United States Tobacco Market Size, Share, Trends and Forecast by Type, and Region, 2026-2034

United States Tobacco Market Size and Share:

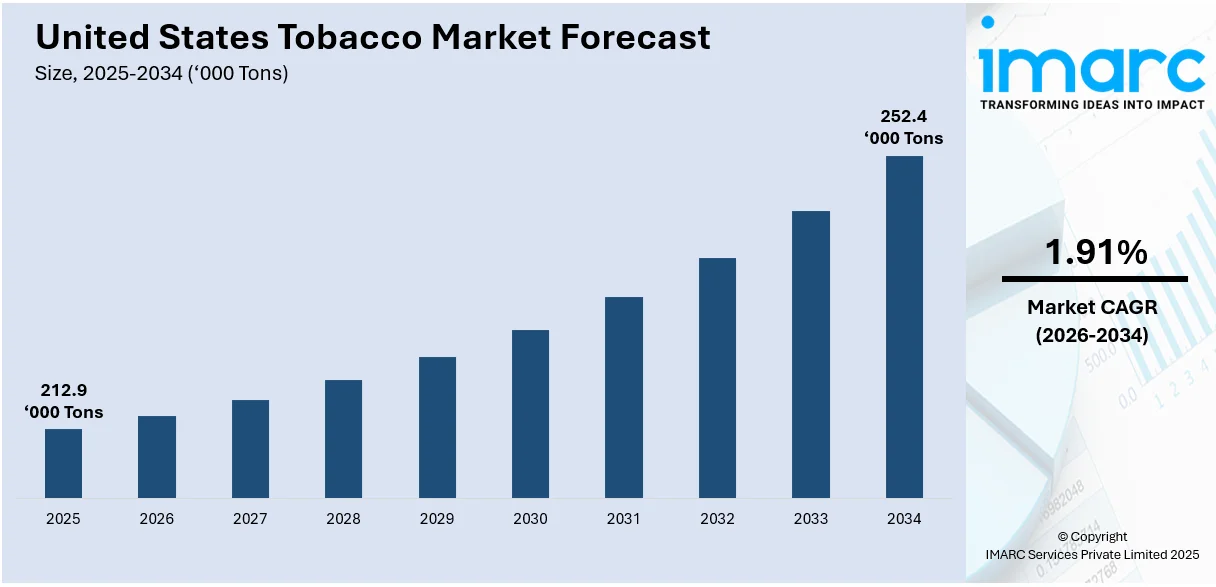

The United States tobacco market size was estimated at 212.9 Thousand Tons in 2025. Looking forward, IMARC Group estimates the market to reach 252.4 Thousand Tons by 2034, exhibiting a CAGR of 1.91% from 2026-2034. The market is evolving with strong growth in alternative products like e-cigarettes and nicotine pouches, steady demand for menthol cigarettes, rising premium tobacco sales, expanding online channels, and robust innovation efforts by major players.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

212.9 Thousand Tons |

|

Market Forecast in 2034

|

252.4 Thousand Tons |

| Market Growth Rate (2026-2034) | 1.91% |

The tobacco market in the United States is expanding as consumers are increasingly adopting tobacco goods such as nicotine pouches, heated tobacco devices, and e-cigarettes. Adult smokers' shifting choices for smoke-free and less dangerous options are the driving force behind this development. Businesses are responding to this need by launching cutting-edge products with streamlined appearances, enhanced flavors, and more covert applications. One important demographic driving this development is younger individuals, especially those between the ages of 18 and 35. Over 2.25 million high school and middle school pupils in the United States reported smoking tobacco products in 2024. Furthermore, marketing tactics play a major factor in the product appeal. In order to reach out to tech-savvy consumers, brands are portraying e-cigarettes and nicotine pouches as lifestyle items and leveraging social media influencers and stylish advertising. These campaigns emphasize convenience, reduced smell, and modernity. As such , the market for e-cigarettes in the country is expected to reach US$ 43.6 billion by 2032. It is growing at a rapid pace of 14.75% from 2024 to 2032.

To get more information on this market Request Sample

With respect to regulations, the FDA has initiated and introduced several propositions for alternative products to enter into the marketplace as long as they meet certain criteria. It creates a huge opportunity for manufacturers not only to expand their product offerings but also to ensure compliance while leading in innovation. One of these include the introduction of flavors like mint, fruits, and menthol that attract consumers, specifically those that are transitioning from combustible tobacco items. For example , menthol-flavored e-cigarette sales increased from 2020 to 2023 by 175.8%, while e-cigarettes with clear or other cooling flavors surged by 872.1%. The change is so significant that it drives many tobacco companies to redefine their long-term strategies and invest heavily in R&D for non-combustible products.

United States Tobacco Market Trends:

Higher Disposable Incomes

Increased disposable income has a major positive impact on the tobacco market in the United States. With a 5.9% rise in disposable personal expenditure in 2023 over 2022, consumers in the US spend more on discretionary items like tobacco products. Higher earnings are also enabling customers to seek out substitutes like premium cigars, heated tobacco products, and vaping devices, which is driving the market's expansion. In 2023, 467 million premium cigars were imported, up from 464 million in 2022, according to an industry study. This rise is also a result of the expanding middle class, which views limited-edition tobacco products and luxury cigars as lifestyle enhancements.

Expanding Online Tobacco Sales

E-commerce has become an essential sales channel for tobacco, especially for smokeless and substitute goods. By the end of 2024, it is anticipated that the nation's total e-commerce sales will increase by 8.7% to around $1.2 trillion, or 16.2% of all retail sales. Because it offers ease and wider access to specialized items like nicotine pouches, heated tobacco devices, and premium cigars, this changing trend is also visible in tobacco products. Regulatory frameworks allow for age verification systems, enabling responsible sales while supporting market expansion. This has encouraged companies to use digital platforms for subscriptions, personalized recommendations, and exclusive product launches, which have resonated well with tech-savvy consumers.

Aggressive Industry Innovation and Branding

Tobacco companies are ramping up innovation to sustain growth. Major companies like Philip Morris spent more than USD 709 million on research and development (R&D) in 2023; 99% of that investment is still focused on smokeless goods and next-generation tobacco products, including lower-risk substitutes. Additionally, branding tactics are changing, emphasizing influencer-driven marketing, streamlined packaging, and a wider appeal to tech-savvy consumers. Tobacco has been effectively reframed as a contemporary, lifestyle-driven option by products like IQOS and Zyn. These innovations help attract younger demographics and retain existing users despite regulatory pressures.

United States Tobacco Industry Segmentation:

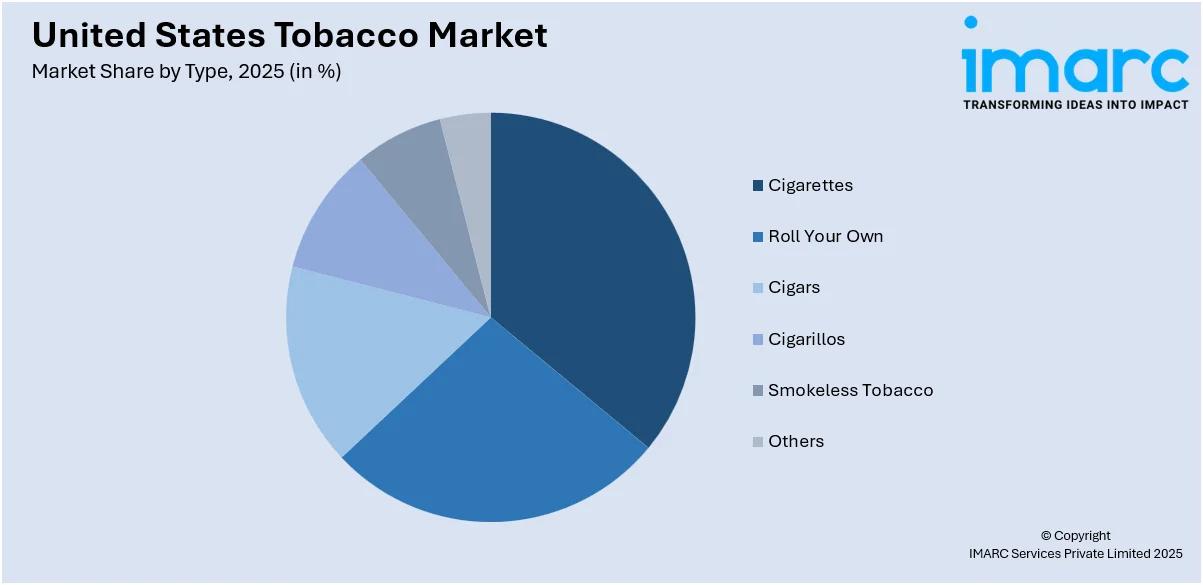

IMARC Group provides an analysis of the key trends in each segment of the United States tobacco market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type.

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Cigarettes

- Roll Your Own

- Cigars

- Cigarillos

- Smokeless Tobacco

- Others

Cigarettes continue to attract a significant portion of consumers, particularly older age groups. Leading brands hold strong market positions, with menthol variants showing consistent demand. This segment benefits from brand loyalty and extensive distribution networks, maintaining its relevance amidst shifting consumer preferences.

The roll-your-own tobacco market appeals to users who are on a budget and want a personalized smoking experience. In 2023, this market grew steadily due to consumer demand for organic and additive-free tobacco products. Younger individuals who appreciate sustainability and ingredient control are especially fond of RYO goods. This market also appeals to niche and environmentally sensitive consumers as well as smokers on a tight budget because it has lower taxes and prices than pre-rolled cigarettes.

The cigar market is expanding as more people see cigars as a luxury item to be used occasionally rather than on a daily basis. In 2023, demand for premium cigars in particular surged due to growing disposable incomes and a developing cigar lounge culture. In response, companies are targeting rich consumers with hand-rolled variations and special releases. Despite having a lesser market share overall, this segment's value proposition is derived from its high-margin items and premium positioning.

Cigarillos are a more accessible and smaller alternative to classic cigars, which appeal to younger adults and urban customers. This market is expanding because of its affordability and variety of taste, which include both fruity and sweet alternatives. Cigarillos combine the premium appeal of cigars with the ease of cigarettes.

Smokeless tobacco, which includes moist snuff, chewing tobacco, and nicotine pouches, is a fast-growing market. In 2023, it had a significant market share, with nicotine pouches boosting innovation and acceptance among younger consumers. This category is especially popular in rural regions, where cultural norms and cost influence demand. Smokeless products are often marketed as discreet and smoke-free alternatives, making them an attractive choice for consumers seeking convenience and options that cause lesser harm in comparison to traditional smoking products.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Premium cigars and smokeless tobacco alternatives are in high demand in the Northeast region of United States, particularly in cities like New York and Boston. The region also boasts a rising market for e-cigarettes and nicotine pouches, which appeal to a health-conscious and urban population looking for alternatives to traditional smoking.

The Midwest is a bastion for conventional tobacco products, such as cigarettes and smokeless tobacco, reflecting regional cultural norms and cost. Roll-your-own tobacco and moist snuff are very popular in this area, appealing to rural customers looking for affordable and personalized solutions. Despite a consistent demand for traditional goods, alternatives such as heated tobacco devices are gaining popularity.

The Southern tobacco market remains strong due to high smoking rates and a strong cultural relationship with tobacco use. There is a significant presence of cigarettes with premium brands holding a vast majority of the market share. The region also holds substantial market space for menthol cigarettes and cigarillos, as it is popular among a variety of customers. Alongside this, smokeless tobacco products are in great demand in the rural areas of the South, thereby increasing the region's share of total market profits.

West, on the other hand, shows increasing demand for new or alternative products such as e-cigarettes, nicotine pouches, and heated tobacco systems across California and Washington. West is also a market for niche organic and roll-your-own tobacco sales, particularly among environmentally savvy consumers. This region well represents a transition from more conventional smoking towards new and smokeless.

Competitive Landscape:

Key market competitors are working on broadening their product ranges to satisfy changing customer preferences and regulatory constraints. They are investing in alternative items such as e-cigarettes, heated tobacco systems, and nicotine pouches, which are becoming increasingly popular among younger and health-conscious consumers. To attract new customers, efforts are being made to innovate, with an emphasis on enhancing product designs, flavors, and user experience. Companies are also using digital channels for direct sales and marketing, such as individualized subscription services and online exclusives, to reach tech-savvy clients. Additionally, premium products like roll-your-own tobacco and cigars, which serve niche markets seeking individualized or luxurious solutions, are becoming popular. Players are also working on changing their strategies to maintain compliance in the midst of regulatory scrutiny while propelling expansion in new markets, especially in areas where alternative goods are becoming more popular. These programs are essential for maintaining overall market growth and counteracting the decline in traditional cigarette sales.

The report provides a comprehensive analysis of the competitive landscape in the United States tobacco market with detailed profiles of all major companies.

Latest News and Developments:

- In July 2024 , Philip Morris International declared that the company is investing $600 million to establish a manufacturing unit in the city of Colorado to meet the rising demand for Zyn nicotine pouches. The corporation stated that they expect plant operations to commence in 2025, creating 500 jobs in the state.

- In June 2024 , Altria Group, Inc. announced the submission of Premarket Tobacco Product Applications (PMTAs) to the U.S. Food and Drug Administration (FDA) for its “on! PLUS” oral nicotine pouch products initiative. The company’s on! PLUS is a spit-free and oral tobacco-derived nicotine (TDN) pouch that is made from a proprietary soft-feel material to provide a more comfortable product experience.

United States Tobacco Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cigarettes, Roll-Your-Own, Cigars, Cigarillos, Smokeless Tobacco, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States tobacco market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States tobacco market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States tobacco industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Tobacco is a plant primarily grown for its leaves, which are processed and used in products like cigarettes, cigars, chewing tobacco, and nicotine pouches. It contains nicotine, a stimulant, and is widely consumed recreationally. Tobacco is included in smoking, smokeless products, and as an ingredient in alternative nicotine delivery systems.

The United States tobacco market size reached 212.9 Thousand Tons in 2025.

IMARC estimates the United States tobacco market to exhibit a CAGR of 1.91% from 2026-2034.

The United States tobacco market is driven by growing demand for alternative products like e-cigarettes and nicotine pouches, strong menthol cigarette sales, rising disposable incomes, expanding online sales, and increasing interest in premium tobacco products.

Some of the major players in the United States tobacco market include Pyxus International Inc., Swedish Match AB, Vector Tobacco, Korea Tobacco & Ginseng Corporation, Imperial Brands, Philip Morris International, Universal Corporation, Japan Tobacco Inc., Scandinavian Tobacco Group, and Vector Group LTD.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)