Venture Capital Investment Market Size, Share, Trends and Forecast by Sector, Fund Size, Funding Type, and Region, 2026-2034

Venture Capital Investment Market Size and Share:

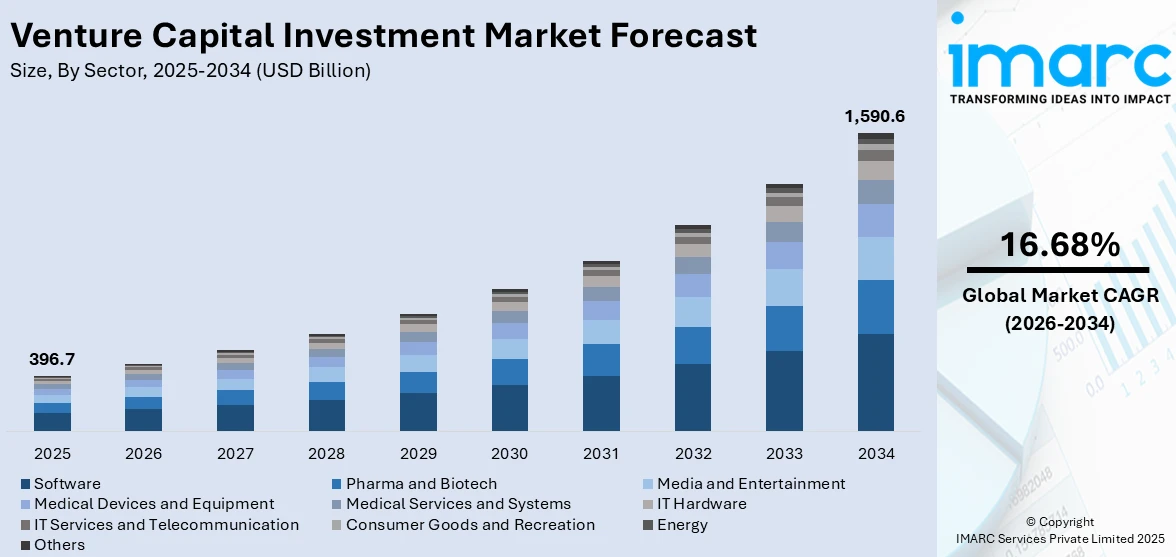

The global venture capital investment market size was valued at USD 396.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,590.6 Billion by 2034, exhibiting a CAGR of 16.68% during 2026-2034. North America currently dominates the market in 2025, with a significant share of around 49.8%. The rapid technological advancements, a surge in startup formations, increasing digital transformation across industries, supportive government initiatives and tax incentives, growing investor interest in high-growth sectors like fintech and biotech, enhanced access to capital through crowdfunding platforms, and expanding corporate venture arms are some of the major factors augmenting venture capital investment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 396.7 Billion |

|

Market Forecast in 2034

|

USD 1,590.6 Billion |

| Market Growth Rate 2026-2034 | 16.68% |

The global market is increasingly influenced by the proliferation of sector-specific accelerators and incubators, which provide startups with tailored mentorship, infrastructure, and access to investor networks. Additionally, the rise of alternative financing models, such as equity crowdfunding platforms, is also expanding the investor base and diversified funding avenues. Notably, on January 13, 2025, Musaffa, a leading Halal investment research platform, announced it has secured over USD 4 Million in seed funding from 525 investors across 50 countries, including nearly USD 1 Million raised through equity crowdfunding. With a user base spanning more than 90 countries, the company plans to initiate a new equity crowdfunding round to further its mission of making Halal and ethical investing more accessible globally. Furthermore, advanced predictive analytics and AI-driven due diligence tools are streamlining investment decisions, improving accuracy and efficiency. Also, the increased institutional participation, particularly from sovereign wealth funds and pension funds, is adding long-term capital stability and professionalization to the venture investment landscape.

To get more information on this market Request Sample

The venture capital investment market in the United States benefits significantly from its robust intellectual property (IP) framework, which enhances investor confidence by safeguarding innovation. Besides this, the prevalence of university-affiliated venture funds and technology transfer offices accelerates the commercialization of academic research. Notably, on August 20, 2024, the University of Washington announced its collaboration with Pack Ventures, an independent venture capital fund aimed at accelerating innovations and supporting startups emerging from the UW ecosystem. Pack Ventures, now a preferred partner of UW and its innovation hub CoMotion, launched its second fund with a target of USD 30 Million, already attracting over 50 investors. In addition to this, the dominance of major tech hubs provides access to mature networks of talent, capital, and infrastructure. Furthermore, recent regulatory flexibility, including SEC adjustments to accredited investor definitions, is widening the pool of eligible investors, which is contributing to the market growth.

Venture Capital Investment Market Trends:

Continuous Technological Innovations

Continual technological innovations are the primary factor contributing to the venture capital investment market growth. It is a fundamental factor responsible for reshaping entire industries. In the fast-paced world, breakthroughs in technology occur regularly, creating new opportunities for startups to disrupt traditional markets or create entirely new ones. Venture capital firms recognize the potential of these innovations and actively seek out companies at the cutting edge of these trends. Emerging technologies like artificial intelligence (AI), blockchain, biotechnology, and clean energy solutions are particularly attractive to venture capitalists. These innovations have the capability to revolutionize sectors, such as healthcare, finance, and energy. A global survey showed that nearly 75% of adults worldwide are enthusiastic about AI's role in healthcare, while 94% of healthcare professionals support its integration. Investors are drawn to startups that harness these technologies to solve complex problems or improve existing processes. The promise of substantial returns on investment motivates venture capitalists to commit significant capital to support innovative ventures. Additionally, technological innovation is happening on a global scale and venture capital investments extend across borders to access the brightest minds and most promising startups worldwide. Venture capitalists aim to be at the forefront of these disruptive changes, positioning themselves to benefit from the growth of groundbreaking technologies.

Large and Untapped Market Opportunities

Venture capitalists seek out startups that target large and untapped markets with significant growth prospects. Startups poised to capture substantial market share are particularly appealing to investors, as they offer the promise of significant returns on investment (ROI). Emerging economies hold tremendous potential for venture capital. These markets are characterized by a burgeoning middle class, increased consumer demand, and rapid economic growth. According to industry reports, 24 countries were combined to represent emerging markets, which contributed 50.4% to the global GDP in 2024 and 65.9% to global GDP growth over the past decade (2014–2024). As a result, venture capitalists are increasingly drawn to startups that can tap into these expanding markets. The sheer scale of these markets, combined with the potential for exponential growth, makes them enticing investment destinations. Moreover, the digital age is enabling startups to access global markets with relative ease. According to venture capital investment market analysis, e-commerce platforms, online advertising, and digital distribution channels allow startups to reach a broader customer base quickly. This ability to scale rapidly and expand internationally is a significant driver of venture capital investment. Furthermore, startups that offer innovative solutions with the potential to disrupt traditional industries are attracting venture capital. These companies may target niche markets or create entirely new ones, but what unites them is the recognition of the transformative impact they can have on the business landscape.

Strong Entrepreneurial Support Ecosystem

The entrepreneurial ecosystem encompasses various elements that create a productive ground for startups to thrive. The key components include access to a talented workforce, mentorship, and support networks, and a culture that fosters innovation and entrepreneurship. Access to talent is critical for the success of startups. Venture capitalists are attracted to regions and cities with renowned universities, research institutions, and a pool of skilled individuals. Startups require expertise in various domains, including technology, marketing, and finance. Locations that offer a steady influx of talent become appealing destinations for venture capital investment. Mentorship programs and networking opportunities play a significant role in nurturing startups. Venture capitalists often provide guidance and support to the companies they invest in, sharing their industry knowledge and connections. This mentorship enhances the chances of startup success and is a significant draw for investors. An industry 2025 survey found that 73% of female-led startups participating in mentorship programs experienced stronger growth and achieved successful funding rounds. Recent venture capital investment market trends show a strong focus on sectors such as fintech, health tech, climate tech, and AI-driven solutions, reflecting investor appetite for scalable, tech-enabled business models. Collaborative ecosystems that encourage knowledge sharing and partnerships are also highly attractive to venture capitalists. These environments foster innovation and provide startups with the resources and expertise required to overcome challenges. The exchange of ideas and collaboration among entrepreneurs, investors, and industry experts create an environment where startups can thrive and rapidly grow.

Venture Capital Investment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global venture capital investment market, along with forecasts at the global and regional levels from 2026-2034. The market has been categorized based on sector, fund size, and funding type.

Analysis by Sector:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

Software leads the market in 2025, with a considerable share of 30.5%. The software sector is dominant due to its high growth rates, scalability, and industry-transforming effect. Software startups attract venture capitalists as they tend to demand less capital outlay than hardware-centric businesses and can quickly expand their base of users by utilizing cloud infrastructure and digital distribution. Software solutions, such as SaaS (Software as a Service), enterprise software, and AI-based platforms, provide recurring revenue models and high customer retention, which are desirable for long-term returns. Additionally, the software industry is a prime driver of innovation in fintech, health tech, and cybersecurity, further enhancing its place in the VC ecosystem. As companies increasingly focus on digital transformation, venture capital firms continue to invest substantial amounts of money in software ventures, seeing their potential to shake up established models and provide exponential growth.

Analysis by Fund Size:

Access the comprehensive market breakdown Request Sample

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- $250 M to $500 M

- $500 M to $1 B

- Above $1 B

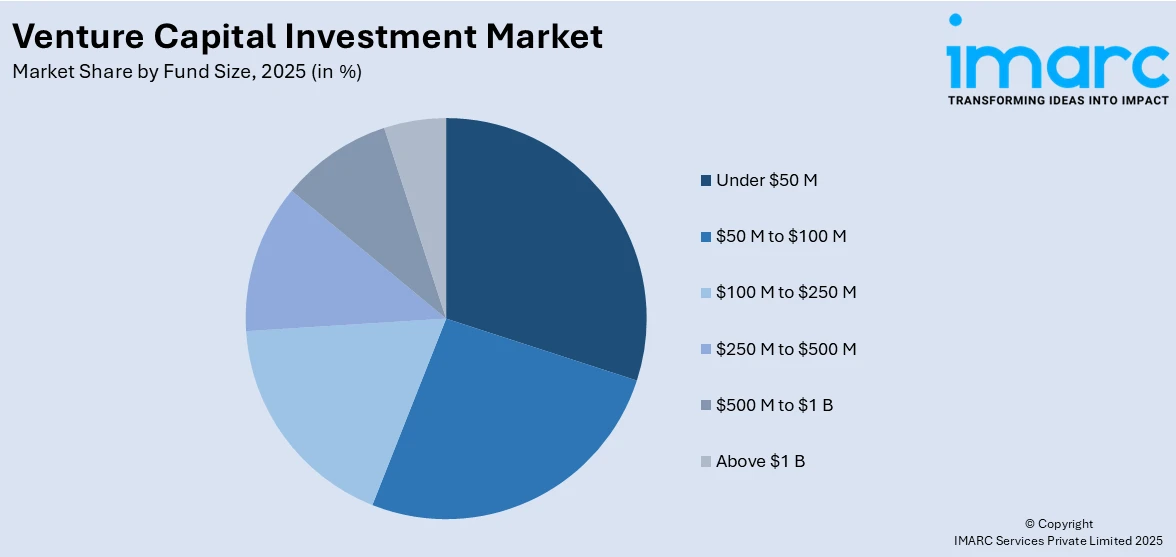

Under $50 M leads the market in 2025, accounting for a significant share of 28.9%. Venture capital funds under $50 Million are a significant factor in the investment environment, especially in funding growth-stage and late-stage startups. These medium-sized funds are ideally suited to drive large funding rounds, providing sufficient money to established business models that are now looking to expand operations, venture into new geographies, or get ready for IPOs or acquisitions. Their size permits them to diversify by industry while still making significant individual investments, frequently allowing them to gain board representation and play a strategic role.

Analysis by Funding Type:

- First-Time Venture Funding

- Follow-on Venture Funding

Follow-on venture funding leads the market in 2025, with a significant share of 85%. Follow-on venture funding offers additional funding to startups after their initial rounds of investment. It is essential for enabling companies to grow in scale, build new products, increase their footprint in new geographies, and achieve profitability. Follow-on investments also indicate the confidence of current investors and tend to trigger new investor participation in later rounds. For venture capital investors, follow-on financing enables them to safeguard and grow their original investments by financing the most successful portfolio companies in their growth phases. It indicates a long-term commitment to a startup's success and can strongly increase its valuation and credibility in the market. Also, follow-on capital helps manage portfolio risk by focusing capital on companies with proven traction, minimizing the potential for complete loss while maximizing the possibility of good returns at exit.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Asia Pacific

- Europe

- Others

In 2025, North America dominates the market with a considerable share of 49.8% due to its matured ecosystem, plentiful capital, and clustering of innovative startups. The United States, particularly cities such as Silicon Valley, New York, and Boston, provides a center of technological innovation and entrepreneurship that not only attracts national but also global investors. Legal and regulatory depth, combined with a rich body of experienced entrepreneurs and a talent base in the North American context, makes it alluring to venture capital. The area is home to some of the world's biggest VC players and leads both in terms of deal volume and investment value consistently. Moreover, its thriving startup ecosystem, proximity to top research institutions, and strong exit opportunities via IPOs or acquisitions also add to its attractiveness. Consequently, North America remains at the forefront of global venture trends, shaping investment strategies and startup creation globally.

Key Regional Takeaways:

United States Venture Capital Investment Market Analysis

The United States holds a substantial share of the North America market with 84.50% in 2025. The market in the United States is primarily driven by the increasing presence of leading tech hubs such as Silicon Valley, fostering innovation and attracting global talent. In line with this, a robust ecosystem of universities and research institutions facilitating groundbreaking discoveries is providing fertile ground for startups, which is further expanding venture capital investment market share. Moreover, the growing availability of a diverse pool of entrepreneurial talent, supported by a culture that encourages risk-taking and resilience, is enhancing the market's dynamism. Furthermore, strong legal frameworks and intellectual property protections safeguarding investor interests are promoting confidence in early-stage ventures and expanding the market scope. Likewise, the growth of emerging sectors like biotech, fintech, and artificial intelligence (AI), diversifying investment avenues, is strengthening market demand. In 2023, the U.S. biotech industry, as highlighted in a report by the Biotechnology Innovation Organization (BIO) and the Council of State Bioscience Associations (CSBA), generated over USD 3.2 Trillion in output. It employed 2.3 million people across 150,000 businesses, with nearly 8 million indirect jobs. Employment grew 15% since 2019, outpacing private sector growth. Besides this, favorable tax policies and incentives for venture capital encouraging long-term investments are creating lucrative opportunities in the market.

Europe Venture Capital Investment Market Analysis

The European market is majorly propelled by the region’s diverse and dynamic startup ecosystem fostering innovation across industries. Additionally, strong government support through grants, tax incentives, and regulatory reforms is enhancing the venture capital investment market outlook. Italy's new competition law, effective December 2024, provided tax exemptions on returns for first and second-pillar pension funds investing in venture capital. To qualify, these funds must allocate at least 5% of their qualified investments to venture capital in 2025, increasing to 10% in 2026. Furthermore, the growing presence of leading academic institutions and research centers generating cutting-edge technologies and providing a robust pipeline for startups, is supporting market expansion. The rise of pan-European venture capital firms promotes cross-border investments, also increasing market integration. Additionally, Europe’s heightened commitment to sustainability and green technologies, creating new opportunities in clean energy and environmental sectors, is augmenting market growth. The increasing adoption of digital transformation across industries, expanding potential for tech-driven startups, is further bolstering market development. Moreover, a well-established network of business incubators and accelerators supporting early-stage ventures is significantly impacting the market trends.

Asia Pacific Venture Capital Investment Market Analysis

The venture capital investment market in Asia-Pacific is significantly influenced by the rapid digitalization across industries augmenting opportunities in fintech, e-commerce, and AI sectors. In 2024, India's venture capital ecosystem grew significantly, with funding rising 43% YoY to USD 13.7 Billion. Consumer technology, software and SaaS (including generative AI), and fintech sectors received over 60% of the total investments, according to an industry report. In accordance with this, the region's large and growing middle class, attracting investments in diverse sectors, is stimulating market accessibility. Furthermore, supportive government initiatives, including favorable regulatory frameworks and startup-friendly policies, are fostering entrepreneurial growth in the market. Similarly, the rise of innovation hubs in cities like Singapore, Bangalore, and Sydney, facilitating cross-border collaborations, is strengthening market demand. The increased access to capital through local and global VC firms enhancing the investment ecosystem is also bolstering the market reach. Moreover, strong entrepreneurial talent, supported by robust education systems and global networks, drives the creation of scalable startups, providing an impetus to the market.

Latin America Venture Capital Investment Market Analysis

In Latin America, the region's expanding digital infrastructure is fostering growth in fintech, e-commerce, and tech startups, which is augmenting venture capital investment market share. In addition to this, a rise in young, tech-savvy population creating robust consumer demand is impelling the market. Furthermore, supportive government policies and increasing foreign direct investment enhancing the investment climate, are strengthening market demand. IMF states that, in 2023, Brazil experienced a USD 130 Billion (approximately 20%) increase in inward direct investment position. Apart from this, the growth in innovation hubs in cities like São Paulo, Mexico City, and Bogotá facilitates regional and global partnerships, escalating the market's attractiveness to venture capitalists.

Middle East and Africa Venture Capital Investment Market Analysis

The venture capital investment market in the Middle East and Africa is experiencing growth attributed to the region's rich natural resources attracting investments in energy-tech and sustainable technologies. According to the International Energy Agency (IEA), energy investments in the Middle East are projected to reach around USD 175 Billion in 2024, with clean energy representing approximately 15% of the total investment. Furthermore, the rise of innovation hubs and tech ecosystems, particularly in cities like Dubai and Nairobi, is fostering startup growth and stimulating market appeal. Similarly, increasing smartphone penetration, expanding digital access, and growing tech-driven ventures, are expanding the market scope. Besides this, strong diaspora networks facilitating cross-border investments and bridging local startups with global venture capital and expertise, are positively influencing the market.

Competitive Landscape:

The key players in the market, which include large multinational corporations, innovative startups, and influential financial institutions, are actively engaged in several strategic initiatives. Many are focusing on digital transformation, investing in cutting-edge technologies like artificial intelligence (AI) and blockchain to manage and streamline operations, enhance customer experiences, and drive efficiency. Sustainability and environmental, social, and governance (ESG) initiatives are also a top priority, with major players committing to reducing their carbon footprint, promoting diversity and inclusion, and aligning investments with responsible and ethical practices. According to venture capital investment market forecast, leading companies are fueling growth by tapping into emerging markets, forming strategic partnerships, and adapting to evolving consumer behaviors and preferences. These initiatives highlight a strong focus on innovation, sustainability, and global expansion.

The report provides a comprehensive analysis of the competitive landscape in the venture capital investment market with detailed profiles of all major companies, including:

- Accel

- Andreessen Horowitz

- Bessemer Venture Partners

- First Round Capital

- Founders Fund

- Granite Asia

- Index Ventures

- New Enterprise Associates (NEA)

- Notable Capital

- Sequoia Capital

- Union Square Ventures (USV)

Latest News and Developments:

- April 2025: Kensington Capital Partners acquired the venture capital investment business of ONE9, an Ottawa-based firm specializing in National Security technologies. The acquisition includes a minority stake in ONE9 Capability Labs and builds on a five-year partnership between the firms, including joint investments in companies like Tomahawk Robotics and Strider Technologies.

- March 2025: To invest in early-stage Indian firms, Prime Venture Partners established a USD 100 Million venture capital fund with a focus on the fintech, global SaaS, AI/deep tech, and Digital India industries. According to reports, international institutional investors will provide more than 80% of the funding.

- November 2024: Razorpay, in partnership with Peak XV Partners and Lightspeed, launched the Razorpay Venture Investment Program. This initiative aims to invest up to USD 1 million in 10-15 early-stage B2B startups annually, offering funding, technology support, and mentorship across sectors like fintech, e-commerce, and healthcare.

- August 2024: Volt VC Fund-1, the first fund from Ahmedabad-based micro venture capital firm Volt VC, aimed to raise INR 45 Crore (about USD 5.41 Million). The fund's pre-seed stage investments would range from INR 50 Lakh (about USD 60,096) to INR 2 Crore (about USD 240,385), with the goal of funding 20–25 consumer-focused firms.

- June 2024: General Catalyst, a US-based venture capital firm, acquired Indian VC firm Venture Highway. This merger led to the formation of General Catalyst India, with plans to invest between USD 500 Million and USD 1 Billion in the country.

Venture Capital Investment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Venture Capital Investment Industry Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, Others |

| Fund Sizes Covered | Under $50 M, $50 M To $100 M, $100 M To $250 M, $250 M To $500 M, $500 M To $1 B, Above $1 B |

| Funding Types Covered | First-Time Venture Funding, Follow-On Venture Funding |

| Regions Covered | North America, Asia Pacific, Europe, Others |

| Companies Covered | Accel, Andreessen Horowitz, Bessemer Venture Partners, First Round Capital, Founders Fund, Granite Asia, Index Ventures, New Enterprise Associates (NEA), Notable Capital, Sequoia Capital, Union Square Ventures (USV), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the venture capital investment market from 2020-2034.

- The venture capital investment market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the venture capital investment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The venture capital investment market was valued at USD 396.7 Billion in 2025.

The venture capital investment market is projected to exhibit a CAGR of 16.68% during 2026-2034, reaching a value of USD 1,590.6 Billion by 2034.

The market is driven by increased startup activity, especially in tech-driven sectors like AI, fintech, and health tech. Favorable government policies, strong innovation ecosystems, and rising demand for disruptive technologies further support growth. The expansion of digital infrastructure, growing investor risk appetite, and availability of large funds through institutional investors and sovereign wealth funds are also contributing to market expansion.

North America currently dominates the venture capital investment market. The dominance is fueled by the presence of Silicon Valley, high research and development (R&D) activities spending, a mature startup ecosystem, abundant funding sources, and supportive regulatory and tax frameworks that encourage entrepreneurial activity.

Some of the major players in the venture capital investment market include Accel, Andreessen Horowitz, Bessemer Venture Partners, First Round Capital, Founders Fund, Granite Asia, Index Ventures, New Enterprise Associates (NEA), Notable Capital, Sequoia Capital, Union Square Ventures (USV), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)