United States Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2026-2034

United States Toys Market Summary:

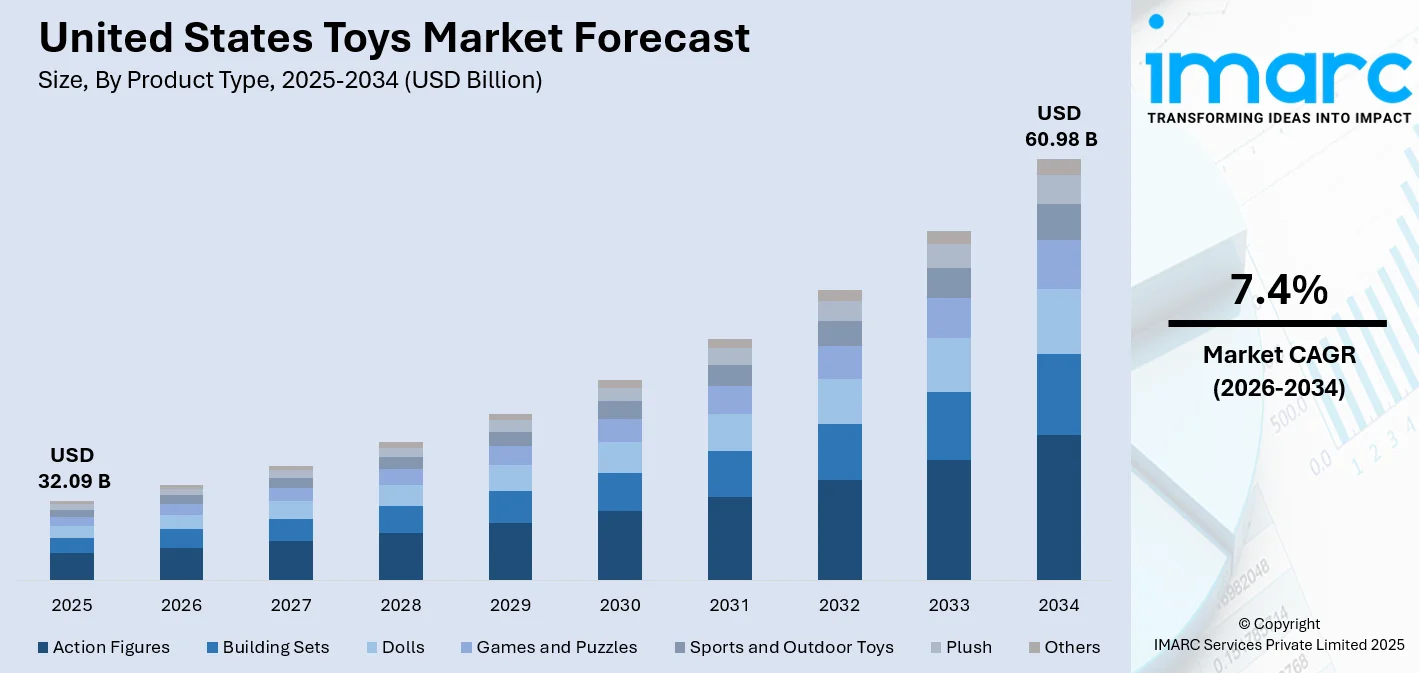

The United States toys market size was valued at USD 32.09 Billion in 2025 and is projected to reach USD 60.98 Billion by 2034, growing at a compound annual growth rate of 7.4% from 2026-2034.

The United States toys industry is consistently showing strength during a period of changing consumer demands towards more learning-based, interactive, and collectible toys. Greater focus on developmental needs, increasing levels of disposable income, and strong gift-giving trends during holidays are driving demand. Greater influence of entertainment-based franchises, development of e-commerce platforms, and a strong focus on learning-based toys for scientific education are leading to a change in consumption trends and a strengthening of the United States toys industry market.

Key Takeaways and Insights:

- By Product Type: Action figures dominate the market with a share of 22% in 2025, driven by the enduring popularity of superhero franchises, collectible trends, and strong licensing partnerships with major entertainment studios.

- By Age Group: 5 to 10 years leads the market with a share of 45% in 2025, reflecting the peak developmental stage where children engage most actively with imaginative play and educational toys.

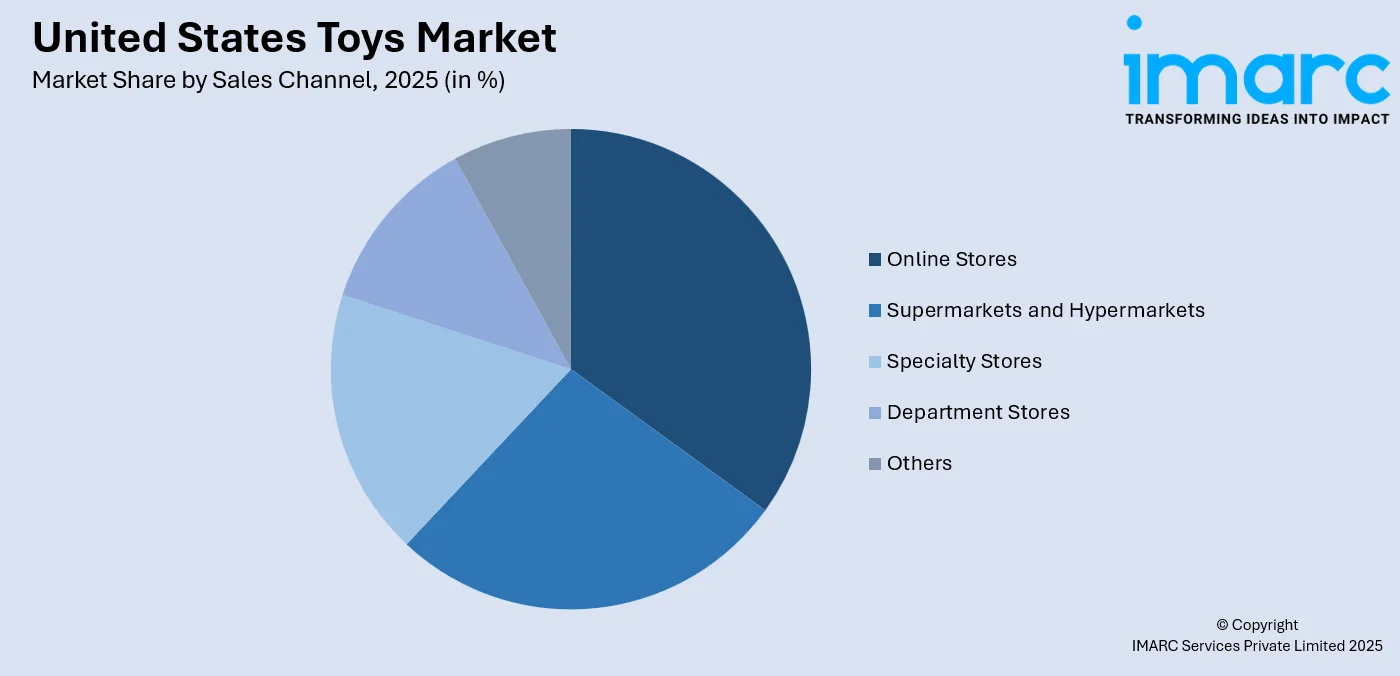

- By Sales Channel: Online stores represent the largest segment with a market share of 28% in 2025, propelled by convenience-driven shopping, wider product selection, and competitive pricing strategies.

- By Region: South dominates the market with a share of 32% in 2025, supported by a large population base, higher birth rates, and robust retail infrastructure across major metropolitan areas.

- Key Players: The United States toys market exhibits a highly competitive landscape with established multinational corporations and emerging specialty manufacturers competing across product categories through innovation, licensing agreements, strategic retail partnerships, and digital engagement initiatives.

To get more information on this market Request Sample

The United States toys market is evolving rapidly as manufacturers respond to shifting consumer expectations and demographic trends. The growing adult collector segment has become a significant market driver, with nearly half of U.S. adults reporting they purchased a toy for themselves in the past year, reflecting a strong surge in “kidult” demand. Parents continue prioritizing toys that combine entertainment with educational value, particularly those promoting STEM skills, creativity, and cognitive development. Licensed toys linked to popular entertainment franchises maintain strong demand, commanding premium pricing and driving overall market expansion. The convergence of physical and digital play experiences is creating new product categories that appeal to tech-savvy families seeking innovative entertainment options for children.

United States Toys Market Trends:

Growing Dominance of Licensed and Collectible Toys

The United States toys market is experiencing significant growth in licensed and collectible product categories as consumers increasingly seek toys connected to popular entertainment properties. According to reports, collectible toys grew by about 33% and licensed toys climbed approximately 14% through the third quarter, with strategic trading card games, sports trading cards, and action figure collectibles leading the way. Franchises spanning video games, movies, and sports are driving consumer interest across multiple age groups, contributing to overall United States toys market growth.

Rise of the Adult Consumer Segment

A notable shift in consumer demographics is reshaping the toys market, with adults emerging as a powerful purchasing force beyond traditional child-focused segments. The kidult phenomenon reflects adults purchasing toys for personal enjoyment, nostalgia, and collection purposes. According to reports, in August 2025, toy sales for recipients aged 18 and older rose by 18% in the United States, underscoring the growing influence of adult buyers on overall industry performance. Further driving innovation, premium offerings, and more targeted marketing strategies within the industry.

Integration of Technology and Educational Value

Technological integration in toys continues accelerating as parents and consumers demand products that blend entertainment with learning outcomes. Smart toys incorporating augmented reality, artificial intelligence, and interactive features are gaining significant traction among tech-savvy families. For example, Mattel announced a strategic partnership with OpenAI in 2025 to co-develop AI-powered toys and games, including potential next-generation interactive products in the iconic Barbie and Uno lines, signaling a major industry push toward intelligent play experiences. Educational toy lines featuring sensory toys, puzzles, and developmental play items designed to enhance cognitive and motor skill development while maintaining entertainment value are increasingly popular.

Market Outlook 2026-2034:

The U.S. toy market is poised for sustained growth, driven by manufacturers’ innovative offerings and the market’s evolving dynamics of the retail sector, which is adapting to meet the demands of the end consumer. E-commerce is also on the cusp of growing, and the retail sector is set for a new face as toy companies aim to reach out to the consumers directly through data-driven personalization. These strategies are expected to enhance engagement, drive loyalty, and capture emerging opportunities across diverse consumer segments. The market generated a revenue of USD 32.09 Billion in 2025 and is projected to reach a revenue of USD 60.98 Billion by 2034, growing at a compound annual growth rate of 7.4% from 2026-2034.

United States Toys Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Action Figures | 22% |

| Age Group | 5 to 10 Years | 45% |

| Sales Channel | Online Stores | 28% |

| Region | South | 32% |

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The action figures dominate with a market share of 22% of the total United States toys market in 2025.

Action figures continue commanding significant market presence driven by their deep connection to popular entertainment franchises and collectible appeal spanning multiple age demographics. For example, in 2025 Hasbro and Playmates Toys announced a strategic global licensing partnership to produce and distribute a new Power Rangers action figure line, reflecting how legacy entertainment properties remain core to manufacturers’ franchise-led strategies. The segment benefits from strategic licensing agreements with major studios producing superhero, sci-fi, and anime content that resonates strongly with both children and adult collectors. Action figure sales reflect sustained consumer interest in highly detailed, articulated figures from franchises spanning comic books, movies, television series, and video games.

The action figures are one of the sectors that provide a point of entry for engaging with the franchise through brand loyalties that are continued through multiple media platforms. The increasing collectibles phenomenon among adults further helps this sector as people look for special variants, retro reproductions, or high-end display items. There is an increasing emphasis on better sculpting and accessory quality to position the products accordingly in the market.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

The 5 to 10 years leads with a share of 45% of the total United States toys market in 2025.

Children aged 5-10 represent the largest consumer demographic in the toys market, reflecting this age group's peak engagement with diverse toy categories including educational products, action figures, building sets, and games. During this developmental stage, children demonstrate enhanced cognitive abilities enabling them to engage with more complex play patterns while maintaining strong interest in imaginative and creative activities, driving substantial market revenue across multiple product categories.

This age bracket represents a critical window for brand loyalty development, as children form lasting preferences and emotional connections with toy brands and entertainment properties. Parents actively seek products combining entertainment value with educational outcomes, particularly STEM-focused toys promoting science, technology, engineering, and mathematics skills. The school-age context also influences purchasing patterns, with toys complementing educational curricula gaining popularity among parents seeking holistic developmental support for their children.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

The online stores dominate with a market share of 28% of the total United States toys market in 2025.

E-commerce platforms have transformed toy retail by offering unprecedented product selection, competitive pricing, and shopping convenience that traditional brick-and-mortar stores cannot easily replicate. This shift is supported by the rapid expansion of the broader U.S. e-commerce landscape, with the market valued at USD 1,236.5 billion in 2025 and projected to reach USD 2,160.3 billion by 2034. Online retailers provide detailed product information, customer reviews, and comparison capabilities that empower informed purchasing decisions for parents and collectors alike. The online sales channel is projected to continue expanding, with major retailers investing heavily in their digital toy assortments and fulfillment capabilities to capture growing consumer demand for convenient home delivery options.

The digital retail environment also enables niche and specialty toy products to reach wider audiences without requiring extensive physical retail presence. Manufacturers increasingly leverage direct-to-consumer online channels to build brand relationships and capture higher margins while offering exclusive products unavailable through traditional retailers. Enhanced logistics networks and faster delivery options continue improving the online shopping experience, further accelerating the shift toward digital commerce across the toys market.

Regional Insights:

- Northeast

- Midwest

- South

- West

South exhibits a clear dominance with a 32% share of the total United States toys market in 2025.

The Southern region commands the largest market share owing to demographic advantages including higher population growth rates, larger family sizes, and significant concentration of households with children compared to other regions. Major metropolitan areas including Dallas, Houston, Atlanta, and Miami serve as substantial consumer markets with robust retail infrastructure supporting toy sales across multiple channels. The region benefits from established distribution networks and strong presence of major retailers offering extensive toy selections to meet diverse consumer preferences.

Economic factors including relatively lower cost of living and favorable housing markets support family formation and household spending on discretionary categories including toys. The South's cultural emphasis on family activities and gift-giving traditions during holidays further strengthens regional demand. Manufacturers and retailers recognize the South's strategic importance and invest accordingly in targeted marketing, regional distribution centers, and localized product assortments addressing consumer preferences across this dominant market territory.

Market Dynamics:

Growth Drivers:

Why is the United States Toys Market Growing?

Rising Demand for STEM and Educational Toys

The growing emphasis on early childhood education and skill development is driving substantial demand for STEM-focused toys that combine learning with entertainment. Parents increasingly prioritize toys teaching science, technology, engineering, and mathematics concepts, viewing play as an essential developmental tool rather than mere entertainment. According to 2025 U.S. toy and play trends data, 60% of parents actively seek toys that help build STEAM (science, technology, engineering, arts, and math) skills when making purchasing decisions, reflecting how educational value has become a core driver for toy purchases. This trend reflects broader concerns about preparing children for technology-driven futures and ensuring academic readiness. Construction toy brands featuring licensed building sets spanning popular properties are directly addressing parental demand for engaging educational products that promote creativity and problem-solving skills while maintaining entertainment value for children.

Expansion of Entertainment Franchise Licensing

The robust ecosystem of entertainment licensing continues propelling toy market growth as manufacturers capitalize on popular media properties spanning movies, television, video games, and streaming content. Licensed toys benefit from built-in consumer awareness and emotional connections established through entertainment consumption, enabling faster market penetration and premium pricing. In April 2025, Mattel renewed its global licensing agreement with WWE, extending rights to create WWE‑themed action figures and toys worldwide, reinforcing how strategic entertainment partnerships support long‑term product pipelines and franchise‑driven sales. All top-performing toy properties are tied to licensing, entertainment content, or movie releases, with video game brands and cinematic franchises driving exceptional growth.

Growing Adult Consumer and Collector Market

The emergence of adult consumers as a significant market segment represents a transformative growth driver reshaping product development and marketing strategies across the toy industry. Adults purchasing toys for personal enjoyment, nostalgia, and collection purposes now constitute a substantial market force with considerable purchasing power. In May 2025, the bipartisan Congressional Toy Caucus was relaunched in the U.S. House of Representatives to highlight the economic, educational, and developmental importance of the toy industry and to help address key issues like product safety and supply chain resilience for American toy companies and consumers. Adults remain a powerful driver of market gains, with sales for recipients aged eighteen and older increasing substantially, split nearly evenly between men and women.

Market Restraints:

What Challenges the United States Toys Market is Facing?

Rising Production and Supply Chain Costs

Manufacturing costs continue impacting the toys market as raw material prices, labor expenses, and logistics costs fluctuate unpredictably. The industry's significant dependence on overseas production, particularly in Asia, creates vulnerability to supply chain disruptions, currency fluctuations, and trade policy changes. These cost pressures squeeze manufacturer margins and potentially translate into higher consumer prices that may dampen demand among price-sensitive buyers.

Stringent Safety Regulations and Recall Risks

Compliance with evolving safety standards represents an ongoing challenge requiring substantial investment in testing, quality control, and documentation across product portfolios. Product recalls due to safety concerns can severely damage brand reputation and consumer confidence while incurring significant financial costs. Smaller manufacturers particularly struggle with regulatory complexity, limiting market entry and innovation capacity within the competitive landscape.

Competition from Digital Entertainment

Children's increasing engagement with digital entertainment options including video games, streaming content, and social media platforms competes directly for attention and discretionary spending traditionally allocated to physical toys. Screen-time concerns among parents create ambiguity around toy purchasing decisions as families balance physical play with digital entertainment, pressuring traditional toy categories while driving demand for technology-integrated products.

Competitive Landscape:

The United States toys market features intense competition among established multinational corporations and specialized manufacturers competing through product innovation, brand development, and retail partnerships. Leading companies leverage extensive licensing portfolios, global distribution networks, and substantial marketing resources to maintain market positions while investing in emerging product categories addressing evolving consumer preferences. Competition increasingly extends beyond traditional product development to encompass digital engagement strategies, direct-to-consumer initiatives, and sustainability commitments that resonate with contemporary consumers. Strategic acquisitions, partnerships, and category expansions enable manufacturers to diversify revenue streams and strengthen competitive positioning across the dynamic marketplace.

Recent Developments:

- In May 2025, Moose Toys signed an exclusive global partnership with CrunchLabs and YouTuber/engineer Mark Rober to launch a new STEM-focused toy line aimed at boosting science and engineering play for kids. The innovative product range is set to hit retailers worldwide in summer 2026.

United States Toys Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports And Outdoor Toys, Plush, Others |

| Age Groups Covered | Up To 5 Years, 5 To 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets And Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States toys market size was valued at USD 32.09 Billion in 2025.

The United States toys market is expected to grow at a compound annual growth rate of 7.4% from 2026-2034 to reach USD 60.98 Billion by 2034.

Action figures, holding the largest revenue share of 22%, leads the United States toys market driven by strong franchise licensing, collector demand, and sustained popularity among both children and adult enthusiasts.

Key factors driving the United States toys market include rising demand for STEM educational toys, expansion of entertainment franchise licensing, growing adult collector segment, e-commerce channel expansion, and continued emphasis on developmental play.

Major challenges include rising production and supply chain costs, stringent safety regulations and recall risks, competition from digital entertainment options, price sensitivity among consumers, and evolving retail landscape dynamics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)