltd., Logitech International S.A., Microsoft Corporation, Vidyo Inc., Zoom Video Communications Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)