United States Printer Market Size, Share, Trends and Forecast by Printer Type, Technology Type, Printer Interface, End User, and Region, 2025-2033

United States printer Market Size and Share:

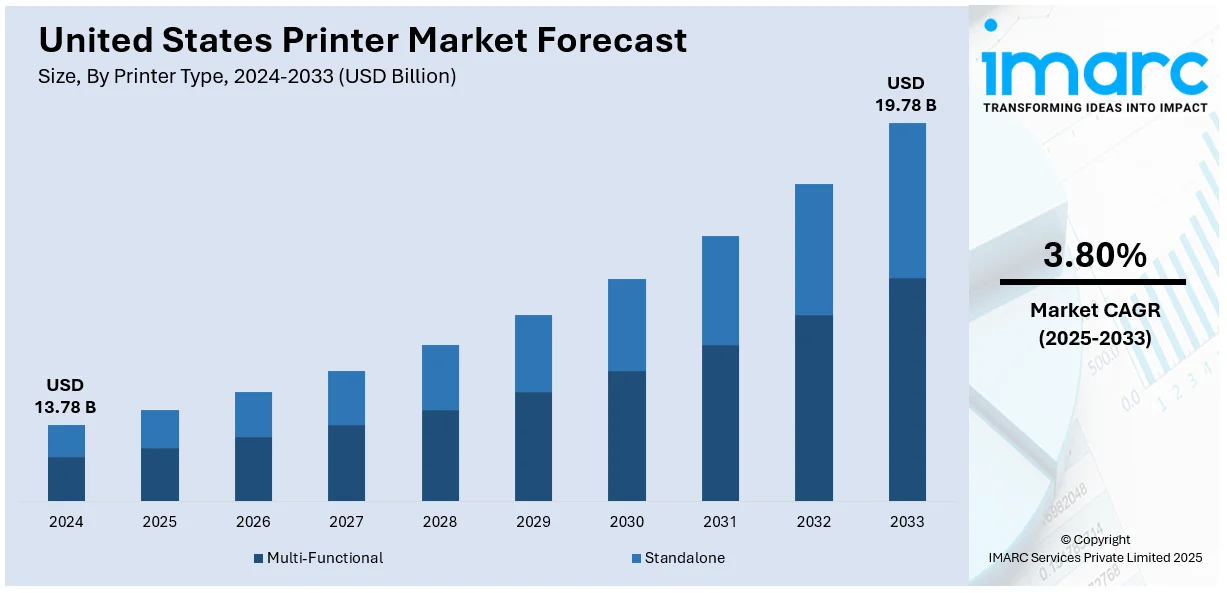

The United States printer market size was valued at USD 13.78 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.78 Billion by 2033, exhibiting a CAGR of 3.80% from 2025-2033. The United States printer market is driven by factors such as the demand for convenience foods, with consumers seeking quick and easy meal solutions. The popularity of fusion dishes combining United States and Italian flavors also fuels growth. In line with this, the increasing preference for healthier, sustainable printer alternatives like gluten-free options supports market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.78 Billion |

| Market Forecast in 2033 | USD 19.78 Billion |

| Market Growth Rate (2025-2033) | 3.80% |

Increasingly, American companies are asking for high-end printer solutions for premium output. In this context, the U.S. printer market is gradually moving forward. High-resolution printing demands from retail, education, and healthcare industries increase commercial demand for a printer. This is the main reason why, amid rapid digitalization, more organizations are turning towards advanced inkjet or laser printer technology for increased productivity, lower cost, and dependability. The need for professional-grade production of materials such as brochures, invoices, and packaging calls for high-end printers that improve on speed, durability, and accuracy.

The shift to remote work and hybrid office environments, accelerated by the COVID-19 pandemic, has driven significant demand for personal and home-office printers in the United States. Many remote workers require printers for tasks such as document management, printing contracts, and educational materials. Consumer preference is thus moving towards multifunction printers (MFPs) that allow scanning, copying, and faxing. There is an increasing demand for cost-effective, user-friendly, and space-saving printers. Companies are now offering home-office workers with a dedicated printing solution. The trend is expected to continue as remote working models of work arrangements continue to become increasingly flexible in the workforce.

United States Printer Market Trends:

Shift Toward Wireless and Cloud-Based Printing

The most notable trend in the United States printer market is a shift toward wireless and cloud-based printing solutions. As more people have become accustomed to using mobile devices and storing files in the cloud, businesses and consumers are seeking printers that are easy to connect to smartphones, tablets, and cloud platforms. This has made it easier to print anywhere without the complexity of network setups or physical connections. It is highly valuable in dispersed enterprises and for working from home to print without sitting at one piece of equipment. Furthermore, users have the flexibility with advanced cloud printing technologies that would provide state-of-the-art security capabilities in enhancing document management. Moreover, the spending plan for cloud computing will be approximately $8.3 billion in FY 2025 for the Federal civilian agencies of the government, thereby an indication of increased investment in the utilization of cloud.

Growth of 3D Printing in Manufacturing and Prototyping

In recent times, 3D printing has come up as one of the transforming technologies for the printer market in the United States. Among various segments like manufacturing, automotive, and product prototyping, 3D printing technology is currently creating great opportunities to make it cut costs for businesses with production as a core competency for more efficiency and savings on cost. 3D printing allows for rapid, low-cost prototyping, customization, and on-demand production with no long lead times associated with traditional manufacturing processes. About two-thirds of U.S. manufacturers are said to be using 3D printing technologies in their businesses, and 56% of respondents said they expected that more than half of its peers would eventually embrace 3D printing within the next 3-5 years, showing potential future expansion. Examples of the industries taking on 3D printing technologies include aerospace and healthcare for more complex parts or molds and in the consumer good sector for various medical devices. The better the technology becomes, the more companies implement 3D printing in their production process.

Sustainability and Eco-Friendly Printing Solutions

Sustainability is becoming a key focus in the printer market, with growing consumer and business demand for eco-friendly printing solutions. Companies are increasingly adopting energy-efficient printers that consume less power and produce fewer emissions. The shift toward digitalization also contributes to reducing paper consumption, aligning with environmental goals. In addition, in the U.S., over 300 million inkjet and 70 million laser cartridges are sold annually, with Americans discarding eight ink cartridges every second. This highlights the significant environmental impact of printer consumables. Printer manufacturers are producing recyclable or biodegradable ink cartridges, reducing waste. Some companies are even implementing take-back programs for used printers and cartridges to promote circular economy practices. As environmental regulations tighten and corporate social responsibility becomes a stronger focus, sustainable printing solutions are expected to gain more United States printer market share.

United States Printer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States printer market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on printer type, technology type, printer interface, and end user.

Analysis by Printer Type:

- Multi-Functional

- Standalone

Multi-functional printers combine printing, scanning, copying, and sometimes faxing capabilities in one device, offering high convenience and space-saving benefits. They are commonly used in offices, providing versatility for various tasks. MFPs improve efficiency, reduce operational costs, and are preferred in environments that require frequent document management and sharing.

Alongside this, the standalone printers are dedicated devices designed solely for printing tasks. They are typically used in smaller environments or specialized printing needs, offering simplicity and reliability. These printers are ideal for those who need high-quality, focused printing without additional functions like scanning or copying, making them cost-effective for personal or low-volume office use.

Analysis by Technology Type:

- Dot Matrix Printer

- Inkjet Printer

- LED Printer

- Thermal Printer

- Laser Printer

Dot matrix printers print through an ink ribbon hit by the print head. Dots build the character or image on paper. The machine is sturdy and very cheap; ideal for multi-part forms, receipts, and invoices. Although not good for the printing quality in modern printing technology, it's also much slower than those other devices.

Along with this, inkjet printers use liquid ink sprayed through tiny nozzles onto paper to create high-quality prints. They are ideal for home and office use, giving vibrant color reproduction for photos and documents. Inkjet printers are affordable, versatile, and offer high resolution but can be costly in the long run due to ink cartridges.

Another similarity that LED printers have with laser printers is the creation of images on the drum by using LED arrays instead of lasers. They have the advantage of fast printing, energy efficiency, and compact design. These printers are relatively quieter and reliable, require fewer maintenance procedures, and are excellent for office and commercial applications.

Another difference is that thermal printers use heat to transfer ink onto paper, either direct (direct thermal) or via a ribbon (thermal transfer). They come in handy for issuing receipts, labels, and barcodes, because of speed, simplicity and low maintenance. Thermal printers are relatively cheap, but the prints on the paper fade with time and require added coatings.

Apart from this, laser printers use laser beams to create static electricity on a drum, which attracts toner powder to form text and images. Laser printers are known for their speed, precision, and high-volume capabilities, making them ideal for office environments, with crisp black-and-white prints. However, they are usually more expensive than inkjet printers.

Analysis by Printer Interference:

- Wired

- Wireless

Wired printers connect directly to devices through cables, offering stable, reliable connections with minimal interference. They are often preferred in environments where security, consistency, and high-volume printing are crucial. Wired printers typically provide faster print speeds and higher quality but lack the flexibility and convenience of wireless alternatives.

Besides this, the wireless printers offer greater flexibility by connecting to devices via Wi-Fi, Bluetooth, or other wireless networks. They enable printing from multiple devices, including smartphones and laptops, without the need for physical connections. These printers are favored for their convenience, especially in home offices and remote work setups, though they may experience occasional connectivity issues.

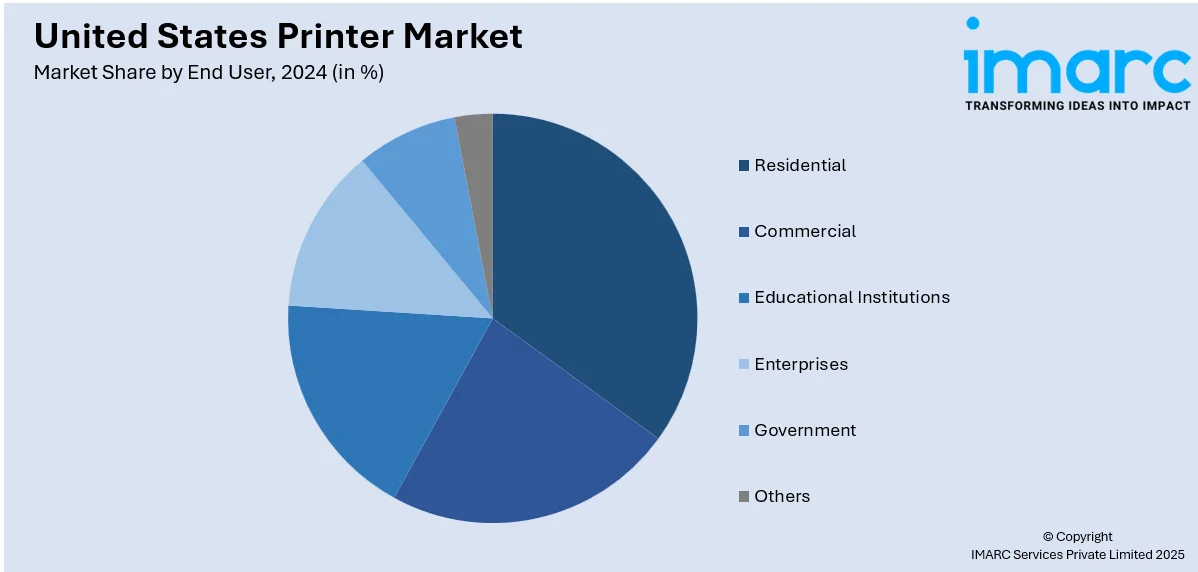

Analysis by End User:

- Residential

- Commercial

- Educational Institutions

- Enterprises

- Government

- Others

The residential segment is driven by the increasing need for personal printing in home offices and remote learning. Consumers seek affordable, compact printers for everyday tasks, such as printing documents, photos, and schoolwork. The trend towards multifunctional devices that combine printing, scanning, and copying is prevalent in this segment.

Also, in the commercial sector, businesses require high-volume, high-quality printers for marketing materials, documents, and transactional printing. Demand is strong for reliable, cost-effective machines that can handle various print applications. The rise of digital marketing and the need for customized print solutions in retail, finance, and healthcare fuel commercial printer adoption.

Moreover, the educational institutions, including schools and universities, need printers for administrative tasks, educational materials, and student projects. The growth of digital learning and hybrid classrooms has led to an increased need for high-quality printing, particularly for printed resources and on-demand materials. Multifunction printers and cost-efficiency are critical for educational institutions.

Apart from this, the enterprises require robust, scalable printing solutions for large volumes of documents, reports, and marketing materials. High-efficiency devices with cloud integration and security features are in demand. As digital transformation accelerates, enterprises are increasingly adopting multifunction devices to streamline operations and reduce costs associated with printing and document management.

Furthermore, the government agencies rely on printers for a wide range of administrative and operational tasks, including printing forms, documents, and communication materials. Security, compliance, and cost-effectiveness are essential in this sector. The government’s push for digital transformation also encourages the adoption of advanced, eco-friendly printing solutions that support sustainability goals.

Along with this, the "Others" category encompasses various sectors, such as healthcare, legal, and non-profit organizations. These industries require specialized printing solutions for documents, reports, and regulatory compliance materials. The demand for customized and highly secure print solutions is growing, with each sector requiring tailored applications to meet their unique needs and challenge.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region has a high demand for advanced printing solutions, driven by a mix of industries including technology, education, and healthcare. Dense urban populations and strong business infrastructure fuel the need for efficient, high-quality printers. Innovation in digital and eco-friendly printing technologies is prevalent in this region.

Concurrently, the Midwest is characterized by manufacturing, agriculture, and logistics, with businesses requiring robust, high-volume printers for industrial applications. The region's demand focuses on cost-efficient, durable printing solutions. Additionally, businesses are increasingly adopting digital printing to meet the growing need for personalized marketing and packaging in a competitive marketplace.

Moreover, the South is witnessing growth in the retail, finance, and government sectors. Expansion in urbanization and the trend of optimizing business processes are raising demand for printers. Wireless and multifunction printers are gaining acceptance in the market as businesses seek to find affordable and flexible solutions for their varied needs.

The West is a hub for technology, entertainment, and creative industries. This creates the demand for high-resolution and specialty printers. The focus of the region on sustainability and innovation also leads to interest in eco-friendly and energy-efficient printing solutions. With remote work gaining traction, there is an increasing demand for home-office printers.

Competitive Landscape:

The competitive landscape of the printer market is shaped by a mix of established players and emerging innovators, each vying for market share through technological advancements and customer-centric offerings. Companies are focusing on expanding their product portfolios, offering features like wireless connectivity, cloud integration, and multifunctionality to cater to evolving consumer demands. Competitive strategy includes price elasticity, where brand offers budget-friendly product lines and expensive models for professional or enterprise use. The focus of sustainability has encouraged the growth of green and power-efficient solutions and, in this regard, pushes brands to work on greener products. Other after-sales services offered by companies as a way of improving customer loyalty through maintenance and support services have increasingly become competitive factors within a saturated marketplace.

The report provides a comprehensive analysis of the competitive landscape in the United States printer market with detailed profiles of all major companies, including

- HP Inc.

- Canon Inc.

- Seiko Epson Corporation

- Brother Industries Ltd

- Xerox Corporation

- Fujifilm Holdings Corporation

- Fujitsu Ltd

- Panasonic Corporation

- Toshiba Corporation

- Roland DG Corporation

Latest News and Developments:

- In January 2025, GoEngineer, a 3D software expert and authorized Stratasys reseller, acquired CAD MicroSolutions, the Canadian engineering software and 3D printing technologies reseller. This acquisition expands GoEngineer's North American presence, which will allow it to provide greater resources and support to its rapidly growing customer base. CAD MicroSolutions is focused on Dassault Systèmes products such as SOLIDWORKS, 3DEXPERIENCE, and DraftSight. It provides specific solutions to the challenges of modern engineering in industries.

- In December 2024, Xerox has announced plans to acquire Lexmark International from Ninestar Corporation, PAG Asia Capital, and Shanghai Shouda Investment Centre for $1.5 billion, including assumed liabilities. The deal, set to close in the second half of 2025, aims to enhance Xerox's print portfolio and broaden its global print and managed print services. CEO Steve Bandrowczak emphasized that the merger of these two industry leaders will position Xerox for sustained growth and innovation in the rapidly changing hybrid workplace.

- In July 2024, Xerox won the PRINTING United Alliance 2024 Pinnacle Product Award for Technology for its Xerox® FreeFlow® Vision Software and Xerox® FreeFlow® Vision Connect Software. Chosen from over 160 contenders, the software tools were recognized for enhancing efficiency and productivity. The company emphasized that these solutions offer real-time control, advanced analytics, and seamless integration, helping print service providers improve operational effectiveness.

- In April 2024, The University of Maine unveiled the world's largest 3D printer, capable of producing eco-friendly, cost-effective, and recyclable housing structures. Named Factory of The Future 1.0, it can create objects as large as 96 feet long and 32 feet wide. Combining artificial intelligence, robotics, and high-performance computing, the printer aims to address homelessness by creating affordable housing neighborhoods, offering new opportunities for sustainable manufacturing.

- In March 2024, HP set a new benchmark in digital printing with the launch of the HP Indigo 120K Digital Press, offering unparalleled productivity and versatility. The company also introduces the HP Indigo 7K Secure Digital Press, redefining digital security printing. HP’s innovations extend to end-to-end automation using AI and robotics, alongside enhancements to the HP PageWide portfolio, aimed at solving production challenges and unlocking growth opportunities in the printing industry.

United States Printer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Printer Types Covered | Multi-Functional, Standalone |

| Technology Types Covered | Dot Matrix Printer, Inkjet Printer, LED Printer, Thermal Printer, Laser Printer |

| Printer Interfaces Covered | Wired, Wireless |

| End Users Covered | Residential, Commercial, Educational Institutions, Enterprises, Government, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States printer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States printer market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States printer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States printer market was valued at USD 13.78 Billion in 2024.

The United States printer market was valued at USD 19.78 Billion in 2033 exhibiting a CAGR of 3.80% in 2025-2033.

The growth of the United States printer market is driven by increasing demand for high-quality business printing solutions, the rise of remote work and home offices, technological advancements in wireless and cloud-based printing, the adoption of eco-friendly solutions, and the expansion of 3D printing applications in various industries.

Some of the major players in the printer market include HP Inc., Canon Inc., Seiko Epson Corporation, Brother Industries Ltd, Xerox Corporation, Fujifilm Holdings Corporation, Fujitsu Ltd, Panasonic Corporation, Toshiba Corporation, Roland DG Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)