Varicose Vein Treatment Market Size, Share, Trends and Forecast by Product, Procedure, End User, and Region, 2025-2033

Varicose Vein Treatment Market Size and Share:

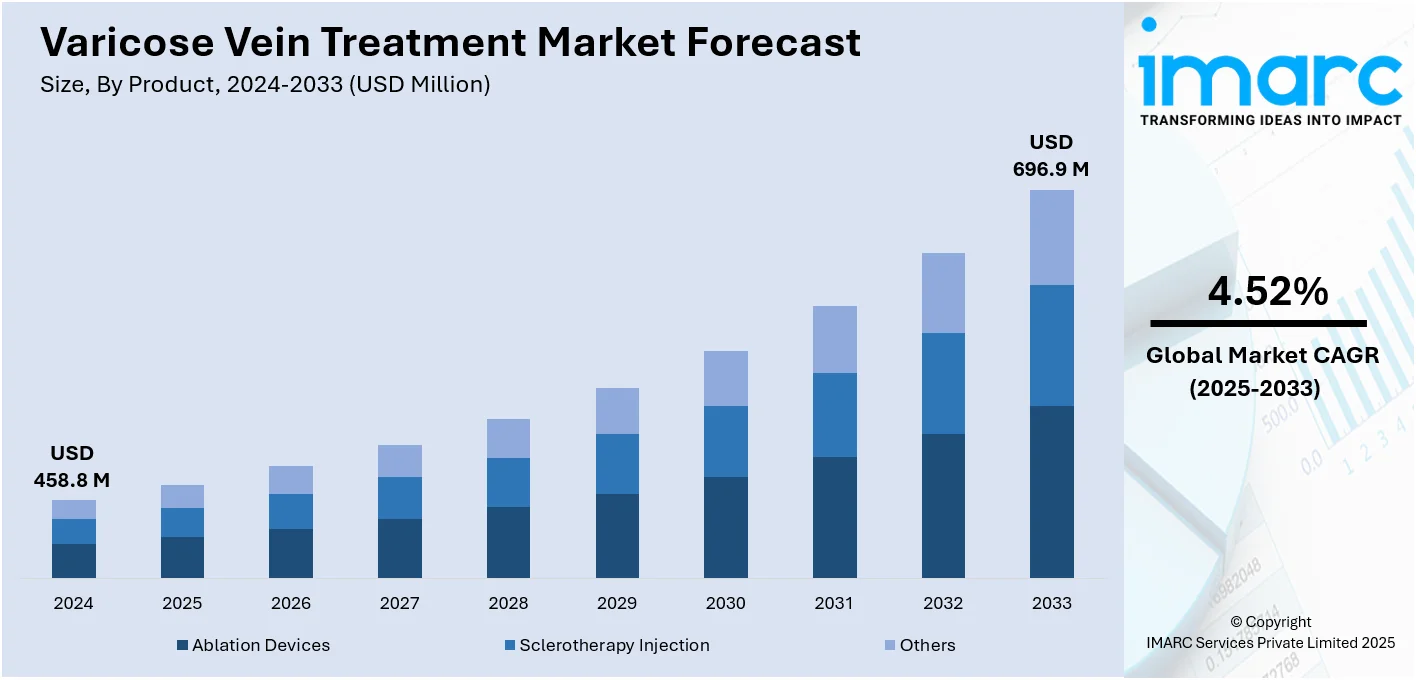

The global varicose vein treatment market size was valued at USD 458.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 696.9 Million by 2033, exhibiting a CAGR of 4.52% from 2025-2033. North America currently dominates the market, holding a market share of over 47.8% in 2024. The growing elderly population, technological advancements in minimally invasive (MI) procedures, increasing awareness and healthcare spending, and key players focusing on innovation and strategic collaborations to expand treatment options and geographic reach are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 458.8 Million |

|

Market Forecast in 2033

|

USD 696.9 Million |

| Market Growth Rate 2025-2033 | 4.52% |

The market is gaining impetus due to the introduction of new, effective, and minimally invasive varicose vein treatment options. The rising geriatric population and lifestyle changes, such as prolonged standing or sedentary activities, are pushing the incidence of varicose veins and resulting diseases. Besides, health awareness concerning potential risks treated before reaching complications such as ulcers or deep vein thrombosis is convincing people to take medical intervention. Moreover, treatment technologies have migrated to more advanced procedures, such as laser surgery, radio frequency ablation, and sclerotherapy, creating more streamlined and less invasive interventions that are also within reach of the average person. As such, outpatient procedures have made a greater demand for minimally invasive treatments.

The United States has emerged as a key regional market for varicose veins treatment. The market in the US is propelled as consumers are becoming more aware about their healthcare needs, and similar medical developmental changes. Moreover, aging populations with sedentary lifestyles create rising numbers of people with varicose veins, thus generating increasing demand in the VVT market for better products. Moreover, the high public awareness levels on adverse health impacts of untreated varicose veins such as chronic pain and venous ulcers have posed as motivating factors for public intervention. Technological innovations, including minimally invasive procedures like laser therapy, radiofrequency ablation, and sclerotherapy, are making treatments safer, faster, and more accessible, further driving market growth.

Varicose Vein Treatment Market Trends:

Technological advancements in treatment

Ongoing advancements like endovenous laser therapy (EVLT), radiofrequency ablation (RFA), and ultrasound-guided sclerotherapy are changing treatment approaches from invasive surgeries to minimally invasive (MI) and non-surgical options. For patients, such new technologies promise quicker recovery, less pain, and smaller chances of post-operation complications, which is causing the popularity of the surgeries to grow. In 2023, the size of the global minimally invasive surgery market was USD 52.9 Billion. As per the report by the IMARC Group, the market is expected to reach USD 91.0 Billion by 2032, exhibiting a CAGR of 6% during 2024-2032. Further development of lasers and radiofrequency devices in combination with imaging technologies for more pinpoint treatment in the ailing veins is driving the varicose vein treatment demand. Companies are channelizing their revenues for research and development (R&D) to make the best use of technologies existing and to come up with new innovations.

Globalization of healthcare

By partnering internationally, healthcare professionals exchange best practices and technologies, enhancing the quality of treatment globally. For instance, VVT Medical announced a strategic distribution agreement with Methapharm to market its ScleroSafe platform in the USA, following FDA approval in June 2023. This collaboration leverages Methapharm's expertise in varicose veins, aiming to transform treatment with ScleroSafe's innovative, non-thermal, non-tumescent technique. This worldwide exchange guarantees that advanced treatment techniques are available in different areas with standardization of care quality, supporting the varicose vein treatment market growth. Medical tourism is also a factor, with patients traveling overseas in search of top-notch treatments at more affordable prices. In 2023, the medical tourism industry in the world was valued at USD 119.7 billion. The IMARC Group estimates the market would expand at a CAGR of 20.1% from 2024 to 2032, reaching USD 650.8 billion in 2032. Globalization leads to increased accessibility and improved quality of varicose vein treatments worldwide, supporting market expansion and technological progress.

Regulatory approvals and support

Obtaining regulatory approvals is essential for the development of varicose vein treatment. Regulatory agencies establish stringent criteria and provide clear approval procedures for new medical devices and treatments. The strict regulatory landscape motivates companies to invest in research and clinical trials to drive innovation. The approval of treatments by authorities builds trust and confidence between healthcare providers and patients, guaranteeing the presence of secure and efficient choices in the market. Furthermore, robust regulations can accelerate the entry of cutting-edge treatments into the market, quickening their adoption and expanding the range of modern options for varicose vein treatment. In April 2024, VVT Medical achieved a major milestone in the Korean market with the approval of its ScleroSafe™ device by the Korean Ministry of Food and Drug Safety. This was after the FDA 510(k) clearance and CE Mark, confirming ScleroSafe™ as a dependable option for varicose vein treatment.

Varicose Vein Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global varicose vein treatment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, procedure, and end user.

Analysis by Product:

- Ablation Devices

- Radiofrequency Ablation Devices

- Laser Ablation Devices

- Others

- Sclerotherapy Injection

- Others

Ablation devices are an important segment, especially radiofrequency and laser ablation devices, as they are preferred in the treatment of varicose veins. These are effective in shutting off problematic veins with ways that are less invasive than those used hitherto, thereby inflicting less pain and delivering the patient to recovery quickly. Radiofrequency ablation devices utilize thermal energy to heat and collapse the vein, while laser ablation uses light energy to accomplish similar outcomes, providing effective options for patients who prefer less invasive treatments. In 2023, the market size of ablation devices worldwide reached USD 5.9 billion. IMARC Group forecasts that the market will reach a value of USD 14.4 billion by 2032, showing a 10.2% CAGR from 2024 to 2032.

Sclerotherapy injections have a solid presence in the industry, thereby influencing the varicose vein treatment market revenue. This technique includes injecting a solution into the varicose veins, which results in scarring and redirecting blood to healthier veins, ultimately causing the treated vein to vanish. The technique is used because of its effectiveness in addressing minor varicose veins and spider veins, its ease of use, and its reasonable cost. It is particularly popular in outpatient settings, where fast recovery is an important factor.

Others encompass a range of additional options, such as compression stockings and surgical procedures. Surgical procedures, while less frequently used now due to the increase in minimally invasive (MI) techniques, are still utilized in serious situations when other treatments do not work. This part serves a wide range of patients, providing options from basic preventive care to extensive surgical treatments.

Analysis by Procedure:

- Injection Sclerotherapy

- Endovenous Ablation

- Surgical Ligation and Stripping

Injection sclerotherapy leads the market with around 70% of varicose vein treatment market share in 2024. Injection sclerotherapy leads the market due to its effectiveness, low level of invasiveness, and cost-effectiveness. The process includes injecting a sclerosant solution into the varicose veins to irritate the vein walls, leading them to collapse and bond. As time passes, the vein that has been treated fades away as it gets absorbed back into the surrounding tissue. The popularity of sclerotherapy is enhanced by its ability to be performed in outpatient settings, its quick resolution of cosmetic concerns and discomfort from small varicose and spider veins, and its short recovery time, making it a preferred option for patients wanting both effectiveness and convenience. In 2023, the sclerotherapy market in the world was valued at US$ 1.2 billion. The IMARC Group projects that the market will expand at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2032, when it reaches US$ 2.0 billion in 2032.

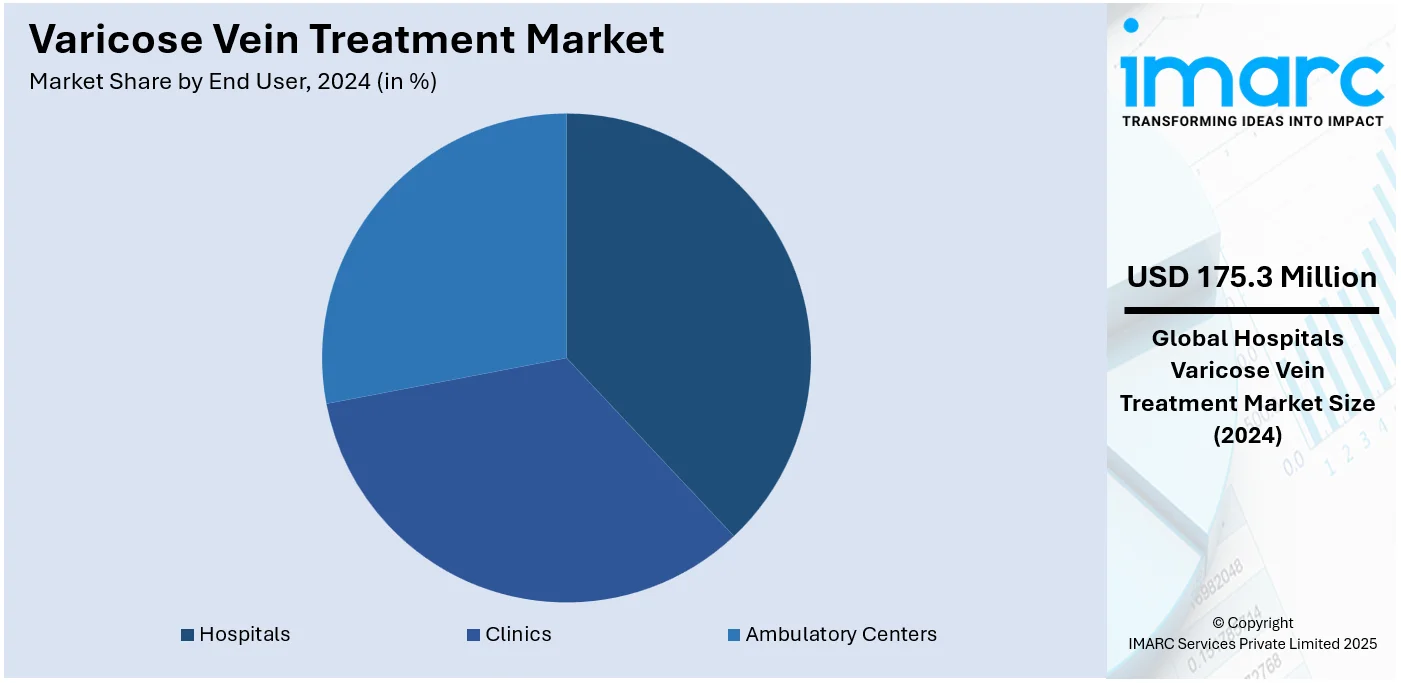

Analysis by End User:

- Hospitals

- Clinics

- Ambulatory Centers

Hospitals leads the market with around 38.2% of market share in 2024. Hospitals dominate the market due to their extensive treatment options and ability to manage complicated cases that require advanced medical interventions, shaping a positive varicose vein treatment market outlook. They have the required infrastructure to offer various types of treatments for varicose veins, including less invasive procedures like sclerotherapy and endovenous ablation and more aggressive techniques such as surgical ligation and stripping. This benefits a strong confidence from patients who are looking for dependable and efficient treatments from specialized vascular surgeons and interventional radiologists. Moreover, hospitals play a key role in are frequently the top choice for patients with advanced varicose veins who may need comprehensive care from various healthcare providers and extended monitoring, solidifying their position in the market.

Regional Analysis

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 47.8%. North America holds biggest share in the market, mainly due to substantial healthcare expenditure, cutting-edge medical technologies, and a solid healthcare system. This area, encompassing both the United States and Canada, shows a high need for minimally invasive (MI) procedures because of a high number of varicose veins in its elderly residents. As per the 2023 US Census Bureau report, the number of people in the US aged 65 and above was projected to increase by 47% from 58 million in 2022 to 82 million by 2050. Furthermore, it is expected that the percentage of people in this age range in the overall population will rise from 17% to 23%. Furthermore, North America is advantaged by having top healthcare firms and a strong regulatory framework that encourages quick uptake of new technologies. The strong presence of the region in the global market is also influenced by its extensive insurance coverage and high level of patient consciousness.

Key Regional Takeaways:

United States Varicose Vein Treatment Market Analysis

In 2024, the United States accounts for 95.00% of the varicose vein treatment market in North America. It is growing in a steady line due to enhanced awareness and resultant demand for a non-invasive procedure. Journal of Vascular Surgery: Venous and Lymphatic Disorders reported that in the United States, about 24% adults have visible varicose veins, and this figure is estimated for about 6% with visible evidence of advanced chronic venous disease. With increasing modern treatment methods, including endovenous laser therapy and radiofrequency ablation, the market is greatly benefited. These minimally invasive procedures are becoming popular because they have proven to be more effective, require less recovery time, and involve fewer complications, so the demand for them is growing constantly. Market leaders include Medtronic, Boston Scientific, and CooperSurgical. Public and private healthcare sectors both contribute to the growth of this market. Government initiatives in health and wellness further support the growth of the market, and technological advancements such as robotic-assisted procedures enhance the quality of care and provide opportunities for the market.

Europe Varicose Vein Treatment Market Analysis

Varicose vein treatment in Europe is growing as a result of the aging population and growing concern with health and wellness. According to Europe PMC, varicose veins are a very common condition in Europe and appear in 35% of adult whites. Such contributions from leading countries like Germany and the UK follow healthcare system investments and the increase of demand for minimally invasive procedures. New treatments such as laser therapy and sclerotherapy are becoming popular due to the high success rates with low risks of complications. Market leaders include Medtronic and Varian Medical Systems, with public-private partnerships contributing to the further advancement of treatment methods. Non-invasive treatments are likely to be the norm for the region with a focus on the alleviation of the pressure on healthcare services.

Asia Pacific Varicose Vein Treatment Market Analysis

The market in Asia Pacific is growing fast due to robust healthcare infrastructure and awareness about vascular diseases. According to an industry report, in India, prevalence of varicose veins is between 5% and 30%. A national survey showed the prevalence of varicose vein is 8.9% of the population in China, or over 100 million people. Healthcare in China 2023. The rising disposable income and aesthetic treatment needs are also promoting the varicose vein treatment market. Invasive treatments like sclerotherapy and laser surgery are gaining ground because they have a lower cost and less time for recovery. Philips and Alcon are now upgrading their offerings. There has been a high level of engagement with training and development programs between local governments and these companies, to improve health outcomes.

Latin America Varicose Vein Treatment Market Analysis

Market for varicose vein treatment is growing in Latin America, as increasing healthcare access and rising incomes boost demand for aesthetic procedures. A study of 1,755 adults in a rural town in Brazil revealed 47.6% of people with varicose veins. Of these, 37.9% of men and 50.9% of non-pregnant women were affected. The prevalence of moderate to severe varicose veins was 21.2%. Healthcare expenditure in Brazil totalled USD 23 Billion in 2023, as per industry reports. The government is investing in accessibility to specialized treatments. About 5 million Latin Americans undergo varicose vein treatments every year, with the majority of treatments happening in Brazil and Mexico. Local manufacturers are increasingly producing advanced treatment devices, further supporting varicose vein treatment market growth. There is a cooperation between private and public healthcare systems in increasing the availability of modern treatment options. It drives innovation and improves patient outcomes.

Middle East and Africa Varicose Vein Treatment Market Analysis

The varicose vein treatment market in the Middle East and Africa is growing steadily, driven by the increasing accessibility of healthcare services and patient awareness. According to industrial reports, the prevalence of varicose veins in the Middle East varies according to location and population, with studies reporting varying prevalence rates. In Saudi Arabia, it has been established that 62% of the population has VVs, and their annual incidence has increased by approximately 5% for females and 2% for males. In Cairo, Egypt, over 51% of the population suffers from VVs, while in Western Jerusalem, a survey showed that 29% of females and 10% of males in a heterogeneous population suffered from VVs. In Saudi Arabia, healthcare expenditure for 2023 is estimated at USD 16.5 billion, which has been expanding the specialized treatment facilities. International collaboration and health tourism are further demanding varicose vein treatments in the region since patients are trying to find a more affordable solution abroad.

Competitive Landscape:

Key players in the market are working diligently on research and development (R&D) to improve the efficiency and safety of current treatments, as well as pursuing approval for new solutions. Leading varicose vein treatment companies are concentrating on broadening their range of products by forming strategic partnerships, merging, and acquiring other companies to strengthen their global market position. For example, DXI Capital Corp. revealed on November 24, 2023, its plan to acquire the entirety of V.V.T. Med Ltd. and Exiteam Acquisition Corp. through a non-binding letter of intent. This move was made to help DXI fulfill TSX Venture Exchange's listing criteria and sustain VVT's varicose vein treatment operations. Furthermore, there is a strong focus on marketing and educational initiatives to increase awareness about the progress in varicose vein treatments among both healthcare providers and patients. These initiatives focus on promoting the use of modern and less intrusive therapies, expanding the range of treatment choices in the market.

The report provides a comprehensive analysis of the competitive landscape in the varicose vein treatment market with detailed profiles of all major companies, including:

- Alma Lasers Ltd. (Sisram Medical Ltd.)

- Angiodynamics Inc.

- Biolitec AG (BioMed Technology Holdings Ltd.)

- Boston Scientific Corporation

- Eufoton S.R.L.

- Fotona, Medtronic plc

- Sciton Inc.

- Teleflex Incorporated

- The Vein Company

- VVT Medical Ltd.

- WON TECH Co. Ltd.

Latest News and Developments:

- July 2024: Medtronic and Swizton Medcare announced that they will open India's first dedicated vein clinic in Bengaluru, which will offer advanced varicose vein treatments. Medtronic will provide the innovative solutions and training, while Swizton Medcare will ensure holistic care through adhesive treatment, radiofrequency ablation, and sclerotherapy.

- July 2024: Metro Vein Centers announced the opening of five new clinics in New Jersey, Texas, and Arizona, along with expanded coverage in Pennsylvania. This expansion brings the network to 50 locations nationwide, offering state-of-the-art treatments for varicose and spider veins, and other venous conditions.

- April 2024: VVT Medical announced that ScleroSafe obtained approval from the South Korea's Ministry of Food and Drug Safety for treating varicose veins on April 25, 2024. This minimally invasive tool is a nonthermal, anesthetic-free device. Additionally, the firm completed GMP certification and registration.

- January 2024: VVT Medical entered a distribution agreement with Methapharm to distribute its ScleroSafe platform for varicose vein treatment in the U.S. ScleroSafe uses a dual syringe technique. Methapharm is dedicated to improving patient care with its knowledge in varicose veins.

- September 2023: The FDA approved ScleroSafe platform by VVT Medical for the treatment of superficial varicose veins without heat or tumescent methods. This gadget, approved in various areas, administers and removes substances at the same time using a dual syringe with a reverse action.

Varicose Vein Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Procedures Covered | Injection Sclerotherapy, Endovenous Ablation, Surgical Ligation and Stripping |

| End Users Covered | Hospitals, Clinics, Ambulatory Centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alma Lasers Ltd. (Sisram Medical Ltd.), Angiodynamics Inc., Biolitec AG (BioMed Technology Holdings Ltd.), Boston Scientific Corporation, Eufoton S.R.L., Fotona, Medtronic plc, Sciton Inc., Teleflex Incorporated, The Vein Company, VVT Medical Ltd., WON TECH Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the varicose vein treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global varicose vein treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the varicose vein treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Varicose vein treatment refers to medical procedures or interventions designed to address varicose veins, which are enlarged, twisted veins typically found in the legs. These veins develop when the valves in the veins fail to function properly, causing blood to pool and the veins to swell. Treatments aim to alleviate symptoms such as pain, swelling, and discomfort, prevent complications like ulcers or blood clots, and improve cosmetic appearance.

The varicose vein treatment market was valued at USD 458.8 Million in 2024.

IMARC estimates the global varicose vein treatment market to exhibit a CAGR of 4.52% during 2025-2033.

The growing elderly population, technological advancements in minimally invasive (MI) procedures, increasing awareness and healthcare spending, and key players focusing on innovation and strategic collaborations to expand treatment options and geographic reach are some of the factors impelling the market growth.

In 2024, injection sclerotherapy represented the largest segment, driven by effectiveness, low level of invasiveness, and cost-effectiveness.

Hospitals lead the market due to their extensive treatment options and ability to manage complicated cases.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global varicose vein treatment market include Alma Lasers Ltd. (Sisram Medical Ltd.), Angiodynamics Inc., Biolitec AG (BioMed Technology Holdings Ltd.), Boston Scientific Corporation, Eufoton S.R.L., Fotona, Medtronic plc, Sciton Inc., Teleflex Incorporated, The Vein Company, VVT Medical Ltd., WON TECH Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)