United States Radiopharmaceuticals Market Size, Share, Trends and Forecast by Product Type, Application, End Use, and Region, 2025-2033

United States Radiopharmaceuticals Market Size and Share:

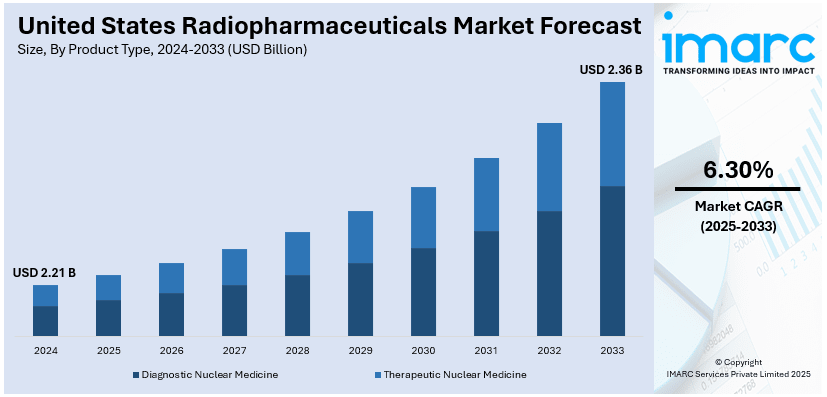

The United States radiopharmaceuticals market size was valued at USD 2.21 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.36 Billion by 2033, exhibiting a CAGR of 6.30% from 2025-2033. The increasing prevalence of chronic diseases, such as cancer and cardiovascular conditions, continual advancements in radiopharmaceutical development, regulatory approvals, and their role in personalized medicine, and government support for nuclear medicine infrastructure and streamlined supply chains contribute to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.21 Billion |

| Market Forecast in 2033 | USD 2.36 Billion |

| Market Growth Rate (2025-2033) | 6.30% |

The growing prevalence of chronic diseases, particularly cancer and cardiovascular disorders, is a key driver for the radiopharmaceuticals market in the United States. According to a 2024 research report by the National Center for Chronic Disease Prevention and Health Promotion, about 129 million Americans have one or more major chronic conditions, of whom 42% have two or more, and 12% have five or more. Five of the top 10 leading causes of death are strongly related to preventable and treatable chronic conditions. Chronic diseases account for 90% of the annual USD 4.1 Trillion U.S. healthcare costs, and their prevalence has been increasing steadily for the past two decades. Along with this, innovations in molecular imaging and increased adoption of positron emission tomography (PET) and single-photon emission computed tomography (SPECT) have further propelled demand. Additionally, the aging population and the rising incidence of age-associated illnesses have amplified the need for early and precise diagnostic tools, positioning radiopharmaceuticals as a crucial component of modern healthcare.

In addition, the continuous advancements in radiopharmaceutical production and delivery systems are significantly supporting the market. On 22nd October 2024, NorthStar Medical Radioisotopes launched the state-of-art 52,000 sq. ft. Dose Manufacturing Center in Beloit, Wisconsin as the first of its kind firm in the country to produce radiopharmaceuticals and simultaneously offer multi-isotope production with commercial scale capability. The center shall be a surety of a steady supply of pivotal isotopes namely Ac-225, Lu-177, In-111, and Cu-64 of advanced nuclear medicines. It proves NorthStar a milestone towards significant improvement in healthcare innovation for quality patient care results. Apart from this, research and development investment, combined with new regulatory approvals for novel radiopharmaceutical drugs, has made the scope for applications in diagnosis as well as therapeutics greater. Advances in personalized medicine based on the higher involvement of radiopharmaceuticals in targeted therapies with significantly fewer adverse effects are improving the market performance. Furthermore, the establishment of efficient supply chains and government support for nuclear medicine infrastructure is streamlining access to these products, ensuring consistent growth in the market.

United States Radiopharmaceuticals Market Trends:

Expansion of Theranostics in Radiopharmaceuticals

Theranostics, the combination of diagnostics and therapeutics, is emerging as a transformative trend in the U.S. radiopharmaceuticals market size. By utilizing radiopharmaceuticals to diagnose and simultaneously treat diseases, this approach offers a personalized and efficient treatment pathway. Applications in oncology, especially for prostate and neuroendocrine cancers, are gaining traction due to the precision and efficacy of theranostic methods. The development of theranostic agents, such as Lutetium-177 and Gallium-68, highlights the market's shift toward integrated healthcare solutions. This trend is further supported by ongoing research and the increasing availability of theranostic technologies across clinical settings, enhancing patient outcomes while reducing overall healthcare costs. On June 11, 2024, TeamBest Global subsidiary Best Cyclotron Systems, Inc., based in the US, announced further expansion of their operations in India, Europe, and the US with a plan of manufacturing hundreds of cyclotrons per year in support of basic research, isotope production, and theranostics. By 2024, BCS plans to deliver 10–15 advanced cyclotrons worldwide, including high-energy proton and multi-particle systems, to advance leading-edge applications in medical imaging, therapy, and heavy ion treatments.

Growing Role of Artificial Intelligence in Radiopharmaceuticals

Artificial intelligence (AI) is revolutionizing the U.S. radiopharmaceuticals industry by optimizing imaging workflows, improving diagnostic accuracy, and accelerating drug development. AI-powered tools can analyze complex imaging data from PET and SPECT scans with greater precision, enabling earlier detection of diseases. On 30th October 2024, Telix Pharmaceuticals collaborated with U.S. based Subtle Medical to develop its PSMA-PET product, Illuccix (68Ga-PSMA-11), combined with AI powered SubtlePET technology by Subtle Medical. The latter is an FDA-cleared deep learning solution cutting PET scan time by up to 75 percent without sacrificing quality, improving both patient comfort and workflow efficiency of U.S. imaging centers. Additionally, machine learning algorithms are being employed to identify novel radiopharmaceutical compounds, reducing the time and costs associated with traditional drug discovery processes. The integration of AI also enhances radiation dose optimization, ensuring patient safety. As healthcare providers increasingly adopt AI-driven solutions, this trend is poised to significantly enhance the efficiency and reliability of radiopharmaceutical applications in both diagnostics and treatment.

Shift Toward Non-Invasive Radiopharmaceutical Applications

A growing preference for non-invasive diagnostic and therapeutic techniques is shaping the U.S. radiopharmaceuticals market growth. On 6th March 2024, Siemens Healthineers announced the Cinematic Reality app on Apple Vision Pro, which makes available immersive 3D visualizations of the human body derived from medical scans. The company designed the app for surgeons, medical students, and patients and for surgical planning, education, and patient comprehension. Visitors at the HIMSS trade show in Orlando (March 12-14) are invited to personally experience it in the Siemens Healthineers booth. Non-invasive radiopharmaceutical imaging offers precise disease localization without requiring surgical interventions, appealing to both patients and providers. This trend is particularly relevant in conditions such as Alzheimer’s disease, where early diagnosis is critical, and minimally invasive procedures are preferred. The development of novel radiotracers that target specific biomarkers has further expanded the utility of these non-invasive applications. As patient-centered care continues to drive healthcare innovations, the demand for non-invasive radiopharmaceutical solutions is expected to grow, fostering advancements in both imaging and therapy.

United States Radiopharmaceuticals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States radiopharmaceuticals market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, application, and end use.

Analysis by Product Type:

- Diagnostic Nuclear Medicine

- Therapeutic Nuclear Medicine

The diagnostic nuclear medicine segment is a major contributor to the U.S. radiopharmaceuticals market share. It includes imaging agents used in technologies including PET and SPECT for early disease detection and monitoring. Radiopharmaceuticals such as Technetium-99m and Fluorine-18 are widely employed for cardiovascular, neurological, and oncological imaging. Advances in molecular imaging have enhanced the accuracy of diagnostic nuclear medicine, driving its adoption across healthcare settings. Increasing demand for precise, non-invasive diagnostics continues to propel growth in this segment.

Therapeutic nuclear medicine, also referred to as radiotherapy, treats diseases using radiopharmaceuticals, providing targeted radiation for diseased cells with a minimization of radiation effects on healthy tissues. Some examples of radioisotopes used for the treatment of cancer are Lutetium-177 and Iodine-131 in cases of thyroid, prostate, and neuroendocrine cancers. Theranostics and personalized medicine support this market. The rise in the number of cancer patients and innovation in radiopharmaceutical therapies drive this segment as it has emerged to be an integral part of modern healthcare.

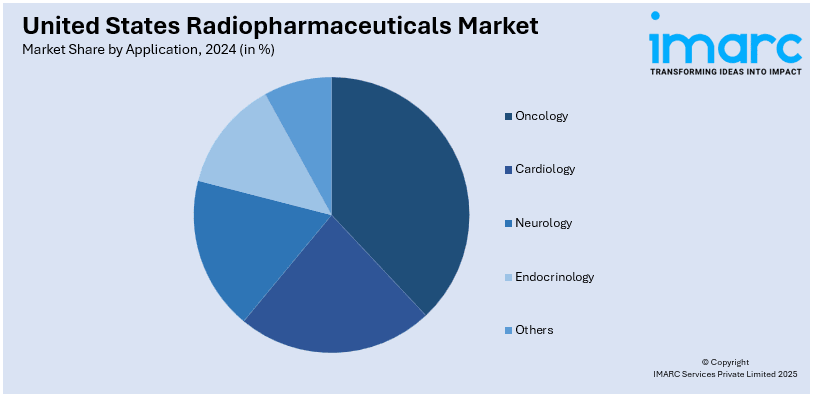

Analysis by Application:

- Oncology

- Cardiology

- Neurology

- Endocrinology

- Others

The oncology segment dominates the market due to its critical role in cancer diagnosis and treatment. Radiopharmaceuticals such as Fluorine-18 and Lutetium-177 are extensively used for imaging and targeted radiotherapy in cancers including prostate, thyroid, and neuroendocrine tumors. Increasing cancer prevalence and advancements in theranostic approaches are driving growth in this application, enhancing precision and patient outcomes.

In cardiology, radiopharmaceuticals are primarily used for imaging and diagnosing heart conditions such as coronary artery disease and myocardial perfusion. Agents such as Technetium-99m enable non-invasive evaluations of cardiac function, aiding early diagnosis and treatment. The increasing prevalence of cardiovascular diseases, coupled with advancements in nuclear imaging technologies, is driving the growth of this segment within the radiopharmaceutical market.

The neurology segment leverages radiopharmaceuticals for the diagnosis and management of neurological conditions, including Alzheimer’s disease, Parkinson’s disease, and epilepsy. Fluorine-18 and other radiotracers are used to visualize brain activity and detect biomarkers of the disease. This application is driven by the growing incidence of neurodegenerative diseases and improvements in brain imaging.

Radiopharmaceuticals in the field of endocrinology primarily are used for the diagnostics and treatment concerning thyroid-related illnesses. Isotopes such as Iodine-131 find wide applications in functional imaging of the thyroid, hyperthyroidism, and cancers of the thyroid. The uprise of endocrine disorders and new breakthroughs in treatments using radiopharmaceutical therapies have expanded this segment, where its role increases for personalized patient care.

Analysis by End Use:

- Hospitals and Clinics

- Research Institutes

- Diagnostic Centers

Hospitals and clinics are high consumers of radiopharmaceuticals according to the U.S. radiopharmaceuticals market size and forecast. These hospitals and clinics use these radiopharmaceuticals widely in diagnostic as well as therapeutic treatment, more particularly in the oncology, cardiology, and neurology sectors. Consumption increases in such areas due to new advanced imaging technologies such as PET and SPECT. A rise in chronic diseases is positively impacting demand. Enhanced health care infrastructure enhances accessibility and thus the usage of radiopharmaceutical services.

Research institutes are key contributors to the development of innovative radiopharmaceuticals, focusing on novel applications and technologies. These facilities drive advancements in molecular imaging and targeted radiotherapy, conducting clinical trials and preclinical studies. The growing emphasis on personalized medicine and theranostic approaches fuels the demand for radiopharmaceuticals in research. Investments in nuclear medicine research and collaborations between academia and industry continue to expand this segment's role in shaping the future of the market.

Diagnostic centers represent an important portion of the market for radiopharmaceuticals, as they offer niche services in imaging by PET and SPECT scans. These centers help treat the mounting demand for non-invasive treatment of diseases in terms of cancers and neurological diseases. The growth has been fueled by rising awareness of the detection of diseases and also through the mushrooming of standalone diagnostic centers. Accessibility of advanced imaging modalities ensures steady development, which makes diagnostic centers essential parts of the radiopharmaceutical value chain.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region leads in radiopharmaceutical adoption due to its robust healthcare infrastructure and high concentration of research institutions. Advanced medical centers and strong research in nuclear medicine are driving demand in this region. The increasing prevalence of cancer and the availability of state-of-the-art diagnostic and therapeutic technologies are contributing to the region's high market share.

The Midwest benefits from a growing number of nuclear medicine facilities and healthcare providers specializing in radiopharmaceutical applications. Rising awareness about the benefits of early disease diagnosis and expanding research collaborations are driving market growth. Additionally, the region's focus on improving healthcare access in rural areas enhances radiopharmaceutical utilization across diverse patient populations.

The South region has a high growth rate in the market as a result of its vast and aging population, creating an increased demand for diagnostics and treatment. With an increasing number of diagnostic centers and enhanced healthcare infrastructure development, the demand for radiopharmaceuticals also increases. Furthermore, the chronic disease prevalence rate in the South region also contributes to a better scenario for the market.

The West region is known for its technological innovation and early adoption of advanced radiopharmaceutical applications. The region is home to leading biotech firms and research institutions, thus significantly advancing nuclear medicine. Increasing investments in personalized medicine and strong demand for non-invasive diagnostic tools further propel the market, positioning the West as a key growth region.

Competitive Landscape:

Innovation and strategic partnerships have become integral aspects of the competitive landscape of the market. Market leaders are trying to establish more advanced state-of-the-art radiopharmaceuticals for diagnostic as well as therapeutic applications primarily in oncology and cardiology. The most common strategies among these companies are investments in research and development, partnerships with academic institutions, and relationships with healthcare providers. Companies are also enhancing production capacities and reducing supply chains for constant product delivery. The need for regulatory approval for novel radiopharmaceuticals and an emphasis on personalized medicine are creating high competition as each market player has a vision of providing targeted solutions with effective outcomes for the ever-escalating needs of healthcare delivery.

The report provides a comprehensive analysis of the competitive landscape in the United States radiopharmaceuticals market with detailed profiles of all major companies, including:

- Lantheus Holdings, Inc.

- BWXT Medical ( BWX Technologies)

- Cardinal Health, Inc.

- Eli Lilly and Company

- GE HealthCare

- Siemens Healthineers

- Curium Pharma

- Jubilant Radiopharma (Jubilant Pharmova Limited’s U.S.)

- Nordion (a division of Sotera Health)

- Advanced Accelerator Applications (Novartis company)

Latest News and Developments:

- May 29, 2024: Fannin Partners announced the launch of Radiomer Therapeutics with pre-seed funding to further advance its radiopharmaceutical therapy platform based on proprietary Raptamer technology. The platform has been designed for targeting cancers including breast, lung, and colorectal cancers, and combines high binding affinity with rapid clinical development. Lead programs for Radiomer are scheduled to start Phase 0 trials in early 2025.

- April 16, 2024: Evergreen Theragnostics, a clinical-stage radiopharmaceutical company, raised USD 26 Million in funding from existing shareholders and new investors, including Petrichor and LIFTT. The funding will be used for the development of its innovative theragnostic pair EVG-321, for the commercialization of its Ga-68 DOTATOC diagnostic kit, and to expand its CDMO services. According to the investors, Evergreen has all the expertise to grow in this expanding radiopharma sector.

- February 13, 2024: Butterfly Network announced the launch in the U.S. of the Butterfly iQ3, the company's latest handheld ultrasound system based on its next-generation P4.3 Ultrasound-on-Chip technology. The FDA granted clearance for the device, which offers superior imaging, accelerated data transfer, and enhanced 3D capabilities such as iQ Slice and iQ Fan in a sleeker, ergonomic design.

- February 12, 2024: RadioMedix and Orano Med announced that AlphaMedixTM (212Pb-DOTAMTATE) has received Breakthrough Therapy Designation by the FDA in the treatment of unresectable or metastatic gastroenteropancreatic neuroendocrine tumors (GEP-NETs) in PRRT-naïve adults. AlphaMedixTM, a Targeted Alpha Therapy in Phase 2, uses lead-212 to preferentially kill cancer cells while avoiding healthy tissue for the treatment of neuroendocrine tumors, providing a significant development in the therapy of neuroendocrine tumors.

United States Radiopharmaceuticals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Diagnostic Nuclear Medicine, Therapeutic Nuclear Medicine |

| Applications Covered | Oncology, Cardiology, Neurology, Endocrinology, Others |

| End Uses Covered | Hospitals and Clinics, Research Institutes, Diagnostic Centers |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Lantheus Holdings, Inc., BWXT Medical ( BWX Technologies), Cardinal Health, Inc., Eli Lilly and Company, GE HealthCare, Siemens Healthineers, Curium Pharma, Jubilant Radiopharma (Jubilant Pharmova Limited’s U.S.), Nordion (a division of Sotera Health), Advanced Accelerator Applications (Novartis company), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States radiopharmaceuticals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States radiopharmaceuticals market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States radiopharmaceuticals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States radiopharmaceuticals market was valued at USD 2.21 Billion in 2024.

The market is driven by the rising prevalence of chronic diseases such as cancer and cardiovascular conditions, advancements in diagnostic imaging and targeted therapies, innovations in radiopharmaceutical production, regulatory approvals, government support for nuclear medicine infrastructure, and the growing adoption of personalized medicine approaches.

IMARC estimates the United States radiopharmaceuticals market to exhibit a CAGR of 6.30% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)