United States Sports and Energy Drinks Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034

Market Overview:

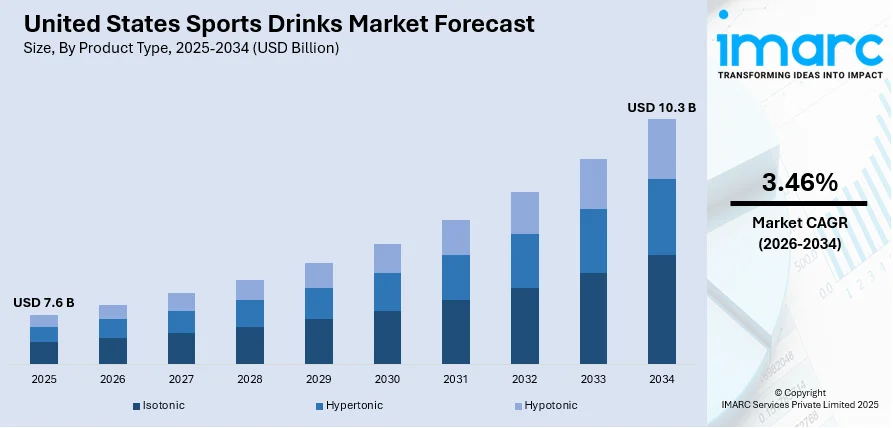

The United States sports and energy drinks market size reached USD 7.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.3 Billion by 2034, exhibiting a growth rate (CAGR) of 3.46% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.6 Billion |

| Market Forecast in 2034 | USD 10.3 Billion |

| Market Growth Rate (2026-2034) | 3.46% |

Access the full market insights report Request Sample

Sports and energy drinks refer to the beverages consumed while performing physical and sports-related activities. They are a rich source of caffeine and essential nutrients, such as carbohydrates, minerals, electrolytes and vitamins. They aid in replenishing the electrolyte levels in the body and providing hydration and an instant boost of energy. Sports and energy drinks are available in a wide variety of flavors, such as apple, strawberry, cranberry, lime and pineapple, and are also consumed for enhancing concentration, facilitating weight loss and increasing body endurance.

To get more information on this market Request Sample

The increasing participation in sports and other fitness-related activities, along with rising health consciousness among the masses, is one of the key factors driving the growth of the market in the United States. Furthermore, various product innovations, such as the development of sports drinks in exotic flavors, are acting as other growth-inducing factors. Product manufacturers are also using natural and organic ingredients, sweeteners and extracts to cater to the diverse taste and preferences of the consumers. Additionally, hectic schedules and changing dietary patterns of consumers have enhanced the consumption of ready-to-drink (RTD) beverages, which, in turn, is contributing to the demand for various sports and energy drinks in the region.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States sports and energy drinks market report, along with forecasts at the country and regional levels from 2026-2034. Our report has categorized the market based on product type, packaging type, distribution channel, type and target consumer.

Sports Drink Market

Breakup by Product Type:

- Isotonic

- Hypertonic

- Hypotonic

Breakup by Packaging Type:

- Bottle (Pet/Glass)

- Can

- Others

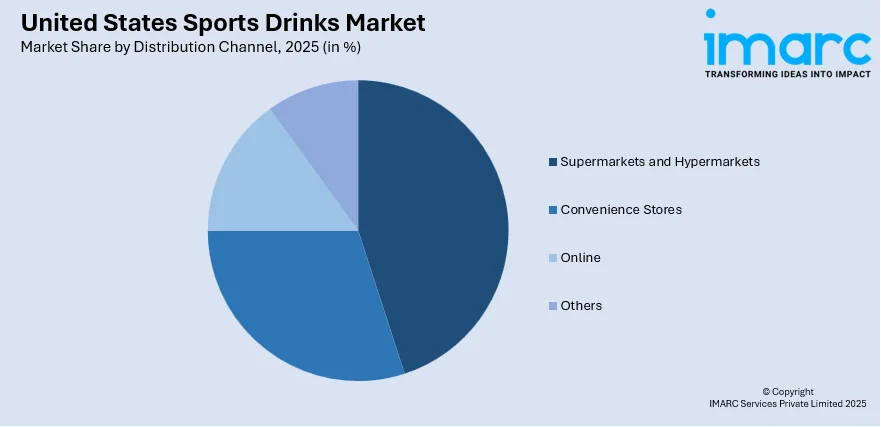

Breakup by Distribution Channel:

To get detailed segment analysis of this market Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Energy Drink Market

Breakup by Product:

- Alcoholic

- Non-Alcoholic

Breakup by Type:

- Non-Organic

- Organic

Breakup by Packaging Type:

- Bottle (Pet/Glass)

- Can

- Others

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Breakup by Target Consumer:

- Teenagers

- Adults

- Geriatric Population

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key Questions Answered in This Report:

- How has the United States sports and energy drinks market performed so far and how will it perform in the coming years?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the packaging type?

- What is the breakup of the market based on the distribution channel?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the target consumer?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the United States sports and energy drinks market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)