UV LED Market Size, Share, Trends and Forecast by Type, Material, Application, Industry Vertical, and Region, 2025-2033

UV LED Market Size and Share:

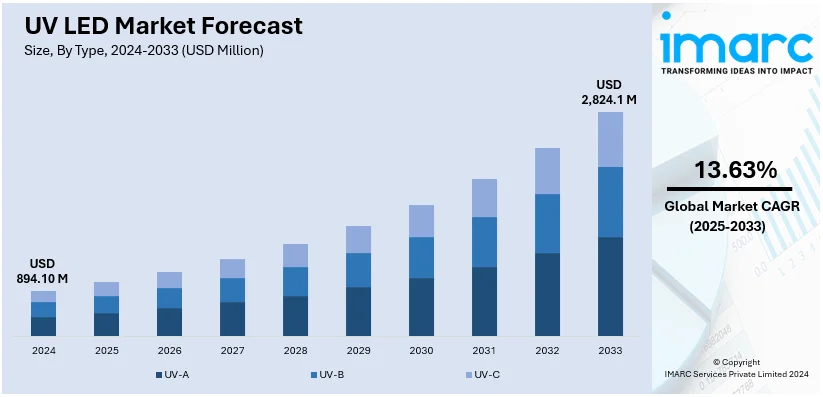

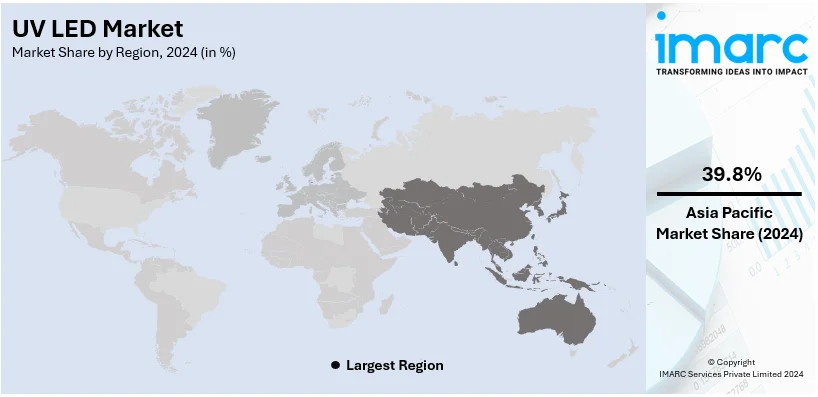

The global UV LED market size was valued at USD 894.10 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,824.1 Million by 2033, exhibiting a CAGR of 13.63% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 39.8% in 2024. The growth of the Asia Pacific region is driven by advanced manufacturing capabilities, increasing adoption of UV technologies, supportive government policies, and rising industrial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 894.10 Million |

|

Market Forecast in 2033

|

USD 2,824.1 Million |

| Market Growth Rate (2025-2033) | 13.63% |

The capacity of ultraviolet (UV) light-emitting diodes (LEDs), especially UV-C, to eradicate harmful microorganisms without employing chemicals is a vital aspect supporting the growth of the market. The efficiency of UV LEDs for water treatment, air cleaning, and surface sanitation is increasing the demand in various sectors, such as healthcare, food and beverage (F&B), and hospitality. Furthermore, regulatory authorities globally are implementing tighter environmental regulations to eliminate mercury-containing lighting systems. UV LEDs, which are free of mercury and highly energy-efficient, are becoming the favored choice for industrial, medical, and consumer uses. These regulations, combined with the worldwide movement towards sustainability, are speeding up the shift to UV LED solutions. In addition, in contrast to conventional UV lamps, UV LEDs greatly decrease energy usage and operational expenses. Their extended lifespan and minimal maintenance needs render them a more cost-effective option for sectors pursuing sustainable and dependable solutions.

The United States is vital in the market, propelled by developments in UV LED technology, which feature greater power output, improved energy efficiency, smaller packaging, and extended lifetimes. Attributes such as electrostatic discharge (ESD) protection and broad exposure angles are enhancing their applicability in high-precision fields like medical sterilization, electronics production, and advanced material curing. In addition to this, growing worries about water pollution, particularly from contaminants such as per- and polyfluoroalkyl substances (PFAS), are boosting the need for UV LED water purification systems. Their capacity to offer economical and chemical-free solutions corresponds with the growing emphasis on enhancing water quality in the US. In 2024, Amway unveiled its redesigned eSpring Water Purifier, which is equipped with the latest UV-C LED technology to improve water quality through the removal of 99.99% of harmful impurities. The system saves 25% of energy, processes up to 1,320 gallons each year, and supports sustainability by replacing around 10,000 disposable plastic bottles annually.

UV LED Market Trends:

Rising Demand in Water Purification Systems

There is an increase in adoption of UV LEDs in water purification systems due to their potential of eliminating bacteria, viruses, and other harmful microorganisms effectively. This technology provides a chemical-free and energy-efficient solution, making it increasingly preferred for residential, commercial, and municipal applications. Reports indicate that 45% of US tap water contains contaminants such as PFAS, heightening the demand for advanced purification methods. UV LEDs, valued at approximately USD 9 billion globally, are emerging as a key solution for addressing these concerns. Beyond water purification, they are also widely employed in sterilization processes, offering the most cost-effective method for delivering safe drinking water. Their compact design and long lifespan further enhance their appeal, allowing integration into various systems, from portable purifiers to large-scale water treatment facilities. As the global demand for clean and safe water grows, UV LEDs are becoming an indispensable tool.

Growing Applications in Indoor Horticulture

The rising application of UV LEDs in indoor farming is strongly influencing the market, as these technologies play a significant role in promoting plant growth and enhancing yields. UV LEDs release specific wavelengths that can activate photosynthesis, enhance the resistance of plants to pests, and even improve crop quality in general. The rise of indoor gardening and controlled-environment agriculture, particularly during the COVID-19 pandemic, has significantly increased the demand for advanced lighting solutions. According to reports, the US houseplant market has risen by 50% between 2017 and 2019, and this trend continued rapidly during the pandemic, with many individuals embracing indoor gardening as a form of leisure and self-sustainability. UV LEDs provide an efficient, economical, and compact answer to this increasing need. eir adaptability in use, ranging from residential gardening setups to large-scale vertical farms, highlights their significance in enhancing growth environments.

Technological Advancements

The development of compact, high-power UV LEDs with enhanced efficiency and environment-friendly designs is meeting the growing demand for advanced disinfection and sterilization solutions. Features such as electrostatic discharge (ESD) protection, wide exposure angles, and mercury-free construction are making these LEDs increasingly versatile for applications in healthcare, water treatment, and industrial processes. Enhanced output capabilities combined with cost-effectiveness are enabling their integration into emerging technologies, including Far-UVC systems, which are gaining traction for safer disinfection in public spaces. These advancements reflect the commitment of key players to addressing industry challenges while driving sustainability and innovation in the global UV LED market. In May 2024, Silanna UV is set to unveil its new 235nm Quad High-Power Far-UVC LED at ICFUST 2024 in Scotland this June. The compact, mercury-free UV LED features a 6.8mm package with ESD protection and a wide exposure angle of over 125°. Delivering 3mW output at 30mA, it promises an environment-friendly, cost-effective solution. This innovation highlights Silanna’s advancements in deep-UVC and Far-UVC LED technologies.

UV LED Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global UV LED market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material, application and industry vertical.

Analysis by Type:

- UV-A

- UV-B

- UV-C

In 2024, UV-C dominates the market, holding 51.0% of the market share. UV-C is the largest segment due to its widespread application in sterilization, disinfection, and water purification. Its capacity to efficiently deactivate bacteria, viruses, and various pathogens renders it crucial in healthcare, water treatment, and air purification systems. The growing adoption of UV-C is due to its eco-friendly, chemical-free operation and high germicidal efficiency. Sectors like food and beverage, pharmaceuticals, and hospitality depend on UV-C technology to uphold strict hygiene requirements. The compact size and energy efficiency of UV-C enables its integration into portable devices and large-scale systems, offering flexibility across diverse applications. The technology also plays a critical role in preventing contamination in sensitive environments, including laboratories and cleanrooms. Continuous advancements in UV-C LED technology, such as higher energy efficiency and improved durability, enhance its application in both the commercial and residential sector.

Analysis by Material:

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- Sapphire

- Others

Silicon carbide (SiC) stands out in the UV LED market because of its excellent thermal conductivity and resilience. These characteristics enable SiC-based UV LEDs to operate effectively in high-power conditions and challenging atmospheres. Its capacity to endure elevated voltages and temperatures makes it perfect for industrial and high-intensity uses like curing, sterilization, and purification. SiC's robustness also ensures longer lifespans for UV LEDs, reducing maintenance and operational costs.

Gallium nitride (GaN) is widely utilized in UV LEDs for its superior efficiency in converting electrical energy into UV light. This material provides a considerable output power, allowing its application in areas such as medical sterilization, water purification, and sophisticated manufacturing processes. The efficiency of GaN decreases energy usage is in line with the increasing focus on sustainable technologies. Moreover, its small form factor enables the creation of portable and lightweight UV LED devices, making it an ideal option for both consumer-grade and specialized industrial uses.

Sapphire is valued in the UV LED market for its excellent optical properties and high resistance to thermal stress. UV LEDs built on sapphire substrates are commonly used in applications requiring precision and consistency, such as counterfeit detection, indoor gardening, and surface treatment. The transparency of sapphire to UV wavelengths enhances the performance of UV LEDs, ensuring consistent output and reliability.

Others, such as aluminum nitride (AlN) and diamond, target specialized applications requiring outstanding performance. These materials are recognized for their unique properties, including excellent thermal conductivity or increased UV transparency.

Analysis by Application:

- Curing

- Disinfection/Purification

- Indoor Gardening

- Counterfeit Detection

- Others

Disinfection and purification represent the largest segment due to the increasing demand for efficient, chemical-free solutions in water and air treatment. The germicidal characteristics of UV-C LEDs are extensively utilized to eradicate pathogens, guaranteeing safety in healthcare environments, municipal water systems, and home applications. UV LED technology provides energy-saving and compact options compared to conventional disinfection techniques, making it ideal for both portable and extensive systems. The increasing emphasis on public health and safety is leading to a rise in the use of UV LEDs for disinfecting medical devices, cleansing drinking water, and ensuring clean air in different settings. Sectors like F&B and pharmaceuticals are adopting UV LED technologies to meet hygiene standards and improve product quality. Improvements in UV LED technology, including enhanced energy efficiency and longer lifespan, are increasingly promoting its application in disinfection. The dependability and efficiency of UV LEDs guarantee their ongoing leadership in this market sector.

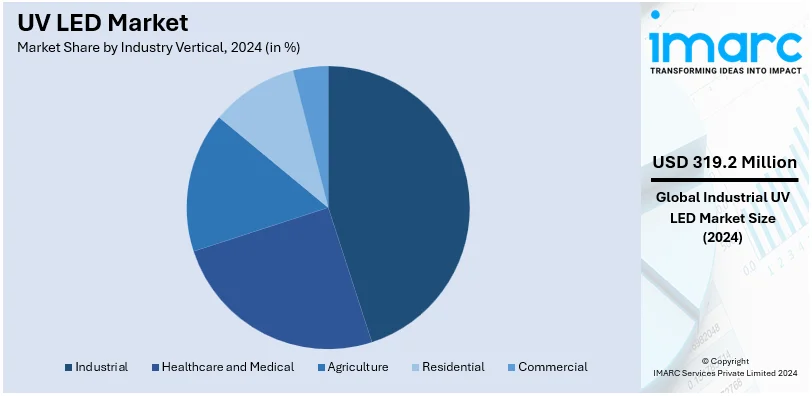

Analysis by Industry Vertical:

- Healthcare and Medical

- Agriculture

- Residential

- Industrial

- Commercial

In 2024, industrial represents the largest segment, accounting 35.7% of market share. The industrial sector leads the market because of its widespread use in manufacturing processes, such as curing adhesives, inks, and coatings, along with material inspection and analysis. The technology's capability to deliver accurate and reliable outcomes renders it essential in high-precision sectors like electronics, automotive, and aerospace. UV LEDs are increasingly being utilized in the treatment of industrial wastewater due to their energy efficiency and chemical-free functioning, which meet sustainability needs. The longevity and robust nature of UV LEDs meet the requirements of industrial settings, reducing maintenance and operational interruptions. Businesses in the industry are implementing UV LED technologies to boost production efficiency, elevate product quality, and adhere to strict regulatory requirements concerning safety and environmental regulations. Furthermore, advancements in UV LED technology are enabling broader adoption in specialized applications, like lithography and surface modification, reinforcing the industrial segment’s leading position in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 39.8%. Asia Pacific is the largest segment, driven by the expanding adoption of UV technologies across various sectors such as healthcare, electronics, and water treatment. The region's focus on improving healthcare infrastructure and addressing water quality challenges is catalyzing the demand for UV-C LEDs in sterilization and purification applications. The electronics industry is also leveraging UV LED technology for precision manufacturing and curing processes. Governments across Asia Pacific are implementing stringent regulations to promote sustainable and energy-efficient solutions, further accelerating market growth. Countries like China, Japan, and South Korea are leading in production and application, making the region a global hub for UV LED solutions. In March 2024, Nichia introduced UV-B (308nm) and UV-A (330nm) LEDs within its 434 Series package, signifying a significant advancement in LED technology. Being the biggest LED manufacturer globally, the company has initiated large-scale production of these sophisticated ultraviolet LEDs. The development aims to address diverse applications, enhancing its leadership in UV lighting solutions. Nichia continues to pioneer advancements from its headquarters in Tokushima, Japan.

Key Regional Takeaways:

United States UV LED Market Analysis

In North America, the United States accounted for 86.15% of the total market share. The need for UV LED technology is influenced by various factors, such as energy efficiency and growing environmental consciousness. The increasing emphasis on sustainability and the demand for reduced energy use in sectors like healthcare, manufacturing, and electronics are key to promoting adoption. There has been considerable growth in applications related to disinfection and sterilization, particularly concerning medical devices and air purification. KPMG forecasts that the global medical device sector will expand by more than 5% each year, approaching USD 800 Billion by 2030, driven by the need for cutting-edge devices, including wearables, which will also favor UV LEDs in healthcare settings. The application of UV LEDs in curing processes, such as for adhesives, coatings, and inks, enhances their attractiveness. Moreover, the growth of the semiconductor sector has increased the need for accurate UV light sources. The advanced research and development facilities in this area boost innovation, facilitating the swift launch of high-performance products. Moreover, strict environmental policies and incentives for energy-efficient alternatives in areas such as water treatment and automotive promote the use of UV LEDs. The region's access to skilled workers, advanced infrastructure, and a significant consumer market makes it well-suited to spearhead the adoption of UV LEDs.

Europe UV LED Market Analysis

In Europe, factors such as stringent environmental regulations, the transition toward sustainable practices, and the growing adoption of energy-efficient technologies contribute to the growing reliance on UV LEDs. These LEDs are utilized in a range of applications, including air and water disinfection, printing, and surface sterilization, meeting the region’s high standards for sustainability. European countries have a strong commitment to reducing carbon emissions, which encourages the shift toward energy-saving technologies like UV LEDs. The healthcare and pharmaceutical industries in Europe also benefit from UV LEDs in sterilization processes and medical equipment. According to EU, in 2022, the EU's healthcare expenditure reached approximately USD 1,789 Billion, 10.4% of GDP. This growing healthcare investment fuels the adoption of UV LEDs, enhancing medical applications and efficiency. Europe’s focus on green innovation, coupled with a well-established regulatory framework, offers a favorable environment for further advancements in UV LED technology. Research initiatives and collaborations across industries also enhance the application of these LEDs for various industrial and commercial uses, ensuring the continued growth of the market in the region.

Asia Pacific UV LED Market Analysis

In Asia-Pacific, the rapid industrialization and increasing demand for energy-efficient solutions are primary driving factors for UV LED technology. The region benefits from robust manufacturing capabilities, which drive the use of UV LEDs in curing applications across the automotive and electronics industries. For instance, India's thriving automotive sector, projected 18 Million vehicles produced in FY 2022, offers great growth opportunities, benefiting from an influx of USD 8-10 Billion in investments. The healthcare sector has also been a significant adopter, with UV LEDs being used for disinfection purposes in hospitals, air purifiers, and water treatment. Additionally, the booming consumer electronics market in the region has driven the need for compact, high-performance UV LED devices. Strong governmental support in the form of subsidies and regulations promoting environmental sustainability further accelerates growth. Countries in this region are increasingly focusing on reducing carbon footprints, making UV LEDs an attractive option. With a significant presence of major electronics and semiconductor manufacturers, Asia-Pacific remains a hub for technological advancements in UV LED solutions, fostering innovation and scalability. The cost-effective production capabilities and well-established supply chains also contribute to the regional advantage, making UV LEDs more accessible across various sectors.

Latin America UV LED Market Analysis

Residential growth in Latin America is a key driving force for the adoption of UV LEDs, especially in energy-efficient lighting and water purification systems. As urbanization increases, there is a growing demand for sustainable technologies in homes, particularly for disinfection and lighting solutions that are both cost-effective and environmentally friendly. For instance, the Brazilian government’s approximately USD 55 Billion investment in urbanization and 2.5 Million housing units by 2025, driven by the FGTS fund, aligns with growing urbanization trends, creating a positive outlook for UV LED adoption in infrastructure applications. As housing development accelerates, particularly in major cities, the use of UV LEDs in air and water treatment systems is expanding, driven by the need to provide better living conditions. The demand for energy-efficient, long-lasting lighting in homes further supports the growth of UV LED applications in residential sectors across the region.

Middle East and Africa UV LED Market Analysis

In the Middle East and Africa, industrial growth plays a major role in the rising demand for UV LEDs. With an expanding focus on industrialization, sectors such as manufacturing and chemicals increasingly rely on UV LEDs for curing processes, surface treatment, and disinfection systems. For instance, manufacturing contributed nearly 10% to the UAE's nominal GDP in 2022 approximately USD 48 Billion, with real growth surging to 8.75%, driven by industrialization. The region’s infrastructure development, combined with growing investments in green technologies, presents a favorable environment for UV LED adoption. Industries looking for cost-effective, sustainable solutions benefit from the energy efficiency and longevity of UV LEDs, helping to meet the demand for cleaner, more efficient production processes in diverse industrial sectors.

Competitive Landscape:

Major participants in the market are concentrating on technological innovations to enhance efficiency, production, and durability. They are funding research efforts to broaden the scope of applications, especially in sterilization, curing, and water treatment. Strategic alliances and collaborations are allowing market leaders to bolster their supply chains and improve product offerings. Businesses are likewise prioritizing regional growth to satisfy the increasing demand in emerging markets. Numerous individuals are embracing environmentally friendly methods and aligning their innovations with sustainability objectives. Moreover, companies are focusing on various industries, such as healthcare, electronics, and eco-friendly solutions, to reach a wider audience. In 2024, Nazdar Ink Technologies introduced its improved 706V2 and 708V2 Series UV LED inks designed for Mimaki printers, which are compatible with LUS120 and LUS170 inks. These inks offer improved color precision, increased water resistance, and are free from SVHCs, ensuring compliance with REACH regulations. Their plug-and-play configuration facilitates smooth transitions without the need for flushing or re-profiling, guaranteeing economical and efficient printing.

The report provides a comprehensive analysis of the competitive landscape in the UV LED market with detailed profiles of all major companies, including:

- Asahi Kasei Corporation

- Dr. Hönle AG

- FUJIFILM Corporation

- Heraeus Holding GmbH

- Koninklijke Philips N.V.

- Lumileds Holding B.V.

- Nichia Corporation

- Nordson Corporation

- Osram Licht AG (ams AG)

- Phoseon Technology

- SemiLEDs Corporation

- Seoul Semiconductor Co. Ltd

Latest News and Developments:

- August 2024: GEW introduced advanced UV LED systems during Labelexpo Americas 2024. The air-cooled AeroLED2 and water-cooled LeoLED2 promise enhanced performance for label and narrow web applications. These innovations deliver higher power levels and broader compatibility across presses. The upgrades aim to redefine UV curing efficiency in the industry.

- June 2024: Buzbug has launched a revolutionary range of UV-LED bug zappers in 2024, transforming insect control technology. The new products feature advanced UV-LED technology for enhanced energy efficiency and effectiveness. This launch also upgrades their existing product line, setting new standards in the industry. The announcement underscores Buzbug's commitment to innovation and sustainability.

- May 2024: Fujifilm and IST METZ introduced SMARTcure, a UV LED digital curing assistant, during Drupa 2024. SMARTcure, powered by AI, optimizes curing precision while reducing energy and costs. This follows the launch of Fujifilm’s LuXtreme UV LED curing system at Labelexpo. The collaboration highlights advanced curing solutions for the graphic arts industry.

UV LED Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | UV-A, UV-B, UV-C |

| Materials Covered | Silicon Carbide (SiC), Gallium Nitride (GaN), Sapphire, Others |

| Applications Covered | Curing, Disinfection/Purification, Indoor Gardening, Counterfeit Detection, Others |

| Industry Verticals Covered | Healthcare and Medical, Agriculture, Residential, Industrial, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Kasei Corporation, Dr. Hönle AG, FUJIFILM Corporation, Heraeus Holding GmbH, Koninklijke Philips N.V., Lumileds Holding B.V., Nichia Corporation, Nordson Corporation, Osram Licht AG (ams AG), Phoseon Technology, SemiLEDs Corporation, Seoul Semiconductor Co. Ltd., etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UV LED market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global UV LED market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UV LED industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

UV LED is an energy-efficient, mercury-free light sources that emit ultraviolet radiation in specific wavelengths such as UVA, UVB, and UVC. It is widely used in applications like sterilization, curing adhesives, and water purification.

The UV LED market was valued at USD 894.10 Million in 2024.

IMARC estimates the global UV LED market to exhibit a CAGR of 13.63% during 2025-2033.

The global UV LED market is driven by rising demand for eco-friendly, mercury-free UV solutions across industries such as healthcare, electronics, and manufacturing. The increasing applications in water purification, sterilization, and curing processes are further supporting the market growth. Advancements in semiconductor technology, coupled with stringent environmental regulations and the growing awareness about energy-efficient lighting, are also positively influencing the market.

In 2024, UV-C represented the largest segment by type, driven by its widespread use in sterilization, disinfection, and water purification applications, along with increasing demand for effective germicidal solutions across industries.

Disinfection/purification leads the market by application owing to the growing concerns about water quality, healthcare hygiene, and effective sterilization methods, alongside the rising adoption of UV-C technology for eco-friendly and chemical-free solutions.

Industrial is the leading segment by industry vertical due to the growing use of UV LEDs in manufacturing processes, such as curing, printing, and coating, alongside increased demand for energy-efficient and precise solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global UV LED market include Asahi Kasei Corporation, Dr. Hönle AG, FUJIFILM Corporation, Heraeus Holding GmbH, Koninklijke Philips N.V., Lumileds Holding B.V., Nichia Corporation, Nordson Corporation, Osram Licht AG (ams AG), Phoseon Technology, SemiLEDs Corporation, and Seoul Semiconductor Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)