US Alfalfa Market Size, Share, Trends and Forecast by Product Type, Animal Type, and Region, 2025-2033

US Alfalfa Market Size and Share:

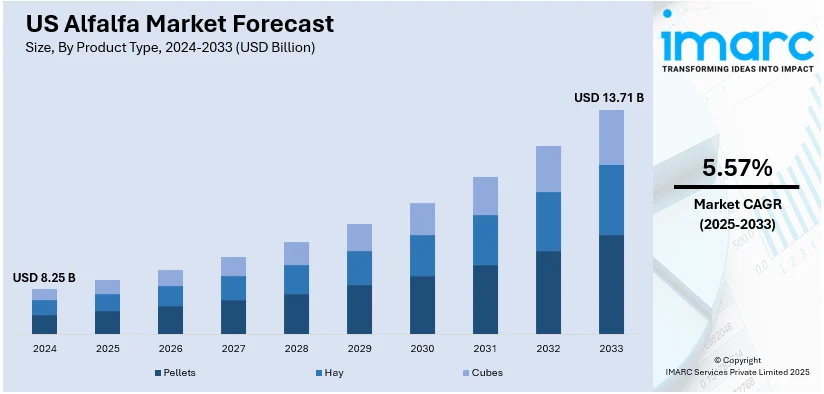

The US alfalfa market size was valued at USD 8.25 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.71 Billion by 2033, exhibiting a CAGR of 5.57% from 2025-2033. Rising demand from the dairy and livestock industries, increasing exports, advancements in seed technology, water-efficient irrigation practices, government support for sustainable agriculture, fluctuating feed costs, strong production in the Midwest due to favorable climate, growing adoption of high-yield alfalfa varieties, and expanding market opportunities in export-driven regions are positively impacting the US alfalfa market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.25 Billion |

|

Market Forecast in 2033

|

USD 13.71 Billion |

| Market Growth Rate (2025-2033) | 5.57% |

US Alfalfa Market Analysis:

- Major Drivers: The U.S. alfalfa industry is fueled by increasing demand for high-protein forage in animal feed, especially dairy and beef segments. Its use for increasing soil fertility and sustainability contributes to adoption. Export demand, particularly from Asia and the Middle East, also reinforces market growth in the US alfalfa market analysis, which provides diversified income to farmers.

- Key Market Trends: Precision agriculture practices, water-saving irrigation, and genetically enhanced alfalfa cultivars are influencing production methods. Rising utilization of alfalfa pellets and cubes increases transport and storage efficiency. Consumer demand for organic and non-GMO alfalfa supports premium segments. Export trends indicate changes towards quality-conscious international buyers prioritizing protein content and safety.

- Market Opportunities: Potential exists to open up export channels, particularly to China, Japan, and the Middle East, where high-quality forage demand is increasing. The development of pest- and drought-tolerant alfalfa varieties allows for resilience. Increasing organic livestock production and alternative protein demand provide room for high-end alfalfa products, which provide farmers greater value margins.

- Market Challenges: According to US alfalfa market forecast, some of the Key challenges are water scarcity because alfalfa is water-intensive, which exposes production to climate change and regulatory limits. Increasing input prices, land competition, and trade policy volatilities impact profitability. Pest pressures and disease outbreaks contribute risk. Dairy and livestock price volatility directly influences alfalfa demand stability and farmer income.

The market in the US is majorly driven by the rising demand for high-protein animal feed, particularly in the dairy and beef industries, where alfalfa is a key ingredient for improving livestock nutrition. Additionally, expanding exports of alfalfa hay to countries such as China, Japan, and Saudi Arabia have increased production and trade opportunities for U.S. farmers, which in turn is fostering the market. Moreover, ongoing technological advancements in irrigation and harvesting techniques have improved yield efficiency, making alfalfa cultivation more profitable, thereby fueling alfalfa market growth in the U.S. For instance, on October 31, 2024, USDA’s National Agricultural Statistics Service published the results of the 2023 Irrigation and Water Management Survey on October 31, 2024. In 2023, 212,714 farms used 81.0 million acre-feet of water to irrigate 53.1 million acres, according to the survey. Notably, energy costs for pumping water totaled USD 3.3 Billion, while equipment expenditures reached USD 3 Billion. Apart from this, rising consumer awareness of organic dairy and meat products has fueled the demand for organically grown alfalfa, contributing to the market growth further. Also, the growing preference for sustainable and non-GMO livestock feed has also contributed to the overall US alfalfa market demand.

To get more information on this market, Request Sample

Furthermore, climate adaptability and drought-resistant alfalfa varieties have supported its cultivation in arid and semi-arid regions, ensuring stable production. Increasing investments in research and development have led to improved seed genetics, bolstering disease resistance and overall crop productivity is a key significant growth inducing factor for the alfalfa market in the U.S. Besides, government subsidies and incentives for forage crop cultivation have encouraged farmers to expand their alfalfa acreage, supporting the market further. For instance, on August 22. 2024, The U.S. Department of Agriculture stated that USD 82.3 Million would be distributed to 65 beneficiaries to increase the competitiveness of specialty crops, such as nursery crops, fruits, vegetables, and tree nuts. Of this money, USD 9.4 Million supports 11 projects through the Specialty Crop Multi-State Program, and USD 72.9 Million is allocated for the Specialty Crop Block Grant Program, which benefits 54 states and territories. Also, improved supply chain logistics and storage facilities have enabled better distribution and reduced post-harvest losses, creating a positive US alfalfa market outlook. Additionally, the diversification of alfalfa-based products, such as pellets and cubes, has expanded its market reach, catering to various livestock feed needs across the United States.

US Alfalfa Market Trends:

Rising Export Demand for Alfalfa Hay

The United States has seen a significant rise in alfalfa hay exports, driven by increasing demand from countries such as China, Japan, South Korea, and the United Arab Emirates. The high nutritional value of U.S. alfalfa makes it a preferred choice for international dairy and livestock industries. Trade agreements and favorable export policies have further strengthened global sales. Notably, on April 10, 2024, The Biden-Harris Administration declared major progress in opening up foreign markets for U.S. agriculture. Under Ambassador Katherine Tai's leadership, U.S. farmers and producers have gained access to markets worth billions of dollars since January 2021. Because of these efforts, tariffs and non-tariff barriers have decreased, making American agricultural products more competitive internationally. Additionally, logistical advancements in shipping and storage have enabled efficient transportation of alfalfa hay, ensuring quality retention and long-term export market growth. The expansion of global dairy production continues to drive this trend forward.

Adoption of Precision Agriculture in Alfalfa Cultivation

The integration of precision agriculture technologies, including GPS-guided machinery, drone-based field monitoring, and automated irrigation systems, has improved alfalfa yield and resource efficiency. For instance, on January 9, 2025, Topcon Agriculture and PFG America, the sole distributor of Deutz-Fahr tractors in the United States, established a strategic distribution partnership. Through this partnership, farmers across the country may now access Topcon's precision agriculture solutions, such as GPS-guided equipment and data management software, through PFG America's dealers. The partnership seeks to increase agricultural productivity and efficiency by giving access to cutting-edge technologies via PFG America's wide dealer network. Advanced soil analysis and data-driven fertilization techniques allow farmers to optimize nutrient application and reduce waste. Remote sensing technology enables real-time monitoring of crop health, facilitating early pest and disease detection. These innovations contribute to reduced operational costs and enhanced sustainability and support US alfalfa market growth. As more farmers adopt precision farming techniques, alfalfa production efficiency improves, supporting market expansion and increasing profitability for growers in the United States.

Growth in Alfalfa-Based Alternative Products

Beyond traditional livestock feed, alfalfa is increasingly being used in alternative markets such as pet food, pharmaceuticals, and bio-based products. Alfalfa’s high protein and mineral content make it a valuable ingredient in pet nutrition, particularly for rabbits, guinea pigs, and horses. Additionally, the expansion of plant-based health supplements has increased demand for alfalfa extracts due to their antioxidant and anti-inflammatory properties. For instance, on December 9, 2024, a new plant-based omega-3 supplement made from algae was unveiled by Nature's Bounty, providing a vegetarian substitute for conventional fish oil. To promote the health of the heart, joints, and skin, each softgel includes 1,000 mg of algal oil, which provides 520 mg of total omega-3 fatty acids, including 510 mg of EPA and DHA. Researchers are also exploring alfalfa-derived biofuels and biodegradable packaging materials, further diversifying its market applications. This shift toward alternative uses is contributing to broader market opportunities for alfalfa producers is therefore one of the major US alfalfa market trends.

US Alfalfa Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the US alfalfa market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and animal type.

Analysis by Product Type:

- Pellets

- Hay

- Cubes

Pellets play a crucial role in the U.S. alfalfa market as they provide a highly compact, nutrient-dense feed option that enhances storage efficiency and reduces transportation costs. These small, uniform particles are easier to handle and distribute, making them ideal for large-scale livestock operations. Pellets also ensure consistent quality, reducing waste and spoilage compared to loose hay. Additionally, they allow for the fortification of essential nutrients, improving animal health and productivity. Their extended shelf life and adaptability to automated feeding systems further contribute to their growing demand.

Hay remains the backbone of the U.S. alfalfa market, providing a natural and cost-effective forage solution for cattle, horses, and dairy livestock. It retains the original fiber structure of alfalfa, promoting healthy digestion and maintaining optimal gut function in ruminants. Hay is widely preferred for its palatability and high protein content, which supports milk production and weight gain in livestock. Despite storage challenges, advancements in baling technology have improved its longevity and ease of transport. Its flexibility in feeding programs continues to drive demand across the industry.

Cubes offer a balanced alternative in the U.S. alfalfa market, combining the benefits of both hay and pellets. These compressed, uniform blocks retain a high fiber content while being more convenient to store and transport than traditional hay. Cubes are particularly beneficial for equine nutrition, as they reduce dust exposure and minimize respiratory issues in horses. Their consistent size and density ensure controlled feeding, preventing overconsumption and waste. Additionally, they can be soaked for older animals or those with dental issues, further expanding their utility in the livestock sector.

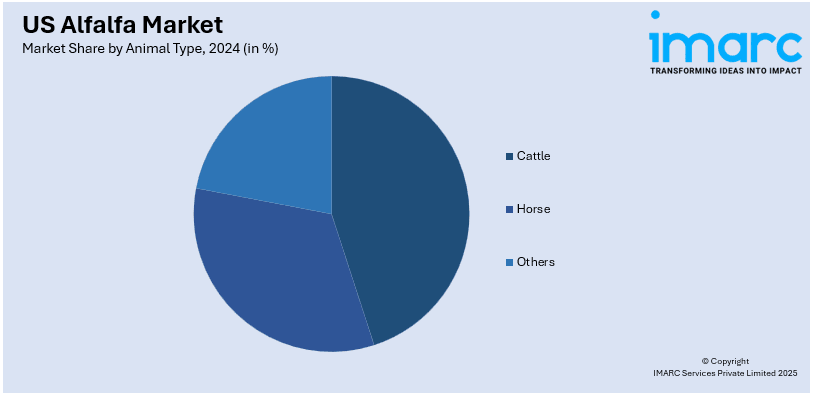

Analysis by Animal Type:

- Cattle

- Horse

- Others

Cattle play a crucial role in the U.S. alfalfa market, as dairy and beef producers rely on alfalfa for its high protein and digestibility. Alfalfa hay serves as a primary forage source, improving milk production efficiency in dairy cows while supporting optimal weight gain in beef cattle. Its high nutritional value, including essential vitamins and minerals, enhances overall herd health and reproductive performance. With the U.S. cattle industry continuously expanding, demand for high-quality alfalfa remains strong, driving consistent growth in production and trade.

Horses significantly contribute to the demand for alfalfa in the U.S., as equine owners prioritize high-quality forage for their animals' health and performance. Alfalfa provides horses with an excellent protein source, essential amino acids, and calcium, supporting muscle development, endurance, and recovery. It is particularly beneficial for racehorses, breeding mares, and growing foals, ensuring proper nutrition and energy levels. As the U.S. equine industry, including recreational riding and competitive sports, continues to thrive, the demand for premium alfalfa hay remains a key factor in market stability.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region plays a vital role in the U.S. alfalfa market due to its strong dairy and livestock industries, which create high demand for quality forage. The region’s moderate climate and well-distributed rainfall support steady alfalfa production, ensuring a consistent supply for local farmers. Despite smaller land availability compared to other regions, advanced farming practices and improved seed varieties enhance yield potential, making the Northeast a crucial contributor to the alfalfa market.

The Midwest is a dominant player in the U.S. alfalfa market, benefiting from its expansive agricultural land and fertile soils. States like Wisconsin and Minnesota rely heavily on alfalfa to support their dairy and beef cattle industries. The region's temperate climate and sufficient rainfall allow for multiple harvests per year, ensuring a steady supply. Additionally, the Midwest serves as a major hub for alfalfa seed development and research, leading to improved crop resilience. Strong infrastructure and access to export markets further enhance its role in national alfalfa production.

The Southern U.S. contributes significantly to the alfalfa market by providing year-round production capabilities due to its warm climate. States like Texas and Georgia cultivate alfalfa for both livestock feed and hay exports. While some areas face water availability challenges, advancements in irrigation and drought-resistant alfalfa varieties help sustain output. The growing cattle and poultry industries in the region drive high demand for forage crops. Additionally, proximity to ports allows for efficient export opportunities, positioning the South as a key supplier in both domestic and international markets.

The Western region is the largest producer of alfalfa in the U.S., with states like California, Arizona, and Idaho leading in production. The region’s arid climate requires extensive irrigation, but access to major river systems and aquifers helps sustain high yields. Western alfalfa is known for its premium quality, making it a preferred choice for dairy farms and international buyers. The strong export market, particularly to Asia, plays a crucial role in driving demand. Additionally, innovations in water management and sustainable farming practices help maintain the region’s competitiveness in the alfalfa market.

Competitive Landscape:

The market is highly competitive, driven by strong demand from the dairy, beef, and export sectors. Producers across different regions compete based on factors such as yield, forage quality, and water efficiency. Western states dominate production due to their large-scale irrigation systems and premium alfalfa quality, while the Midwest and South contribute significantly to domestic supply. Advancements in seed genetics, pest resistance, and sustainable farming practices further intensify competition. Additionally, international trade dynamics, fluctuating feed prices, and climate conditions impact market positioning, making efficiency and innovation critical for success.

The report provides a comprehensive analysis of the competitive landscape in the US alfalfa market with detailed profiles of all major companies.

Latest News and Developments:

- On January 13th, 2025, S&W Seed Company announced that its Board of Directors is exploring various strategic alternatives to enhance shareholder value. These potential opportunities include the company’s sales, a merger, a recapitalization, or the continued execution of the company's long-term business plan. The company has recently taken steps to strengthen its position, such as divesting from its Australian subsidiary and focusing on its core US-based sorghum and alfalfa operations.

- On September 9, 2024, the USDA’s National Institute of Food and Agriculture (NIFA) awarded a USD 936,000 grant to a research team led by UC Davis Professor Charlie Brummer. This initiative aims to identify genetic traits in alfalfa seed banks to develop climate-resilient and pest-resistant alfalfa varieties. In collaboration with Cornell University and the USDA Agricultural Research Service, the study will assess global alfalfa genetic resources to enhance adaptability, yield, and nutritional quality. By strengthening breeding programs, this research supports long-term sustainability in forage production under changing environmental conditions.

- On August 28, 2024, a USD 3.7 Million investment in the Alfalfa Seed and Alfalfa Forage System Program (ASAFS) was announced by the National Institute of Food and Agriculture (NIFA). With the help of plant breeding, better management techniques, and methods to lessen biotic and abiotic stressors, this funding supports initiatives that will increase alfalfa yields and quality. The initiative also promotes the investigation of novel applications for alfalfa, including the production of high-value chemicals, fish feed, and substitute protein sources for human use.

- On February 4, 2024, the Brazilian government declared that the United States has approved the importation of dried clove flower, yerba mate, alfalfa hay, and timothy hay from Brazil without the need for a phytosanitary certificate. International trust in Brazil's sanitary and phytosanitary standards is strengthened by this breakthrough. With beef, coffee, and orange juice among its top exports, Brazil cemented its status as the world's largest agricultural exporter to the United States in 2024.

US Alfalfa Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pellets, Hay, Cubes |

| Animal Types Covered | Cattle, Horse, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US alfalfa market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the US alfalfa market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US alfalfa industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alfalfa market in the US was valued at USD 8.25 Billion in 2024.

The US alfalfa market is projected to exhibit a CAGR of 5.57% during 2025-2033, reaching a value of USD 13.71 Billion by 2033.

The U.S. alfalfa market is driven by strong demand for high-protein livestock feed, especially in dairy and beef sectors. Growing exports, adoption of sustainable farming practices, and improvements in high-yield and resilient alfalfa varieties support market growth. Efficient irrigation and soil-enhancing benefits further encourage widespread cultivation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)