Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and Region 2025-2033

Used Cooking Oil Market Size and Share:

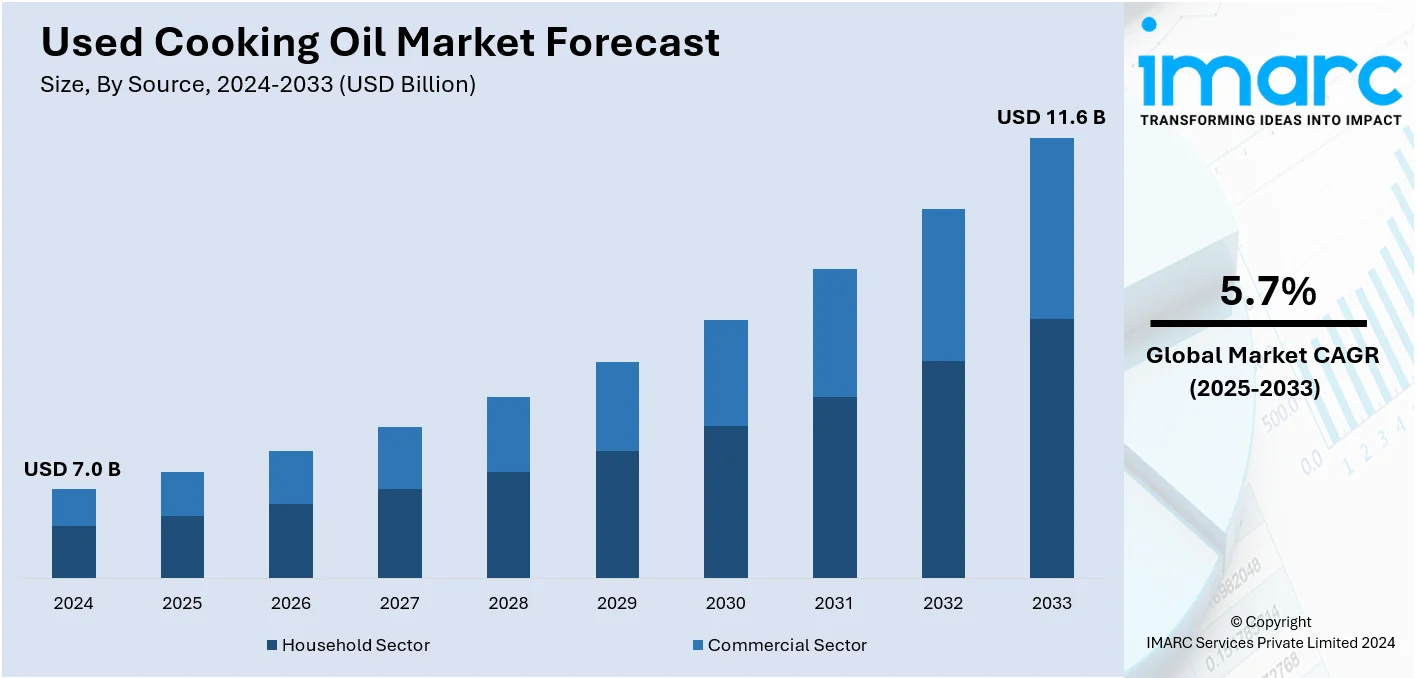

The global used cooking oil market size was valued at USD 7.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.6 Billion by 2033, exhibiting a CAGR of 5.7% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 44.3% in 2024. The increasing use of used cooking oil in producing industrial greases, rising investments in research to enhance recycling methods, the growing need for food security, and the development of recycling facilities and collection systems are some of the factors propelling the market across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.0 Billion |

|

Market Forecast in 2033

|

USD 11.6 Billion |

| Market Growth Rate 2025-2033 | 5.7% |

The global used cooking oil market is primarily driven by increasing demand for biodiesel as a sustainable energy alternative, reducing reliance on fossil fuels, and lowering greenhouse gas and carbon dioxide emissions. According to industry reports, in 2024, total global carbon dioxide emissions were estimated to reach 41.6 GtCO2, an increase of 2% from the previous year. Growing awareness about environmental sustainability and waste management has encouraged recycling efforts in both commercial and household sectors. The expansion of industries utilizing used cooking oil in applications such as animal feed, soap production, and industrial lubricants further boosts demand. Besides this, supportive government policies, incentives, and regulations promoting the recycling of waste oils are also supporting overall industry expansion.

The United States has emerged as a key regional market for used cooking oil, driven by the growing demand for biodiesel as a renewable energy source and supported by government policies such as the Renewable Fuel Standard (RFS) and tax incentives. The expansion of industries utilizing used cooking oil for animal feed, chemicals, and industrial lubricants further drives demand. As per a report published by IMARC Group, the United States industrial lubricants market size reached USD 7.8 Million in 2024 and is projected to reach USD 10.5 Million by 2033, exhibiting a CAGR of 3.3% during 2025-2033. Besides this, rising focus on sustainability and corporate responsibility among businesses is positively impacting industry expansion.

Used Cooking Oil Market Trends:

Government regulations and recycling initiatives promoting sustainability

Rising government efforts to reduce oil wastage through stringent regulations and recycling initiatives are significantly propelling the growth of the used cooking oil (UCO) market. Policies such as India’s Extended Producer Responsibility (EPR) for waste oil management underscore a broader global trend toward sustainable resource utilization and environmental accountability. These frameworks mandate producers to ensure the proper collection, recycling, and environmentally sound disposal of used cooking oil, thereby minimizing its illegal discharge and promoting circular economy practices. Such regulations not only address environmental and public health concerns but also facilitate the structured recovery and repurposing of UCO as a feedstock for biodiesel production. The integration of regulatory measures with sustainability goals incentivizes businesses and food establishments to participate in organized UCO collection networks. This increased availability of recycled oil contributes to market stabilization and influences the used cooking oil market price by ensuring a more consistent and regulated supply. These initiatives enhance feedstock availability for renewable fuel production, reduce dependency on fossil fuels, and support national targets for carbon emission reduction.

Increasing adoption of bio-based fuels

The increasing adoption of bio-based fuels, notably biodiesel, is significantly driving the used cooking oil market size. According to the U.S. Energy Information Administration, the capacity to produce biofuels increased by 7% in the United States during 2023, reaching 24 Billion gallons per year (gal/y) at the start of 2024. As communities prioritize sustainability and seek alternatives to fossil fuels, used cooking oil has emerged as a valuable feedstock for producing biodiesel. The conversion of used cooking oil into biodiesel offers a dual advantage as it repurposes waste while contributing to renewable energy sources. As a result, industries are increasingly recognizing the economic and environmental benefits of biodiesel derived from used cooking oil, leading to expanded collection and recycling efforts. The demand for bio-based fuels also aligns with the global shift toward cleaner energy solutions, reducing greenhouse gas emissions and promoting a greener future. Governments, industries, and consumers support this transition, resulting in policies and incentives that further boost the utilization of used cooking oil for biodiesel production. This trend ensures more responsible waste management and also strengthens the position of used cooking oil as a versatile resource with a vital role in the renewable energy sector.

Rising product uptake in the manufacturing of animal feed

The increasing adoption of used cooking oil in animal feed manufacturing is stimulating the used cooking oil market growth. According to IMARC Group, the global animal feed market was valued at USD 533.4 Billion in 2024. As industries and consumers seek sustainable alternatives, used cooking oil presents an attractive option for enhancing animal feed composition. Its incorporation offers nutritional value, serving as a rich energy source and essential fatty acids for livestock. Additionally, the use of used cooking oil in feed reduces the demand for virgin vegetable oils, promoting resource conservation and reducing waste. The rising awareness about responsible waste management and the circular economy further supports the utilization of used cooking oil in animal feed. By repurposing used cooking oil, industries contribute to reduced waste generation while providing balanced animal nutrition. Regulatory initiatives that promote sustainable practices and discourage food waste also propel the adoption of used cooking oil in animal feed manufacturing. The growing emphasis on sustainability and waste reduction is significantly boosting the demand for used cooking oil in animal feed applications.

Significant growth in the food and beverage industry

The significant growth in the food and beverage industry offers numerous market opportunities, contributing to the used cooking oil market share. As consumer lifestyles change, the demand for diverse and innovative food and beverage products is rising. This growth is attributed to shifting dietary preferences, increased focus on convenience, and a growing interest in health-conscious and sustainable options. Forty percent of consumers focus on health-positive food and beverage choices as a key part of their approach to maintaining good health, while an equal proportion strives for a balanced diet. The expansion of the food and beverage industry also has a cascading effect on related sectors, including packaging, distribution, and marketing. Technological advancements play a vital role, with online platforms, delivery services, and digital marketing strategies reshaping the industry landscape. Moreover, the food and beverage industry contributes to economies, generating employment and supporting local agricultural sectors. Its influence extends to trends such as farm-to-table practices, clean labeling, and reduced food waste, reflecting a growing consciousness about ethical and sustainable consumption.

Used Cooking Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global used cooking oil market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on source, and application.

Analysis by Source:

- Household Sector

- Commercial Sector

Commercial sector stands as the largest component in 2024, holding around 78.6% of the used cooking oil market share. The commercial sector, including restaurants, hotels, and food processing units, is a substantial source of used cooking oil. Businesses are increasingly recognizing the importance of sustainable practices, including used cooking oil recycling. As a result, partnerships between used cooking oil companies and commercial establishments are being established to ensure proper collection and recycling processes. By offering efficient collection systems, educational resources, and sometimes even financial incentives, the commercial sector is incentivized to recycle used cooking oil responsibly. The implementation of such initiatives aligns with corporate social responsibility goals and supports the circular economy model.

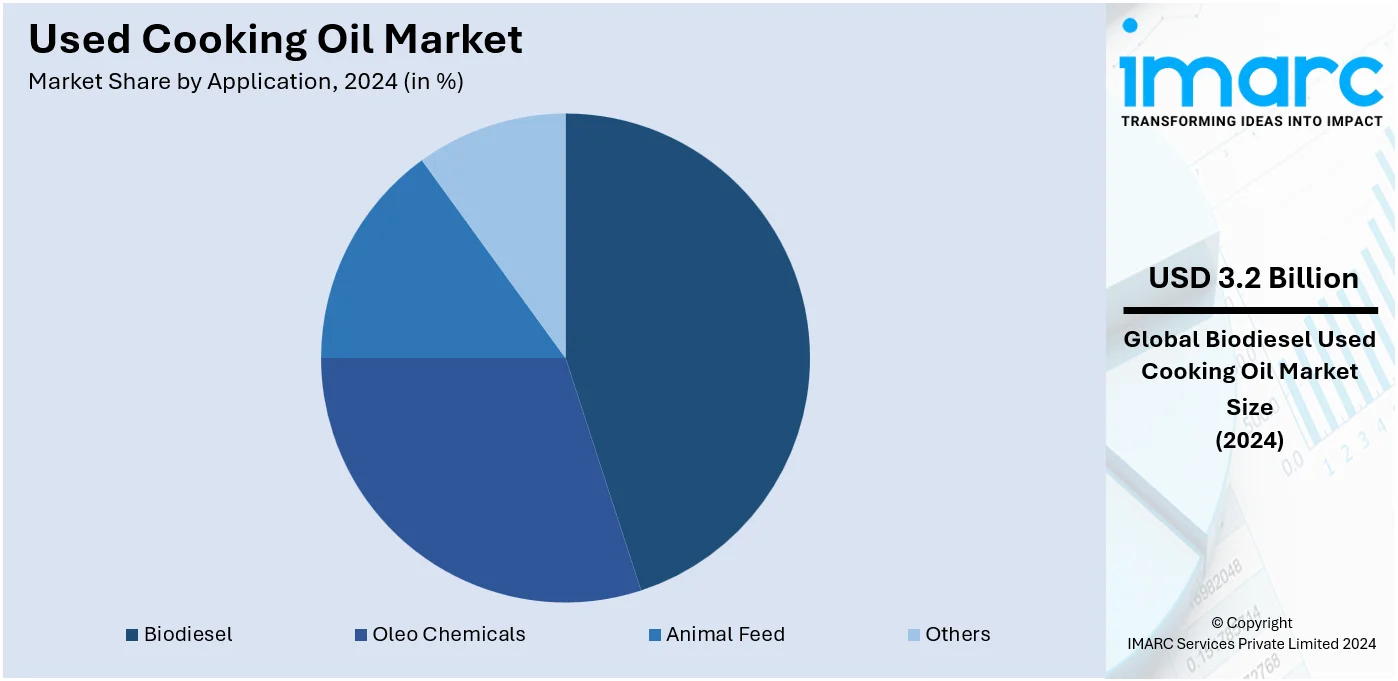

Analysis by Application:

- Biodiesel

- Oleo Chemicals

- Animal Feed

- Others

Biodiesel leads the market with around 45.5% of used cooking oil market share in 2024. The biodiesel sector is a major driver of used cooking oil market growth. The utilization of used cooking oil as a feedstock for biodiesel production reduces waste and also contributes to cleaner energy sources. As a result, biodiesel manufacturers are partnering with used cooking oil companies to secure a reliable supply of raw materials, minimizing dependence on traditional fossil fuels. This synergy supports sustainable practices and aligns with global efforts to reduce greenhouse gas emissions. Biodiesel derived from used cooking oil also provides an alternative to conventional diesel and helps meet regulatory requirements for biofuel usage.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 44.3%. The Europe region is a significant driver of the used cooking oil market growth due to various factors. Environmental consciousness and stringent regulations related to waste disposal and sustainability drive the demand for used cooking oil recycling. The region's robust industrial and commercial sectors, including restaurants and food processing units, also contribute to substantial used cooking oil generation. Collaborations between used cooking oil companies, biodiesel manufacturers, and oleochemical producers are fostering the repurposing of used cooking oil into biofuels and eco-friendly products. Moreover, consumer awareness campaigns and governmental initiatives encourage responsible used cooking oil disposal in households. The availability of advanced technologies and collection systems further streamline the recycling process. The European market's emphasis on renewable energy and eco-friendly practices further positions used cooking oil as a valuable resource for reducing carbon emissions and promoting circular economy principles.

Key Regional Takeaways:

United States Used Cooking Oil Market Analysis

In 2024, the United States accounts for over 75.40% of the used cooking oil market in North America. The United States used cooking oil market is driven by its expanding application in biodiesel production, a key alternative to fossil fuels. As reported by the IEA Bioenergy, in 2023, the US had a biodiesel production capacity of 2.1 BGPY. Further, growing awareness regarding pollution and government policies focusing on the development of renewable sources encourage the use of the cheapest feedstock available for the production of biodiesel, primarily used cooking oil. Federal initiatives such as the Renewable Fuel Standard (RFS) also make industries more willing to recycle used cooking oils. Apart from this, the food service industry is a significant contributor to market growth as there are high volumes of used cooking oil generated in restaurants and commercial kitchens. Also, recycling partnerships and infrastructure developments are making the collection and processing of used cooking oil easier and increasing its availability for industrial purposes. As sustainability gains importance, business and consumers are moving toward more sustainable waste management alternatives, which fuels the market growth. Another key driver is its use in animal feed and industrial lubricants, which diversifies demand. Apart from this, the automotive sector’s shift toward cleaner energy alternatives is also adding momentum as biodiesel is increasingly adopted to meet emission standards.

Asia Pacific Used Cooking Oil Market Analysis

Demand for biodiesel in the Asia Pacific used cooking oil market is increasing due to governments focusing on cleaner energy solutions in their regions as they face environmental issues. Blending mandates in countries such as China, India, and Indonesia are driving significant increases in biodiesel usage, making used cooking oil a preferred feedstock due to its cost-effectiveness and lower environmental impact compared with virgin oils. In line with this, the thriving food service industry, propelled by rapid urbanization and inflating income levels, is supporting the market growth. As per the Press Information Bureau (PIB), it is expected that by 2030, more than 40% of India's population will live in urban areas. Large-scale food chains, restaurants, and commercial kitchens are also key contributors, while the expansion of collection networks is streamlining the logistics of used cooking oil recovery, increasing its availability for industrial use. Export opportunities also drive the market, as Asia Pacific nations supply used cooking oil to biodiesel producers in regions such as Europe, where stringent renewable energy regulations increase demand for sustainable feedstocks. This trade dynamic creates an economic incentive for better collection and recycling systems across the Asia Pacific region.

Europe Used Cooking Oil Market Analysis

The main drivers for the Europe used cooking oil market are stringent environmental regulations and ambitious renewable energy targets set by the European Union. Renewable energy sources accounted for an estimated 24.1% of the European Union's final energy use in 2023, according to the European Environment Agency. Policies such as RED II ensure the increased utilization of renewable fuels in transport and, owing to its sustainability advantage and also because of economic competitiveness with virgin oils, used cooking oil has become an emerging feedstock for the production of biodiesel. These regulations are significantly increasing the demand for used cooking oil as an essential component of Europe’s energy transition strategy. In line with this, the well-established biodiesel industry in Europe further fuels used cooking oil demand, supported by robust collection and recycling infrastructures. Countries such as Germany, the Netherlands, and France are advancing systems for recovering used cooking oil from food service establishments, households, and industrial sources. This strong supply chain enables consistent availability for biodiesel producers, making used cooking oil a preferred feedstock for meeting renewable energy quotas. Additionally, used cooking oil exports to regions with growing biodiesel demand, such as Asia-Pacific and North America, provide economic incentives for European recyclers and processors.

Latin America Used Cooking Oil Market Analysis

The demand in the Latin American used cooking oil market is supported by growing biodiesel production and government initiatives in renewable energy promotion. Brazil and Argentina, which are leaders in biodiesel production, support the recycling of used cooking oil as a secondary feedstock, as this feedstock is relatively cheap and more eco-friendly compared to virgin oils. Biofuel blending mandates support these demands even more. Growing food service industry due to urbanization and increasing income, produces considerable amounts of used cooking oil that are mostly recovered for industrial use. According to CIA, in 2023, the urban population in Mexico made up 81.6% of the total population. The availability of better collection infrastructure and agreements with restaurants and commercial kitchens are also increasing the supply of used cooking oil as a feedstock for biodiesel. Besides this, export opportunities also fuel growth, as Latin America supplies used cooking oil to regions like Europe, where demand for sustainable feedstocks is high.

Middle East and Africa Used Cooking Oil Market Analysis

Increasing demand for renewable energy, as well as biodiesel manufacturing, provides favorable market conditions. According to Saudi and the Middle East, by the end of 2023, production capacities of renewable projects under construction within Saudi Arabia have exceeded 8 GW. Moreover, governing agencies are beginning to implement policies that support biofuels to further sustainability initiatives and reduce fossil fuel consumption. Used cooking oil is a low-cost and environmentally friendly feedstock for biodiesel production; therefore, it addresses these goals. Increasing food service in urban centers also is leading to the usage of high volumes of used cooking oil, thereby presenting an adequate supply for recycling. Improved networks of collection and recycling further boost used cooking oil availability due to its collaborations with restaurants, hotels, and food processing industries. Besides this, rising export demand, especially from Europe and Asia-Pacific, where biodiesel production is more mature, offers economic incentives for used cooking oil collection and processing in the region.

Competitive Landscape:

The key players in the used cooking oil market are implementing various strategies to drive growth and promote sustainability. Companies are investing in advanced collection and recycling technologies to enhance the efficiency of used cooking oil recovery and processing. Partnerships with restaurants, food chains, and municipal waste systems are being established to ensure a consistent used cooking oil supply. Many players are expanding biodiesel production capacities to meet the rising demand for sustainable energy solutions. Other campaigns that organizations are undertaking include raising public awareness about recycling used cooking oil within households and small businesses. Due to stringent environmental regulations and new recycling solutions being developed, these market players lead the market in growth and also help the global sustainability agenda.

The used cooking oil market report provides a comprehensive analysis of the competitive landscape in the with detailed profiles of all major companies, including:

- ABP Food Group

- Arrow Oils Ltd

- Baker Commodities Inc.

- Brocklesby Limited

- Grand Natural Inc.

- Greasecycle LLC

- MBP Solutions Ltd.

- Oz Oils Pty Ltd

- Valley Proteins Inc.

- Veolia Environment S.A.

Latest News and Developments:

- March 2025: Petchsrivichai Enterprise Plc, a SET-listed Thai palm oil manufacturer, announced the launch of a campaign to collect more used cooking oil, crucial for biodiesel and sustainable aviation fuel (SAF).

- March 2025: Cosmo Oil, in partnership with Suita City, Osaka Prefecture, JGC Holdings, REVO International, and SAFFAIRE SKY ENERGY, launched an initiative to convert used cooking oil into sustainable aviation fuel (SAF) and related products. Suita City will supply about 27,000 liters of used cooking oil annually, the largest such municipal effort in Japan. Oil will be collected at 15 public facilities, then processed at Cosmo Oil’s Sakai Refinery. The project aims to promote decarbonization and a resource-recycling society, with plans to expand collection points.

- March 2025: Olleco opened two new used cooking oil processing plants in Dagenham and Liverpool. These facilities utilize advanced technology to maximize efficiency and minimize environmental impact. The Dagenham plant, located on the Thames estuary, is expected to significantly expand the volume of waste processed in the UK. Both plants will help reduce Olleco’s carbon footprint and support the UK’s green economy by converting waste into valuable resources, especially biofuels.

- March 2025: Charoen Pokphand Foods Public Company Limited (CP Foods) teamed up with Bangchak Corporation to transform used cooking oil from its quick-service restaurants (including Five Star and Chester’s) into Sustainable Aviation Fuel (SAF). This initiative supports CP Foods’ commitment to waste-to-value innovation and alternative energy solutions.

- February 2025: The UAE Ministry of Energy and Infrastructure, in partnership with Lootah Biofuels, launched a new initiative to collect used cooking oil from individuals, families, and businesses in designated containers for conversion into clean biofuel. This effort supports the UAE’s transition to renewable energy and its Net-Zero 2050 Strategy.

- December 2024: Fastmarkets and ICE launched the ICE Used Cooking Oil (UCO) Gulf Futures contract to address rising biofuel demand. The contract aids risk management, ensures pricing transparency, and supports biofuel supply chain participants. It reflects US Gulf-based UCO market dynamics for accurate pricing.

Used Cooking Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Household Sector, Commercial Sector |

| Applications Covered | Biodiesel, Oleo Chemicals, Animal feed, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Companies Covered ABP Food Group, Arrow Oils Ltd, Baker Commodities Inc., Brocklesby Limited, Grand Natural Inc., Greasecycle LLC, MBP Solutions Ltd., Oz Oils Pty Ltd, Valley Proteins Inc., Veolia Environment S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the used cooking oil market from 2019-2033.

- The used cooking oil market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the used cooking oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The used cooking oil market was valued at USD 7.0 Billion in 2024.

The used cooking oil market is projected to exhibit a CAGR of 5.7% during 2025-2033, reaching a value of USD 11.6 Billion by 2033.

The market is driven by the rising demand for biodiesel production as a sustainable energy source, increasing focus on waste management and sustainability, growing use in animal feed and industrial applications, expanding regulations and incentives for recycling, and development of efficient collection and recycling infrastructure.

Europe currently dominates the used cooking oil market, accounting for a share of 44.3% in 2024. The dominance is fueled by strict environmental regulations promoting biodiesel production, growing awareness of sustainable energy sources, and the increasing demand for renewable fuels in the region.

Some of the major players in the used cooking oil market include ABP Food Group, Arrow Oils Ltd, Baker Commodities Inc., Brocklesby Limited, Grand Natural Inc., Greasecycle LLC, MBP Solutions Ltd., Oz Oils Pty Ltd, Valley Proteins Inc., and Veolia Environment S.A., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)