Urinary Incontinence Devices Market Size, Share, Trends and Forecast by Product, Category, Incontinence Type, Patient, End User, and Region, 2025-2033

Urinary Incontinence Devices Market Size and Share:

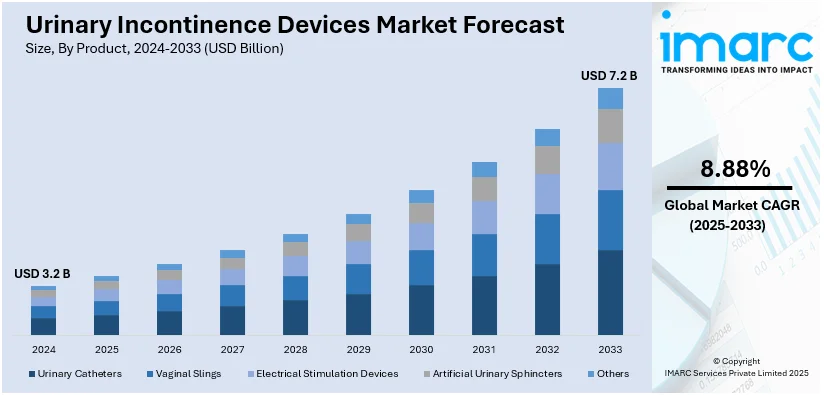

The global urinary incontinence devices market size was valued at USD 3.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.2 Billion by 2033, exhibiting a CAGR of 8.88% during 2025-2033. North America currently dominates the market in 2024. The growing occurrence of neurological diseases, diabetes, and obesity, the increasing number of individuals who are addicted to smoking and alcohol consumption, and the rising preference of patients to opt for minimally invasive (MI) treatment options represent some of the key factors driving the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.2 Billion |

|

Market Forecast in 2033

|

USD 7.2 Billion |

| Market Growth Rate 2025-2033 | 8.88% |

The global urinary incontinence devices market is primarily driven by an increasing geriatric population, which leads to a higher prevalence of incontinence among elderly individuals. Moreover, advancements in medical technology have led to the development of more comfortable, discreet, and effective urinary incontinence devices, further driving demand. Rising healthcare expenditure and a shift toward home healthcare services are also contributing to market growth, as patients increasingly prefer using these devices in the comfort of their homes. According to the IMARC Group, the home healthcare market size reached USD 424.0 Billion in 2024 and is forecasted to reach USD 816.4 Billion by 2033, exhibiting a CAGR of 7.48% during 2025-2033. Furthermore, the growing number of women experiencing incontinence issues is also expanding the market.

The United States has emerged as a key regional market for urinary incontinence devices, driven by the increasing geriatric population, as the incidence of incontinence increases with age, particularly among seniors. As per the National Council on Aging (NCOA), by 2040, adults over the age of 65 are projected to constitute 22% of the total population in the United States. In addition, increased awareness and education surrounding incontinence treatments have encouraged more individuals to seek devices to manage the condition. Technological advancements in urinary incontinence devices, which offer improved comfort, convenience, and discretion, are also fueling market growth. Moreover, the rising adoption of home healthcare services, combined with a preference for at-home management, has boosted demand for such devices.

Urinary Incontinence Devices Market Trends:

Increasing geriatric population globally

The urinary incontinence devices market growth is considerably influenced by the increasing geriatric population. According to industry reports, the total number of people aged 60 years and above is estimated to reach 2.1 Billion by 2050, making up 26% of the total global population. As lifespans continue to be longer, older populations are multiplying and with older age, patients increasingly suffer from urinary incontinence. It occurs when the patients develop weakened muscles in the pelvis. For instance, hypertrophied prostrate in males and alteration of hormonal conditions in females approaching the menopausal stage of life. The main reason these incontinence devices are in great demand is due to the fact that the demographic is highly prone to urinary disorders, creating a huge demand for effective management solutions. Incontinence devices such as absorbent pads, catheters, and external urinary devices play an essential role in helping the elderly manage their condition, hence propelling the market growth.

Significant technological advancements

Technological advancements in urinary incontinence product design and functionality are significantly driving the urinary incontinence devices market. What were originally large, cumbersome pieces have evolved to be highly effective, comfortable, and discreetly hidden. State-of-the-art technologies, for instance, now involve smart products for incontinence and wearables, leading to better absorption capabilities, improved fitting, and increased comfortability, which are all matters patients had reservations about with former products. Advanced materials such as breathable fabrics and moisture-wicking components further increase the attraction of these devices. Improvements in technology to make the device more functional, have better odor control, skin protection, and easy usage of the device make them more attractive for users, hence creating a demand globally.

Rising awareness and changing attitudes

Improving knowledge and evolving societal perceptions related to urinary incontinence have greatly contributed to its market development. In the past, urinary incontinence was considered a taboo subject and hidden by most. Consequently, such diagnosis and subsequent treatments were highly delayed. Mass campaigns for healthy lifestyles and health-related advocacy for increased awareness, particularly in regard to this matter, have eased much of that embarrassment about this condition. As a result, more people have been seeking some form of remedy, such as devices for urinary incontinence, rather than keeping silent about the condition. Furthermore, healthcare workers are now much more proactive in seeking to educate patients on the proper management of this condition, leading to increased knowledge of available devices. With growing awareness that this is a manageable condition, increased demand for devices continues to drive growth in the market.

Urinary Incontinence Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global urinary incontinence devices market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, category, incontinence type, patient, and end user.

Analysis by Product:

- Urinary Catheters

- Vaginal Slings

- Electrical Stimulation Devices

- Artificial Urinary Sphincters

- Others

Vaginal slings stand as the largest component in 2024. The primary reason for vaginal slings to dominate the urinary incontinence devices market is their effectiveness in treating stress urinary incontinence, particularly among women. The support provided by these devices helps the urethra and thereby prevents urine leakage during coughing or sneezing, among other physical activities. The device is minimally invasive and allows for relatively short recovery times with improved comfort as compared to other treatments. Vaginal slings are increasingly preferred because they provide a permanent solution, reducing the need for ongoing maintenance or repeated interventions. This combination of effectiveness, convenience, and durability continues to drive their dominance in the market.

Analysis by Category:

- External Urinary Incontinence Devices

- Internal Urinary Incontinence Devices

Internal urinary incontinence devices lead the market in 2024. The discreet, effective, and long-term management of urinary incontinence has led to internal urinary incontinence devices being the most dominating in the urinary incontinence devices market. Other devices in this category include urethral inserts, artificial urinary sphincters, and catheters, which provide an effective option to address stress as well as urge incontinence. All these devices promise better comfort and ease of living to patients. Patients find the devices appropriate because they are easy to use and adaptable to everyday activities. Internal devices are suitable for patients with more severe incontinence conditions and serve as a non-invasive but highly effective alternative to surgery. Their growth in adoption across health settings contributes to their market dominance.

Analysis by Incontinence Type:

- Stress Urinary Incontinence

- Urge Urinary Incontinence

- Overflow Urinary Incontinence

- Mixed Incontinence

Stress urinary incontinence represents the largest market share in 2024. Stress urinary incontinence, with a higher prevalence among females, dominates the market of urinary incontinence devices. Such an event mainly occurs due to pregnancy, childbearing, obesity, and old age, as all of these reduce the pelvic floor muscles' strength and, eventually, cause the loss of voluntary urine flow control by patients during sneezing, coughing, or doing exercises. As a result, there is a huge demand for effective and non-invasive devices to manage stress urinary incontinence, such as vaginal slings, pelvic floor stimulators, and urethral inserts. Long-term relief from these devices makes them the first choice in managing stress urinary incontinence, which propels their market dominance.

Analysis by Patient:

- Female

- Male

Female accounted for the leading market segment in 2024. Females form the majority share of the urinary incontinence devices market because, in comparison with men, there is a more significant prevalence of urinary incontinence among females, particularly stress urinary incontinence and urge incontinence. Pregnancy, childbirth, and menopause weaken pelvic floor muscles and make women more vulnerable to these conditions. The aging population and physiological differences in women's anatomy also increase the demand for urinary incontinence devices that are specifically designed. Thus, women are the largest demographic for incontinence treatment solutions, including devices such as vaginal slings, pelvic floor stimulators, and bladder control products, which is fueling the growth of the market.

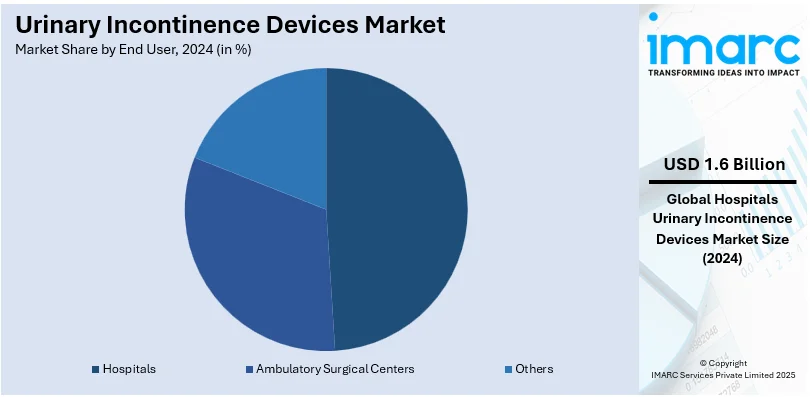

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Others

Hospitals exhibited a clear dominance in the market in 2024. Hospitals lead the market for urinary incontinence devices since they are key institutions in the diagnosis and treatment of patients with urinary incontinence, particularly in severe or complicated cases. Their care is special, including surgeries and access to more advanced devices for incontinence, such as artificial urinary sphincters, urethral slings, and catheters. In addition, hospitals have infrastructures that facilitate full care for patients and ensure long-term follow-up. The presence of trained healthcare professionals and a wide range of treatment options available make hospitals the primary setting for using urinary incontinence devices, hence driving their market share.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest urinary incontinence devices market share, due to various crucial factors. The area exhibits a significant occurrence of urinary incontinence, especially among the elderly, creating a need for innovative solutions. Additionally, the area features a robust healthcare infrastructure that promotes the integration of advanced medical technologies. Supportive reimbursement policies additionally motivate patients and healthcare providers to use these devices. Furthermore, North America hosts leading manufacturers and suppliers of urinary incontinence products, enhancing product accessibility and innovation. The significant focus on research and development results in the launch of technologically sophisticated products, including minimally invasive instruments and wearable technologies, improving patient comfort and satisfaction.

Key Regional Takeaways:

United States Urinary Incontinence Devices Market Analysis

The rising adoption of urinary incontinence devices is closely tied to advancements in the healthcare sector. For instance, U.S. healthcare companies are securing venture capital deals of USD 15 Million and are driving robust investment growth, focusing on innovation in medical technology to meet rising market demands. Enhanced technological integration in diagnostics and treatment methodologies has elevated the efficiency and reliability of these devices. Healthcare providers are increasingly focusing on patient-centric care, incorporating minimally invasive solutions that offer comfort and long-term benefits. The availability of training programs for medical practitioners on device usage has further driven the preference for these advanced solutions. Additionally, the expansion of clinical trials has enabled innovation in material design and improved usability, making these devices more appealing. Access to state-of-the-art medical equipment and growing awareness about addressing urinary incontinence effectively have bolstered demand. Consumer confidence in modern treatment options and continuous product innovations designed for comfort and discretion play a vital role. Overall, increasing acceptance of innovative healthcare interventions continues to propel the market.

Asia Pacific Urinary Incontinence Devices Market Analysis

The prevalence of diabetes significantly influences the adoption of urinary incontinence devices in Asia Pacific, as the condition often leads to complications that require such interventions. According to the National Library of Medicine, the prevalence of diabetes in India has risen from 7.1% in 2009 to 8.9% in 2019. Rising healthcare literacy has encouraged early diagnosis and treatment, creating a growing demand for efficient solutions. The introduction of educational campaigns and improved access to medical infrastructure have empowered individuals to address their conditions proactively. Furthermore, advancements in manufacturing have reduced production costs, enabling a broader population to afford high-quality products. Collaborative efforts within the healthcare industry to offer tailored solutions have also strengthened the adoption rates. Increased participation in wellness programs focusing on diabetes management indirectly drives demand for complementary treatments, including incontinence care. Additionally, the integration of specialized features catering to the unique needs of patients with diabetes has made these devices more desirable. This upward trend reflects an evolving focus on holistic health management strategies.

Europe Urinary Incontinence Devices Market Analysis

Aging populations across the region have driven a marked increase in the adoption of urinary incontinence devices, as age-related health issues often necessitate their use. For instance, Europe's geriatric population is rising, with one in five Europeans now aged 65 or older, projected to approach 30% by 2050. Medical professionals are increasingly recommending urinary incontinence devices due to their effectiveness in managing age-associated conditions. Innovations in design have made them more comfortable and discreet, appealing to the elderly population. Community awareness initiatives emphasizing quality-of-life improvements have helped reduce the stigma around using such devices. Furthermore, the healthcare sector has prioritized solutions that ensure mobility and independence, aligning with the needs of older adults. Integration of user-friendly features, such as easy application and maintenance, has contributed to their growing popularity. The establishment of specialized healthcare facilities and home care services for senior citizens further supports this trend. As a result, the market is witnessing steady growth, catering to the unique requirements of the aging demographic.

Latin America Urinary Incontinence Devices Market Analysis

The rising incidence of obesity is a major factor driving the adoption of urinary incontinence devices in the region. According to a UN report, over the past 50 years, overweight and obesity rates have tripled, now impacting 62.5% of the region's population. Obesity is associated with an increased risk of urinary incontinence, prompting higher demand for effective management solutions. Advancements in healthcare have enabled better diagnosis and treatment, encouraging individuals to seek appropriate care. The availability of cost-effective and adaptable devices has also boosted their appeal. Awareness campaigns highlighting the link between obesity and urinary incontinence have played a significant role in reducing stigma and fostering demand for these devices. Additionally, improved access to healthcare professionals specializing in weight-related conditions has contributed to the growing adoption of incontinence management solutions.

Middle East and Africa Urinary Incontinence Devices Market Analysis

The expansion of healthcare infrastructure has significantly enhanced the adoption of urinary incontinence devices. According to the Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022, projected to expand further by 3-6% in facilities and 10-15% in professionals in 2023. Improved accessibility to medical services has enabled more individuals to seek treatment for incontinence issues. Efforts to raise awareness about effective management options have encouraged greater acceptance of these devices. Enhanced focus on offering patient-centric care has driven innovation in device design, making them more user-friendly and comfortable. Increasing availability of specialized training for medical practitioners has also boosted their recommendations. As a result, the market continues to grow, reflecting the region’s commitment to improving healthcare outcomes.

Competitive Landscape:

Key players in the urinary incontinence devices market are undertaking several strategic measures to drive the growth of the market. Leaders are focusing on product innovation and introducing advanced, more comfortable incontinence solutions with features such as better absorbency, breathability, and odor control. Additionally, they are investing in research and development (R&D) to incorporate smart technologies, such as wearable devices with sensors for real-time monitoring. These are further helped through strategic partnerships with healthcare providers and an expanding network of distribution. Besides this, the focus of companies on education and awareness regarding the benefits of these devices through focused marketing campaigns and awareness programs also increases product adoption in international markets.

The report provides a comprehensive analysis of the competitive landscape in the urinary incontinence devices market with detailed profiles of all major companies, including:

- B. Braun Melsungen AG

- Baxter International Inc

- Becton Dickinson and Company

- Boston Scientific Corporation

- Caldera Medical Inc.

- Coloplast A/S

- ConvaTec Group plc

- Cook Group Inc.

- Johnson & Johnson

- Kimberly-Clark Corporation

- Laborie Medical Technologies Inc.

- Medtronic plc

- Teleflex Incorporated

Latest News and Developments:

- December 2024: Pelvital has launched the next-generation FDA-cleared Flyte® System to treat all severities of stress urinary incontinence (SUI). This non-invasive, at-home solution strengthens pelvic floor muscles and now includes enhanced tracking through a new app and provider portal. The advancements aim to improve treatment outcomes and foster better provider-patient collaboration. Flyte offers a proven, effective alternative to invasive procedures, benefiting women with mild to severe SUI.

- November 2024: Medtronic launched the InterStim X Sacral Neuromodulation (SNM) system in India, aimed at treating overactive bladder (OAB), chronic fecal incontinence (FI), and non-obstructive urinary retention. This therapy targets nerve signals to improve bladder control and reduce symptoms like frequent urination. The implantation involves a two-stage process, allowing patients to evaluate effectiveness before permanent installation. The device features a long-lasting battery, a smart programmer for personalized settings, and MRI compatibility, enhancing patient care options.

- October 2024: BlueWind Medical presented two-year data from its OASIS pivotal study at AUGS and ICS 2024 conferences, showcasing the sustained efficacy and safety of its Revi® implantable Tibial NeuroModulation system for urgency urinary incontinence. Results demonstrated 97% patient satisfaction, reinforcing the therapy's role as a leading solution in pelvic floor disorder management.

- September 2024: The Asian Institute of Nephrology and Urology (AINU) has introduced a new AI-driven device to treat urinary incontinence, developed by JOGO. Using electromyography (EMG) biofeedback, the device retrains weakened pelvic muscles by monitoring and displaying muscle movements. Patients can regain muscle control through guided therapy. This innovative technology aims to improve the quality of life by restoring normal function.

- May 2024: The FDA has approved Yōni.Fit®, an intravaginal bladder support, for managing stress urinary incontinence (SUI) in women aged 18 and older. This prescription device offers temporary control of urine leakage during specific activities or for up to 12 hours without affecting voluntary urination. The clearance follows a clinical study (NCT03978741) demonstrating its safety and efficacy. Yōni.Fit provides a non-surgical option for women with SUI, enhancing daily activity management.

Urinary Incontinence Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Urinary Catheters, Vaginal Slings, Electrical Stimulation Devices, Artificial Urinary Sphincters, Others |

| Categories Covered | External Urinary Incontinence Devices, Internal Urinary Incontinence Devices |

| Incontinence Types Covered | Stress Urinary Incontinence, Urge Urinary Incontinence, Overflow Urinary Incontinence, Mixed Incontinence |

| Patients Covered | Female, Male |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun Melsungen AG, Baxter International Inc, Becton Dickinson and Company, Boston Scientific Corporation, Caldera Medical Inc., Coloplast A/S, ConvaTec Group plc, Cook Group Inc., Johnson & Johnson, Kimberly-Clark Corporation, Laborie Medical Technologies Inc., Medtronic plc, Teleflex Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the urinary incontinence devices market from 2019-2033.

- The urinary incontinence devices market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the urinary incontinence devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Urinary incontinence devices are medical tools designed to manage and treat involuntary leakage of urine. They include products such as catheters, slings, pessaries, and external devices that support bladder control. These devices are used for various conditions, such as stress or urge incontinence, and aim to improve patient comfort, restore normalcy, and enhance quality of life.

The global urinary incontinence devices market was valued at USD 3.2 Billion in 2024.

IMARC estimates the global urinary incontinence devices market to exhibit a CAGR of 8.88% during 2025-2033.

The increasing prevalence of urinary incontinence, rising awareness and acceptance of incontinence management solutions, technological advancements in non-invasive and wearable devices, growth in healthcare expenditure, and expanding adoption of urinary incontinence devices in homecare settings are the primary factors driving the global urinary incontinence devices market.

According to the report, vaginal slings represented the largest segment by product due to their effectiveness in providing long-term solutions for stress urinary incontinence, particularly in women.

Internal urinary incontinence devices lead the market by category, driven by their ability to offer more discreet and comfortable solutions for long-term management of urinary incontinence.

Stress urinary incontinence accounted for the largest market share by incontinence type due to its high prevalence, particularly among women, caused by factors such as pregnancy, childbirth, and aging.

Female represented the leading market segment by patient due to the higher prevalence of urinary incontinence among women, particularly after childbirth, menopause, and aging.

Hospitals hold the largest market share by end user, driven by their role as primary healthcare providers for patients with severe or chronic incontinence conditions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global urinary incontinence devices market include B. Braun Melsungen AG, Baxter International Inc, Becton Dickinson and Company, Boston Scientific Corporation, Caldera Medical Inc., Coloplast A/S, ConvaTec Group plc, Cook Group Inc., Johnson & Johnson, Kimberly-Clark Corporation, Laborie Medical Technologies Inc., Medtronic plc, Teleflex Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)