Urgent Care Apps Market Size, Share, Trends and Forecast by App Type, Clinical Area Type, and Region, 2025-2033

Urgent Care Apps Market Size and Share:

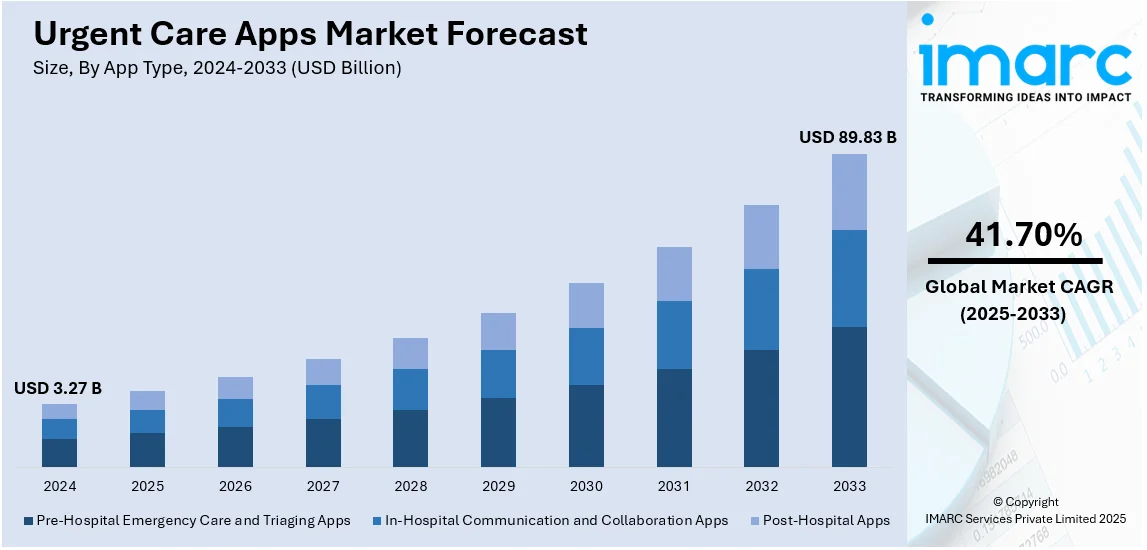

The global urgent care apps market size was valued at USD 3.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 89.83 Billion by 2033, exhibiting a CAGR of 41.70% from 2025-2033. North America currently dominates the market, holding a market share of over 38.2% in 2024. The market is growing due to increasing smartphone penetration, rising demand for instant medical assistance, and advancements in telemedicine. These apps enhance patient engagement, reduce emergency room visits, and improve healthcare accessibility. With continuous technological innovations and integration with AI, the market is expected to expand further, boosting urgent care apps market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.27 Billion |

| Market Forecast in 2033 | USD 89.83 Billion |

| Market Growth Rate (2025-2033) | 41.70% |

The urgent care apps market is driven by the rising adoption of smartphones, increasing demand for remote healthcare access and the growing prevalence of chronic diseases requiring immediate medical attention. According to the GSMA's 2023 report, 54% of the global population about 4.3 billion people own smartphones. Nearly 4 billion (49% of the population) use mobile internet via smartphones. However, 3.4 billion remain unconnected with significant usage gaps especially in Sub-Saharan Africa (59%) and South Asia (52%). Integration with telemedicine platforms, AI-driven symptom checkers and real-time communication between patients and healthcare providers enhance user engagement. Government initiatives promoting digital health solutions coupled with the expansion of 5G networks further accelerate market growth. The need for cost-effective, on-demand medical assistance is strengthening the adoption of urgent care apps globally.

The United States urgent care apps market is driven by increasing healthcare digitalization, rising emergency room congestion and growing demand for immediate medical assistance. The widespread adoption of telehealth, AI-powered triage systems and mobile health monitoring tools enhances accessibility to urgent care services. Strong government support for digital health solutions, advancements in 5G connectivity and the rising prevalence of chronic diseases further fuel market growth. According to the data published by CDC, 129 million Americans have at least one major chronic disease, with 42% facing two or more conditions. Chronic diseases including heart disease and diabetes are linked to five of the top ten leading causes of death. They account for 90% of the annual $4.1 trillion healthcare expenditure. Additionally, high smartphone penetration and consumer preference for on-demand healthcare services are accelerating the adoption of urgent care apps.

Urgent Care Apps Market Trends:

Increasing Prevalence of Various Health Conditions

The increasing prevalence of chronic diseases worldwide is significantly driving the urgent care app market. The World Health Organization (WHO) states that chronic conditions are the leading cause of mortality globally. For instance, ischemic heart disease accounted for around 8.89 million deaths in 2019. This surge in cardiac patients is further fueling the necessity for urgent care applications, which provide immediate medical assistance. Furthermore, the Global Stroke Fact Sheet 2022 from the World Stroke Organization reported more than 12.2 million new strokes occurring annually worldwide up to 2022. In addition, there is a growing demand for pre-hospital emergency care and triaging apps aimed at minimizing medication errors and enhancing training, which also supports market expansion. A randomized clinical trial conducted in August 2021, titled 'Effect of a Mobile App on Pre-hospital Medication Errors During Simulated Pediatric Resuscitation,' revealed a notable reduction in medication errors, drug preparation time, and delivery time when utilizing urgent care apps. Consequently, the urgent care apps market demand is expected to rise significantly.

Technological Advancements

Several emerging technologies, including Machine Learning, Big Data, and the Internet of Things (IoT), are transforming the mHealth sector. According to UN Trade & Development, the number of IoT devices is expected to grow by 2.5 times, reaching 39 billion by 2029, which will enhance connected healthcare systems and improve patient outcomes. Additionally, the market outlook is positive due to new product launches and strategic initiatives by key industry players. For example, in February 2021, Pulsara introduced Pulsara HQ, a web-based command center designed to improve patient coordination. This application enables clinicians to efficiently manage patient information and status in one central location. Likewise, in October 2023, Cedars-Sinai unveiled a new AI-driven mHealth application for California patients, offering virtual care for a variety of clinical conditions. The Cedars-Sinai Connect app provides 24/7 access to healthcare professionals for urgent needs and same-day appointments for primary care. Patients can use the app to seek assistance for a range of issues, including colds, headaches, anxiety, type 2 diabetes, wellness visits, and specialist referrals. In addition, in May 2023, Zocdoc, a leading healthcare platform that simplifies the process of finding and scheduling in-person or virtual care across over 200 specialties and various insurance plans, announced it would be incorporating Urgent Care into its offerings. This category is among the fastest growing on Zocdoc for both patients and providers. These advancements are expected to significantly boost the market value of urgent care apps in the coming years.

Increasing Number of Smartphone Users

The widespread use of mobile phones and the growing adoption of 4G and 5G networks are transforming communication methods and costs for pre-hospital emergency care systems. For example, as reported by the Telecom Regulatory Authority of India (TRAI), there were 829.30 million internet users in India as of December 31, 2021, marking a 4.29% increase from the previous year. Additionally, it is projected that by 2024, around 4.88 billion people will possess smartphones, representing a surge of 635 million new users from 2023 to 2024. Since 2020, the global smartphone user base has expanded by a factor of 2.15, adding 2.61 billion new smartphone owners. Moreover, increased investments, partnerships, mergers, and government initiatives aimed at promoting urgent care applications are contributing positively to the urgent care apps market outlook. For instance, in March 2020, Epic launched a new mobile application in partnership with OCHIN, designed to provide urgent care to individuals on the frontlines of the COVID-19 pandemic who lacked immediate access to electronic health records (EHR).

Urgent Care Apps Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global urgent care apps market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on app type and clinical area type.

Analysis by App Type:

- Pre-Hospital Emergency Care and Triaging Apps

- In-Hospital Communication and Collaboration Apps

- Post-Hospital Apps

- Medication Management Apps

- Rehabilitation Apps

- Care Provider Communication and Collaboration Apps

Post hospital apps stand as the largest app type in 2024, holding around 44.3% of the market. As per the urgent care apps market overview, the increasing awareness regarding benefits offered by urgent care apps in managing routine check-ups and the medicinal dosage is contributing to the substantial growth of the segment. In addition to this, various benefits offered by these apps, such as decreased costs, error reduction, improved treatment outcomes, enhanced patient experience, ensured proactive care, and better drug management, are further increasing the adoption of post-hospital apps.

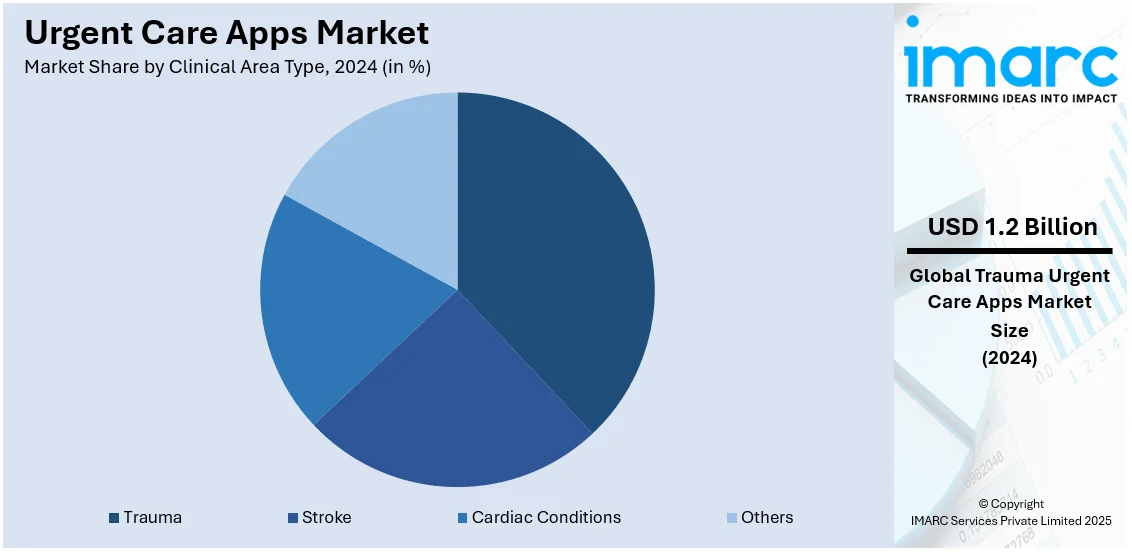

Analysis by Clinical Area Type:

- Trauma

- Stroke

- Cardiac Conditions

- Others

Trauma leads the market with around 37.4% of market share in 2024. Trauma refers to the psychological impact resulting from a profoundly distressing or disturbing event. The rising number of road accidents and other mentally challenging life experiences is driving the need for post-hospital care, leading to an increase in demand for urgent care apps in this area. According to a report from the World Health Organization published in 2019, around 1.3 million people die each year from injuries related to car accidents and road traffic incidents. It also noted that 93% of global road fatalities occur in low- and middle-income countries, which represent 60% of the world's vehicles.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.2%. A range of factors contributing to growth in the North American region includes an increasing aging population, supportive government initiatives, and advancements in technology. Additionally, the region benefits from a robust healthcare infrastructure and considerable medical spending, which further fuels market expansion. Research on the urgent care apps market highlights that numerous partnerships and acquisitions, along with the presence of major players in the United States, are poised to propel the growth of this market segment. For example, in February 2022, Stryker Corporation acquired Vocera Communications, and in April 2021, Vocera acquired PatientSafe Solutions. This consolidation by Stryker strengthened its offerings in the urgent care apps market. Consequently, such strategic developments are expected to enhance revenue in this sector in the years ahead.

Key Regional Takeaways:

United States Urgent Care Apps Market Analysis

In 2024, the United States accounted for over 89.70% of the urgent care apps market in North America. The United States urgent care apps market is witnessing rapid growth due to increasing digitalization in healthcare and the rising adoption of mobile health solutions. Consumers are increasingly becoming aware of the benefits of real-time medical assistance and remote healthcare services, leading to the integration of urgent care apps with telemedicine platforms for on-demand consultations and prescription management. Additionally, the integration of wearable devices and AI-driven diagnostics is enhancing user experience and improving healthcare outcomes. According to reports, the use of technology, including artificial intelligence (AI), continues to grow in healthcare. In 2024, U.S. digital health startups raised USD10.1 Billion across 497 deals, with USD1.8 Billion secured from 118 deals in Q4 alone. This influx of investment is fostering innovation in urgent care apps, enabling improved functionalities such as AI-powered triage, remote monitoring, and predictive analytics for personalized healthcare. The increasing prevalence of chronic diseases and the need for immediate medical intervention are driving more users toward these digital solutions. The market is also benefiting from the growing emphasis on patient-centric care, where urgent care apps are playing a pivotal role in reducing emergency room visits and streamlining healthcare services.

Europe Urgent Care Apps Market Analysis

The Europe urgent care apps market is expanding rapidly due to telemedicine and digital health solutions. These apps offer efficient alternatives to traditional visits, benefiting from rising mobile healthcare awareness and an aging population. The integration of AI and machine learning improves diagnostics and treatment recommendations. Moreover, the strong growth of the broader telehealth sector is playing a crucial role in driving the urgent care apps market forward. The Europe telehealth market was valued at USD 5.7 Billion in 2024, and IMARC Group projects it to reach USD 23.4 Billion by 2033, growing at a CAGR of 17.1% from 2025 to 2033. This rapid expansion reflects the increasing acceptance of digital healthcare solutions, which is expected to further boost the adoption of urgent care apps. The digital health market is experiencing growth due to favorable regulations, technological advancements, and the adoption of on-demand services. Urgent care apps are expected to streamline patient care and reduce healthcare facility pressure, further driving the market's upward trajectory.

Asia Pacific Urgent Care Apps Market Analysis

The Asia Pacific urgent care apps market is expanding rapidly, fueled by increasing smartphone adoption and the growing preference for digital healthcare solutions. Healthcare apps are enhancing accessibility through virtual consultations, symptom assessment tools, and medication management. The demand for remote services is driving market growth, with AI-driven diagnostics and telemedicine integration enhancing urgent care apps' effectiveness. The expansion of digital health initiatives is also contributing to the widespread adoption of these solutions. The increasing penetration of smartphones is further accelerating the market growth. For instance, as per the India Brand Equity Foundation, the Indian smartphone market grew by 7.2%, reaching 69 Million units in the first half of 2024, highlighting the region's growing digital connectivity. Urgent care apps are transforming healthcare by improving patient care and medical accessibility, with the Asia Pacific market expected to experience strong growth due to advancements in technology.

Latin America Urgent Care Apps Market Analysis

The Latin America urgent care app market is expanding due to the widespread adoption of mobile healthcare solutions, including telemedicine services, which enhance patient engagement. The growing focus on digital health transformation is enhancing the adoption of these apps, allowing healthcare providers to offer more efficient and accessible services. A report by the Brazilian Institute of Geography and Statistics (IBGE) states that nearly 80% of households in urban areas now have access to the internet, a figure that continues to grow with expanding infrastructure. This increasing internet penetration is driving the adoption of mobile health solutions. With continuous advancements in digital healthcare, urgent care apps are becoming an integral part of healthcare delivery, supporting better patient outcomes and medical accessibility across Latin America.

Middle East and Africa Urgent Care Apps Market Analysis

The Middle East and Africa urgent care apps market is expanding as digital healthcare solutions gain traction. These apps provide users with access to virtual consultations, real-time health monitoring, and medication management, improving healthcare accessibility. The increasing adoption of mobile health technologies is driving market growth. Telemedicine expansion and digital healthcare initiatives are enhancing the role of urgent care apps in streamlining medical services. In Saudi Arabia, for instance, the telehealth market reached USD 657.2 Million in 2024 and is expected to grow at a CAGR of 20.6% during 2025-2033, reaching USD 4,112.7 Million. This rapid expansion reflects the region’s increasing reliance on digital healthcare solutions. As mobile health continues to evolve, urgent care apps are playing a crucial role in improving healthcare services across the region.

Competitive Landscape:

The urgent care apps market is highly competitive, driven by increasing demand for real-time healthcare solutions and telemedicine integration. Companies are focusing on enhancing user experience, expanding functionalities, and integrating AI-powered features for improved diagnostics and patient monitoring. Strategic partnerships, mergers, and acquisitions are common strategies to strengthen market presence. Regulatory compliance and data security remain key concerns, influencing app development and adoption. Market players are also investing in cloud-based solutions and interoperability with electronic health records (EHRs) to improve efficiency. As competition intensifies, continuous innovation and scalability will be critical factors shaping the market's future growth.

The report provides a comprehensive analysis of the competitive landscape in the urgent care apps market with detailed profiles of all major companies, including:

- Alayacare

- Allm Inc.

- CommuniCare Technology Inc.

- Imprivata Inc.

- Medisafe

- Siilo

- TigerConnect Inc.

- Twiage Solutions Inc.

- Vocera Communications Inc. (Stryker Corporation)

Latest News and Developments:

- February 2025: Medisafe introduced PATHWAYS, a complimentary digital platform aimed at enhancing the coordination of Alzheimer's treatment. This tool assists healthcare professionals in monitoring dosing, testing, and patient advancements. PATHWAYS, tailored for FDA-approved monoclonal antibodies, fosters improved collaboration among care teams. Providers can effectively manage patients, organize testing schedules, and modify care plans securely while ensuring compliance with HIPAA regulations.

- January 2025: AlayaCare unveiled Layla, an AI-driven assistant designed for home-based caregiving that boosts efficiency and patient results. Fully integrated with AlayaCare Cloud, Layla offers caregivers instantaneous access to care information, maintains HIPAA compliance, and delivers real-time insights. CEO Adrian Schauer highlighted the significant impact of AI in overcoming challenges within the industry.

- March 2024: CHG Healthcare, a US-based company, launched two mobile apps, MyCompHealth and MyWeatherby, catering to healthcare providers involved in locum tenens assignments. These applications aim to create a thorough platform for clinicians who appreciate flexibility in temporary roles, ensuring seamless management of their assignments. The technology is also designed to assist hospitals and healthcare facilities in maintaining essential coverage and minimizing patient care gaps.

- February 2024: Imprivata rolled out a Biometric Patient Identity solution, employing facial recognition technology to enhance patient identification and safeguard privacy. Integrated with Epic, this innovation decreased instances of duplicate records and medical errors while being suitable for individuals wearing masks and glasses. Built on the Imprivata Cloud Platform, it bolstered security without the need for specialized equipment.

- October 2023: Cedars-Sinai launched an AI-enhanced mHealth application in California that offers patients virtual care options for a variety of clinical issues. The Cedars-Sinai Connect app provides 24/7 access to healthcare professionals for urgent care and facilitates same-day appointments for primary care. Through the app, patients can receive care for various conditions, such as colds, headaches, anxiety, type 2 diabetes, wellness check-ups, and specialist referrals.

Urgent Care Apps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| App Types Covered |

|

| Clinical Area Types Covered | Trauma, Stroke, Cardiac Conditions, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alayacare, Allm Inc., CommuniCare Technology Inc., Imprivata Inc., Medisafe, Siilo, TigerConnect Inc., Twiage Solutions Inc., Vocera Communications Inc. (Stryker Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the urgent care apps market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global urgent care apps market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the urgent care apps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The urgent care apps market was valued at USD 3.27 Billion in 2024.

IMARC estimates the urgent care apps market to reach USD 89.83 Billion by 2033, exhibiting a CAGR of 41.70% during 2025-2033.

The market is driven by increasing smartphone adoption, growing demand for instant healthcare access, and the rising prevalence of chronic diseases. Advancements in telemedicine, AI integration, and cloud-based solutions further boost market growth. Additionally, the need to reduce emergency room congestion and improve patient engagement accelerates adoption.

North America currently dominates the urgent care apps market, driven by advanced healthcare infrastructure, high smartphone penetration, and strong telemedicine adoption. Favorable government initiatives, rising healthcare costs, and increasing demand for real-time patient management further contribute to the region's leading market share.

Some of the major players in the urgent care apps market include Alayacare, Allm Inc., CommuniCare Technology Inc., Imprivata Inc., Medisafe, Siilo, TigerConnect Inc., Twiage Solutions Inc., Vocera Communications Inc. (Stryker Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)