Urban Air Mobility Market Size, Share, Trends and Forecast by Type, Operation, Range, Platform Architecture, End Use, and Region, 2025-2033

Urban Air Mobility Market Size and Share:

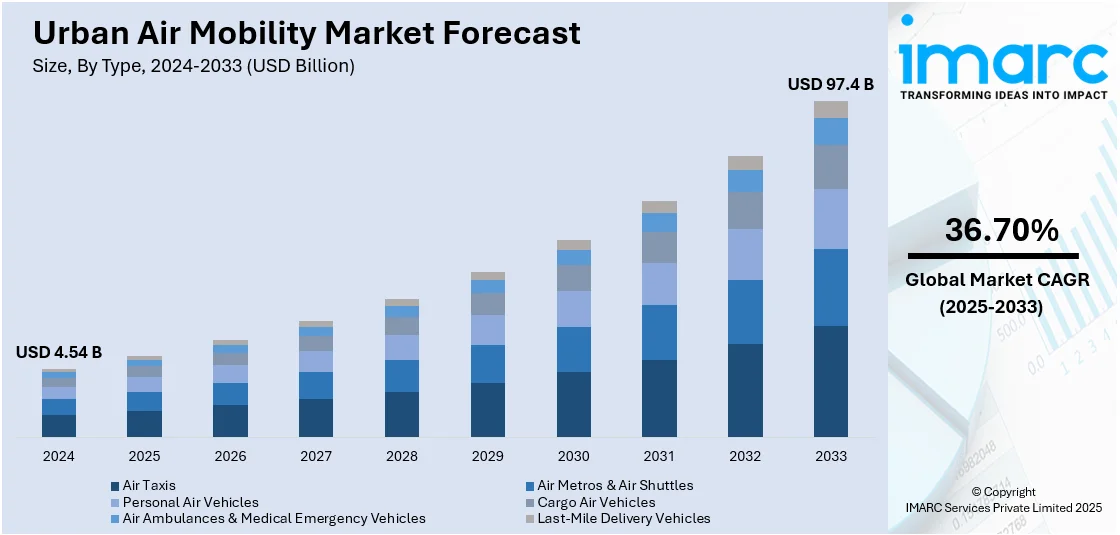

The global urban air mobility market size was valued at USD 4.54 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 97.4 Billion by 2033, exhibiting a CAGR of 36.70% from 2025-2033. North America currently dominates the market, holding a market share of over 42.5% in 2024. The advances in electric vertical takeoff and landing (eVTOL) aircraft, aiming to reduce urban congestion through effective air transport solutions, along with heavy public and private sector investments further spur the development and integration of UAM services within the region, thus contributing to the urban air mobility market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.54 Billion |

| Market Forecast in 2033 | USD 97.4 Billion |

| Market Growth Rate 2025-2033 | 36.70% |

The urban air mobility (UAM) market is undergoing rapid transformation, driven by the development of electric vertical takeoff and landing (eVTOL) aircraft, stepped-up investment, and increasing demand for efficient urban transportation solutions. Trends of note include the creation of lightweight, energy-efficient planes with the intent of minimizing emissions and operating efficiently in city settings. Large aerospace and automotive firms are collaborating with startups to speed up innovation and deliver scalable UAM solutions to the market. Moreover, regulatory agencies are also making efforts to define safety standards, air traffic control infrastructure, and certification processes to enable commercial operations. Infrastructure development, including vertiports and charging stations, is picking up pace in major metropolitan regions. Collaboration between public and private sectors plays an important role in creating a sustainable environment that can accommodate passenger and cargo transportation. As cities are looking to minimize congestion and enhance mobility, UAM is becoming an ultra-modern and feasible part of the overall smart city and transportation ecosystem.

The United States stands out as a key market disruptor, driven by its robust ecosystem of innovation, sophisticated regulatory systems, and powerful industry stakeholders. Boasting a healthy ecosystem of aerospace start-ups and long-standing aviation incumbents, the US is leading the acceleration of electric vertical takeoff and landing (eVTOL) aircraft and surrounding infrastructure development. The nation's forward-looking policymaking and readiness to make airspace rules flexible are creating a supportive climate for the expansion of UAM. Furthermore, partnerships among private businesses and public institutions that are strategically oriented are clearing the way for extensive commercialization and operational readiness. The United States also has a strong investment ecosystem and technology-forward consumer base that is ready to embrace future-ready transportation options. These factors place the US as a major market and a leading force in redefining the urban transportation scene, shaping the revolution in aerial mobility technology.

Urban Air Mobility Market Trends:

Emergence of Electric Vertical Takeoff and Landing (eVTOL) Aircraft

Among the most revolutionary urban air mobility trends is the speedy advancement of electric vertical takeoff and landing (eVTOL) aircraft. According to the IMARC Group, the global eVTOL aircraft market size reached USD 13.9 Billion in 2024 and is further expected to reach USD 37.0 Billion by 2033, exhibiting a growth rate (CAGR) of 11.4% during 2025-2033. These machines are made to be quiet, efficient, and without the carbon footprint of conventional helicopters or light planes. Their small size and ability to fly vertically make them well suited for urban settings where space is scarce, and traffic is heavy. eVTOLs are being created for passenger and cargo transport, providing a promising means of on-demand, short-range air travel. With advancements in battery technology, propulsion systems, and safety components, eVTOLs are becoming increasingly feasible for commercial applications. The transition to electric propulsion also coincides with the worldwide shift toward minimizing carbon footprints in the transportation industry. With increased interest from startups, aerospace companies, and ride-sharing operators, eVTOLs are redesigning the future of urban air mobility as a viable and environmentally friendly option.

Urban Air Mobility Infrastructure Development

With advances in UAM technologies, infrastructure development is emerging as a key factor providing a positive impact on the urban air mobility market outlook. The success of UAM systems depends on the innovation of aircraft along with the development of enabler infrastructure, including vertiports, maintenance facilities, and integrated air traffic management systems. Urban planners and technology companies are hence collaborating to engineer vertiports that are flexible enough to be integrated into the existing urban fabric, including rooftops, parking garages, and transport hubs. These terminals must be capable of supporting charging, boarding passengers, safety processes, and rapid vehicle turnaround. Seamless integration into existing transportation systems is also critical to ensure UAM supports, and not replaces, existing transportation modes. Urban air traffic management is also a critical element, and strong systems must be able to monitor and direct large numbers of low-altitude aircraft safely. The buildout of this infrastructure is complex yet inevitable, and it is a significant opportunity for cities to update and adapt to a more interconnected, aerial future. According to industry reports, the Advanced Air Mobility implementation plan, Innovate28, by the U.S. Federal Aviation Administration aims to facilitate large-scale AAM operations in the US by 2028, coinciding with the LA Olympics. The European Union, China, United Arab Emirates, and Japan are at varying levels of AAM development, with China being the initial nation to provide an Advanced Air Mobility type certificate, which is utilized to validate or certify an AAM vehicle. China is currently utilizing these vehicles for the transport of individuals.

Evolution of Regulation and Public Acceptance

Regulation and public opinion play pivotal roles in defining the direction of the UAM market. Governments and aviation regulators are striving to establish transparent frameworks that guarantee the safety, security, and scalability of UAM operations. These rules need to cover vehicle certification, pilot training (or autonomous flight), airspace integration, and noise requirements. As skies in cities become increasingly congested, coordination with current air traffic control systems will be essential. Aside from the technical rules, public acceptance is also vital. Citizens need to feel secure with planes flying over the populated urban areas and be assured of privacy, noise management, and environmental stewardship. Businesses are thus, investing in community engagement, pilot projects, and openness efforts to establish trust and at the same time, showcase the advantages of UAM—like decreased traffic, quicker travel, and lower emissions. The speed of regulatory advancement and public acceptance will ultimately decide how rapidly UAM moves from an idea to common reality.

Urban Air Mobility Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global urban air mobility market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, operation, range, platform architecture, and end use.

Analysis by Type:

- Air Taxis

- Air Metros & Air Shuttles

- Personal Air Vehicles

- Cargo Air Vehicles

- Air Ambulances & Medical Emergency Vehicles

- Last-Mile Delivery Vehicles

Air taxis lead the market with around 44.0% of market share in 2024. Air taxis are developing as the most prominent segment in the worldwide urban air mobility (UAM) market, fueled by increasing demand for speedy, efficient travel in densely populated cities. These electric vertical takeoff and landing (eVTOL) machines are designed for short-range, on-demand commuting, providing a futuristic alternative to ground-based conventional travel. Their potential to cut through traffic and offer direct, point-to-point transport places them in high demand for both business and recreational travelers. Air taxis are attracting attention as they are convenient and compatible with sustainable mobility objectives. Several companies are making significant investments in the commercialization and development of air taxi operations, collaborating with airlines, ride-sharing companies, and governments. As infrastructure like that of vertiports and air traffic management develop, air taxis will become a dominant feature of city transport, revolutionizing how cities are traveled.

Analysis by Operation:

- Remotely Piloted

- Fully Autonomous

- Hybrid

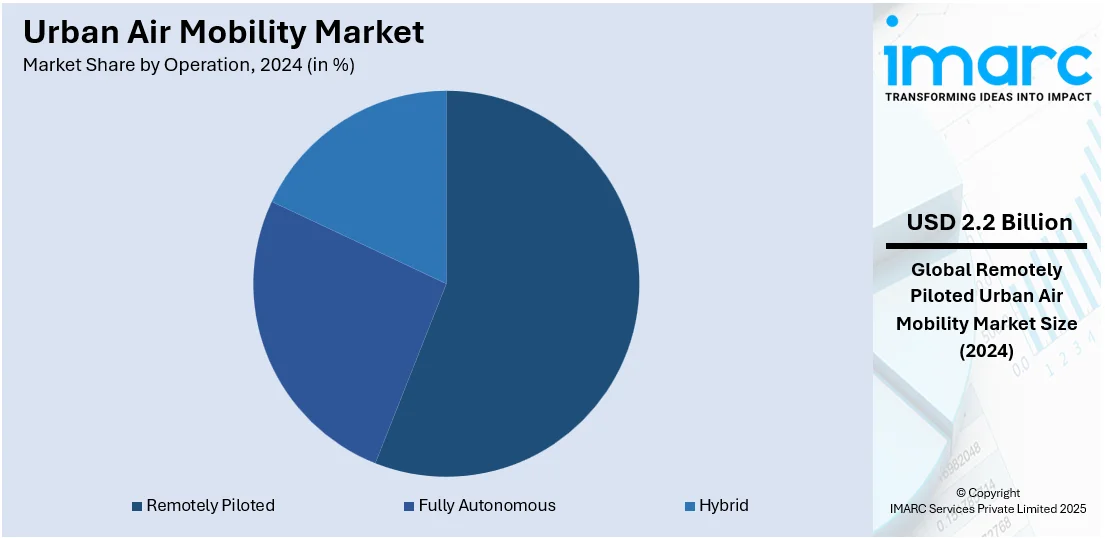

Remotely piloted leads the market with around 55.7% of market share in 2024. Remotely piloted operations are playing a vital intermediate role between manned piloted flights and autonomous systems. This type of operation enables more control and safety while taking advantage of advanced communication and navigation technologies. Under a remotely piloted configuration, trained pilots operate eVTOL (electric vertical takeoff and landing) aircraft from centralized command centers, maintaining accurate route management and rapid response to changing conditions. This model provides increased safety supervision, particularly in urban areas where regulatory needs are still being developed. It also minimizes the necessity for an onboard pilot, maximizing passenger or cargo capacity and efficiency. Remotely piloted systems enable developers and regulators to obtain operational data and hone protocols prior to fully autonomous flight. As trust and infrastructure become established, this strategy offers a scalable and adaptable operating framework, setting the stage for a smooth transition to autonomous urban air transport in the future.

Analysis by Range:

- Intracity

- Intercity

Intracity leads the market with around 53.6% of market share in 2024. Intracity travel directly targets the increasing problem of congestion and time wastage in high-density urban areas. This market targets short-distance, point-to-point intracity transportation within one city using eVTOL (electric vertical takeoff and landing) aircraft to move people between important locations like business districts, airports, and residential neighborhoods. The attraction of intracity UAM is its potential to dramatically shorten commute times, enhance productivity, and offer a high-end substitute for ground travel. Urban areas with heavy traffic congestion are well-positioned for UAM deployment, given the infrastructure and demand are conducive to the operating range of most early-generation UAM vehicles. Intracity routes also enable companies and regulators to pilot safety, logistics, and airspace integration prior to scaling to regional travel. As vertiports and digital air traffic infrastructures emerge, intracity UAM will become a revolutionary mobility solution.

Analysis by Platform Architecture:

- Fixed Wing

- Rotary Blade

- Hybrid

Rotary blade stands as the largest component in 2024, holding around 70.0% of the market. Rotary blade design is presently the most advanced platform segmentation because of its technological maturity, established design, and versatility in performing vertical takeoff and landing flight operations. Rotary blade configuration featuring multiple rotors or propellers is typical in helicopters and contemporary electric vertical takeoff and landing (eVTOL) aircraft. The rotary blade configuration provides better maneuverability, stability, and control, which are critical to effectively guide through complicated urban environments. Their ability to lift vertically means that planes can take off and land from small areas such as rooftops or vertiports, without the use of runways. Also, rotary blade platforms can be used for short, intracity flights, fitting in with today's demand for fast, efficient urban transportation. As noise suppression, protection systems, and battery integration improve with manufacturers, this platform is still an attractive option for initial commercialization. With regulatory authorities and infrastructure builders themselves also placing attention on rotary-based designs, this architecture is in the driver's seat when it comes to shaping the near-term future of UAM.

Analysis by End Use:

- E-Commerce

- Commercial Ridesharing Operators

- Private Operators

- Medical Emergency Organizations

- Others

Private operators lead the market share in 2024. Private operators are driven by their potential to innovate rapidly, make significant investments, and respond to changing market requirements. These operators, such as startups, airlines, and technology-enabled mobility companies, are leading the development and deployment of eVTOL aircraft and associated services. In contrast to government or public sector projects, private operators have the leeway to enter strategic partnerships, create proprietary technology, and establish scalable business models suited to urban mobility requirements. They are actively developing pilot programs, infrastructure planning, and regulatory cooperation, positioning themselves as central to defining the future of UAM. Focusing on high-value applications like air taxi services, cargo delivery, and corporate transportation, private operators are at the forefront of commercialization. Their emphasis on customer experience, operational efficiency, and swift deployment positions them at the center of the UAM market's initial growth and ultimate success.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 42.5%. North America is the dominant regional segment of the urban air mobility (UAM) market, fueled by its robust ecosystem of technological innovation, regulatory support, and engaged industry participation. The region, and the United States in particular, is home to a number of pioneering UAM firms that are creating and testing electric vertical takeoff and landing (eVTOL) aircraft and associated infrastructure. A supportive regulatory framework, with proactive bodies such as the Federal Aviation Administration (FAA), facilitates effective pilot schemes and rapid aircraft certification. Moreover, North America enjoys a developed aviation industry, strong investment climate, and sophisticated urban planning efforts, and hence represents an excellent environment for the adoption of UAM in its early stages. Collaborations among aviation authorities, city governments, and private operators are driving vertiport construction, air traffic management infrastructure, and public outreach campaigns. All these factors together put North America at the forefront of UAM implementation, laying the ground for global scalability and long-term domination.

Key Regional Takeaways:

United States Urban Air Mobility Market Analysis

In 2024, the United States accounted for over 83.70% of the urban air mobility market in North America. The United States is at the forefront of the urban air mobility (UAM) sector, driven by technological advancements, favorable regulatory environments, and huge investments. Joby Aviation and Archer Aviation are some of the companies that are spearheading the creation of electric vertical takeoff and landing (eVTOL) planes, which have the potential to transform urban transportation by curbing congestion and travel times. In June 2024, Archer Aviation was issued its Part 135 Air Carrier and Operator Certificate by the Federal Aviation Administration (FAA), a major milestone toward commercial operations. The FAA has also taken a leading role by providing new regulations in October 2024, and with this, the commercialization of electric air taxis will become possible, with operations starting by 2025. Additionally, the creation of the National Advanced Air Mobility Center of Excellence in September 2023 further highlights the region's drive for the development of UAM technology and infrastructure. These developments, complemented by considerable investments and a regulatory environment favorable for growth, make the United States the leading market in the UAM sector.

Europe Urban Air Mobility Market Analysis

Europe is aggressively moving forward with the urban air mobility (UAM) market, driven by technological advancements, friendly regulatory environments, and informed investments. Germany, France, and the United Kingdom are at the forefront of integrating eVTOL (electric vertical takeoff and landing) aircraft and autonomous drones into urban transportation systems. The European Union has provided regulatory frameworks to make sure that the integration of these technologies into urban space is ensured safely, with public-private partnerships being promoted to create essential infrastructure like vertiports and charging facilities. These efforts are intended to relieve urban congestion, mitigate carbon emissions, and improve transport efficiency. Recently, in December 2024, the most recent edition of the European ATM Masterplan was released by the Single European Sky ATM Research (SESAR) joint undertaking, outlining the roadmap and objectives for the digitization and integration of air traffic management in the European Union. U-space and eVTOL traffic oversight are essential components of the roadmap. A completely scalable system for piloted and non-piloted aviation (Phase D of the roadmap), backed by a digital framework, comprehensive air-ground system integration, distributed data services, and advanced automation and connectivity should be accomplished by 2045. Hence, the expansion of the UAM market is facilitated by Europe's focus on sustainability and technology, making the region a leading participant in the transformation of urban air mobility.

Asia Pacific Urban Air Mobility Market Analysis

The Asia Pacific urban air mobility (UAM) market is witnessing robust momentum, driven by fast-paced urbanization, growing need for effective intra-city transport, and government-driven smart city programs. China, Japan, South Korea, and India are leading the pack, actively driving the adoption of electric vertical takeoff and landing (eVTOL) aircraft into their urban transportation systems. Several unique factors fueling the urban air mobility demand includes the blending of highly concentrated mega-cities with a robust manufacturing and tech infrastructure, which makes it possible to quickly prototype, test, and scale UAM solutions. Governments are also actively engaged, providing regulatory assistance and facilitating collaboration among aerospace companies and city planners. Exhibitions like the 2025 Osaka Expo are being utilized as platforms for proving the viability of UAM technologies. Apart from this, in April 2025, Twenty-four Asia-Pacific nations and administrations collaboratively created a collection of reference documents on advanced air mobility (AAM) for civil aviation regulators in the Asia-Pacific region to support the operations of electric vertical take-off and landing (eVTOL) aircraft and uncrewed aircraft systems (UAS). The Civil Aviation Authority of Singapore (CAAS) states that this marks the first occasion in which regulators have collaborated to create a collection of reference resources that can be considered, modified, and utilized by regulators to prepare for and support the commercial operations of eVTOL aircraft and UAS in their individual jurisdictions. Hence, the region's focus on innovation, mobility modernization, and minimizing traffic congestion positions Asia Pacific a world leader in defining the future of aerial urban transport.

Latin America Urban Air Mobility Market Analysis

Latin America's urban air mobility (UAM) market is growing rapidly, fueled by fast-paced urbanization, technological innovation, and strategic investment. Brazil, Mexico, and Argentina are among the countries actively pursuing the integration of electric vertical takeoff and landing (eVTOL) aircraft into their transportation systems to mitigate urban congestion and improve mobility. One of the regional characteristic differences is its varied topography and large distances, which are challenges and possibilities for the applications of UAM in connecting distant places with cities. Initiative by governments to promote smart city developments and green mobility solutions is developing a favorable climate for the adoption of UAM. Public-private partnerships are enabling the construction of required infrastructure, including vertiports and charging points, as well as creating regulatory environments to enable safe operations. In March 2025, EHang, the top global company in Urban Air Mobility (UAM) technology, revealed the successful inaugural flight of its EH216-S unmanned electric vertical take-off and landing (eVTOL) aircraft in Mexico, signifying the first flight of this aircraft model in the country. This significant milestone extends EHang's international reach for the EH216-S, enhancing its flight coverage to 19 nations. This achievement strengthens Mexico's important position in the worldwide UAM market and also accelerates the progress of the global UAM sector. With its heavily populated urban centers, lively tourism industry, and well-established manufacturing sector, Mexico offers an excellent setting for the development of Advanced Air Mobility (AAM) solutions.

Middle East and Africa Urban Air Mobility Market Analysis

The Middle East and Africa (MEA) urban air mobility (UAM) industry is witnessing tremendous growth fueled by fast-paced urbanization, technology innovation, and strategic investments. Nations such as Saudi Arabia and the United Arab Emirates (UAE) are enthusiastically embracing electric vertical takeoff and landing (eVTOL) aircraft to become part of the transportation system to counter urban congestion and improve mobility. Moreover, government programs, like the mapping of air corridors for air taxis and cargo drones in the UAE and investments in Saudi Arabian aviation infrastructure, are fostering a supportive climate for the uptake of UAM. Recently, in March 2025, The Modern College of Business and Science (MCBS) along with Boeing revealed plans to work together on innovation and develop talent for the upcoming advanced air mobility sector in Oman. The collaborative initiative "Air Taxis and Advanced Air Mobility" will utilize MCBS' robust academic background and Boeing's industry knowledge to unlock the possibilities of this field in Oman. The program will offer MCBS’ undergraduate aviation students, 76% of whom are female, chances for innovative research to lead advancements in air mobility technologies. These collaborative efforts are making the MEA region a growing hotspot for UAM innovation, potentially revolutionizing urban transport on the continent.

Competitive Landscape:

Major players in the urban air mobility (UAM) industry are making strategic and innovative moves to drive the development and commercialization of future air transportation. Joby Aviation, Archer Aviation, Lilium, Volocopter, and EHang are investing heavily in the research, design, and testing of electric vertical takeoff and landing (eVTOL) aircraft. The focus is on advancing safety, increasing range, minimizing noise, and gaining regulatory certification. Partnerships with leading aerospace and automotive companies, airlines, and ride-hailing services are assisting in scaling up operations and integrating with current transportation systems. Most companies are engaging with government authorities to influence airspace rules, certification procedures, and urban planning, such as vertiports and charging points. Pilot schemes in major cities are being initiated to try out real-world operations and win public confidence. Concurrently, research and development are underway to advance autonomy, connectivity, and air traffic management to facilitate safe and efficient UAM systems. These simultaneous efforts demonstrate a common vision of mitigating urban congestion, improving mobility, and fostering sustainability. The combined energy of these stakeholders is positioning UAM as a revolutionary mode of transportation, with commercial launches expected in the near term across a number of regions.

The report provides a comprehensive analysis of the competitive landscape in the urban air mobility market with detailed profiles of all major companies, including:

- Airbus

- Archer Aviation Inc.

- BETA Technologies, Inc.

- Embraer Group

- Eve Holding, Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd

- Hyundai Motor Company

- Joby Aero, Inc.

- Lilium GmbH

- Safran Group

- Textron Inc.

- The AIRO Group, Inc.

- Uber Technologies, Inc.

- Vertical Aerospace

- Volocopter GmbH

- Wingcopter GmbH

Latest News and Developments:

- In January 2025, JetSetGo, a private airline offering private jet and helicopter services in India, revealed its collaborations with SkyDrive and Eve Air Mobility to create and implement urban air mobility (UAM) solutions in India. The declaration was presented at the Urban Air Mobility Expo, which is a segment of the Bharat Mobility Show.

- In March 2025, Archer Aviation revealed that it has finalized a deal with Ethiopian Airlines, marking it as the second client intending to implement Archer’s Midnight through the “Launch Edition” program. Ethiopian Airlines, the largest airline in Africa and a part of Star Alliance, runs a vast worldwide network, catering to more than 140 international locations across five continents. The pair will now collaborate to establish a fully electric air taxi system in the area utilizing Archer’s Midnight aircraft.

- In December 2024, Archer Aviation Inc. revealed that it has formed a multi-party partnership agreement with significant entities in the UAE and Abu Dhabi to promote the development of electric air taxi services in Abu Dhabi. The accord seeks to standardize the collaboration among UAE and Abu Dhabi participants in readiness for the debut of the inaugural commercial eVTOL flight.

- In June 2024, Airbus and Avincis, two prominent European helicopter operators, signed a Memorandum of Understanding (MoU) to collaborate on the advancement of Advanced Air Mobility (AAM). The firms will work together to investigate possibilities for utilizing electric vertical take-off and landing (eVTOL) aircraft across Europe.

- In August 2024, the Saudi Arabian General Authority of Civil Aviation revealed that it is collaborating with strategy consultants to develop its National Advanced Air Mobility plan and roadmap for the nation. The project seeks to create an innovative ecosystem for advanced air mobility, intending to improve mobility, logistics, environmental sustainability, quality of life, and economic development in Saudi Arabia. Kearney has been assisting with the overall strategy process, conducting market evaluations, and exploring significant opportunities for KSA, including the spill-over advantages to other sectors.

Urban Air Mobility Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air Taxis, Air Metros & Air Shuttles, Personal Air Vehicles, Cargo Air Vehicles, Air Ambulances & Medical Emergency Vehicles, Last-Mile Delivery Vehicles |

| Operations Covered | Remotely Piloted, Fully Autonomous, Hybrid |

| Ranges Covered | Intracity, Intercity |

| Platform Architectures Covered | Fixed Wing, Rotary Blade, Hybrid |

| End Uses Covered | E-Commerce, Commercial Ridesharing Operators, Private Operators, Medical Emergency Organizations, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airbus, Archer Aviation Inc, BETA Technologies, Inc, Embraer Group, Eve Holding, Inc, Guangzhou EHang Intelligent Technology Co. Ltd, Hyundai Motor Company, Joby Aero, Inc, Lilium GmbH, Safran Group, Textron Inc, The AIRO Group, Inc, Uber Technologies, Inc, Vertical Aerospace, Volocopter GmbH, Wingcopter GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the urban air mobility market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global urban air mobility market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the urban air mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The urban air mobility market was valued at USD 4.54 Billion in 2024.

The urban air mobility market is projected to exhibit a CAGR of 36.70% during 2025-2033, reaching a value of USD 97.4 Billion by 2033.

The urban air mobility market is driven by urban congestion growth, technology advancements in electric propulsion systems, and an upsurge in demand for environmentally friendly modes of transportation. Encouraging government policies, increasing investments in eVTOL aircraft, and smart city strategies also drive the market forward, making UAM a future prospect for low-emission, efficient urban travel.

North America currently dominates the urban air mobility market, propelled by technological innovation, supportive regulatory frameworks, and substantial investments. The region's robust aerospace sector and proactive agencies like the FAA foster UAM development. Collaborations among industry leaders, such as Joby Aviation's partnership with Toyota, drive advancements in eVTOL aircraft.

Some of the major players in the urban air mobility market include Airbus, Archer Aviation Inc., BETA Technologies, Inc., Embraer Group, Eve Holding, Inc., Guangzhou EHang Intelligent Technology Co. Ltd, Hyundai Motor Company, Joby Aero, Inc., Lilium GmbH, Safran Group, Textron Inc., The AIRO Group, Inc., Uber Technologies, Inc., Vertical Aerospace, Volocopter GmbH, Wingcopter GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)