United States Soybean Oil Market Size, Share, Trends and Forecast by End Use, and Region, 2026-2034

United States Soybean Oil Market Size and Share:

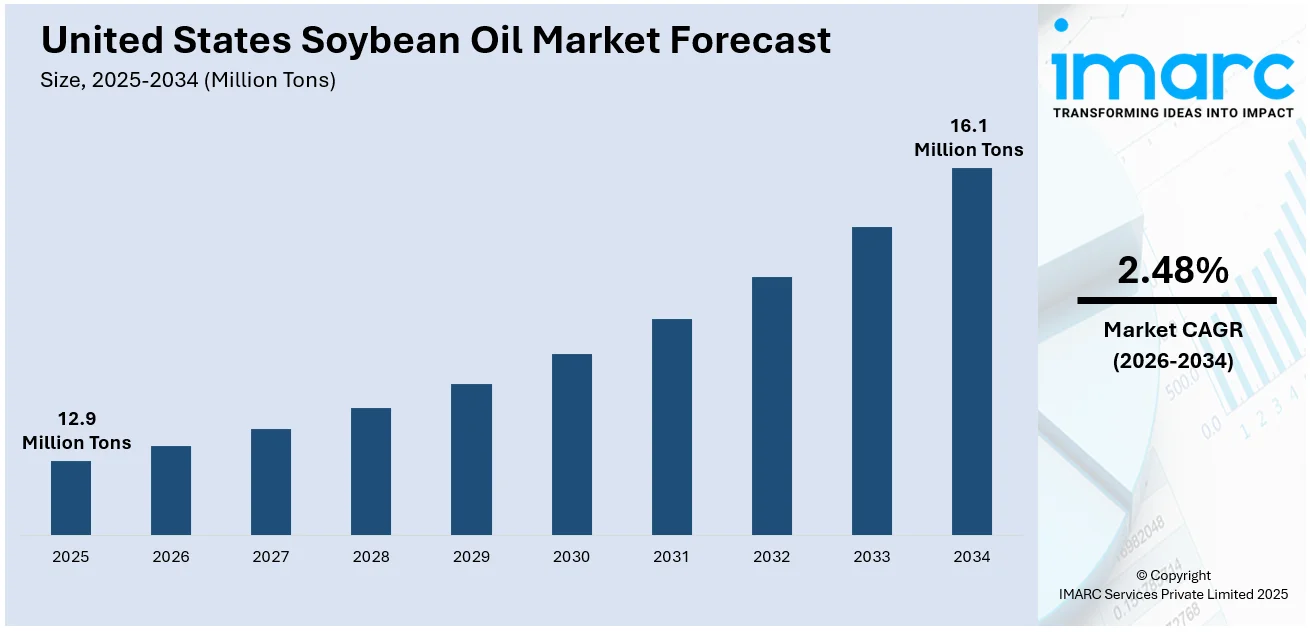

The United States soybean oil market size reached 12.9 Million Tons in 2025. Looking forward, IMARC Group estimates the market to reach 16.1 Million Tons by 2034, exhibiting a CAGR of 2.48% from 2026-2034. The rising demand for plant-based oils in food processing, increasing biodiesel production, surging number of health-conscious consumers, rising government policies supporting biofuel initiatives, and changing supply chain dynamics are some factors driving the market demand in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 12.9 Million Tons |

| Market Forecast in 2034 | 16.1 Million Tons |

| Market Growth Rate (2026-2034) | 2.48% |

The demand for soybean oil in the United States (U.S.) is expanding due to the rising consumption of plant oils in the food industry. In addition, snack manufacturers are extensively adopting soybean oil, as it is cost efficient than other alternatives, which is aiding the market growth. Moreover, the rising shift towards healthier cooking oils based on trans-fat sensitization and the health of the cardiovascular system is significantly contributing to the market expansion. Besides this, consumers and food manufacturers are developing a healthier attitude towards consuming products containing useful fats, including polyunsaturated fats, thus catalyzing the market demand.

To get more information on this market Request Sample

Concurrently, the growth of the biodiesel market is acting as another growth-inducing factor, as soybean oil is one of the main feedstocks for biodiesel production in the region owing to the federal and state renewable energy regulations. In conjunction with this, regulatory standards like Renewable Fuel Standards (RFS) and tax credits have emerged as viable replacements for petroleum products, which is strengthening the market share. Apart from this, variations in the yield of soybean oil due to conditions like climate have a significant impact on soybean production, availability, and prices, thereby propelling the market forward.

United States Soybean Oil Market Trends:

Increased demand for biodiesel and renewable energy

The increased demand for biodiesel and renewable energy is fueling the demand for soybean oil in the country. In line with this, biodiesel production is boosted by the RFS and other state-level renewable energy programs. Moreover, renewable energy is mostly derived from soya bean oil since it is affordable and accessible. According to the U.S. Energy Information Administration (EIA), the West Coast particularly California, Oregon, and Washington are the major consumers of renewable fuel because they have vigorous clean fuel programs that encourage the use of the fuel through incentives. Additionally, the demand for biodiesel is rising because of the effort of the country to reduce the use of fossil fuels. This is further augmented by government incentives like tax credits which have incentivized the use of sustainable energy systems in transportation and industrial use, thus fueling the market demand.

Health and wellness-focused consumption

The demand for soybean oil in the country is increasing due to the rising consumption of healthier food choices. For instance, the food consumption indicator in 2023 occupied 12.9 % of total consumption expenditures, supporting the assumption of changing consumption patterns towards wellness. Moreover, people prefer soybean oil, which contains polyunsaturated fats and omega-3 fatty acids, as it is healthier than most saturated oils used in cooking. Furthermore, soybean oil is widely used in processed foods, salad dressings, and as a frying oil by restaurants, promoting health and wellness. Also, product innovation based on the growing global trends towards veganism and taking care of the health of the heart has led to the popularity of soybean oil in healthy foods, which is contributing to the market expansion.

Volatility in soybean production and weather-related risks

The volatility in soybean production along with weather-related risks is surging the demand for soybean oil in the country. In addition, the soybean oil price and its availability have strong connections with fluctuation in the production process of soybeans depending on the climate. For example, every percentage of the US soybean crop planted at a late time reduces the yield by 0.07 bushels per acre. Additionally, the climate risks persist over the soybean yielding periods, which leads to low growth, and price volatility. Apart from this, variations in supply and production contribute to price volatility, allowing stakeholders to align with weather and agricultural factors to stabilize the market, thereby impelling the market growth.

United States Soybean Industry Segmentation:

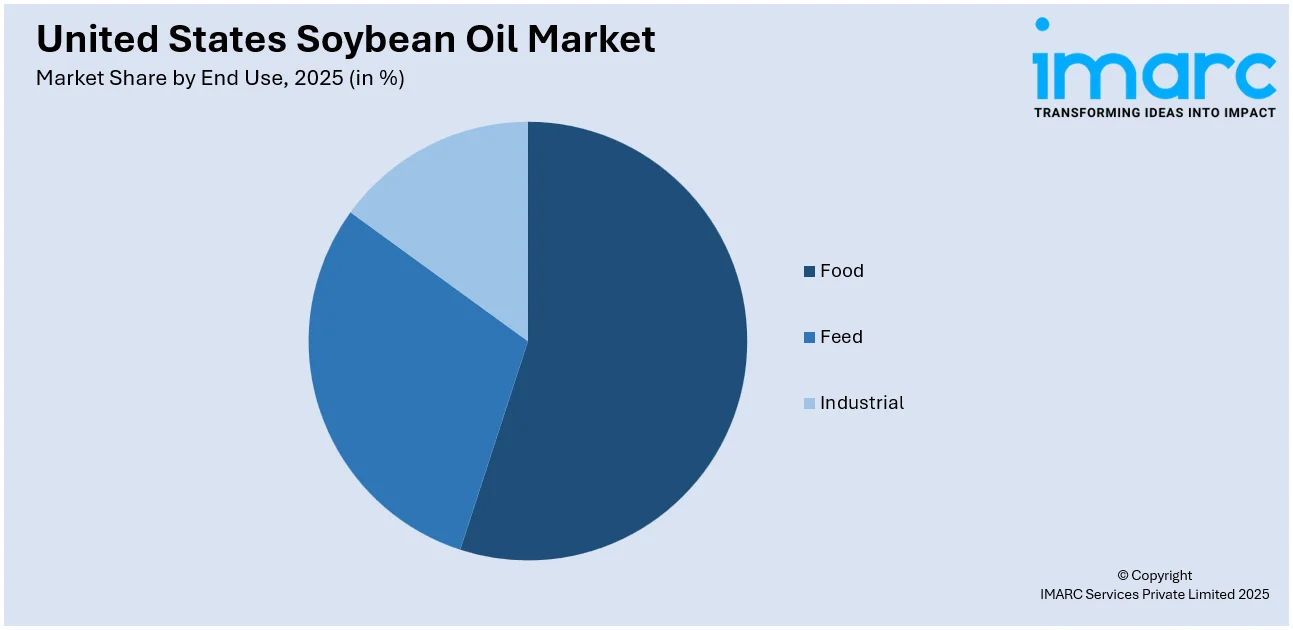

IMARC Group provides an analysis of the key trends in each segment of the United States Soybean Oil market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on end use.

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Food

- Feed

- Industrial

Refined soybean oil is basically used in food industries as refined cooking oil meant for frying as well as for baking. Its use is found in processed food products such as snack foods, margarine and salad dressings. Moreover, its affordability, and bland taste make it a preferred choice among food manufacturers, thus fostering the market growth.

Furthermore, soybean oil is widely used as a feed ingredient in animal food, especially in livestock and poultry feed batches. It is also an important source of fats and energy, as it improves animal growth and well-being. Additionally, the continuous demand for animal protein in manufacturing animal fodder, in the feed industry is providing an impetus to the market.

Additionally, soybean oil is preferred in industrial productions, such as biodiesel, lubricants, paints, and plastic products, as it is a natural reoccurring product. Besides this, the application of soybean oil in various sectors is promoted due to the growing demand for renewable energy production, like biodiesel, which is aiding the market growth.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The demand for soybean oil in the Northwest is growing, driven by its expanding use in the food processing industries. In confluence with this, the region is close to major ports, which significantly enhances the import and export of soybean oil globally, aiding the market growth.

In the Midwest, the demand for soybean oil is increasing due to the rising production activities. Concurrent with this, the region is a great producer of agricultural products for local use and export, which supports the manufacturing of food and biofuels, thereby contributing to the market expansion.

The demand for soybeans in the South is spurring, driven by the rising production of refined oil and biodiesel. This primarily relies on the refineries and renewable energy projects in the region, along with the favorable climatic conditions which is important for manufacturing industrial raw material, thus impelling the market growth.

In the West, the demand for soybean oil is rising due to the shifting preference for products related to health-conscious foods and the growing trend of vegan diets. Moreover, the biodiesel market in the region is rising the need for sustainable energy sources, which is bolstering the market demand.

Competitive Landscape:

The competitive landscape of the United States soybean oil market is shaped by a few large-scale refiners, regional producers, and biodiesel manufacturers. Major players dominate refining and distribution, serving a wide range of industries including food, animal feed, and industrial applications. Moreover, the biodiesel segment is particularly competitive, driven by renewable energy policies like the RFS, which encourages the use of soybean oil for biofuel production. Additionally, small and regional producers focus on niche markets, such as organic or specialty oils. Furthermore, with the sifting preference of the consumer towards healthy and non-genetically modified organs (GMO), the market is exploring factors such as high-oleic soybean oil. Apart from this, the changes in the soybean price, climate, and other international trade variables are consistently shaping the competitive landscape of the soybean market in the U.S.

The report provides a comprehensive analysis of the competitive landscape in the United States soybean oil market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Perdue AgriBusiness launched a new vessel called "Miss Madeline", to optimize crude soybean oil transport, reduce emissions, decrease road congestion, and promote sustainable practices, aligning with the United States agriculture and environmental goals.

- In November 2024, Wilmar International Limited planned to sell a 6.5% stake in Adani Wilmar by February 2025 to meet Indian regulatory regulations. This sale is anticipated to lead to a one-off positive impact and possibly improve Wilmar’s financial structure, supporting advancement in soybean oil processing and supply chain improvements in the United States.

- In October 2024, the David City Plant of AG Processing Inc (APG), is set to launch in 2025. It will process 50M+ bushels annually, boosting domestic soybean oil production, supporting United States farmers, enhancing food security, and strengthening local economies.

- In August 2024, Bunge Limited announced a $34 Billion partnership with Viterra, strengthening agricultural exports, enhancing market competitiveness and creating one of the largest global trade networks in the United States.

- In August 2024, Archer Daniels Midland Company (ADM) and Farmer Business Network (FBN) established a 50/50 venture called Gradable with an open goal to speed up the delivery of technologies that would allow farmers and buyers to get value from sustainably grown grain in America.

United States Soybean Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Food, Feed, Industrial |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States soybean oil market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States soybean oil market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States soybean oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Soybean oil is a vegetable oil extracted from soybeans, commonly used in cooking, frying, and baking. It is a key ingredient in salad dressings, margarine, and various processed foods. Additionally, it is widely applicable in industrial products like biodiesel, paints, and cosmetics.

The United States soybean oil market size reached 12.9 Million Tons in 2025.

IMARC estimates the United States soybean oil market to exhibit a CAGR of 2.48% during 2026-2034.

The outlook for United States soybean oil market is positively driven by the growing demand in food processing, increasing biodiesel production, changing health-conscious consumer preferences, rising focus on sustainability, adoption of renewable energy, and innovation in oil products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)