Vegan Yogurt Market Size, Share, Trends and Forecast by Source, Flavor, Application, Distribution Channel, and Region, 2025-2033

Vegan Yogurt Market Size and Share:

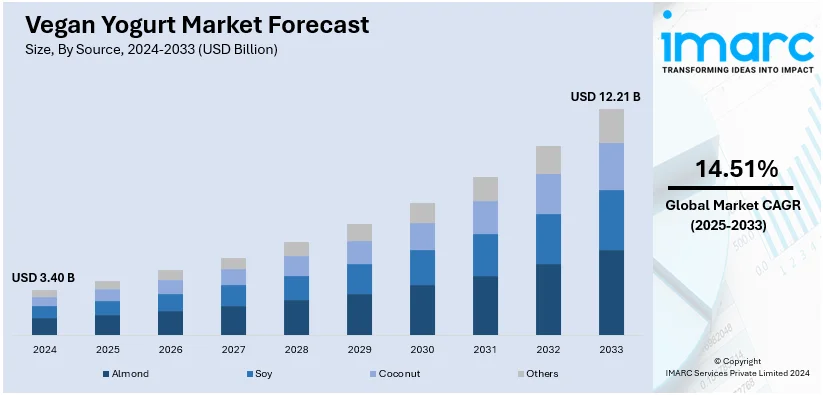

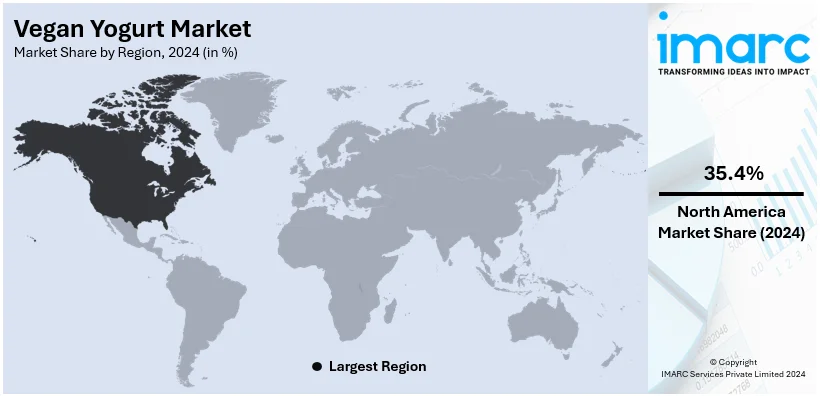

The global vegan yogurt market size was valued at USD 3.40 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.21 Billion by 2033, exhibiting a CAGR of 14.51% from 2025-2033. North America currently dominates the market, holding a market share of over 35.4% in 2024. The growing health awareness among the masses, increasing prevalence of dietary restrictions, escalating concerns about climate change and environmental degradation, lower production costs of plant-based ingredients, and recent technological advancements are some of the major factors propelling the vegan yogurt market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.40 Billion |

| Market Forecast in 2033 | USD 12.21 Billion |

| Market Growth Rate (2025-2033) | 14.51% |

Vegan Yogurt Market Analysis:

- Major Drivers: Health-oriented consumers are fueling growth as they look for healthy dairy substitutes with reduced saturated fats and cholesterol-free alternatives. Increasing prevalence of lactose intolerance, which strikes 68% worldwide and 42% in the US, brings huge demand for plant-based substitutes that provide digestive relief without sacrificing nutrition.

- Key Market Trends: Innovative plant-based products with almond, oat, and coconut bases are creating superior taste and texture profiles thus supporting the vegan yogurt market demand. Functional ingredients such as probiotics, vitamin B12, and omega-3 fortification are addressing nutritional demands. Premium organic and clean-label offerings are picking up among discerning consumers.

- Market Challenges: Consistency in taste and texture with dairy yogurt is still challenging for producers in the vegan yogurt market outlook. Increased production costs of plant-based ingredients influence pricing strategy. Short shelf life and storage needs present distribution challenges, especially for developing markets with limited cold chain infrastructure.

- Market Opportunities: Based on the vegan yogurt market forecast, the increases in distribution via online channels and specialty outlets offer growth opportunities. New protein-rich formulation innovation and environmentally friendly packaging create competitive differentiators. Developing markets with increasing vegan populations provide substantial expansion opportunities for mature and new brands.

The global vegan yogurt market is growing, driven by the increasing demand for plant-based alternatives from consumers who are increasingly motivated by health, environmental, and ethical factors. Consumer acceptance is increasing on the back of awareness about dairy health risks and, in recent years, particularly about lactose intolerance and a high saturated fat content. Additionally, the environmental impact of dairy farming, particularly its carbon footprint and water usage, is prompting eco-conscious individuals to choose vegan products. Innovations in plant-based yogurt, with improved taste, texture, and nutritional profiles, have also contributed to the market's growth.

To get more information on this market, Request Sample

The USA is establishing itself as a dominant player with 88.50% of the market share. Its growth is primarily driven by several key factors, including increasing health consciousness, environmental concerns, and the rising popularity of plant-based diets. Moreover, as more consumers seek dairy alternatives due to lactose intolerance, veganism, or ethical considerations, plant-based yogurt has become a prominent choice, strengthening the market growth. Besides this, ongoing innovations in taste and texture, particularly with coconut, almond, and oat bases, have further fueled demand. Additionally, environmental awareness is pushing people to reduce dairy consumption due to its carbon footprint. With brands expanding their plant-based lines, the market is experiencing rapid expansion.

Vegan Yogurt Market Trends:

The growing health awareness among the masses

The surge in health awareness among consumers is an important factor propelling the vegan yogurt market growth. Moreover, the rising concern over the use of dairy products, owing to their saturated fat content, potential hormonal imbalances, and cholesterol levels is fostering the market growth. This increased concern has boosted the rise of plant-based vegan yogurt that aligns well with contemporary nutritional diets. According to reports, between 1-4 percent of Americans are vegan. It is known to be lower in saturated fats and devoid of cholesterol which positions it as a heart-friendly option. Moreover, vegan yogurts often come fortified with essential nutrients, such as vitamin B12, calcium, and omega-3 fatty acids, which aids in addressing the common nutritional deficiencies that consumers worry about when switching to plant-based diets. Besides this, the ongoing proliferation of scientific research advocating for reduced animal product consumption for health reasons is acting as a growth-inducing factor.

The increasing prevalence of dietary restrictions

The increasing number of dietary restrictions, including lactose intolerance and milk allergies, is considered one of the major growth drivers for the growing share of the vegan yogurt market. Lactose intolerance cause symptoms of bloating, diarrhea, and abdominal cramps. To many consumers, the feeling or sensation is utterly distasteful as if drinking poison. Interestingly, statistics suggest that 68% of individuals globally and 42% in America are facing this problem. Apart from this, milk allergy is one of the leading food allergies in children, and it manifests as skin reactions, gastrointestinal disorders, and allergic rhinitis. An estimated 2.5% of America's children aged three years or younger have milk allergy. In this regard, vegan yogurt is a non-threatening and hypoallergenic source of these conditions since it is produced from plant-based sources, such as almonds, soy, coconut, and oats, which are inherently lactose-free and easier to digest.

The escalating concerns about climate change and environmental degradation

The traditional dairy industry is water-intensive, land-consuming, and cattle feed-intensive. These factors are contributing to the growth of demand for vegan yogurt. The environmental footprint of vegan yogurt is lower than that of traditional yogurt because plant-based sources use less water and emit fewer GHGs compared to dairy. United States Environmental Protection Agency reports that in 2022, U.S. greenhouse gas emissions increased 0.2% from 2021 levels. The ever-increasing purchasing capacity of the consumers who can take an independent buying decision according to the sustainability aspects of the products they buy contributes to market growth. Along with this, firms underlining the sustainable aspects of their products, including carbon neutral packaging and transparent sourcing, promote the growth of the industry. Beyond this, the negative environmental impact that animal agriculture brings in the public debate has pushed part of the market consumers to look for more sustainable solutions, hence fueling the market demand.

Vegan Yogurt Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vegan yogurt market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on source, flavor, application, and distribution channel.

Analysis by Source:

- Almond

- Soy

- Coconut

- Others

Soy remains the largest segment in 2024, with a market share of about 45.7%. Soy is dominating the market because it provides a high protein content similar to that of dairy yogurt, thus making it a healthy choice for consumers who want plant-based protein sources. Furthermore, it has been widely researched and is a well-established base for plant-based products, such as yogurt. Soy is more economical than some other plant-based options, including almonds and cashews, for manufacturing and thus consumer purchase, too. And soy is also one of the most widely produced legumes on the planet. It's really necessary for mass manufacturing and market reach for the existence of a solid supply chain. Also, with advanced food technology the emergence of soy-based yogurts of improved taste and texture further catalyzes growth in vegan yogurt market size.

Analysis by Flavor:

- Vanilla

- Strawberry

- Mixed Berry

- Raspberry

- Peach

- Others

Vanilla has a universally accepted taste. Thus, it is highly consumed by consumers. It is gentle and different from the usual taste of other products. Therefore, its addition in plant-based ingredients of vegan yogurt complements them, which would further enhance the experience of eating. Additionally, vanilla acts as a base for any number of other flavors, fruits, or toppings. That makes it an easy option for consumers who would like to modify their yogurt to their own tastes.

Strawberry has a sweet and tangy flavor profile, which will complement the natural tartness of yogurt. As a result, it will offer a well-balanced taste experience that is likely to appeal to a wide variety of consumers. Furthermore, strawberry flavor is so familiar that it can be used as a stepping stone for those who are trying vegan yogurt for the first time. This way, manufacturers can introduce new customers to their range of plant-based yogurts, thereby expanding market reach.

The popularity of mixed berry-flavored vegan yogurts is driven by consumer preference for vibrant, sweet, and tangy flavors. Berries are rich in antioxidants, which appeal to health-conscious individuals seeking natural, nutrient-dense options. This flavor's versatility also supports product innovation.

Raspberry-flavored vegan yogurt has found popularity because it is bold, tart, and fits the fast-growing demand for fruit-based low-sugar options. The vitamin C content in the berry along with its antioxidant properties makes the berry appealing for health-conscious consumers seeking functional plant-based snacks.

Peach-flavored vegan yogurt is gaining popularity because of its refreshing, naturally sweet taste and smooth texture. This flavor appeals to consumers who want indulgent yet dairy-free options and to those looking for a lighter, tropical alternative to traditional yogurts.

Other options in vegan yogurts comprise flavors that increasingly reflect an interest in the uncommon and exotic like coconut, mango, or vanilla. Consumers look for more different, adventurous flavor options, while brands innovate new flavors to serve the evolving taste and dietary demands of consumers.

Analysis by Application:

- Frozen Dessert

- Food

- Beverages

- Others

Vegan yogurt would be the perfect base for frozen desserts because they are very rich in creamy texture and flavors with a similar dairy-based equivalent. Additionally, this versatility allows incorporating different flavors, sweeteners, and additives for a range of frozen dessert products, including ice creams, sorbets, and frozen yogurts. The growth of the industry has been spurred by advancing food processing technologies that have also enabled vegan frozen desserts to somewhat more closely simulate their non-vegan counterparts regarding texture and flavor, and so become more easily accepted.

Vegan yogurt is increasingly being added to a wide variety of foods, including smoothies, salad dressings, baked goods, and desserts. In addition, the growth in the ready-to-eat (RTE) and convenience food industries is further driving the adoption of vegan yogurt in food applications. Its longer shelf life, compared to many dairy-based yogurts, makes it a suitable ingredient for packaged food products that require extended storage.

There is strong market growth for vegan yogurt beverages with the growing demand for functional drinks that may better support gut health, immunity, and digestion. They appeal to conscious consumers seeking convenient, plant-based, and probiotic-rich alternatives to traditional dairy-based options.

The other segment, which includes applications such as desserts, smoothies, and baked goods, is growing due to more and more consumers experimenting with plant-based ingredients. The adaptability of vegan yogurt in recipe usage, combined with its health benefits, helps in its adoption into a wide range of recipes and food products.

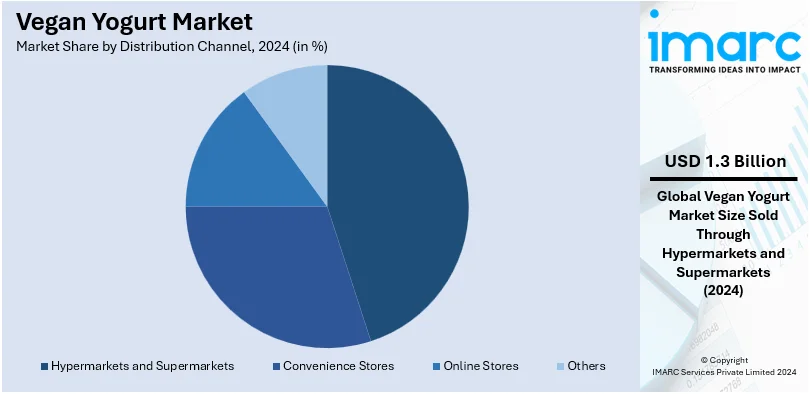

Analysis by Distribution Channel:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Stores

- Others

Hypermarket and supermarket held the first market segment, which comprised 37.5% of the total share. Hypermarkets and supermarkets dominate the market since they offer multiple choices in a single place that make it easier for the consumers to compare and select the preferred vegan yogurt of a specific brand and flavor from multiple brands and flavors in one place. Besides, the well-established infrastructure and strategic locations of hypermarkets and supermarkets are easily accessible to the mass population. In addition, they use promotional methods like discounts, loyalty programs, and in-store tastings that increase consumer knowledge and product sampling. Additionally, hypermarkets and supermarkets have a refrigerated area that is very important for perishable products such as vegan yogurt. This makes sure that the product remains fresh, hence giving confidence and satisfaction to the customer.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America has the highest market share of more than 35.4%. The market growth is being influenced by the rising health consciousness of North American consumers, who are switching from dairy to vegan alternatives. The growth in awareness and concern for animal welfare in the region, which encourages the consumption of plant-based foods, is also fueling the growth of the vegan yogurt market. Positive impact on the growth of the North American market can be seen because of the well-developed network of distribution throughout the region with the presence of supermarkets, specialty stores, and online platforms. Thus, this network makes it easily accessible for a larger base of consumers towards vegan yogurt. Incorporation of advanced food processing technology by regional manufacturers to develop quality tasty products for the market, further supports its growth. Besides, the availability of big players in the North American market that offers a wide selection for the consumers creates an environment of competition that pushes the prices to more reasonable prices that support the growth of the market.

Key Regional Takeaways:

United States Vegan Yogurt Market Analysis

The increasing preference for healthy and nutritious dietary options has significantly influenced the adoption of vegan yogurt. According to survey, social media influences 60% of Americans to make healthier dietary choices, fostering a surge in demand for vegan yogurt as a nutritious, plant-based alternative. This shift aligns with a broader awareness of nutritional benefits and the need for alternatives that support overall well-being. The availability of options catering to dietary restrictions, such as lactose intolerance, has contributed to this trend. Such is the popularity of vegan yogurt made from almond, soy, and oat milk, all because it's nutrient-dense. Local retail outlets and health-centric cafes have also amplified consumer accessibility. Social media has amplified its popularity, with influencers highlighting its benefits. As consumer knowledge grows, so does the inclination toward products with minimal processing and clean labels, which vegan yogurt often represents.

Europe Vegan Yogurt Market Analysis

The growing food and beverage industry in Europe is promoting the vegan yogurt market that meets increased consumer demand for plant-based products. Reports indicate that around 445k operate in the food & drink wholesaling industry in Europe. As awareness about dairy-free diets increases, partly due to welfare, sustainability, and health issues, the food industry has responded by launching more options of dairy-free products into the market, including vegan yogurt. The launch of such products into mass supermarkets and restaurants also expands accessibility and makes it easier for consumers to eat plant-based diets. In addition, the demand for new and healthy plant-based products has increased, and companies are investing in new and improved vegan yogurt flavors. As people increasingly adopt a vegan and plant-based lifestyle, the growth in the food and beverages industry fuels the expansion of vegan yogurt in the region.

Asia Pacific Vegan Yogurt Market Analysis

Plant-based yogurt adoption is rising in the Asia-Pacific region, led by an increase in vegan diets and preference for a plant-based food option. As mentioned in the report, India leads the statistics with 38% of its population declaring themselves as vegetarians. In this regard, the growing population is becoming conscious of health and environmental factors associated with a plant-based diet and has been seeing a huge movement toward dairy-free products, such as yogurt alternatives. Additionally, the pursuit of sustainable lifestyles and ethical consumption habits has led consumers to opt for plant-based products as a means of minimizing their ecological footprint. The shift towards plant-based diets, both culturally and environmentally driven, is contributing to the region of diverse food preferences and heightened health awareness as a driving factor for the acceptance of plant-based yogurt.

Latin America Vegan Yogurt Market Analysis

In Latin America, the expansion of online shopping platforms has driven the growing adoption of plant-based yogurt alternatives. According to reports, the sales value is 2.8X, and transactions have increased by 3.1X from 2019-2023, which shows that the e-commerce sector is on the rise.

This boom helps vegan yogurt gain access to markets and customers. As the penetration of the internet and the emergence of digital commerce continue, more consumers are easily able to get a wide range of vegan food options, such as plant-based yogurts. E-commerce online has provided an easy, direct access route to these products, thus allowing consumers to find and purchase more plant-based options. This growth in online shopping is particularly useful in regions where brick-and-mortar retail outlets might have limited options for vegan products. As the e-commerce sector continues to expand and more consumers turn to online platforms for their food and beverage needs, demand for vegan yogurt will continue to rise.

Middle East and Africa Vegan Yogurt Market Analysis

The growing demand for frozen desserts in the Middle East and Africa has driven the increased adoption of plant-based yogurt. As tourism continues to grow in the region, consumers are looking for healthier and more diverse dessert options that align with dietary preferences, including vegan and dairy-free alternatives. For instance, from January to October 2024, Dubai welcomed 14.96 Million overnight visitors. This was 8% higher than in the same period in 2023, with good growth in tourism. Vegan frozen yogurt has become a popular choice among tourists looking for refreshing, plant-based options that fit their dietary restrictions or preferences. The rising foodservice demand, mainly in areas rich in tourist hotspots, has further helped popularize the need for plant-based alternatives; among them frozen desserts, namely vegan yogurt, continues to push upward. Increasing tourist activity supports demand for vegan frozen yogurt that further supports acceptance of vegan yogurt within this geographical space.

Competitive Landscape:

The competitive industry of global vegan yogurts is marred with a high number of participants competing for market share within an increasingly health-conscious and environmentally aware consumer base. Key players include well-established brands in the dairy industry, who now offer plant-based yogurts under their added product lines. They leverage their established distribution networks and strong brand recognition to capture a significant share of the market. Specialized plant-based brands are growing rapidly by following the single stream of plant-based products and exciting new flavors, more favorable textures, and nutrient-rich formulations. A competitive strategy adopted by this industry includes product innovations like alternative bases from almonds, coconut, or oats, alongside clean-labeling and organic labels. Also, strategic mergers and acquisitions, partnerships have been common since companies seek to increase their market breadth and keep pace with the growing demand for dairy-free foods.

The report provides a comprehensive analysis of the competitive landscape in the vegan yogurt market with detailed profiles of all major companies, including:

- Barambah Organics Pty Ltd.

- Blue Diamond Growers

- Daiya Foods Inc. (Otsuka Pharmaceutical Co. Ltd.)

- Dean Foods (Dairy Farmers of America)

- General Mills Inc.

- Granarolo S.p.A.

- The Hain Celestial Group Inc.

- Vitasoy

- White Wave Foods (Danone)

Latest News and Developments:

- July 2024: UK-based brand The Coconut Collab introduces a plant-based protein yogurt with 10g of protein per serving and on-the-go yogurt with granola. Made from ethically sourced coconuts, the yogurt is gluten-free, low in sugar, and enriched with soy and almond proteins for all nine amino acids. Fermented with live cultures, it supports gut health while minimizing waste.

- March 2024: Bored Cow unveiled its first-ever animal-free drinkable yogurt, made with fermented milk proteins, coconut cream, and cane sugar. The strawberry, vanilla, and passion fruit mango flavored 7-oz bottles deliver 8 grams of protein, calcium, vitamins D and B12, and probiotics. This version is lactose-free, and there's no cholesterol, hormones, or antibiotics.

- February 2024: Danone Canada's Silk brand launches a Greek-style, plant-based yogurt that uses locally sourced Canadian pea protein. The two flavors, vanilla and key lime, offer a creamy texture and strong taste. At 175g, each serving provides an impressive 12 grams of protein to the health-conscious consumer. It's another new launch by Silk to emphasize innovation in plant-based nutrition in the Canadian market.

- February 2024: Icelandic Provisions has launched Oatmilk Skyr, the first plant-based offering in the skyr yogurt category, nationwide. Made with oatmilk, it delivers a rich, creamy texture and 12g of protein per serving, mirroring the brand's traditional dairy skyr. The innovation responds to consumer demand for better-tasting, nutritious plant-based yogurts. Chief Innovation Officer John Heath calls it a "truly unbelievable" product crafted with clean, high-quality ingredients.

- January 2024: Nature’s Fynd has introduced the world’s first fungi-based yogurt, Dairy-Free Fy Yogurt, made with sustainable fungi protein, Fy™. Launching nationwide at Whole Foods Market, this creamy, vegan alternative redefines yogurt by skipping cow milk, nuts, oats, or soy. The product becomes part of Nature's Fynd's offerings, which also feature Dairy-Free Cream Cheese and Meatless Fy Breakfast Patties.

Vegan Yogurt Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Almond, Soy, Coconut, Others |

| Flavors Covered | Vanilla, Strawberry, Mixed Berry, Raspberry, Peach, Others |

| Applications Covered | Frozen Dessert, Food, Beverages, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Barambah Organics Pty Ltd., Blue Diamond Growers, Daiya Foods Inc. (Otsuka Pharmaceutical Co. Ltd.), Dean Foods (Dairy Farmers of America), General Mills Inc., Granarolo S.p.A., The Hain Celestial Group Inc., Vitasoy, White Wave Foods (Danone), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vegan yogurt market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global vegan yogurt market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vegan yogurt industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Vegan yogurt is a plant-based alternative to traditional dairy yogurt, made from plant-derived ingredients such as soy, almond, coconut, or oat. It is often fortified with probiotics, vitamins, and minerals to mimic the taste and texture of dairy yogurt while being lactose-free and dairy-free.

The global vegan yogurt market was valued at USD 3.40 Billion in 2024.

IMARC estimates the global vegan yogurt market to exhibit a CAGR of 14.51% during 2025-2033

The key factors driving the global vegan yogurt market include rising health consciousness, dietary restrictions like lactose intolerance, environmental concerns over dairy production, and innovations in taste and texture that appeal to health-conscious and eco-aware consumers.

In 2024, soy represented the largest segment by source, driven by its high protein content, cost-effectiveness, and established presence in plant-based yogurt products.

In 2024, hypermarkets and supermarkets represented the largest segment by distribution channel, driven by their wide variety of choices, strategic locations, and promotional strategies that increase consumer awareness and product accessibility.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global vegan yogurt market include Barambah Organics Pty Ltd., Blue Diamond Growers, Daiya Foods Inc. (Otsuka Pharmaceutical Co. Ltd.), Dean Foods (Dairy Farmers of America), General Mills Inc., Granarolo S.p.A., The Hain Celestial Group Inc., Vitasoy, White Wave Foods (Danone), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)