United States Solar Power Market Size, Share, Trends and Forecast by Technology, Solar Module, End Use, Application, and Region, 2025-2033

United States Solar Power Market Size and Share:

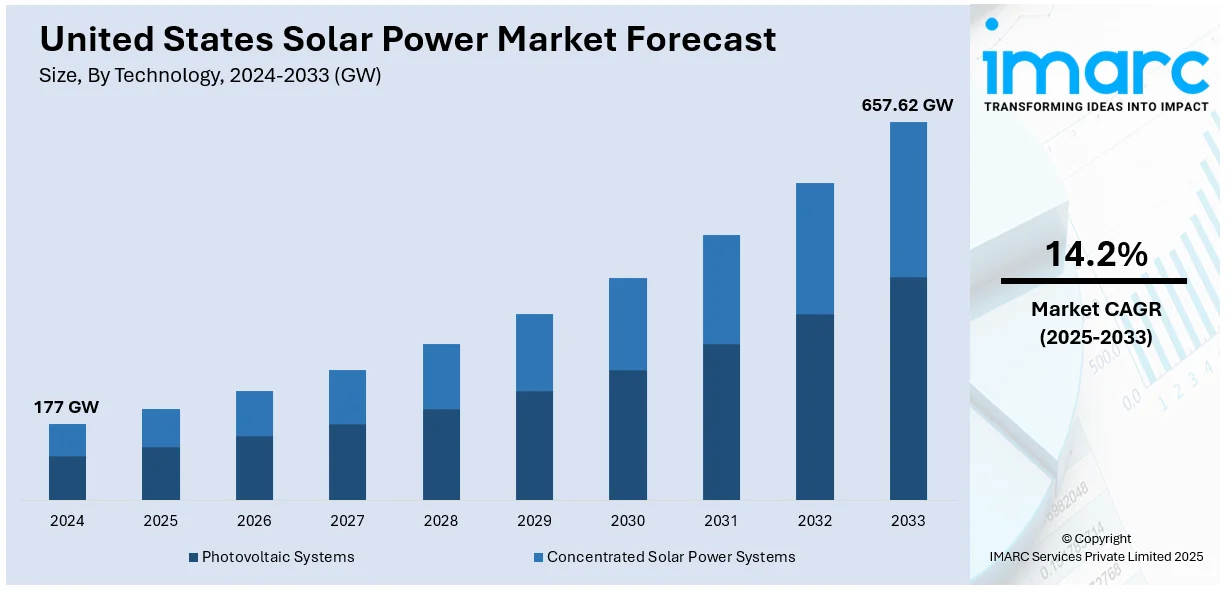

The United States solar power market size was valued at 177 GW in 2024. Looking forward, IMARC Group estimates the market to reach 657.62 GW by 2033, exhibiting a CAGR of 14.2% from 2025-2033. The United States solar power market share is expanding, driven by the growing investments in solar energy infrastructure projects and technology development to enhance efficiency and reliability and provide cost-effectiveness, along with the rising integration of solar panels into vehicle designs, which help charge the battery and power accessories.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 177 GW |

| Market Forecast in 2033 | 657.62 GW |

| Market Growth Rate (2025-2033) | 14.2% |

At present, the increasing environmental awareness among the masses is fueling the market growth in the United States. People are understanding the ecological impact of traditional energy sources. As concerns over climate change, pollution, and the depletion of natural resources grow, individuals and businesses are looking for cleaner and more sustainable energy options. Solar power, being renewable and eco-friendly, is an attractive alternative to fossil fuels. Many people and companies choose solar energy to reduce their carbon footprints. This rise in environmental consciousness has led to a shift towards greener lifestyles, with solar power becoming an important part of that transition. People are not only encouraged by the need to minimize greenhouse gas emissions but also by the desire to protect natural reserves and preserve nature for future generations.

Technological advancements are impelling the United States solar power market growth. They assist in making solar energy more competent and affordable. New developments in solar panel designs, such as higher efficiency cells and improved materials, allow better energy conversion and longer lifespans. Innovations in energy storage systems also help to solve the issue of intermittency, making solar power more effective for both residential and commercial use. Additionally, modern smart grid technology and solar monitoring systems enable more reliable distribution and management of energy. These technologies reduce installation and upkeep expenses, enhancing the accessibility of solar energy. Consequently, solar power has become a more attractive option for those seeking to lower their energy costs and decrease their carbon impact.

United States Solar Power Market Trends:

Growing investments in renewable energy

Increasing investments in renewable energy are propelling the market growth. The United States Budget FY 2024 allocated USD 2 Billion to enhance clean energy jobs and infrastructure initiatives nationwide, comprising USD 107 Million for the Grid Deployment Office to assist utilities and state and local governments in creating a grid that is more reliable and resilient while accommodating increasing levels of renewable energy. As the country moves towards cleaner energy sources, more funding is being directed into solar power infrastructure and technology development. This expenditure supports the establishment of solar energy projects with refined capabilities across residential, commercial, and industrial sectors, leading to greater outputs. As per reports, the US solar market installed 8.6 GWdc of capacity. Additionally, government incentives, tax credits, and private sector spending help to ensure solar energy is more cost-effective and available for individuals and companies. Besides this, high investments in innovations in solar panel efficiency and storage solutions are improving the reliability of solar power.

Rising production of photovoltaic (PV) modules

The increasing production of photovoltaic (PV) modules is positively influencing the market. As reported on the official site of the US Department of Energy, in the initial six months of 2024, the United States generated 4.2 GW of PV modules, marking a 75% rise from the prior year, with an equal split between thin-film and crystalline silicon (c-Si) technologies. A PV module is one unit made up of several linked solar cells that transform sunlight into electricity. As producers increase output, the price of PV modules keeps falling, facilitating the adoption of solar energy for residential and commercial sectors alike. The high production enables more advancements in PV technology, resulting in improved efficiency and performance of solar power systems. This encourages homeowners, companies, and industries to adopt solar energy.

Increasing applications of solar power in the automotive sector

The growing adoption of solar power in the automotive sector is offering a favorable United States solar power market outlook. The production and sales of electric vehicles (EVs) are rising in the country. According to the data released on the official government site of the United States, plug-in electric vehicles (PEVs) accounted for 9.1% of the total sales of light duty vehicles (LDVs) in June 2024, as reported by Argonne National Laboratory. A total of 120,314 PEVs were sold across the United States. This encourages the installation of solar-powered charging stations, thereby reducing dependency on the grid. Additionally, EV manufacturing companies are integrating solar panels into their vehicle designs, like solar roofs, which help to charge the battery of cars while also powering other accessories.

United States Solar Power Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States solar power market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on technology, solar module, end use, and application.

Analysis by Technology:

- Photovoltaic Systems

- Concentrated Solar Power Systems

The photovoltaic systems are adopted due to their widespread employment and ease of installation. They transform sunlight directly into electricity through semiconductor materials, usually solar panels based on silicon. They are popular for both residential and commercial applications because of their cost-effectiveness and scalability. The technology continues to improve in terms of efficiency and affordability, making solar power accessible to a broader range of users.

Concentrated solar power systems employ lenses or mirrors to concentrate sunlight onto a specific spot, creating elevated temperatures that produce electricity. It is mainly used for large-scale solar power plants, as it requires significant land and sunlight. They offer higher efficiency in areas with abundant direct sunlight.

Analysis by Solar Module:

- Monocrystalline

- Polycrystalline

- Cadmium Telluride

- Amorphous Silicon Cells

- Others

Monocrystalline solar modules are recognized for their superior efficiency and longevity. They consist of one crystal structure, enabling electrons to move more freely. This leads to greater power generation in comparison to different kinds of solar cells. Monocrystalline panels provide an extended lifespan and superior reliability in confined areas. They are frequently used in home and business settings where conserving space is essential.

Polycrystalline solar panels are created from silicon crystals that are fused together. This results in increased affordability and reliability. Polycrystalline panels are commonly utilized, particularly in extensive solar setups where space is not a significant limitation. They provide a favorable combination of price and performance, making them a favored option in the United States solar power market.

Cadmium telluride solar panels consist of thin-film technology. They are used as a semiconductor material because they are light and flexible. Their lower manufacturing costs make them attractive for large-scale utility projects. Furthermore, they can produce energy even in dim lighting situations. Consequently, they are gaining popularity in particular applications where prioritizing cost-effectiveness and scalability is essential.

Amorphous silicon cells comprise non-crystalline silicon, providing them with flexible and lightweight properties. They can be utilized in different applications where standard modules may be ineffective. Amorphous silicon cells are also more adaptable, as they can be utilized on surfaces, such as glass, plastic, and metal. They are mainly employed in compact and portable solar devices.

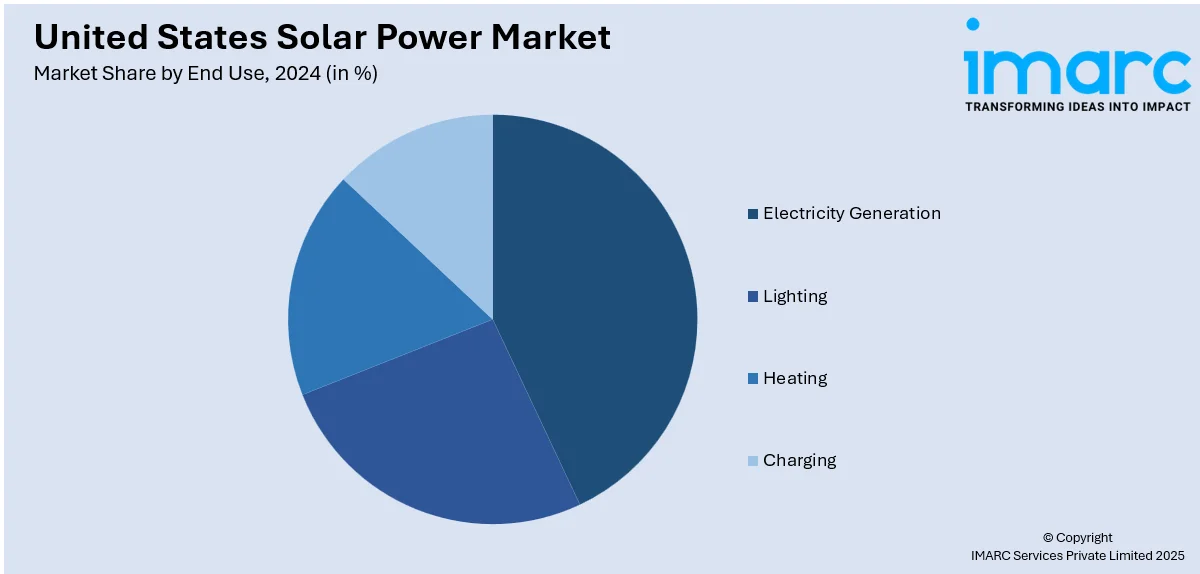

Analysis by End Use:

- Electricity Generation

- Lighting

- Heating

- Charging

Electricity generation holds a significant United States solar market value. Solar panels are used in residential, commercial, and utility-scale applications to produce clean electricity. Electricity generation through solar power helps to minimize reliance on fossil fuels, reduce energy expenses, and assist sustainability goals. The high demand for renewable energy, along with advancements in solar technology, is making electricity generation via solar power more efficient and affordable.

For lighting applications, solar power is widely employed in the country. Solar lighting systems are commonly found in streetlights, garden lights, and outdoor decorations. These systems capture sunlight during the day and retain energy in batteries, which are subsequently utilized to illuminate lights during nighttime. Solar lighting is eco-friendly, cost-effective, and easy to install, making it a popular choice in both residential and public spaces.

Heating is an important end use in the solar power market in the United States. Solar thermal systems, such as solar water heaters and space heating systems, convert sunlight into heat energy. These systems are used in homes, businesses, and industries to reduce reliance on conventional heating methods like gas or electricity. Solar heating systems offer a sustainable and eco-friendly method to warm water and indoor areas.

Charging is a growing end use, particularly for EVs and portable electronics. Solar-powered charging stations are being set up in public spaces, parking lots, and homes to provide clean energy for EVs. Additionally, solar chargers are increasingly employed for charging devices like smartphones, laptops, and cameras, offering a renewable alternative to conventional charging methods.

Analysis by Application:

- Residential

- Commercial

- Industrial

In the residential sector, solar power is popular, as homeowners seek to lower energy expenses and their environmental impact. Numerous individuals place solar panels on their roofs to produce electricity for daily use. With the growing focus on sustainability and government incentives, more homeowners are opting for solar energy. Additionally, energy storage systems like home batteries are being paired with solar installations to store excess energy for later use.

In the commercial sector, businesses are adopting solar power to lower operational costs and enhance their sustainability profiles. Solar energy helps to reduce electricity expenses and provides a reliable source of power for a range of commercial buildings, including offices, retail stores, and warehouses. Many companies also employ solar power as part of their corporate social responsibility initiatives, highlighting their commitment to renewable energy.

The industrial sector in the United States is employing solar power to meet large-scale energy demands while minimizing environmental footprints. Factories and manufacturing plants install solar panels to power their operations, lower energy costs, and comply with sustainability regulations. Solar energy systems are often integrated into industrial infrastructure to support various functions, such as production lines, heating, and cooling.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is among the fastest-growing solar markets in the United States. In the Northeast, the uptake of solar power is significant, owing to state incentives, regulations, and a commitment to adopt renewable energy. The region bets on improvements in solar panel efficacy, enabling efficient energy production even during less sunny periods. States, such as New York, Massachusetts, and New Jersey are at the forefront of solar panel installations. The area's transition to clean energy and the incorporation of solar power into energy systems persist in increasing the installation of solar energy in residences, enterprises, and neighborhoods.

In the Midwest, the popularity of solar energy is increasing due to rising energy expenses and a focus on sustainability. States, such as Illinois, Minnesota, and Ohio utilize solar energy to broaden their energy sources and lessen dependence on fossil fuels. The flat landscape and extensive open areas in the region create a perfect setting for large solar farms. As local government bodies provide incentives and technology becomes more cost-effective, the expansion continues.

The South comprises one of the largest solar markets in the United States. In the South, solar energy is harnessed because of the plentiful sunlight, ideal weather, and falling prices of solar technology. States like Texas, Florida, and Georgia implement solar energy for residential use as well as utility-scale purposes. The area's extended summers and significant energy adoption render solar energy an especially attractive option for both residents and companies.

The West is recognized for significant solar power use in states, such as California, Nevada, and Arizona. This area benefits from high solar radiation levels, rendering it a perfect site for extensive solar power initiatives and home installations. California, specifically, has established ambitious targets for renewable energy, which has generated a demand for solar power within the state.

Competitive Landscape:

Key players work on developing modern energy solutions to meet the United States solar power market demand. Energy firms and tech suppliers bet on advancements to enhance the affordability and reliability of solar energy. They allocate significant resources to research and development (R&D) activities to enhance solar technologies, including panels and storage solutions, thus making them more available to people and enterprises. Utility companies are broadening their solar infrastructure and providing solar initiatives for both residential and commercial users. Furthermore, solar installers and service providers ensure that solar systems are efficiently set up and maintained. These key players work closely with government agencies to navigate incentives and regulations, helping to reduce the cost of solar adoption. For instance, in October 2024, SB Energy, a renewable energy organization specializing in large-scale utility installations, announced that three solar power projects became operational in Texas, US. The solar farms, which possessed around 900 MW of total generation capacity, aimed to enhance the state's power grid and supply electricity to Google’s data centers and its cloud region situated in the Dallas area, US. These solar farms employ over 1.3 Million modules made in America.

The report provides a comprehensive analysis of the competitive landscape in the United States solar power market with detailed profiles of all major companies, including:

- Acciona

- All Earth Renewables

- Canadian Solar

- Complete Solar

- Complete Solar

- First Solar

- Jinko Solar

- SHARP Corporation

- Silfab Solar Inc.

Latest News and Developments:

- January 2025: Aptera Motors, a prominent automotive manufacturing startup based in the US, introduced its inaugural production vehicle, a solar-powered electric car, at the 2025 Consumer Electronics Show in Las Vegas, US. This advanced vehicle features built-in solar panels and offers a daily range of up to 60 kilometers without needing to be plugged in. The firm obtained almost 50,000 reservations for the solar-powered EV.

- January 2025: Waaree Solar Americas Inc., a division of Waaree Energies Ltd., declared the initiation of commercial manufacturing of solar modules at its 1.6 GW production plant in Brookshire, Texas. It signifies an essential advancement in establishing solar manufacturing within the United States, aiding in job creation and economic development whilst decreasing dependence on imported solar goods. It intends to increase the capacity of its Texas facility to 3 GW by fiscal 2026 and 5 GW by fiscal 2027.

- December 2024: Leeward Renewable Energy, a leading renewable energy company, commenced commercial operations at its 200-MW Morrow Lake solar plant in Frio County, Texas, US. It intended to supply electricity to Microsoft Corp according to an existing power purchase agreement.

- October 2024: TotalEnergies, the multinational integrated energy and petroleum firm, began commercial operations for solar initiatives at Danish Fields and Cottonwood, two large-scale solar installations featuring integrated battery storage in southeast Texas, US. These initiatives, totaling a capacity of 1.2 GW, are included in TotalEnergies’ 4 GW renewable energy portfolio. Danish Fields, the company’s biggest solar farm in the US, has a capacity of 720 MWp and features 1.4 Million ground-installed solar panels.

United States Solar Power Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | GW |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Photovoltaic Systems, Concentrated Solar Power Systems |

| Solar Modules Covered | Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon Cells, Others |

| End Uses Covered | Electricity Generation, Lighting, Heating, Charging |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current United States solar power market size and trends, market forecasts, and dynamics from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States solar power market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States solar power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States solar power market in the region was valued at 177 GW in 2024.

The increasing concerns about climate change and the need for sustainable energy sources are encouraging individuals and organizations to adopt solar power. Besides this, innovations in solar technology are improving efficiency and energy storage, making solar power more reliable and efficient. Moreover, the rising large-scale solar projects in the US are promoting the usage of solar power.

The United States solar power market is projected to exhibit a CAGR of 14.2% during 2025-2033, reaching a value of 657.62 GW by 2033.

Some of the major players in the United States solar power market include Acciona, All Earth Renewables, Canadian Solar, Complete Solar, Complete Solar, First Solar, Jinko Solar, SHARP Corporation, Silfab Solar Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)