Utility Billing Software Market Report by Deployment Mode (On-premises, Cloud-based), Type (Platform as a Service, Infrastructure as a Service, Software as a Service), End User (Water, Power Distribution, Oil and Gas, Telecommunication, and Others), and Region 2026-2034

Market Overview:

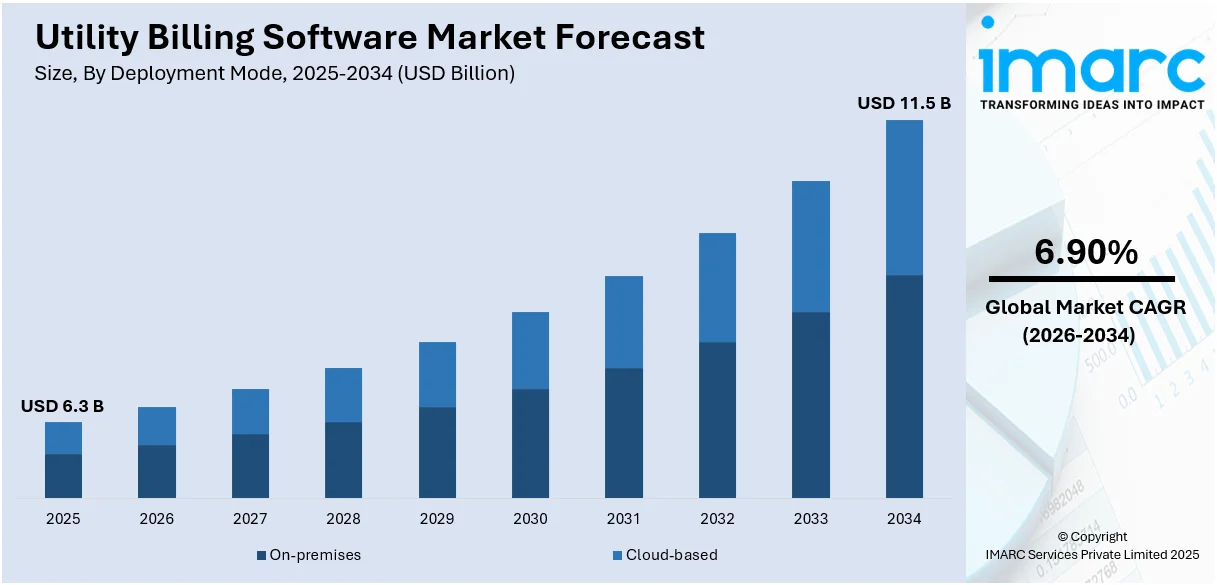

The global utility billing software market size reached USD 6.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.5 Billion by 2034, exhibiting a growth rate (CAGR) of 6.90% during 2026-2034. Growing awareness and importance of energy conservation, evolving regulations and mandates in various regions, increasing customer expectations, rapid urbanization, significant advancements in technology, global expansion of utility services, and environmental sustainability, are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6.3 Billion |

|

Market Forecast in 2034

|

USD 11.5 Billion |

| Market Growth Rate 2026-2034 | 6.90% |

Utility billing software (UBS) is a comprehensive solution that helps streamline the process of managing and invoicing utility consumption for residential, commercial, and industrial customers. This software enables utility companies to track usage data, calculate accurate bills, integrate finances, manage accounts, mitigate the risks of fraudulent activities, resolve user inquiries, and efficiently communicate with their customers. It incorporates advanced features, such as real-time data analytics and customer engagement tools that help enhance operational efficiency, reduce billing errors, and provide customers with greater transparency and control over their utility expenses. It is available in various deployment models, including cloud-based, on-premises, and build-your-own solutions.

To get more information on this market Request Sample

The growing awareness and importance of energy conservation have led to increased adoption of utility billing software as it helps in monitoring and managing energy consumption, ultimately promoting energy efficiency. In addition to this, the evolving regulations and mandates in various regions are driving utility companies to maintain accurate billing records and provide transparency to customers, thereby boosting the demand for UBS. Moreover, rapid urbanization has increased the demand for utility services, which, in turn, is impelling the adoption of UBS among utility providers to allow them to efficiently manage and bill for these services in densely populated areas. Furthermore, significant advances in technology, such as the Internet of Things (IoT) and smart meters, have enhanced data collection capabilities and made UBS more valuable for data analysis and billing accuracy, thereby strengthening the market growth.

Utility Billing Software Market Trends/Drivers:

Rising demand for energy efficiency

The increasing global awareness of environmental sustainability and the rising need to reduce energy consumption are pivotal factors driving the utility billing software market. As societies become more conscious of their carbon footprint, utility companies are under pressure to enhance energy efficiency. UBS plays a crucial role by providing real-time insights into energy usage patterns, enabling customers to make informed decisions on reducing consumption. This demand for energy efficiency solutions is further fueled by government regulations and incentives aimed at promoting responsible energy use. Besides this, UBS empowers consumers to monitor and manage their energy consumption and assists utility providers in optimizing resource allocation and reducing waste, making it an indispensable tool in today's eco-conscious world.

Regulatory compliance

Evolving regulatory frameworks and increased scrutiny of utility providers have made regulatory compliance a paramount concern. UBS is essential for utility companies to meet these requirements by maintaining accurate billing records, ensuring transparency, and adhering to billing standards. In an environment of changing regulations, such as data privacy and consumer protection laws, UBS offers the adaptability and scalability necessary to stay compliant. Concurrent with this, the ability to generate comprehensive reports and audit trials enhances transparency, reduces the risk of non-compliance penalties, and fosters trust among customers and regulatory bodies alike. Therefore, the growing complexity of regulatory landscapes is a significant driver for the adoption of utility billing software.

Increasing customer expectations

With the expanding penetration of digitalization and connectivity, customers expect instant access to their utility data, personalized services, and transparent billing processes. UBS addresses these heightened customer expectations by offering self-service portals and mobile applications that empower consumers to monitor their usage, receive real-time alerts, and access billing information conveniently. This emphasis on customer-centric solutions is driving utility providers to invest in advanced billing software that not only enhances customer experience but also fosters brand loyalty. As competition in the utility sector intensifies, meeting and exceeding customer expectations has become a strategic imperative, making utility billing software a critical tool for retaining and attracting customers in an increasingly competitive market landscape.

Utility Billing Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on deployment mode, type and end user.

Breakup by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based holds the largest share in the market

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises, and cloud-based. According to the report, cloud-based represented the largest segment.

Cloud-based utility billing software offers unparalleled scalability, allowing utility companies to adapt to fluctuating demand seamlessly. Moreover, cloud-based solutions considerably reduce the burden of infrastructure management, cutting down on capital expenditures and operational overhead. This cost-efficiency is especially attractive to utility providers seeking to optimize their spending while maintaining robust software capabilities. Concurrently, cloud-based deployment ensures accessibility from anywhere with an internet connection, facilitating remote work and real-time data access for utility companies and their customers. Apart from this, it also provides robust security measures and data backup, addressing concerns about data protection and business continuity, which makes it the dominant choice in the deployment mode segment of the utility billing software market.

Breakup by Type:

- Platform as a Service

- Infrastructure as a Service

- Software as a Service

The report has provided a detailed breakup and analysis of the market based on the type. This includes platform as a service, infrastructure as a service, and software as a service.

Platform as a service (PaaS) UBS offers a ready-made development environment with pre-configured Infrastructure and tools that accelerate the software development process for utility billing solutions, reducing time-to-market. This presents remunerative opportunities for market expansion. In confluence with this, the surging popularity of infrastructure as a service (IaaS) for UBS providers as they offer a vast range of infrastructure services, including virtual machines, storage, and networking, that can be provisioned quickly is contributing to the market’s growth. Furthermore, this agility enables utility companies to deploy and update their billing software rapidly, adapting to changing market conditions and customer needs with ease, thereby boosting product adoption. Additionally, the expanding deployment of software as a service (SaaS) in UBS platforms due to their inherently scalable nature, easily accommodating changes in user numbers, data volume, and service expansion, is aiding in market expansion.

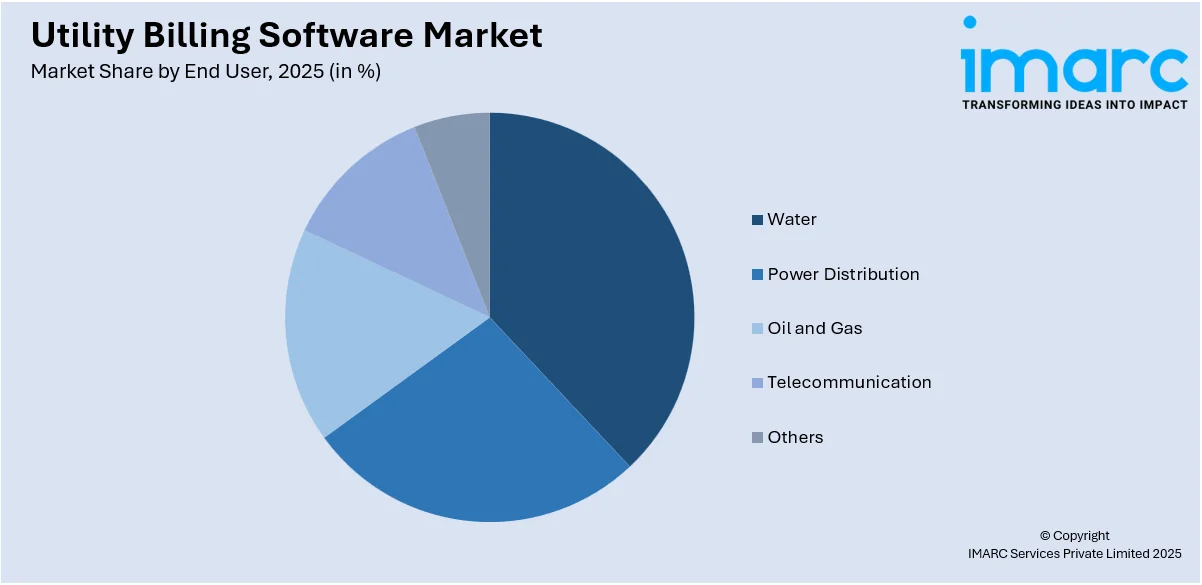

Breakup by End User:

Access the comprehensive market breakdown Request Sample

- Water

- Power Distribution

- Oil and Gas

- Telecommunication

- Others

Power distribution holds the largest share in the market

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes water, power distribution, oil and gas, telecommunication, and others. According to the report, power distribution accounted for the largest market share.

Electricity is an essential utility service, and power distribution companies serve a vast customer base, including residential, commercial, and industrial consumers. This widespread consumer reach creates a substantial demand for utility billing software, as power distribution companies require robust and scalable solutions to manage billing processes efficiently. In addition to this, regulatory bodies often closely monitor the power distribution industry, imposing stringent requirements for billing accuracy, transparency, and compliance. Utility billing software provides the necessary tools to ensure compliance with these regulations, lessening the risk of penalties and legal challenges. Concurrent with this, the power distribution sector's size, complexity, technological advancements, and regulatory demands underscore the crucial role of utility billing software in efficiently managing power distribution operations and meeting customer expectations, positively impacting the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest utility billing software market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America's highly developed and mature utility sector comprising a vast network of electricity, water, gas, and other utility providers necessitates robust and sophisticated billing solutions, driving the demand for utility billing software. Moreover, the increasing emphasis on sustainability and energy efficiency in the region has led to a rising demand for advanced utility billing solutions that can help consumers and businesses track and manage their energy consumption. In line with this, stringent regulatory compliance and surging customer expectations for convivence and transparency play a substantial role in fueling the market growth. Furthermore, the growing adoption of smart meters and IoT technology in North America has created a rising need for billing software that can effectively handle the vast amount of data generated by these devices, enabling utilities to offer real-time billing and consumption information to customers, thereby creating a favorable outlook for market expansion.

Competitive Landscape:

The global utility billing software market is characterized by intense competition, shaped by numerous established software providers and emerging startups vying for market share, offering a wide range of solutions to cater to the diverse needs of utility companies worldwide. The leading market players are expanding their global presence by entering new markets and forming strategic partnerships. Moreover, these companies understand the diverse needs of utility providers, and they are focused on creating flexible and scalable solutions. Besides this, they are building strong partnerships with utility companies, demonstrating a commitment to data security, and offering user-friendly interfaces to gain a competitive edge in this market. The competitive landscape is further influenced by mergers and acquisitions, as companies seek to expand their offerings and geographic reach.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Banyon Data Systems, Inc.

- Continental Utility Solutions Inc. (CUSI)

- EnergyCAP, LLC

- ePsolutions Inc.

- Exceleron

- Harris Computer (Constellation Software Inc.)

- Jayhawk Software

- Jendev

- Methodia Group

- Oracle

- SkyBill

- TEAM Energy

- United Systems & Software

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- In December 2022, Harris Computer announced the acquisition of Service-Link and added a mobile workforce management solution to its Utilities Group.

- In October 2022, Exceleron Softwares Inc. announced an enhancement to the MyUsage solution in order to support Amazon web services and tier-1 private cloud options that MyUsage hybrid cloud offerings provide customers with greater flexibility and scalability.

- In January 2020, AMCS, an Ireland-based technology provider announced the acquisition of Utilibill Pvt. Ltd. For an undisclosed amount.

Utility Billing Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Types Covered | Platform as a Service, Infrastructure as a Service, Software as a Service |

| End Users Covered | Water, Power Distribution, Oil and Gas, Telecommunication, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Banyon Data Systems, Inc., Continental Utility Solutions Inc. (CUSI), EnergyCAP, LLC, ePsolutions Inc., Exceleron, Harris Computer (Constellation Software Inc.), Jayhawk Software, Jendev, Methodia Group, Oracle, SkyBill, TEAM Energy, United Systems & Software, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the utility billing software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global utility billing software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the utility billing software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global utility billing software market was valued at USD 6.3 Billion in 2025.

We expect the global utility billing software market to exhibit a CAGR of 6.90% during 2026-2034.

The sudden outbreak of the COVID-19 pandemic has led to the rising utilization for utility billing software, owing to the changing consumer inclination from conventionally used bill paying methods towards online bill paying methods to combat the transmission of the coronavirus infection upon human interaction.

The increasing integration of cloud computing and IoT solutions to meet the evolving dynamics of the utility industry and to enhance the overall operational efficiency at reduced costs, is primarily driving the global utility billing software market.

Based on the deployment mode, the global utility billing software market has been segmented into on-premises and cloud-based. Currently, cloud-based holds the majority of the total market share.

Based on the end user, the global utility billing software market can be divided into water, power distribution, oil and gas, telecommunication, and others. Among these, the power distribution sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global utility billing software market include Banyon Data Systems, Inc., Continental Utility Solutions Inc. (CUSI), EnergyCAP, LLC, ePsolutions Inc., Exceleron, Harris Computer (Constellation Software Inc.), Jayhawk Software, Jendev, Methodia Group, Oracle, SkyBill, TEAM Energy, and United Systems & Software.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)