Vacuum Pumps Market Size, Share, Trends and Forecast by Type, Lubrication, Pressure, Application, and Region, 2025-2033

Vacuum Pumps Market Size and Share:

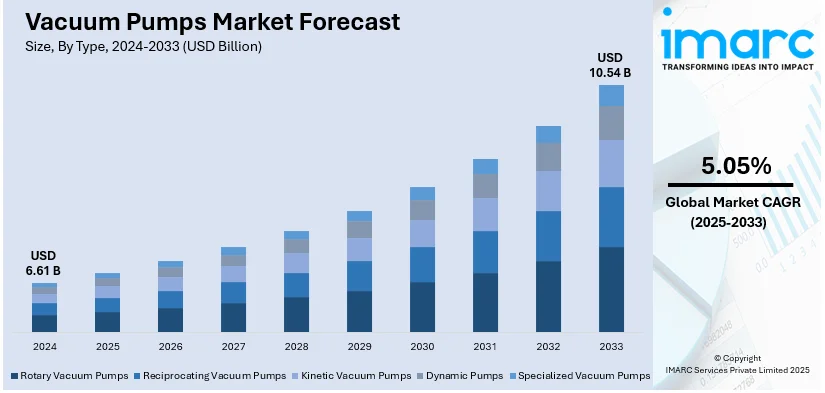

The global vacuum pumps market size was valued at USD 6.61 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.54 Billion by 2033, exhibiting a CAGR of 5.05% from 2025-2033. Asia Pacific currently dominates the vacuum pumps market share by holding over 45.0% in 2024. The market is driven by rapid industrialization, strong demand from semiconductor and pharmaceutical industries, expanding chemical processing and energy sectors, increasing automation, and significant government investments in manufacturing hubs across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.61 Billion |

| Market Forecast in 2033 | USD 10.54 Billion |

| Market Growth Rate (2025-2033) | 5.05% |

The global vacuum pumps market growth is driven by the rising demand in semiconductor manufacturing, as vacuum pumps are essential for chip production and advanced electronics. In addition, the expanding pharmaceutical and biotechnology industries require vacuum technology for drug manufacturing, sterilization, and laboratory applications, aiding the market demand. Besides this, the growth in industrial automation increases the need for vacuum pumps in robotics, material handling, and packaging, driving the market growth. For instance, in January 2024, Atlas Copco completed the acquisition of Kracht, a German company specializing in pump and valve manufacturing. This move aims to enhance Atlas Copco's product portfolio in industrial applications. Furthermore, ongoing advancements in energy-efficient technologies drive adoption as industries seek cost-effective and sustainable solutions, providing an impetus to the market. Also, the expanding aerospace and nanotechnology research and development (R&D) fuels innovation, requiring high-performance vacuum systems, thus impelling the market growth.

The United States holds a share of 88.70% in the vacuum pumps market. The growth in the region is driven by surging demand in renewable energy (RE) sectors, particularly in hydrogen production and carbon capture technologies requiring advanced vacuum systems. In confluence with this, the expanding space exploration initiatives by NASA and private companies fuel demand for high-performance vacuum pumps in aerospace applications, which is contributing to the market expansion. Additionally, stringent environmental regulations push industries to adopt vacuum-based emission control and wastewater treatment solutions, strengthening the vacuum pumps market share. Moreover, the rising adoption of vacuum pumps in food processing enhances vacuum packaging and freeze-drying techniques, significantly supporting the market growth. Concurrently, continuous advancements in medical devices are also driving the market demand for vacuum technology in diagnostics and imaging systems. Apart from this, the increasing defense and military applications boost the need for specialized vacuum systems in radar and avionics, thereby propelling the market forward.

Vacuum Pumps Market Trends:

Growing Demand from the Chemical, Pharmaceutical, and Manufacturing Industries

The thriving chemical industry represents one of the key factors influencing the vacuum pumps market trends. Vacuum pumps are widely used in various industrial applications, including composite molding, flight instruments, electron microscopy, photolithography, uranium enrichment, and mass spectrometers. Additionally, they play a crucial role in cabinetry fabrication and operations in glass and stone-cutting factories. The pharmaceutical industry is another major end-user of vacuum pumps, utilizing them for critical processes such as crystallization, distillation, drying, and degassing. As pharmaceutical production expands globally due to increasing healthcare demands, the need for efficient vacuum pump technology continues to rise. For example, in 2024, Edwards introduced a new small dry scroll pump, expanding their range of dry pumping solutions. The product offers vacuum users more choices for applications requiring clean and efficient vacuum generation. This growing adoption across the chemical, pharmaceutical, and manufacturing industries is driving the overall expansion of the vacuum pumps market worldwide.

Rising Adoption in the Food & Beverage and HVAC Sectors

Vacuum pumps are employed in the food and beverage (F&B) industry for chocolate production, dairy processing, coffee roasting, deaeration of mineral water, and sterilization of tea and spices. The global F&B processing equipment market size reached USD 64.2 Billion in 2024, highlighting the sector’s expansion. Additionally, air conditioning (AC) and refrigeration systems often become contaminated with moisture and incondensable gases like air, which can lead to internal icing and corrosion. The presence of these contaminants reduces the efficiency and longevity of heating, ventilation, and air conditioning (HVAC) systems. Consequently, the demand for vacuum pumps is increasing to eliminate moisture and air from these systems, ensuring optimal performance. As food processing and HVAC industries continue to grow, the integration of vacuum pump technology is becoming more prevalent, supporting the vacuum pumps market demand.

Expansion in the Oil & Gas Sector and Industrial Applications

The rising oil and gas exploration activities are catalyzing the demand for vacuum pumps worldwide. Industry reports indicate that upstream oil and gas investment rose by 7% in 2024, reaching USD 570 billion, primarily led by Middle Eastern and Asian national oil companies. Vacuum pumps are essential in various industrial processes, including the manufacturing of vacuum tubes and electric lamps, further driving their demand. The oil and gas sector's significant growth, coupled with advancements in vacuum pump technology, is creating a positive outlook for the market. As industries seek efficient solutions for maintaining process integrity and operational efficiency, the adoption of vacuum pumps continues to rise. This increasing reliance on vacuum pumps across multiple industrial applications is reinforcing their role as a vital component in modern manufacturing and energy sectors, thereby enhancing the vacuum pumps market outlook.

Vacuum Pumps Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vacuum pumps market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, lubrication, pressure, and application.

Analysis by Type:

- Rotary Vacuum Pumps

- Rotary Vane Pumps

- Screw and Claw Pumps

- Roots Pumps

- Reciprocating Vacuum Pumps

- Diaphragm Pumps

- Piston Pumps

- Kinetic Vacuum Pumps

- Ejector Pumps

- Turbomolecular Pumps

- Diffusion Pumps

- Dynamic Pumps

- Liquid Ring Pumps

- Side Channel Pumps

- Specialized Vacuum Pumps

- Getter Pumps

- Cryogenic Pumps

Rotary vacuum pumps hold the largest market share in the global vacuum pumps market, driven by their versatility, efficiency, and wide industrial applications. Among them, rotary vane pumps dominate due to their cost-effectiveness, compact design, and strong performance in low and medium vacuum applications. These pumps are extensively used in semiconductor manufacturing, pharmaceuticals, food packaging, and industrial automation, driving their demand. Additionally, increasing use in HVAC systems, automotive applications, and medical devices further boosts the market growth. Moreover, the rise in environmental and energy-efficient solutions has led to the development of oil-free rotary vane pumps, appealing to industries aiming for sustainability. Furthermore, expanding chemical processing and RE sectors rely on rotary vacuum pumps for precise vacuum conditions. As industries continue adopting automation and digitalized vacuum systems, the demand for rotary pumps, particularly rotary vane types, is expected to rise significantly.

Analysis by Lubrication:

- Dry Vacuum Pump

- Wet Vacuum Pump

Wet vacuum pumps dominate the market with a 57.5% share, driven by their high efficiency, strong suction capabilities, and reliability in handling moisture-laden gases and harsh process environments. These pumps are widely used in chemical processing, pharmaceuticals, power generation, and F&B industries, where they provide consistent performance in demanding applications. Besides this, oil-sealed rotary vane pumps and liquid ring pumps are the most commonly used types, benefiting from strong demand in industrial vacuum processes, wastewater treatment, and oil & gas refining. The rising need for vacuum distillation and solvent recovery in petrochemicals and bioprocessing further supports the market growth. Additionally, increasing investments in semiconductor fabrication and medical vacuum systems drive adoption. While environmental concerns are pushing industries toward oil-free and dry vacuum alternatives, ongoing technological advancements in wet vacuum pump efficiency and emission control sustain their market leadership.

Analysis by Pressure:

- Rough Vacuum Pumps (103 Mbar to 1 Mbar)

- Medium Vacuum Pumps (1 Mbar to 10-3 Mbar)

- High Vacuum Pumps (10-3 Mbar to 10-7 Mbar)

- Ultra-High Vacuum Pumps (10-7 Mbar to 10-12 Mbar)

- Extreme High Vacuum Pumps (Less Than 10-12 Mbar)

Medium vacuum pumps, operating in the 1 mbar to 10⁻³ mbar range, hold the largest market share due to their versatility and extensive industrial applications. These pumps are widely used in semiconductor manufacturing, pharmaceuticals, food processing, and industrial coating, where precise vacuum conditions are essential. Rotary vane, roots, and diaphragm pumps are commonly used in this category, offering reliable performance for vacuum drying, degassing, and material handling. Concurrently, the growing demand for automation in manufacturing, advancements in medical devices, and increasing semiconductor production are key drivers fueling the market growth. Additionally, rising adoption in research laboratories, aerospace applications, and energy storage industries supports their expansion. As a result, the trend toward energy-efficient and oil-free vacuum solutions has led to technological advancements in medium vacuum pumps, enhancing their appeal. With ongoing industrial expansion and regulatory requirements for cleaner production, demand for medium vacuum pumps is expected to remain strong.

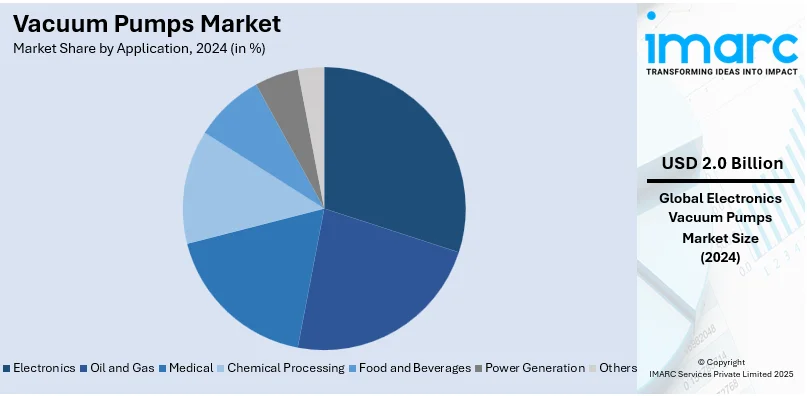

Analysis by Application:

- Oil and Gas

- Electronics

- Medical

- Chemical Processing

- Food and Beverages

- Power Generation

- Others

The electronics sector holds the largest market share at 30.2%, driven by the expanding semiconductor, display panel, and microelectronics industries. Vacuum pumps play a crucial role in chip fabrication, thin-film deposition, and printed circuit board (PCB) manufacturing, where precise vacuum conditions are required for high-performance electronic components. The rising demand for advanced consumer electronics, 5G technology, and Internet of Things (IoT) devices is fueling vacuum pump adoption in semiconductor manufacturing. Additionally, growing investments in artificial intelligence (AI) chips and electric vehicle (EV) batteries are boosting the market demand. The transition to smaller, more powerful microchips is increasing the need for ultra-clean and contamination-free vacuum environments, driving technological advancements in dry and oil-free vacuum pumps. Moreover, government initiatives to strengthen domestic semiconductor production, particularly in the U.S., China, and Europe, are propelling vacuum pump market growth within the electronics sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific dominates the global vacuum pumps market with a 45.0% share, driven by rapid industrialization, expanding semiconductor manufacturing, and strong demand from pharmaceuticals and chemical processing industries. Countries like China, Japan, South Korea, and Taiwan are global leaders in semiconductor fabrication and electronics production, significantly increasing the demand for high-performance vacuum pumps. Moreover, government initiatives and heavy investments in domestic chip manufacturing, such as China’s “Made in China 2025” and India’s semiconductor incentive programs, are fueling the market growth. Additionally, the region’s thriving pharmaceutical and biotechnology industries, particularly in vaccine production and drug development, are boosting adoption. Besides this, the expansion of industrial automation, food processing, and RE sectors, along with increasing demand for vacuum-based emission control solutions is significantly contributing to the market expansion. As a result, Asia Pacific strengthens its position as a global manufacturing hub, and demand for advanced, energy-efficient vacuum pump technologies is expected to rise steadily.

Key Regional Takeaways:

North America Vacuum Pumps Market Analysis

The North America vacuum pumps market is experiencing steady growth, driven by expanding semiconductor and electronics manufacturing, particularly in the U.S. and Canada. In line with this, the rising demand from pharmaceutical and biotechnology industries fuels the adoption of vacuum technology in drug production, laboratory research, and medical applications. Increasing investments in aerospace and defense drive demand for high-performance vacuum systems in space exploration, avionics, and military applications. For example, the U.S. government allocated an additional $3 billion to aerospace and defense projects in 2024, emphasizing the need for high-performance vacuum systems in new spacecraft and military aircraft developments. Furthermore, environmental regulations are pushing industries to adopt vacuum-based emission control and wastewater treatment solutions. Also, the growth in the food processing sector is boosting the use of vacuum pumps in packaging and freeze-drying. Additionally, continuous advancements in hydrogen energy and carbon capture technologies are supporting market expansion across the region.

United States Vacuum Pumps Market Analysis

The US vacuum pumps market is experiencing robust growth, driven by increasing demand across industries such as automotive, pharmaceuticals, food processing, and construction. As of February 2023, the Mining, Logging, and Construction industry employed 8.27 Million people, reflecting a 3.88% increase in employment from the previous year. This workforce growth fuels the demand for vacuum pumps, especially in construction machinery and industrial equipment. The automotive sector is also a significant contributor, with rising electric vehicle production driving the need for vacuum pumps in brake systems. The pharmaceutical industry’s expansion, particularly in drug manufacturing and research, further accelerates demand for vacuum solutions. Technological innovations, such as energy-efficient pumps and automation in manufacturing processes, are also reshaping the market landscape. Environmental regulations promoting reduced emissions and greater energy efficiency are another driving force, particularly in sectors like oil and gas. Moreover, the increasing focus on industrial automation and process efficiency is enhancing the role of vacuum pumps in manufacturing. With the continued growth of key sectors and technological advancements, the US vacuum pumps market is expected to maintain a positive growth trajectory in the coming years.

Europe Vacuum Pumps Market Analysis

The European vacuum pumps market is poised for significant growth, fueled by the demand from critical industries such as chemicals, automotive, pharmaceuticals, and construction. In 2023, the European construction market reached a size of USD 3.38 Billion, with ongoing infrastructure development driving the need for advanced industrial solutions, including vacuum pumps. The chemical industry, focusing on process efficiency and safety, increasingly relies on vacuum technology for filtration, drying, and distillation processes. Additionally, the push for automotive electrification has further bolstered vacuum pump demand, particularly in electric vehicle production. The pharmaceutical sector’s continued advancements in biologic drug production and precision manufacturing are key factors supporting market growth. The energy sector's shift toward sustainability, with investments in renewable energy and oil and gas exploration, also contributes to the rise in vacuum pump adoption. Furthermore, stringent environmental regulations, such as those focusing on emissions reduction, are driving the need for more energy-efficient and eco-friendly vacuum solutions. Technological advancements in vacuum pump design, including automation and energy efficiency improvements, are expected to keep the market expanding, while digitalization across manufacturing processes accelerates the adoption of smart factory solutions, further boosting vacuum pump demand in Europe.

Asia Pacific Vacuum Pumps Market Analysis

The APAC vacuum pumps market is growing rapidly, driven by industrialization, urbanization, and increased demand from key sectors like automotive, chemicals, pharmaceuticals, and electronics. According to World Bank data, East Asia and the Pacific are the world’s most rapidly urbanizing regions, with an average annual urbanization rate of 3%. This rapid urbanization fuels the demand for infrastructure, industrial facilities, and manufacturing, leading to higher adoption of vacuum pumps. Countries like China and India are expanding their pharmaceutical and semiconductor industries, which rely heavily on vacuum technology for precise manufacturing processes. The region’s focus on renewable energy, coupled with growing investments in healthcare infrastructure, also supports the market. Additionally, the rise of smart manufacturing and automation in factories enhances the demand for advanced vacuum pumps. As the region continues to industrialize and urbanize, the market for vacuum pumps is expected to expand further in the coming years.

Latin America Vacuum Pumps Market Analysis

Latin America's vacuum pumps market is driven by the expanding oil and gas sector, particularly in Brazil, where the market is projected to grow at a CAGR of 3.33% from 2025 to 2033. This growth fuels the demand for efficient vacuum pumps in exploration and production activities. Additionally, the increasing focus on renewable energy solutions, coupled with the region’s expanding industrial base, enhances the market for vacuum technology. The pharmaceutical and food processing sectors are also key contributors, as they require vacuum pumps for packaging and manufacturing processes. These factors position Latin America for steady market growth in the coming years.

Middle East and Africa Vacuum Pumps Market Analysis

The Middle East and Africa vacuum pumps market is bolstered by the growth of the specialty chemicals sector, which is projected to grow at a CAGR of 4.88% from 2024 to 2032. This expansion increases the demand for vacuum pumps in chemical processing, particularly in filtration, drying, and distillation applications. Additionally, the region’s emphasis on infrastructure development and the rising focus on oil and gas exploration contribute to the market’s growth. Technological advancements in energy-efficient vacuum solutions and increasing investments in manufacturing and healthcare further drive demand, positioning the region for continued market expansion.

Competitive Landscape:

Market players in the global vacuum pumps industry are actively engaging in technological advancements, focusing on energy-efficient and oil-free vacuum solutions to meet sustainability goals. Companies are expanding through strategic mergers and acquisitions, strengthening their market presence and enhancing product portfolios. Additionally, R&D investments are increasing to develop high-performance vacuum systems for semiconductor, pharmaceutical, and aerospace applications. Moreover, regional expansions and manufacturing facility upgrades in various regions are addressing rising demand. The industry is also witnessing a shift toward digitalization and smart vacuum pumps, integrating IoT-enabled monitoring systems for predictive maintenance. Furthermore, collaborations with renewable energy (RE) sectors are driving innovation in hydrogen production and carbon capture technologies.

The report provides a comprehensive analysis of the competitive landscape in the vacuum pumps market with detailed profiles of all major companies, including:

- Atlas Copco AB

- Becker Pumps Corporation

- Busch Group

- Cutes Corporation

- Ebara Corporation

- Flowserve Corporation

- Graham Corporation

- Ingersoll Rand Inc.

- Pfeiffer Vacuum GmbH

- PPI Pumps Pvt. Ltd.

- Tsurumi Manufacturing Co. Ltd.

- ULVAC Inc

Latest News and Developments:

- February 2025: Falcon Vacuum Pumps & Systems, based in Faridabad, showcased its full product range at PrintPack India 2025. Specializing in oil-lubricated, oil-sealed, and dry vacuum pumps, along with ring blowers, the company primarily serves the printing and packaging industries.

- November 2024: ULVAC, Inc. has introduced the Gv135 oil rotary vacuum pump, optimized for the analytical equipment industry. The pump addresses the demand for quiet operation in sensitive environments, featuring advanced noise reduction, achieving 46 dB, and enhanced oil leakage and backflow prevention. This design improves operational productivity and provides a quieter, more comfortable work environment, especially in research labs and offices.

- November 2024: Leybold has introduced the DURADRY dry screw vacuum pump, designed for medium-severe industrial processes with high temperatures, oxygen, and corrosive conditions. For applications including crystal pulling, plasma cleaning, and battery manufacturing, the DURADRY provides ease of operation, low maintenance, and reliable vacuum performance. Available in 160 and 250 m³/h pump speed classes, it features an innovative rotor design, variable speed drive, and Smart Drive monitoring of critical parameters.

- October 2024: Pfeiffer Vacuum+Fab Solutions has launched the DuoVane series of rotary vane vacuum pumps, succeeding the Pascal and DuoLine series. The DuoVane pumps offer a pumping speed of 6 to 22 m³/h, improved water vapor compatibility, and enhanced safety features. With an energy-efficient IE2 motor, they ensure reliable, quiet operation, making them suitable for applications such as freeze drying, sterilization, HVAC, and analytical devices like electron microscopes.

- August 2023: Edwards Vacuum has introduced the E2S series, a new oil-sealed rotary vane vacuum pump for low and medium vacuum use in industrial and research environments. With its compact design, it provides a high pumping speed of 90 m³/h and an ultimate vacuum of 3 x 10⁻³ mbar, improving cycle times and throughput without added energy consumption. The E2S provides easy operation, while its low-noise sintered steel bearings and continuous lubrication offer quieter operation.

Vacuum Pumps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Lubrications Covered | Dry Vacuum Pump, Wet Vacuum Pump |

| Pressures Covered | Rough Vacuum Pumps (103 Mbar to 1 Mbar), Medium Vacuum Pumps (1 Mbar to 10-3 Mbar), High Vacuum Pumps (10-3 Mbar to 10-7 Mbar), Ultra-High Vacuum Pumps (10-7 Mbar to 10-12 Mbar, Extreme High Vacuum Pumps (Less Than 10-12 Mbar) |

| Applications Covered | Oil and Gas, Electronics, Medical, Chemical Processing, Food and Beverages, Power Generation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Copco AB, Becker Pumps Corporation, Busch Group, Cutes Corporation, Ebara Corporation, Flowserve Corporation, Graham Corporation, Ingersoll Rand Inc., Pfeiffer Vacuum GmbH, PPI Pumps Pvt. Ltd., Tsurumi Manufacturing Co. Ltd., ULVAC Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vacuum pumps market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global vacuum pumps market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vacuum pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vacuum pumps market was valued at USD 6.61 Billion in 2024.

IMARC estimates the vacuum pumps market to exhibit a CAGR of 5.05% during 2025-2033, expecting to reach USD 10.54 Billion by 2033.

The vacuum pumps market is driven by rising demand in semiconductor manufacturing, pharmaceuticals, and industrial processes, along with increasing automation, chemical processing needs, and advancements in energy-efficient technologies, while expanding healthcare applications, growing aerospace and nanotechnology research and development (R&D), and the push for cleaner production methods further propel market growth.

Asia Pacific currently dominates the market, accounting for a share exceeding 45.0% in 2024. This dominance is fueled by the rising demand for semiconductor manufacturing, pharmaceuticals, industrial automation, chemical processing, and energy sectors, along with strong government investments, rapid industrialization, and expanding production facilities in China, Japan, and South Korea.

Some of the major players in the vacuum pumps market include Atlas Copco AB, Becker Pumps Corporation, Busch Group, Cutes Corporation, Ebara Corporation, Flowserve Corporation, Graham Corporation, Ingersoll Rand Inc., Pfeiffer Vacuum GmbH, PPI Pumps Pvt. Ltd., Tsurumi Manufacturing Co. Ltd., and ULVAC Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)