US Perforating Gun Market Size, Share, Trends and Forecast by Gun Type, Depth, Well Type, Well Pressure, and Region 2026-2034

US Perforating Gun Market Size and Share:

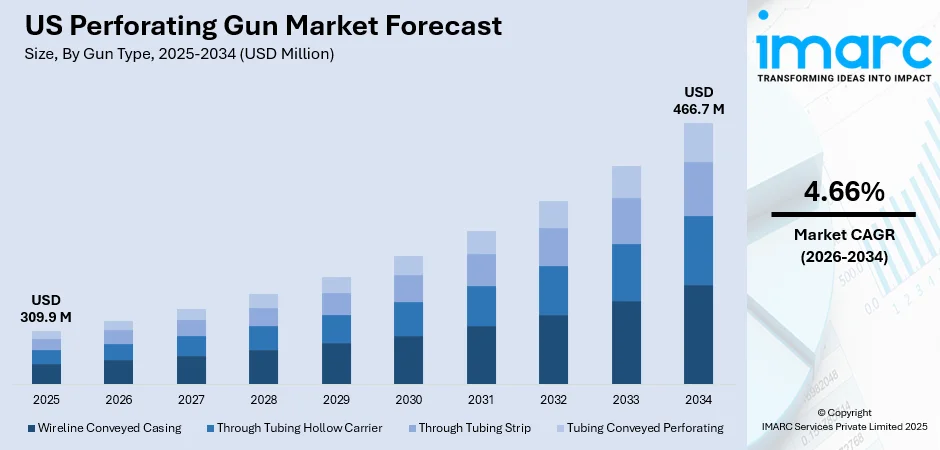

The US perforating gun market size was valued at USD 309.9 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 466.7 Million by 2034, exhibiting a CAGR of 4.66% from 2026-2034. The market is witnessing significant growth due to the escalating demand for unconventional oil and gas extraction and rapid technological advancements in perforating gun systems. Additionally, growing emphasis on environmental sustainability, increasing integration of digital technology, and increasing deepwater and ultra-deepwater reserves further propel the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 309.9 Million |

| Market Forecast in 2034 | USD 466.7 Million |

| Market Growth Rate (2026-2034) | 4.66% |

The increasing focus on unconventional oil and gas extraction is a significant driver of the U.S. perforating gun market. Hydraulic fracturing and horizontal drilling techniques, crucial for accessing shale gas and tight oil reserves, heavily rely on perforating guns to optimize well productivity. For instance, in Texas, U.S. footage drilled per well has increased, boosting oil production in the Permian Basin by 15.4% from 4.849 MMbpd in 2020 to 5.595 MMbpd in early 2024. As the U.S. continues to lead in shale oil and gas production, the need for efficient perforation tools grows, enabling operators to create precise perforations and enhance reservoir connectivity. This demand is further bolstered by advancements in perforating gun technologies, which improve operational safety, efficiency, and environmental compliance, aligning with the industry's evolving needs.

To get more information on this market Request Sample

The adoption of advanced perforating gun systems is another key factor driving the market. Innovations such as shaped charges, modular designs, and advanced detonating systems are enhancing perforation accuracy and reducing operational risks. For instance, in 2024, GEODynamics introduced The EPIC collection featuring EPIC Precision and EPIC Flex gun systems with advanced integrated and open-architecture designs, ensuring safety, uptime, and efficiency in unconventional wells, supported by 24/7 Wellsite Direct service. These advancements cater to the increasing complexity of well-designed and high-pressure environments, ensuring optimal performance in challenging conditions. Additionally, the integration of digital technologies, such as real-time data monitoring, is enabling operators to improve decision-making and efficiency. As the energy sector emphasizes cost-effective and sustainable extraction practices, technological advancements in perforating guns are playing a pivotal role in meeting industry demands while maintaining environmental standards.

US Perforating Gun Market Trends:

Growing Emphasis on Environmental Sustainability

Environmental concerns and stricter regulations are reshaping the U.S. perforating gun market. Operators are focusing on perforating systems that minimize environmental impact by reducing debris and improving perforation efficiency. Eco-friendly perforation technologies are being developed to comply with regulatory standards while maintaining cost-effectiveness. For instance, in 2024, Hunting's patented perforating gun system (US11982163B2) introduced a pre-wired loading tube assembly, auto-shunting detonator, and selective switch, enhancing the precision and efficiency of shaped charge operations in oil and gas exploration. This innovation contributes to environmental sustainability by optimizing resource utilization and reducing the environmental footprint associated with drilling and extraction activities. Additionally, advancements in reusable and recyclable perforating gun components are gaining traction, addressing sustainability goals, and aligning with the industry’s emphasis on greener extraction practices.

Increased Integration of Digital Technologies

Digital transformation is revolutionizing the U.S. perforating gun market, with companies integrating real-time monitoring and data analytics capabilities into perforation systems. For instance, in 2024, coiled tubing conveyed over 1,200 ft of perforating guns in extended-reach wells, leveraging downhole tractors and real-time monitoring to overcome lockup, enhancing efficiency, and minimizing risks. These technologies enable operators to assess well conditions instantly, optimize perforation processes, and enhance decision-making. The use of digital twin models and AI-driven insights is further improving operational efficiency and reducing downtime. As the energy sector embraces Industry 4.0, the adoption of smart perforating systems is poised to redefine industry standards, ensuring enhanced productivity and operational excellence.

Increasing Exploration of Deepwater and Ultra-Deepwater Reserves

The growing focus on exploring deepwater and ultra-deepwater reserves is a significant driver of the U.S. perforating gun market. As conventional oil and gas reserves decline, energy companies are shifting toward offshore drilling to meet rising energy demands. For instance, in 2024, U.S. Energy Development Corporation plans to invest $750 million in the Permian Basin to expand Delaware wells through its partnership with Atlantic. In addition, perforating guns play a crucial role in accessing hydrocarbons in challenging deepwater environments by enabling precise well stimulation and maximizing reservoir connectivity. Advances in high-pressure, high-temperature (HPHT) perforation systems are further supporting this trend, ensuring operational efficiency and reliability in extreme offshore conditions. This shift underscores the critical importance of perforating guns in offshore energy production.

US Perforating Gun Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the US perforating gun market, along with forecasts from 2026-2034. The market has been categorized based on gun type, depth, well type, and well pressure.

Analysis by Gun Type:

- Wireline Conveyed Casing

- Through Tubing Hollow Carrier

- Through Tubing Strip

- Tubing Conveyed Perforating

Wireline-conveyed casing guns are perforating systems deployed through wireline cables to create precise openings in well casings for reservoir access. Their efficiency, accuracy and reduced operational risks make them integral to the U.S. perforating gun market, addressing demands for cost-effective and environmentally conscious oilfield solutions in advanced energy extraction operations.

Through-tubing hollow carrier guns are compact perforating systems designed for deployment within existing tubing to access reservoirs without removing the tubing. Their adaptability, precision, and minimized operational downtime make them a vital solution in the U.S. perforating gun market, enhancing efficiency in well interventions, and maximizing production in mature fields.

Through-tubing strip guns are lightweight perforating systems used within existing tubing to enable targeted reservoir access in challenging well conditions. Their streamlined design allows efficient deployment in restricted spaces, making them a critical tool in the U.S. perforating gun market for cost-effective well intervention and optimized hydrocarbon production.

Tubing-conveyed perforating (TCP) systems are deployed through production tubing, enabling large-scale, high-efficiency reservoir perforation in a single run. This method enhances operational flexibility and reduces completion times, serving the U.S. perforating gun market by addressing demands for cost-effective solutions in complex well operations and maximizing hydrocarbon recovery.

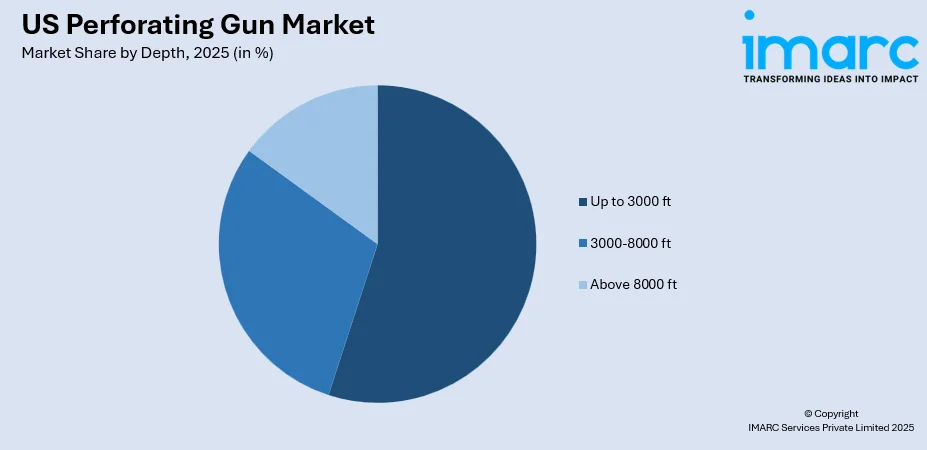

Analysis by Depth:

To get detailed segment analysis of this market Request Sample

- Up to 3000 ft

- 3000-8000 ft

- Above 8000 ft

The up to 3000 ft in depth segment caters to shallow to mid-depth wells perforation needs, a critical area for the US perforating gun market. It enables efficient operations in unconventional reservoirs, enhancing resource extraction while minimizing costs. This segment supports operators in optimizing production within cost-effective drilling depths.

The 3000–8000 ft depth segment addresses mid-range wells perforation, a vital category in the US perforating gun market. It serves operators by enabling efficient resource extraction in deeper reservoirs and supporting advanced drilling techniques. This segment enhances operational flexibility, meeting the increasing demand for precision and reliability in challenging subsurface environments.

The above 8000 ft depth segment focuses on deep-well perforation, essential for the US perforating gun market's advanced operations. It enables resource access in ultra-deep reservoirs, supporting high-pressure and high-temperature environments. This segment drives innovation, ensuring precision and performance for challenging extraction projects in complex geological formations.

Analysis by Well Type:

- Horizontal

- Vertical

The horizontal well type segment is crucial in the US perforating gun market, addressing the specific needs of directional drilling. It enhances hydrocarbon recovery by enabling precise perforation along extended lateral sections, maximizing contact with the reservoir. This segment supports efficient resource extraction and drives advancements in unconventional drilling technologies.

The vertical well type segment serves as a foundation in the US perforating gun market, supporting traditional drilling operations. It facilitates efficient perforation in straight wellbores, optimizing resource extraction in conventional reservoirs. This segment remains integral for cost-effective drilling strategies and continues to meet demand in mature oil and gas fields.

Analysis by Well Pressure:

- High Pressure

- Low Pressure

The high-pressure well segment is pivotal in the US perforating gun market, addressing the challenges of extracting resources from reservoirs with elevated pressures. It ensures safe and efficient operations by utilizing advanced perforating technologies designed for extreme conditions, supporting enhanced recovery, and enabling exploration in complex, high-demand environments.

The low-pressure well segment supports the US perforating gun market by catering to operations in reservoirs with reduced pressure levels. It enables efficient perforation in mature or depleted fields, optimizing resource recovery while maintaining cost-effectiveness. This segment sustains production in established wells, contributing to the industry's overall operational stability.

Competitive Landscape:

The U.S. perforating gun market features a competitive landscape driven by technological innovation and strategic collaborations. Leading players focus on advanced perforation systems to enhance operational efficiency and safety. Emerging companies emphasize modular designs and environmentally sustainable solutions. Market participants also invest in R&D and digital integration, strengthening their portfolios to meet the growing demand for high-performance perforating guns in the energy sector. For instance, in 2024, SLB launched Stream high-speed intelligent telemetry, leveraging AI and TruLink to deliver uninterrupted, high-fidelity real-time subsurface data, enhancing drilling performance across 14 countries with over 370 deployments. This advancement directly impacts the perforating gun market by enabling more precise and efficient deployment of perforating systems during drilling operations.

The report provides a comprehensive analysis of the competitive landscape in the US perforating gun market with detailed profiles of all major companies, including:

- Baker Hughes

- Core Laboratories

- DynaEnergetics, Fhe USA

- Halliburton

- Hunting Plc

- NOV Inc.

- Schlumberger

- Weatherford

- Yellow Jacket Oil Tools

Latest News and Developments:

- In 2024, SWM Technologies sold over 800,000 PerfAlign units, showing its strong performance. The PerfAlign+ System’s self-orienting perforating gun creates uniform holes, improving stimulant flow during fracking and setting new standards.

US Perforating Gun Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Gun Types Covered | Wireline Conveyed Casing, Through Tubing Hollow Carrier, Through Tubing Strip, Tubing Conveyed Perforating |

| Depths Covered | Up to 3000 ft, 3000-8000 ft, Above 8000 ft |

| Well Types Covered | Horizontal, Vertical |

| Well Pressures Covered | High Pressure, Low Pressure |

| Companies Covered | Baker Hughes, Core Laboratories, DynaEnergetics, Fhe USA, Halliburton, Hunting Plc, NOV Inc., Schlumberger, Weatherford and Yellow Jacket Oil Tools |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US perforating gun market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the US perforating gun market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US perforating gun industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The US perforating gun market was valued at USD 309.9 Million in 2025.

IMARC estimates the US perforating gun market to reach USD 466.7 Million by 2034, exhibiting a CAGR of 4.66% during 2026-2034.

Key factors driving the U.S. perforating gun market include increased shale exploration, advancements in well-completion technologies, and growing demand for efficient oil and gas extraction. Environmental concerns are fostering innovation in eco-friendly perforating systems while rising energy needs and investments in unconventional resources further boost market growth.

Some of the key players in the US perforating gun market include Baker Hughes, Core Laboratories, DynaEnergetics, Fhe USA, Halliburton, Hunting Plc, NOV Inc., Schlumberger, Weatherford and Yellow Jacket Oil Tools, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)