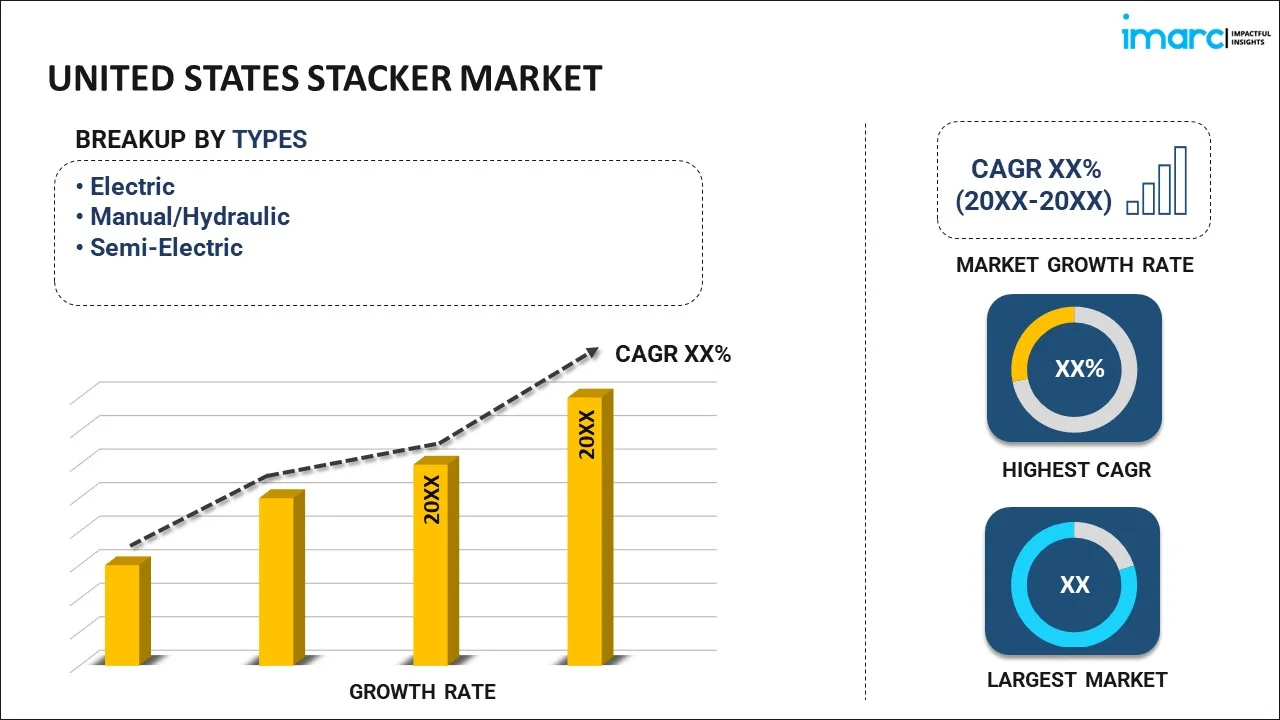

United States Stacker Market Report by Type (Electric, Manual/Hydraulic, Semi-Electric), End User (Retail and Wholesale, Logistics, Automobile, Food and Beverages, and Others), and Region 2025-2033

United States Stacker Market Size:

The United States stacker market size reached USD 467.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 706.8 Million by 2033, exhibiting a growth rate (CAGR) of 4.3% during 2025-2033. The market is being driven by the rapid expansion of warehouse and distribution centers across the country, numerous technological advancements including the integration of automation and robotics in stacker machinery, considerable rise in the e-commerce sector facilitating easy product availability, and continual improvements in cold storage facilities and food processing plants.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 467.5 Million |

|

Market Forecast in 2033

|

USD 706.8 Million |

| Market Growth Rate 2025-2033 | 4.3% |

United States Stacker Market Analysis:

- Major Market Drivers: Increasing warehouse automation and e-commerce demand drive the United States stacker market. Also, growing emphasis on efficient material handling in various industries bolsters the need for advanced stackers. Moreover, the rise in industrial output and warehouse expansion further propels market growth.

- Key Market Trends: The increasing adoption of electric stackers over traditional models is a significant trend, attributed to environmental concerns and operational efficiency. Integration of IoT and smart technologies in stackers enhances productivity and monitoring capabilities. Besides this, the shifting trend towards customized stackers to meet specific industry requirements is also gaining traction, thereby contributing to the expanding United States stacker market share.

- Competitive Landscape: Leading players focus on innovation and technology integration to maintain a competitive edge. Partnerships and collaborations with tech firms enhance product offerings and market reach. Competitive pricing and extensive after-sales service are key strategies to attract and retain customers.

- Challenges and Opportunities: High initial investment costs pose a challenge for small and medium enterprises. However, the increasing shift towards automation presents significant growth opportunities. Addressing skilled labor shortages through training and advanced technology adoption can mitigate operational challenges.

United States Stacker Market Trends:

Increased adoption of compact material handling equipment

The use of small material handling equipment has grown in recent years due to its ease of maintenance, portability, and comparable performance to big machinery. Furthermore, unlike large machinery, compact material handling equipment, such as stackers, do not require qualified personnel and are far easier to use. Moreover, stackers are more popular among end users since they are less expensive than other conventional material handling equipment. As a result, the growing popularity of the product among the masses is significantly contributing to the United States stacker market growth.

Versatile benefits associated with stackers

Stackers, with their small size and increased agility, offer numerous benefits in a variety of professions in manufacturing, shop floors, retail and wholesale hubs, warehouses, logistics, and factories. For example, this technology is more adaptable to small, enclosed locations, is easy to transport, is inexpensive, and requires little upkeep. Furthermore, the increased use of stackers in recent years has been ascribed to the need for safe and effective material handling equipment in a wide range of industries. In the next years, these benefits are expected to drive the United States stacker demand.

Rapid technological innovations

The ability to handle numerous pallets and move horizontally has increased the adoption of battery-operated stackers in end-user industries. Long-distance travel and light-duty material handling applications are now conceivable thanks to the use of lithium-ion batteries for increased flexibility and energy efficiency. Several firms invest heavily in developing stackers with increased durability, dependability, and efficiency. One example is the Raymond Courier 3030 stacker, which Toyota-owned Raymond Corporation debuted in May 2019. The automatic lift truck stacker is the next version in this line, capable of moving pallets both horizontally and vertically. As a result, this trend is creating substantial United States stacker market recent opportunities.

United States Stacker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Breakup by Type:

- Electric

- Manual/Hydraulic

- Semi-Electric

The report has provided a detailed breakup and analysis of the market based on the type. This includes electric, manual/hydraulic, and semi-electric.

Breakup by End User:

- Retail and Wholesale

- Logistics

- Automobile

- Food and Beverages

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes retail and wholesale, logistics, automobile, food and beverages, and others.

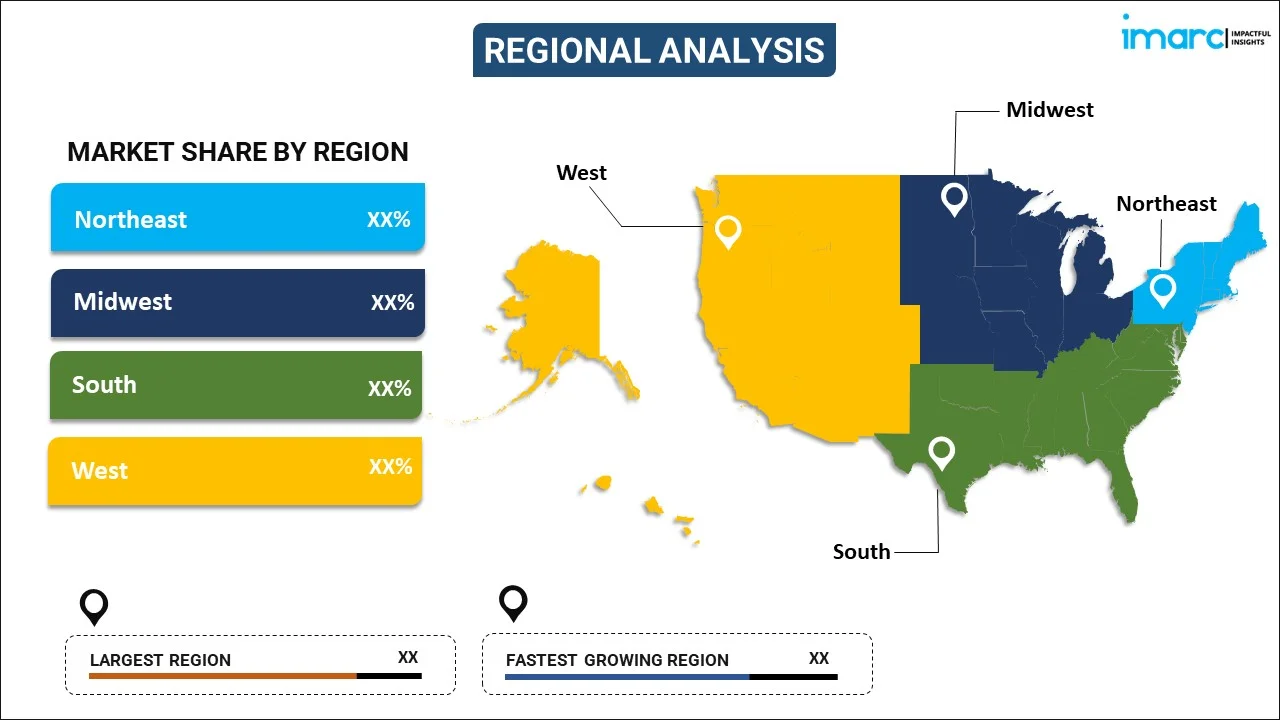

Breakup by Region:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major markets in the country, which include Northeast, Midwest, South, and West.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- The top United States stacker companies are using important strategies such as product development to increase market reach and maintain competitiveness. They are focusing on investing in advanced technologies such as automation, IoT, and AI to enhance the efficiency, safety, and reliability of stackers. Leading companies are also investing extensively in R&D to improve their product offerings to help the market grow even further. In addition to this, the major firms are offering comprehensive training programs and after-sales support to ensure customers can effectively operate and maintain their equipment. They are also developing eco-friendly products and incorporating sustainable practices in manufacturing processes to attract environmentally conscious consumers. This, in turn, is leading to the growth of the United States stacker market revenue.

United States Stacker Market News:

- March 11, 2024: Material handling equipment manufacturer The Raymond Corporation introduced two new solutions to expand its automation portfolio: the Raymond Courier 3030 Automated Stacker and the Raymond Courier Automatic Charging System. The stacker offers improved motion control, object detection, increased speeds, and Lane Staging, enhancing flexibility and reliability. The charging system integrates with iBATTERY® and iWAREHOUSE® systems, allowing operators to focus on valuable tasks and giving managers flexible charging schedules. This, in turn, is creating a positive United States stacker market outlook.

- April 11, 2023: Toyota Material Handling (TMH), the industry leader in material handling innovation, recently launched a new electric walkie stacker under the brand Tora-Max, adding to the company’s growing portfolio of material handling products and solutions. The Tora-Max Walkie Stacker offers supreme versatility, accessibility, and load stability. The new walkie stacker enhances Toyota’s industry-leading lineup of electric products, and with advanced features, it ensures efficiency and reliability for various industrial applications. Therefore it is an ideal solution for customers in the warehousing, manufacturing, beverage, retail, and distribution industries. As per the United States stacker market forecast, the introduction of advanced and versatile products like the Tora-Max Walkie Stacker highlights the ongoing innovation and growth potential within the sector.

- March 19, 2024: On March 19, 2024, Jungheinrich introduced its new EJC 1i series of electric pedestrian stackers at LogiMAT 2024 in Stuttgart. The series features lithium-ion batteries, providing a compact design and increased performance, including faster lifting and lowering speeds. The innovative design offers higher residual capacity, improved stability, and better visibility, making it ideal for small and medium-sized enterprises with limited space.

United States Stacker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electric, Manual/Hydraulic, Semi-Electric |

| End Users Covered | Retail And Wholesale, Logistics, Automobile, Food and Beverages, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States stacker market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the United States stacker market?

- What is the breakup of the United States stacker market on the basis of type?

- What is the breakup of the United States stacker market on the basis of end user?

- What are the various stages in the value chain of the United States stacker market?

- What are the key driving factors and challenges in the United States stacker market?

- What is the structure of the United States stacker market, and who are the key players?

- What is the degree of competition in the United States stacker market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States stacker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States stacker market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States stacker industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)