Unsaturated Polyester Resins Market Size, Share, Trends and Forecast by Type, End-Use, Form, and Region, 2026-2034

Unsaturated Polyester Resins Market Size and Share:

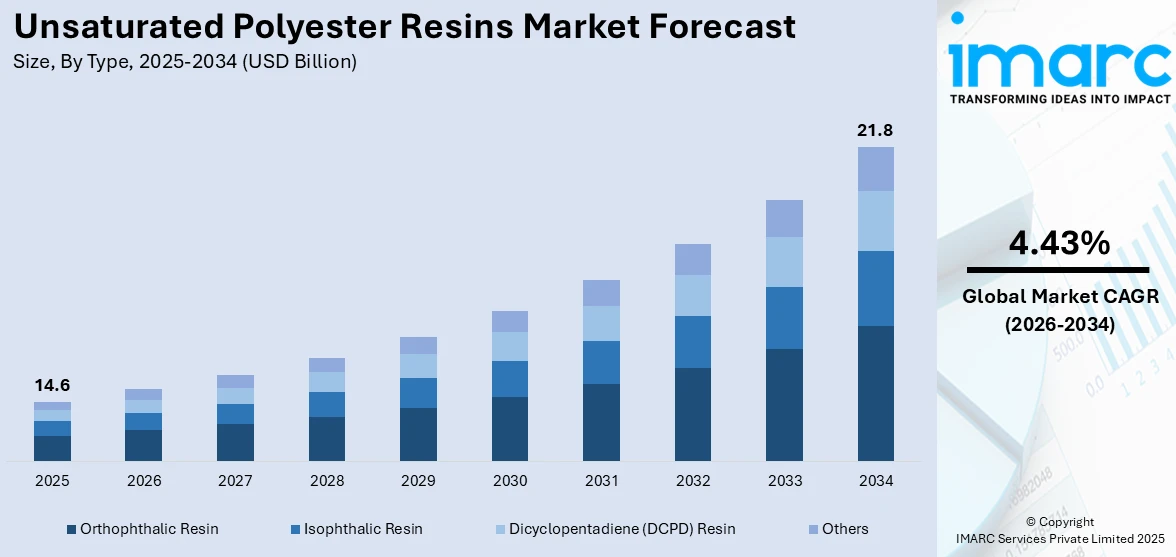

The global unsaturated polyester resins market size was valued at USD 14.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 21.8 Billion by 2034, exhibiting a CAGR of 4.43% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 58.0% in 2025. The market is driven by the rising product demand in construction, automotive, and marine industries due to its lightweight, high-strength and corrosion-resistant properties. Increasing infrastructure projects, expanding wind energy applications and advancements in composite materials are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 14.6 Billion |

|

Market Forecast in 2034

|

USD 21.8 Billion |

| Market Growth Rate (2026-2034) | 4.43% |

Unsaturated polyester resins are increasingly used in construction, automotive and marine industries due to its high strength, corrosion resistance and cost-effectiveness. This represents one of the key unsaturated polyester resins market trends. The growth in infrastructure projects and lightweight composite materials in transportation fuels the market expansion. According to the report published by the International Energy Agency, electric car sales are expected to rise by 3 million in 2024 primarily driven by China reaching around 10 million units a 25% increase. The U.S. anticipates a 20% rise totaling nearly 500,000 more sales. Europe’s growth is expected at less than 10% hitting 3.5 million units. Global sales outside major markets may surpass 1 million with India expecting 50% growth. The adoption in wind energy for turbine blades and ecofriendly bio-based resins also contribute to the demand. The market for UPR further grows due to advancements in manufacturing processes regulatory support for low-VOC resins and rising applications in electrical and consumer goods.

To get more information on this market Request Sample

The United States unsaturated polyester resins (UPR) market is driven by the rising demand in construction, automotive and marine industries due to their lightweight, durability and cost efficiency. According to the report published by the U.S. Census Bureau, in November 2024, U.S. construction spending reached an annual rate of $2,152.6 billion nearly unchanged from October. Private construction was $1,650.7 billion including $906.2 billion in residential spending. Public construction stood at $501.9 billion with highway projects increasing slightly to $142.9 billion. Year-to-date spending rose 6.5% from 2023. Infrastructure growth increasing adoption of composites in transportation and expanding applications in corrosion resistant tanks and pipes boost demand. The wind energy sector's reliance on UPR for turbine blades further accelerates growth. Regulatory focus on low-VOC and bio-based resins along with advancements in high-performance composites supports market expansion across various industrial applications.

Unsaturated Polyester Resins Market Trends:

Rising Demand from Construction Sector

The booming growth of the construction sector is substantially increasing the demand for unsaturated polyester resins. Infrastructure projects around the globe including bridges, highways and commercial buildings are increasingly adopting these resins due to their superior mechanical properties, durability and resistance to environmental factors. Unsaturated polyester resins are widely used in concrete reinforcement that enhances the strength and longevity of structures and protective coatings that offer robust resistance to corrosion and wear. Increased demand for sustainable and efficient building materials heightens their utilization. Unsaturated polyester resins are also increasingly being demanded within the construction industries due to widespread urbanization on a global basis and the consequent infrastructural development. It is projected to increase unsaturated polyester resins market revenue in the near future. For example, industry reports indicate that the construction sector in India experienced a robust growth of 13.3% during July-September 2023 compared to the same period in 2022 and a 7.9% rise in relation to the previous quarter. This significant growth played a crucial role in enhancing the country's GDP. Notably, new residential projects saw a substantial 24% increase. The construction boom attributed to rising per capita income and a severe housing shortage in major cities is projected to continue with estimates suggesting a 9.6% real term expansion for 2023.

Rapid Expansion in Automotive Industry

The automotive sector is increasingly moving towards lightweight yet durable materials that improve fuel efficiency and vehicle performance. This has significantly driven demand for unsaturated polyester resins which are known for their strength and versatility. These resins are used in various automobile components including body panels, interiors and under-the-hood parts to reduce the weight of the vehicle without compromising on durability. This trend supports the industry's thrust toward sustainability and regulatory demands to reduce emissions. As auto manufacturers continue to innovate and develop vehicle design the use of unsaturated polyester resins will increase and become an integral part of the automotive market. According to a report from the Society of Indian Automobile Manufacturers (SIAM), the Indian automotive sector experienced positive growth across all categories in April 2024. Total production comprising Passenger Vehicles, Three Wheelers, Two Wheelers and Quadricycles reached 2,358,041 units. Passenger Vehicle sales saw a slight increase of 1.3%, totaling 335,629 units. In contrast, Two-Wheeler sales surged by 30.8% with 1,751,393 units sold. The Three-Wheeler segment also saw a notable growth of 14.5% selling 49,116 units in April 2024 compared to the same month in 2023.

Increasing Demand from Aerospace and Marine Sector

The marine and aerospace industries are increasingly using unsaturated polyester resins due to their excellent corrosion resistance and mechanical strength. In the marine industry resins are inevitable for building strong and light hulls, decks and other parts to ensure long lasting performance in aggressive saltwater environments. Unsaturated polyester resins are used in the aerospace industry for manufacturing lightweight yet strong composite materials for aircraft interiors and structural parts. This adoption helps reduce overall weight, improving fuel efficiency and performance. The growing use of these resins in both industries is significantly driving unsaturated polyester resins market growth supported by continuous advancements in resin technology. According to the unsaturated polyester resins market forecast the demand for unsaturated resins is expected to increase significantly mainly due to their growing application in the marine and aerospace sector. According to the report published by IEA, India's civil aviation industry is experiencing significant growth with expectations of exceeding 500 million air travelers by 2030 and aspiring to take the lead in the global aviation market by 2047. In 2022, domestic air passenger numbers surged by almost 50% while international traffic rose by more than 150%. The nation had 147 airports in 2022 with plans to expand that number to 220 by 2025. The Airports Authority of India (AAI) is pursuing an ambitious privatization strategy aiming to bundle profitable and loss-making airports in the sales process.

Unsaturated Polyester Resins Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global unsaturated polyester resins market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, end-use and form.

Analysis by Type:

- Orthophthalic Resin

- Isophthalic Resin

- Dicyclopentadiene (DCPD) Resin

- Others

Orthophthalic resin stand as the largest type in 2025, holding around 35.7% of the market. Orthophthalic resin holds the highest market share in the Unsaturated Polyester Resins (UPR) market primarily due to its cost-effectiveness, versatility and wide applicability in industries. It has excellent mechanical properties, chemical resistance and ease of processing making it ideal for construction, marine and automotive sectors. Growing demand for lightweight, durable and corrosion resistant materials further fuels its adoption. Its compatibility with fiberglass reinforcement also enhances structural strength thereby boosting usage in composite manufacturing. Global expansion of infrastructure and industrialization contributes to the market dominance.

Analysis by End-Use:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Automotive

- Marine

- Pipes, Ducts and Tanks

- Wind Energy

- Electrical and Electronics

- Others

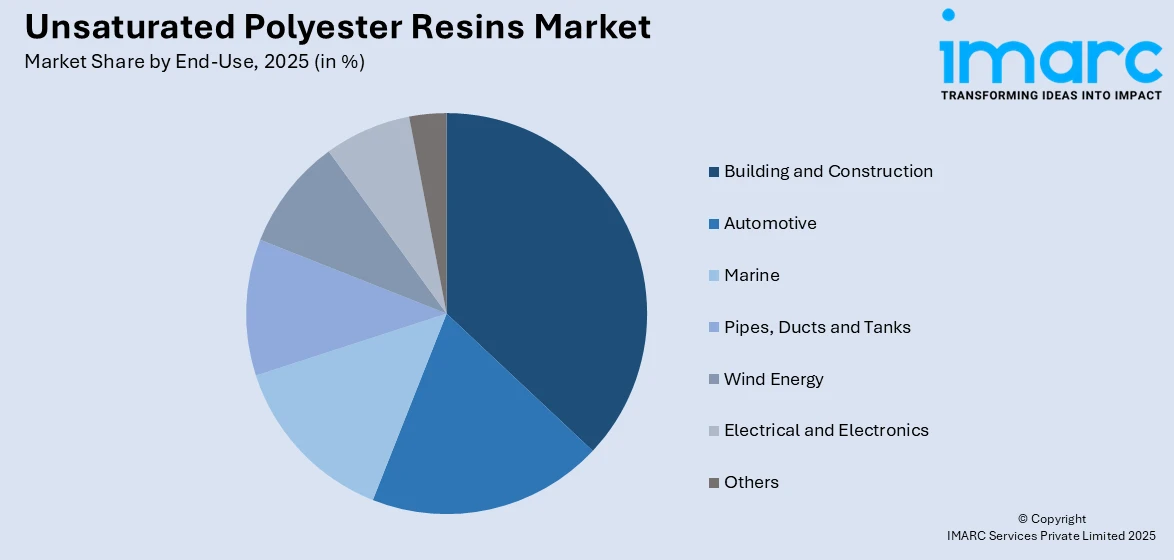

Building and construction leads the market with around 36.7% of the unsaturated polyester resins market share in 2025. The building and construction sector is dominating the Unsaturated Polyester Resins (UPR) Market since it requires sturdy, lightweight and cost-effective materials. Superior strength, corrosion resistance and ease of molding make UPR ideal for use in roofing, wall panels, pipes and composites and the demand for infrastructure projects, urbanization and sustainable construction practices drives the adoption process. The production of energy efficient and weather resistant materials also strengthens its position in the construction industry.

Analysis by Form:

- Liquid Form

- Powder Form

The powder form of unsaturated polyester resin is leading the market because of its superior handling, reduced VOC emissions and enhanced storage stability. It offers excellent adhesion, durability and chemical resistance making it ideal for coatings, composites and adhesives. Its growth is further driven by the increasing demand for environmentally friendly and high-performance materials in industries like automotive, construction and electronics. The ease of application and cost-effectiveness make it widely adopted thus ensuring its market leadership. Technological advancements in powder resin formulations are also benefiting the market enabling improved performance and sustainability. The adoption is further accelerated by stringent environmental regulations that promote low-emission products. Emerging economies are witnessing increased industrialization which further fuels demand. With ongoing innovations and expanding application scope the powder form of unsaturated polyester resin is expected to maintain its dominance in the global market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 58.0%. Asia Pacific leads the unsaturated polyester resins market growth due to high industrialization, urbanization and infrastructure development across major economies like China, India and Japan. This construction sector along with increased automotive and marine industries drives the demands of composites and coatings UPR-based. Robust manufacturing base, availability of raw materials and cost-effective production add to the growth of this market. Governmental initiatives for sustainable and lightweight products also push for adoption. Further growth in the wind energy and transportation sectors adequately strengthen the Asia Pacific supremacy of the global UPR market.

Key Regional Takeaways:

North America Unsaturated Polyester Resins Market Analysis

The North American unsaturated polyester resins market is growing with increasing demand in construction, automotive, marine and renewable energy sectors. Infrastructure development is one of the main drivers with UPR widely used in bridges, pipelines and corrosion resistant structures for its durability and cost-effectiveness. The wind energy sector is expanding increasing demand for UPR composites in turbine blades, thereby facilitating the overall unsaturated polyester resins market demand. Automotive manufacturers are adopting UPR for lightweight components improving fuel efficiency and performance. The marine industry will benefit from the moisture and harsh environment resistance of UPR ideal for boat hulls and decks. Growing interest in sustainable materials and advancements in low-VOC and bio-based resins are shaping market growth and driving innovation in multiple industrial applications.

United States Unsaturated Polyester Resins Market Analysis

In 2025, the United States captured 85.00% of revenue in the North American market. The adoption of unsaturated polyester resins is being propelled by urbanization and the rapid growth of infrastructure projects in various regions. According to survey, the United States is projected to invest around USD 8.4 billion in infrastructure from 2018 to 2027. With urban growth and the construction of new infrastructure there is a rising need for resilient materials capable of enduring environmental challenges. Unsaturated polyester resins are particularly favoured for their versatility, low cost and high strength. They are extensively used in the construction of buildings, bridges and other structures where high-performance materials are required. Their ability to provide excellent durability and resistance to corrosion makes them ideal for such applications. Moreover, the focus on sustainability in urban planning further accelerates their adoption as they can be used to create lightweight long-lasting products with minimal environmental impact. These resins are also being incorporated into a wide array of infrastructure projects such as roadways, railways and tunnels where their impact resistance is essential.

Europe Unsaturated Polyester Resins Market Analysis

The rising demand for unsaturated polyester resins in Europe is mainly because of their growing application in the aerospace and marine industries. For instance, France is the second largest exporter in the world aerospace industry holding 22% of the market share. In this industry unsaturated polyester resins are used to produce lightweight and strong components for aircraft including wings and fuselage sections. Their low weight and excellent resistance to corrosion make them ideal for such critical applications. In the marine sector unsaturated polyester resins are widely employed in the production of boat hulls, decks and other structures. Their ability to resist the harsh conditions of water environments such as saltwater and moisture further enhances their appeal for use in marine applications. As the aerospace and marine industries continue to grow with the advancement of technology and increased transportation needs the use of unsaturated polyester resins is likely to increase providing a robust market for these versatile materials.

Latin America Unsaturated Polyester Resins Market Analysis

The increasing adoption of unsaturated polyester resins in Latin America can be attributed to the growing demand from the electrical and electronics industry. For example, Mexico has become a significant hub for the manufacturing of electronic components with Foreign Direct Investment (FDI) exceeding USD 7.8 billion in the last twenty years. As the region witnesses rapid technological development and the expansion of the electronics industry there is a need for strong and cost-effective materials. Unsaturated polyester resins possess excellent properties like high strength, chemical resistance and good electrical insulation which makes them suitable for many electronic applications. This is also backed by the growing production of electrical components and consumer electronics in Latin America where the requirement for materials that can withstand extreme conditions is growing. The focus on sustainable and efficient manufacturing practices in the region further boosts the adoption of these resins thereby creating a favourable environment for growth.

Middle East and Africa Unsaturated Polyester Resins Market Analysis

The building and construction sector in the Middle East and Africa is expanding rapidly thus increasing the demand for unsaturated polyester resins. According to reports, Saudi Arabia's construction sector is expanding significantly with more than 5,200 active projects amounting to USD 819 billion in value. These resins are highly sought after for their application in construction materials such as pipes, roofing sheets and flooring due to superior durability, weather resistance and cost-effectiveness. As major infrastructure projects and residential buildings continue to grow in these regions unsaturated polyester resins provide a reliable solution for long-lasting and strong materials that can withstand harsh environmental conditions. Another factor driving the use of these resins is the move toward sustainable building practices. They can be used in the manufacture of ecofriendly building materials. The ever-increasing need for modern infrastructure and urbanization is driving up demand for unsaturated polyester resins in building and construction in the Middle East and Africa.

Competitive Landscape:

The unsaturated polyester resins market is highly competitive with several manufacturers focusing on product innovation, capacity expansion and sustainability initiatives. Companies are investing in research and development to enhance resin performance, improve durability and develop ecofriendly formulations with lower volatile organic compounds. Market players are also strengthening their supply chains and expanding their global reach to cater to growing demand from industries such as construction, automotive, marine and wind energy. Strategic partnerships, mergers and acquisitions are common as companies aim to diversify product portfolios and gain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the unsaturated polyester resins market with detailed profiles of all major companies, including:

- AOC LLC

- Ashland LLC

- BASF SE

- CCP Composites Ltd

- E. I. Du Pont

- Allnex Resins Australia Pty Ltd

- Polynt Composites USA Inc.

- Reichhold Inc.

- Koninklijke DSM N.V.

- Scott Bader Company Ltd.

- Upc Technology Corporation

Latest News and Developments:

- January 2025: Ecoinvent has unveiled new life cycle assessment (LCA) data for unsaturated polyester (UP) and vinyl ester (VE) resins allowing composite manufacturers to effectively assess the environmental impact of their products. This information introduced in Ecoinvent 3.11 stems from a study commissioned by five European resin producers and carried out by Ernst & Young. The revamped life cycle inventory encompasses energy use, emissions and waste generation across different resin chemistries.

- December 2024: AOC, a prominent player in specialty resins has completed a new manufacturing line in Nanjing, China focused on unsaturated polyester resin. This development aligns with national industrial strategies and addresses the increasing demand for advanced composites. The facility boosts AOC’s capacity by an additional 10,000 tons ensuring a reliable supply of high-performance resins for local composite producers.

- April 2024: BASF's Coatings division has launched a new series of eco-efficient clearcoats and undercoats resins tailored for the Asia Pacific refinish market. These cutting-edge products improve quality, enhance productivity and lower carbon dioxide emissions assisting body shops in enhancing both profitability and sustainability. The introduction highlights BASF's dedication to environmental stewardship in the automotive refinish industry.

- March 2024: BÜFA and AOC have broadened their sales partnership to include Sweden providing an expanded range of resins, gelcoats and supplementary materials. This extension fortifies their long-term collaboration across Europe granting Swedish customers access to high-quality products through BÜFA Composites Nordics.

- March 2024: DIC Corporation has inaugurated the DIC South Asia Private Limited Application Lab in India aimed at evaluating coating resins for automotive and infrastructure purposes. Situated in Mumbai and Badlapur this new lab is designed to respond quickly to customer requirements and offer comprehensive solutions based on evaluation outcomes. The facility started operations in February 2024.

Unsaturated Polyester Resins Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Orthophthalic Resin, Isophthalic Resin, Dicyclopentadiene (DCPD) Resin, Others |

| End-Uses Covered | Building and Construction, Automotive, Marine, Pipes, Ducts and Tanks, Wind Energy, Electrical and Electronics, Others |

| Forms Covered | Liquid Form, Powder Form |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AOC LLC, Ashland LLC, BASF SE, CCP Composites Ltd, E. I. Du Pont, Allnex Resins Australia Pty Ltd, Polynt Composites USA Inc., Reichhold Inc., Koninklijke DSM N.V., Scott Bader Company Ltd., Upc Technology Corporation. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the unsaturated polyester resins market from 2020-2034.

- The unsaturated polyester resins market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the unsaturated polyester resins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The unsaturated polyester resins market was valued at USD 14.6 Billion in 2025.

IMARC estimates the unsaturated polyester resins market to reach USD 21.8 Billion by 2034 exhibiting a CAGR of 4.43% during 2026-2034.

The Unsaturated Polyester Resins Market is driven by rising demand in construction, automotive, and marine sectors due to its lightweight, high strength, and corrosion resistance. Increasing infrastructure projects, expanding wind energy applications, advancements in composite materials, and the shift towards eco-friendly, low-VOC resin formulations are further creating a positive unsaturated polyester resins market outlook.

In 2025, Asia-Pacific accounted for the largest market share of over 58.0%, driven by rapid industrialization, infrastructure development, and high demand from the construction, automotive, and marine industries, particularly in China and India.

Some of the major players in the unsaturated polyester resins market include AOC LLC, Ashland LLC, BASF SE, CCP Composites Ltd, E. I. Du Pont, Allnex Resins Australia Pty Ltd, Polynt Composites USA Inc., Reichhold Inc., Koninklijke DSM N.V., Scott Bader Company Ltd., Upc Technology Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)