United States Track and Trace Solutions Market Size, Share, Trends and Forecast by Product, Technology, Application, End Use Industry, and Region, 2026-2034

United States Track and Trace Solutions Market Summary:

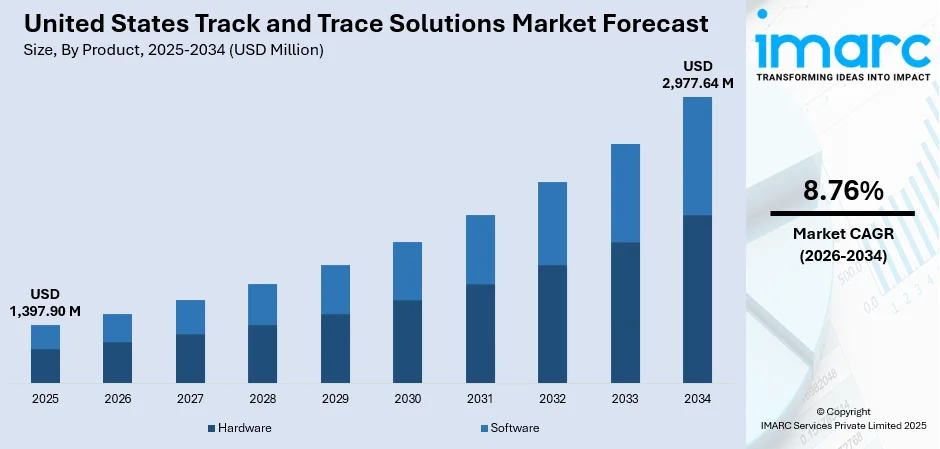

The United States track and trace solutions market size was valued at USD 1,397.90 Million in 2025 and is projected to reach USD 2,977.64 Million by 2034, growing at a compound annual growth rate of 8.76% from 2026-2034.

The United States track and trace solutions market is experiencing robust expansion driven by stringent regulatory mandates and heightened focus on supply chain transparency. The Drug Supply Chain Security Act enforcement deadlines and FDA UDI requirements for medical devices are compelling pharmaceutical manufacturers and healthcare providers to adopt comprehensive serialization systems. Rising counterfeit product concerns across industries and increasing e-commerce logistics complexity are further accelerating technology adoption. Cloud-based software platforms and integration of AI capabilities are enhancing real-time visibility capabilities, strengthening market momentum and expanding United States track and trace solutions market share.

Key Takeaways and Insights:

- By Product: Software dominates the market with a share of 60% in 2025, establishing itself as the dominant solution category through cloud-based platforms that provide scalability, real-time data analytics, and seamless integration with existing enterprise systems.

- By Technology: Barcode leads the market with a share of 57.83% in 2025, serving as the foundational technology for product identification due to its cost-effectiveness.

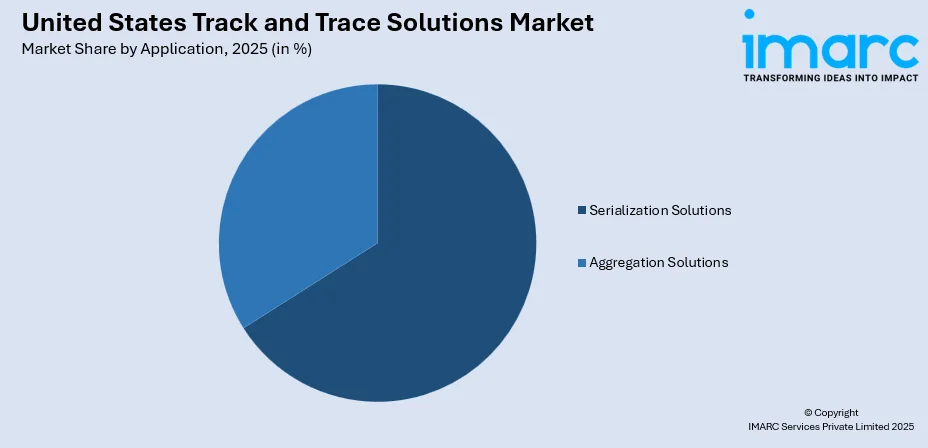

- By Application: Serialization solutions represent the largest segment with a market share of 66% in 2025, representing the critical requirement for assigning unique identifiers to individual product units.

- By End Use Industry: Pharmaceutical leads the market with a share of 26.85% in 2025, reflecting mandatory serialization requirements, patient safety priorities, counterfeit drug prevention initiatives, and comprehensive DSCSA compliance implementation.

- Key Players: The United States track and trace solutions market exhibits intensive competition, with leading technology providers expanding software capabilities, enhancing interoperability features, developing AI-powered analytics tools, and forming strategic partnerships to capture growing demand for end-to-end supply chain visibility solutions.

To get more information on this market Request Sample

The United States track and trace solutions market is advancing rapidly as regulatory frameworks evolve, and industries prioritize supply chain security. The pharmaceutical sector leads adoption with manufacturers implementing comprehensive serialization systems to meet November 2024 DSCSA enforcement deadlines. In October 2024, the FDA announced staggered exemptions extending compliance dates into 2025, with manufacturers required to fully comply by May 2025 and wholesalers by August 2025. Medical device manufacturers are simultaneously addressing FDA UDI requirements, with the EU aiming for EUDAMED database full implementation by 2025. The food and beverage industry is preparing for FSMA 204 traceability requirements originally scheduled for January 2026, though compliance dates were extended 30 months to July 2028 in March 2025. These developments demonstrate the market's shift toward sophisticated, data-driven platforms that extend beyond basic compliance to deliver comprehensive supply chain intelligence and operational optimization.

United States Track and Trace Solutions Market Trends:

Software-Driven Digital Transformation and Cloud Integration

Track and trace solutions are transitioning from hardware-centric implementations to sophisticated software platforms that leverage cloud architectures for enhanced scalability and operational flexibility. Software held a major portion of market share in 2024, reflecting widespread adoption of cloud-based solutions that reduce upfront capital requirements while enabling seamless updates and multi-site deployments. These platforms integrate with enterprise resource planning systems and warehouse management software to create unified data ecosystems that support real-time decision-making. Subscription-based models are gaining traction, with Axway reporting significant revenue growth in the Americas region accounting for 40% of total revenue in first half 2024 following its strategic focus on cloud integration and API management platforms.

Regulatory Compliance Evolution with Extended Implementation Timelines

Regulatory frameworks governing product traceability are experiencing significant evolution as authorities balance enforcement rigor with industry readiness. The FDA established a one-year stabilization period until November 27, 2024, for DSCSA electronic tracing requirements before announcing staggered exemptions in October 2024 extending manufacturer compliance to May 2025 and wholesaler compliance to August 2025. Similarly, the FDA delayed FSMA 204 food traceability compliance by 30 months from January 2026 to approximately July 2028, announced in March 2025, providing additional preparation time for businesses handling high-risk foods. These regulatory adjustments are driving sustained investment in serialization infrastructure while allowing organizations to develop robust implementation strategies that minimize supply chain disruptions and ensure long-term compliance sustainability across pharmaceutical, medical device, and food sectors.

Artificial Intelligence (AI), Internet of Things (IoT), and Blockchain Convergence for Enhanced Traceability

Advanced technologies are converging to create next-generation track and trace capabilities that extend beyond basic serialization to deliver comprehensive supply chain intelligence. IMARC Group predicts that the US blockchain supply chain market is projected to grow at 46.43% CAGR between 2025 and 2033, enabling immutable transaction records and transparent multi-party verification systems. Research demonstrates blockchain reduces fraud by 50% and boosts operational efficiency by 30%, with Walmart's food traceability initiative reducing tracking time from six days to 2.2 seconds using blockchain technology. IoT sensors are being integrated with track and trace platforms to provide real-time environmental monitoring, with a major number of supply chain leaders expressing willingness to adopt IoT technology according to industry surveys. This technological convergence is creating sophisticated ecosystems where AI analytics process vast serialization datasets to identify anomalies, predict supply disruptions, and optimize distribution networks.

Market Outlook 2026-2034:

The United States track and trace solutions market is positioned for sustained expansion as regulatory enforcement intensifies, and industries recognize the strategic value of comprehensive supply chain visibility. The market generated a revenue of USD 1,397.90 Million in 2025 and is projected to reach a revenue of USD 2,977.64 Million by 2034, growing at a compound annual growth rate of 8.76% from 2026-2034. The market is supported by expanding serialization mandates across industries, growing e-commerce logistics complexity, and increasing recognition of traceability systems as competitive differentiators that enable rapid recall execution, counterfeit prevention, and operational optimization throughout complex distribution networks.

United States Track and Trace Solutions Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Software | 60% |

| Technology | Barcode | 57.83% |

| Application | Serialization Solutions | 66% |

| End Use Industry | Pharmaceutical | 26.85% |

Product Insights:

- Hardware

- Printing and Marking Solutions

- Monitoring and Verification Solutions

- Labelling Solutions

- Others

- Software

- Plant Manager Software

- Line Controller Software

- Bundle Tracking Software

- Others

Software dominates with a market share of 60% of the total United States track and trace solutions market in 2025.

Software solutions are establishing market leadership by delivering comprehensive platforms that integrate serialization data management, analytics capabilities, and enterprise system connectivity within scalable cloud architectures. These solutions enable pharmaceutical manufacturers and healthcare distributors to process billions of serialized transactions annually while maintaining regulatory compliance across complex multi-site operations. Software held a major portion of the market share, driven by increasing demand for real-time visibility, predictive analytics, and automated compliance reporting.

The shift toward subscription-based models reduces upfront capital requirements while providing continuous feature updates and security enhancements. In 2025, Infor NexusTM, the single-instance supply chain network that offers unmatched visibility and collaboration, has unveiled NexTrace. This creative solution aims to enhance customer clarity and deliver a competitive edge. NexTrace offers complete transparency by effortlessly monitoring raw materials to finished goods and beyond, guaranteeing full traceability throughout the whole supply chain process. It combines supplier ESG data and certificates for a comprehensive understanding of sustainability and compliance details

Technology Insights:

- Barcode

- RFID

- Others

Barcode leads with a share of 57.83% of the total United States track and trace solutions market in 2025.

Barcode technology maintains market dominance through cost-effectiveness, established scanning infrastructure, and consistent regulatory acceptance across pharmaceutical, medical device, and food safety applications. Two-dimensional barcodes such as DataMatrix codes dominated the market in 2024, offering superior data storage capacity compared to traditional linear barcodes while maintaining compatibility with existing scanning equipment. These codes can encode product identifiers, serial numbers, batch information, and expiration dates within compact symbols that remain readable even with partial damage or contamination.

The technology's resilience stems from ubiquitous scanner availability, straightforward implementation processes, and proven reliability in high-speed packaging line environments. In 2025, Socket Mobile, Inc., a prominent California-based provider of data capture and delivery solutions, unveiled XtremeScan v16e, a greatly improved version of its high-performance industrial barcode scanners. The XtremeScan v16e devices have been enhanced for the iPhone® 16e and feature a revamped casing, better ergonomics, broader scanning capabilities, and complete camera access, offering a more robust and user-friendly experience for mobile workers in the field.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Serialization Solutions

- Bottle Serialization

- Label Serialization

- Carton Serialization

- Others

- Aggregation Solutions

- Bundle Aggregation

- Case Aggregation

- Pallet Aggregation

Serialization solutions exhibit a clear dominance with a 66% share of the total United States track and trace solutions market in 2025.

Serialization solutions represent the foundational application layer that enables individual product unit identification through unique serial numbers applied at packaging lines. These solutions accounted for a major portion of the market, reflecting mandatory requirements across pharmaceutical, medical device, and emerging food safety applications. Serialization encompasses bottle, label, carton, and vial marking systems that apply machine-readable codes containing product identifiers, production dates, batch numbers, and expiration information. The technology enables real-time authentication, targeted recall execution, and supply chain visibility by creating digital identities for individual units.

In January 2025, Systech unveiled a semi-automated aggregation module at Pharmapack offering quicker upgrade paths for facilities with constrained floor space, demonstrating continued innovation in serialization implementation approaches. The system identifies when a case is prepared and starts the packaging procedure, while checking the case label for accuracy, as stated by the company. It has also been created to offer flexibility, enabling operators to utilize either a case label or a pallet label printer, while additionally providing the choice for pallet label inspection. The growing emphasis on patient safety and counterfeit prevention is driving pharmaceutical manufacturers to implement comprehensive serialization across global production networks to meet diverse regulatory requirements.

End Use Industry Insights:

- Pharmaceutical

- Medical Device

- Food and Beverages

- Cosmetics

- Others

Pharmaceutical leads with a share of 26.85% of the total United States track and trace solutions market in 2025.

The pharmaceutical sector dominates track and trace solutions adoption through comprehensive DSCSA serialization mandates, counterfeit drug prevention initiatives, and patient safety requirements that necessitate end-to-end supply chain visibility. Pharmaceutical manufacturers commanded a major share in the market, establishing track and trace as fundamental infrastructure rather than optional compliance technology. The November 2024 DSCSA deadline requiring electronic interoperability and product-level verification drove sustained investment in serialization systems, with the FDA's October 2024 exemption announcement extending manufacturer compliance to May 2025 and wholesaler compliance to August 2025.

In July 2024, Systech, a division of Markem-Imaje and Dover, recognized as a premier provider of digital traceability, serialization, and compliance solutions for the pharmaceutical sector, declared its choice by Praxis Packaging Solutions to deliver a track and trace platform for enhanced supply chain transparency. This partnership provides Praxis clients with access to top-tier aggregation and improved product tracing to promptly fulfill global compliance standards like the FDA-required DSCSA (Drug Supply Chain Security Act) regulation, which has a deadline for enforcement in November 2024. Systech serves as the serialization partner for Praxis, utilizing its reliable UniSeries® suite for Levels 1-3. Praxis will now enjoy the advantages of Systech’s comprehensive (L1-L5) offerings. Along with serialization, this all-encompassing system features Systech’s UniTrace® Level 4 platform, a complete aggregation and rework station, and Systech Insight™, for real-time performance monitoring and line intelligence.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast market is shaped by strong adoption across pharmaceuticals, healthcare, and high-value manufacturing. States like New York, New Jersey, and Massachusetts host dense clusters of drug manufacturers, biotech firms, and research institutions that rely on serialization and product authentication to meet regulatory needs. Hospitals and healthcare providers in the region increasingly use track and trace systems to reduce medication errors and manage recalls efficiently.

In the Midwest, the market is driven by manufacturing-heavy industries, including automotive, food processing, and industrial goods. States such as Illinois, Ohio, and Michigan use tracking systems to improve supply chain visibility, prevent counterfeiting, and manage inventory across large distribution networks. Food safety regulations and growing demand for product transparency are encouraging adoption in agribusiness and packaged food segments. Logistics hubs in the region benefit from real-time tracking to reduce losses and delays.

The Southern United States shows rising demand for track and trace solutions due to growth in pharmaceuticals, retail, and logistics. States like Texas, Florida, and Georgia act as major distribution and export gateways, increasing the need for shipment monitoring and compliance tracking. Pharmaceutical serialization, cold-chain monitoring, and anti-diversion measures are gaining traction as healthcare manufacturing expands. Retailers and e-commerce players also deploy track and trace tools to manage high shipment volumes and returns.

The West region, led by California, Washington, and Arizona, represents a technology-driven Track and Trace Solutions market. Strong presence of technology firms, medical device manufacturers, and life sciences companies encourages early adoption of advanced tracking tools. Companies use cloud-based platforms, RFID, and IoT-enabled systems to manage complex global supply chains. Strict quality control standards in pharmaceuticals, food, and electronics increase reliance on real-time traceability. Ports along the West Coast also push demand for shipment-level visibility and security. Innovation, data integration, and automation play a major role in shaping purchasing decisions across the region.

Market Dynamics:

Growth Drivers:

Why is the United States Track and Trace Solutions Market Growing?

Stringent Regulatory Mandates Across Pharmaceutical and Healthcare Sectors

Comprehensive federal regulations governing product traceability are compelling pharmaceutical manufacturers, medical device companies, and healthcare distributors to implement sophisticated tracking systems that ensure supply chain integrity. These mandates require unique product identifiers on prescription drug packages and detailed transaction information exchange at each ownership transfer point. Medical device manufacturers face FDA UDI requirements with device labelers required to include unique identifiers on labels and submit information to the Global Unique Device Identification Database, with compliance dates varying by device classification. The regulatory framework creates sustained demand for serialization software, hardware systems, and integration services that enable organizations to meet complex recordkeeping requirements while maintaining operational efficiency throughout distribution networks. The Food and Drug Administration plans to lengthen the compliance deadline for the final rule, “Requirements for Additional Traceability Records for Certain Foods,” because of worries regarding the time necessary for impacted entities to adhere to the rule's requirements. If enacted, this regulation would push back the compliance deadline by 30 months, moving it from January 20, 2026, to July 20, 2028.

Rising Counterfeit Product Concerns and Patient Safety Requirements

Growing threats from sophisticated counterfeiters and increasing emphasis on patient safety are driving investments in authentication technologies that verify product legitimacy throughout supply chains. In pharmaceutical markets, counterfeit products not only represent lost revenue but severely damage brand reputations when patients experience adverse effects from fake medications bearing trusted names. According to the U.S. Centers for Disease Control and Prevention (CDC), counterfeit medications are thought to account for under 1% of sales in physical pharmacies across the U.S. Track and trace systems create unbreakable verification chains by establishing digital pedigrees that can be authenticated at any supply chain point, immediately flagging suspicious products before reaching patients. These capabilities extend beyond pharmaceuticals to medical devices, where implantable product tracking supports post-market surveillance and adverse event investigation.

Expanding E-commerce and Supply Chain Transparency Demands

The explosive growth of e-commerce logistics and consumer expectations for supply chain transparency are creating new requirements for real-time tracking capabilities that extend beyond regulatory compliance. E-commerce sales in the second quarter of 2025 accounted for 16.3% of total sales according to the U.S. Census Bureau, necessitating enhanced tracking systems to manage complex return processes and ensure product authenticity in direct-to-consumer channels. Companies are recognizing track and trace solutions as competitive differentiators that enable rapid recall execution, minimize supply disruptions, and provide operational insights that optimize inventory management and distribution networks. The integration of IoT sensors with tracking platforms provides real-time environmental monitoring for temperature-sensitive products, creating comprehensive visibility ecosystems that enhance both compliance and operational performance.

Market Restraints:

What Challenges the United States Track and Trace Solutions Market is Facing?

High Implementation and Integration Costs

The substantial capital investment required for comprehensive track and trace system deployment presents significant barriers, particularly for small and medium-sized enterprises operating on tight margins. Implementation costs encompass specialized software licensing, RFID and barcode scanning equipment, integration with existing enterprise resource planning systems, staff training programs, and ongoing system maintenance requirements. These upfront costs can exceed hundreds of thousands of dollars for multi-line operations, creating financial deterrents especially in developing markets and smaller manufacturing facilities.

Legacy System Integration Challenges and Data Interoperability Issues

Integrating modern track and trace solutions with existing legacy infrastructure creates technical complexities that slow deployment and increase project risks. Many pharmaceutical manufacturers and distributors operate manufacturing execution systems and warehouse management platforms implemented years before serialization requirements, creating compatibility gaps that necessitate extensive middleware development and system upgrades. The fragmented nature of global supply chains involving multiple trading partners with disparate technology platforms exacerbates interoperability challenges.

Data Security, Privacy, and Standardization Complexities

Managing vast volumes of serialization data while ensuring security, privacy, and standardization compliance presents ongoing operational challenges that constrain market growth. Track and trace systems generate massive datasets containing sensitive product information, transaction records, and supply chain intelligence that become prime targets for cyberattacks. Federal Trade Commission reports indicate data breaches affecting supply chain systems surged by over 40% in the past year, raising concerns about unauthorized access and data manipulation risks. Organizations must implement sophisticated encryption, access controls, and backup systems while navigating data privacy regulations that govern information sharing across trading partners.

Competitive Landscape:

The United States track and trace solutions market exhibits intensive competition as technology providers expand capabilities and pharmaceutical manufacturers demand comprehensive platforms that deliver both regulatory compliance and operational intelligence. Leading players are focusing on cloud-based software development, AI-powered analytics integration, and blockchain technology adoption to differentiate offerings beyond basic serialization. Strategic partnerships are accelerating innovation cycles, with companies collaborating with pharmaceutical manufacturers, contract development organizations, and healthcare distributors to develop solutions addressing real-world implementation challenges. Competition extends across software platforms, hardware systems, and professional services, with vendors investing heavily in customer support capabilities that facilitate smooth deployment and ongoing compliance maintenance. Market consolidation continues through acquisitions that combine complementary technology portfolios and expand geographic reach, while specialized providers capture niche segments through modular solutions designed for mid-tier manufacturers.

Recent Developments:

- In June 2025, OpenSpace, the worldwide frontrunner in 360° reality capture and AI-driven analytics, has announced the introduction of OpenSpace Progress Tracking today. Fueled by Disperse, the innovative milestone-driven solution assists construction teams in rapidly collecting visual jobsite information and producing actionable insights, facilitating the earlier identification of productivity challenges and budget overruns.

- In March 2025, Zebra Technologies Corporation, a worldwide frontrunner in digitizing and automating frontline processes, revealed new solutions aimed at enhancing automation and visibility throughout manufacturing, warehousing, and supply chain operations. Zebra will present its range of new and existing solutions at Booth #S637 during ProMat 2025 from March 17-20 at McCormick Place in Chicago.

United States Track and Trace Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Technologies Covered | Barcode, RFID, Others |

| Applications Covered |

|

| End Use Industries Covered | Pharmaceutical, Medical Device, Food and Beverages, Cosmetics, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States track and trace solutions market size was valued at USD 1,397.90 Million in 2025.

The United States track and trace solutions market is expected to grow at a compound annual growth rate of 8.76% from 2026-2034 to reach USD 2,977.64 Million by 2034.

Software, holding the largest revenue share of 60%, dominates the market through cloud-based platforms that deliver comprehensive serialization data management, real-time analytics, seamless enterprise integration, and scalable architectures that support multi-site pharmaceutical operations and evolving regulatory requirements.

Key factors driving the United States track and trace solutions market include stringent regulatory mandates across pharmaceutical and healthcare sectors, rising counterfeit product concerns requiring authentication capabilities, expanding e-commerce logistics complexity, increasing emphasis on patient safety, and growing recognition of traceability systems as competitive differentiators that enable operational optimization.

Major challenges include high implementation and integration costs particularly for small and medium-sized enterprises, legacy system compatibility issues requiring extensive middleware development, data security and privacy concerns with growing cyberattack risks, lack of standardized global protocols forcing multinational companies to maintain multiple compliance frameworks, and complexity of retrofitting existing packaging lines with serialization capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)