Version Control Systems Market Size, Share, Trends and Forecast by Type, Deployment Type, Enterprise Size, End Use, and Region, 2025-2033

Version Control Systems Market Size and Share:

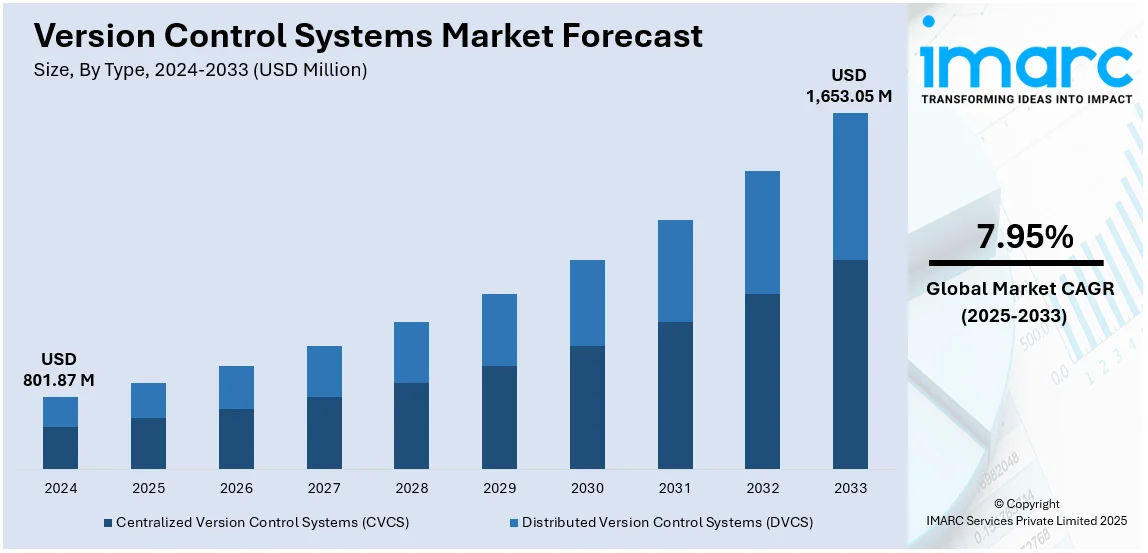

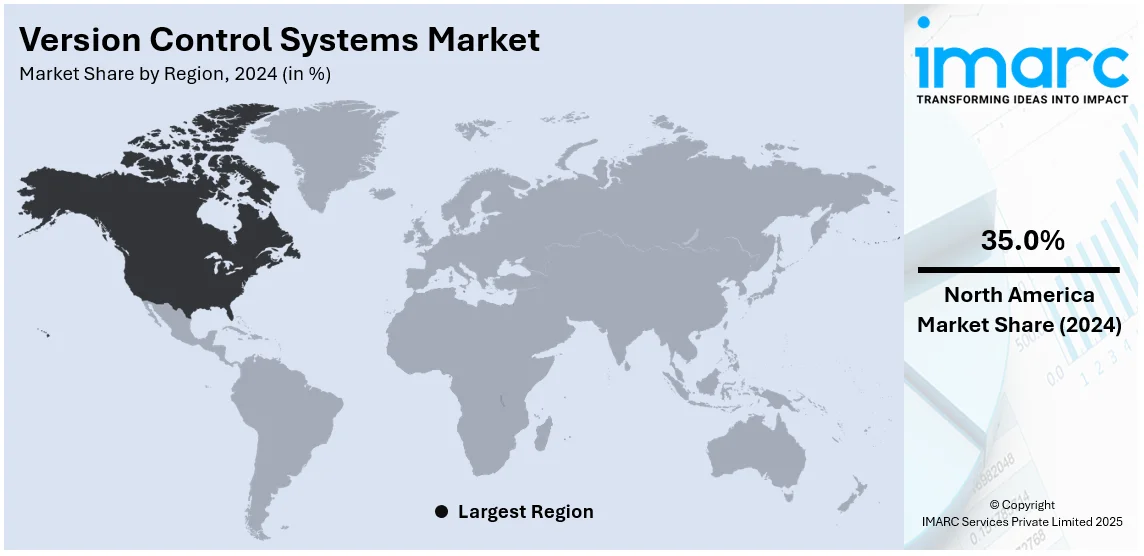

The global version control systems market size was valued at USD 801.87 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,653.05 Million by 2033, exhibiting a CAGR of 7.95% from 2025-2033. North America currently dominates the version control systems market share by holding over 35.0% in 2024. The market in the region is driven by the increasing demand for advanced fire protection systems, stringent safety regulations, and the expansion of commercial and industrial infrastructure.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 801.87 Million |

|

Market Forecast in 2033

|

USD 1,653.05 Million |

| Market Growth Rate (2025-2033) | 7.95% |

The global version control systems (VCS) market demand is spurred by the increasing adoption of DevOps and Agile methodologies in software development, which enhances the need for VCS to facilitate collaboration and efficient code management. A Gartner survey indicates that 75% of global software development teams are fully adopting Agile methodologies in 2024, driving increased VCS adoption for better code management. In addition, the rise in remote work requires scalable and secure tools for distributed teams to work efficiently, which is impelling the market growth. Moreover, the increasing complexity of software projects drives the demand for version tracking to ensure smooth updates and prevent errors, contributing to the market expansion. Besides this, the need for enhanced security and audit trails for code versions is boosting the market demand. Also, the expanding use of cloud-based VCS platforms enhances accessibility, providing an impetus to the market. Additionally, the adoption of continuous integration and continuous delivery (CI/CD) practices is driving demand for automated version control, further accelerating market growth.

The United States VCS market growth accounts for 85.30%, driven by the rise of startups and tech companies, as they require scalable VCS solutions to manage rapid software development cycles. In line with this, the increasing integration of artificial intelligence (AI) in software development promotes the need for sophisticated version tracking, driving the market demand. Additionally, government regulations mandating data integrity and transparency encourage the adoption of secure VCS tools, strengthening the market share. Concurrently, the expansion of the Internet of Things (IoT) ecosystem necessitates reliable code management for diverse devices, impelling the market growth. Furthermore, continuous advancements in machine learning (ML) and data analytics fuel the market demand for optimized VCS systems. Apart from this, the surge in open-source software development boosts the need for collaborative version control solutions, thereby propelling the market forward. For instance, a study reveals 73% of healthcare organizations have adopted DevOps, reflecting its growing role as IT becomes essential in services. This trend underscores the increasing reliance on VCS tools across industries, particularly in sectors like healthcare, where data integrity and rapid software development are critical.

Version Control Systems Market Trends:

Software Development Practices

The emergence of new software development techniques ranks among the primary reasons favoring the version control systems market trends. With agile methodologies, continuous integration as well and DevOps practices becoming mainstream, there is a need for smooth and collaborative version control. This trend is further reinforced by the rapid expansion of the software development workforce. According to the U.S. Bureau of Labor Statistics (BLS), employment of software developers, quality assurance analysts, and testers is expected to grow by 17% from 2023 to 2033, significantly outpacing the average growth rate across all occupations. Also, about 140,100 openings for these roles are expected annually over the decade, indicating the growing need for efficient development tools. Version control systems are responsible for code integration, automated builds, and smooth deployment processes which are in tune with modern software development practices. In this era of globalization, remote software development teams are becoming more and more common. With version control systems, a centralized repository that team members from different parts of the world can access enables them to work together effectively. The use of distributed version control systems like Git has increased significantly because they support teamwork and offline work.

Collaboration and Team Productivity

Collaboration plays a crucial role in software development. Version control systems enable multiple developers to work on the same project simultaneously while preventing conflicts and ensuring seamless code integration. They are supplied with the functionality that can be manifested in the form of branches and merge, which allows individual developers to work on their unique code branches offline and their changes may be smoothly merged. These collaborative abilities boost team productivity, manage code reviews, and knowledge sharing effectively. Additionally, open-source software which lead to the popularity of version control systems as well. Many open-source projects widely use version control systems to let their worldwide communities of developers collaborate, thereby fueling the version control systems demand. Such systems encourage transparency, simplify contribution tracking, and lower barriers for developers irrespective of their geographical location. For example, immersive authoring tools, including virtual reality (VR) platforms, are experiencing rapid growth. According to reports, the global VR market is expected to reach USD 120 billion by 2026. Collaborative VR design is on the rise, with 70% of industry professionals expecting mainstream adoption within five years (Digi-Capital). Effective Version Control Systems (VCSs) are crucial in VR, as indicated by a Forrester Research study showing that 85% of businesses consider version control essential for managing digital assets. VRGit addresses these needs with intuitive visualization and real-time collaboration features, making it a promising solution for managing VR content versions.

Integration with Development Tools and Services

VCS can work with a long list of development tools and services like IDEs, CI/CD systems, project management platforms, and issue-tracking systems. This integration smoothes out development workflows, enhances productivity, and facilitates the full automation of the software development processes. In a scenario where companies increasingly look for more efficient and standardized solutions, businesses like Redgate Software continue to innovate towards those ends. Last October 2022, Redgate Software unveiled a host of updates for its database DevOps portfolio. This update comprises enhancements on Flyway in helping organizations streamline and standardize cross-database development. These advancements are further manifestations of the need for VCS solutions to sustain complex database environments and their integrations with various platforms. Furthermore, the version control systems can be commercial or open-source and are available to both small and big organizations. Moreover, cloud-based version control services including GitHub and Bitbucket assist organizations to avoid keeping and management of their infrastructure, which results in the reduction of operational costs. This, in turn, is providing an impetus to the version control systems market outlook.

Version Control Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global version control systems market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, deployment type, enterprise size, and end use.

Analysis by Type:

- Centralized Version Control Systems (CVCS)

- Distributed Version Control Systems (DVCS)

According to the report, centralized version control systems (CVCS) represented the largest segment. The rising demand for CVCS in the global market is mainly because of the inbuilt command and organization features of CVCS. On top of that, CVCS provides a higher level of security and access control, which might be a priority for bigger organizations with crucial data. These systems lower the need for local storage and computing power which in turn helps organizations with resource constraints. The learning curve of CVCS is also less steep compared to distributed version control systems. Therefore, adoption in industries where users are not highly technical becomes an easier task to handle.

Analysis by Deployment Type:

- On-premises

- Cloud-based

On-premises leads with around 55.8% of version control systems market share in 2024. The on-premises deployment type in the market is largely driven by growing concerns about data security, control, and compliance. Businesses often go for the on-premises systems, especially those in highly regulated industries such as healthcare, finance, and government because they offer much control for data, infrastructure, and security protocols. Additionally, on-premises solutions provide customization opportunities to meet specific organizational needs and integrate with existing IT systems. This flexibility, combined with enhanced privacy and control over data, makes on-premises deployments particularly attractive for enterprises with strict regulatory requirements.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

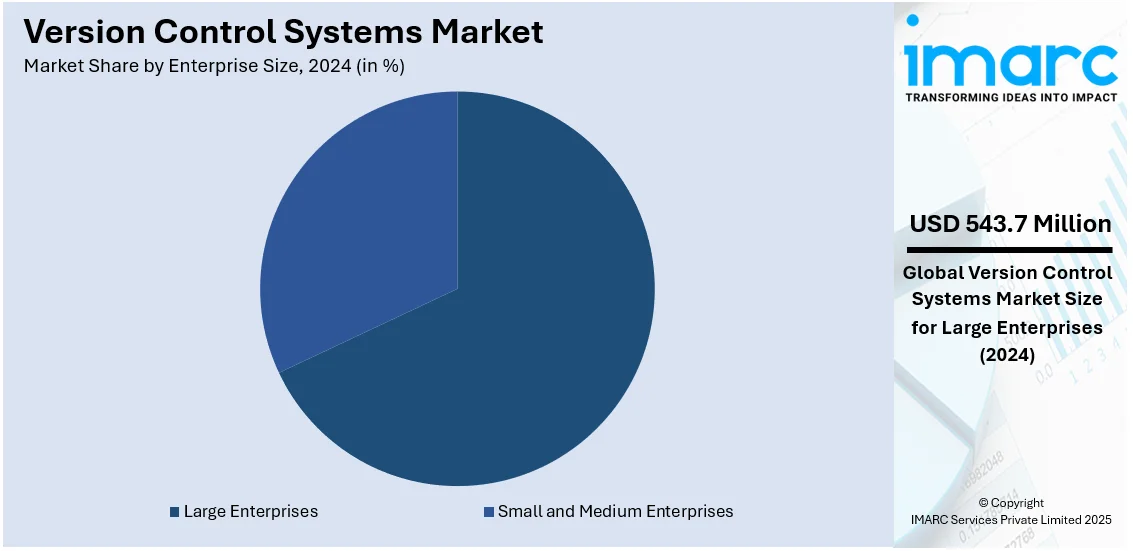

Large enterprises lead the market with around 67.8% of market share in 2024. Their large and often geographically distributed teams usually involve robust version control systems to deal with sophisticated code bases and facilitate seamless collaboration. Nevertheless, this is more demanding due to the growing use of DevOps and Agile, which are heavily based on efficient version control. Larger corporations also tend to have multiple projects running in parallel, thus requiring systems that can handle these development efforts efficiently while keeping them separate from the rest of the development. In addition to this, as a result of their size and visibility, these institutions have bigger risks in terms of data security and compliance.

Analysis by End Use:

- BFSI

- Education

- Healthcare and Life Sciences

- IT and Telecom

- Retail and CPG

- Others

According to the report, IT and telecom accounted for the largest market share. The version control systems market in the IT and telecom sector is expanding due to the increasing complexity of software projects, the demand for seamless team collaboration, and the drive for shorter release cycles. These industries are pioneering innovation and employing the latest software development techniques. Such platforms help with the management of different versions of software code, code conflict avoidance, and seamless rollback in case of issues. Additionally, they support CI/CD practices, ensuring rapid deployment and efficient project management in fast-paced environments.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0%. The North American market is primarily led by the strong growth of the IT sector as well as finance, healthcare, and telecommunications which are redesigning their operations using efficient software development and management practices. The high ratio of innovation in the area, and the high adoption rate of cutting-edge technologies such as cloud computing, AI, and ML, reinforce the demand. Furthermore, North America is the home for many of the world’s biggest tech companies and startups, hence, calling for more effective collaboration tools, such as version control systems that facilitate the management of the commonly large and complex projects.

Key Regional Takeaways:

United States Version Control Systems Market Analysis

The United States version control systems market is in high growth mode, driven by the expanding software and IT services industry. In fact, the U.S. is home to approximately 585,000 software and IT services companies, depending on a very skilled workforce including 2.2 million software and web developers, as per reports. As complexity and collaboration drive software development further, the need for efficient version control systems remains on the upswing. In addition, the larger tech sector is also growing upwards, with ITA projecting employment to rise to 6.6 million in 2024. The fast-growing tech workforce highlights the crucial role of version control systems in facilitating seamless collaboration, efficient code integration, and automation in software development. With the growing use of agile methodologies, DevOps practices, and distributed development teams, companies are looking for solid version control solutions. Further, cloud-based services like GitHub and Bitbucket are also pushing the market further with the reduction of infrastructure management costs and easy access, making version control systems an indispensable part of the U.S. tech landscape.

Europe Version Control Systems Market Analysis

Smartphone adoption and the digital transformation in Europe are the most important factors that are driving the market growth. GSMA reported that by the end of 2021, four out of five mobile connections in Europe were smartphones, which increases the demand for mobile app development and, consequently, version control systems to manage and track code changes efficiently. The DIGITAL Europe Programme, valued at EUR 7.5 billion (USD 7.8 billion), aims to strengthen the EU's strategic digital capabilities, with a focus on cloud computing, artificial intelligence (AI), high-performance computing (HPC), and data infrastructure. It is further boosting the adoption of cloud-based technologies, which further increases the requirement for version control systems to make it easier for distributed teams to collaborate. As digital technologies continue to proliferate across industries, the demand for advanced version control solutions will rise, supporting the growth of the market across Europe.

Asia Pacific Version Control Systems Market Analysis

The Asia-Pacific market is expected to grow significantly, as the region is rapidly digitalizing, and the tech industry is expanding. According to an industry report, the whole cloud spending is expected to grow at a CAGR of 17.3% and reach USD 329.1 Billion by 2027, which will further increase the dependency on cloud-based infrastructure, thereby directly benefiting version control systems, especially those like GitHub and Bitbucket that offer cloud services. Moreover, as per reports, the prospective contribution of over USD 1 Trillion from the mobile industry to the economy of the region by 2030, along with the accelerated adoption of 5G technologies will increase demand for developing mobile applications and in turn increase the demand for effective version control tools. As more companies embrace agile methodologies, distributed teams become the norm, and remote collaboration becomes the new normal, the need for robust version control systems to streamline workflows and manage code efficiently will continue to rise, driving market expansion across Asia-Pacific.

Latin America Version Control Systems Market Analysis

The market in Latin America is appreciably growing on the back of several drivers. First, the region is experiencing a digital transformation, which is leading to strong mobile technology adoption. For instance, GSMA found that 80 percent of the Brazilian population were users of smartphones by 2022, thereby increasing the demand for efficient and scalable development tools such as version control systems. Government initiatives are also working great for Brazil. For instance, in 2021, Brazil launched the Brazilian AI Strategy, and in 2024, it rolled out a National Plan for AI, which allocated approximately USD 4 billion for AI infrastructure, innovation, and development. Its implementation is driving the tech ecosystem. Business accelerating its usage of AI and cloud technology makes it all the more imperative to have streamlined collaboration and version control solutions. This increased usage of mobile technology and AI with government investment enhances the demand for version control systems, thus providing a continued opportunity for growth within the Latin America market.

Middle East and Africa Version Control Systems Market Analysis

With the rising adoption of cutting-edge technologies and digital transformation high on the list of priorities, the Middle East and Africa market is expected to grow significantly in the coming years. National strategies like the UAE Strategy for Artificial Intelligence 2031 and the UAE Strategy for Digital Economy, which emphasize technology adoption across various sectors, are driving the implementation of advanced software development tools, including version control systems. Moreover, the EMEA public cloud services market is estimated to be at USD 415.1 Billion in 2028 with a CAGR of 20.0% during 2023 to 2028, as per reports. Such increased cloud adoption has direct linkage to the need for distributed teams to work efficiently on projects with collaboration tools such as version control systems for software development process simplification and maintaining integrity in the code. Increasing investments in AI, cloud, and digital infrastructure will fuel the rapid adoption of modern development practices across the MEA region, hence fuelling demand for version control systems that make software development smoother through collaboration and automation.

Competitive Landscape:

The market is witnessing rapid growth owing to the widespread acceptance of Agile and DevOps methodologies in software development. This is increasing the significance of having robust version control in place. Beyond that, the leading corporations are working on things like tools that work with other things in the development pipeline, multiple branching, and resolving conflicts effortlessly. Furthermore, cloud-based version control systems provide scalability, cost-effectiveness, as well as remote accessibility, which are all very needed in the circumstances of remote or hybrid work environments. Therefore, building the cloud-native version control systems or accelerating the existing ones for the cloud can be correspondingly profitable. When it comes to the area of end-use sectors, financial services, and healthcare industries are bound by strict regulations and deal with highly confidential data. Hence, companies provide robust security features, detailed audit trails, and strong access controls in these sectors. As per the version control systems market forecast, the expansion of digital transformation in non-tech industries such as the manufacturing sector and retail will result in the formation of an entirely new market segment for version control systems.

The report provides a comprehensive analysis of the competitive landscape in the version control systems market with detailed profiles of all major companies, including:

- Amazon.com Inc.

- Atlassian Corporation Plc

- GitHub Inc. (Microsoft Corporation)

- International Business Machines Corporation

- LogicalDOC

- Luit Infotech

- Micro Focus

- Perforce Software Inc.

- PTC Inc.

- Unity Software Inc.

- WANdisco plc.

- Wildbit LLC

Latest News and Developments:

- April 2025: PTC Inc. launched Onshape AI Advisor, an AI-powered assistant that streamlines CAD workflows, boosts design productivity, and aids teams in transitioning from legacy systems. Alongside, Onshape Government addresses ITAR and EAR compliance for U.S. agencies and defense contractors, hosted securely on AWS GovCloud. Both solutions leverage Onshape’s cloud-native platform, enabling real-time collaboration and robust version control, allowing multiple users to work simultaneously, track changes, and maintain a complete design history for efficient, secure, and compliant product development.

- April 2025: LogicalDOC integrated Litera Compare into version 9.1, significantly enhancing its document comparison and control features. This integration allows users to compare different document versions or formats, view detailed differences, and download highlighted outputs. Users can select the number of versions to compare and configure comparison technologies and metadata checks to fit their workflows.

- April 2025: Amazon QuickSight introduced dashboard versioning and the ability to publish any analysis to any dashboard. These features enhance author productivity by allowing users to view, revert, and re-publish previous dashboard versions, complete with update notes and author details. Authors can now publish analyses to any dashboard, not just the original, enabling seamless updates without changing dashboard links or depreciating old versions. If issues arise, authors can quickly revert to earlier versions, ensuring dashboards remain functional. Both features are available in all supported QuickSight regions.

- March 2025: AWS Glue announced support for version control and custom visual transforms in AWS GovCloud (US) regions. This serverless ETL service enables customers to integrate GitHub and AWS CodeCommit for managing job changes, streamlining DevOps workflows, and simplifying deployment from development to production. The Git integration applies to all AWS Glue job types, both visual and code-based. Additionally, AWS Glue Studio’s visual editor allows creation and reuse of custom transforms, enhancing consistency and reducing duplicated effort across teams. These features are broadly available in all AWS regions and GovCloud.

- March 2025: Perforce Software announced its acquisition of Snowtrack and the beta release of P4 One, an intuitive version control client designed for digital artists and designers. P4 One integrates into the Perforce P4 Platform, unifying digital creation tools to streamline collaboration across creative and technical teams in industries like gaming, media, and automotive. It offers fast local versioning, secure remote access, and seamless sharing, addressing adoption challenges among artists. The full global launch is planned for late 2025, enhancing Perforce’s leadership in DevOps and version control.

- February 2025: Sourcepoint launched two key features-Legal Preferences and Transaction Receipts-within its Universal Consent & Preferences platform to unify privacy choice management. Legal Preferences centralizes all legal policies with version control and regional customization, while Transaction Receipts create a comprehensive, searchable record of user privacy interactions, including consent and acknowledgments. These tools help organizations manage complex privacy regulations, including AI governance and sensitive data processing, ensuring compliance, auditability, and confident activation of first-party data across digital properties and multi-brand deployments.

Version Control Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Centralized Version Control Systems (CVCS), Distributed Version Control Systems (DVCS) |

| Deployment Types Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Uses Covered | BFSI, Education, Healthcare and Life Sciences, IT and Telecom, Retail and CPG, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon.com Inc., Atlassian Corporation Plc, GitHub Inc. (Microsoft Corporation), International Business Machines Corporation, LogicalDOC, Luit Infotech, Micro Focus, Perforce Software Inc., PTC Inc., Unity Software Inc., WANdisco plc., Wildbit LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the version control systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global version control systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the version control systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The version control systems market was valued at USD 801.87 Million in 2024.

IMARC estimates the version control systems market to exhibit a CAGR of 7.95% during 2025-2033, expecting to reach USD 1,653.05 Million by 2033.

Key factors driving the version control systems market include the increasing demand for collaboration in distributed teams, the rise of agile development methodologies, the need for enhanced security and data integrity, the adoption of DevOps and CI/CD practices, and the growing complexity of software development projects across industries.

North America currently dominates the market, accounting for a share exceeding 35.0% in 2024. This dominance is fueled by the rising demand for advanced software development tools, the presence of major tech companies, high investments in innovation, and the widespread adoption of DevOps and Agile practices.

Some of the major players in the version control systems market include Amazon.com Inc., Atlassian Corporation Plc, GitHub Inc. (Microsoft Corporation), International Business Machines Corporation, LogicalDOC, Luit Infotech, Micro Focus, Perforce Software Inc., PTC Inc., Unity Software Inc., WANdisco plc., Wildbit LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)