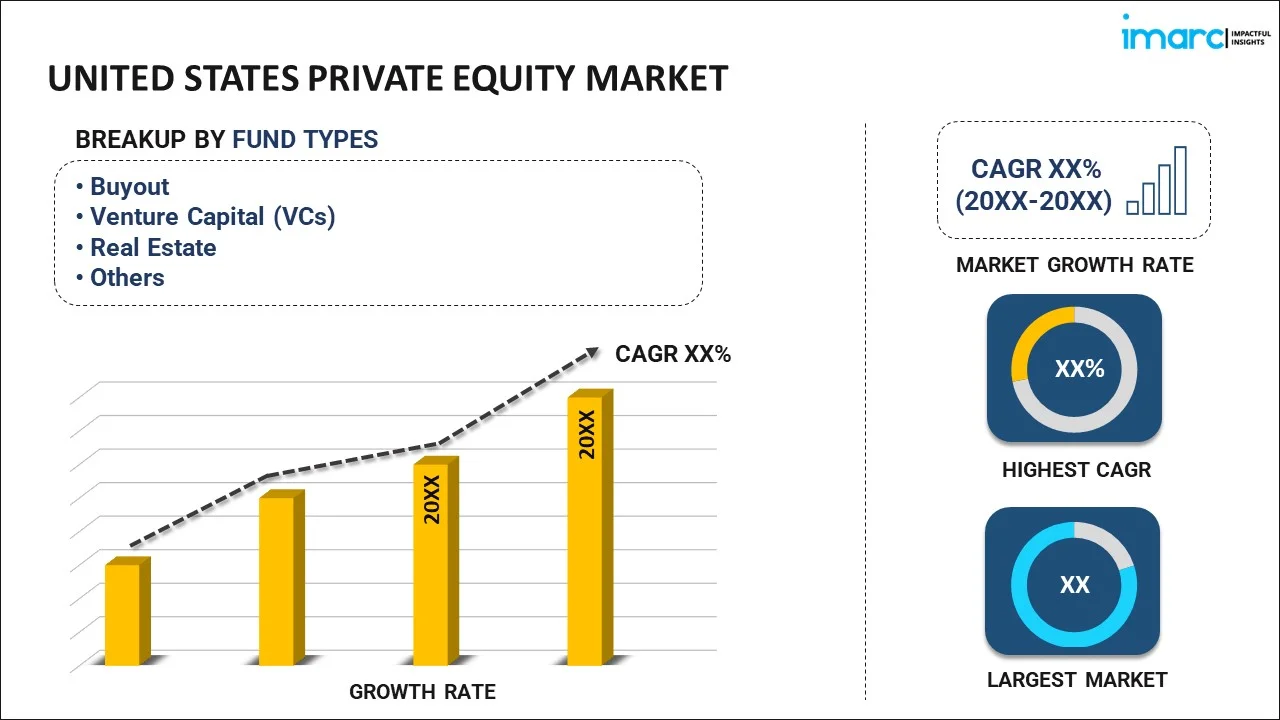

United States Private Equity Market Report by Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, and Others), and Region 2025-2033

Market Overview:

The United States private equity market size reached USD 464.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,212.8 Billion by 2033, exhibiting a growth rate (CAGR) of 10.2% during 2025-2033. The continuing evolution of tax legislation, which favors capital investments, the presence of a strong economic foundation and regulatory environment conducive to business growth, and technological innovation represent some of the key factors driving the United States private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 464.6 Billion |

| Market Forecast in 2033 | USD 1,212.8 Billion |

| Market Growth Rate (2025-2033) | 10.2% |

United States Private Equity Market Analysis:

- Growth Drivers: Private equity growth is driven by a number of factors, including substantial M&A activity, corporate restructuring demand, favorable interest rates, digital innovation, regulatory freedom, institutional investor appetite, and strong capital inflows. These factors also promote portfolio diversification and high-return prospects.

- Key Market Trends: Some of the key United States private equity market trends are the rise in technology-focused deals, ESG integration, increased secondary transactions, co-investments, sector specialization, AI-driven deal sourcing, and growing interest in healthcare, fintech, and infrastructure dominate evolving private equity strategies in the U.S.

- Market Opportunities: Expansion into mid-market deals, digital transformation investments, distressed asset acquisitions, ESG-focused funds, cross-border collaborations, healthcare innovation, and infrastructure development create lucrative prospects for private equity players in an evolving economic landscape.

- Market Challenges: Rising valuations, economic uncertainty, regulatory scrutiny, intense competition, limited quality deal flow, talent retention, geopolitical tensions, and higher borrowing costs pose significant hurdles to sustaining returns in the U.S. private equity market.

Private equity refers to a type of investment strategy that involves the acquisition of ownership stakes in private companies or the buyout of public companies to make them private, with the goal of later selling the stake for a profit. This investment approach is distinct from traditional public equity investment, where shares are bought and sold on public stock exchanges. It is generally employed by firms known as private equity firms, which raise funds from institutional investors and high-net-worth individuals and use these funds to acquire stakes in companies. Once the firms receive these stakes, they often take a hands-on approach to management, aiming to improve financial and operational performance to increase the company's value. The private equity industry plays a vital role in the economy by offering alternative sources of capital for enterprises that might not have access to other forms of financing, thus driving growth, innovation, and employment. The private equity realm is characterized by distinct investment phases, beginning with the identification of promising investment targets. Due diligence is meticulously conducted to assess the viability of the investment, including scrutinizing financials, evaluating market positioning, and analyzing growth potential. Once an investment is made, private equity firms actively collaborate with management teams, drawing upon their expertise to formulate strategies that bolster operational efficiency, streamline costs, and optimize resource allocation.

United States Private Equity Market Trends:

Institutional Investor Appetite for Alternative Assets

Institutional investors such as pension funds, endowments, insurance companies, and sovereign wealth funds continue to allocate significant capital to private equity due to its potential for higher risk-adjusted returns compared to public markets. With volatile equity markets and low fixed-income yields in recent years, private equity has emerged as a reliable avenue for portfolio diversification and long-term value creation. Co-investment opportunities and customized fund structures are attracting even more institutional participation. Additionally, the illiquidity premium and longer investment horizons of PE align well with institutional mandates seeking consistent returns over time. This steady inflow of institutional capital provides private equity firms with the resources to pursue larger deals, expand into niche sectors, and maintain resilience even during periods of macroeconomic uncertainty, cementing their critical role in capital formation and economic growth thus aiding the United States private equity market demands.

Technology and Digital Transformation Investments

The U.S. private equity market has seen a surge in technology-focused investments as digital transformation reshapes nearly every industry. PE firms are actively targeting companies in software, cloud computing, cybersecurity, AI, and data analytics, recognizing their strong growth potential and recurring revenue models. Technology adoption across traditional sectors—such as healthcare, finance, and manufacturing—has also fueled deal activity, as PE firms acquire and modernize legacy businesses to improve efficiency and scalability. The accelerated digitization driven by the pandemic has further underscored the need for tech-driven solutions, making tech-enabled companies highly attractive investment targets. Additionally, private equity firms are leveraging advanced analytics and AI for deal sourcing, risk assessment, and operational improvements, enhancing portfolio performance. This technology-centric approach is not only driving deal volumes but also ensuring higher exit valuations, making it one of the strongest growth engines in the United States private equity market analysis.

Robust Mergers & Acquisitions (M&A) and Restructuring Activity

M&A and corporate restructuring continue to be at the heart of U.S. private equity expansion. While firms look for strategic reorientation in a highly competitive global environment, PE companies are positioned to purchase low-performing or non-strategic business segments, rationalize operations, and generate value through restructuring. The market has also witnessed increased take-private deals, where PE companies purchase listed corporations to maximize performance outside the pressures of quarterly market demands. Separately, distressed asset buying and corporate carve-outs have picked up pace, especially in sectors hit by economic downturns or supply chain shocks. PE firms provide operational know-how, capital injection, and strategic advice, making them desirable partners for transformational companies. The deals not only yield compelling returns but also allow private equity participants to diversify their portfolios across sectors, thereby cementing United States private equity market growth.

United States Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States private equity market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on fund type.

Fund Type Insights:

To get more information on this market, Request Sample

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

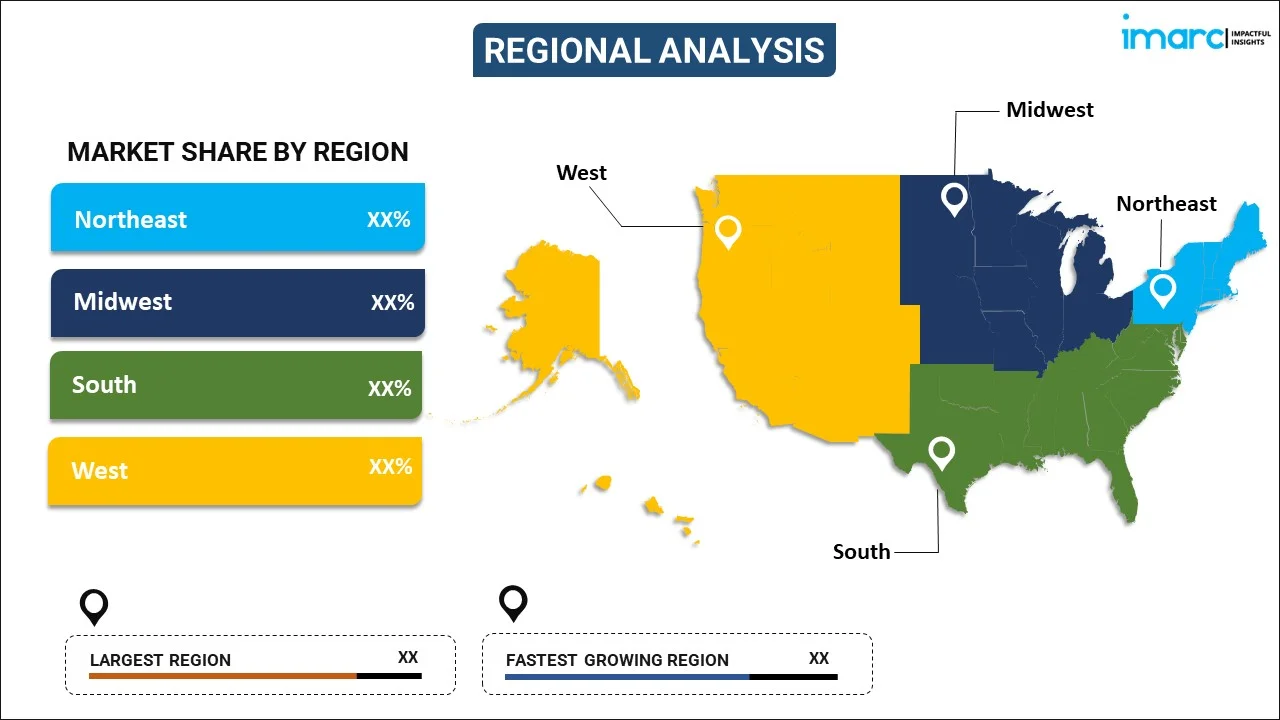

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In July 2025, Pacific Petroleum Operating, a fund of Pacific Bays Capital, has completed the $9.65 million acquisition of oil-producing assets in Wyoming from a portfolio company of a leading private equity group. The deal, finalized on June 11, 2025, involved institutional investors from Japan via a Delaware-based investment vehicle using a U.S. tax blocker for cross-border efficiency. Operations will be managed by VCP Wyoming, an affiliate of experienced operator VCP Operating.

- In April 2025, Morgan Stanley Investment Management launched the North Haven Private Assets Fund (NHPAF), its first evergreen private equity fund, offering individual investors access to institutional-quality co-investments and secondaries in the lower middle market. Managed by Morgan Stanley Private Equity Solutions, with a 25-year track record, NHPAF aims to provide diversified exposure, enhanced liquidity options, and simplified tax reporting, reflecting MSIM’s commitment to democratizing alternatives and expanding private market access beyond traditional institutional investors.

United States Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States private equity market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States private equity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The private equity market in the United States was valued at USD 464.6 Billion in 2024.

The United States private equity market is projected to exhibit a CAGR of 10.2% during 2025-2033, reaching a value of USD 1,212.8 Billion by 2033.

Key factors driving the United States private equity market include strong institutional investor demand for alternative assets, abundant dry powder, favorable regulatory frameworks, and robust M&A activity. Additionally, technology-driven transformation, sector-focused strategies, and opportunities in lower middle-market deals enhance value creation, while co-investments and secondaries expand investor access and diversification.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)