Variable Frequency Drives Market Size, Share, Trends and Forecast by Product Type, Power Range, Application, End Use, and Region, 2025-2033

Variable Frequency Drives Market Size and Share:

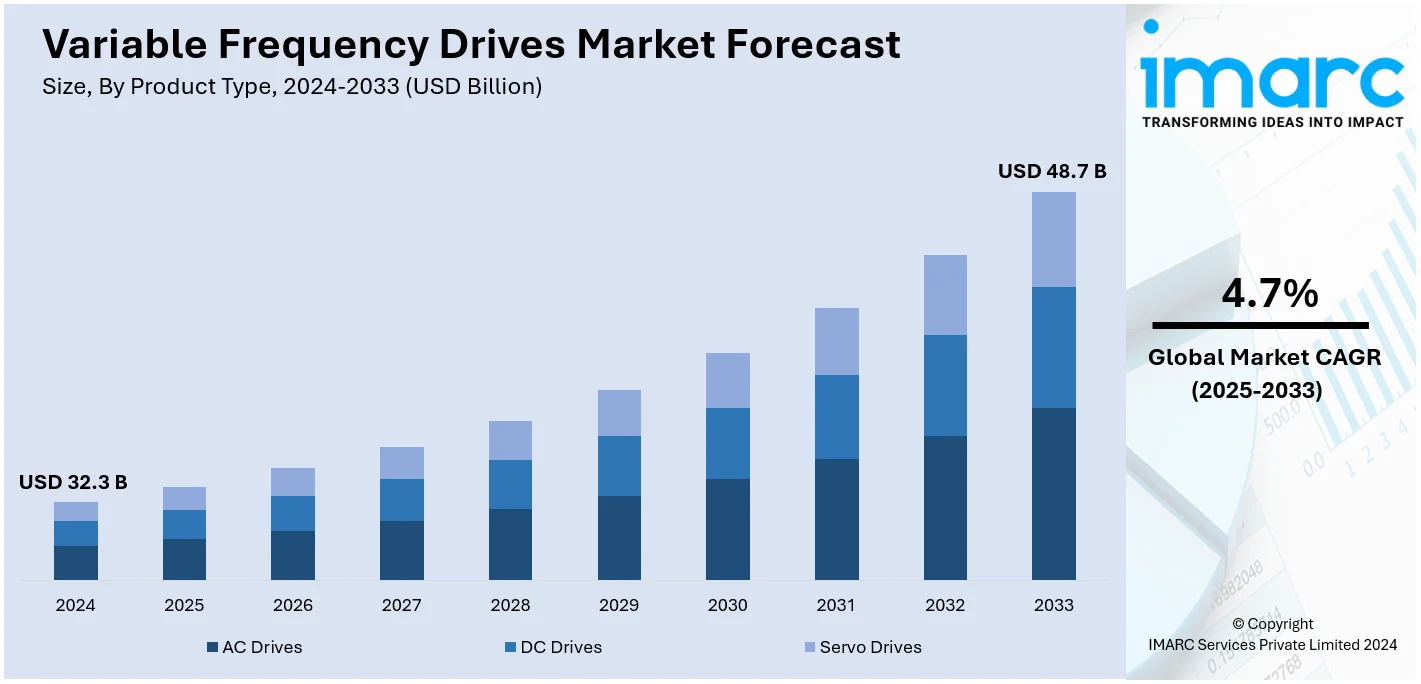

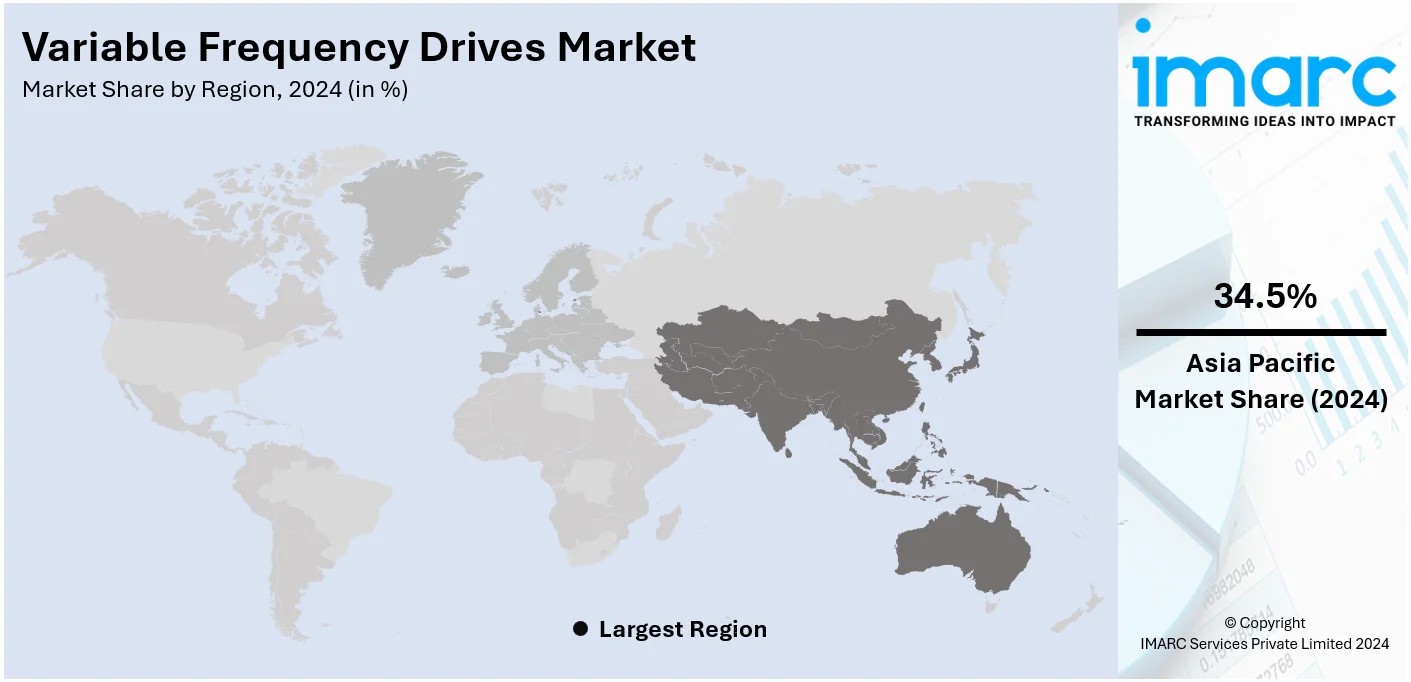

The global variable frequency drives market size was valued at USD 32.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 48.7 Billion by 2033, exhibiting a CAGR of 4.7% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 34.5% in 2024. The variable frequency drives market share is growing due to the rising demand for energy efficiency, industrial automation, and renewable energy integration. Advancements in IoT-enabled drives and supportive regulations further boost adoption, driving innovation and market growth globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 32.3 Billion |

|

Market Forecast in 2033

|

USD 48.7 Billion |

| Market Growth Rate (2025-2033) | 4.7% |

Increasing energy efficiency demand, fast-paced industrialization, and a constantly growing trend toward automation across industries drive the variable frequency drives market toward growth. Energy efficiency remains a dominant concern in manufacturing, heating, ventilation, and air conditioning, as well as in water treatment processes, and is the key factor for adopting VFDs. The rapidly advancing technology in IoT-enabled drives and integration into smart grids are other factors that spur market growth. For example, in October 2024, IIT Bombay and ABB India announced a partnership to set up a state-of-the-art electrical machine and drives laboratory with energy-efficient equipment, including variable frequency drives (VFDs). This facility will provide hands-on training preparing students for careers in the evolving energy sector while promoting sustainability and innovation in industrial applications. The strict government regulations on energy efficiency and the increasing demand for renewable energy sources are driving the demand for VFDs in the global market.

The U.S. market for variable frequency drives is growing owing to higher standards of energy efficiency and increased industrial automation in various industries, including manufacturing, oil and gas and HVAC. Interest in sustainable solutions and renewable energy also contributes toward VFD adoption in energy-intensive applications. For example, Green Hydraulic Power, Inc. offers VFD industrial hydraulic solutions such that energy may be consumed by up to 80%, and noise by 20 decibels, thus enhancing workplace safety and sustainability. Advanced real-time monitoring smart VFD technologies are improving efficiency, while government incentives promote broader product adoption across the country.

Variable Frequency Drives Market Trends:

Compact and Modular Devices

The development of compact, lightweight, and modular variable frequency drives (VFDs) addresses the need for versatile and space-saving solutions in diverse industrial applications. Compact designs allow easier installation in constrained spaces, such as small machinery or control panels, without compromising performance. Lightweight VFDs enhance portability and simplify handling during installation and maintenance. Modular VFDs offer flexibility by enabling users to customize or upgrade specific components, reducing downtime and costs associated with replacements. These innovations are particularly beneficial in industries like manufacturing, HVAC, and automation, where adaptability, efficiency, and scalability are crucial. For instance, in October 2024, SmartD Technologies announced its partnership with Celestica to manufacture its Clean Power VFD leveraging Celestica's manufacturing expertise to enhance scalability and streamline supply chain operations. This collaboration aims to meet the increasing demand for SmartD's Silicon Carbide-based technology in industrial automation, facilitating broader adoption across North America and beyond. Additionally, these designs align with the growing trend of optimizing industrial systems for enhanced productivity and reduced operational complexity.

Rising focus on Energy Efficiency

The increasing focus on energy conservation is driving the development of high-performance, energy-efficient variable frequency drives (VFDs). These devices optimize motor speed and torque, reducing unnecessary energy consumption in industrial applications. By precisely matching energy use to operational demands, energy-efficient VFDs lower electricity costs and contribute to sustainability goals. Industries like HVAC, manufacturing, and water treatment benefit from these advancements, achieving significant energy savings while enhancing productivity. For instance, in February 2024, Danfoss launched the iC2-Micro family of compact variable frequency drives, designed to replace the VLT Micro Drive for HVAC and general applications. The drives enhance motor control efficiency, feature a user-friendly interface, and support both 200-240 VAC and 380-480 VAC models with advanced functionalities. Additionally, governments and regulatory bodies worldwide are enforcing stricter energy efficiency standards, further propelling innovation in VFD technology. These efforts align with global initiatives to reduce carbon emissions and promote sustainable industrial practices.

Rising Demand in HVAC Systems

Variable Frequency Drives (VFDs) are becoming integral to HVAC systems, offering precise control over fan and pump speeds, which directly improves temperature regulation in commercial and industrial spaces. By modulating motor speeds based on demand, VFDs significantly lower energy consumption compared to traditional constant-speed systems, reducing operational costs. This technology also minimizes wear and tear on HVAC components, extending the lifespan of equipment and lowering maintenance needs. Additionally, VFDs enhance overall system performance by reducing noise levels and improving air quality through optimized airflow. For instance, in July 2024, RS announced the availability of MEAN WELL's energy-saving VFD Series motor drives, designed for three-phase energy-efficient motors. These compact, fanless drives enhance energy efficiency and reduce costs, supporting industrial customers in achieving sustainability goals. The series includes models compatible with AC and DC inputs and offers silent operation and high efficiency. Their adaptability to varying conditions makes them indispensable for modern energy-efficient HVAC designs.

Variable Frequency Drives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global variable frequency drives market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, power range, application and end use.

Analysis by Product Type:

- AC Drives

- DC Drives

- Servo Drives

AC drives stand as the largest product type in 2024, holding around 67.1% of the market. AC drives dominate the Variable Frequency Drives (VFD) market due to their widespread use in controlling the speed and torque of AC motors across diverse industries. These drives are favored for their ability to enhance energy efficiency, reduce operational costs, and improve system performance in applications such as manufacturing, HVAC, water treatment, and renewable energy systems. Their scalability and compatibility with various motor types make them suitable for both small-scale and large-scale operations. The growing emphasis on energy conservation, industrial automation, and the integration of IoT technologies further boosts the demand for AC drives, cementing their position as the largest product type in the VFD market.

Analysis by Power Range:

- Micro (0-5 kW)

- Low (6-40 kW)

- Medium (41-200 kW)

- High (>200 kW)

Low (6-40 kW) leads the market with around 40.0% of market share in 2024. The 6-40 kW power range segment leads the Variable Frequency Drives (VFD) market due to its versatile applications across industries such as manufacturing, HVAC, agriculture, and water treatment. These drives are well-suited for small to medium-sized motors, making them ideal for systems requiring moderate power. Their ability to enhance energy efficiency, reduce operational costs, and optimize performance in processes like conveyor operations, pumps, and compressors has fueled the demand. Additionally, the widespread adoption of these drives in renewable energy and automated systems has surged with industrial modernization. Their cost-effectiveness and adaptability further solidify their position as a preferred choice in the VFD market.

Analysis by Application:

- Pumps

- Fans

- Conveyors

- HVAC

- Extruders

- Others

Pumps leads the market with around 34.2% of market share in 2024. Pumps dominate the Variable Frequency Drives (VFD) market by application due to their critical role in industries such as water treatment, oil and gas, agriculture, and HVAC systems. VFDs optimize pump performance by adjusting motor speeds based on demand, reducing energy consumption and operational costs. This capability ensures precise flow and pressure control, improving system efficiency and minimizing wear on components. In sectors like wastewater management and irrigation, VFDs enable sustainable water usage by preventing over-pumping and energy waste. Their ability to handle varying load conditions and extend equipment lifespan makes them indispensable for pump applications across multiple industries.

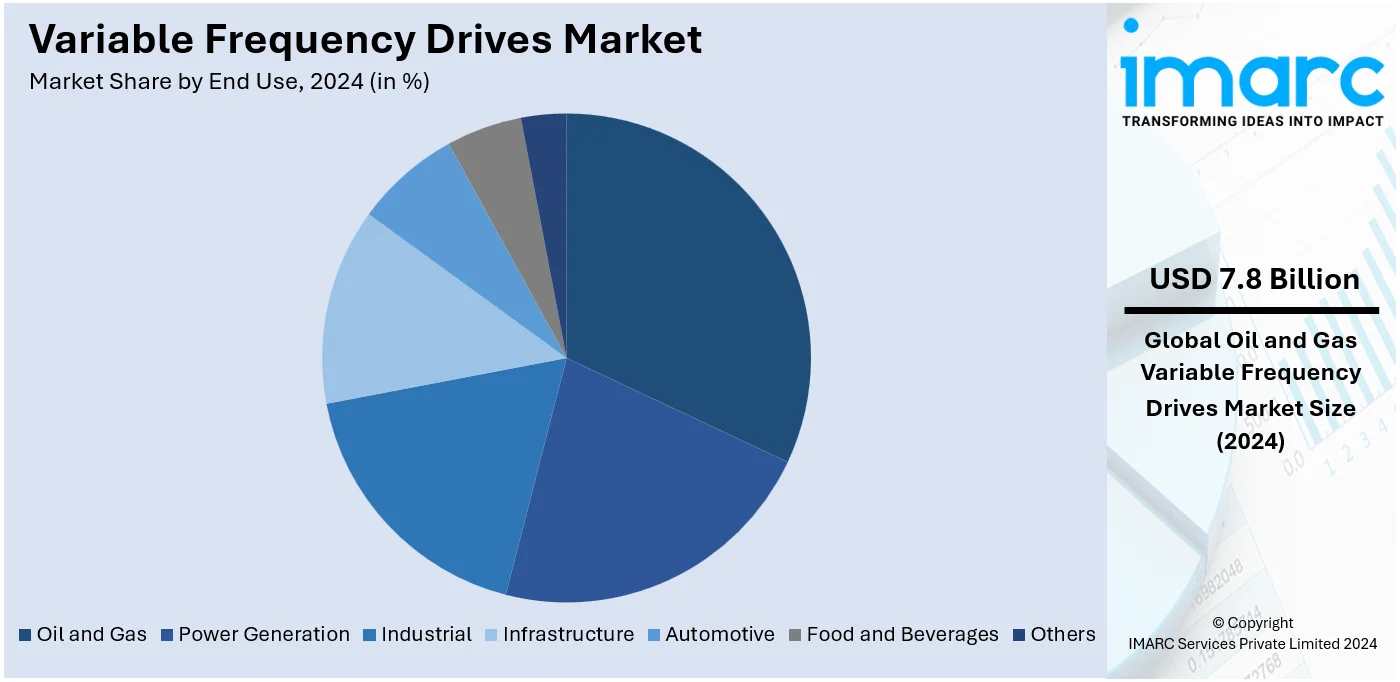

Analysis by End Use:

- Oil and Gas

- Power Generation

- Industrial

- Infrastructure

- Automotive

- Food and Beverages

- Others

Oil and gas leads the market with around 24.3% of market share in 2024. The oil and gas industry is the largest end-use segment in the Variable Frequency Drives (VFD) market due to its high demand for energy-efficient and reliable motor control solutions in upstream, midstream, and downstream operations. VFDs optimize motor-driven processes such as drilling, pumping, and compressor systems, significantly reducing energy consumption and operational costs. Their ability to adjust motor speeds enhances process precision and minimizes equipment wear, ensuring uninterrupted operations in harsh environments. With the increasing focus on sustainability and energy efficiency, coupled with the complexity of oil and gas processes, VFDs have become indispensable for improving productivity and reducing emissions.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest variable frequency drives market share of over 34.5%. Asia-Pacific holds the largest share of the Variable Frequency Drives (VFD) market, driven by rapid industrialization, urbanization, and infrastructure development across the region. Countries like China, India, and Japan are leading in adopting VFDs due to their expanding manufacturing, oil and gas, and HVAC sectors. The rising focus on energy efficiency and government initiatives promoting sustainable technologies further boost demand. Additionally, the growth of renewable energy projects and increased investments in automation technologies in industries solidify the region's dominance. The availability of cost-effective VFD solutions from regional manufacturers also contributes to Asia-Pacific's leadership in the global market.

Key Regional Takeaways:

North America Variable Frequency Drives Market Analysis

The North American VFD market is experiencing significant growth driven by increasing emphasis on energy efficiency and the modernization of industrial processes. With advanced grid infrastructure and rising adoption of renewable energy sources the region is leveraging VFDs to optimize motor-driven systems like pumps, fans, and compressors. These technologies are critical for minimizing energy wastage and improving operational efficiency across sectors including manufacturing, HVAC, and water treatment. The push toward carbon reduction and stringent energy regulations has further accelerated the adoption of VFDs to replace outdated motor control systems. Additionally, the integration of smart grid technologies supports real-time energy management ensuring stability during peak demand periods. Local investments in sustainable infrastructure and advanced digital monitoring solutions continue to strengthen the market enabling industries to meet evolving efficiency and sustainability targets while reducing operational costs.

United States Variable Frequency Drives Market Analysis

In 2024, United States accounted for a share of 73.90% of the North America market. Variable frequency drives (VFDs) are gaining traction due to the increasing demand for energy efficiency across power generation facilities. According to the United States Environmental Protection Agency, the rising electricity demand has led to a 13% increase in total gross power generation, driving the adoption of variable frequency drives (VFDs) to optimize energy efficiency and support growing power generation needs. VFDs role in optimizing motor-driven systems, including pumps, compressors, and fans, is critical in reducing energy wastage. The adoption is further supported by the expansion of renewable energy sources, where VFDs help stabilize fluctuating energy output. The region benefits from advanced grid infrastructure, enabling easier integration of VFD technologies. Additionally, the rising focus on carbon reduction initiatives encourages industries to upgrade outdated equipment with energy-saving solutions. Local initiatives promoting modernized power systems have further strengthened investments in VFDs for both conventional and renewable power plants, enhancing overall operational efficiency. The adoption of smart grid technology further amplifies the need for VFDs to ensure energy stability and optimized load management. Increased demand for reliable power supply during peak load periods has driven the replacement of conventional motor controls. Additionally, advancements in digital monitoring solutions allow real-time analysis, helping maximize performance and extend equipment life.

Europe Variable Frequency Drives Market Analysis

The food and beverage growth are witnessing steady adoption of VFDs for process optimization, including mixing, cooling, and packaging. According to reports, the food & drink wholesaling industry in Europe, comprising approximately 445,000 businesses, has grown at a CAGR of 4.7 percent from 2019 to 2024, driving demand for variable frequency drives. This growth enables enhanced energy efficiency and process control, aligning with the evolving needs of food and beverage companies. Energy efficiency and automation remain top priorities for manufacturers aiming to align with sustainability targets. VFDs allow precise speed control, reducing energy consumption and minimizing production downtime. Regional advantages include a strong focus on eco-friendly production systems, supported by stringent energy regulations and emission reduction initiatives. Modernization of processing facilities, combined with advanced logistics infrastructure, creates opportunities for further VFD integration. Manufacturers are also leveraging VFDs to enhance operational scalability, catering to seasonal production peaks. Furthermore, the growing emphasis on reducing waste in food and beverage operations highlights the role of VFDs in optimizing resource utilization. These technologies are instrumental in meeting evolving consumer demands for efficiency and quality while maintaining cost-effective operations.

Latin America Variable Frequency Drives Market Analysis

Variable frequency drives are being adopted to improve efficiency in infrastructure development, particularly in HVAC systems, water treatment facilities, and public utilities. For instance, Latin America’s urbanization has surged from 40% in 1950 to 80%, with cities projected to house 90% of the population by 2050. This rapid growth, with 260 million people in 198 large cities generating 60% of the region’s GDP, drives infrastructure expansion, creating significant opportunities for variable frequency drives to enhance energy efficiency and operational reliability in urban systems. The focus on cost reduction in construction and maintenance projects is accelerating VFD integration. Regional benefits include ongoing urbanization, which drives the need for energy-efficient infrastructure and smart technologies. Infrastructure expansion plans further emphasize the role of VFDs in enhancing equipment longevity and reducing operational costs, creating consistent demand in the region.

Middle East and Africa Variable Frequency Drives Market Analysis

The oil and gas industry are increasing VFD adoption to optimize equipment performance in exploration, extraction, and refining processes. According to International Trade Administration, Saudi Arabia, with approximately 17 percent of the world's proven petroleum reserves, is one of the largest net exporters of petroleum. Saudi Aramco, a global leader in energy and chemicals, is driving advancements in cleaner technologies, including carbon capture and hydrogen, while aiming for net-zero emissions by 2050. VFDs offer significant advantages by reducing energy costs and improving motor efficiency under fluctuating load conditions. The region’s focus on modernizing aging oil infrastructure and enhancing resource management aligns with the growing use of VFDs. Harsh operational conditions in oilfields further highlight the benefits of energy-efficient technologies, strengthening their role in supporting sustainable and cost-effective operations. Additionally, the integration of VFDs into critical systems is aiding in minimizing downtime and ensuring uninterrupted operations. This approach not only boosts productivity but also aligns with the industry's shift toward greener and more resilient practices.

Top 10 VFD Manufacturers in The World:

The Variable Frequency Drives (VFD) market is highly competitive, characterized by the presence of established players offering diverse product portfolios to meet various industrial needs. Competition centers on innovation, with companies focusing on energy-efficient, compact, and technologically advanced solutions to gain a competitive edge. The market sees significant investment in research and development to incorporate IoT-enabled features, real-time monitoring, and predictive maintenance capabilities. Regional players are leveraging cost-effective manufacturing and local expertise to cater to specific markets, further intensifying competition. Additionally, the shift toward renewable energy and automation has created opportunities for new entrants offering niche solutions. Strategic partnerships and collaborations are also driving market dynamics, fostering innovation and expanding product reach across different industries. For instance, in March 2024, Danfoss India installed advanced Variable Frequency Drives (VFDs) and Pressure Independent Balancing and Control Valves (PIBCVs) at IIM Bodh Gaya and Vishakhapatnam, enhancing energy efficiency and sustainability. This initiative aligns with India’s decarbonization goals, optimizing energy use in critical systems while reducing emissions and operational costs in educational institutions.

The report has also analysed the competitive landscape of the market with some of the key players being:

- ABB Ltd.

- Danfoss A/S

- Eaton Corporation PLC

- Fuji Electric Co. Ltd.

- General Electric Company

- Hitachi Ltd.

- Honeywell International Inc.

- Johnson Controls International PLC

- Mitsubishi Electric Corporation

- Nidec Motor Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

- Yaskawa Electric Corporation

Latest News and Developments:

- October 2024: Compatio AI has launched its groundbreaking VFD System Configurator Model for industrial automation distributors and manufacturers. The tool simplifies the discovery, selection, and configuration of complete Variable Frequency Drive (VFD) systems with enhanced speed and accuracy. Built on the Compatio Configure platform, the model ensures seamless compatibility of all VFD components. This innovation aims to boost efficiency for sales teams, technical teams, and customers.

- June 2024: Danfoss has unveiled its next-generation iC2 and iC7 intelligent variable frequency drives in India, targeting enhanced energy efficiency across industries like food, power, HVAC, and water treatment. The launch events in Pune and Mumbai received strong industry support, highlighting the drives’ role in boosting operational efficiency and decarbonization efforts.

- April 2024: Rockwell Automation expands its PowerFlex 6000T medium voltage VFDs with enhanced firmware, enabling efficient control of permanent magnet motors for high-speed applications up to 120 Hz. Designed for industries like oil, gas, and HVAC, these VFDs support energy-efficient solutions across 2.3–11 kV motor control. The upgrade also enhances device analytics, meeting sustainability and performance goals.

- March 2024: Invertek Drives has expanded its Optidrive Coolvert range of variable frequency drives (VFDs) with two new compact frame sizes featuring higher power ratings at MCE 2024 in Milan. Designed for BLDC compressors, heat pumps, and CDUs, the drives optimize HVAC-R system performance while supporting A2L, A3, and CO2 refrigerants like R290 and R744. The new Frame Sizes 3 and 4 enhance output current capabilities, meeting evolving F-Gas regulations.

- February 2024: ABB has launched the ACH580 4X Variable Frequency Drive (VFD), designed for outdoor use and extreme HVACR environments. Certified to UL Type 4X (NEMA 4X, IP66), it offers robust protection against rain, snow, salt spray, dust, corrosion, and UV damage. This addition to ABB's all-compatible drive portfolio ensures reliable performance in harsh conditions. The VFD is ideal for demanding applications, safeguarding against extreme weather and chemical exposure.

Variable Frequency Drives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | AC Drives, DC Drives, Servo Drives |

| Power Range Covered | Micro (0-5 kW), Low (6-40 kW), Medium (41-200 kW), High (>200 kW) |

| Application Covered | Pumps, Fans, Conveyors, HVAC, Extruders, and Others |

| End Use Covered | Oil and Gas, Power Generation, Industrial, Infrastructure, Automotive, Food and Beverages, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Danfoss A/S, Eaton Corporation PLC, Fuji Electric Co. Ltd., General Electric Company, Hitachi Ltd., Honeywell International Inc., Johnson Controls International PLC, Mitsubishi Electric Corporation, Nidec Motor Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Toshiba Corporation and Yaskawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the variable frequency drives market from 2019-2033.

- The variable frequency drives market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the variable frequency drives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The variable frequency drives market was valued at USD 323 Billion in 2024.

The variable frequency drives market is estimated to exhibit a CAGR of 4.7% during 2025-2033.

The market is growing due to the rising demand for energy efficiency, industrial automation, and renewable energy integration. Advancements in IoT-enabled drives and supportive regulations further boost adoption, driving innovation and market growth globally.

Asia Pacific currently dominates the market, driven by rapid industrialization, urbanization, and infrastructure development across the region.

Some of the major players in the variable frequency drives market include ABB Ltd., Danfoss A/S, Eaton Corporation PLC, Fuji Electric Co. Ltd., General Electric Company, Hitachi Ltd., Honeywell International Inc., Johnson Controls International PLC, Mitsubishi Electric Corporation, Nidec Motor Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Toshiba Corporation and Yaskawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)