Veterinary Healthcare Market Size, Share, Trends and Forecast by Product, Animal Type, End User, and Region 2025-2033

Veterinary Healthcare Market Size and Share:

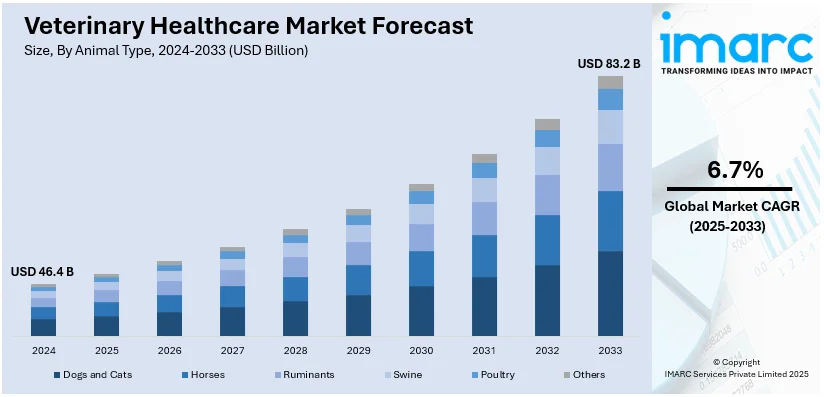

The global veterinary healthcare market size was valued at USD 46.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 83.2 Billion by 2033, exhibiting a CAGR of 6.7% during 2025-2033. North America currently dominates the market, with over 40.6% market shares in 2024. The increasing prevalence of various zoonotic, food-borne, and chronic diseases, the rising concerns of pet owners toward animal health, and the introduction of veterinary health information systems are some of the major factors expanding the veterinary healthcare market share across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 46.4 Billion |

| Market Forecast in 2033 | USD 83.2 Billion |

| Market Growth Rate (2025-2033) |

6.7%

|

Several significant factors contribute to the growth of the global veterinary healthcare market, representing growing concerns about animal health and welfare. These include an increase in pet adoption rates, which is very prevalent in developed nations, with an increasing number of households regarding their pets as members of the family. Such changes have driven a need for more advanced veterinary services, preventive treatments, and insurance for pets. The rising livestock counts to meet the growing global demand for animal products like meat, milk, and eggs have improved the market. Farmers are investing in veterinary services to keep productivity of animals while controlling diseases appropriately. Additionally, the emergence of zoonotic diseases such as avian flu has boosted demand for animal immunizations and diagnostics. Moreover, as per the Unites States Center for Disease Control and Prevention (CDC), 80% of potential bioterrorism diseases are zoonotic diseases, such as anthrax and plague, ensuring the health of animals has also become critical in both public health safety and global biosecurity.

The United States stands out as a key market disruptor, driven the increase in human-animal bonding owing to the increased animal ownership, leading to heavy spending on pet healthcare service, diagnostics, and treatments. Advances in the scale and prevalence of chronic and infectious diseases among pets create a need for better veterinary care, including vaccination and regular check-ups, thus increasing the scale of the veterinary care market. Additionally, livestock farming also expanded nationally and internationally in terms of sales for meat and dairy products that had ever-rising domestic and international demand. Besides this, farmer investments into the health of the animals have resulted in an even greater stimulation for veterinary care market. Such technologies as telemedicine, wearable technology for pets, and higher accuracy diagnostics contribute further to good service quality. Supportive government policies, availability of pet insurance, and raising awareness about diseases transferred from pets to humans contributed to the market growth in the United States.

Veterinary Healthcare Market Trends:

Rising occurrence of different zoonotic, food-related, and long-term illnesses

As pet owners and livestock farmers continue to be confronted with the alarming issues of zoonotic diseases (diseases that may be transmitted from animals to human beings), they are increasing demands in the veterinary services, which include routine check-ups, vaccinations, diagnosis, and treatment for animal diseases, including curative treatment for various animal diseases, including curative measures to reduce the risk of animal-to-human disease transmission. Over 200 known zoonotic diseases caused by a range of pathogens which transmit across species to humans according to the GAO. Incidences of chronic diseases, which in pets present through cancer have catalysed growth and demand advanced diagnostics and the necessary therapeutic treatment approaches. As advanced technologies such as the usage of various medicines are seen and used widely within veterinary medical professionals, to ascertain and successfully deal with all manner of illness among animals. This, in turn drives growth in the market for veterinary diagnostics and therapeutics.

Rising concerns of pet owners toward animal health

Pet owners who prioritize their pet's well-being often pursue preventive veterinary services. This encompasses routine check-ups, vaccinations, dental hygiene, and pest management. The rising recognition of the importance of preventive care has led to a higher utilization of veterinary services and consequently boosted revenue in the industry. The Global Pet Parent Study 2024 estimates that there are approximately 1 billion pets globally. Additionally, the pet owner in question might pursue cardiology, dermatology, and oncology services to address particular issues affecting their pets. This trend has led to a rise in veterinary specialties, resulting in greater income for the market. Furthermore, the growing awareness of animal well-being has led to a rise in the adoption of pet insurance. It is more probable that pet owners would invest in insurance plans that cover veterinary expenses. This will provide them with financial stability, making them more willing to seek any necessary healthcare, thus further providing a positive veterinary healthcare market outlook.

Introduction of veterinary health information systems

VHIS enables veterinarians to access comprehensive and up-to-date medical records for individual animals quickly. This means better-informed diagnoses and treatment plans. By having a complete history of an animal's health readily available, veterinarians can make more accurate decisions, leading to improved patient outcomes. According to PubMed Central, there are approximately 600,000 veterinarians worldwide, with their distribution being uneven across regions. Moreover, VHIS allows for the collection and analysis of health data in real-time. This capability is especially valuable for tracking disease outbreaks and patterns. By identifying health issues early and monitoring disease trends, veterinarians and public health officials can respond more effectively to emerging threats, including zoonotic diseases that can affect both animals and humans. Besides, VHIS facilitates communication and collaboration among veterinary professionals. It enables sharing of patient data, images, and test results securely, which can be invaluable for consulting with specialists or seeking second opinions. This interconnectedness among professionals can lead to more comprehensive and effective care for animals, thus propelling the market.

Veterinary Healthcare Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global veterinary healthcare market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, animal type, and end user.

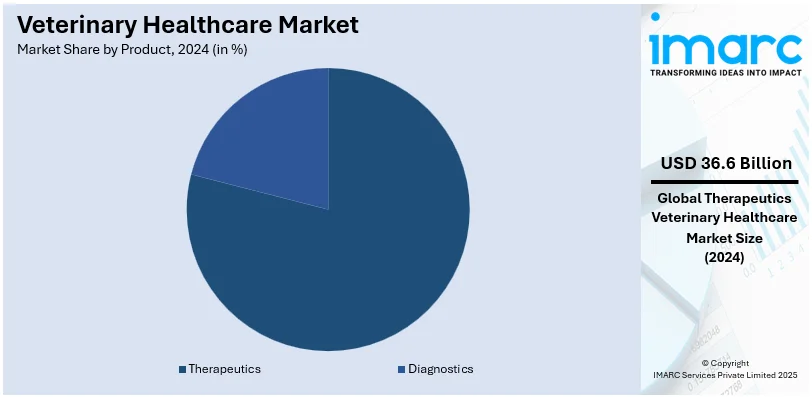

Analysis by Product:

- Therapeutics

- Vaccines

- Parasiticides

- Anti-Infectives

- Medical Feed Additives

- Others

- Diagnostics

- Immunodiagnostic Tests

- Molecular Diagnostics

- Diagnostic Imaging

- Clinical Chemistry

- Others

Therapeutics stand as the largest component, holding 78.9% of the market share in 2024. Therapeutics are primarily used to treat various health conditions in animals. This includes medications and treatments for infectious diseases, chronic illnesses, injuries, and other medical issues. Veterinary therapeutics are essential for alleviating suffering and improving the quality of life for animals in need of medical care. Moreover, therapeutics also encompass preventive treatments such as vaccines and parasite control products. These are administered to animals to prevent diseases and health problems from occurring in the first place. Preventive therapeutics play a crucial role in maintaining the overall health of animals and reducing the spread of diseases. Besides, certain health issues in animals are quite common and require ongoing treatment. For instance, conditions like arthritis, allergies, and dental problems are frequently encountered in pets. Therapeutic products provide ongoing relief and management for these common ailments.

Analysis by Animal Type:

- Dogs and Cats

- Horses

- Ruminants

- Swine

- Poultry

- Others

Dogs and cats category includes veterinary healthcare services, treatments, and products specifically designed for dogs and cats, which are among the most common domestic pets. It encompasses routine check-ups, vaccinations, surgeries, medications, and preventive care for these beloved companion animals.

Ruminants are a group of mammals that includes animals like cattle, sheep, and goats. Veterinary healthcare for ruminants involves herd health management, reproductive services, nutrition assessment, and treatment of diseases and conditions affecting these animals, which are often raised for meat, milk, and wool.

Swine veterinary healthcare is directed at the health and well-being of pigs, which are primarily raised for pork production. Services in this category include disease prevention, vaccination programs, nutrition analysis, and treatment of swine-specific health issues.

Poultry healthcare focuses on the health and management of birds raised for meat and egg production. This category includes services like disease control, vaccination, nutritional guidance, and addressing various poultry-related health concerns to ensure the quality and safety of poultry products.

Analysis by End User:

- Veterinary Hospitals

- Veterinary Clinics

- Veterinary Laboratory Testing Services

- Others

Veterinary hospitals lead the market in 2024. Veterinary hospitals are equipped to provide a wide range of services under one roof. This includes routine check-ups, surgeries, diagnostic imaging, laboratory testing, dental care, and emergency services. The ability to offer comprehensive care makes veterinary hospitals a one-stop solution for pet owners, which is convenient and reassuring. Moreover, many veterinary hospitals have specialists on staff, such as surgeons, dermatologists, and cardiologists. This enables them to handle complex cases and offer specialized treatments that may not be available in smaller clinics. Pet owners are often willing to seek out veterinary hospitals for access to these specialized services.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America dominates the market, with over 40.6% of market shares. North America has one of the highest rates of pet ownership in the world. Dogs, cats, and other companion animals are integral parts of many households in the region. This large pet population drives the demand for veterinary services and healthcare products. The veterinary healthcare infrastructure in North America is highly developed. It boasts a vast network of veterinary hospitals, clinics, and specialized centers equipped with state-of-the-art medical technology and highly trained professionals. This advanced infrastructure attracts pet owners seeking the best care for their animals. Besides, pet owners in North America tend to prioritize the wellness and health of their animals. This includes preventive care, routine check-ups, vaccinations, and nutritional guidance. The emphasis on proactive healthcare contributes to a steady demand for veterinary services.

Key Regional Takeaways:

United States Veterinary Healthcare Market Analysis

In 2024, the United States accounts for over 79.00% of the veterinary healthcare market in North America. This is due to several important factors such as growing pet wellness awareness and the humanization of animals affect the veterinary health care sector. As pets become more viewed as family members, there is a greater need for excellent veterinary care. According to the National Pet Owners Survey 2023-2024 carried out by the American Pet Products Association (APPA), nearly 66% of the households in the U.S., that is approximately 86.9 million families, have a pet, up by a considerable amount from 56% in 1988. This surge in pet ownership in city regions leads to the growing need for veterinary care, including preventive services, diagnostics, and emergency treatments. The ever-aging pet population is now witnessing the need for specific care, with more emphasis on geriatric treatments and services for cancer. The incidence of zoonotic diseases increases the veterinary healthcare market demand. Pet insurance is also highly sought after, which helps in the management of escalating veterinary care expenses. U.S. government funding of veterinary research and animal health initiatives also helps create a conducive market environment that promotes the emergence of new treatments and vaccines. This factor combined is expected to keep driving the growth of the veterinary healthcare market in the U.S.

Asia Pacific Veterinary Healthcare Market Analysis

The Asia-Pacific veterinary healthcare market is rapidly growing due to the increased rate of pet adoption, especially in emerging markets like China and India. Economic development and the rising middle class have increased disposable income, enabling more people to invest in pet healthcare. According to the World Bank, East Asia and the Pacific is the world's most rapidly urbanizing region, with an average annual urbanization rate of 3%. This urbanization pattern is boosting veterinary service demand. There is more prevalence of zoonotic diseases, and its increased cases increase the demand for preventive care and diagnostics and various treatments. Progress in veterinary medicine has also made advanced diagnostic tools help improve the curative treatment opportunities for both the pet and animals. As the APAC countries further modernize their veterinary infrastructure, the market benefits from improved healthcare frameworks and access to high-quality products and services.

Europe Veterinary Healthcare Market Analysis

This trend in Europe of the veterinary health market is mostly driven by rising pet ownership and humanizing pets, which consequently boosts the demand for high-quality services such as preventive care, diagnostics, and special treatments. As per reports, the young population (15–29 years) of the EU stood at 16.3% of the total population as of January 1, 2021. These people are usually more pet-loving, and this segment of the population is a huge reason for the rising demand for veterinary care. Another reason is that the aging population of pets increases the demand for geriatric care and specialized treatments. Awareness of zoonotic diseases and the introduction of more rigorous animal health regulations have also supported the growth of the market. Growing availability of pet insurance also enables access to veterinary care, hence increasing demand. The European market also enjoys a significant investment in veterinary research that promotes the discovery of advanced treatment and diagnostic technology, thereby furthering the welfare of pets as well as animals. All these factors drive the forward expansion of the veterinary healthcare market in Europe.

Latin America Veterinary Healthcare Market Analysis

In Latin America, the veterinary care market is growing because of rising awareness about animal health and a rise in pet ownership in urban regions. Furthermore, according to the UNCCD, almost 31 million youths between the ages of 15 and 29 live in rural areas across 20 Latin American nations, with about 9.6 million employed in agriculture. This agricultural workforce is crucial in boosting the need for veterinary services for livestock, especially concerning disease prevention and treatment. With the enhancement of the region's economic situation, access to veterinary healthcare is also increasing, which in turn boosts market expansion.

Middle East and Africa Veterinary Healthcare Market Analysis

In the Middle East and Africa, the veterinary healthcare market is driven by increasing pet adoption and growing awareness of animal welfare. According to industry reports, the pet population in the UAE has grown by 3% in the last year, highlighting a broader trend of rising pet ownership across the region. This growth, coupled with a rising middle class and higher disposable incomes, is fueling the demand for veterinary services. Additionally, the expanding livestock industry further drives the need for veterinary care, while increasing awareness of zoonotic diseases and government initiatives also support veterinary healthcare market growth.

Competitive Landscape:

The key players within the veterinary healthcare sector are engaging in multiple strategic movements to improve growth and address increasing demand for leading-edge solutions for animal health. Companies are investing significantly in the development of innovative veterinary medicines, vaccines, and diagnostics against pets and livestock for many prevalent and emerging diseases. Strategic alliances and partnership are very common, which will enable the firms to expand their product lines and geographical presence. Many players have begun focusing on the development of telemedicine platforms and wearable health monitoring devices, using digital technologies to develop remote care solutions and enhance diagnostics. Expansion into untapped markets, including emerging economies through mergers and acquisitions, is another popular approach.

The report provides a comprehensive analysis of the competitive landscape in the veterinary healthcare market with detailed profiles of all major companies, including:

- Animalcare Group plc

- Boehringer Ingelheim International GmbH (C. H. Boehringer Sohn AG & Co. KG)

- Ceva Animal Health LLC

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Heska Corporation

- IDEXX Laboratories Inc.

- INDICAL Bioscience GmbH (Vimian Group)

- Merck & Co. Inc.

- Norbrook Laboratories Ltd

- Vetoquinol India Animal Health Pvt Ltd (Vétoquinol S.A.)

- Virbac

- Zoetis Inc.

Latest News and Developments:

- December 2024: Zoetis will be launching the Vetscan OptiCell™, an AI-powered, screenless hematology analyzer, at the Veterinary Meeting & Expo (VMX). This cartridge-based tool provides quick, accurate CBC analysis using viscoelastic focusing (VEF) technology for sharp imaging and reduced errors. It simplifies diagnostics with minimal maintenance and no calibration, enabling fast, reliable results for veterinary practices.

- October 2024: Panav Biotech has launched Maropitine Injection, a new treatment for nausea and vomiting in dogs and cats. This product addresses motion sickness, chemotherapy-induced nausea, and post-anaesthesia vomiting, offering a reliable solution for companion animals. The launch underscores Panav Biotech’s ongoing commitment to advancing animal healthcare.

- July 2024: In Faridabad, Haryana, the Animal Care Organization (TACO), a division of the Anil Agarwal Foundation, has established a veterinary clinic complete with a mobile health van and an animal birth control unit. The facility offers surgeries, diagnostics, and vaccinations, and focuses on controlling stray animal populations through spaying and neutering. The mobile health van provides services within a 20km radius. The hospital also features an open OPD space, restraints for large animals, and a section for blind animals, alongside sustainable practices like fodder cultivation and waste management.

- July 2024: Elanco Animal Health Incorporated has recently partnered with a biotechnology company to develop innovative solutions for animal health, aiming to provide better healthcare options for animals.

Veterinary Healthcare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Animal Types Covered | Dogs and Cats, Horses, Ruminants, Swine, Poultry, Others |

| End Users Covered | Veterinary Hospitals, Veterinary Clinics, Veterinary Laboratory Testing Services, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Animalcare Group plc, Boehringer Ingelheim International GmbH (C. H. Boehringer Sohn AG & Co. KG), Ceva Animal Health LLC, Dechra Pharmaceuticals PLC, Elanco Animal Health Incorporated, Heska Corporation, IDEXX Laboratories Inc., INDICAL Bioscience GmbH (Vimian Group), Merck & Co. Inc., Norbrook Laboratories Ltd, Vetoquinol India Animal Health Pvt Ltd (Vétoquinol S.A.), Virbac, Zoetis Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the veterinary healthcare market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global veterinary healthcare market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the veterinary healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global veterinary healthcare market was valued at USD 46.4 Billion in 2024.

IMARC estimates the global veterinary healthcare market to exhibit a CAGR of 6.7% during 2025-2033.

The global veterinary healthcare market is driven by increasing pet ownership, rising livestock population, advancements in veterinary technology, growing awareness of animal health, and the need to address zoonotic diseases.

North America currently dominates the market due to the rising pet ownership and humanization that encourage pet owners to seek the best care for their animals.

Some of the major players in the global veterinary healthcare market include, Animalcare Group plc, Boehringer Ingelheim International GmbH (C. H. Boehringer Sohn AG & Co. KG), Ceva Animal Health LLC, Dechra Pharmaceuticals PLC, Elanco Animal Health Incorporated, Heska Corporation, IDEXX Laboratories Inc., INDICAL Bioscience GmbH (Vimian Group), Merck & Co. Inc., Norbrook Laboratories Ltd, Vetoquinol India Animal Health Pvt Ltd (Vétoquinol S.A.), Virbac, Zoetis Inc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)