United States Specialty Generics Market Size, Share, Trends and Forecast by Route of Administration, Therapeutic Application, and Distribution Channel, and Region 2025-2033

United States Specialty Generics Market Size and Share:

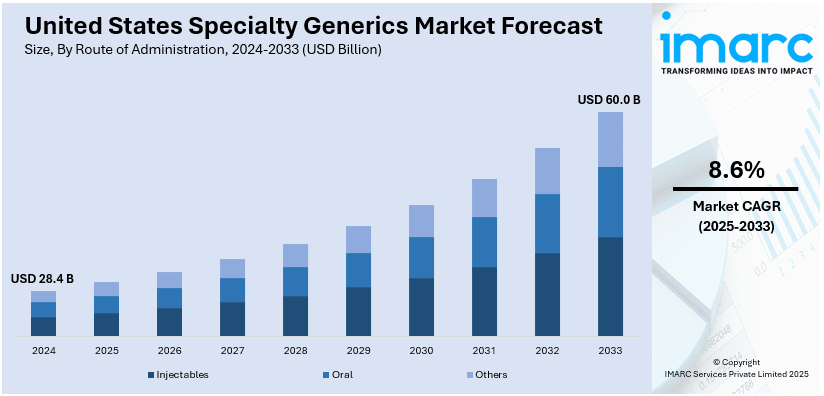

The United States specialty generics market size was valued at USD 28.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 60.0 Billion by 2033, exhibiting a CAGR of 8.6% from 2025-2033. The key factors fuelling the market in the United States are the increased cost of healthcare, rising incidences of chronic ailments, and the enhanced need for affordable branded specialty drugs. The regulatory support for generic approvals, patent expirations of key branded drugs, and improved drug formulations favors the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.4 Billion |

| Market Forecast in 2033 | USD 60.0 Billion |

| Market Growth Rate (2025-2033) | 8.6% |

The increasing cost of healthcare in the U.S. has created a growing demand for cost-effective treatment options. According to industry reports, in 2023 and 2024, the United States' per capita healthcare expenditures were predicted to be $14,423 and $15,074, respectively. Between 2023 and 2032, spending is expected to increase by an average of 5.6% annually, exceeding the 4.3% annual growth rate of the gross domestic product. Specialty generics offer similar efficacy as branded drugs at lower prices and are an attractive solution for patients and healthcare providers. Moreover, the expiration of patents on numerous branded specialty drugs has paved the way for generic manufacturers to enter the market. This has led to increased availability of generic versions of high-cost specialty drugs, further driving market growth.

The increasing cases of chronic diseases such as cancer, diabetes, autoimmune disorders, and cardiovascular conditions has increased the demand for specialty medications. According to the National Cancer Institute, as of January 2022, there were an estimated 18.1 million cancer survivors in the United States. By 2032, it is expected that there will be 22.5 million cancer survivors. Prostate, lung, and colorectal cancers account for an estimated 48% of all cancers diagnosed in men in 2024. For women, the three most common types of cancers are breast, lung, and colorectal, and they account for an estimated 51% of all new cancer diagnoses in women in 2024. Specialty generics cater to these conditions, offering affordable treatment alternatives for long-term care.

United States Specialty Generics Market Trends:

Rising Healthcare Costs

The rising costs of medications within the United States is one of the key drivers for the specialty generics market. Specialty generics are less costly than costly branded drugs thus attracting patients, prescribers, and insurers. Since the emphasis is made on decreasing total healthcare expenditures, these generics offer a significant chance of obtaining reasonably priced therapies for chronic and complicated illnesses. Specialty generics are less expensive while maintaining effectiveness, thus encouraging its adoption in the healthcare sector. For instance, in October 2024, the U.S. Centers for Medicare & Medicaid Services released a preliminary list of 101 generic drugs available for no more than $2 for a month's supply to those enrolled in the government's Medicare program. The first list contains medications for high blood pressure, high cholesterol, and other chronic illnesses, as well as typical prescriptions like metformin, lithium, penicillin, and albuterol asthma inhalers.

Patent Expirations

The rising expiration of patents on branded specialty drugs is positively impacting the generic manufacturers to offer alternatives at cheaper costs. These patent cliffs affect competition within the pharmaceutical industry by facilitating the availability and advancements in specialty generics. When the exclusivity of key branded drugs expires, generics are promptly available, rendering treatment more accessible than ever and fueling the overall specialty generics market. For instance, in August 2024, Lupin introduced Doxorubicin Hydrochloride Liposome Injection, a generic cancer treatment medication, to the US market. The drug, a generic form of Doxil from Baxter Healthcare Corporation, is used to treat multiple myeloma, ovarian cancer, and Kaposi's Sarcoma, which is linked to AIDS. The medication's expected yearly sales were USD 40.9 million.

Regulatory Support and Advancements

The FDA’s streamlined approval processes for generic drugs, including specialty generics, encourage market expansion. For instance, in December 2024, the U.S. Food and Drug Administration (FDA) approved Victoza (liraglutide injection) 18 milligram/3 milliliter, a glucagon-like peptide-1 (GLP-1) receptor agonist as the first generic reference. It is recommended as a supplement to diet and exercise to improve glycemic control in adults and pediatric patients with type 2 diabetes who are 10 years of age and older. Regulatory initiatives promoting competition in the pharmaceutical sector boost the availability of complex generics like injectables and biologics. Technological developments in the formulation of medicines also increase the creation of superior specialty generics, which also boosts the market’s progression.

United States Specialty Generics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States specialty generics market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on route of administration, therapeutic application, and distribution channel.

Analysis by Route of Administration:

- Injectables

- Oral

- Others

Injectables dominate specialty generics in the United States because they are essential for managing chronic and complicated diseases such as cancer, diabetes, autoimmune and cardiovascular diseases.

These medications often require precise delivery methods and rapid absorption, making injectables the preferred choice for many therapies. The growing prevalence of chronic illnesses and the rising adoption of biosimilars further drive demand for injectable generics. Additionally, advancements in formulation technologies, ease of administration, and healthcare providers' preference for cost-effective treatment options contribute to their dominance in the specialty generics market. Regulatory approvals also support their widespread availability.

Analysis by Therapeutic Application:

- Oncology

- Hepatitis

- Multiple Sclerosis

- HIV

- Other Autoimmune Diseases

- Others

Oncology holds the largest share in the United States specialty generics market due to the high prevalence of cancer and the significant cost burden of branded oncology drugs. Specialty generics provide affordable alternatives, improving accessibility for patients requiring long-term cancer treatments. The rising use of targeted therapy and biosimilar medications also stimulates the need for generic cancer drugs. Outsourcing opportunities and the existing growth of regulatory support of the approval of generics and patent expirations of the primary oncology brand medications provide market development. Additionally, advancements in generic formulations, including injectables and oral medications, enhance treatment options, making oncology a dominant segment in the specialty generics market.

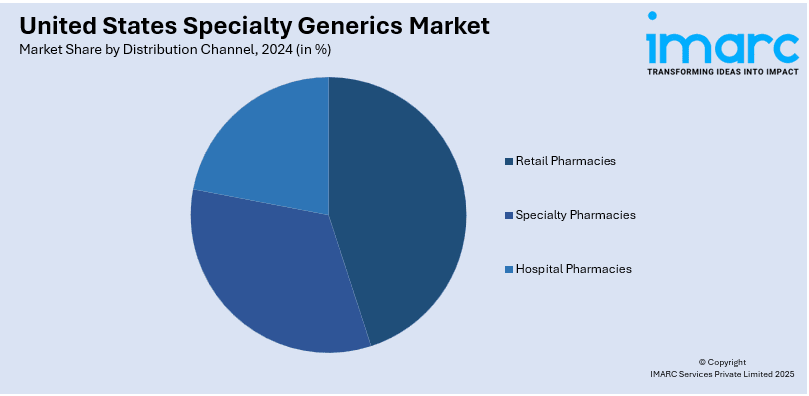

Analysis by Distribution channel:

- Retail Pharmacies

- Specialty Pharmacies

- Hospital Pharmacies

Retail pharmacies hold the largest share in the United States specialty generics market due to their accessibility and widespread presence, making them a primary patient distribution channel. They are convenient sources for obtaining specialty generic drugs for chronic and complicated diseases including cancer, diabetes, and autoimmune diseases. Retail pharmacies heavily interface with prescribers and insurance plans to maintain product cost and delivery and gain better access to patients. Also, most retail chains provide additional pharmacy services for patients, including counseling and prior authorization approval for specialty drugs contributing to the market’s leadership of specialty medications.

Competitive Landscape:

The specialty generics market in the United States is effectively competitive and comprises key players such as Teva Pharmaceuticals, Sandoz, Mylan, and Amgen. These companies majorly focus on creating affordable versions of specialty branded drugs such as injectable and biosimilar products aimed at chronic diseases like cancers, autoimmune diseases, and diabetes. The market is also affected by agencies such as the FDA that help to fast-track the approval of generic medicines. The increasing patent expiration and players of all types seeking growth opportunities to add to their stables. Furthermore, retail pharmacies and hospitals have a positive impact on growth and fuel the market distribution channels. For instance, in June 2024, a U.S. unit of Teva Pharmaceutical Industries Ltd., Teva Pharmaceuticals, Inc., declared the introduction of an authorized generic of Victoza®1 (liraglutide injection 1.8mg), in the United States. Generic Victoza, the first generic GLP-1, helps meet the growing demand for this class of treatments in the US market.

Latest News and Developments:

- In August 2204, the Mumbai-based pharmaceutical company Glenmark Therapeutics Inc., USA, announced in a regulatory filing that it had introduced Olopatadine Hydrochloride Ophthalmic Solution (OTC) to the US market. Fabio Moreno, Head of OTC Sales & Marketing at Glenmark Pharmaceuticals Inc., introduced Olopatadine Ophthalmic Solution (USP, 0.1 percent) in response to the increasing need for a new provider in this market.

- In April 2024, Zydus Lifesciences Limited launched Mirabegron Extended-Release Tablets, 25 mg, in the US following FDA approval. This makes Zydus one of the first suppliers of this generic medication, which treats overactive bladder symptoms. The company plans to launch the 50 mg version soon.

- In October 2024, a U.S. unit of Teva Pharmaceutical Industries Ltd., Teva Pharmaceuticals, declared the introduction of the Sandostatin®1 LAR Depot's first and sole generic version, in the United States. The generic form of Sandostatin® LAR Depot, octreotide acetate for injectable suspension, is prescribed to treat severe diarrhea and acromegaly in patients with carcinoid syndrome.

- In October 2024, Sandoz launched a generic version of paclitaxel in a single-dose vial, enhancing its oncology portfolio in the U.S. This initiative aims to improve patient access to affordable cancer treatment options. The availability of this medication is expected to contribute significantly to cancer care by offering a cost-effective alternative to branded therapies, ultimately benefiting the healthcare system.

United States Specialty Generics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Route of Administrations Covered | Injectables, Oral, Others |

| Therapeutic Applications Covered | Oncology, Hepatitis, Multiple Sclerosis, HIV, Other Autoimmune Diseases, Others |

| Distribution Channels Covered | Retail Pharmacies, Specialty Pharmacies, Hospital Pharmacies |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States specialty generics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States specialty generics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States specialty generics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The keyword market was valued at USD 28.4 Billion in 2024.

Key factors driving the U.S. specialty generics market include increasing healthcare costs, patent expirations of branded specialty drugs, rising prevalence of chronic diseases, growing demand for affordable treatment options, and advancements in drug formulations. Regulatory support and the shift towards cost-effective therapies also contribute to market growth.

IMARC estimates the keyword market to exhibit a CAGR of 8.6% during 2025-2033.

Oncology leads the market by therapeutic application due to high cancer prevalence, cost-effective alternatives, and increasing biosimilar adoption.

In the United States, specialty drugs are high-cost medications used to treat complex, chronic, or rare conditions like cancer, HIV, and autoimmune disorders. These drugs often require special handling, administration, or monitoring. They are typically not available in retail pharmacies and may involve complex insurance or reimbursement processes.

Key opportunities in the U.S. specialty generics market include the expiration of patents for high-cost specialty drugs, increasing demand for affordable treatments, expanding access to specialty generics in healthcare systems, and technological advancements in drug formulation. Additionally, regulatory incentives and partnerships with pharmaceutical companies offer growth potential.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)