United States Tequila Market Size, Share, Trends and Forecast by Product type, Purity, Price Range, Distribution Channel, and Region, 2026-2034

United States Tequila Market Size and Share:

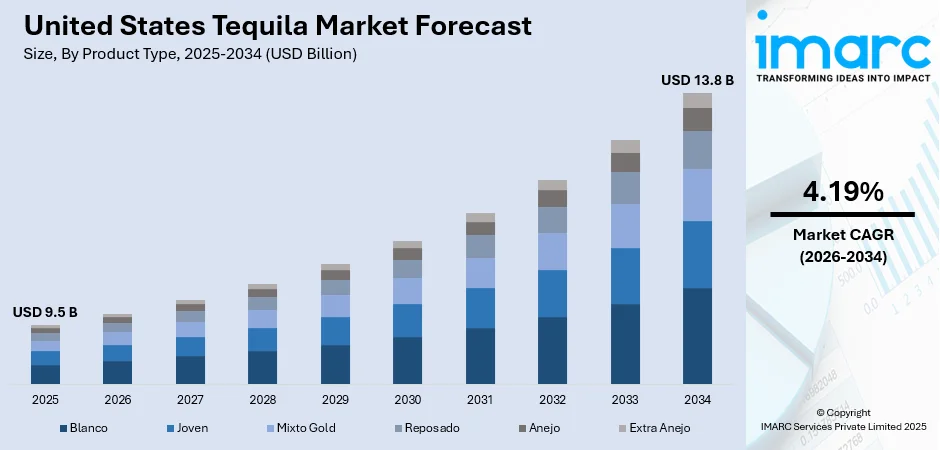

The United States tequila market size was valued at USD 9.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 13.8 Billion by 2034, exhibiting a CAGR of 4.19% from 2026-2034. The market is witnessing steady expansion, impacted by magnifying requirement for artisanal and premium products, transforming customer choices, and the proliferating popularity of cocktails. Furthermore, the market heavily profits from bolstering agave spirit imports and advancements addressing the younger section, sustainability, and authenticity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 9.5 Billion |

|

Market Forecast in 2034

|

USD 13.8 Billion |

| Market Growth Rate (2026-2034) | 4.19% |

Access the full market insights report Request Sample

One of the primary drivers of the U.S. tequila market is the growing consumer demand for premium, high-quality spirits. As awareness of tequila’s heritage and craftsmanship increases, consumers are increasingly opting for 100% agave tequila, particularly aged varieties like Reposado and Añejo. For instance, in August 2024, Humano, a tequila company, launched in the United States with four varieties, including Joven, Blanco, Añejo, and Reposado. Moreover, this shift is fueled by a broader trend towards authentic, artisanal products, as well as the rising popularity of craft cocktails. Additionally, the premiumization of the spirits market, driven by higher disposable incomes and a desire for unique experiences, has significantly boosted tequila’s market growth.

To get more information on this market Request Sample

The fast-growing U.S. tequila market benefits from consumer demand for natural, clean-label beverages that contain fewer calories as consumers advance their wellness-focused practices. Since its production involves natural processes and contains minimal additives tequila, especially 100% agave alcohol type, it matches the preferences of health-oriented consumers. For instance, as per industry reports, California has over 400 acres dedicated to agave cultivation. Clean label's rise in popularity results from increasing consumer focus on natural lifestyle choices which views tequilas as a healthier alcohol alternative to traditional spirits. Tequila has also gained increased appeal from health-focused young consumers who prefer natural beverages matching their pursuit of quality and functionality.

United States Tequila Market Trends:

Premiumization of Tequila

A principal trend in the U.S. tequila market is the constant inclination towards super-premium or premium products. As customers are currently looking for authenticity as well as better quality, there is an escalating shift towards 100% agave tequila, especially for aged variations. This trend highlights a comprehensive inclination in the alcohol sector, where customers are receptive to expend on premium beverages that provide unique flavor attributes and artisanal craftsmanship. In addition to this, the premiumization of tequila is fueled by magnifying disposable incomes, enhanced customer education, and the intense need for sophisticated drinking experiences influencing the market expansion. For instance, according to the Bureau of Economic Analysis, in August 2024, personal income rose by USD 50.5 Billion, reflecting a 0.2% increase on a monthly basis.

Rise in Tequila-Based Cocktails

Another chief trend contributing to the expansion of the U.S. tequila market share is the magnifying preference of tequila-based cocktails. As the cocktail culture is rapidly augmenting, tequila is notably emerging as an integral need in several drinks, with the margarita establishing itself as the most prominent choice. In addition to this, customers are also actively experimenting with unique tequila cocktails, mainly including Tequila Sour or the Paloma. For instance, in Q1 2024, Proximo Spirits, a major U.S.-based tequila brand with robust presence in Paloma category, recorded a 1% rise in overall sales, with the U.S. region showing a 7.4% growth compared to the same period in 2023. Moreover, this trend has been significantly impacted by advanced mixologists as well as bartenders who are currently utilizing tequila to craft high-quality and distinctive drinks. The requirement for premium and versatile tequila expressions is bolstering as customers are actively navigating for one-of-a-kind cocktail experiences.

Sustainability and Eco-Friendly Practices

Sustainability is a rising trend which is intensely crucial for the U.S. tequila industry, with customers as well as producers rapidly gaining more awareness regarding the environmental impact. Brands are increasingly opting for environmentally friendly methods, encompassing utilizing sustainable packaging, lowering water usage, and deploying renewable energy in production methodologies. Besides this, customers, particularly younger population, are rapidly being drawn to companies that exhibit environmental responsibility, resulting in several tequila companies to exhibit their sustainability efforts. This trend not only caters to the comprehensive global sustainability objectives but also highlights an elevating user inclination toward eco-conscious, ethical products, further steering the tequila market in the U.S. For instance, in August 2024, DE-NADA Tequila, a U.S.-based brand, announced the introduction of its new sustainable packaging that will strengthen the brand's current carbon-neutral certification while enhancing the distillery's environmentally friendly practices. This step includes the launch of new aluminum bottle for its Blanco and Reposado spirits, with a 100% sustainable cork topper composed of wood components.

United States Tequila Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States tequila market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, purity, price range, and distribution channel.

Analysis by Product Type:

- Blanco

- Joven

- Mixto Gold

- Reposado

- Anejo

- Extra Anejo

United States tequila market forecast indicates that blanco tequila holds the largest market share within the country by product type, driven by its versatility and pure flavor profile. This unaged variant offers a clean, crisp taste, positioning it as an ideal option for cocktails, including margaritas and tequila sours. Blanco tequila's appeal lies in its direct connection to the agave plant, maintaining its raw, unaltered qualities. Moreover, as consumer preference shifts towards authentic and premium spirits, blanco tequila's market share continues to grow, particularly among younger, health-conscious consumers seeking a refreshing and light alternative to other spirits. For instance, in June 2024, Santo Spirits launched its 110 Proof Blanco Tequila in the United States. This brand is prominent for producing 100% additive-free tequila with conventional methods.

Analysis by Purity:

- 100% Tequila

- 60% Tequila

100% tequila is prominent in the U.S. market by purity, as consumers increasingly prioritize quality and authenticity. Made exclusively from blue agave, this variant offers a smoother, purer taste, free from added sugars or flavorings. With growing awareness about the benefits of consuming authentic, high-quality spirits, 100% tequila has gained significant traction, particularly among discerning consumers and those seeking a premium drinking experience. Additionally, This trend is reflected in the rising demand for higher-end expressions like Reposado and Añejo, contributing to the continued growth of 100% tequila in the U.S. market.

The 60% tequila segment, often referred to as mixto tequila, holds a smaller share of the U.S. market due to its lower purity. Comprising 60% blue agave and 40% other sugars, mixto tequila is typically more affordable, making it appealing to budget-conscious consumers. While it lacks the full-bodied, agave-forward flavors of 100% tequila, mixto is still widely used in mass-produced products and well-known cocktail brands. Despite its lower market share compared to 100% tequila, 60% tequila remains prevalent due to its price competitiveness and widespread availability across various retail channels.

Analysis by Price Range:

- Premium Tequila

- Value Tequila

- Premium and Super-Premium Tequila

- Ultra-Premium Tequila

In the U.S., premium tequila commands the largest market share by price range, reflecting the growing demand for high-quality, aged expressions. Premium tequilas, such as Reposado and Añejo, often undergo extended aging in oak barrels, which enhances their flavor profiles with rich, complex notes. The trend toward luxury spirits has been bolstered by increased consumer interest in fine dining and craft cocktails. Furthermore, as disposable incomes rise and tequila gains recognition as a refined spirit, the premium segment is poised for continued growth, with consumers increasingly willing to invest in superior products for a superior drinking experience. For instance, in September 2024, Zamora Company USA launched its organically resourced ultra-premium and additive-free tequila brand Tequila VOLTEO. This has been developed under a strong partnership between Zamora Company USA, Casa de Piedra distillery, and Prescott.

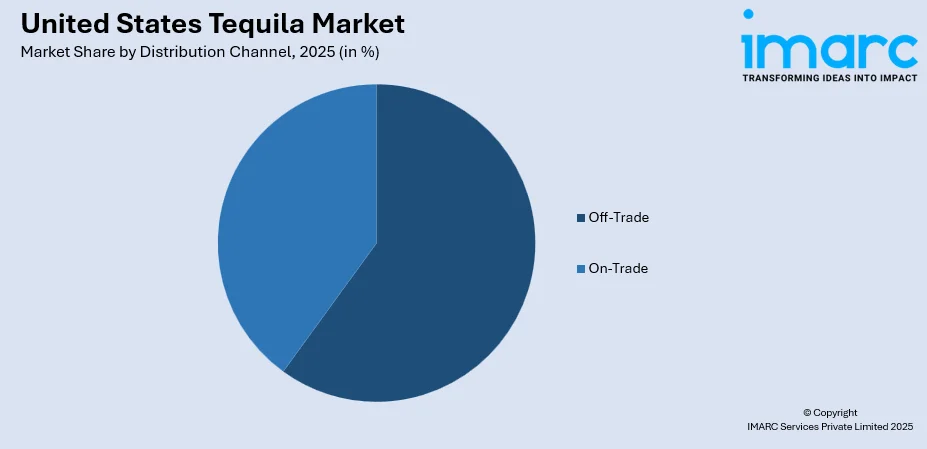

Analysis by Distribution Channel:

To get detailed segment analysis of this market Request Sample

- Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

- On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

The on-trade distribution channel, including bars, restaurants, and clubs, captures the largest market share in the U.S. tequila market. This channel benefits from the increasing popularity of tequila-based cocktails, which are staples in both casual and high-end establishments. In addition to this, the notable emergence of cocktail as well as mixology culture has contributed to the surge in on-premise tequila consumption. As consumers seek unique and premium drinking experiences, on-trade outlets provide an ideal setting for brands to showcase their high-quality tequilas through curated menus and specialty drinks. For instance, as per industry reports, in 2024, agave-based spirits are projected to overtake vodka in sales within the US on-trade market. Consequently, the on-trade segment remains a key driver of tequila sales and brand visibility. For instance, as per industry reports, with 263 superstores, Total Wine & More has recently achieved the status of the largest alcohol retailer in the United States, with an annual revenue of USD 5 Billion in November 2024. Total Wine & More owns numerous liquor stores, highlighting its prominence.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region of the United States represents a significant market for tequila, driven by a combination of affluent consumers and a vibrant cocktail culture. This area, which includes major metropolitan cities like New York and Boston, has seen increased demand for premium and craft tequilas, particularly among younger, health-conscious demographics. The region’s diverse and cosmopolitan population is drawn to both traditional and innovative tequila offerings, with growing interest in aged varieties like Reposado and Añejo. Additionally, the Northeast's strong bar and restaurant scene fosters tequila's popularity, contributing to its expanding market share.

The Midwest, historically dominated by whiskey and beer, is experiencing a gradual yet notable rise in tequila consumption. As consumer preferences evolve, the region has seen a surge in demand for premium and super-premium tequilas, with growing interest in cocktails such as margaritas and Palomas. Furthermore, larger cities like Chicago and Detroit are leading the way in tequila adoption, driven by an increasing number of bars, restaurants, and consumers exploring new drinking experiences. This shift reflects a broader trend toward diversification in alcohol preferences, further enhancing tequila's presence in the Midwest market.

The South region of the United States is a key player in the tequila market, with tequila consumption historically rooted in the region's cultural affinity for Mexican cuisine and flavors. States such as Texas, Florida, and Louisiana consistently exhibit high tequila consumption rates, driven by both traditional and contemporary cocktail preferences. The region’s robust hospitality industry further fuels tequila demand, particularly in bars and restaurants serving tequila-forward drinks like margaritas. Additionally, growing consumer interest in premium, 100% agave tequila is helping to drive market growth in the South, reflecting a shift toward higher-quality spirits.

The West region of the U.S. holds the largest market share for tequila, driven by its proximity to Mexico and a long-standing affinity for tequila-based beverages. Major markets such as California, Arizona, and Nevada have experienced exponential growth in tequila consumption, particularly in premium and super-premium segments. California, in particular, is a key player, where tequila's popularity is bolstered by its sophisticated consumer base and a growing preference for artisanal, high-quality spirits. With an expanding craft cocktail scene and increasing consumer education, the West continues to be the leading region for tequila in the U.S. market.

Competitive Landscape:

The market is intensely competitive, with several firms striving for significant market share across several price segments. Major international producers dominate the premium and super-premium categories, leveraging brand recognition and extensive distribution networks. However, emerging craft distillers are gaining traction by emphasizing authenticity, sustainability, and innovation in their offerings. Additionally, both established and new entrants focus on expanding consumer engagement through targeted marketing, collaborations with mixologists, and an increasing presence in bars and restaurants. For instance, in January 2025, Cincoro Tequila, a U.S.-based brand, announced a tactical distribution agreement with Southern Glazer's Wine & Spirits, a major alcohol distributor. Under the agreement, Southern Glazer's will proliferate the Cincoro Tequila's distribution to seven new markets, raising the count to 43. The new markets encompass Maryland, Illinois, Florida, Colorado, Delaware, Minnesota, and Washington D.C. This competitive landscape is further shaped by changing consumer preferences for high-quality, artisanal products and tequila-based cocktails.

The report provides a comprehensive analysis of the competitive landscape in the United States tequila market with detailed profiles of all major companies, including:

- Bacardi and Company Ltd.

- Diageo PLC

- Pernod Ricard

- Constellation Brands, Inc.

- Suntory Holdings Limited

- Heaven Hill Distilleries, Inc.

- Campari Group

- Casa Aceves

- Sazerac Company Inc.

- Brown-Forman Corporation

Latest News and Developments:

- In November 2024, Maguey Spirits' U.S. distribution arm Maguey Imports strategically acquired Pasote Tequila and Bozal Mezcal to boost Mexico's agave spirits legacy while offering the excellent craftmanship of these two Mexico-based brands.

- In September 2024, Reserva de la Familia, a major Añejo Tequila brand, collaborated with MICHELIN Guide U.S. as its official tequila partner for the year 2025. This collaboration highlights Reserva de la Familia's robust aim to promote premium Mexican cuisine across the United States.

- In March 2024, Tequila Ocho unveiled its new packaging, which is expected to launch across the U.S. in April. The new packaging highlights the company's dedication to showcasing terroir in spirits.

- In January 2024, Zamora Co announced plans to expand its footprint in the United States' tequila segment with its upcoming Volteo brand. This new brand is produced by Destileria Casa De Piedra and will be both additive-free and organic.

United States Tequila Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Blanco, Joven, Mixto Gold, Reposado, Anejo, Extra Anejo |

| Purities Covered | 100% Tequila, 60% Tequila |

| Price Ranges Covered | Premium Tequila, Value Tequila, Premium and Super-Premium Tequila, Ultra-Premium Tequila |

| Distribution Channels Covered | Off-Trade: Supermarkets and Hypermarkets, Discount Stores,Online Stores, Others On-Trade: Restaurants and Bars, Liquor Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States tequila market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States tequila market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States tequila industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States tequila market was valued at USD 9.5 Billion in 2025.

The market expansion is boosted by elevating customer need for craft and premium tequila, amplifying appeal for agave-based spirits, proliferating cocktail culture, and an amplifying emphasis on authenticity and sustainability. In addition, younger population is embracing tequila as a trendy and versatile beverage option.

IMARC estimates the United States tequila market to reach USD 13.8 Billion by 2034, exhibiting a CAGR of 4.19% from 2026-2034.

Blanco segment accounted for the largest product type market share.

Some of the major players in the United States tequila market include Bacardi and Company Ltd., Diageo PLC, Pernod Ricard, Constellation Brands, Inc., Suntory Holdings Limited, Heaven Hill Distilleries, Inc., Campari Group, Casa Aceves, Sazerac Company Inc., Brown-Forman Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)