United States Protein Bar Market Size, Share, Trends and Forecast by Type, Source, Distribution Channel, and Region, 2026-2034

United States Protein Bar Market Summary:

The United States protein bar market size was valued at USD 989.00 Million in 2025 and is projected to reach USD 1,565.04 Million by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034.

The United States protein bar market is experiencing robust expansion driven by heightened health consciousness among consumers seeking convenient, nutrient-dense snacking options. The growing emphasis on active lifestyles and fitness culture, coupled with busy schedules demanding portable nutrition solutions, continues to propel demand. Rising adoption of plant-based diets, increasing gym memberships, and the proliferation of e-commerce platforms are further accelerating market penetration and enhancing accessibility across diverse consumer demographics in the United States protein bar market share.

Key Takeaways and Insights:

- By Type: Sports nutrition bar leads the market with a share of 55.8% in 2025. This dominance is driven by the expanding fitness culture, increased gym participation, and growing demand for performance-enhancing nutrition among athletes and fitness enthusiasts seeking post-workout recovery solutions.

- By Source: Plant-based dominates the market with a share of 65.06% in 2025, owing to the escalating shift toward sustainable and ethical dietary choices among consumers. The growing prevalence of veganism, lactose intolerance awareness, and demand for clean-label ingredients are reinforcing preference for plant-derived protein alternatives.

- By Distribution Channel: Online stores hold the largest market share of 38.98% in 2025, reflecting the digital transformation of retail purchasing behavior. E-commerce platforms offer convenience, competitive pricing, subscription models, and extensive product variety that attract health-conscious consumers.

- By Region: South represents the largest region with 32% share in 2025, driven by the concentration of health-conscious consumers, robust fitness center infrastructure, and expanding retail networks across metropolitan areas including Texas, Florida, and Georgia.

- Key Players: Key players drive the United States protein bar market by expanding product portfolios, introducing innovative flavors, and enhancing nutritional profiles with functional ingredients. Their investments in clean-label formulations, strategic retail partnerships, direct-to-consumer channels, and targeted marketing campaigns boost brand awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

The United States protein bar market is witnessing remarkable momentum propelled by the convergence of health awareness and convenience-driven consumption patterns. The modern American lifestyle, characterized by demanding work schedules and time constraints, has elevated demand for portable, nutritious snacking solutions that deliver sustained energy without compromising dietary goals. According to the International Food Information Council, 71% of American consumers in 2024 reported actively trying to increase their protein intake, signifying a fundamental shift in dietary priorities. The fitness boom, wellness movement, and growing emphasis on preventive healthcare are reshaping snacking behaviors, with protein bars emerging as preferred alternatives to traditional processed snacks. Additionally, the proliferation of specialized dietary formulations catering to vegan, keto, gluten-free, and low-sugar preferences is broadening market appeal. The integration of functional ingredients including adaptogens, probiotics, and superfoods is further enhancing product differentiation and consumer engagement.

United States Protein Bar Market Trends:

Rising Demand for High-Protein, Low-Sugar Formulations

American consumers are increasingly gravitating toward protein bars featuring elevated protein content while minimizing sugar levels. The emphasis on clean nutrition and metabolic health is driving manufacturers to reformulate products with natural sweeteners and enhanced protein density. Shoppers are scrutinizing ingredient labels more carefully, favoring bars that deliver substantive nutritional benefits without excessive calories or artificial additives. This preference aligns with broader wellness objectives including weight management, blood sugar regulation, and sustained energy throughout the day. In September 2024, David Protein founded by RXBAR creator Peter Rahal, launched protein bars containing 28 grams of protein with zero sugar, representing the highest protein content with no sugar in the category, directly addressing consumer demand for high-protein, low-sugar formulations.

Expansion of Plant-Based and Clean-Label Options

The plant-based movement is profoundly influencing the protein bar landscape as consumers seek sustainable, ethical, and allergen-friendly alternatives. Manufacturers are diversifying protein sources beyond traditional whey to incorporate pea, rice, hemp, and seed-based proteins. The clean-label trend is compelling brands to simplify ingredient lists, eliminate artificial preservatives, and emphasize whole food components. This evolution reflects consumer desire for transparency, environmental responsibility, and nutrition that aligns with flexitarian or vegan dietary frameworks. For instance, in January 2025, ALOHA. a B Corp-certified plant-based protein brand, doubled its product lineup and expanded to over 1,000 Target stores nationwide, featuring USDA Certified Organic protein bars made with pumpkin seed and brown rice proteins, reflecting the growing mainstream acceptance of plant-based clean-label protein options.

Integration of Functional and Nootropic Ingredients

Protein bars are evolving beyond basic nutrition to incorporate functional ingredients targeting specific health benefits. Manufacturers are infusing products with adaptogens, mushroom extracts, collagen, probiotics, and cognitive-enhancing nootropics to address holistic wellness demands. This functional innovation appeals to consumers seeking multi-benefit snacking solutions that support immunity, gut health, stress management, and brain function. The convergence of sports nutrition and functional foods is creating differentiated product offerings that transcend traditional protein supplementation. In June 2024, MOSH, co-founded by Maria Shriver and Patrick Schwarzenegger, became the first and only protein bar to feature Cognizin Citicoline, a clinically studied nootropic for attention and focus support, along with lion's mane mushroom, ashwagandha, omega-3s, and vitamins B12 and D3.

Market Outlook 2026-2034:

As consumers continue to prioritize convenience and health, the forecast for the US protein bar business is incredibly optimistic. The steady growth trajectory is indicative of changing snacking habits, as customers with limited time are increasingly substituting protein bars for traditional meal components. The growth is supported by ongoing product innovation, a variety of distribution channels, and focused marketing tactics that target different demographic groups. Throughout the projected period, it is anticipated that e-commerce acceleration, clean-label reformulations, and functional ingredient integration would maintain momentum. The market generated a revenue of USD 989.00 Million in 2025 and is projected to reach a revenue of USD 1,565.04 Million by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034.

United States Protein Bar Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Sports Nutrition Bar |

55.8% |

|

Source |

Plant-Based |

65.06% |

|

Distribution Channel |

Online Stores |

38.98% |

|

Region |

South |

32% |

Type Insights:

To get more information on this market, Request Sample

- Sports Nutrition Bar

- Meal Replacement Bar

- Others

Sports nutrition bar leads with a share of 55.8% of the total United States protein bar market in 2025.

The sports nutrition bar segment maintains leadership driven by the expanding fitness culture and rising gym membership rates across the United States. According to the Health & Fitness Association, American fitness facility memberships reached a record 77 Million in 2024, representing 25% of the population actively engaged in structured exercise programs. This burgeoning fitness participation directly correlates with increased demand for performance-oriented protein bars designed to support muscle recovery, energy replenishment, and athletic performance optimization.

Sports nutrition bars are strategically formulated to deliver high protein content, branched-chain amino acids, and optimal macronutrient ratios that appeal to athletes and fitness enthusiasts. The segment benefits from strong endorsement within gym communities, sports training facilities, and wellness-focused retail environments. Product innovation emphasizing performance claims, enhanced bioavailability, and specialized formulations targeting specific athletic goals continues to differentiate sports nutrition bars from general snacking alternatives within the competitive market landscape.

Source Insights:

- Plant-Based

- Animal-Based

Plant-based dominates with a market share of 65.06% of the total United States protein bar market in 2025.

The plant-based protein bar segment is experiencing accelerated growth driven by the substantial expansion of vegan and flexitarian dietary preferences across American consumer demographics. Pea protein, rice protein, and hemp-derived formulations are gaining prominence as manufacturers respond to demand for allergen-friendly, sustainable nutrition alternatives. Consumers are increasingly prioritizing ethical sourcing, environmental responsibility, and clean-label transparency when selecting protein bars. The rising awareness about lactose intolerance and dairy sensitivities is further propelling adoption of plant-based options. Additionally, advancements in taste and texture formulations have significantly improved consumer acceptance, enabling plant-derived proteins to compete effectively with traditional whey-based alternatives in mainstream retail channels.

Consumer preference for clean-label, environmentally conscious products continues to reinforce plant-based segment dominance in the United States protein bar market. Manufacturers are leveraging innovative extraction technologies to enhance texture, taste, and amino acid profiles, addressing historical criticisms of plant protein palatability. The intersection of health consciousness, ethical considerations, and sustainability concerns positions plant-based protein bars as the preferred choice for environmentally aware consumers seeking nutrition that aligns with broader lifestyle values and dietary frameworks.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

The online stores exhibit a clear dominance with a 38.98% share of the total United States protein bar market in 2025.

The online distribution channel has emerged as the leading sales avenue propelled by digital transformation and evolving consumer purchasing preferences. E-commerce platforms are revolutionizing protein bar accessibility through innovative services including subscription models, personalized recommendations, and direct-to-consumer delivery. Online retailers offer extensive product variety, competitive pricing, and convenient comparison-shopping capabilities that attract digitally savvy health-conscious consumers. The proliferation of mobile shopping applications and seamless checkout experiences has further accelerated online purchasing adoption. Additionally, social media marketing and influencer partnerships are effectively driving brand discovery and consumer engagement, positioning digital channels as essential touchpoints for protein bar manufacturers seeking to expand market reach and build direct customer relationships.

The proliferation of direct-to-consumer brands and social media marketing has accelerated online channel growth within the United States protein bar market. Subscription-based purchasing models provide recurring revenue streams while enhancing customer retention and brand loyalty. E-commerce platforms enable smaller, specialized brands to compete effectively with established players by reaching targeted consumer segments without traditional retail infrastructure requirements. The convenience of home delivery, combined with detailed nutritional information and customer reviews, reinforces online purchasing preference.

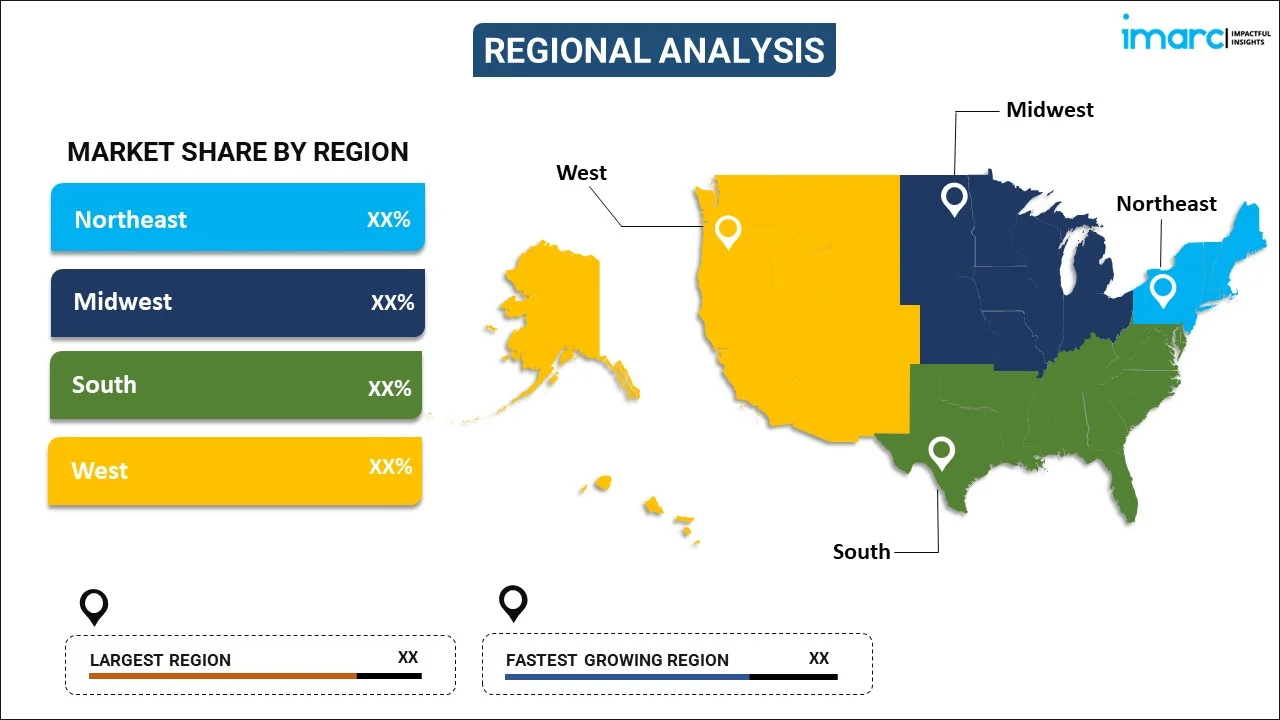

Regional Insights:

To get more information on this market, Request Sample

- Northeast

- Midwest

- South

- West

South represents the leading region with a 32% share of the total United States protein bar market in 2025.

The South commands market leadership driven by substantial population concentration across major metropolitan centers including Houston, Dallas, Atlanta, and Miami. The region benefits from an expanding fitness infrastructure, rising health consciousness, and robust retail network development that enhances protein bar accessibility. Texas and Florida particularly demonstrate strong demand dynamics fueled by thriving e-commerce sectors, growing urban populations, and increasing penetration of specialty health food retailers serving diverse consumer demographics seeking convenient nutritional solutions.

The Southern states exhibit distinctive consumption patterns influenced by active outdoor lifestyles, warm climate conditions encouraging year-round fitness activities, and a culturally diverse population embracing varied dietary preferences. The proliferation of gymnasiums, wellness centers, and sports facilities across suburban and urban communities has cultivated a strong fitness culture driving protein bar adoption. Furthermore, the region's economic growth, rising disposable incomes, and expanding middle-class demographics are contributing to increased spending on premium health-focused snacking options, positioning the South as the dominant regional market.

Market Dynamics:

Growth Drivers:

Why is the United States Protein Bar Market Growing?

Escalating Health and Fitness Consciousness

The United States market is going through a historic period of heightened awareness about health and fitness that has a profound influence on the consumption patterns of food. American consumer behavior has demonstrated a focus on food that offers substantial benefits with a view to supporting their own personal fitness needs. The consciousness has broadened from only athletes to people who are generally concerned about their well-being. Increased knowledge of the physiological needs of the human being has raised consumption levels of proteins in the diet. The diet of American consumers has shifted from calorie-reduction focused to a macronutrient-oriented food behavior pattern for diet control. Macrotrends are shifting consumer behavior from calorie reduction through diet control to fitness-oriented behavior through proteins. The contemporary fitness food trend has broadened consumer groups of protein bars from only gym-going fitness buffs to the average American who wishes to remain fit.

Demand for Convenient On-the-Go Nutrition

The fast-paced American lifestyle characterized by demanding work schedules, lengthy commutes, and time-constrained routines has elevated demand for portable, ready-to-consume nutritional options. Modern consumers increasingly skip traditional meal occasions, replacing them with convenient snacking solutions that deliver comparable nutritional value without preparation requirements. Protein bars satisfy this demand by offering shelf-stable, portable formats that can be consumed anywhere, anytime. The evolution from discretionary snacking toward functional nutrition reflects changing meal patterns where snacks increasingly serve as primary dietary components. Working professionals, students, and busy families are incorporating protein bars as breakfast alternatives, midday energy boosters, and pre- or post-workout sustenance. The convenience factor extends beyond consumption to include simplified purchasing through expanded retail availability and e-commerce accessibility, reducing barriers to regular protein bar integration into daily nutritional routines. According to Mondelēz International's 2024 State of Snacking report, approximately 60% of consumers prefer snacks or smaller meals more frequently as opposed to traditional meals, while 88% of consumers participate in snacking at least once a day.

Product Innovation and Diversification

By meeting a variety of consumer preferences, dietary constraints, and specific nutritional needs, ongoing product innovation is increasing market appeal. Manufacturers are expanding the addressable market beyond typical fitness demographics by creating formulations for vegan, ketogenic, gluten-free, and allergen-conscious consumers. Protein bars have evolved from functional supplements to decadent snacking experiences thanks to flavor innovation, with dessert-inspired variations directly competing with traditional confections. Protein bars are positioned as multi-benefit health products rather than one-use supplements by the addition of functional ingredients such adaptogens, probiotics, collagen, and cognitive enhancers. Consumer desire for products that support holistic health philosophies is met by clean-label reformulations that prioritize whole food ingredients, minimal processing, and transparency. By using this diversification strategy, brands can stay relevant in the face of shifting customer preferences while capturing new dietary trends.

Market Restraints:

What Challenges the United States Protein Bar Market is Facing?

Premium Pricing Concerns

The pricing for these bars is relatively high as compared to other snacking food sources, owing to barriers to accessibility, especially considering budget-conscious groups as target consumers. The reason for a higher price is as follows: When these bars are priced relatively high, it becomes expensive for budget-conscious people to buy, and as a result, it acts as an obstacle to wider accessibility as far as penetration among low-income groups is concerned. Given the current economic trends and developments, it may further worsen the scenario.

Taste and Texture Challenges

Despite the progress made through formulations, the issues of taste and texture remain a challenge to widespread consumer acceptance, specifically concerning plant-protein variants. Some consumers may view protein bars as having a chalky texture or an unnatural aftertaste relative to more traditional confectionery options. These types of limitations may serve as a barrier to initial and repeat sales to the consumer who values indulgent eating experiences.

Intense Market Competition and Saturation

The market is subject to growing dynamics of competition due to established brands, new startups, and other private label options. The market is saturated, making it difficult to establish brand identity in a market where companies are forced to spend significant amounts of money to ensure it is visible. There are so many brand options in the market, making it difficult to make a decision, which may lead to a reduction in consumer engagement in the market. Small companies will have it harder competing with huge multinationals.

Competitive Landscape:

The United States market for protein bars has a relatively fragmented market structure with large multinational companies and smaller specialized brands and new market entrants. Competitive rivalry among market participants focuses on continuous innovation, new flavors, and geographical reach through extensive distribution. Differentiation and segmentation strategies include clean labels, functional ingredients, and focused branding associated with specialized consumer preferences and needs. M&As allow large companies to enlarge their portfolio and gain access to innovative formulation from smaller and agile competitors. Direct-to-consumers market access has empowered emerging competitors and allowed them to compete effectively without a retail distribution channel. Market promotions have increasingly shifted to digital platforms, social media partnerships, and engagement for consumer loyalty from health-minded market segments.

Recent Developments:

- In January 2025, Once Upon a Farm launched refrigerated protein bars in the United States market in Oatmeal Chocolate and Cinnamon Roll formats. The products feature apple puree, cocoa butter, and dates as primary ingredients, targeting health-conscious families seeking whole-food-based nutrition options for convenient, portable snacking occasions.

- In August 2024, Barebells launched an exclusive United States protein bar variant in Key Lime Pie flavor. The Swedish brand stated the new bar contains 20 grams of protein with no added sugar, expanding its presence in the American market while addressing consumer preference for indulgent flavors without compromising nutritional profiles.

United States Protein Bar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Sports Nutrition Bar, Meal Replacement Bar, Others |

| Sources Covered | Plant-Based, Animal-Based |

| Distribution Channels Covered | Supermarkets and Hypermarket, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States protein bar market size was valued at USD 989.00 Million in 2025.

The United States protein bar market is expected to grow at a compound annual growth rate of 5.23% from 2026-2034 to reach USD 1,565.04 Million by 2034.

Plant-based dominated the market with a share of 65.06%, driven by escalating consumer preference for sustainable, vegan-friendly, and allergen-conscious protein alternatives that align with ethical and environmental values.

Key factors driving the United States protein bar market include rising health consciousness, expanding fitness culture, demand for convenient on-the-go nutrition, product innovation, and e-commerce proliferation.

Major challenges include premium pricing concerns limiting mass market accessibility, taste and texture formulation challenges, intense market competition and saturation, fluctuating raw material costs, and consumer skepticism regarding health claims.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)