United States Traction Control System Market Size, Share, Trends and Forecast by Type, Component, Vehicle Type, Distribution Channel, and Region, 2026-2034

United States Traction Control System Market Size and Share:

The United States traction control system market size was valued at USD 12.7 Million in 2025. The market is projected to reach USD 21.8 Million by 2034, exhibiting a CAGR of 6.13% from 2026-2034. The market is driven by amplified demand for car safety, increasing application of electric vehicles (EV’s), and improved accuracy of sensors and electronic control technologies. Such systems improve vehicle stability by avoiding wheel slippage, especially under unfavorable road and weather conditions. OEMs are highly incorporating traction systems in a variety of automobiles ranging from passenger vehicles to commercial fleets. Supportive regulatory guidelines and mounting consumer demands are also driving adoption, propelling United States traction control system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 12.7 Million |

| Market Forecast in 2034 | USD 21.8 Million |

| Market Growth Rate (2026-2034) | 6.13% |

One of the major factors for the traction control system market in the United States is the increasing emphasis on automotive safety integration into consumer and regulatory infrastructure. With growing public cognizance of automotive safety systems, manufacturers are compelled to integrate systems that provide real-time driving responsiveness and stability. According to the reports, in November 2024, Continental's sophisticated brake control system with built-in TCS for the Bugatti Bolide reflects intensified demand for high-performance traction technology, affirming trends towards innovation in the United States traction control system market. Furthermore, traction control systems reduce the risk of vehicle instability during acceleration by regulating brake pressure and engine torque to avoid wheel slip. Consequently, these systems have evolved from being optional add-ons to mandatory features in the majority of vehicle classes. Government regulations promoting the adoption of safety technologies, as well as consumer demand for safe and secure driving experiences, are further propelling this trend. Moreover, buyers of vehicles are highly aware of the value proposition of traction-based features, creating a wider market pull. This steady interest will continue to propel steady traction control system integration in new as well as replacement vehicle platforms.

.webp)

To get more information on this market Request Sample

The growing use of electric and hybrid cars is proving to be a significant driving force for the United States traction control system market growth. As per the sources, in August 2024 – Stellantis invented a hybrid-specific launch control system that combines electric and combustion torque in sync, to lessen motor stress and deliver improved performance in forthcoming hybrid variant. Moreover, such vehicles usually produce greater torque at lower speeds than their internal combustion engine counterparts, so accurate wheel control and grip management become important factors. Traction control in electric drivetrains assists in better torque distribution so that power transmission can never be at the cost of road safety, particularly under low-friction or heavy-load situations. With manufacturers realizing different drivetrain arrangements and going for multi-motor configurations, the importance of traction control intensifies even further in terms of performance and handling. In addition, the development of vehicle architecture in EVs—through digital control systems and sophisticated sensor networks—has facilitated the inclusion of traction management within an extended vehicle stability strategy. This compatibility is driving increased traction system adoption, especially with boosting electric mobility and consumers looking for safety technologies that can keep pace with the performance capability of current vehicles.

United States Traction Control System Market Trends:

Weather-Driven Demand for Improved Road Safety

As per the United States traction control system market analysis, the country's high rate of weather-related accidents—1.24 million crashes a year—has had a profound impact on the market for the traction control system (TCS). Rain, snow, and ice conditions reduce traction, making tire slippage-preventing vehicle safety technologies imperative. TCS, which sustains wheel grip at acceleration and deceleration, is now considered an essential safety feature. It is crucial in maintaining vehicle stability on slippery roads through brake pressure and engine torque modulation. Consumers and policymakers in the U.S. are both giving high priority to systems capable of mitigating the threats from prevailing weather conditions, especially in the areas that experience constant change in the climate. This demand assumes relevance in the backdrop of the increasing thrust towards auto safety innovations in both internal combustion engine (ICE) and electric vehicle (EV) segments. While environmental uncertainty on the rise, the U.S. traction control system market will continue to grow with its implication in crash avoidance and vehicle control.

Increased ADAS and TCS Integration for Accident Avoidance

The amplifying uptake of Advanced Driver-Assistance Systems (ADAS) has infused new energy into the United States traction control system market trends. According to Injury Facts, ADAS technologies may be able to prevent more than 14 million nonfatal injuries and almost 250,000 fatalities by 2050. In this array of technology, TCS has a crucial function of controlling torque and tire grip, thus supporting other ADAS capabilities such as lane-keeping assist, automatic emergency braking, and adaptive cruise control. The fusion of TCS with contemporary ECUs, engine throttle position sensors, and wheel speed sensors allows cars to respond rapidly to current driving situations. This integration of safety technologies is an extension of a larger trend under which manufacturers seek to provide end-to-end safety solutions, as opposed to standalone systems. The development of ADAS not only raises confidence in driving but also speeds regulatory and consumer pressure for harmonized safety systems across new car platforms, thus stimulating sustained investment in TCS innovation.

Technological Advancements and Consumer Safety Priorities

Technological innovation and changing consumer priorities are transforming the traction control system environment in the United States. Innovations in sensor precision, hydraulic modulators, and software-based electronic control units (ECUs) are enabling TCS systems to function more effectively across a broader range of vehicle types, including electric vehicles. According to industry surveys, 78% of U.S. drivers rank enhanced safety systems as their top technology priority, underlining a robust demand for active safety features. Car makers are retaliating by integrating TCS into not only top-of-the-line models but also mid-range and low-end cars, making safety universally accessible. This boom in consciousness, propelled by both regulatory requirement and campaigns on road safety education, has positioned TCS as the focal point in the design of new vehicles. While the auto industry moves toward connected and semi-autonomous driving, traction control systems will be a core technology, delivering both moment-to-moment vehicle stability and lasting consumer confidence in safety technologies.

United States Traction Control System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States traction control system market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on type, component, vehicle type, and distribution channel.

Analysis by Type:

- Mechanical Linkage

- Electrical Linkage

Mechanical Linkage traction control systems are popular in traditional cars because of their affordability and easier integration into existing frameworks. Such systems work through mechanical control of braking force to manage wheel grip with basic stability assistance. Continued application in low-cost model cars maintains consistent demand in regional and rural markets with fewer priorities set on high-end electronics.

Electrical Linkage traction control systems are gaining traction with contemporary vehicle platforms, particularly those featuring electronic stability programs. The systems provide quicker response times, improved adaptability, and smooth integration with digital safety features. Their support for advanced driver-assistance systems positions them well for technologically advanced vehicles, supporting market growth in premium and mid-range segments.

Analysis by Component:

- Hydraulic Modulators

- ECU

- Sensors

- Others

Hydraulic Modulators control brake pressure in traction systems to provide accurate modulation upon slip detection. Their function is essential in providing smooth brake application between wheels in real time. They are a common part in conventional and high-performance systems and are the basis for traction control operation in all vehicle types.

Electronic Control Units (ECUs) are the focal processing centers for traction control systems, translating sensor signals and managing actuator responses. As vehicle dynamics have grown more complex, ECUs have evolved to be more intelligent and effective, enabling integration with several safety subsystems and improving vehicle handling and driver safety in varied driving conditions.

Sensors such as wheel speed and throttle position sensors offer the real-time information required for traction control engagement. Their precision has a direct bearing on responsiveness and overall safety of the system. With continuing sensor technology improvements in accuracy and toughness, their relevance increases on both internal combustion and electric vehicle platforms, allowing for improved control during demanding road conditions.

Other pieces, like brake actuators and wiring harnesses, help facilitate entire operation of traction control systems by providing connectivity and mechanical feedback. Though not the system's primary pieces, they are crucial for coordination and reliability. These pieces provide smooth interaction between hardware and software, leading to consistent performance and less need for maintenance.

Analysis by Vehicle Type:

- ICE Vehicles

- Electric Vehicles

Internal Combustion Engine (ICE) Vehicles are a principal usage segment for traction control systems, particularly in areas with changing climates and poor road conditions. These vehicles gain improved safety and maneuverability with the incorporation of TCS, increasing adoption based on regulatory support and demand from consumers for safer, more stable vehicle behavior under normal driving conditions.

Electric Vehicles (EVs) support high torque delivery under low speeds, rendering traction control systems necessary for safe accelerating and handling. TCS in EVs maximizes power transmission and avoids wheel spin, especially on slippery roads. With the adoption of EVs ramping up countrywide, demand for bundled traction solutions will see tremendous growth.

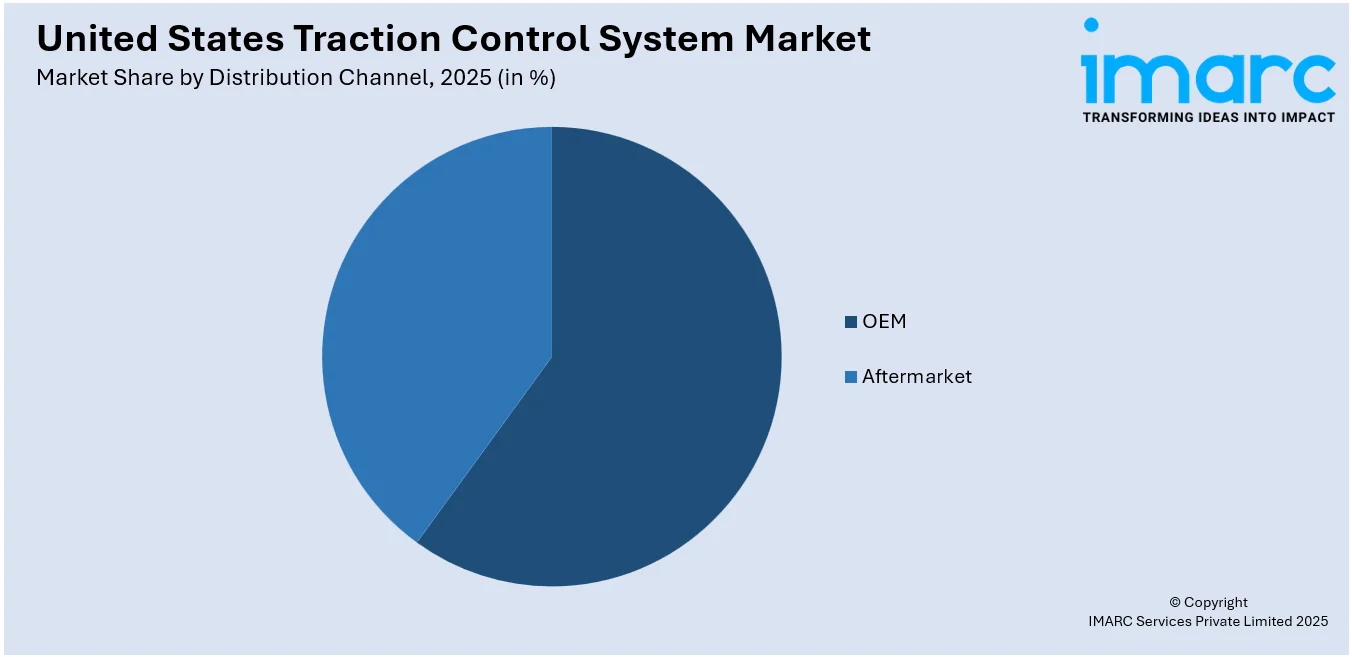

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

OEM distribution channels dominate the traction control system market by offering factory-installed solutions in new vehicles. Manufacturers increasingly include TCS as a standard feature, aligning with safety standards and consumer expectations. This channel benefits from technological compatibility and seamless system integration, supporting consistent growth across passenger and commercial vehicle segments.

Aftermarket traction control systems serve vehicle upgrades and replacement, especially in older vehicles or commercial fleets without the built-in safety features. The channel enables affordable entry to enhanced driving stability. Expansion within the segment is underpinned by increasing safety benefit awareness and the presence of adaptable traction solutions in various vehicle forms.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast market demonstrates high demand for traction control systems because of common snow, icy streets, and mountainous terrain. Customers here give utmost importance to safety upgrades for vehicles, particularly during winter. Regulatory push towards enhanced safety features in urban centers also drives increased adoption rates, especially in heavily populated states with extreme seasonal driving conditions.

The Midwest provides diverse road conditions, including icy roads and highway travel, behind the demand for traction control in family vehicles and utility vehicles. The robust automotive manufacturing industry within the region also underpins OEM expansion. Buyers support dependable handling features, so TCS deployment is routine on family vehicles, pickup trucks, and commercial fleets.

The Southern American market is helped by higher traction control system adoption rates owing to heavy rains, flood threats, and growing urban infrastructure. High car ownership, coupled with mounting curiosity for high-end auto tech, promotes OEM as well as aftermarket traction system demand across a wide range of vehicle types, from crossovers and sedans to electric pickups.

The Western region, where a combination of mountains and high population areas exists, has diverse demand for traction control systems. Regulation norms in states such as California favor the incorporation of advanced vehicle control technologies. The popularity of electric vehicles in the region also favors increased use of electronic traction systems adapted for mountainous and coastal driving.

Competitive Landscape:

The United States traction control system market's competitive environment is characterized by endless innovation, with manufacturers aiming to improve system accuracy, integration capacity, and connectivity with latest vehicle platforms. As vehicle safety technology demand increases, firms are committing money to advanced sensor technologies, small electronic control units, and software-based traction systems that enable real-time response. The market witnesses robust cooperation among component suppliers and automotive OEMs to provide factory-installed solutions for differing performance and regulatory requirements. Apart from that, the move toward electrification and connected mobility is also encouraging companies to create traction systems appropriate for electric and hybrid vehicles. Aftermarket prospects are also growing as old vehicles are equipped with upgraded safety functions. The United States traction control system market forecast predicts strong growth, fueled by increasing consumer awareness, regulatory requirements in regions, and converging technologies. Such an environment creates a dynamic and competitive landscape where innovation and flexibility are the keys to market success.

The report provides a comprehensive analysis of the competitive landscape in the United States traction control system market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Harley-Davidson launched the $110,000 CVO Road Glide RR, its most powerful production motorcycle, featuring 153 hp and advanced safety systems. Equipped with high-performance suspension, Brembo brakes, and traction-enhancing components, the model showcased track-derived engineering to boost street-legal handling, control, and stability for aggressive performance riding.

- January 2025: Segway unveiled third-generation eKickScooters featuring Segway Dynamic Traction Control (SDTC) and other advanced technologies. The GT3 and GT3 Pro super scooters incorporate high-speed performance with enhanced braking and traction systems, reflecting Segway’s commitment to safer, smarter micro-mobility through innovations in control, stability, and verified performance standards.

- January 2025: Hyundai revealed the Ioniq 9 three-row electric MPV at the Bharat Mobility Expo, featuring advanced traction technologies like Terrain Traction Control and Auto Terrain Mode using AI. Equipped with dynamic torque vectoring and lateral wind stability control, the Ioniq 9 enhanced driving safety and control across diverse terrains and conditions.

United States Traction Control System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mechanical Linkage, Electrical Linkage |

| Components Covered | Hydraulic Modulators, ECU, Sensors, Others |

| Vehicle Types Covered | ICE Vehicles, Electric Vehicles |

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States traction control system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States traction control system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States traction control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The traction control system market in the United States was valued at USD 12.7 Million in 2025.

The United States traction control system market is projected to exhibit a CAGR of 6.13% during 2026-2034, reaching a value of USD 21.8 Million by 2034.

Major drivers of the United States traction control system market are escalating consumer interest in vehicle safety, higher adoption of electric vehicles that need accurate torque management, and improved sensor and control technologies. Focused regulation on road safety and incorporation of traction systems in OEM platforms also drive higher adoption across various vehicle types and driving environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)