United States Self Monitoring Blood Glucose Market Report and Forecast by Component, and Region, 2025-2033

United States Self Monitoring Blood Glucose Market Size and Share:

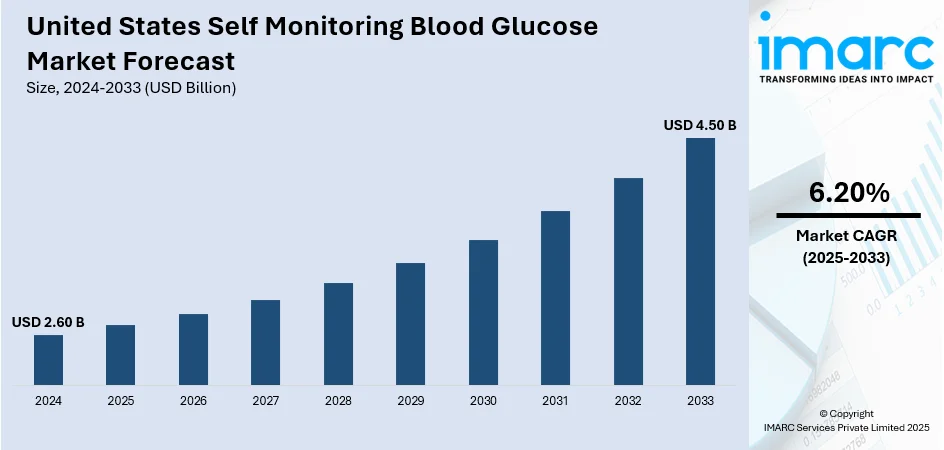

The United States self monitoring blood glucose market size was valued at USD 2.60 Billion in 2024. Looking forward, the market is projected to reach USD 4.50 Billion by 2033, exhibiting a CAGR of 6.20% from 2025-2033. The market is witnessing significant growth, mainly driven by the growing incidence of diabetes, increased awareness about preventive healthcare, and demand for convenient, home-based glucose monitoring solutions. Technological advancements in glucose meters, test strips, and connected devices are also supporting wider adoption. With the growing emphasis on personalized diabetes management, the United States self monitoring blood glucose market share is expanding across both individual consumers and healthcare providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.60 Billion |

| Market Forecast in 2033 | USD 4.50 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

The self-monitoring blood glucose market in the United States is largely influenced by the rising rates of diabetes and prediabetes, leading to an increased need for regular glucose monitoring. There is a growing awareness about the significance of early diagnosis and continuous monitoring to prevent complications, which further drives adoption of these tools. Technological advancements, including user-friendly digital meters and smartphone compatibility, are encouraging patients to embrace self-monitoring, making diabetes management both more convenient and effective. For instance, in March 2024, the FDA granted approval for the Dexcom Stelo Glucose Biosensor System, marking it as the first over-the-counter continuous glucose monitor (CGM) available for adults aged 18 and above who do not require insulin. This system allows for real-time glucose monitoring through a smartphone app, improving access to diabetes management resources and supporting health equity. These elements are substantially contributing to United States self monitoring glucose market growth.

To get more information on this market, Request Sample

In addition, there is a notable trend toward personalized healthcare and preventive wellness. Patients are opting for self-monitoring solutions to take better control of their treatment plans and lessen the need for frequent hospital visits. Government initiatives that support this direction, favorable reimbursement policies, and greater availability of advanced testing strips are also improving accessibility to these monitoring options. Furthermore, the transition toward value-based healthcare and increasing physician endorsements for at-home monitoring are positively influencing the market's development.

United States Self Monitoring Blood Glucose Market Trends:

Rising Prevalence of Diabetes

According to the IMARC Group’s report, the United States diabetes market size reached USD 29.3 Billion in 2023. As the number of people diagnosed with diabetes, particularly type 2, is rising, the demand for self monitoring blood glucose (SMBG) equipment including glucose meters, test strips, and lancets is increasing. These gadgets are used to frequently monitor and manage blood glucose levels, which is critical for avoiding complications and properly managing the disease. With an increasing diabetic population, there is a greater emphasis on disease care to avoid serious complications such as cardiovascular disease, kidney failure, and neuropathy. According to the International Diabetes Federation (IDF), the number of individuals aged 20-79 years diagnosed with diabetes in the United States reached USD 38.5 Million in 2024. This number is projected to reach USD 43.0 Million by 2050. Regular blood glucose monitoring is an essential component of diabetes management, necessitating the need for dependable and easily available SMBG systems. Healthcare practitioners are prescribing SMBG as part of a comprehensive diabetes management strategy. As more people are diagnosed with diabetes, physicians are prescribing SMBG devices to assist them control their blood glucose levels within a certain range, which is impelling the market growth. The rising prevalence of pre-diabetes, a condition in which blood sugar levels are higher than usual but not yet high enough to be diagnosed as diabetes, is also bolstering the United States self monitoring blood glucose market demand.

Aging Population Growth

Elderly people, particularly those over the age of 65, are more prone to acquire type 2 diabetes due to variables, such as decreased physical activity, increasing body fat, and insulin resistance. As the population of older people are expanding, the number of people who need SMBG devices to control their diabetes is rising. Older persons are more likely to have many chronic diseases, including diabetes. To avoid difficulties, it is necessary to monitor blood glucose levels on a regular basis. As the population is aging, the demand for SMBG devices as part of chronic disease management is growing. The elderly people often choose or require home-based healthcare options to manage their ailments. SMBG devices enable older people to effortlessly monitor their blood glucose levels at home, decreasing the need for frequent visits to medical institutions. This shift toward home healthcare is propelling the use of SMBG devices among older persons. Diabetes-related consequences in older persons include cardiovascular disease, renal difficulties, and neuropathy. Regular blood glucose monitoring is critical for addressing these risks, resulting in increased demand for SMBG devices in the country. According to the Population Reference Bureau (PRB) website, it is anticipated that the population of individuals aged 65 and older will rise by 82 million by the year 2050.

United States Self Monitoring Blood Glucose Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States self monitoring blood glucose market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component.

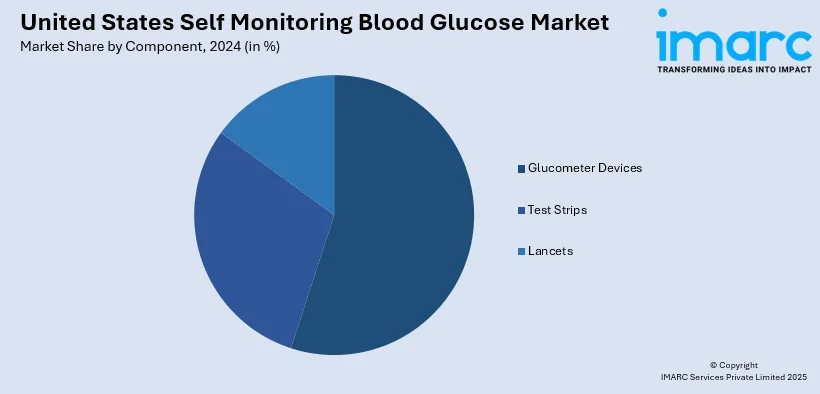

Analysis by Component:

- Glucometer Devices

- Test Strips

- Lancets

Glucometers are a key segment, offering patients portable and easy-to-use tools for monitoring blood sugar levels. Increasing demand for digital, connected devices with Bluetooth and app integration is driving adoption. Their role in enabling real-time tracking and better disease management makes them essential in the United States self monitoring blood glucose market.

Test strips represent the largest recurring revenue component, as they are required for every blood glucose test. Their affordability, accuracy, and availability contribute to steady demand. Manufacturers are focusing on enhancing sensitivity and reducing sample sizes, ensuring reliable readings. The growing diabetic population directly boosts test strip consumption across the US market.

Lancets are small, disposable devices used to obtain blood samples for glucose testing. Their consistent need for routine monitoring ensures stable demand. Innovations in safety features, such as ultra-fine needles and painless sampling, are improving patient compliance. With the emphasis on user comfort and hygiene, lancets play a vital role in supporting growth and reflect a significant United States self monitoring blood glucose market trend toward safer, more patient-friendly solutions.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast market benefits from a strong healthcare infrastructure and high adoption of advanced medical devices. Rising diabetes prevalence, coupled with a large aging population, drives consistent demand. Increased awareness programs and proactive patient management further support market expansion in this region.

The Midwest shows stable growth, with lifestyle-related health issues contributing to diabetes cases. The availability of affordable monitoring devices and government initiatives supporting preventive healthcare are boosting adoption. Rural areas are gradually embracing self-monitoring solutions, enhancing overall accessibility in this region.

The South has one of the highest diabetes prevalence rates in the country, fueling strong demand for self-monitoring devices. High obesity levels and growing awareness about preventive care encourage regular glucose testing. Affordable test strips and reimbursement support further strengthen market penetration across this region, highlighting a positive United States self monitoring blood glucose market outlook with sustained growth opportunities.

The West region shows robust demand due to its tech-savvy population and adoption of innovative healthcare devices. Increasing investments in digital health and personalized care are fostering growth. With a focus on preventive healthcare and chronic disease management, the West remains a dynamic contributor to the overall market.

Competitive Landscape:

The landscape of the United States self monitoring blood glucose market is continuously shaped by innovation, advancements in technology, and a strong emphasis on patient convenience. Market players are focusing on creating compact, user-friendly devices that incorporate digital platforms for easy monitoring and data sharing. Test strips and lancets continue to be essential revenue sources, while the rising interest in connected solutions is leading to greater product differentiation. Factors such as pricing strategies, distribution channels, and adherence to regulatory standards also play a significant role in the competitive environment. Companies are actively investing in research to enhance accuracy, improve patient comfort, and meet the changing demands of healthcare. According to United States self monitoring blood glucose market forecast, competition is expected to escalate as consumer expectations shift toward personalized and preventive healthcare solutions.

The report provides a comprehensive analysis of the competitive landscape in the United States self monitoring blood glucose market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Trividia Health, Inc. announced that its TRUE METRIX Self-Monitoring Blood Glucose Systems will be preferred for all Fee-for-Service Medicaid and Managed Medicaid Plans in Pennsylvania beginning July 7, 2025. The TRUE METRIX line of devices is designed to deliver exceptional performance based on scientific research and continuous technological advancements. The TRIPLE SENSE TECHNOLOGY used in the TRUE METRIX Test Strips ensures reliable clinical precision and trustworthy results.

- March 2025: Nanowear established a data and licensing partnership with Dexcom for Continuous Glucose Monitoring (CGM) systems, which is a type of self-monitoring blood glucose system. As part of this partnership, Dexcom G7 CGM data will be transmitted for investigational reasons via Nanowear's app, platform, and server, providing the first-ever continuous, self-administered, home-based cardiometabolic evaluations for customers.

- October 2024: Trividia Health, Inc. announced the preferred listing of its TRUE METRIX Self-Monitoring Blood Glucose System for all Fee-for-Service Medicaid and Managed Medicaid Plans across Florida. With this listing, individuals in Florida can test their blood glucose levels with confidence and effectively monitor their diabetes using the TRUE METRIX Self-Monitoring Blood Glucose Meters and Test Strips.

- September 2024: Trividia Health, Inc. officially launched the TRUENESS Blood Glucose Monitoring System. The new technology allows patients to self-monitor blood glucose with confidence as it offers increased precision and sets a new standard for cost efficiency in diabetes care.

United States Self Monitoring Blood Glucose Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Glucometer Devices, Test Strips, Lancets |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States self monitoring blood glucose market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States self monitoring blood glucose market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States self monitoring blood glucose industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The self monitoring blood glucose market in the Unites States was valued at USD 2.60 Billion in 2024.

The United States self monitoring blood glucose market is projected to exhibit a CAGR of 6.20% during 2025-2033, reaching a value of USD 4.50 Billion by 2033.

The United States self monitoring blood glucose market is driven by the rising prevalence of diabetes, increasing focus on preventive healthcare, and growing patient preference for at-home monitoring solutions. Technological advancements in glucometers and test strips, along with supportive reimbursement policies, further accelerate adoption and strengthen market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)