Vessel Sealing Devices Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Vessel Sealing Devices Market Size and Share:

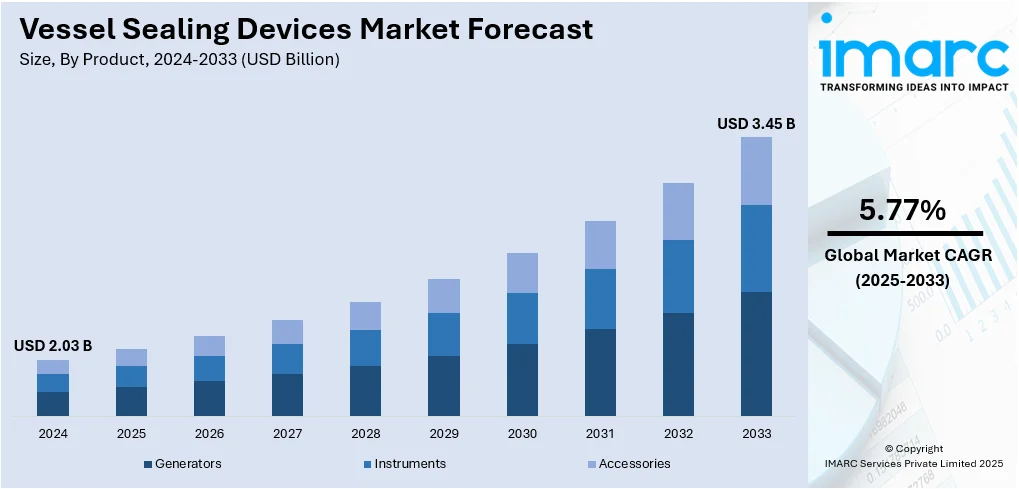

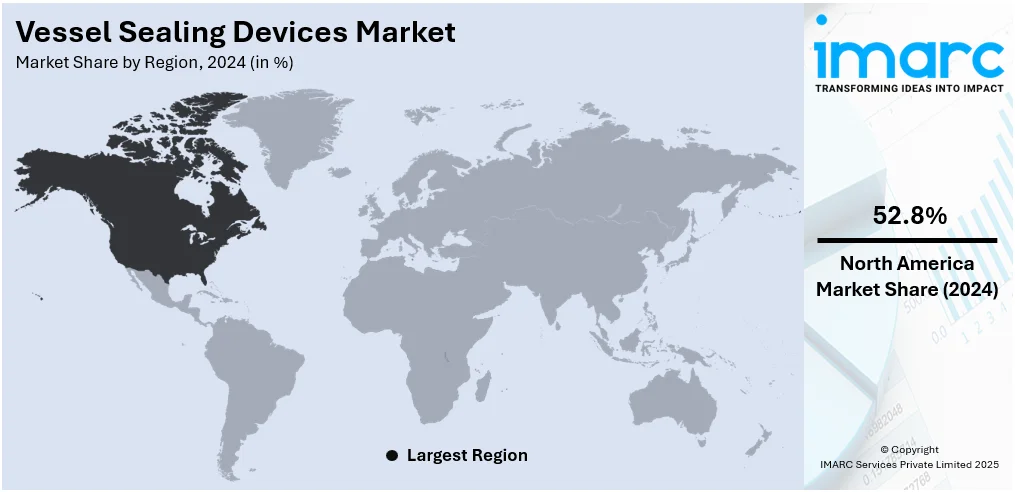

The global vessel sealing devices market size was valued at USD 2.03 Billion in 2024. The market is projected to reach USD 3.45 Billion by 2033, exhibiting a CAGR of 5.77% during 2025-2033. North America currently dominates the market, holding a significant market share of around 52.8% in 2024. The market is propelled by the surging demand for minimally invasive surgical techniques, which provide quicker recovery and fewer postoperative complications. Moreover, the growing prevalence of chronic illnesses like cancer and cardiovascular diseases is also driving the uptake of advanced surgery technologies, including vessel sealing devices. In addition to this, continuous advancements in energy-based surgery instruments are further augmenting the vessel sealing devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.03 Billion |

|

Market Forecast in 2033

|

USD 3.45 Billion |

| Market Growth Rate 2025-2033 | 5.77% |

The market is majorly influenced by continual advancements in surgical procedures that require precise tissue sealing and cutting. Besides, there is a rising awareness about the advantages of these devices, such as reduced bleeding risks, which supports market expansion. Moreover, technological innovations in vessel sealing devices, such as enhanced energy settings and improved safety features, are attracting healthcare professionals Additionally, the growing preference for minimally invasive surgeries, which offer faster recovery times and reduced complications, is further propelling market growth. Also, one of the significant vessel sealing devices market trends is the growing adoption of robotic surgeries. A recent industry study investigates the use of the Vessel Sealer in robotic-assisted paraaortic lymphadenectomy for high-risk endometrial cancer. It compares outcomes between surgeries using the Vessel Sealer and those using monopolar scissors. The findings indicated that the use of the Vessel Sealer led to significantly reduced blood loss (p < 0.05) and enabled the removal of a greater number of pelvic lymph nodes. Additionally, robotic procedures incorporating the Vessel Sealer demonstrated shorter operative durations, especially among patients with a history of prior surgeries.

To get more information on this market, Request Sample

In the United States, the market is primarily driven by the growing number of surgical procedures across multiple specialties, particularly in oncology and cardiovascular care. The heightened requirement for advanced surgical tools that offer precision, safety, and reduced operative time is further accelerating market adoption. According to industry reports, overall cardiac surgical volumes rose by 4.2% in 2023 compared to 2022, reflecting a steady rise in procedure volumes that directly support the need for reliable vessel sealing technologies in complex surgeries. Furthermore, increasing healthcare expenditure, coupled with the growing focus on patient safety and clinical efficiency, is increasing the adoption of advanced sealing technologies. Apart from this, the preference for minimally invasive surgery (MIS) techniques is gaining traction, as these procedures provide reduced recovery times and shorter hospital stays. In line with this, the well-established healthcare infrastructure and strong regulatory support further augment market growth in the U.S.

Vessel Sealing Devices Market Trends:

Rising prevalence of chronic diseases

The rising frequency of chronic diseases like cancer, cardiovascular problems, and obesity is a major growth-inducing factor for the market. As these illnesses frequently require surgical procedures, there is an increased demand for sophisticated surgical equipment that can improve procedural efficacy and safety. As per an industry report, an estimated 129 Million people in the US have at least 1 major chronic disease including heart disease, cancer, diabetes, obesity, and hypertension. Besides, five of the top 10 leading causes of death in the US are, or are strongly associated with, preventable and treatable chronic diseases. Vessel sealing devices are especially important in procedures involving substantial tissue manipulation and hemostasis as they offer consistent sealing of blood vessels and tissue bundles, reducing intraoperative blood loss and postoperative problems. Apart from this, the growing burden of chronic diseases around the world, combined with the aging population, magnifies the need for surgical treatments, which is significantly contributing to the vessel sealing devices market growth.

Rising healthcare expenditure

Increased healthcare spending and continued development of healthcare infrastructure worldwide are major factors propelling market expansion. As per an industry report, U.S. health care spending grew 4.1% to reach $4.5 Trillion in 2022, faster than the increase of 3.2% in 2021. Besides, in 2022, the insured share of the population reached 92% (a historic high). Private health insurance enrollment increased by 2.9 Million individuals and Medicaid enrollment increased by 6.1 Million individuals. Additionally, government and private sector expenditures in healthcare facilities, particularly in emerging nations, are leading to the construction of modern surgery centers outfitted with cutting-edge technology. This expansion improves the accessibility and affordability of advanced surgical procedures, increasing the use of vessel sealing devices. Furthermore, the focus on improving surgical results and patient safety in both developed and developing nations encourages the demand for high-performance surgical equipment, particularly vascular sealing devices.

Increasing adoption of minimally invasive surgeries

Another key trend creating a favorable vessel sealing devices market outlook is the transition to minimally invasive surgical (MIS) procedures. Minimally invasive procedures, such as laparoscopic and robotic surgeries, have various advantages over traditional open surgeries, including less postoperative pain, shorter hospital stays, faster recovery times, and a lower chance of complications. According to industry reports, in 2017, 9.8 Million inpatient major operating room procedures were analyzed, of which 11.1% were MIS and 2.5% were robotic-assisted, compared with 9.6 Million inpatient operating room procedures (11.2% MIS and 2.9% robotic-assisted) in 2018. Vessel sealing devices are essential for MIS procedures because they enable precise and successful hemostasis in limited surgical fields. The popularity of minimally invasive operations among patients and healthcare providers has led to increased demand for sophisticated vascular sealing technologies.

Vessel Sealing Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vessel sealing devices market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Generators

- Instruments

- Accessories

Instruments leads the market with around 44.7% of market share in 2024. Vessel sealing instruments are utilized in many different surgical procedures, including general surgery, gynecology, urology, and cardiovascular surgery. Their ability to produce consistent hemostasis and prevent intraoperative blood loss makes them essential in many complex and minimally invasive operations. The adaptability of these devices in handling diverse tissue kinds and sizes, as well as their compatibility with various surgical procedures, broadens their use range. Hence, the increasing number of surgeries is escalating the demand for vessel sealing devices, resulting in a considerable market share.

Analysis by Application:

- General Surgery

- Laparoscopic Surgery

Laparoscopic surgery leads the market with around 63.8% of market share in 2024. Advanced vascular sealing technologies considerably improve the precision and safety of laparoscopic surgery. These technologies enable surgeons to properly and swiftly seal blood arteries and tissue bundles, lowering blood loss and the risk of complications. The exact control over sealing and cutting decreases temperature diffusion to adjacent tissues, which is especially critical in the delicate and limited regions of laparoscopic surgery. This high level of precision drives the widespread adoption of vessel sealing devices in laparoscopic procedures. Besides, technological developments in both laparoscopic equipment and vascular sealing technologies have increased their popularity. Innovative features including integrated cutting and sealing capabilities, ergonomic designs, and improved energy delivery systems have considerably improved the effectiveness of vessel sealing devices.

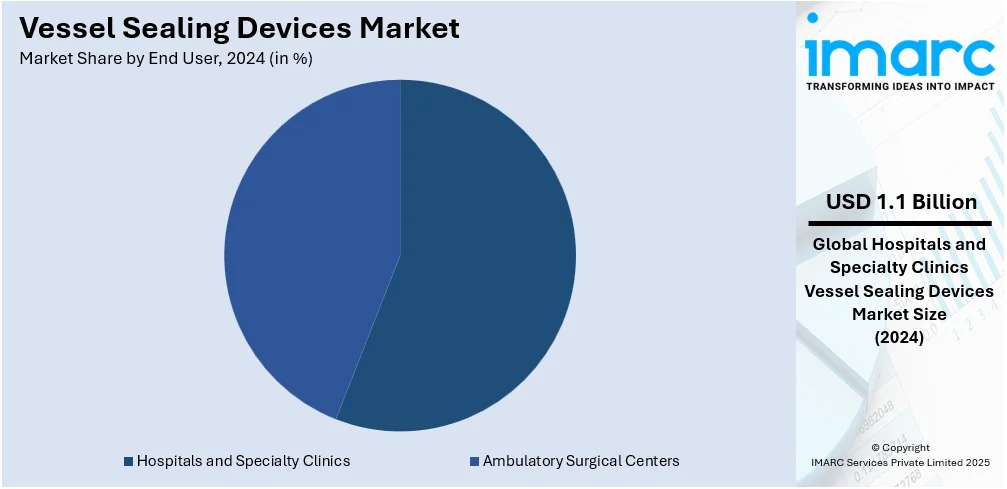

Analysis by End User:

- Hospitals and Specialty Clinics

- Ambulatory Surgical Centers

Hospitals and specialty clinics lead the market with around 55.9% of market share in 2024. The rise in chronic diseases is a crucial factor driving the growth of hospitals and specialty clinics. As per Centers of Diseases Control and Prevention, an estimated 129 Million people in the US have at least 1 major chronic disease such as heart disease, cancer, diabetes, obesity, hypertension. Moreover, five of the top 10 leading causes of death in the US are, or are strongly associated with, preventable and treatable chronic diseases. Over the past 2 decades prevalence has increased steadily, and this trend is expected to continue. Chronic conditions such as diabetes, hypertension, cancer, and respiratory diseases require ongoing medical attention, frequent monitoring, and specialized treatments. This has led to a surge in demand for healthcare services and facilities that can manage these conditions effectively. Specialty clinics focusing on diabetes care, oncology, cardiology, and pulmonology are expanding to meet the needs of patients with chronic diseases which in turn is escalating the vessel sealing devices demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 52.8%. North America, especially he United States, has one of the most advanced healthcare systems in the world. The 2021 World Index on Healthcare Innovation, conducted by the Foundation for Research on Equal Opportunity (FREOPP), ranked the United States in 6th place among the world’s healthcare systems. The analysis finds that the United States is a global leader in scientific advancement but that our healthcare system is fiscally unsustainable. The availability of well-equipped hospitals, specialist surgical facilities, and clinics promotes the use of innovative medical technologies, such as vascular sealing devices. Besides, the region's healthcare system invests heavily in cutting-edge equipment and technology, allowing for high-quality surgical care. Moreover, the high healthcare spending, led by both the public and private sectors, enables significant investment in medical technologies and surgical innovations.

Key Regional Takeaways:

United States Vessel Sealing Devices Market Analysis

In 2024, the United States holds a substantial share of around 88.80% of the market share in North America. The market in the United States is primarily driven by the rising prevalence of chronic diseases such as cancer and cardiovascular conditions. In 2025, the NCI estimates 2,041,910 new cancer cases and 618,120 cancer-related deaths in the U.S. The cancer incidence rate is 445.8 per 100,000 people, while the cancer mortality rate is 145.4 per 100,000 people. In line with this, the growing adoption of minimally invasive surgeries, combined with technological advancements that enhance sealing efficiency, is driving market growth. The ongoing shift towards laparoscopic and robotic-assisted surgeries is further accelerating device use. Similarly, the expansion of ambulatory surgical centers (ASCs) and the increasing adoption of outpatient procedures are contributing to higher adoption rates of products. The increased healthcare spending and favorable reimbursement policies are also impelling the market. The aging population’s increasing need for surgical interventions is expanding market reach. Additionally, enhanced patient safety and reduced complication rates associated with vessel sealing devices are fostering their widespread acceptance. Moreover, the growing focus on patient-centric care is driving the use of these advanced surgical solutions, thereby providing a significant impetus to the market.

Europe Vessel Sealing Devices Market Analysis

The market for vessel sealing devices in Europe is experiencing growth due to increasing healthcare investments and technological advancements in surgical tools. As such, Scalpel AI, a London-based medtech company specializing in surgical tool management using computer vision, secured GBP 3.8 Million in funding, led by Mercia Ventures. The investment will support global expansion and improve surgical efficiency by tracking instruments across the supply chain. Similarly, the growing adoption of robotic-assisted and minimally invasive surgeries is expanding the use of vessel-sealing devices. The increase in outpatient surgeries and ambulatory surgical centers (ASCs) is further augmenting the market accessibility. Furthermore, the aging population’s need for surgical interventions is contributing to rising market development. The heightened focus on patient safety and reducing surgical complications is also accelerating the adoption of these technologies. Additionally, favorable reimbursement policies for advanced technologies are enhancing market access. Besides this, ongoing developments in sealing technology are enhancing device reliability, thereby strengthening their role in complex surgical procedures.

Asia Pacific Vessel Sealing Devices Market Analysis

The Asia Pacific market is majorly propelled by the region’s expanding healthcare infrastructure and increased access to advanced surgical technologies. In addition to this, the increasing number of surgical procedures, particularly in countries such as China and India, is fueling the market demand. According to a recent industry report, India performs over 30 Million surgeries each year, with around 82% of these procedures taking place in small and medium-sized hospitals. Furthermore, the increasing prevalence of lifestyle diseases, such as obesity and diabetes, contributing to a higher number of surgeries, is impelling the market. The growing adoption of specialized training programs for surgeons is elevating the effective use of vessel sealing technologies. Additionally, favorable government initiatives aimed at improving surgical outcomes are fostering market growth. Moreover, the growing emphasis on patient recovery and safety, particularly through a reduction in surgical complications, is expanding the market scope.

Latin America Vessel Sealing Devices Market Analysis

In Latin America, the market is progressing due to increasing healthcare investments and improved infrastructure. Similarly, the rising number of private hospitals and surgical centers is encouraging the higher adoption of these devices. The data from the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde) revealed that 62% of Brazil's 7,191 hospitals are privately owned. Furthermore, the growing prevalence of chronic diseases and complex surgical procedures is strengthening the market demand for high-quality sealing tools. Apart from this, the ongoing shift towards minimally invasive surgeries, which require precise tissue sealing, is accelerating the uptake of vessel sealing technologies, fostering market expansion across the region.

Middle East and Africa Vessel Sealing Devices Market Analysis

The market in the Middle East and Africa is significantly influenced by the growing adoption of advanced surgical technologies. Furthermore, increasing healthcare expenditure across the region is improving access to state-of-the-art medical equipment, accelerating market growth. Healthcare spending in GCC countries is expected to grow by 4 to 8.8% over the next five years, with the UAE and Saudi Arabia experiencing the highest growth. The region's Healthcare Expenditure (CHE) is projected to reach USD 159 Billion by 2029, according to an industry report. Similarly, the rising demand for healthcare services, fueled by population growth and urbanization, is driving the uptake of vessel-sealing devices. Furthermore, the expansion of medical tourism in countries such as the UAE and Saudi Arabia is further bolstering the market development. Besides this, the region's heightened focus on enhancing surgical outcomes and patient safety is creating lucrative market opportunities.

Competitive Landscape:

The competition in the market is very intense, with both established players and newcomers. The market players are targeting innovation, offering sophisticated and efficient solutions for different surgical procedures. Additionally, there is an increase in investments in research and development (R&D) activities for the launch of new technologies, including better safety aspects and more precision, to meet the increasing demand for minimally invasive surgery. Apart from this, market players also emphasize widening their product ranges, enhancing device performance, and enhancing product reliability. Moreover, strategic mergers, acquisitions, and partnerships are frequent as firms look to consolidate their market bases and move internationally. Also, the growing emphasis on patient safety and improved clinical outcomes has placed greater importance on device quality, regulatory compliance, and usability. According to the vessel sealing devices market forecast, competition within the market is anticipated to increase with the adoption of pricing strategies, distribution channels, and marketing strategies due to firms' efforts to differentiate themselves on the basis of technology, cost, and customer care.

The report provides a comprehensive analysis of the competitive landscape in vessel sealing devices market with detailed profiles of all major companies, including:

- B. Braun Melsungen AG

- BOWA-electronic GmbH & Co. KG

- Erbe Elektromedizin GmbH

- Hologic Inc.

- Intuitive Surgical Inc.

- Johnson & Johnson

- KLS Martin Group

- Lamidey Noury Medical

- Medtronic plc

- Olympus Corporation

- OmniGuide Holdings Inc.

- Xcellance Medical Technologies Private Limited

Latest News and Developments:

- May 2025: Merit Medical acquired Biolife Delaware for USD 120 Million, gaining Biolife’s patented hemostatic devices, StatSeal and WoundSeal. The acquisition enhances Merit’s portfolio for vascular closure and bleeding complications, addressing a USD 350 Million global market opportunity. Merit aims to expand product reach and improve profitability.

- April 2025: Baxter launched the Hemopatch Sealing Hemostat, a room-temperature collagen pad for hemostasis and sealing. It offers a 3-year shelf life and is suitable for various surgeries, providing fast, effective hemostasis. The device enhances surgical outcomes by preventing leaks and promoting tissue absorption in 6-8 weeks.

- March 2025: LivsMed planned to unveil ArtiSeal, the world’s first 90° double-jointed articulating vessel sealer, at the SAGES conference. This system enables precise, perpendicular sealing for difficult-to-reach vessels and tissue bundles in minimally invasive and open procedures, offering enhanced safety and effectiveness for surgeons.

- December 2024: Signati Medical completed its successful IDE trial for the Separo Vessel Sealing System in vasectomy procedures. All patients met the primary endpoint, and the trial confirmed the device's safety and efficacy. The company will now initiate the FDA's De Novo submission process for market clearance.

- August 2024: Olympus expanded its POWERSEAL Sealer/Divider portfolio with the introduction of two new instruments: the Straight Jaw Double-Action (SJDA) and the Curved Jaw Single-Action (CJSA) devices. These advanced bipolar surgical energy devices offer precise vessel sealing, ergonomic comfort, and multifunctional capabilities for various surgical procedures, enhancing efficiency and comfort.

Vessel Sealing Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Generators, Instruments, Accessories |

| Applications Covered | General Surgery, Laparoscopic Surgery |

| End Users Covered | Hospitals and Specialty Clinics, Ambulatory Surgical Centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun Melsungen AG, BOWA-electronic GmbH & Co. KG, Erbe Elektromedizin GmbH, Hologic Inc., Intuitive Surgical Inc., Johnson & Johnson, KLS Martin Group, Lamidey Noury Medical, Medtronic plc, Olympus Corporation, OmniGuide Holdings Inc., Xcellance Medical Technologies Private Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vessel sealing devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global vessel sealing devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vessel sealing devices industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vessel sealing devices market was valued at USD 2.03 Billion in 2024.

The vessel sealing devices market is projected to exhibit a CAGR of 5.77% during 2025-2033, reaching a value of USD 3.45 Billion by 2033.

The market is driven by the continual technological advancements in surgical procedures, growing demand for minimally invasive surgeries, and the increasing prevalence of chronic diseases. Additionally, the rise in healthcare spending, improving patient outcomes, and the adoption of advanced medical technologies further support market growth.

North America currently dominates the vessel sealing devices market with a market share of around 52.8%. The dominance is fueled by high healthcare expenditure, advanced healthcare infrastructure, strong adoption of minimally invasive surgeries, and the presence of key industry players. Additionally, increasing awareness and rising geriatric population contribute to market growth.

Some of the major players in the vessel sealing devices market include B. Braun Melsungen AG, BOWA-electronic GmbH & Co. KG, Erbe Elektromedizin GmbH, Hologic Inc., Intuitive Surgical Inc., Johnson & Johnson, KLS Martin Group, Lamidey Noury Medical, Medtronic plc, Olympus Corporation, OmniGuide Holdings Inc., and Xcellance Medical Technologies Private Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)