US Cryptocurrency Market Report by Type (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, and Others), Component (Hardware, Software), Process (Mining, Transaction), Application (Trading, Remittance, Payment, and Others), and Region 2024-2032

Market Overview:

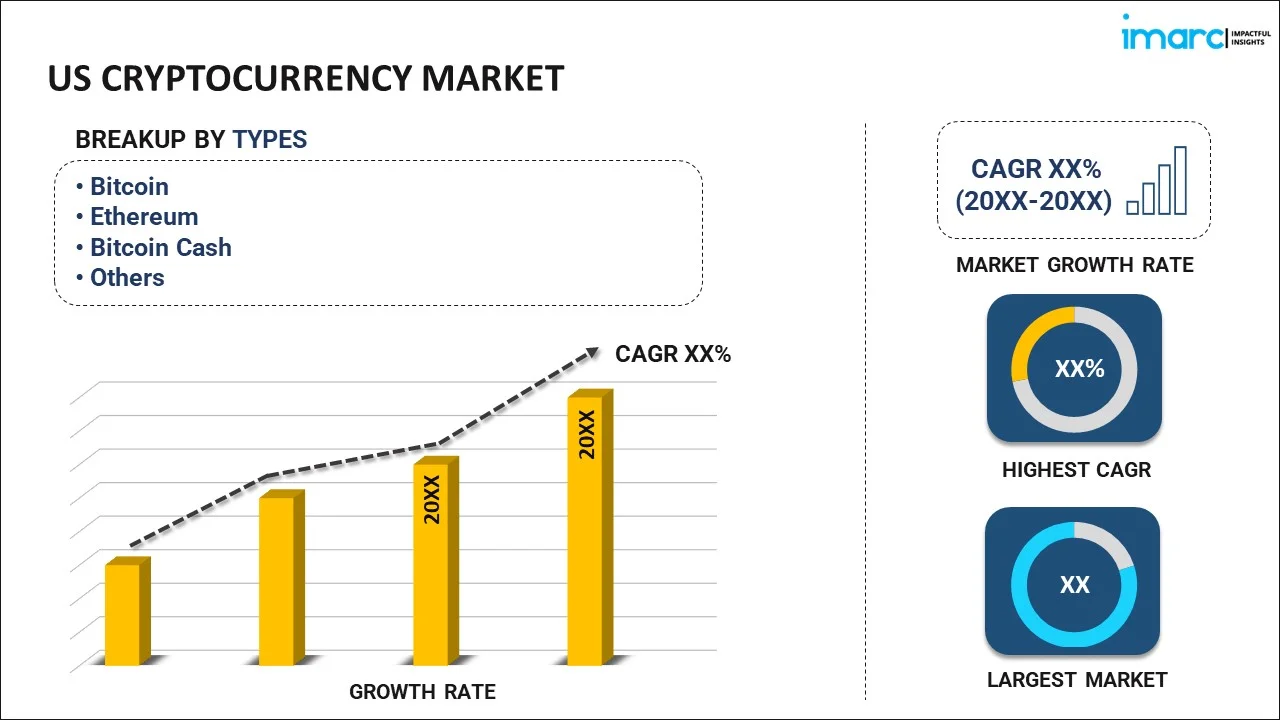

The United States cryptocurrency market is projected to exhibit a growth rate (CAGR) of 58.88% during 2024-2032. Numerous initiatives undertaken by the government in regulatory developments and legal clarity surrounding cryptocurrencies, the advancements in blockchain networks, DeFi platforms, and NFTs and the increasing adoption and awareness among the masses represent some of the key factors driving the market.

Cryptocurrency refers to digital or virtual currencies that utilize cryptography for security and operate on decentralized networks known as blockchains. Blockchain is the fundamental technology behind cryptocurrencies that has the potential to revolutionize various industries, including supply chain management, voting systems, and identity verification, by providing transparent, secure, and immutable record-keeping capabilities. One of the key features of cryptocurrencies is decentralization, which means that they are not controlled or regulated by any central authority, such as a government or financial institution. Instead, transactions and the creation of new units of cryptocurrency are managed by a network of computers. It offers several advantages over traditional fiat currencies, such as they enable fast and secure peer-to-peer transactions without the need for intermediaries, and eliminating the delays and costs associated with traditional payment systems. Additionally, cryptocurrencies provide individuals with greater control over their finances, as users hold the private keys to their digital wallets and have direct ownership of their funds. As a result, it is gaining widespread traction due to its potential to revolutionize various aspects of finance and technology.

US Cryptocurrency Market Trends:

The United States cryptocurrency market is driven by the presence of a regulatory environment. Also, Finally, regulatory developments and legal clarity surrounding cryptocurrencies, including guidelines for ICOs and investor protection, provide confidence and attract investment, which is creating a positive market outlook. Institutional adoption is another significant driver, as more banks, asset managers, and hedge funds recognize the potential of cryptocurrencies as an investment asset class, bringing legitimacy, liquidity, and capital into the market is providing an impetus to the demand. Furthermore, the development of robust market infrastructure, including regulated exchanges and custodial services, provides a secure environment for investors significantly supporting the adoption of cryptocurrencies across the United States. Additionally, continual technological innovation, such as the advancements in blockchain networks, DeFi platforms, and NFTs, is impelling the growth and diversification. In addition to this, the increasing consumer adoption and awareness, driven by broader acceptance and integration of cryptocurrencies in various industries, is also contributing to market expansion. Apart from this, economic uncertainty and inflation concerns are encouraging individuals and institutions to seek alternative investment options, thus influencing the market. The market is further driven by extensive media coverage of cryptocurrencies, particularly during periods of market volatility or major events, has a significant impact on market sentiment and investor interest. Positive coverage highlighting success stories or adoption by prominent companies and negative coverage highlighting risks or regulatory concerns can drive market trends and influence investor behavior.

US Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States cryptocurrency market report, along with forecasts at the country level for 2024-2032. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the United States cryptocurrency market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the United States cryptocurrency market based on the component has also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the United States cryptocurrency market based on the process. This includes mining and transaction.

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the United States cryptocurrency market based on the application has also been provided in the report. This includes trading, remittance, payment and others.

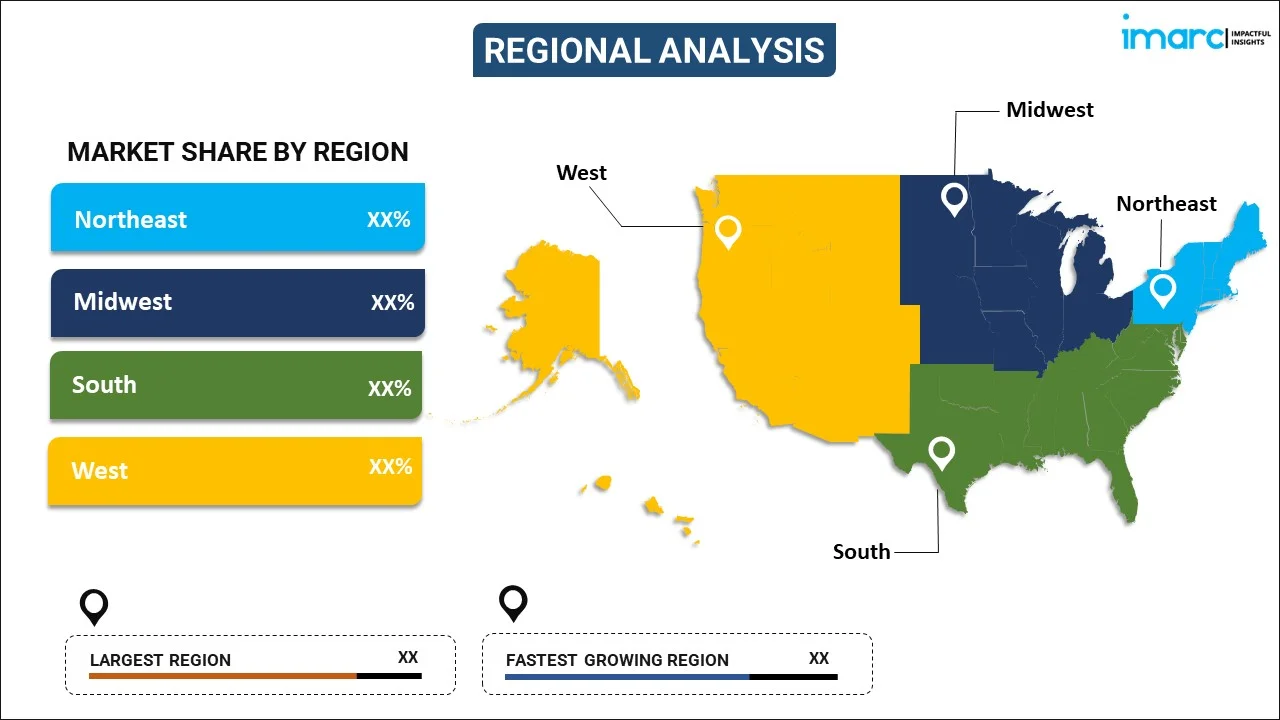

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South and West.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the United States cryptocurrency market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Units | US$ Billion |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Report Price and Purchase Option | Single User License: US$ 2699 Five User License: US$ 3699 Corporate License: US$ 4699 |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States cryptocurrency market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the United States cryptocurrency market?

- What is the breakup of the United States cryptocurrency market on the basis of type?

- What is the breakup of the United States cryptocurrency market on the basis of component?

- What is the breakup of the United States cryptocurrency market on the basis of process?

- What is the breakup of the United States cryptocurrency market on the basis of application?

- What are the various stages in the value chain of the United States cryptocurrency market?

- What are the key driving factors and challenges in the United States cryptocurrency market?

- What is the structure of the United States cryptocurrency market and who are the key players?

- What is the degree of competition in the United States cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States cryptocurrency market from 2018-2032.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)