Utility Poles Market Size, Share, Trends and Forecast by Type, Material, Pole Size, Application and Region, 2025-2033

Utility Poles Market 2024, Size and Trends:

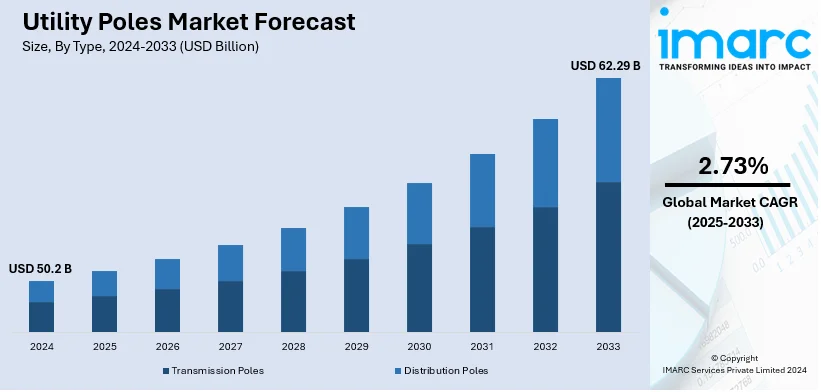

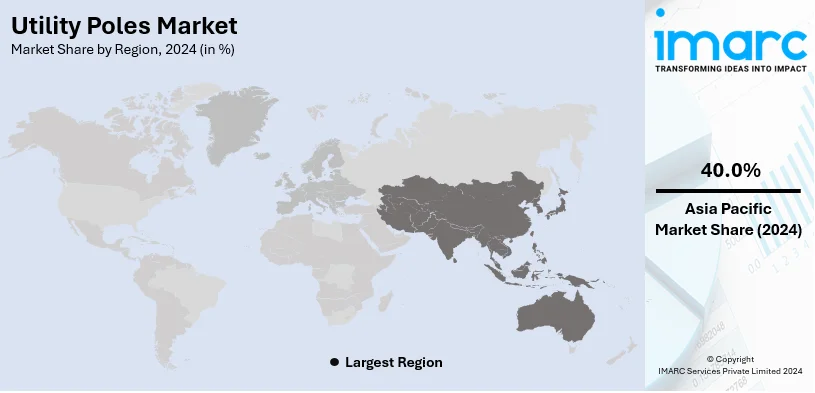

The global utility poles market size was valued at USD 50.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.29 Billion by 2033, exhibiting a CAGR of 2.73% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 40.0% in 2024. The utility poles market share in this region is driven by urbanization, rural electrification, renewable energy projects, infrastructure modernization, and growing telecommunication network expansions, including 5G deployment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 50.2 Billion |

|

Market Forecast in 2033

|

USD 62.29 Billion |

| Market Growth Rate (2025-2033) | 2.73% |

The global utility poles market demand is growing due to increasing electricity demand driven by urbanization and industrialization, particularly in developing regions. The growth of renewable energy projects, such as wind and solar farms, also increases the demand for utility poles for power transmission. The modernization of aging power infrastructure in developed countries is also an opportunity for growth. Rising telecommunication needs, driven by the expansion of 5G networks and fiber optic installations, are boosting the adoption of utility poles for network infrastructure. In addition, innovations in materials, such as composite poles offering durability and weather resistance, are enhancing their appeal. Furthermore, government investments in rural electrification and infrastructure development programs are also playing a key role in utility poles market growth.

The U.S. utility poles market is emerging as a major market, holding 81.50% of the total share. This is due to the increasing electricity demand that is being triggered by urbanization and industrial expansion, which requires the development and upgradation of the transmission and distribution networks. New infrastructure, such as utility poles, is needed to integrate wind and solar farms into the grid. The growth of data centers and the rollout of 5G networks are also driving demand for utility poles to support improved telecommunication services. Replacement of aging infrastructure and adoption of durable materials, like composite poles, are also contributing to market growth.

Utility Poles Market Trends:

Increase in Safety Standards

Enhanced safety requirements are encouraging utilities to use stronger and more resilient pole designs, which improve resistance to harsh weather events and reduce the chance of outages. In March 2024, Halonix Technologies announced the launch of its switchgear category, the ‘SURE MCB Series.’ It is a suite of cutting-edge circuit breakers specifically designed for unmatched electrical safety, reliability, and assurance. This is expanding the utility poles market share.

Integration of Smart Utility Poles

As per the latest utility poles market outlook, the incorporation of technology into utility poles, such as sensors and communication devices, is growing to support smart grid projects and improve monitoring and management capacities. Thus, it is serving as a significant growth-inducing factor. In June 2024, Creative Composites Group (CCG), one of the leading manufacturers of fiber reinforced polymer (FRP) composites, announced the launch of a full line of utility and telecommunication poles with StormStrong technology for power transmission, distribution, data, and municipal lighting applications.

Implementation of Renewable Energy

As countries prioritize renewable energy, utility poles are increasingly being constructed to accept solar panels and wind turbines, thereby enabling a decentralized electricity infrastructure. According to the utility poles market overview, this is acting as a significant growth-inducing factor. For example, in July 2024, Tesla secured a large contract to provide over 15 GWh of Megapack to California’s Intersect Power.

Utility Poles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global utility poles market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material, pole size, and application.

Analysis by Type:

- Transmission Poles

- Distribution Poles

According to the recent utility poles market forecast, distribution poles hold the largest share in the utility poles market in 2024, accounting for about 62.5% of the total share. This segment is led by the large demand for electricity distribution networks in urban and rural areas. The rising power consumption requires robust and reliable infrastructure, especially for low and medium-voltage lines, making it preferential to use distribution poles. Modernization efforts at the old, obsolete infrastructure in developed economies complement the growth of this segment, while rural electrification efforts in developing economies further the demand for this segment. In addition, growth in renewable sources such as solar and wind increases the demand for distribution networks. Innovations in materials, such as steel and composites, are making poles more durable and cost-effective, strengthening this segment's market position.

Analysis by Material:

- Concrete

- Wood

- Steel

- Composites

Steel remains the market leader among utility poles in 2024, with a share of 49.5% driven by its superior durability, high strength to weight, and resistance to environmental aggressors, such as wood rot and pests, together with weathering. Other advantages that steel poles carry over wooden poles include lifespan and reduced maintenance costs on the product, thereby extending the overall lifecycle cost. They bear higher tensile strength and thereby are apt for supporting modern electricity grids that offer increased loads, including renewable energy integration. Galvanization and coatings have also gained improvements, increasing the corrosion resistance of steel poles. Urbanization and infrastructure development in developing and developed regions remain upward for steel utility poles.

Analysis by Pole Size:

- Below 40ft

- Between 40 and 70ft

- Above 70ft

In 2024, between 40 and 70ft accounts for the majority of the market at around 42,4%. This range is suitable for a variety of applications ranging from medium- to high-voltage power distribution, through telecommunication networks. Such versatility suits urban, suburban, and rural settings alike, where height is paramount to maintaining clearance and ensuring safety in power transmission. The segment benefits from the upgradations and expansions in the infrastructure, particularly in renewable energy projects, where taller poles are needed for overhead lines. Besides, such poles are also in an optimum cost-functionality-structural capacity ratio, making them a choice for most projects. Their dominance also shows an increasing demand for efficient and adaptable solutions in power and communication networks.

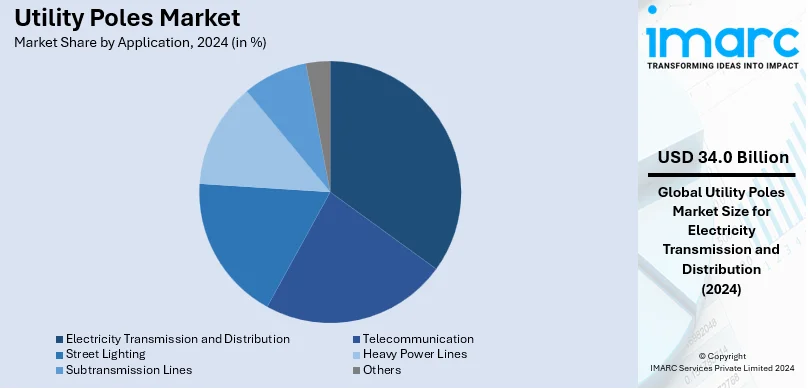

Analysis by Application:

- Electricity Transmission and Distribution

- Telecommunication

- Street Lighting

- Heavy Power Lines

- Subtransmission Lines

- Others

In 2024, electricity transmission and distribution emerged as the leading application segment in the utility poles market, accounting for approximately 67.7% of the total share. This dominance is driven by the escalating demand for reliable power supply fueled by urbanization, industrialization, and population growth. Expanding renewable energy projects, including wind and solar farms, also require robust transmission infrastructure to connect generation sites with consumption hubs. Investments by governments and utility providers in the renewal of aging grid systems with efficient and reduced outages increase the demand. Rural electrification initiatives and smart grid technologies have now opened up new poles of installation. This market has also surged because of its need in making efficient delivery of energy to every part of the world.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia Pacific region dominated the utility poles market, holding more than 40.0% of the global share. Rapid urbanization and industrial growth across emerging economies like China, India, and Southeast Asian nations are key drivers. The region's growing electricity demand, coupled with extensive rural electrification initiatives, has spurred investments in transmission and distribution infrastructure. Expansion of renewable energy projects, such as wind and solar farms, also adds to the demand for strong utility poles. Governments in the region are investing heavily in upgrading grid systems and expanding telecommunication networks, including 5G rollouts. The availability of raw materials and low-cost manufacturing processes in Asia Pacific also gives it a competitive edge in the global market.

Key Regional Takeaways:

North America Utility Poles Market Analysis

The growth in the North America utility poles market is induced by increased demand for electricity due to urbanization and industrial development, thus expanding and modernizing transmission and distribution networks. For instance, in 2024, the government of the United States announced that four electricity transmission projects in the southwest, southeast, and New England will receive $1.5 billion in public funding to improve the grid's resilience and connect customers with clean energy. The funds come from a 2021 bipartisan infrastructure law and will enable nearly 1,000 miles of new transmission lines in Louisiana, Maine, Mississippi, New Mexico, Oklahoma, and Texas. Besides this, the rise in renewable energy projects, like wind and solar farms, needs new infrastructure, including utility poles, to integrate these sources into the grid. Also, the rising penetration of data centers and 5G networks is boosting the demand for utility poles to support better telecommunication services. The replacement of old infrastructure and the adoption of durable materials like composite poles also contribute to the growth of the market. Government initiatives toward improving rural electrification and infrastructure only add further to this upward trend.

United States Utility Poles Market Analysis

The utility pole market in the United States is currently being driven by a combination of ongoing infrastructure upgrades, the increasing integration of renewable energy sources, and the growing need for resilient electrical grids to withstand extreme weather events. Electric utilities are expanding and modernizing transmission and distribution networks to accommodate rising electricity demand and enhance reliability. The shift toward renewable energy is necessitating the installation of utility poles for connecting wind and solar farms to the grid. Simultaneously, utilities are replacing aging wooden poles with advanced materials like composite and steel poles to improve durability and reduce maintenance costs. The adoption of 5G networks is spurring demand for poles equipped to host small cell technology, facilitating faster data transmission and improved connectivity. According to CTIA, since 5G was launched in 2018, three nationwide networks—and regional provider networks across the U.S.—already covered 330 million Americans. Furthermore, government investments in grid hardening and rural electrification programs are supporting the deployment of new poles in underserved areas. Utilities are also responding to regulatory pressures by installing fire-resistant poles in wildfire-prone regions, ensuring compliance and minimizing risks. Lastly, post-disaster recovery efforts are driving the replacement of poles damaged by hurricanes and other natural calamities, reflecting the market's ongoing momentum in addressing both immediate and long-term utility infrastructure needs.

Europe Utility Poles Market Analysis

The utility pole market in Europe is currently being driven by the increasing focus on upgrading and modernizing aging power infrastructure to meet the growing energy demand across the region. Governments and utility companies are investing in the replacement of outdated poles with more durable and sustainable materials, such as composite and steel, to enhance grid resilience against extreme weather conditions. The market is also benefiting from the ongoing expansion of renewable energy projects, with utility poles playing a critical role in connecting wind and solar farms to the grid. Additionally, telecommunication companies are actively deploying fibre optic networks for high-speed internet, necessitating the installation of new utility poles to support these networks in both urban and rural areas. Regulations emphasizing the adoption of eco-friendly materials are encouraging manufacturers to innovate and produce poles with lower environmental impact, aligning with the European Union's sustainability goals. Furthermore, increasing urbanization is driving the development of smart city projects, which integrate advanced utility poles equipped with smart sensors for efficient energy distribution and real-time data collection. According to government of UK, in 2019, 56.3 Million people lived in urban areas (82.9% of England’s population). These factors, coupled with ongoing initiatives to electrify remote areas, are reinforcing the demand for utility poles across Europe.

Asia Pacific Utility Poles Market Analysis

The utility poles market in the Asia-Pacific region is currently being driven by rapid urbanization and industrialization, which are spurring the expansion of electrical transmission and distribution networks. According to the India Brand Equity Foundation (IBEF), manufacturing exports have registered their highest ever annual exports of USD 447.46 Billion with 6.03% growth during FY23 surpassing the previous year (FY22) record exports of USD 422 Billion. Governments across the region are actively investing in infrastructure development projects, including rural electrification programs, to ensure energy access in underserved areas. The increasing adoption of renewable energy sources, such as solar and wind, is necessitating the installation of utility poles for efficient power distribution. Simultaneously, telecommunication companies are deploying utility poles to support the proliferation of 5G networks and broadband connectivity, catering to the growing demand for high-speed internet. The construction of smart cities is integrating advanced grid systems, further accelerating the demand for poles with enhanced durability and load-bearing capacities. Moreover, the replacement of aging infrastructure is underway in several countries, with a focus on modernizing existing systems to enhance resilience against natural disasters. Manufacturers are also innovating by introducing eco-friendly and composite utility poles, aligning with increasing environmental regulations and sustainability goals. This is being complemented by competitive pricing strategies and government incentives, which are reducing the cost burden for utility providers. As a result, the utility pole market in Asia-Pacific is witnessing robust growth across diverse sectors.

Latin America Utility Poles Market Analysis

The demand for utility poles in Latin America is steadily increasing, driven by region-specific developments. Governments and utility companies are actively investing in the expansion and modernization of energy infrastructure to meet the growing electricity demand in urban and rural areas. Ongoing electrification programs in underserved communities are necessitating the installation of new utility poles to extend power distribution networks. Telecommunications providers are rapidly deploying fiber optic cables and improving internet connectivity, particularly in remote regions, which is boosting the demand for poles capable of supporting these installations. Simultaneously, countries like Brazil and Mexico are implementing renewable energy projects, requiring robust pole infrastructure for wind and solar farms. The construction and transportation sectors are relying on utility poles to support high-voltage transmission lines for new industrial developments and highway expansions. Governments are also enforcing stricter safety standards for pole materials, prompting the replacement of aging wooden poles with steel, concrete, and composite alternatives. Additionally, the region’s vulnerability to natural disasters is leading to the reinforcement and replacement of poles to withstand adverse weather conditions. According to World Bank Climate Change Knowledge Portal, in 2020, 93.9% of the people residing in Brazil were affected because of flood. These trends are collectively shaping the utility pole market across Latin America, aligning with the region's focus on sustainable development and infrastructure resilience.

Middle East and Africa Utility Poles Market Analysis

The demand for utility poles in the Middle East and Africa is steadily growing, driven by several region-specific factors that reflect ongoing developments and priorities. Governments are actively expanding and modernizing electricity distribution networks to support growing urbanization and electrification efforts in underserved rural areas. According to reports, 63% of South Africans are already living in urban areas. Simultaneously, renewable energy projects, particularly solar and wind farms, are integrating into existing grids, necessitating the installation of utility poles for power transmission. Telecommunication providers are also aggressively deploying infrastructure for 4G and 5G networks, using utility poles to accommodate increasing demand for connectivity in both urban and remote areas. Moreover, industries in the region, such as oil and gas and mining, are relying on utility poles to support critical power and communication needs in their operations. In addition, ongoing efforts to replace aging infrastructure with more durable and sustainable materials, such as composite or concrete utility poles, are further boosting demand. Regional governments are also implementing regulations and policies focused on enhancing grid resilience against harsh weather conditions, prompting investments in utility pole upgrades. These factors, combined with rising construction activities in the region, are continuously driving the utility pole market's expansion in the Middle East and Africa.

Competitive Landscape:

As per the emerging utility poles market trends, the competitive landscape is marked by key players focusing on innovation, strategic partnerships, and regional expansion. Leading manufacturers dominate through diversified product offerings, including wood, steel, concrete, and composite poles. Companies are prioritizing advanced materials like composites for durability and environmental benefits, gaining an edge in sustainability-conscious markets. Regional players contribute by catering to localized needs, particularly in emerging economies where rural electrification and infrastructure projects are prevalent. Mergers and acquisitions are reshaping the market, allowing larger firms to consolidate their positions and expand their geographical footprint. Increasing investments in smart grids and renewable energy infrastructure present significant growth opportunities, intensifying competition among industry leaders.

The report provides a comprehensive analysis of the competitive landscape in the utility poles market with detailed profiles of all major companies, including:

- El Sewedy Electric Company

- FUCHS Europoles GmbH

- Hill & Smith Holdings PLC

- KEC International Ltd

- Koppers Inc.

- Nippon Concrete Industries Co. Ltd.

- Omega Company

- Pelco Products Inc.

- Skipper Limited

- Stella-Jones

- Valmont Industries Inc.

Latest News and Developments:

- July 2023: Valmont® Industries, Inc., North America’s largest utility pole manufacturer, is the first to sustainably commercialize an eco-concrete product at scale in the GHG heavy concrete utility pole industry. Moreover, Valmont has opened the on-site solar array co-located at its Bristol plant to offset an expected 100% of its energy consumption and transition to the environmentally-friendly poles for installment across the country.

- March 2024: Halonix Technologies announced the development of its Switchgear category, the ‘SURE MCB Series.’ It is a suite of cutting-edge circuit breakers designed for unmatched electrical safety, reliability, and assurance.

- April 2024: Construction materials manufacturer Wagners has introduced a new 356mm Fibre Reinforced Polymer (FRP) utility pole, designed to address the challenges faced by electricity networks due to ongoing timber shortages.

- June 2024: Creative Composites Group (CCG), one of the leading manufacturers of fiber reinforced polymer (FRP) composites, announced the launch of a full line of utility and telecommunication poles with StormStrong technology for power transmission, distribution, data, and municipal lighting applications.

- July 2024: Tesla and Intersect Power announced a contract for 15.3 GWh of Megapacks, Tesla’s battery energy storage system, for Intersect Power’s solar + storage project portfolio through 2030. This agreement, when combined with previous commitments, make Intersect Power one of the largest buyers and operators of Megapacks globally with nearly 10 GWh of large-scale energy storage expected to be deployed by the end of 2027.

Utility Poles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Transmission Poles, Distribution Poles |

| Materials Covered | Concrete, Wood, Steel, Composites |

| Pole Sizes Covered | Below 40ft, Between 40 and 70ft, Above 70ft |

| Applications Covered | Electricity Transmission and Distribution, Telecommunication, Street Lighting, Heavy Power Lines, Subtransmission Lines, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | El Sewedy Electric Company, FUCHS Europoles GmbH, Hill & Smith Holdings PLC, KEC International Ltd, Koppers Inc., Nippon Concrete Industries Co. Ltd., Omega Company, Pelco products Inc., Skipper Limited, Stella-Jones, Valmont Industries Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the utility poles market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global utility poles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the utility poles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The utility poles market was valued at USD 50.2 Billion in 2024.

IMARC estimates the utility poles market to exhibit a CAGR of 2.73% during 2025-2033.

The market is driven by rising electricity demand, renewable energy integration, telecommunication network expansion, aging infrastructure modernization, and government investments in rural electrification.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the utility poles market include El Sewedy Electric Company, FUCHS Europoles GmbH, Hill & Smith Holdings PLC, KEC International Ltd, Koppers Inc., Nippon Concrete Industries Co. Ltd., Omega Company, Pelco products Inc., Skipper Limited, Stella-Jones, Valmont Industries Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)