Veterinary Vaccines Market Report by Vaccine Type (Livestock Vaccines, Companion Animal Vaccines), Technology (Attenuated Live Vaccines, Inactivated Vaccines, Toxoid Vaccines, Recombinant Vaccines, and Others), Route of Administration (Subcutaneous, Intramuscular, Intranasal), Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies and Drug Stores, and Others), and Region 2025-2033

Market Overview:

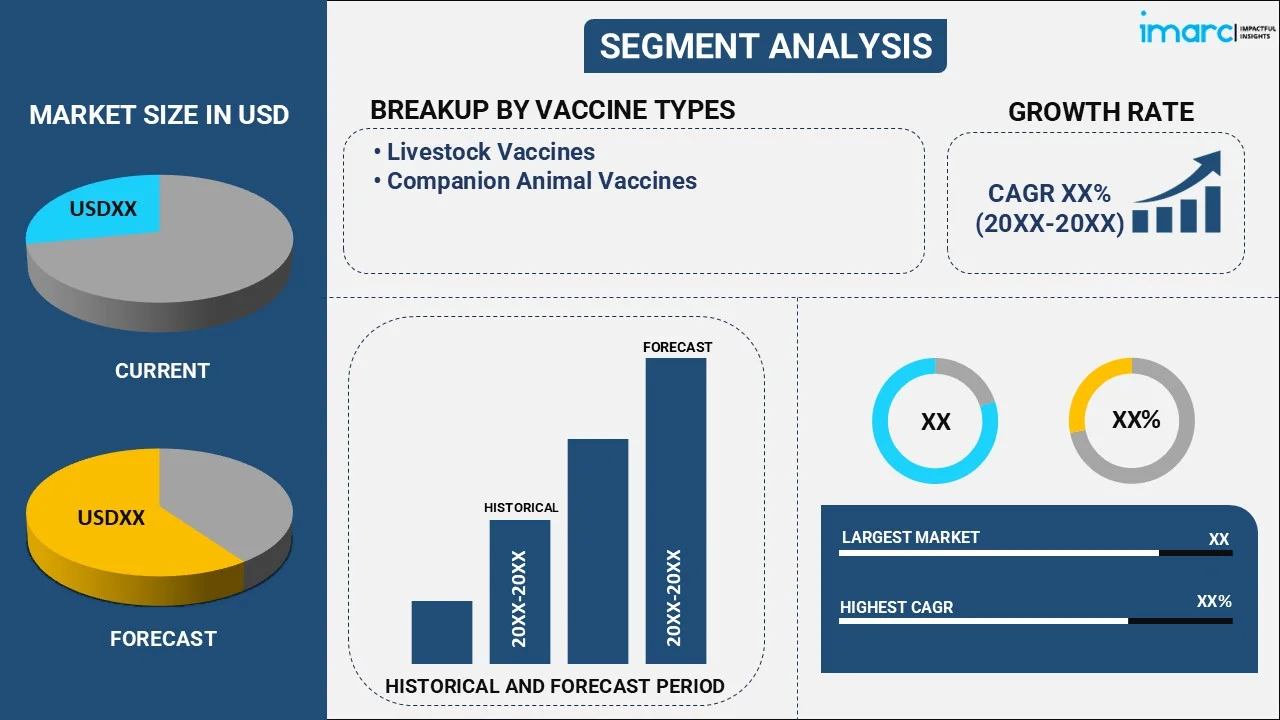

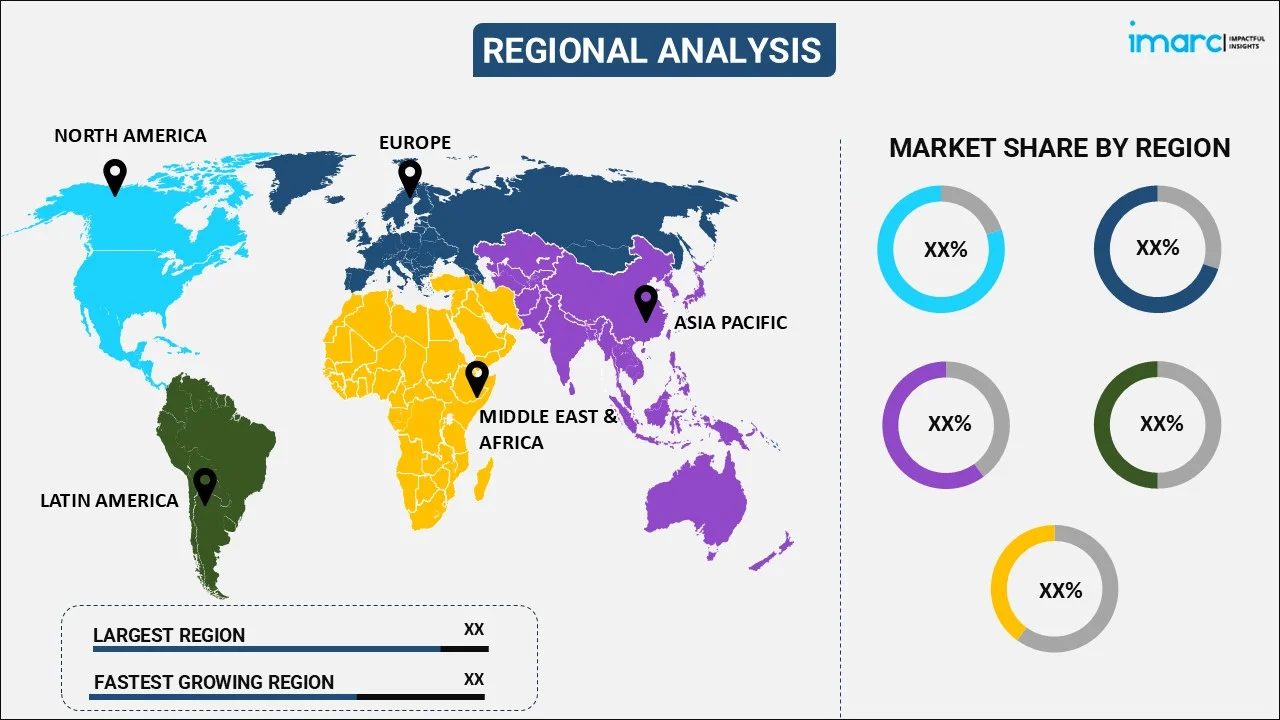

The global veterinary vaccines market size reached USD 14.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 29.6 Billion by 2033, exhibiting a growth rate (CAGR) of 7.71% during 2025-2033. The market is driven primarily because of the growing focus on veterinary healthcare, need for livestock insurance and the launch of new veterinary vaccinations. At present, North America dominates the market because of the rising number of pet parents, advanced veterinary healthcare infrastructure, and significant livestock industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.7 Billion |

|

Market Forecast in 2033

|

USD 29.6 Billion |

| Market Growth Rate 2025-2033 | 7.71% |

Veterinary vaccines represent bio-prepared immunizations that are administered to domestic animals or wild species through parenteral and oral routes to stimulate protective immune responses without causing the disease itself. They involve inactivated, live attenuated and recombinant vaccines as some common medications. These inoculations aid in reducing animal suffering, enhancing immune efficiency, and preventing the risk of developing and transmitting various contagious zoonotic diseases.

Veterinary Vaccines Market Trends:

Growing focus on veterinary healthcare

According to the IMARC Group’s report, the global veterinary healthcare market reached USD 43.3 Billion in 2023. As more individuals are becoming pet parents, there is a greater emphasis on their well-being, resulting in increased veterinary appointments and preventive treatment. Vaccinations are an important aspect of keeping pets healthy, which is driving the demand for veterinary vaccinations. The growing awareness among the masses about the necessity of preventing animal diseases rather than simply treating them is offering a favorable veterinary vaccines market outlook. Vaccination is a very efficient preventive measure, making it an essential component of veterinary healthcare regimens for both companion animals and cattle. Pet parents and livestock producers are willing to pay more on healthcare, including vaccines, to prevent diseases that could harm animal health and productivity. This tendency is catalyzing the demand for a wide variety of immunizations, particularly as veterinary services become more accessible.

Increasing demand for livestock insurance

The IMARC Group’s report shows that the global livestock insurance market reached USD 3.6 Billion in 2023. Many livestock insurance policies demand vaccinations against common diseases as a condition of coverage. Insured farmers and livestock owners are incentivized to vaccinate their animals to meet policy obligations, which is positively influencing the veterinary vaccines market share. Livestock insurance is generally used to reduce the financial risks connected with livestock loss caused by disease, accidents, or natural catastrophes. Farmers who vaccinate their animals lessen the chance of disease outbreaks, making their livestock more insurable and lowering the possibility of claims. This encourages regular vaccinations, which increases vaccine demand.

New launches

New veterinary vaccinations are being produced to combat developing diseases and newly discovered pathogens impacting animals. As outbreaks of previously unknown or developing illnesses are arising, the demand for novel vaccines is rising, thereby propelling veterinary vaccines market growth. Next-generation vaccines, such as recombinant, DNA, and vector-based vaccinations, improve the efficacy and safety of disease prevention in animals. These new vaccines are frequently more effective, have fewer side effects, and give longer-lasting protection, making them more appealing to physicians and pet owners. New releases frequently feature vaccines that cover many diseases or strains in a single shot, making life easier for vets and owners.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global market, along with veterinary vaccines market forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on vaccine type, technology, route of administration and distribution channel.

Breakup by Vaccine Type:

- Livestock Vaccines

- Bovine Vaccines

- Poultry Vaccines

- Porcine Vaccines

- Others

- Companion Animal Vaccines

- Canine Vaccines

- Feline Vaccines

- Equine Vaccines

Breakup by Technology:

- Attenuated Live Vaccines

- Inactivated Vaccines

- Toxoid Vaccines

- Recombinant Vaccines

- Others

Breakup by Route of Administration:

- Subcutaneous

- Intramuscular

- Intranasal

Breakup by Distribution Channel:

- Veterinary Hospitals

- Veterinary Clinics

- Pharmacies and Drug Stores

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global veterinary vaccines market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Elanco Animal Health Incorporated

- Hester Biosciences Limited

- HIPRA

- Indian Immunologicals Limited

- Merck & Co. Inc.

- Neogen Corporation

- Phibro Animal Health Corporation

- Virbac SA

- Zoetis Inc.

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Veterinary Vaccines Market News:

- March 2024: Boehringer Ingelheim acquired Saiba Animal Health AG, a company focused on the development of novel therapeutic medicines to address chronic diseases in pets, to strengthen its animal health research and development (R&D) pipeline, specifically in the fast-growing pet therapeutics category.

- April 2023: Mars Incorporated and Heska Corporation announced that they have entered into a definitive agreement under which Mars will acquire Heska, a global provider of advanced veterinary diagnostic and specialty products, to broaden access to diagnostics and technology, accelerate R&D and innovation, and better serve more veterinary professionals and pets.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Vaccine Type, Technology, Route of Administration, Distribution Channel, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boehringer Ingelheim International GmbH, Ceva Santé Animale, Elanco Animal Health Incorporated, Hester Biosciences Limited, HIPRA, Indian Immunologicals Limited, Merck & Co. Inc., Neogen Corporation, Phibro Animal Health Corporation, Virbac SA, Zoetis Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global veterinary vaccines market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global veterinary vaccines market?

- What are the key regional markets?

- What is the breakup of the market based on the vaccine type?

- What is the breakup of the market based on the technology?

- What is the breakup of the market based on the route of administration?

- What is the breakup of the market based on the distribution channel?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global veterinary vaccines market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)