United States Project Portfolio Management Market Share, Trends and Forecast by Component, Solution Type, Deployment Type, Organization Size, Vertical, and Region 2025-2033

United States Project Portfolio Management Market Size and Share:

The United States project portfolio management market size was valued at USD 1.68 Billion in 2024. Looking forward, the market is expected to reach USD 3.09 Billion by 2033, exhibiting a CAGR of 6.27% during 2025-2033. The market is expanding due to increasing demand for strategic planning tools, real-time performance tracking, and resource optimization across industries. Growth is further supported by the integration of cloud-based platforms and advanced analytics, enhancing decision-making and agility in complex project environments. This drives the rising United States project portfolio management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.68 Billion |

| Market Forecast in 2033 | USD 3.09 Billion |

| Market Growth Rate (2025-2033) | 6.27% |

The market is experiencing sturdy development, driven by the increasing requirements to have an efficient allocation of resources, increased visibility, and proper project positioning within the organizations. With businesses handling more complex and multi-layered portfolios, the need to have integrated tools that would help streamline planning, realization, and monitoring is rising. Institutions in various industries, especially those in IT, construction, finance, and healthcare, are implementing a PPM solution to increase time, money, and risk control. For instance, in April 2025, Tempo, a prominent provider of project, program, and portfolio management solutions, unveiled its latest Strategic Portfolio Management (SPM) platform, named Allegro. This new launch enhances the Tempo product suite by introducing advanced workflow functionalities, offering intelligent insights for real-time plan adjustments, and strengthening connectivity with top-tier work management systems through deeper integrations.

To get more information on this market, Request Sample

The United States project portfolio management market growth is also driven by the shift toward cloud-based platforms, enabling real-time collaboration, remote accessibility, and scalable infrastructure. These solutions make agile methodologies and less co-located work environments, which are currently mainstream in US business enterprises. Furthermore, decision-making opportunities in organizations are also changing due to the incorporation of modern technologies, including artificial intelligence (AI), machine learning (ML), and data analysis. These functions provide predictive analytics, scenario planning, and automatic reporting and improve the capability of proactively managing a project portfolio. For instance, in February 2025, Cora Systems, a prominent project portfolio management (PPM) solutions provider, announced a strategic collaboration with Intra Management Solutions (IMS), a consultancy firm with deep expertise in the aerospace, defense, engineering, and government domains. Under this partnership, IMS will serve as a certified implementation partner for Cora Systems, enhancing the deployment and impact of its PPM offerings within these key sectors.

United States Project Portfolio Management Market Trends:

Increasing Project Complexity Across Enterprises

As organizations in sectors like IT, construction, healthcare, and finance handle larger and more intricate projects, the need for advanced project portfolio management tools has intensified. These projects often involve multiple stakeholders, cross-functional teams, tight budgets, and strict timelines, making manual or traditional project tracking insufficient. PPM solutions enable centralized oversight, resource allocation, risk assessment, and milestone tracking across diverse projects and programs. With growing pressure to improve transparency, meet compliance requirements, and align projects with strategic objectives, businesses are turning to PPM platforms to streamline operations and enhance productivity. According to the United States project portfolio management market trends, this complexity is driving consistent investment in scalable, intelligent project portfolio management systems throughout the United States. For instance, in December 2024, Smartsheet, an enterprise-grade work management platform enhanced with AI capabilities, published its latest findings on the evolving workplace's impact on project and portfolio management (PPM) professionals. Featured in the 2025 Project and Portfolio Management Priorities Report, the study reveals that 92% of PPM experts face challenges in adapting to workplace transformations. These difficulties stem from persistent issues such as rapidly shifting priorities, inadequate communication and collaboration channels, and restricted access to vital data—factors that ultimately hinder business performance.

Adoption of Cloud-Based and Remote Collaboration Tools

The widespread shift toward hybrid and remote work models has accelerated the demand for cloud-based PPM solutions. An industry report finds that 64 % of business leaders say their companies have adopted hybrid arrangements, amplifying demand for cloud‑based, collaborative PPM solutions that keep dispersed teams synchronized and projects on track. According to the United States project portfolio management market forecast, these platforms enable real-time collaboration, mobile access, and remote project tracking, making them essential for distributed teams across the US Cloud-native PPM tools also offer scalability, automated updates, and seamless integration with other enterprise applications like CRM, ERP, and collaboration software. This improves data consistency, facilitates better decision-making, and enhances team coordination. As organizations prioritize flexibility and agility, cloud-enabled PPM systems provide the infrastructure to manage evolving project demands while maintaining efficiency and visibility, making them a cornerstone of modern project governance strategies.

Demand for Data-Driven Decision Making and Automation

With the rise of big data and analytics, companies are increasingly seeking PPM tools that offer real-time insights, performance metrics, and predictive capabilities. Crucially, companies that actively manage and prioritize their project portfolios can outperform their peers by up to 40 %, according to a recent report, underscoring the tangible ROI of effective PPM practices. According to reports, U.S. private‑sector AI investment reached USD 109.1 Billion in 2024, highlighting the explosive growth of data‑driven capabilities that PPM platforms now integrate AI, predictive analytics, and real‑time reporting to optimize resource allocation and sharpen decision‑making. These features help stakeholders optimize resource use, forecast project outcomes, and align execution with long-term goals. Automation within PPM platforms also minimize administrative tasks, such as status updates, reporting, and budget tracking, allowing project managers to focus on strategy. Integration with AI and machine learning further enhances these systems by identifying risks, suggesting adjustments, and improving overall responsiveness. This data-centric approach not only improves operational control but also enables enterprises to drive innovation, reduce failure rates, and remain competitive in dynamic market environments.

United States Project Portfolio Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States project portfolio management market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, solution type, deployment type, organization size, and vertical.

Analysis by Component:

- Software

- Services

Software stands as the largest component in 2024, holding 67.1% of the market due to its critical role in streamlining complex project operations, enabling real-time decision-making, and ensuring alignment with strategic business goals. Modern PPM software offers advanced features like predictive analytics, AI-powered forecasting, automated reporting, and seamless integration with other enterprise tools such as ERP, CRM, and collaboration platforms. These capabilities improve visibility, enhance resource utilization, and support agile methodologies, making them essential in dynamic and remote-first work environments. Additionally, cloud-based deployment and scalability allow organizations of all sizes to adopt software solutions tailored to their needs. As demand grows for transparency, performance tracking, and efficient execution, software remains the backbone of digital project and portfolio management strategies.

Analysis by Solution Type:

- Information Technology Solutions

- New Product Development Solutions

- Others

Information Technology solutions lead the market with 54.3% of market share in 2024 due to the sector’s high project volume, complexity, and rapid innovation cycles. IT organizations frequently manage multiple simultaneous initiatives, ranging from software development and cybersecurity to infrastructure upgrades and digital transformation, requiring robust PPM tools for prioritization, resource allocation, and risk management. These solutions help streamline workflows, improve collaboration across teams, and ensure alignment with business objectives. The IT sector’s early adoption of cloud computing, agile methodologies, and data-driven decision-making further amplifies its reliance on advanced PPM platforms. Additionally, IT departments often lead enterprise-wide technology integration, making them central users and promoters of PPM tools across various business functions.

Analysis by Deployment Type:

- On-premises

- Cloud-based

Cloud-based leads the market with 70% of market share in 2024 due to their flexibility, scalability, and cost-effectiveness. These platforms enable real-time collaboration, remote access, and seamless integration with other enterprise systems, making them ideal for today’s hybrid and distributed work environments. Organizations prefer cloud-based PPM tools because they eliminate the need for heavy upfront infrastructure investment while offering regular updates, enhanced security, and improved data accessibility. Additionally, cloud platforms support agile workflows and allow teams to quickly adapt to shifting project priorities. As businesses increasingly prioritize digital transformation and operational agility, cloud-based PPM solutions continue to dominate the market by offering superior speed, ease of deployment, and the ability to manage complex portfolios efficiently.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises hold the largest share in the market due to the scale and complexity of their operations. These organizations typically manage numerous concurrent projects across departments, regions, and business units, necessitating comprehensive tools for resource allocation, risk mitigation, and strategic alignment. PPM solutions enable large enterprises to standardize processes, track performance, and make data-driven decisions across their entire project landscape. Moreover, these firms have greater budgets to invest in advanced technologies like AI, cloud integration, and real-time analytics, which is further creating a positive United States project portfolio management market outlook. Their emphasis on long-term planning, regulatory compliance, and return on investment also drives demand for robust PPM platforms. As a result, large enterprises lead the adoption of enterprise-grade PPM tools to maintain efficiency and competitive advantage.

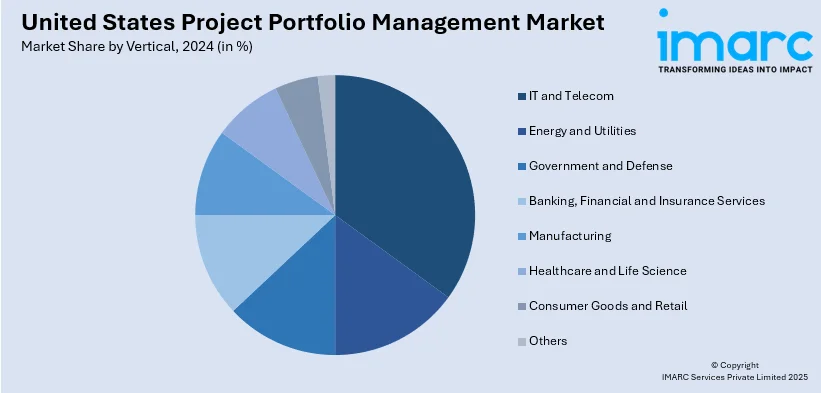

Analysis by Vertical:

- Energy and Utilities

- Government and Defense

- IT and Telecom

- Banking, Financial and Insurance Services

- Manufacturing

- Healthcare and Life Science

- Consumer Goods and Retail

- Others

IT and Telecom leads the market with 26.5% of market share in 2024 due to its high volume of complex, technology-driven projects and constant demand for innovation. These industries often manage multiple concurrent initiatives, such as infrastructure upgrades, software development, cybersecurity enhancements, and network expansions, each requiring detailed planning, resource management, and timeline tracking. PPM tools help streamline project workflows, improve cross-functional collaboration, and ensure alignment with strategic goals. Additionally, the IT and telecom sector is typically an early adopter of digital tools, including cloud-based platforms and AI-powered analytics, further accelerating PPM integration. As these sectors continuously evolve to meet changing customer needs and technological advancements, robust PPM systems remain essential for efficiency and competitiveness.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region, home to financial hubs like New York and Boston, drives strong demand for PPM solutions due to the concentration of banking, insurance, healthcare, and consulting industries. These sectors manage large-scale, compliance-driven projects that require detailed tracking, risk mitigation, and strategic alignment. The emphasis on digital transformation, coupled with the prevalence of Fortune 500 companies, supports enterprise-wide adoption of advanced PPM tools. Additionally, regional investments in technology, research institutions, and education foster innovation, pushing organizations to prioritize resource optimization, agile planning, and real-time analytics, core capabilities offered by modern project portfolio management platforms.

In the Midwest, strong demand for PPM solutions is fueled by the region’s robust manufacturing, automotive, and logistics industries. These sectors often undertake long-term, capital-intensive projects involving multiple stakeholders and strict regulatory requirements. PPM tools support efficient resource allocation, cost control, and project tracking across supply chains and production lines. Additionally, the rise of smart manufacturing and Industry 4.0 initiatives has prompted many firms to adopt digital PPM platforms to improve project oversight and align innovation with operational goals. The region’s growing IT and healthcare presence also contributes to PPM market expansion through complex infrastructure and technology upgrade projects.

The South’s rapidly expanding infrastructure, energy, and real estate sectors significantly drive demand for PPM solutions. States like Texas and Florida are hubs for large-scale development and utility projects that require robust project governance and resource coordination. The region’s rising tech presence—especially in Austin and Atlanta—has further increased adoption of agile, cloud-based PPM tools to support software development and digital transformation. Public sector initiatives, including smart city programs and transportation projects, also contribute to the need for portfolio-level oversight. With economic growth accelerating across urban centers, organizations in the South are investing in scalable PPM platforms to manage risk and improve ROI.

The West, led by innovation centers like Silicon Valley and Seattle, sees high PPM adoption driven by the tech, entertainment, and aerospace industries. These sectors operate in fast-paced environments with multiple concurrent projects requiring agile execution and continuous innovation, which is driving the United States project portfolio management market demand. Cloud-native companies prioritize digital project management tools with AI, real-time analytics, and remote accessibility. Additionally, significant investment in renewable energy and infrastructure projects across California and neighboring states supports portfolio management tools for compliance, cost efficiency, and timeline control. The region’s startup ecosystem and emphasis on rapid scaling further enhance the demand for flexible, integrated PPM solutions that support growth and adaptability.

Competitive Landscape:

The United States project portfolio management (PPM) market is highly competitive, with a strong presence of global and regional players offering a wide range of cloud-based and on-premise solutions. Leading companies such as Microsoft, Oracle, SAP, Planview, Smartsheet, and Broadcom dominate the landscape by continuously enhancing their platforms with AI, analytics, and integration capabilities. These firms cater to diverse industries, including IT, telecom, construction, healthcare, and finance. Startups and niche providers are also gaining ground by offering agile, user-friendly tools tailored to SMEs. Strategic partnerships, mergers, and technological innovation are key competitive strategies. The focus remains on delivering real-time visibility, scalability, and strategic alignment—critical factors shaping market positioning in the dynamic US PPM sector.

The report provides a comprehensive analysis of the competitive landscape in the United States project portfolio management market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: MDS Aero selected Cora as its Project Portfolio Management (PPM) solution to streamline its operations and drive strategic growth. The Canadian company, specializing in gas turbine engine test facilities for aviation, industrial, and marine sectors, chose Cora for its flexibility, configurability, and comprehensive functionality. Cora's platform, offering scalable solutions across resource, financial, and risk management, aligns with MDS's vision for operational efficiency and long-term success.

- March 2025: WorkOtter rebranded as Prism PPM to reflect its expanded focus on empowering PMOs with scalable, cloud-based solutions. The platform offered enhanced visibility, resource allocation, and security features. Prism PPM aimed to optimize project success through portfolio-level insights, aligning with evolving enterprise and government needs amid rising complexity and digital transformation.

- February 2025: Bloomberg launched MARS Climate to help portfolio managers assess climate-related financial risks. Integrated into its MARS suite, the tool enabled users to evaluate risks like physical and transition impacts at the security level. It aligned with NGFS frameworks, aiding regulatory compliance and supporting risk-informed investment and portfolio management strategies.

United States Project Portfolio Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Solution Types Covered | Information Technology Solutions, New Product Development Solutions, Others |

| Deployment Types Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Verticals Covered | Energy and Utilities, Government and Defense, IT and Telecom, Banking, Financial and Insurance Services, Manufacturing, Healthcare and Life Science, Consumer Goods and Retail, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States project portfolio management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States project portfolio management market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States project portfolio management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The project portfolio management market in the United States was valued at USD 1.68 Billion in 2024.

The United States project portfolio management market is projected to exhibit a CAGR of 6.27% during 2025-2033, reaching a value of USD 3.09 Billion by 2033.

Key factors driving the United States project portfolio management market include increasing project complexity, rising demand for real-time data and analytics, widespread adoption of cloud-based solutions, and growing need for strategic alignment, resource optimization, and agile execution across diverse industries such as IT, construction, and healthcare.

IT and telecom represent the largest segment by vertical in the United States project portfolio management market due to high project volumes, rapid innovation cycles, and the need for agile tools that manage complexity, ensure scalability, and support digital transformation initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)